Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 4, 2025Technical Analysis and Outlook:

In the course of this week's trading activities, we noted a successful retest of the Interim Coin Rally at 88400, with particular emphasis on the Mean Support at 82500. This development indicates the potential for an extension in a trajectory toward the previously established Outer Coin Rally at 78700. An upward momentum may originate from the Mean Support at 82500 and/or the Key Support at 79000/completed Outer Coin Dip at 78700.

Macroeconomic Analysis And Trading Ideas

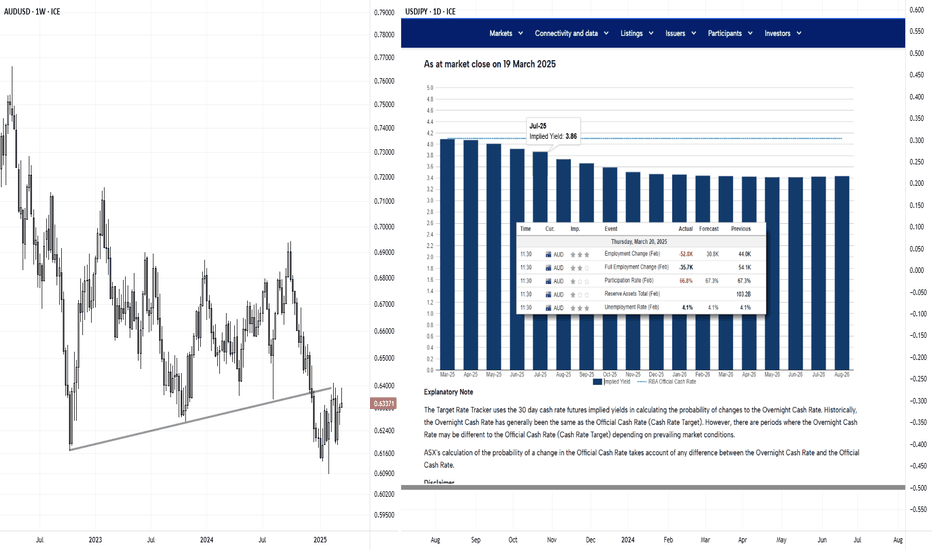

RBA Holds Their Cash Rate, May Cut Neither Confirmed Nor DeniedThe RBA held their cash rate at 4.1%, and keep a May cut up in the air without any appetite to commit to one. I highlight my observations on the RBA's statement, before updating my analysis for AUD/USD, AUD/CAD and GBP/AUD.

Matt Simpson, Market Analyst at City Index and Forex.com

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 28, 2025Technical Analysis and Outlook:

Bitcoin underwent several significant peaks as it completed the Interim Coin Rally 88400. Subsequently, it experienced a decline, moving towards the Mean Support 82500, with the possibility of extending its trajectory to retest the previously completed Outer Coin Rally 78700. An upward momentum may be initiated from the Mean Support of 82500 or the Key Support of 79000/completed Outer Coin Dip of 78700.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

This week's trading session demonstrated considerable volatility in Bitcoin's price action. The cryptocurrency made multiple attempts to attain our Interim Coin Rally 88400, yet it ultimately remained at the same level as the week commenced. The current analysis suggests that Bitcoin must reach our Mean Support of 82500 before initiating an upward progression aimed at the Interim Coin Rally of 88400 through the Mean Resistance of 87000. Furthermore, a retest of the completed Outer Coin Dip 78700 is essential before the emergence of a significant rally.

Why the Weak AU Jobs Report Might Not Force the RBA's HandAustralia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given.

Matt Simpson, Market Analyst at City Index and Forex.com

EUR/USD Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

As indicated in the analysis from the previous week, the Euro has commenced an upward trend, successfully retesting the completed Inner Currency Rally at 1.086 and advancing toward the Mean Resistance level at 1.093. Consequently, the currency is currently experiencing a retreat and is directing its focus toward the Mean Support level at 1.078, possibly declining further to the Mean Support level at 1.061. Conversely, should the anticipated downward trend fail to materialize, it is plausible that the Eurodollar will retest the Mean Resistance level at 1.093 and subsequently aim for the completed Outer Currency Rally level of 1.124, traversing Key Resistance at 1.119 along the way.

Amid Price Uncertainty, Gold Straddle Paves the PathYellow metal prices have soared. It has been setting several new all-time highs with futures trading just shy of the USD 3,000/oz level. However, gold has struggled to breach past the crucial mark despite multiple attempts.

Some data points suggest that the rally in gold might be losing steam even though fundamental demand drivers remain intact.

A nuanced position is required at times like this. Options are tailored to help portfolio managers to position shrewdly in such dicey situations.

GEOPOLITICAL RISK IS PERSISTENTLY ELEVATED IN THE NEW WORLD ORDER

The Geopolitical Risk Index (GPR) remains above one hundred since 2022 which reflects sustained global uncertainty driven by ongoing geopolitical tensions. This trend has persisted for years, with recent tariff-related uncertainty adding fuel to this fire.

Data Source: Economic Policy Uncertainty

Gold, as a safe haven asset, benefits from these conditions. However, the recent bond selloff has driven Treasury rates higher which could potentially reduce demand for gold as it is a non-yielding asset.

CENTRAL BANKS ARE LOADING ON RISING GLOBAL TRADE UNCERTAINTIES

Central banks are resuming gold purchases, with January showing an uptick, albeit below the 2024 average. The accelerating pace could signal further momentum, particularly amid rising global trade uncertainty.

Data Source: WGC

China resumed gold buying in November 2024 following a six-month hiatus. China was one of the largest buyers in 2023 and a repeat of that in 2025 will see a sharp demand spike.

LARGE GOLD FLOWS INTO THE US

The large financial institutions which serve as counterparties in the futures market have been importing significant quantities of physical gold to the US. The recent flows have surpassed levels seen during COVID pandemic.

Physical imports have been driven by fears of a tariff on gold imports. However, the pace of imports has slowed down and is starting to plateau.

Looking back at 2020, when similar conditions arose, prices remained stagnant after the sharp rally driven by physical gold imports. The risk of a repeating pattern is even more potent given the strong resistance at the USD 3,000/oz level. A strong driver may be required to allow prices to cross this threshold.

Chart Source: WGC

Another factor contributing to the temporary physical supply shock is the refining process required before gold reaches the U.S.

The physical gold reserves held in London for Good Delivery are the 400-oz bars, which must be refined into 1-kilo bars for CME delivery. This process requires an intermediate stop in Switzerland, adding delays that exacerbate supply constraints.

However, as the additional refined metals reach the U.S. in the coming weeks, supply is expected to normalize, potentially putting downward pressure on prices.

Chart Source: WGC

Other supply stress indicators are easing. Gold leasing rates, which reflect the cost of borrowing for physical use, recently surged above 5%, with near-term borrowing costs rising sharply. Leasing rates have returned to normal, albeit slightly elevated.

TECHNICAL SIGNALS POINT TO STRONG MOMENTUM ENCOUNTERING RESISTANCE

The summary below suggests a bullish stance in gold but prices are encountering resistance. Over the past month, prices have faced strong resistance at the USD 3,000 level despite a strongly bullish sentiment.

The resistance formed after a stunning rally which pushed gold into overbought territory, a correction at this stage is expected.

Should momentum fade, gold prices may continue to consolidate between present levels and the 100-day moving average.

Gold futures prices formed a death-cross on 5th March 2025 which may fuel a near term price correction.

GOLD VOLATILITY IS NOT LOW BUT CAN RISE HIGHER IF CONDITIONS TURNS TENSE

Gold Volatility as measured by CME’s Gold CVol printed a high of 50.13 on 18th March 2020 and a low of 8.18 on 3rd May 2019.

Presently hovering at 16.35, the implied volatility in gold is not too low but below average with the potential to spike higher should geopolitical or other shocks rock the market.

Source: CME CVol

HYPOTHETICAL TRADE SETUP

Fundamentals remain intact and could intensify if tariff and/or geopolitical tensions peak. That said, the phenomenal gold rally is starting to lose shine as it encounters strong resistance with death cross forming on 5th March 2025.

Supply shocks that fueled the rally in Feb are now fading.

Equity risks are elevated with expensive S&P 500 P/E multiples. Geopolitical and trade risk remain tense. These conditions support a further bullish position in gold.

With prices expected to swing either way, portfolio managers are best positioned to have a convex position that gains from sharp moves in either direction.

To express this ambivalent view on the path ahead for gold prices, portfolio managers can utilize CME Micro Gold Options to establish a long straddle (combination of long put & long call) that gains from (a) deep pull back in prices (puts gain in value), or (b) sharp rally (calls deliver the gains), and (c) implied volatility expansion (where both puts & calls gain in value).

Conversely, this trade will incur losses if prices remain flat and if volatility shrinks.

The pay-off of the hypothetical long straddle set up using CME Micro Gold Options June 2025 contract expiring on 27th May 2025 is illustrated below.

The long call at a strike of 2,945 will cost USD 84.9 per lot and the long put at the same strike will cost USD 86.9 per lot adding up to USD 171.80 per lot in total premiums. The long straddle will generate positive returns at expiry if the underlying futures prices are (a) above the upper break even point of USD 3,116.80/oz, or (b) below the lower break even point of USD 2,732.20/oz.

Source: QuikStrike Strategy Simulator

If the underlying futures prices stay within the break-even points, this straddle is exposed to a maximum loss of USD 171.80/lot representing the total premium. Happy Investing.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 7, 2025Technical Analysis and Outlook:

In the trading session for this week, we observed significant volatility characterized by considerable fluctuations, ultimately culminating in the completion of the coin Interim Coin Rally 94500. The coin experienced a substantial increase, reaching our Mean Resistance level of 92600, before encountering a steep pullback that resulted in its stabilization at the starting point of Mean Support of 84700.

This upward fluctuation indicates a potential for higher prices and suggests a likelihood of retesting the target Mean Resistance levels at 90600, coinciding with the conclusion of Interim Coin Rally 94500. Nonetheless, a retest of the Key Support level at 79000 and the completed of the Outer Coin Dip 78700 may occur prior to any further upward momentum.

Can Brazil’s Bonds Defy Global Chaos?In an era of escalating trade tensions and economic uncertainty, Brazil’s financial markets offer a compelling enigma for the astute investor. As of March 3, 2025, with the USD/BRL exchange rate at 1 USD = 5.87 BRL, the Brazilian real has shown resilience, appreciating from 6.2 to 5.8 this year. This strength, intriguingly tied to a bond market boasting 10-year yields near 15%, prompts a deeper question: could Brazil emerge as an unexpected sanctuary amid global turmoil? This exploration unveils a landscape where high yields and domestic focus challenge conventional investment wisdom.

Brazil’s bond market operates as an idiosyncratic force with yields dwarfing those of peers like Chile (5.94%) and Mexico (9.49%). Driven by local dynamics—fiscal policy, inflation, and a central bank unbound by global rate cycles—it has seen yields ease from 16% to 14.6% year-to-date, signaling stabilization. This shift correlates with the real’s rise, suggesting a potent inverse relationship: as yields moderate, confidence grows, bolstering the currency. For the inquisitive mind, this interplay invites a reevaluation of risk and reward in a world where traditional havens falter.

Yet, the global stage adds layers of complexity. U.S.-China trade tensions, while not directly targeting Brazil, ripple through its economy—offering trade diversion benefits like increased soybean exports to China, yet threatening slowdowns that could dim growth. With China as its top trade partner and the U.S. second, Brazil straddles opportunity and vulnerability. Investors must ponder: can its bond market’s allure withstand these crosswinds, or will global forces unravel its promise? The answer lies in decoding this delicate balance, a challenge that inspires curiosity and strategic daring.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 28, 2025Technical Analysis and Outlook:

At the beginning of the week, Bitcoin was observed trading at a lower level, close to the Mean Support level of 95700. It could not reach our predetermined Mean Resistance level marked at 98300, which can be attributed to a substantial decline that occurred, resulting in the completion of our Outer Coin Dip between 89000 and 78700. Following this decline, Bitcoin experienced a robust rebound to the Mean Resistance level of 86200. This upward trend indicates the potential for higher prices as it will target Mean Resistance levels at 89200 and 92600, respectively. However, a retest of the Key Support level at 79000 must occur before further upward movement may take place.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 21, 2025Technical Analysis and Outlook:

During last week's trading session, Bitcoin was unable to reach our designated Mean Resistance level at 101300 and has remained stagnant near the Mean Support at 95700. This trend indicates a potential continuation of the pullback, which may cross-check the Mean Support level at 95700, with the prospect of further decline toward the Outer Coin Dip identified at 89000 via additional Mean Support levels at 94400, and 92500. Conversely, should the anticipated pullback not materialize, Bitcoin may experience upward momentum, thereby testing the newly established Mean Resistance level at 98300. This development could facilitate an extension toward 101500 and beyond.

AUD/NZD could be veering towards a breakoutThe RBNZ just delivered their third 50bp cut in a row, and they have left the door open for further easing this year. And given I expect the RBNZ's cash rate to remain beneath the RBA's for the remainder of the year, it could pave the way for a bullish breakout on AUD/NZD.

Matt Simpson, Market Analyst at City Index and Forex.com

The RBA just cut by 25bp: Instant ViewThe RBA have just cut their cash rate for the first time since late 2020. Using their monetary policy statement and updated forecast, I provide my instant high-level view of what this could mean fir future policy - with an update to my AUD/USD outlook thrown in for good measure.

Matt Simpson, Market Analyst at City Index and Forex.com

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 14, 2025Technical Analysis and Outlook:

During this week's trading session, Bitcoin has remained closely aligned with the completed Outer Coin Dip at 96000. This development suggests a potential pullback to retest the Mean Support level at 91800, with the possibility of further decline down to the Outer Coin Dip marked at 89000 before a possible resurgence in the bull market.

On the other hand, if the anticipated pullback does not occur, the cryptocurrency may experience upward momentum, retesting the Mean Resistance level at 101300. This could lead to an extension toward challenging the completed Outer Coin Rally at 108000 through Key Resistance at 106000.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 7, 2025Technical Analysis and Outlook:

On Monday, during the current week’s trading session, Bitcoin reached the Mean Support level of 91800 and consistently hit the targeted Outer Coin Dip at 96000. This development indicates a likely pullback to retest the Mean Support level of 91800, with the possibility of further decline down to the Outer Coin Dip located at 89000 before a potential resurgence in the bull market.

Conversely, the anticipated pullback does not materialize. In that case, the cryptocurrency may experience upward momentum, retesting the Key Resistance level at 106000 and potentially extending to challenge the completed Outer Coin Rally at 108000 and beyond.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 31, 2025Technical Analysis and Outlook:

During this week’s trading session, Bitcoin reached its targeted Mean Support levels, specifically at 101300 and 98000. This development indicates a probable pullback to retest the Mean Support level of 98000, with the potential for further extension to the Outer Coin Dip positioned at 96000 before a possible resurgence in the bull market occurs. Conversely, should this anticipated pullback not materialize, the currency may experience upward movement, retesting the completed Inner Coin Rally at 108000 and potentially expanding to 110000 and 114500, ultimately challenging the outermost Outer Coin Rally at 122000.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 24, 2025Technical Analysis and Outlook:

During this week's trading session, Bitcoin has successfully achieved and completed a significant Inner Coin Rally at the 108000 level. This development indicates a probable pullback to the Mean Support level of 101300, with the potential for further extension to the Mean Support level of 98000 before a resurgence in the bull market may occur. Conversely, should this pullback not transpire, the currency may experience upward movement, retesting the completed Inner Coin Rally at 108000 and challenging the next Outer Coin Rally at 110000 and beyond.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 17, 2025Technical Analysis and Outlook:

Bitcoin has reached our significant Key Resistance level of 106000 during the current week's trading session. This development signals a retest of the completed Outer Coin Dip of the 108000 cryptocurrency before the expansion of the continued upward movement. Nevertheless, an interim decline may likely occur, leading down to the Mean Support level of 100000, with a potential further extension to the Mean Support level of 95000 before any resurgence in the bull market occurrence.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 10, 2025Technical Analysis and Outlook:

Bitcoin has surpassed our crucial Mean Resistance of 99500 in this week's trading session by plunging sharply back to a critical Mean Support of 91800. This decline suggests that a significant interim pullback may be underway, potentially bringing the cryptocurrency to the Outer Coin Dip 83400 before any resurgence in the bull market occurs. However, an interim strong upside move to Mean Res 97300 might be in the works.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 3, 2025Technical Analysis and Outlook:

As specified in the Bitcoin Daily Chart Analysis for December 27, an extraordinary rebound bull movement occurred from the Mean Support of 91800. Current analysis suggests a high likelihood that the cryptocurrency will continue to advance, potentially testing the Mean Resistance level of 99500 and aiming for a retest of the completed Inner Coin Rally marked at 108000. Nevertheless, it is crucial to recognize the possibility of a pullback to retest the Mean Support level of 91800 again before any resurgence in the bull market.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Dec27, 2024Technical Analysis and Outlook:

During this week's trading session, Bitcoin exhibited fluctuations within the newly defined Mean Resistance of 99500 and Mean Support of 91800. The analysis suggests a high probability that the cryptocurrency will experience a decline to the Inner Coin Dip 88500 prior to initiating a significant rebound. This rebound is expected to facilitate the re-establishment of its bullish trend. It is essential to consider that a rebound bull movement may indeed occur from the Mean Support 91800.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Dec20, 2024Technical Analysis and Outlook:

Bitcoin's spectacular pullback to Mean Sup 91800 is noted. We anticipate a rebound to the upside, targeting the key Resistance level of 106000. Nevertheless, it is essential to acknowledge that a retest of the Mean Support level 91800 remains a plausible scenario.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Dec13, 2024Technical Analysis and Outlook:

Bitcoin's repeated pullback in this week's trading session by upholding firmly at the Mean Sup 96000 price level within the completion of the Inner Coin Rally 103600 is now noted. Recent analyses indicate that the cryptocurrency will likely retest the completed Inner Coin Rally 103600 by navigating the weak Mean Resistance 102300. This movement is anticipated to revitalize its upward trajectory toward the projected Outer #1 Coin Rally 110000 and beyond. Furthermore, a potential decline to the Mean Support 97000 would prepare the market for the subsequent phase of a bullish trend.