CENTURYPLY Low Risk High Reward IdeaAs per my analysis on weekly chart NSE:CENTURYPLY has been retraced. Not it will be best to take entry for long when price come to 556 with stop loss of 528 (-28 Points). My expected upside target will be 593 (+40 Points), 620 (+64 Points) & 620 (+79 Points). It could low risk and high reward option.

Note: This is my personal analysis, only for learning. Thanks

Century

Century textile - 790 on cardsCentury textile trading just near to all time high and also forming a rounding bottom pattern. 640-660 is a resistance zone, if it breaks then level of 790 is possible

Disclaimer - this is just for educational purpose and not a trading or investment advise

CENTURY TEXTILES - Could it be an easy climb?"Stocks Go Down Faster Than They Go Up, but Go Up More Than They Go Down". In this case it might as well go up fast.

Lets see !

*****

Help Me to Help Us.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

Always keep a stop loss to rescue you out of troubles.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the motivation.

CenturyLink - PT $26 Next year $36 - Strong buyWe think that CenturyLink is undervalued.

CenturyLink (NYSE:CTL): Q2 Non-GAAP EPS of $0.42 beats by $0.10; GAAP EPS of $0.35 beats by $0.07.

Revenue of $5.19B (-3.5% Y/Y) beats by $50M.

Q2 adjusted EBITDA of $2.1B vs. a consensus of $2.18B.

CenturyLink Reports Second Quarter 2020 Results

seekingalpha.com

The Revenue was actually pretty good, when you compare it to other companies where the revenue dropped more than 60%.

First price target: $26

Second price target: $36

CENTURY TEXTILES Confluences of AB = CD move CENTURY TEXTILES has formed a double top on a strong resistance zone and good bearish candles .

Lot of confluences of support and resistance levels .

Can go short at CMP or retracement back to resistance zone and then AB = CD move to the next support levels .

DJI Monthly Chart with Historical notesJust a visualization of Historical events and their effects on the DowJones Industrial Average over the last century.

Incomplete and not very accurate.

Initially Intended for private use only, not inferring any forecasts from it.

(Inspired by T. Vays who has done this a long time ago. thx Tone)

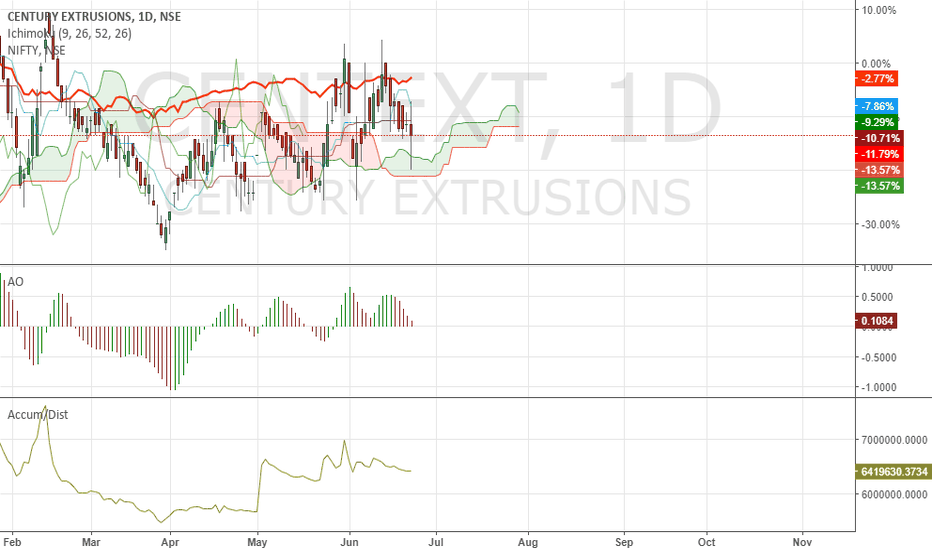

Buy Century extrusion at CMP for short termAdvised to keep a strict SL below senkou B on closing basis. To be honest not a great setup from ichimoku elements perspective but still its worth a shot. The price is in sync with Nifty 50 and is moving in range similar to the benchmark.

Happy Trading / Investing

Best Regards

Shamoil