Symmetrical Triangle Nearing Resolution: Breakout or Breakdown?BTC/USD H4 Analysis – Symmetrical Triangle Nearing Resolution: Breakout or Breakdown?

📊 Technical Outlook – 4H Timeframe

Bitcoin is currently consolidating within a clear symmetrical triangle, with price tightening ahead of a potential major breakout. The chart shows price testing the upper boundary of the triangle, supported by MA13 and MA34 from below.

Key resistance zones: 86,594 and the extended target zone at 88,753. A successful breakout above this region could trigger a strong rally toward 90,000+.

Key support levels: 81,397 – 78,725 – 75,102, acting as critical retracement zones in case of downside rejection.

The structure suggests two primary scenarios:

Bullish breakout to 86,594 → 88,753, followed by a pullback and continuation higher.

False breakout or breakdown, leading to a sell-off toward 78,725 and possibly down to 75,102 if market sentiment deteriorates.

🌍 Macro Context & Market Sentiment

Investor sentiment remains fragile, impacted by ongoing geopolitical risks and the Fed’s cautious stance on monetary policy.

Altcoins are underperforming, signaling that capital rotation remains limited – often a precursor to short-term correction or distribution in BTC.

Volume is fading as price coils inside the triangle, typically a precursor to a sharp move in either direction.

🧠 Trading Strategy Ideas

Watch closely for price action near 86,594 – 88,753. If rejection or wick rejections occur, short-term pullback trades may be viable.

A breakdown below the triangle support (~84,000 area) could open up downside targets at 81,397 and 78,725.

A clean breakout with volume confirmation? Look for retest buys around 86k with continuation potential.

⚠️ Caution Advised

BTC is in a “calm-before-the-storm” zone. This is not the time to chase moves or overleverage. Let the market confirm direction and trade based on structure, not emotion.

💬 Are you leaning bullish or bearish on BTC’s next move? Will we see 90k or a drop back to 75k? Share your thoughts below! 👇👇👇

Cfdtrading

GOLD MARKET UPDATE – Trend Breakouts and Market Structure Shift🟡 GOLD MARKET UPDATE – Trend Breakouts and Market Structure Shift

Gold has broken through both the parallel ascending channel and a narrow triangle pattern at the edges, resulting in a strong buying momentum (FOMO BUY). This move can be attributed to a mild positive shift in the US stock market yesterday, along with some upward momentum in the Asian and European markets today.

📉 Current Situation: It’s still unclear whether this movement is tied to positive news about tariffs, but an important level to watch is 3075 – 3077. If this level is breached, it may be time to reassess the outlook and consider shifting towards a BUY.

💡 Currently, there’s strong buying activity during the European session. It’s recommended to avoid jumping into BUY positions at these levels and to refrain from selling too aggressively.

📌 Scenario for Today: Look for potential BUY opportunities at the important levels 3030 – 3018 during the European session, and stay tuned for updates regarding FOMC tonight.

🔮 Be Cautious: The FOMC meeting will take place later today, which could lead to significant market movements. Be prepared for potential volatility and liquidity sweeps in less liquid areas.

🧭 Key Technical Levels:

🔺 Resistance: 3075 – 3090 – 3110

🔻 Support: 3030 – 3018 – 3000 – 2988 – 2974

🎯 Trade Setup:

🔴 SELL ZONE: 3074 – 3076

SL: 3080

TP: 3070 – 3066 – 3062 – 3058 – 3054 – 3050 – 3040

🟢 BUY ZONE: 2976 – 2974

SL: 2970

TP: 2980 – 2984 – 2988 – 2992 – 2996 – 3000

📌 Reminder: The market is currently very sensitive, so stick to risk management rules, ensure full TP/SL implementation, and avoid making hasty decisions.

Be cautious and watch the market movements closely!

— AD | Money Market Flow

GOLD MARKET OUTLOOK – Investor Panic After Fake News🟡 GOLD MARKET OUTLOOK – Investor Panic After Fake News, Bearish Bias Remains

📉 Current Strategy: Focus on SELL setups at key resistance zones – short-term bearish outlook remains valid

📌 US Session Recap:

Gold saw a sharp sell-off after a fake news report circulated about the US delaying its planned tariff policy.

→ While the White House later confirmed it was misinformation, the damage was done — panic selling hit across global markets.

💥 As a result, gold dropped aggressively and reached the 295x zone, aligning perfectly with AD’s previous short bias.

Meanwhile, US equities also continued to bleed red.

🧠 Market Sentiment: “Cash is King” is Back

With global instability and fear on the rise:

🔹 Investors are hoarding cash

🔹 USD demand increases, along with inflows into US government bonds

🔹 Risk assets like gold, stocks, and crypto are being dumped

💡 This could be part of Trump’s larger play — forcing global capital to flow back into US Treasuries while applying pressure on speculative markets.

🔮 AD’s View:

Unless we see a clear shift in investor sentiment, the base case remains: → Sell rallies through midweek, then reassess.

🧭 Key Technical Zones to Watch:

🔺 Resistance: 3005 – 3016 – 3035 – 3056 – 3076

🔻 Support: 2980 – 2969 – 2956 – 2930 – 2912

🎯 TRADE PLAN:

🟢 BUY ZONE: 2930 – 2928

SL: 2924

TP: 2934 – 2938 – 2942 – 2946 – 2950

🔴 SELL ZONE: 3034 – 3036

SL: 3040

TP: 3030 – 3026 – 3022 – 3018 – 3014 – 3010 – ???

📌 Keep an Eye on DXY:

The US Dollar Index is currently testing a major 3-year support level.

→ If equities fail to recover and fear persists, DXY could bounce — and gold would likely continue its correction lower.

⚠️ Final Note:

We’re in a highly volatile and uncertain environment.

→ Stick to the plan. Respect your SL/TP levels. Avoid emotional decisions.

—

📣 Found this perspective useful? Follow for daily macro-backed trade ideas and real-time market structure breakdowns.

Clarity. Consistency. Risk Management.

— AD | Money Market Flow

GOLD WEEKLY OPEN – Sentiment-Driven Marke🟡 GOLD WEEKLY OPEN – Sentiment-Driven Market as Asian Sellers Hit Early

Gold kicked off the new week with a sharp drop during the early Asian session, falling over 40 points from last week’s highs into the 297x zone — a move that reflects lingering sell-side pressure from last Friday’s close.

However, price quickly rebounded nearly 40 points, showing clear buy-side interest at the 297x zone — which acts as a key structural support on the H4 and D1 timeframes.

📌 If price breaks below this level convincingly, it could trigger a deeper move toward 295x.

🔍 Technical Breakdown:

The overall structure on H4 and D1 remains bullish

But right now, investor sentiment is leading, not just technicals

On H1 and H2, price is reacting to the 0.5 Fibonacci retracement zone

If gold closes below 3030, we could see another leg down into the 295x area

🧠 Sentiment Is In Control (For Now)

So far, only Asia and Australia have shown their hand

We’re waiting on London and New York to step in before confirming trend direction

With price whipping around inside a broad range — only trade from key zones with clear price reaction

🧭 Key Technical Zones:

🔺 Resistance:

3055 – 3076 – 3107

🔻 Support:

3024 – 3005 – 2970 – 2952

🎯 Trading Plan:

🟢 BUY ZONE: 2980 – 2978

SL: 2974

TP: 2984 – 2988 – 2992 – 2996 – 3000

🔴 SELL ZONE: 3076 – 3078

SL: 3082

TP: 3072 – 3068 – 3064 – 3060 – 3056 – 3050

📅 What To Watch This Week:

This week brings major market movers:

CPI → PPI → Fed speakers — all lined up midweek.

→ Be selective with your trades and keep tight risk control.

AD will continue updating intraday zones across sessions.

✅ Trade smart. Respect your risk. Let the market come to you.

— AD | Money Market Flow

IS THE GLOBAL “BIG SHORT” ON ITS WAY?TRADE WAR WARNING – IS THE GLOBAL “BIG SHORT” ON ITS WAY?

In the last 24 hours, global financial markets were rattled after Donald Trump unveiled a sweeping set of new global tariffs. This wasn’t just a political move — it may well mark the beginning of a new wave of global economic instability.

Markets across the board took a hit:

📉 US, European, and Asian equities

📉 Gold (XAU/USD), the US Dollar Index (DXY), and even crypto — all plunged into the red.

🔍 So, What Actually Happened?

Gold dropped by over 100 points in a single session — and strangely, the US dollar also fell.

Normally, a weaker USD would support gold. So why did gold sell off this time?

➡️ One likely explanation is that institutional investors sold gold positions to cover losses in equity markets, or to free up margin amidst the chaos.

📉 This wasn’t just a correction — it might be the early signal of a global BIG SHORT forming across multiple asset classes.

🧨 The Start of Something Bigger?

Markets aren’t just reacting to tariffs. They’re pricing in the risk of a full-scale trade war, which could disrupt global supply chains and hammer corporate earnings.

Industries like construction, healthcare, logistics, and manufacturing are already showing signs of strain.

If this escalates, we could be looking at something far more serious than a short-term sell-off.

📉 The Data Doesn’t Look Great Either

While inflation in the US continues to cool, other key data points are deteriorating:

ISM Services PMI (March): 50.8 (vs 53.0 expected)

Employment sub-index: 46.2 (down sharply from 53.9)

New orders, export orders and backlogs also fell

👉 These are real signs of economic slowdown, especially considering that services make up over 70% of the US economy.

🧠 Market Sentiment: FOMO, Fear, and Panic

At the moment, it’s hard to ignore how unsettled sentiment has become.

Retail and institutional traders alike are acting on fear. And that’s dangerous.

🔔 Tonight’s Non-Farm Payrolls (NFP) report could either calm things down — or add more fuel to the fire.

🏦 Will the Fed Cut Rates Sooner?

Markets are rapidly shifting their expectations:

A rate cut could come as early as May or June 2025

Traders are now pricing in 2 to 4 cuts this year (previously just 2)

There’s now a strong chance the Fed pivots earlier than expected

If jobs data continues to soften, the Fed may have no choice but to act faster — despite core inflation not yet fully under control.

⚠️ Trading Strategy: Observation Over Action

Right now, your best position might be… no position.

"Sometimes, the most profitable trade is the one you don’t take."

This isn’t the time to chase wild price action.

It’s the time to prepare and plan with logic — not emotion.

📊 Key Technical Levels on XAU/USD

🔺 Resistance:

3110 – 3119 – 3136 – 3148 – 3167

🔻 Support:

3086 – 3075 – 3055 – 3040 – 3024

🟢 BUY ZONE: 3056 – 3054

SL: 3050

TP: 3060 – 3064 – 3068 – 3072 – 3076 – 3080

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

💬 Final Thoughts

The combination of tariffs, recession fears, and rate cut speculation is building into what could become a perfect storm.

Gold is in the eye of that storm.

Now is not the time to panic — but to trade with clarity and control.

📌 Don’t let emotion drive your trades.

Stick to the chart. Stick to your plan. Protect your capital.

🧠 Patience is what separates the lucky from the consistently profitable.

GOLD TRADING PLAN – After Breaking ATH & Sharp CorrectionGOLD TRADING PLAN – After Breaking ATH & Sharp Correction

🔥 Former U.S. President Donald Trump has officially announced a comprehensive global tariff policy, targeting multiple countries and regions. This sparked:

📉 A major sell-off in risk assets

💵 A sharp weakening in the U.S. Dollar

🪙 A strong rally in gold, reaching a new All-Time High (ATH) at 3167 as a preferred safe-haven asset

📉 Latest Market Reaction – Gold Corrects from ATH

After a strong bullish breakout, gold is now pulling back from its peak, driven by profit-taking and investor caution ahead of key economic data — including the upcoming Nonfarm Payrolls (NFP) report.

Despite the short-term pullback, the overall trend remains bullish on higher timeframes.

📐 Technical Overview

Yesterday, we identified and traded a symmetrical triangle pattern, which broke out sharply as expected. Now, price is retesting previous breakout zones — where new long opportunities may form.

📌 Focus on BUY setups during the Asian & EU sessions, and be cautious during the U.S. session due to expected volatility.

🔍 Key Technical Levels

🔺 Resistance Levels:

3167 (ATH) – 3175 – 3185 – 3198 – 3206

📝 (These are psychological levels & Fibonacci extensions. Wait for clear candle confirmation before entering.)

🔻 Support Levels:

3140 – 3132 – 3120 – 3112 – 3106 – 3100

🛒 TRADE PLAN

🟢 BUY ZONE: 3112 – 3110

🛑 Stop Loss: 3106

🎯 Take Profits: 3116 – 3120 – 3124 – 3128 – 3132 – 3136 – 3140

🔴 SELL ZONE: 3167 – 3169

🛑 Stop Loss: 3173

🎯 Take Profits: 3162 – 3158 – 3154 – 3150

⚠️ Final Notes

📈 The uptrend is still in play — no need to FOMO sell near the highs.

⏳ Be patient, wait for price to react at key support/resistance zones.

🚫 Avoid overtrading or rushing into trades — tariff news has major global impact.

📅 Stay sharp ahead of Friday’s NFP release — we'll reassess trend direction after the data.

✅ Stick to your risk management: follow your TP/SL strictly.

Wishing you safe & profitable trades! 💼📊

ADP in Focus: Will Strong Jobs Data Trigger Gold Pullback?🟡 GOLD MARKET BRIEF – Early Asian Surge Meets Resistance Ahead of Key US Jobs Data

Gold kicked off the day with a sharp rally during the Asian session, driven by consistent demand from Asian and Middle Eastern investors — a pattern we’ve seen forming repeatedly during early sessions lately.

However, price reacted swiftly at the 3130–3135 resistance zone, exactly as mapped out in yesterday’s trading plan. With sellers stepping in again, my outlook remains:

🔻 Look for reaction-based SELL opportunities in the Asian and London sessions, especially if price pulls back into key resistance.

📉 Technical Outlook:

Gold is approaching the apex of a symmetrical triangle pattern, suggesting a breakout is imminent.

✅ As always: Wait for the breakout — then trade the retest in the confirmed direction.

📰 Fundamental Focus:

All eyes today will be on the US ADP Non-Farm Employment report, which tends to offer early clues ahead of Friday’s NFP.

Should the data come in stronger than expected, USD could gain traction — likely applying downward pressure on Gold, in line with our target zone around 308x–307x.

🧭 Key Technical Levels:

🔺 Resistance: 3128 – 3135 – 3142 – 3148

🔻 Support: 3110 – 3100 – 3080 – 3070

🎯 Trade Plan:

🟢 BUY ZONE: 3102 – 3100

SL: 3096

TP: 3106 – 3110 – 3114 – 3118 – 3122 – 3126 – 3130

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

📌 Caution: With ADP on deck during the US session, expect a spike in volatility.

Stick to clear levels, protect capital, and trade with discipline — not emotion.

Let the market come to you.

— AD | Money Market Flow

Gold Eyes Fresh Highs Amid Geopolitical Tensions🟡 Gold Eyes Fresh Highs Amid Geopolitical Tensions & Quarter-End Volatility

Gold started April with a strong bullish gap, reaching another all-time high during the Asian session. Price is now trading near the upper bound of a multi-day structure, supported by ongoing geopolitical risks, macro uncertainty, and flight-to-safety flows.

European and UK traders should remain cautious today, as end-of-month volatility may lead to fake breakouts, stop hunts, and liquidity grabs – especially ahead of key U.S. economic data later this week.

🧠 Market Context:

Risk sentiment remains fragile as global equities faced pressure overnight.

Safe haven demand is elevated following weekend headlines tied to geopolitical conflict and natural disaster risks in Asia.

Traders are also watching the market’s reaction to Trump’s softened tone on tariffs — potentially shifting macro flows in risk assets.

🔍 Technical Outlook:

Price action remains bullish overall, but the pair is extended at current levels.

Expect high volatility today as monthly candles close — with a chance of both upside wicks and liquidation dips.

Scalping or reacting at well-defined zones is preferred over chasing.

🧭 Key Technical Levels:

🔺 Resistance: 3158 – 3166 – 3172 – 3180

🔻 Support: 3133 – 3122 – 3111 – 3100

🎯 Trading Plan:

🟢 BUY ZONE: 3122 – 3120

SL: 3116

TP: 3126 – 3130 – 3134 – 3138 – 3142 – 3146 – 3150

🔴 SELL ZONE: 3170 – 3172

SL: 3176

TP: 3166 – 3162 – 3158 – 3152 – 3148 – 3144 – 3140

⚠️ Final Note:

Today’s session could be chaotic with month-end flows and low liquidity pockets.

Stick to clean setups. Wait for confirmation. Always use SL/TP.

📌 If you found this plan helpful, like & follow for daily setups and institutional-level insights.

📊 Trade with structure, manage your risk, and let the market come to you.

Silver Approaching ATH – Major Breakout Incoming?Silver is showing a strong bullish structure on the weekly timeframe. The price has been consistently forming Higher Highs (HH) and Higher Lows (HL), respecting a long-term ascending trendline that’s acting as dynamic support. This trendline has held multiple pullbacks, confirming strong underlying demand.

Currently, Silver is approaching its All-Time High (ATH) resistance near $34.83 while testing the upper resistance trendline of an ascending channel. A clean breakout above this level could trigger a major rally, potentially setting a new ATH. If the price faces rejection, a healthy pullback toward the support zone around $30 could offer another long-entry opportunity.

The structure remains bullish as long as Silver holds above the trendline support. A successful breakout above $34.83 could lead to a strong bullish continuation.

Still DYOR, NFA

Found this analysis helpful? Don’t forget to like, drop a comment, and follow us for more insights. Thanks for the love!

GDP Data in Focus – Gold Traders Prepare for Volatility⚠️ GDP Data in Focus – Gold Traders Prepare for Volatility

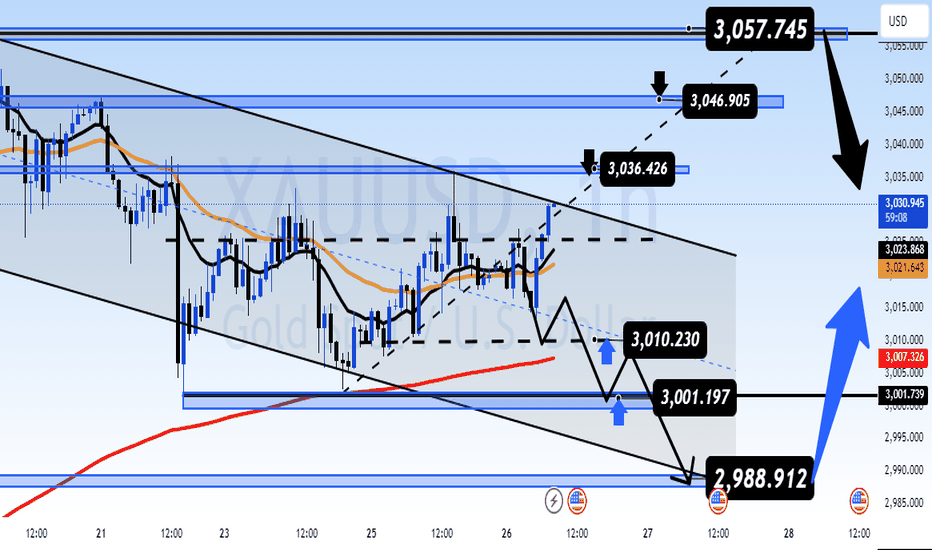

🟡 Market Brief – 27/03/2025

📰 Trump’s Latest Tariff Remarks Leave Markets Unshaken

Earlier this morning (end of US session), Donald Trump made new comments on tariff policy.

However, unlike previous occasions, his speech did not trigger significant market volatility.

He stated:

“Reciprocal tariffs will be eased, broadly applied to all countries, but not harshly.”

🔹 A 25% import tariff on cars will take effect from April 2

🔹 No additional tariffs for now on semiconductors or pharmaceuticals

→ It appears the market had already priced in this announcement, resulting in a muted reaction.

📊 Today’s Spotlight – Final US GDP (q/q)

This is the broadest measure of inflation, reflecting price changes for all goods and services included in GDP.

Given the weakness in recent US inflation indicators (CPI & PPI),

AD anticipates today’s GDP may also come in weaker than expected.

⚠️ However, market reaction might remain limited (≈30 pts),

as Core PCE data tomorrow is expected to be the true driver of weekly volatility.

🟡 Gold Strategy – Intraday Setup

Gold may retest resistance levels or recent highs,

before a potential strong move to the downside – the BIG SHORT scenario AD has been tracking.

📌 Plan for Today:

Look for intraday BUY opportunities during the Asian and European sessions,

especially near key support levels marked on the chart.

🧭 Key Technical Levels:

🔻 Support: 3019 – 3011 – 3002 – 2988

🔺 Resistance: 3036 – 3046 – 3056

🎯 Trade Zones – 27/03:

🟢 BUY ZONE: 3002 – 3000

SL: 2996

TPs: 3006 – 3010 – 3014 – 3018 – 3022 – 3026 – 3030

🔴 SELL ZONE: 3055 – 3057

SL: 3061

TPs: 3051 – 3047 – 3042 – 3038 – 3034 – 3030

🧠 Final Note:

This week’s volatility hinges on two major macro releases:

✅ Today’s Final GDP report

✅ Tomorrow’s Core PCE data

→ During Asia & London sessions: respect the levels and trade reactively

→ For New York session: stay alert — AD will update instantly if needed

Good luck, trade safe, and stay disciplined.

— AD | Money Market Flow

Gold Outlook – Steady Range Before Key Data Hits🟡 Market Context:

Gold has been trading in a steady range since the start of the week, with no significant breakout or momentum shift observed.

Today’s session is expected to remain quiet, as there are no major economic events scheduled.

All eyes are on the Thursday GDP release and Friday’s PCE inflation data from the US — both of which are likely to determine the direction for gold into the end of the month and quarter.

📆 Key Data to Watch:

Thursday: US Quarterly GDP

Friday: US PCE Price Index (Federal Reserve’s preferred inflation gauge)

These events are considered high-impact catalysts that may trigger sharp moves in gold, especially if surprises occur.

🔍 Technical Structure:

Price continues to respect key support and resistance zones identified earlier this week.

There is no confirmed breakout yet, so the strategy remains range-based:

➡️ Trade the levels. Watch for reaction signals at extremes.

➡️ Wait for clearer momentum following the macro releases.

🧭 Key Price Levels:

🔺 Resistance: 3,010 – 3,036 – 3,046 – 3,057

🔻 Support: 3,010 – 3,001 – 2,988

🎯 Trade Plan – 26/03

BUY ZONE: 2988 – 2986

SL: 2982

TP: 2992 – 2996 – 3000 – 3004 – 3008 – 3015

SELL ZONE: 3045 – 3047

SL: 3051

TP: 3042 – 3038 – 3034 – 3030 – 3026 – 3020

🧠 Final Notes:

The market remains in accumulation mode ahead of key US data.

No need to rush — protect your capital, wait for clean setups, and let the market reveal its hand.

— AD | Money Market Flow

What Are Financial Derivatives and How to Trade Them?What Are Financial Derivatives and How to Trade Them?

Financial derivatives are powerful instruments used by traders to speculate on market movements or manage risk. From futures to CFDs, derivatives offer potential opportunities across global markets. This article examines “What is a derivative in finance?”, delving into the main types of derivatives, how they function, and key considerations for traders.

What Are Derivatives?

A financial derivative is a contract with its value tied to the performance of an underlying asset. These assets can include stocks, commodities, currencies, ETFs, or market indices. Instead of buying the asset itself, traders and investors use derivatives to speculate on price movements or manage financial risk.

Fundamentally, derivatives are contracts made between two parties. They allow one side to take advantage of changes in the asset's price, whether it rises or falls. For example, a futures contract locks in a price for buying or selling an asset on a specific date, while a contract for difference (CFD) helps traders speculate on the price of an asset without owning it.

The flexibility of derivatives is what makes them valuable. They can hedge against potential losses, potentially amplify returns through leverage, or provide access to otherwise difficult-to-trade markets. Derivatives are traded either on regulated exchanges or through over-the-counter (OTC) markets, each with distinct benefits and risks.

Leverage is a very common feature in derivative trading, enabling traders to control larger positions with less capital. However, it’s worth remembering that while this amplifies potential returns, it equally increases the risk of losses.

These instruments play a pivotal role in modern finance, offering tools to navigate market volatility or target specific investment goals. However, their complexity means they require careful understanding and strategic use to potentially avoid unintended risks.

Key Types of Financial Derivatives

There are various types of derivatives, each tailored to different trading strategies and financial needs. Understanding the main type of derivative can help traders navigate their unique features and applications. Below are the most common examples of derivatives:

Futures Contracts

Futures involve a contract to buy or sell an asset at a set price on a specific future date. These contracts are standardised and traded on exchanges, making them transparent and widely accessible. Futures are commonly used in commodities markets—like oil or wheat—but also extend to indices and currencies. Traders commonly utilise this type of derivative to potentially manage risks associated with price fluctuations or to speculate on potential market movements.

Forward Contracts

A forward contract is a financial agreement in which two parties commit to buying or selling an asset at a predetermined price on a specified future date. Unlike standardised futures contracts, forward contracts are customizable and traded privately, typically over-the-counter (OTC). These contracts are commonly used for hedging or speculating on price movements of assets such as commodities, currencies, or financial instruments.

Swaps

Swaps are customised contracts, typically traded over-the-counter (OTC). The most common types are interest rate swaps, where two parties agree to exchange streams of interest payments based on a specified notional amount over a set period, and currency swaps, which involve the exchange of principal and interest payments in different currencies. Swaps are primarily used by institutions to manage long-term exposure to interest rates or currency risks.

Contracts for Difference (CFDs)

CFDs allow traders to speculate on price changes of an underlying asset. They are flexible, covering a wide range of markets such as shares, commodities, and indices. CFDs are particularly attractive as they allow traders to speculate on rising and falling prices of an asset without owning it. Moreover, CFDs provide potential opportunities for short-term trading, which may be unavailable with other financial instruments.

Trading Derivatives: Mechanisms and Strategies

Trading derivatives revolves around two primary methods: exchange-traded and over-the-counter (OTC) markets. Each offers potential opportunities for traders, depending on their goals and risk tolerance.

Exchange-Traded Derivatives

These derivatives, like futures, are standardised and traded on regulated exchanges such as the Chicago Mercantile Exchange (CME). Standardisation ensures transparency, making it potentially easier for traders to open buy or sell positions. For example, a trader might use futures contracts to hedge against potential price movements in commodities or indices.

Over-the-Counter (OTC) Derivatives

OTC derivatives, including swaps and forwards and contracts for difference, are negotiated directly between two parties. These contracts are highly customisable but may carry more counterparty risk, as they aren't cleared through a central exchange. Institutions often use OTC derivatives for tailored solutions, such as managing interest rate fluctuations.

Strategies for Trading Derivatives

Traders typically employ derivatives for speculation or hedging. Speculation involves taking positions based on anticipated market movements, such as buying a CFD if prices are expected to rise. Hedging, on the other hand, can potentially mitigate losses in an existing portfolio by offsetting potential risks, like using currency swaps to protect against foreign exchange volatility.

Risk management plays a crucial role when trading derivatives. Understanding the underlying asset, monitoring market conditions, and using appropriate position sizes are vital to navigating their complexity.

CFD Trading

Contracts for Difference (CFDs) are among the most accessible derivative products for retail traders. They allow for speculation on price movements across a wide range of markets, including stocks, commodities, currencies, and indices, without owning the underlying asset. This flexibility makes CFDs an appealing option for individuals looking to diversify their strategies and explore global markets.

How CFDs Work

CFDs represent an agreement between the trader and the broker to exchange the difference in an asset's price between the opening and closing of a trade. If the price moves in the trader’s favour, the broker pays the difference; if it moves against them, the trader covers the loss. This structure is straightforward, allowing retail traders to trade in both rising and falling markets.

Why Retail Traders Use CFDs

Retail traders often gravitate towards CFDs due to their accessibility and unique features. CFDs allow leverage trading. By depositing a smaller margin, traders can gain exposure to much larger positions, potentially amplifying returns. However, you should remember that this comes with heightened risk, as losses are also magnified.

Markets and Opportunities

CFDs offer exposure to an extensive range of markets, including stocks, forex pairs, commodities, and popular indices like the S&P 500. Retail traders particularly appreciate the ability to trade these markets with minimal upfront capital, as well as the availability of 24/5 trading for many instruments. CFDs also enable traders to access international markets they might otherwise find difficult to trade, such as Asian or European indices.

Traders can explore a variety of CFDs with FXOpen.

Considerations for CFD Trading

While CFDs offer potential opportunities, traders must approach them cautiously. Leverage and high market volatility can lead to significant losses. Effective risk management in derivatives, meaning using stop-loss orders or limiting position sizes, can help traders potentially navigate these risks. Additionally, costs like spreads, commissions, and overnight fees can add up, so understanding the total cost structure is crucial.

Key Considerations When Trading Derivatives

Trading derivatives requires careful analysis and a clear understanding of the associated risks and potential opportunities.

Understanding the Underlying Asset

The value of a derivative depends entirely on its underlying asset, whether it’s a stock, commodity, currency, or index. Analysing the asset’s price behaviour, market trends, and potential volatility is crucial to identifying potential opportunities and risks.

Choosing the Right Derivative Product

Different derivatives serve different purposes. Futures might suit traders looking for exposure to commodities or indices, while CFDs provide accessible and potential opportunities for those seeking short-term price movements. Matching the derivative to your strategy is vital.

Managing Risk Effectively

Risk management plays a significant role in trading derivatives. Leverage can amplify both returns and losses, so traders often set clear limits on position sizes and overall exposure. Stop-loss orders and diversification are common ways to potentially reduce the impact of adverse market moves.

Understanding Costs

Trading derivatives involves costs like spreads, commissions, and potential overnight financing fees. These can eat into potential returns, especially for high-frequency or leveraged trades. A clear understanding of these expenses may help traders evaluate the effectiveness of their strategies.

Monitoring Market Conditions

Derivatives are sensitive to their underlying market changes, from geopolitical events to macroeconomic data. In stock derivatives, this might be company earning reports or sudden shifts in management. Staying informed helps traders adapt to shifting conditions and avoid being caught off guard by sudden price swings.

The Bottom Line

Financial derivatives are versatile tools for trading and hedging, offering potential opportunities to access global markets and diversify strategies. While their complexity demands a solid understanding, they can unlock significant potential for informed traders. Ready to explore derivatives trading? Open an FXOpen account today to trade CFDs on more than 700 assets with competitive costs, fast execution, and advanced trading tools. Good luck!

FAQ

What Is a Derivative?

The derivatives definition refers to a financial contract whose value is based on the performance of an underlying asset, such as stocks, commodities, currencies, or indices. Derivatives are financial instruments used to hedge risk, speculate on price movements, or access specific markets. Examples include futures, forwards, swaps, and contracts for difference (CFDs).

What Are the 4 Main Derivatives?

The primary categories of derivatives are futures, forwards, swaps, and contracts for difference (CFDs). Futures are commonly traded on exchanges, while forwards, swaps and CFDs are usually traded over-the-counter (OTC). Each serves different purposes, from risk management to speculative trading.

What Is the Derivatives Market?

The derivatives market is where financial derivatives are bought and sold. It includes regulated exchanges, like the Chicago Mercantile Exchange, and OTC markets where customised contracts are negotiated directly between parties. This market supports hedging, speculation, and risk transfer across global financial systems.

What Is the Difference Between Derivatives and Equities?

Equities signify ownership in a company, typically in the form of stock shares. Derivatives, on the other hand, are contracts that derive their value from the performance of an underlying asset, which can include equities. Unlike equities, derivatives do not confer ownership.

Is an ETF a Derivative?

No, an exchange-traded fund (ETF) is not a derivative. It is a fund that tracks a basket of assets, such as stocks or bonds, and trades like a stock. However, ETFs can use derivatives, such as futures, to achieve their investment objectives.

Is the S&P 500 a Derivative?

No, the S&P 500 is not a derivative. It is a stock market index that tracks the performance of 500 large companies listed in the US. Derivatives, like futures, can be created based on the S&P 500’s performance.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Trading CFDs on Stocks vs ETFs: Differences and AdvantagesTrading CFDs on Stocks vs ETFs: Differences and Advantages

Many traders wonder whether it’s worth trading ETFs vs stocks. The truth is that they both offer distinct advantages depending on your strategy. Whether you're drawn to the diversification of ETFs or the high volatility of individual stocks, understanding their differences is key. This article breaks down the difference between stocks and ETFs and the advantages of each.

What Are ETFs vs Stocks?

Although you are well aware of what stocks and ETFs are, let us give a quick overview. ETFs, or exchange-traded funds, are collections of assets like stocks, bonds, or commodities bundled into a single security. Instead of buying individual assets, traders gain exposure to an entire market segment or strategy by trading ETFs. For example, SPY tracks the S&P 500, providing access to 500 major companies in one trade. ETFs are traded on exchanges like stocks, with prices fluctuating throughout the day based on supply and demand.

Stocks, by contrast, signify direct ownership in a particular company. When trading stocks, you’re focusing on the performance of that single entity, whether it’s a household name like Tesla (TSLA) or an emerging small-cap company. In comparing stocks vs an ETF, stocks are often more volatile than ETFs, creating opportunities for traders to capture sharp price movements.

In this article, we will talk about CFDs on ETFs and stocks. Contracts for Difference (CFDs) allow traders to speculate on the rising and falling prices of an asset without owning it. To explore a world of stocks and ETFs, head over to FXOpen.

Key Differences Between ETFs and Stocks

Understanding the distinctions between an ETF vs stocks is essential for traders aiming to refine their strategies. While both are popular instruments, they behave differently in the market and suit different trading approaches. Let’s break it down.

1. Composition

The primary difference between an ETF and a stock is its makeup. ETFs are baskets of assets like stocks, bonds, or commodities, offering built-in diversification. For example, the Invesco QQQ ETF holds top Nasdaq-listed companies like Apple, Microsoft, and Tesla. Stocks, however, represent a single company. Trading a stock like Amazon (AMZN) means your potential returns depend solely on its performance, while ETFs spread risk across multiple assets.

2. Volatility

Stocks are generally more volatile. A single earnings miss or CEO resignation can send a stock’s price soaring or crashing. ETFs, because they pool multiple assets, experience smaller swings. For instance, SPY’s price tends to move more steadily than a volatile stock like Tesla, making ETFs potentially easier to analyse for certain trading strategies.

3. Liquidity and Trading Volume

Liquidity varies significantly. ETFs tracking major indices like SPY are considered liquid instruments, with high trading volumes. Stocks can be just as liquid, especially large-cap companies, but smaller or niche ETFs and stocks may suffer from lower liquidity and wider spreads or gaps in pricing.

4. Costs

Investing in stocks typically involves just the price of the shares and brokerage fees. ETFs often have expense ratios—annual fees taken from the fund’s value. While these are usually small (e.g., 0.09% for SPY), they’re an added cost traders need to consider.

However, with ETF CFDs, these fees are bypassed, leaving traders with only the broker’s spread and commission to consider. Stock CFDs work similarly, eliminating transaction costs tied to owning the underlying asset.

Advantages of Trading ETFs

Trading ETFs offers unique opportunities that appeal to a range of strategies. Their structure, diversity, and flexibility make them a valuable choice for traders. Here’s what sets them apart:

1. Diversification in a Single Trade

Trading ETFs gives exposure to a group of assets, reducing the risk of being impacted by a single asset's performance. For instance, SPY tracks the S&P 500, spreading risk across 500 companies. This makes ETFs a great way to trade entire sectors or indices without committing to individual assets.

2. Sector or Thematic Focus

ETFs allow traders to target industries, regions, or themes with precision. Whether it's technology through XLK, emerging markets via EEM, or even volatility with UVXY, ETFs open the door to strategies that align with traders’ interests and market views.

3. Lower Volatility

Because ETFs pool assets, they experience less extreme price movements than individual stocks. This steadier behaviour can make them suitable for traders looking to avoid the sharp volatility of single stocks while still taking advantage of price action.

4. Liquidity in Major Funds

Popular ETFs like QQQ and SPY are highly liquid, which may contribute to tighter spreads. Their volume also supports smooth execution for both large and small positions.

5. Accessibility Through CFDs

Many traders prefer ETFs via CFDs, which allow traders to open buy and sell positions without owning the underlying asset. CFDs often provide leverage, giving traders the potential to amplify returns while keeping costs tied to spreads and commissions instead of fund expense ratios (please remember about high risks related to leverage trading).

Advantages of Trading Stocks

Trading stocks offers a direct and focused way to engage with the market. In ETF trading vs stocks, stocks may provide unique opportunities for traders who are drawn to fast-paced action or want to specialise in specific companies or sectors. Here’s what makes trading stocks appealing:

1. High Volatility for Bigger Moves

Stocks often experience significant price swings, creating potential opportunities for traders to capitalise on sharp movements. For example, earnings reports, product launches, or market news can drive stocks like Tesla (TSLA) or Amazon (AMZN) to see dramatic intraday price changes.

2. Targeted Exposure

With stocks, traders can zero in on a single company, sector, or niche. If a trader believes Apple (AAPL) is set to gain due to new product developments, they can focus entirely on that potential without being diluted by other assets in a fund.

3. News Sensitivity

Stocks respond quickly and significantly to news events, providing frequent trading setups. Mergers, management changes, or regulatory updates often result in immediate price movements, making them popular among traders who thrive on analysing market catalysts.

4. Wide Range of Opportunities

The sheer variety of stocks—from large-cap giants to small-cap companies—offers endless opportunities for traders. Whether trading high-profile names like Nvidia (NVDA) or speculative small-caps, there’s something for every trading style and risk tolerance.

5. Leverage with CFDs

Stocks can also be traded via CFDs, allowing traders to take advantage of price movements with smaller initial capital. This opens the door to flexible position sizes and leverage, amplifying potential returns in active trading.

ETFs for Swing Trade and Day Trade

ETFs cater to both swing and day traders with their diverse offerings and high liquidity. Some popular swing trading ETFs and ETFs for day trading strategies include:

ETFs for Swing Trading

- SPY (S&P 500 ETF): Tracks the S&P 500, offering exposure to large-cap US companies with steady trends.

- IWO (Russell 2000 ETF): Focuses on small-cap stocks, which tend to be more volatile, providing swing traders with stronger price movements.

- XLK (Technology Select Sector SPDR): A tech-heavy ETF that moves in response to sector trends, popular for capturing medium-term shifts.

- XLE (Energy Select Sector SPDR): Tracks energy companies, useful for swing traders analysing oil and energy market fluctuations.

Day Trading ETFs:

- QQQ (Invesco Nasdaq-100 ETF): Offers high intraday liquidity and volatility, making it a favourite for fast trades in tech-heavy markets.

- UVXY (ProShares Ultra VIX Short-Term Futures ETF): A volatility ETF that reacts quickly to market fear, providing potential opportunities for rapid price changes.

- XLF (Financial Select Sector SPDR): Tracks financial stocks and has consistent volume for capturing short-term sector-driven moves.

Stocks for Swing Trading and Day Trading

Selecting the right stocks is crucial for effective trading. High liquidity and volatility are key factors that make certain stocks more suitable for swing and day trading. Here are some of the most popular options for both styles:

Stocks for Swing Trading

- Apple Inc. (AAPL): Known for its consistent performance and clear trends.

- Tesla Inc. (TSLA): Exhibits significant price movements, offering potential opportunities to capitalise on medium-term swings.

- NVIDIA Corporation (NVDA): A leader in the semiconductor industry with strong momentum, suitable for capturing sector trends.

- Amazon.com Inc. (AMZN): Provides steady price action, allowing traders to take advantage of consistent movements.

Stocks for Day Trading

- Advanced Micro Devices Inc. (AMD): High daily volume and volatility make it a favourite among day traders.

- Meta Platforms Inc. (META): Offers substantial intraday price swings, presenting potential trading opportunities.

- Microsoft Corporation (MSFT): Combines liquidity with moderate volatility, suitable for quick trades.

- Alphabet Inc. (GOOGL): Provides consistent intraday movements.

How to Choose Between an ETF vs Individual Stocks for Trading

Choosing between stocks and ETFs depends on your trading goals, strategy, and risk appetite. Each offers unique advantages, so understanding their characteristics can help you decide which suits your approach.

- Risk Tolerance: Stocks often come with higher volatility, making them attractive for traders comfortable with sharper price movements. ETFs offer diversification, which can reduce the impact of individual market shocks.

- Trading Strategy: For short-term trades, highly liquid ETFs like QQQ or volatile stocks like TSLA might be considerable. If you're swing trading, ETFs and large-cap stocks may provide steady trends.

- Market Focus: In individual stocks vs ETFs, ETFs give access to broad sectors or indices, popular among traders analysing macro trends. Stocks allow for focused plays on individual companies reacting to earnings or news.

- Time Commitment: Stocks typically require more monitoring due to their rapid price changes. ETFs, especially sector-specific ones, may demand less frequent attention depending on your strategy.

The Bottom Line

ETFs and stocks may offer unique opportunities, whether you're targeting diversification or sharp price movements. By understanding the differences between ETFs versus stocks and aligning them with your strategy, you can take advantage of different trading conditions. Ready to start trading? Open an FXOpen account today to access a wide range of ETF and stock CFDs with trading conditions designed for active traders.

FAQ

What Is an ETF vs a Stock?

ETFs (exchange-traded funds) are collections of assets, such as stocks or bonds, combined into a single tradable unit. They offer built-in diversification, as buying one ETF provides exposure to multiple assets. Stocks, in contrast, signify ownership in an individual company.

Should I Trade the S&P 500 or Individual Stocks?

Trading the S&P 500 (via ETFs like SPY or through index CFDs) provides exposure to the 500 largest US companies, reducing reliance on any single stock. Individual stocks offer higher volatility and opportunities for sharper price movements. Evaluate your strategy and risk tolerance to choose the suitable asset.

ETFs vs Individual Stocks: Which Is Better?

Neither ETFs nor individual stocks are inherently better—it depends on your goals. ETFs offer diversification and potentially lower volatility, making them suitable for broad market exposure. Stocks provide targeted opportunities from individual company performance.

Do ETFs Pay Dividends?

Yes, ETFs often pay dividends when their underlying holdings generate income. These are typically paid out periodically, similar to dividends from individual stocks. However, when trading CFDs, dividends are not paid in the traditional sense, as you do not own the underlying asset. However, adjustments are made to your account to reflect dividend payments.

Can I Sell ETFs Anytime?

ETFs trade on exchanges during market hours, making them highly liquid. Therefore, you can buy or sell ETFs on specific days and hours.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

US30 Update - Continuation building? Thanks for checking out our latest update. Today, we are looking at the US30 daily chart.

After some heavy selling to end 2024, have we started to find a new point of support? If we see further confirmation price-wise with a new break higher and a new higher low, this could line up with a continuation pattern.

We have run over a few scenarios price-wise that we are watching moving forward. The key to the continuation is a hold of 42,260 support.

Will Trump taking office on the 20th have any influence? We will wait and see, but a break of support and trendline could be a warning sellers have further to go.

Happy New Year, good trading from Eightcap.

How to Use Stock Volume in CFD TradingHow to Use Stock Volume in CFD Trading

Volume is one of the fundamental aspects of all markets. If you're wondering, "What does volume mean in the stock market?," you're about to discover how this critical measure of shares traded can unlock deeper insights into market trends and investor behaviour. We delve into how to use stock volume to improve your trading, offering practical approaches for confirming market sentiment, trends, reversals, and more.

What Is Volume in the Stock Market?

The volume in the stock market definition refers to the total number of shares traded during a specific time frame. It's a vital indicator of market activity and investor interest in a particular stock.

High volume often signals strong investor interest and market movement, either upward or downward. Conversely, low volume may indicate decreased interest or uncertainty in a stock. In essence, it provides insights into sentiment, helps confirm trends, and aids in identifying potential reversals or breakouts.

As we walk through the varying insights volume offers stock traders, you may gain the best understanding by applying your knowledge to real-time charts. Head over to FXOpen’s free TickTrader platform to see how volume affects hundreds of unique stocks.

Volume and Market Sentiment

When considering volume in a stock, meaning its traded shares, its relationship with market sentiment becomes pivotal. This sentiment, essentially the collective attitude of traders towards a stock, is often inferred from volume patterns.

At its most basic, high trading activity during a stock's price increase is often seen as a confirmation of positive sentiment, showing trader confidence. Such a scenario often reflects a robust demand overpowering supply.

In contrast, if a stock declines on high volume, this may signal negative sentiment, suggesting a strong selling pressure. This situation typically indicates that investors and traders are actively offloading their shares.

Volume and Price Movement

So, how does volume affect stock prices? Volume acts as a force behind price movements, as discussed.

However, its impact isn't always straightforward. A stock might rise on low volume, which can be a sign of caution, as it may indicate a lack of conviction among traders, potentially making the price rise unsustainable. Similarly, a drop on low volume might not necessarily signify a bearish trend but rather a temporary lack of interest.

Additionally, the number of shares traded can be crucial in identifying a stock’s tops or bottoms. For instance, a sudden spike after a long period of price increase might signal a top, as it could represent a final push by exhausted buyers before a reversal. Similarly, a significant increase in market activity at a low could indicate a bottom.

Identifying Trading Signals with Volume

Learning how to trade volume involves recognising nuanced trading signals that volume fluctuations can offer. Beyond the basic interpretations of high or low volume, traders look for specific patterns or anomalies in activity data to make informed decisions.

One key signal is the volume spike. A sudden increase in trading activity, especially when it deviates notably from the norm, may indicate a significant event or sentiment change. For instance, a volume spike accompanying a breakout from a consolidation pattern might confirm the strength of a new trend, offering a buying opportunity for traders.

Conversely, an unexpected, sustained drop in interest during a steady trend might be a warning sign. This could suggest that the current trend is losing momentum and might be nearing its end, reflecting a potential exit point or even a reversal opportunity.

Another aspect to consider is the trend over time. Gradually increasing volume in a trending market reinforces the trend's validity and vice versa.

Overall, trading volume isn't just about high or low numbers. It's about understanding the context of these changes and how they align with price movements.

Volume Indicators and Tools

When exploring how to use volume in trading, several key indicators and tools stand out. These provide insights into market dynamics, aiding in decision-making:

- On Balance Volume (OBV): OBV totals volume during up periods and subtracts it during down periods. A rising OBV usually suggests bullish trends, while a falling OBV indicates bearish trends. It's used to confirm movements or spot divergences.

- Volume Price Trend (VPT): VPT combines volume and price change to assess the strength of price moves. An increasing VPT usually indicates strong buying pressure, while a decreasing VPT suggests selling pressure.

- Accumulation/Distribution Line: This indicator considers the trading range and the volume. It helps identify whether a stock is being accumulated (bought) or distributed (sold). A rising line usually suggests accumulation, while a falling line indicates distribution.

- Chaikin Money Flow (CMF): CMF combines price and volume to measure buying and selling pressure over a set period. A positive CMF usually demonstrates buying interest, while a negative CMF suggests that sellers are in charge.

Volume as an Indicator of Liquidity

Lastly, volume is a key indicator of liquidity in the stock market. High trading activity reflects that a significant number of shares are being bought and sold, which typically indicates good liquidity. This liquidity may help traders execute trades quickly and at prices close to the market rates, reducing the cost of transactions.

Conversely, low volume signals poor liquidity, where fewer shares are traded. In such scenarios, executing large orders may be challenging without significantly impacting the stock. Such a lack of liquidity can lead to larger bid-ask spreads and potentially less favourable execution prices for traders.

The Bottom Line

As we've journeyed through the intricate world of stock volume, it's clear that understanding volume is more than a skill – it's an essential aspect of savvy trading. From recognising sentiment to navigating various market conditions, volume serves as a powerful tool in your trading arsenal.

To put this knowledge into practice and experience the dynamic world of trading, consider opening an FXOpen account. Once you do, you'll have the opportunity to apply these insights in real-time, potentially enhancing your trading journey with informed decisions driven by volume analysis. Happy trading!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Copper 1D Long – Targeting 0.5-0.6 Fibonacci LevelsCopper is showing signs of a potential bullish move on the daily chart. The setup suggests a possible retracement before a continuation to higher levels. We’re targeting the 0.5 to 0.6 Fibonacci retracement levels, with price targets set between 4.5000 and 4.7000.

Technical Analysis:

• Fibonacci Levels: The 0.5 to 0.6 Fibonacci retracement levels align with previous resistance areas, making them key targets for this move.

• Trendline Breakout: The price has broken through a descending trendline, signaling a potential shift in momentum to the upside.

• Retest Expectation: We might see a retest of the breakout level before the price resumes its upward movement.

Trade Setup:

• Entry: Enter a long position on a potential retest or near the current level, anticipating further upward movement.

• Target: The primary targets are the 4.5000 to 4.7000 range, which aligns with the 0.5-0.6 Fibonacci levels.

• Stop-Loss: Remember, this is a swing trade, so it could take a few days to potentially extend to weeks. It’s important to understand this trading style and adjust your position size accordingly to accommodate the longer timeframe and potential market fluctuations.

This Copper trade leverages a potential shift in trend with clear targets and risk management strategies. Keep an eye on the retest for a better entry, and stay focused on the price action as it develops.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

SPX500: Price discussion pre-US CPI dataToday's focus: SPX500

Pattern – Continuation

Support – 5211

Resistance – 5267

Hi, traders. Thanks for tuning in for today's update. Today, we are looking at SPX500 on its daily chart.

Today, we wonder if the SPX500 can maintain its current bullish bias and possibly test or break all-time highs. Yesterday, buyers fought back after the PPI data, helped by comments from Fed Chair Powell.

Will we see retail sales and US CPI match or drop below data that is mainly expected to come in lower? Will this back up comments that maintained buyer hopes yesterday?

On the other side of the coin, if data comes in higher, could this set off some sharp selling as buyers may find themselves in a bull trap?

It could be an interesting CPI data today.

Good trading.

ITALY 40 Bearish Heist Plan Down SideHola Ola Smart Traders,

This is our master plan to Heist Bearish side of ITALY 40. I have two Targets to heist this market please look at the chart I have mentioned in our heist plan, Our target is Caution Green Zone Target 1 for Day Trade Robbers and Target 2 for swing Trade Robbers. My dear Robbers please book some partial money it will manage our risk. Be safe and be careful and Be rich.

Loot and escape near the target 🎯

support our robbery plan we can make money take money 💰💵 Join your hands with US. Loot Everything in this market everyday with my master Plan.

Gold: Lower high confirming? Today's focus: Gold

Pattern – Lower High swing point

Support – 2290.50 to 2315

Resistance – 2338.40

Hi, traders. Thanks for tuning in for today's update. Today, we are looking at Gold on its daily chart.

Do we have a new swing lower in play after sellers formed a lower high? This could be the case, but we still need some confirmation. In today's video, we have run over our thoughts on the price and possibilities we are looking at.

Currently, the USD does not influence Gold too much, but we have the FOMC and NFP this week. Keep an on these releases.

Good trading.

Gold: Thoughts and AnalysisToday's focus: Gold

Pattern – Correctional phase.

Support –

Resistance – $2394

Hi, traders. Thanks for tuning in for today's update. Today, we are looking at Gold on the daily chart.

We have reviewed recent price actions and our thoughts on what we are seeing and looking for moving forward. Is this just a bout of profit-taking that will kick off a new trend?

The next rally is key for us and could give us signs depending on what we see from price.

Good trading.

Bitcoin: is price set to get cheaper or.....?Today's focus: BTCUSD

Pattern – Range, seller test.

Support – 62,000 area

Resistance – 73,000 area

Hi, traders; thanks for tuning in for today's update. Today, we are looking at BTC on the daily.

With sellers continuing to check buyers, it continues to look like we could see a new move at support. But for now, buyers continue to hold firm from around the 62,000 area.

We have run over a few scenarios. Could we see a move-through support to test the next lower Fibb point? Or will we see support contnue to hold the current range pattern?

Good trading.

Oil: Thoughts and analysis Today's focus: Oil

Pattern – Continuation?

Support – 85.38

Resistance – 87.37

Hi, traders; thanks for tuning in for today's update. Today, we are looking at oil on the daily.

After a surge from the USD caught a lot of attention yesterday, we are watching oil after it rejected a push lower by sellers and continues to hold in a potential continuation type set-up.

Do you think that price is showing signs of a continuation? Could a close above yesterday's high signal a new move higher that could test resistance at 87.37?

Watch out for a new move lower that tests the 85.50 area, as that could be a sign that sellers have more numbers than first thought.

Good trading.

NDQ100 (Nasdaq) Price Breakdown Pre-CPI

Today's focus: Nasdaq

Pattern – Range

Support – 17,832

Resistance – 18,355

Hi, traders; thanks for tuning in for today's update. Today, we are looking at the Nasdaq daily.

Price remains range-bound. Do traders feel today's CPI will be bearish or bullish?

Yesterday, buyers showed some strength, stopping a bear move and reversing losses. Could good news on the CPI and minutes front maintain buyer control?

We have run over the primary levels and are currently holding the price. Depending on what we see from the CPI, could we see a new break that is lower or higher? Traders also have to be aware of false breakouts.

Good trading.