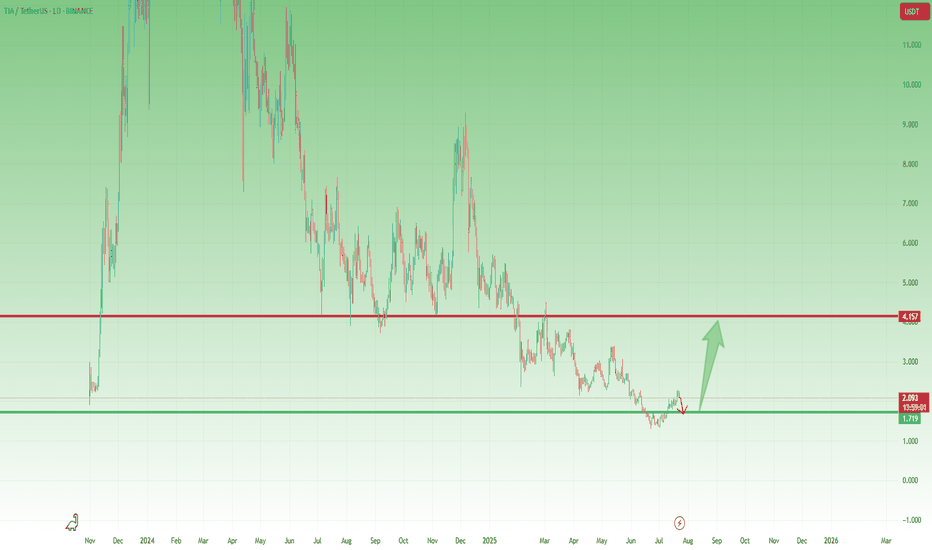

TIA- Is the Coin Finally Ready to Wake Up?After its launch on Binance in November 2023 and the immediate 10x pump, BINANCE:TIAUSDT has been, to put it mildly, a constant disappointment.

Since then, the hype has faded, and the price slowly deflated — leaving holders frustrated and the chart uninspiring.

🔍 Recent Signs of Life

However, something has started to shift.

After a fresh dip to 1.35, the coin formed a small double bottom and managed to recover above the 2.00 zone.

⚠️ Important to note: the rise hasn’t been impulsive.

But in the context of a broader altcoin revival — which I've outlined in my recent dominance analyses — TIA could become a decent candidate for a relief rally.

🔽 What I’m Watching

The recent structure looks like a bearish flag, and there’s a decent chance the pattern breaks down first before any real rally begins.

That’s why I’m watching the 1.70 area closely.

If price dips into that zone and gives a positive reversal signal, I’ll look to buy the dip.

🎯 Target and Potential

My upside target for this move is around 4.00, which would represent over 100% potential from the entry zone.

No moon calls. Just technical setup + potential market rotation + favorable risk/reward.

✅ Conclusion

TIA isn’t a favorite.

But sometimes, unloved charts offer the cleanest reversals.

I’ll let the market speak near 1.70.

If it holds and gives confirmation — I’m in. 🚀

Celestia

CelesTIA, All-Time Low Last Month, Trend Change—2025 Bull MarketI am showing multiple charts but my prediction is that the market will turn—the entire Cryptocurrency market—the altcoins market will turn bullish.

CelesTIA

There is an uptrend between late 2023 and early 2024, the same with the rest of the market. There was also a bullish wave late 2024. Huhhh, there will be an uptrend in late 2025 and early 2026.

Ok. Celestia. TIAUSDT.

It is easy to distinguish the downtrend vs no more downtrend.

The period drawn orange did produce lower lows but it is very different compared to the "downtrend," red on the chart.

So this is the transition. Strong down, then sideways, then up.

This pair is producing lower lows in its consolidation period but I also showed you many pairs that are producing higher lows, it makes no difference. Lower lows or higher lows, the action is very different compared to the "downtrend." The downtrend is no more.

My thesis concludes with a change of trend. This is where everything is leading, hundreds and hundreds of charts, more than 500 since 7-April. They all say the same.

In short, these hundreds of charts are saying that the market is about to become extremely bullish and that is something that we welcome with open arms. Actually, we have been waiting patiently, and some not so patiently, for this change to occur.

Many trust me; trusted me;

Many doubted me and that is also ok.

I love the truster and the doubter...

I love the reader and the follower...

I love TradingView and the Cryptocurrency market; but I will be proven right in the end.

I accept the fact that it is impossible to get it always right. I accept the fact that many times I am so, so very wrong.

You have to accept the fact that time is running out, Crypto is going up.

Celestia just hit a new all-time low and this is awesome news for me and for you, because, from this bottom low we will grow. You can mark these words... Just watch!

I would like to take just a few seconds of your time to say, thank you. Time is precious, and you took the time to read this long. If you enjoy the content, make sure to follow.

Thanks a lot for your continued support.

There is only one Cryptocurrency market, this is us.

It is you and me, it is all of us. It is not the whales or the exchanges. We are the whales and the exchanges. We are the government, the institutions, the programmers, the designers; the owners, the planners, the coders, the security expert, the writer, the reporter, the auditor; the professor, the mom, the father and the son. You are the market. You are it. You are the whole thing, the whole world.

You might think yourself unimportant as just a tiny ray of light, but there is no life without the sun. You being light, you permeate everything that exist around us. So you are the Cryptocurrency market. You are Bitcoin and you are the altcoins.

Namaste.

Celestia (TIA) – Ascending Triangle Setup (4H)BINANCE:TIAUSDT is printing a clean ascending triangle on the 4H chart, signalling a potential reversal.

Key Levels

• Support: Ascending trendline

• Resistance: $2.30 – a key level that acted as support since early April

• Measured Target: $2.50–$2.55 – aligns with prior support area

• Watch out for the longer-term descending trendline, which could act as resistance on breakout around ~$2.40

Breakout Trigger

A solid 4H close above $2.30 with convincing volume could confirm the move

Invalidation

A sustained break below the ascending support would fully invalidate the setup and potentially lead to a drop to $1.70

Tia bearish short term.To me the view is pretty clear.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

Celestia TIA price analysis#TIA price currently looks “weak,” gradually sliding down and updating lows.

A “ray of hope” may be a repeat of the fractal behavior of the OKX:TIAUSDT price from last year, when, after the third slight update of the low, the price began to rebound upward.

If we take this fractal as a basis, then in the near future, the price of the #Celestia token should rebound to $4, followed by a correction and continued growth to $5.55.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

The key is whether it can rise above 3.211

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(TIAUSDT 1D chart)

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if the HA-Low indicator falls, there is a possibility of a stepwise downtrend, and if the HA-High indicator rises, there is a possibility of a stepwise uptrend.

Therefore, when the HA-Low indicator is first created, the probability of rising is higher than the probability of falling, and when the HA-High indicator is first created, the probability of falling is higher than the probability of rising.

If the HA-Low indicator rises and then meets the previously formed HA-Low indicator again, the probability of falling is higher.

On the contrary, the HA-High indicator has a higher probability of rising.

You should check the movement of the chart with these characteristics in mind.

However, you should comprehensively judge the correlation between the OBV indicator and the StochRSI indicator.

-

From a trend perspective, since the M-Signal of the current 1D chart is < M-Signal of the 1W chart, you can see that it is in a reverse arrangement.

Therefore, when trading in a reverse arrangement, it is recommended to trade for a short period of time using day trading.

Therefore, if it shows a price that rises above the M-Signal indicator of the 1W chart and maintains the price, it is highly likely that a trend will be formed that can be traded.

In other words, when looking at the current price position, it can be seen that it can be traded for a short period of time or longer only when it rises above 3.211 and shows support.

-

Since the HA-Low indicator is formed at the 2.490 point, the price must be maintained above this point.

If not, there is a possibility of an additional stepwise downtrend, so you should think about a countermeasure for this.

-

If the average purchase price is significantly higher than the current price, you should not buy too much and increase your investment ratio.

In this case, it is better to trade with a relaxed mind and faithfully follow the basic trading strategy.

However, it is better to trade by increasing the number of coins (tokens) corresponding to the profit realization method and increasing the number of coins (tokens).

In other words, trade by purchase price.

If you bought 100 USDT at the current price of 2.840, you should sell 100 USDT when the price rises and shows resistance at 3.211.

In this case, only the number of coins (tokens) corresponding to the profit will remain.

At this time, you should be careful about the transaction fee.

Since you have to sell the purchase amount including the transaction fee, the actual selling amount when you place an order is not 100 USDT.

The transaction fee rate varies depending on the exchange.

For example, if the trading fee is 0.1%, you can trade 100USDT - (100USDT x 0.2%) = 99.8USDT.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

Celestia: Easy New ATH $33 & Mid-Term Target $14 (TAC-S6)Good afternoon my fellow Cryptocurrency genius, you have great timing and also a great choice here.

Celestia's bottom came in just a month ago, 7-April. This date is the same date when the entire Cryptocurrency market hit bottom, with some exceptions of course.

After the low 7-April TIAUSDT starts to recover but very slowly. Notice that there is no big volume candles after this low.

Now, today, notice the difference... The big green candle is supported by really high volume after a local higher low. This confirms the 7-April low as the corrective cycle bottom and thus the start of a bullish phase.

Growth will be really strong for this pair, really strong... It will be amazing that I am certain of. You can count on it.

» The first target is very easy and reaches $14 ($13.88). Profits potential from current price is 410%.

» The second target is a new All-Time High at $33 ($32.88) and this one while a new ATH should be easy to hit. High probability I mean. Profits potential reaches 1,109%. That's more than 12X.

So, all is good. Timing is right, the price is right... A great Top Altcoin Choice (TAC).

Thanks a lot for your support.

Namaste.

TIAUSDT — 2025 Technical RoadmapTIAUSDT — Daily Technical Roadmap

🕞 60-Second Read

Trend on the 1-D chart is still structurally bearish ; price (spot 2.865 USDT) just carved a higher-low off the 2.44 vector block and is knocking on the Yearly BC lid. Two large upside voids now beckon.

Hot-Zone #1 – 2.60 → 2.44 (1 D + 4 H vector demand): stacked fresh liquidity, 9-15 % under spot.

Hot-Zone #2 – 2.985 (Yearly BC): first breaker & range cap, only 4 % above; a daily close above here opens the air-pocket to 4.27.

Hot-Zone #3 – 4.932 → 6.947 (Yearly Pivot ↔ Yearly TC): macro supply shelf guarding a 72-142 % rally window.

💧 Liquidity & Imbalance

Daily vector 7.85 (77 % fill-rate inside 60 d).

Stacked 4 H vectors 9.86 / 9.83 = 2.5 % supply shelf.

Demand stack 2.69 – 2.44 only 18 d old.

⚡ Volatility & Momentum

GMMA Z-Score curling up from −2 σ; short ribbons still under long ribbons – suggests pause, not reversal.

🎲 Probability Dashboard

HTF Structure −3

Liquidity voids +1

Momentum −1

Vol-regime 0

Bear / Neutral / Bull ≈ 42 % / 33 % / 25 %

📈 Trade Playbook

Strategy 1

1. Layered Limit Grid – Aggressive Counter-Trend Long

Entry layers (size %):

2.60 – 40 % of your allocated TIAUSDT size

2.44 – 30 %

2.05 – 20 %

1.90 – 10 %

SL = 1.75 (≈ 1 ATR below extreme demand)

TP ladder:

2.985 – 25 % off-load

3.722 – 25 %

4.932 – 25 %

6.947 – 15 %

7.849 – 10 %

Weighted R:R ≈ 4.3

Strategy 2

2. Layered Limit Grid – Conservative Breakout Long

Trigger: daily close > 3.722 (Yearly Low reclaim), then place grid orders.

Entry layers (size %):

3.75 – 40 %

3.55 – 30 %

3.25 – 20 %

2.985 – 10 %

SL = 2.70

TP ladder:

4.932 – 30 %

6.947 – 30 %

7.849 – 20 %

9.860 – 15 %

12.432 – 5 %

Weighted R:R ≈ 3.8

⚠️ Risk Radar

Low-float token – slippage risk on size.

Macro event: FOMC 1 May → volatility spike possible.

BTC options IV rising – spill-over risk to alts.

Price must conquer 2.985 to open the upside magnet trail toward 4.27 → 4.93. Failure keeps 2.60 → 1.90 demand stack in play before any durable markup.

Not financial advice – do your own research & manage risk.

TIA | Next Altcoin to MOON ??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

In an earlier publication, I made an update about the ideal entry point for TIA:

A key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around. It is a bullish sign to see the gradual higher lows.

Moving Averages:

TIAUSDT - analysis of the downtrend phase and potentialProject :

Celestia is one of the key players in the new generation of modular blockchain architecture. Unlike traditional monolithic solutions, it separates the execution and consensus layers. This provides flexibility, scalability, and creates the infrastructure for rollup and L2 ecosystems.

📍 CoinMarketCap: #47

📍 Twitter (X): 397.7K

____________________________________________________________

🔎 Technical picture :

I marked the Seed / Series A / Series B zones on the chart — it's clear how early investors locked in massive profits: from listing, the price skyrocketed +634%, and their returns are many times higher!)

From the current levels, the price is down ~87% from its all-time high.

Formation: the price is moving inside a large descending channel. At the same time, a potential “cup” structure and a possibly emerging ascending channel are forming.

We are close to the lower boundary of these formations — it's an interesting zone.

A final sweep/fakeout toward the lower boundary of the descending channel is possible — keep this in mind when calculating risk.

Key level: the orange trendline marks the boundary of the secondary trend. A confident breakout and hold above it would be one of the reversal signals.

____________________________________________________________

💡 General conclusions :

Liquidity — solid.

The coin is traded on major exchanges.

Trend potential is marked on the chart.

As always — everything depends on your strategy and patience.

____________________________________________________________

📌 This review is not financial advice but my personal analysis and observations on the project.

TIA: 40% Crash in Sight – What's Next?TIA recently lost its strong $4 support, and that level is now acting as resistance. For the past two months, the price hasn’t been able to climb back above $4, leaving us with one burning question: Is more blood on the table?

Broken Support: TIA has given up its $4 support, which now serves as resistance.

Looking at November 2024: The low from November 2024 was around $1.9. Revisiting that level could provide us with a high-probability long trade.

Trade Setup Opportunity

Entry Point: Set an alarm for the $1.9 low. A successful bounce here would signal a potential long trade opportunity.

Target & Reward: With the goal of targeting the $3 level, this trade could offer a risk-to-reward ratio of at least 5:1.

Implication: If the $1.9 level is revisited and holds, we could be looking at a scenario with roughly 40% more downside in the current trend—but also a setup for a low-risk long if the bounce holds.

TIA | PERFECT Bottom??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

Trend based indicators are great to identify the immediate predominant pressure on the chart, in this case, bearish. A "Buy" signal in the weekly timeframe would be the first step in the right direction (reversal).

Trend Based Indicator:

Another key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around.

Moving Averages:

______________________

BINANCE:TIAUSDT

Breaking: $TIA Surges 17% Eyeing A Move to $5 The first modular blockchain network that enables anyone to easily deploy their own blockchain with minimal overhead by rethinking blockchain architecture from the ground up broke out of a falling wedge patten soaring 17% albeit the crypto market is highly volatile with CRYPTOCAP:BTC reclaiming the FWB:83K pivot.

Celestia Network Native token ( LSE:TIA ) has shocked the mainstream crypto market after breaking out of a falling wedge escaping the gasp of the support point holding it at the $2 zone.

With building momentum, LSE:TIA is eyeing a move to the $5 zone should it break the $4 resistant zone a move to the $5 target isn't far-fetched. With the Relative Strength Index (RSI) at 58, LSE:TIA is poised for a bullish run should the crypto market stabilize.

Celestia Price Live Data

The live Celestia price today is $3.74 USD with a 24-hour trading volume of $220,357,891 USD. Celestia is up 17.41% in the last 24 hours. with a live market cap of $2,091,803,371 USD. It has a circulating supply of 558,964,944 TIA coins and the max. supply is not available.

Celestia TIA price analysis🟣 For the second day in a row, the LSE:TIA price is showing growth

But would we risk buying OKX:TIAUSDT now - rather no than yes...

🟡 Above the orange trend line, purchases will be safer.

🟢 And during the $3 retest in the blue scenario, it's even safer)

Although, in the medium term, seeing #Celestia at $9 again is more than a realistic task.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Celestia Short-Term Bullish Target Goes Beyond 200%This is another pair that is bullish and is now about to produce a strong advance while Bitcoin crashes. Bitcoin isn't going any lower, or, I should say, TIAUSDT is about to move up.

TIAUSDT is trading above EMA8 and EMA13 on the daily timeframe.

The previous peak happened in February 2024.

The most recent bottom happened in February 2025. That's a full year of bearish action.

There was a strong correction in the form of a bearish impulse. This bearish impulse was followed by a sideways market. The sideways market produced a small bullish breakout and later a lower low to reach this present day. Present day, TIAUSDT is bullish and about to go up. The targets can be found on the chart. Here we have an easy 216% target and up to 378% short-term.

Thank you for reading.

Namaste.

TIA 3DLSE:TIA 3D;

It continues its course just above the discount level and at the same time continues its movement towards a strong wedge contraction.

In order for an uptrend to start, a daily close above $5.7 is needed in the first place. In order to say that the main trend has returned, a closing above $9.3 is required.

#celestia #tia

TIA SHORT/LONGTIA has dropped below $3.7, the lower boundary of its range, which isn't necessarily a bad thing.

If the price manages to reclaim $3.7, it would confirm a major fakeout, potentially pushing the price back up to $5-$6.

In the short term, we might see a small bounce toward the 21 EMA on the daily timeframe, accompanied by a bullish cross on the Stoch RSI.

After that, another pullback could happen, setting up a second bullish cross on the Stoch RSI—which, historically, has often led to stronger upward moves.

$TIAUSDT on the Brink – 4.6 Accumulation for Big Moves to ATHsBINANCE:TIAUSDT Bottoming Out – Accumulating Below 4.6 for the Breakout

Looks like BINANCE:TIAUSDT is bottoming here, but it might take a couple of weeks for a breakout.

I’m patiently accumulating under 4.6. The daily hasn’t triggered a signal above 5.5 yet, so no rush to add above my current buy zone.

Last time I was expecting new ATHs, so this time I’ll chill and just call it – Our final stand towards ATHs 😂

Solid setup, just needs time.

TIA (Celestia) Main trend. Maximum targets of the cycle. XXL+10XLogo of rhymes. Time frame 3 days. Everything is shown and described on the price chart of this pre-planned super hype, to earn super profits out of nothing.

"Collected" (principle and scheme of deception) for 7 rounds of financing (the principle of the "access pyramid") - $ 156.5 million. This is the principle of super pumping and listing on exchanges for super huge profits of almost all hype assets since 2020.

Under the logic of the chart, as a rule, they pull under the general trend of the market cycle by another + 800-1000%. According to the chart, the average price between accumulation and distribution of the cycle is usually 500-800%. The main thing is to keep the logic of the chart under the general market cycle (for constant small, imperceptible sales). Such assets are constantly sold in trend, which is logical, there is no difference between 50x -100x - 1000X.

No matter how funny and illogical it may sound, while the “whales” are selling, you can be in the asset and be safe. When sales stop, that is, there is no interest in maintaining the hype, the prospects of the legend and the liquidity of the asset for sales, - a sharp (hack, break-in, or other fiction - justification for "closing the project") or slow death (the asset loses major players and demand / supply is given into the hands of “the majority of those waiting for XXX, who will never be”), that is, depreciation and scam.

The previous legend of prospects does not matter, as the focus of attention of the crowd shifts to other freshly created similar assets and marketing to attract “fresh blood” of new stupid money. All new assets are created, and most importantly advertising, at the expense of profits from the previous ones, only on a large scale. This is a disguised Ponzi scheme, which everyone agrees with, as they are sure that they will not be “the last”.

Linear for clarity.

Local game.

Tia’s Next Move: Opportunity Below $6?Tia/USDT has been lagging recently, and while other altcoins surged strongly after Trump’s election, Tia only recently managed to break above a key resistance level at $6.

After reaching the recent high, the price corrected and is now back at the previous resistance level, which has turned into support.

I expect this support to hold, and if it does, we could see a new upward leg for Tia.

The immediate resistance is in the $7.3–$7.5 zone, and a breakout above this level could pave the way for further gains, potentially reaching the next key resistance levels at $9 or even $12.

Buying below $6 could offer a solid entry point with a favorable risk-to-reward ratio.