Crown Castle Inc. (CCI) 1WTechnical Analysis

- The weekly chart of Crown Castle Inc. (CCI) shows a potential reversal after a prolonged downtrend.

- A breakout above the descending trendline and consolidation above $110.85 (0.786 Fibonacci) could signal the start of an upward movement.

- Key Resistance Levels: $132.06 – $146.95 – $161.85 – $180.28 – $210.07.

- Key Support Zone: $83.83 - $90.

- CCI and RSI indicators confirm improving sentiment.

A sustained breakout above $110-112 could lead to mid-term growth.

Fundamental Analysis

Crown Castle is one of the largest telecommunications infrastructure operators in the US.

- Stable revenues due to long-term contracts with telecom providers.

- Dividend yield of ~6%, making it attractive for long-term investors.

- 5G expansion and IoT growth create long-term opportunities.

Risks: High debt burden, interest rate impact, and competition with American Tower.

CCI has growth potential if it breaks above the $110-112 zone. However, macroeconomic risks remain relevant.

Centered Oscillators

Potential Downtrend in AlcoaAlcoa has bounced this month, but some traders could think it’s due for a pullback.

The first pattern on today’s chart is the series of lower lows and lower highs since December. The aluminum company has climbed to the top of that falling channel, which may create potential resistance.

Second, prices stalled at the falling 50-day moving average (SMA) in February and seem to be peaking at the same SMA this month.

Speaking of the 50-day SMA, it recently had a “death cross” below the 200-day SMA.

Next, stochastics are dipping from an overbought condition.

Finally, the 52-week low is near $27 and last year’s low is under $25. Combined with the falling channel, those levels may provide space for potential moves to the downside.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

The Election Was Support. Has it Become Resistance?Last year’s presidential election was a catalyst for stocks. Today’s idea considers its potentially shifting impact on sentiment.

The first pattern on today’s S&P 500 chart is the range between 5597 and 5783. Those prices are the low of November 4 and the high of November 5, the Monday and Tuesday of election week.

On January 13, SPX pulled back to find support at the top of the range. That bounce seemed to reflect ongoing optimism about the coming administration. (Inauguration was exactly a week later.)

The index remained above that zone through early March before sliding below it. Prices have now rebounded but appear to be stalling at the bottom of the price range. Does that show a newer anxiety about policy?

Next, Wilder’s relative strength index (RSI) made lower highs from early December -- despite SPX making incrementally higher highs. That kind of bearish divergence may be consistent with a longer-term trend fading.

Third, SPX is under its 200-day simple moving average (SMA). Staying here may confirm a break of its longer-term uptrend.

Finally, the 50-day SMA recently crossed below 100-day SMA. Both are falling. That may also suggest prices have stopped rising.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

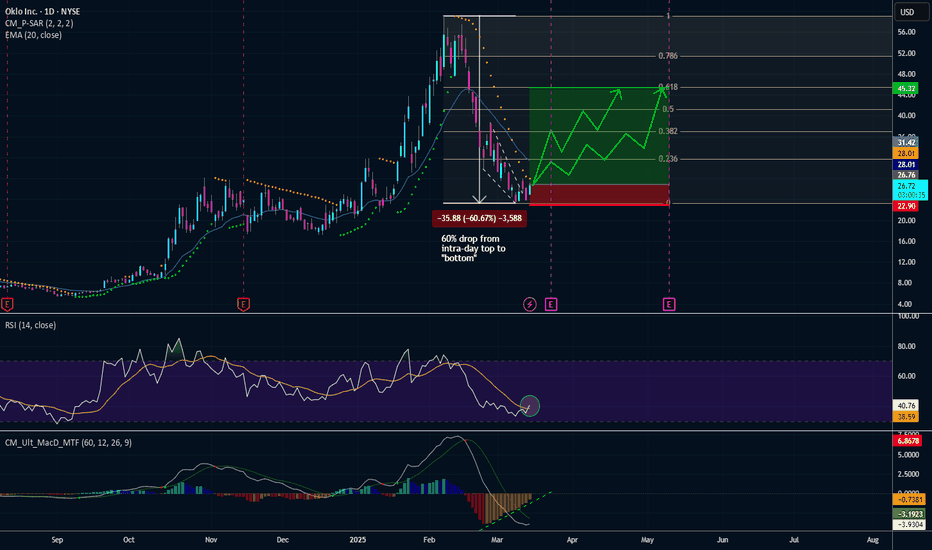

70% Upside Potential in this Nuclear StockOKLO is my personal favorite nuclear play that feeds off the AI energy. Really beat up since it's height in early February, down over 50% as of today (as are a lot of other stocks given the macroeconomic backdrop). Chris Wright, a member of its Board of Directors, was confirmed as the U.S. Secretary of Energy on February 3, 2025. As a result, Wright has stepped down from Oklo’s Board to assume this critical role in advancing the nation’s energy policies.

I can see upside trade heading closer to Q4 earnings March 24.

Bullish Technicals:

- Rounding Bottom

- RSI breaking above RSI MA

- MACD: histogram trending up

- Moving out of the falling wedge

- Just sitting below daily PSAR

OKLO's Key Focus Areas:

- Microreactors – Oklo’s primary product is the Aurora microreactor, a compact and efficient reactor designed to produce power for remote areas, industrial sites, and off-grid locations.

- Fast Reactors – Their reactors use a fast neutron spectrum and liquid metal coolant (like sodium) rather than water, making them more efficient and capable of reusing nuclear waste as fuel.

- Fuel Recycling – Oklo aims to use recycled nuclear fuel (like spent fuel from conventional reactors), reducing nuclear waste and increasing fuel efficiency.

- Long Lifespan – The Aurora reactor is designed to operate for up to 20 years without refueling, minimizing maintenance and operational costs.

Pivoting Drop on Netflix. NFLXLast short idea was profitable for us, and I think this is a time for a pivot now. Price action is king. The drop down looked like ABC of a larger zigzag A wave, so now B which may be quite protracted. Fib goals here are for illustration purposes, as I recommend you never keep your goals stationary but use an adaptive indicator or indicator pair to exit.

Johnson and Johnson Falling Off a Cliff. JNJA much larger ABCDE formation is complete, not pivoting back to gravity. There is confirmation with MIDAS cross of price action with supporting of RSX exiting OBOS area and VZO/Stoch duo being bearish divergent for some time now. The incoming stream could be a tumultous C Wave impulse to the bears, if Elliott is to be believed.

Reversal To The Long on Meta Platforms. METAThe previous ides on short was very profitable and I believe that we are facing a local reversal here based on price action and volatility , stochastic indicators below. This is a within one candlestick set up, so relatively risky. And yet most pivot setups are.

Stocks May Be OversoldThe S&P 500 has been falling swiftly, but it may be considered oversold.

The first pattern on today’s chart is Wilder’s Relative Strength Index (RSI) in the lower study. RSI slipped below 30 for the first time since October 2023. That could make some traders think it’s due for a potential bounce.

Next, the middle study includes our MA Distance custom script. It shows price dropped the furthest below its 50-day simple moving average (SMA) since October 2022. That may also suggest it’s experienced a healthy pullback.

Third is July 5’s last price of 5567, which was the first weekly close in the second half of 2024. It became resistance in early August and support in two subsequent weeks. SPX held that level again yesterday, so it may be reemerging as a meaningful area.

If the index manages to stabilize here and rebound, how high might the bounce go? Traders could potentially look to the price zone between January 13's low of 5773 and the March 4 low of 5733. It’s also near the 200-day SMA.

Investors with a longer-term view may expect further volatility given the sharpness of the recent drop and the uncertainty caused by tariffs. That may prompt them to eye a deeper low around 5402, where SPX held in early September before breaking out to new highs.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Exit Tight Trading Range on Exxon. XOMTight trading ranges are always tough, as they cause indicators to constantly throw off false signals. There is no way to know which signals will be false. Taking a chance on this one nonetheless. Three soldier candlestick pattern that breaks MIDAS curve and crossings on VZO+offset and Ehlers StochRSI. BB%PCT also crossed zero line. vWAP/US duo in alignment and supportive. It is uncommon to see all the stars lineup like that.

Philip Morris Hit The Ceiling. PMOur last game take on PM centering on a bullish butterfly gave us profits on that very healthy looking impulse up. Now, it is time to come back to reality for this stock. RSX wise - out of OBOS territory, while crossing the MIDAS line. vWAP/US show gradient of trend and are resistant and in alignment. The technicals below have been divergent for a very long time, an indication that a correction has been long overdue.

AB=CD on Chevron. CVXEarly bounce off support now, full steam ahead to the upside , crossing vWAP and US in the second last candle. Now MIDAS crossed. Below oscillators have or are about to turn bullish, reflective of the upgoing candlesticks. This is an AB=CD as far as I'm concerned and Kennedy channeling for stationary goals in any parallelogram structure applies.

Goldman Pulls BackGoldman Sachs hit a new high two weeks ago, and some traders may see opportunities in its latest pullback.

The first pattern on today’s chart is the November high around $613. The Wall Street giant is apparently stabilizing at that level. Has old resistance become new support?

Second, stochastics have dipped to an oversold condition.

Third, GS gapped higher after its last earnings report on January 15. That may reflect strong fundamentals.

Finally, GS is trying to hold its 50-day simple moving average (SMA). The 100-day is also rising from below. Both of those patterns may be consistent with a bullish uptrend.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Zerebro autonomous AI system to 15x ??On the above 16hr chart price action has corrected 96%. A number of reasons now exist to be bullish. They include:

1) Price action and RSI resistance breakouts.

2) Trend reversal.

3) Regular bullish divergence. 9 oscillators print positive divergence with price action.

4) Falling wedge forecasts 2000% move to 70 cents.

Is it possible price action continues correcting? Sure.

Is it probable? No.

Ww

Nucor May Be StallingNucor has trended lower since April, and some traders may expect another push to the downside.

The first pattern on today’s chart is the November 6 gap after Donald Trump was reelected U.S. President. The steelmaker failed to hold that bounce and proceeded to a new 52-week low by early January. It then rebounded and may have made a lower high.

Next, prices are stalling at a low from October 2023 where NUE bounced several times in late 2024. Has old support become new resistance?

Third, the 50-day simple moving average (SMA) is below the 100-day SMA. Both are under the 200-day SMA. That may be consistent with a longer-term downtrend.

Finally, MACD just turned negative.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Learn more about how the Professionals Trade Stocks.This lesson is about TWAP vs VWAP order types, Indicators that reveal reversals before price moves. You will learn about Dark Pool candle patterns, Professional traders setups and how to determine with a high degree of probability what direction the stock price will take in the near term.

Learning about why certain candlesticks and indicator patterns reveal who is in control of price helps you select the best stocks to trade with the high probability of excellent profits.

Within every chart, there are patterns and indications that tell you what is most likely to occur in price action next for the near term. This is based on recognizing which professional market participant group has taken control of price.

Also the time of day that each market participant group seizes control of price and why that happens.