CFX Bulls Eyeing 38% Surge Toward Explosive 0.29 TargetHello✌

Let’s analyze Conflux’s upcoming price potential 📈.

BINANCE:CFXUSDT has shown solid bullish momentum recently, supported by a series of positive fundamental catalysts 📈. Price is now approaching a daily support zone that also aligns with a key Fibonacci retracement level. If this level holds, I’m expecting a potential move of around 38% to the upside, with a mid-term target near 0.29 . Watching closely for price action confirmation around support before considering entry 🚀.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

CFXUSDT

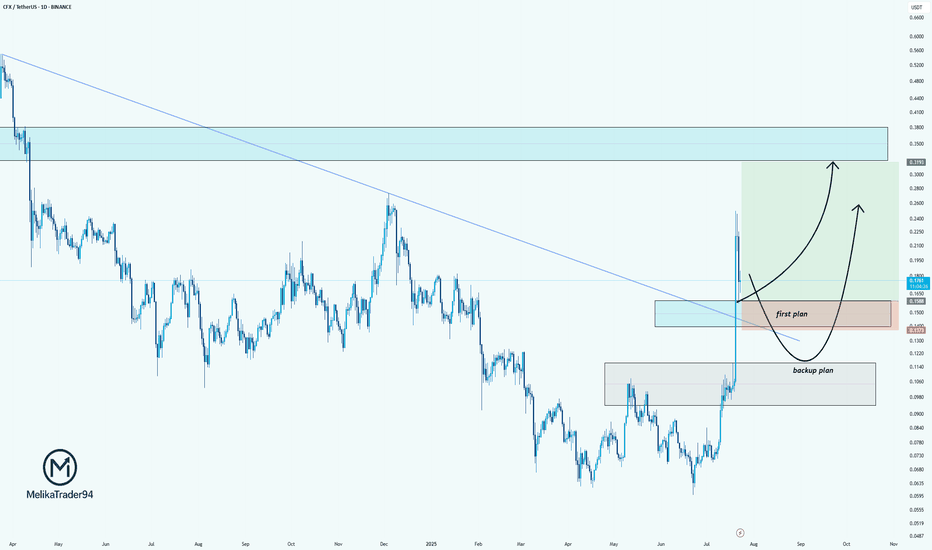

CFX/USDT: Two-Plan Strategy for the Next MoveHello guys.

CFX just broke out of a long-term downtrend line, showing strong bullish momentum. After this sharp impulse, we're now patiently watching for the pullback zone.

Here’s my plan:

✔ First plan: Looking for a reaction around the breakout retest zone (0.1500–0.1300). This is the ideal area for a bullish continuation if buyers step in early.

✔ Backup plan: If the price drops deeper, the second demand zone (around 0.1060–0.0950) is where we’d expect stronger buyer defense.

Potential upside target: 0.31+, where price previously showed strong selling pressure.

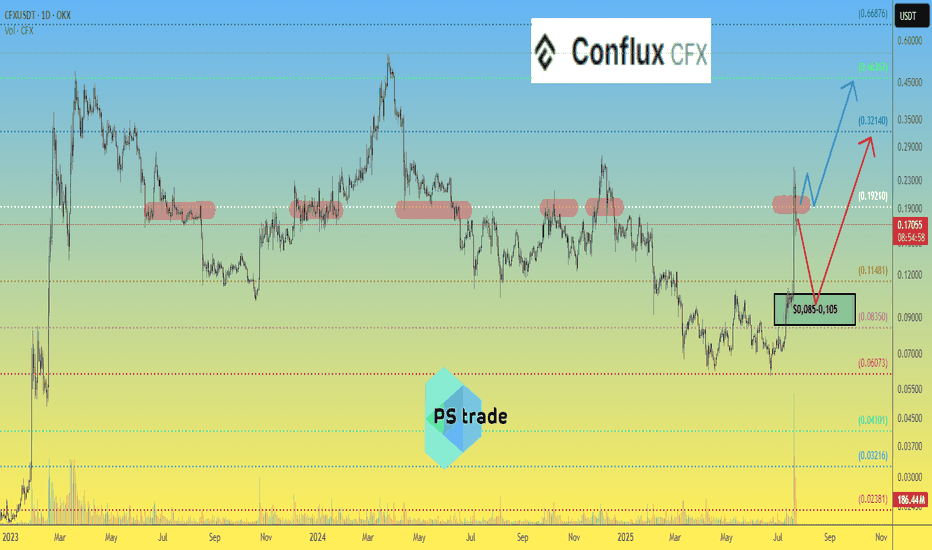

Conflux CFX price analysis Recently, #CFX price shot up very strongly, due to the publication of the news that:

#ConfluxNetwork, China's Tier 1 blockchain, announced the launch of #Conflux 3.0 in August and announced plans to help issue a stablecoin pegged to the offshore yuan as China explores the possibility of issuing yuan stablecoins.

The news already reads as “very vague, promising...” but let's remember that we are talking about China, where crypto has been gradually banned since 2013 and finally banned in 2021.

💰 Looking at the OKX:CFXUSDT chart, we see that the price cannot be fixed above $0.19, which means that you should be careful with longs.

📈 If the words from the news are confirmed by actions, then the #CFX price will definitely consolidate above $0.19 and then it will be safe to open a long position.

🐻 And if the desired cannot be realized, then a correction to the $0.085-0.105 zone may become a new reality.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

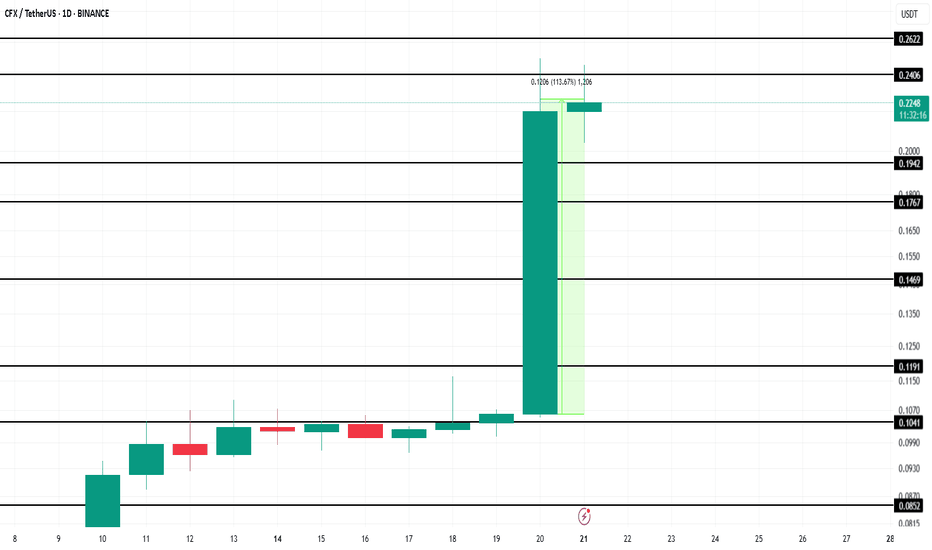

Altcoin To Watch This Week - Conflux (CFX) And Its 113% RiseBINANCE:CFXUSDT has seen a major rally, becoming one of the top-performing altcoins in recent days. Boosted by the recent Conflux Conference in Shanghai, CFX surged 113% in the last 24 hours. The altcoin is now trading at $0.22, drawing investor attention amid heightened momentum and renewed community optimism.

Excitement continues to grow as BINANCE:CFXUSDT gears up for its 3.0 upgrade , scheduled for early August. This major milestone could act as a bullish catalyst. If CFX rebounds from the $0.17 support level, the altcoin may breach $0.24 and potentially rise toward the key psychological mark of $0.30 in the short term.

However, risk remains if investors begin securing profits after the significant gains. A drop below the $0.17 support could drive BINANCE:CFXUSDT lower toward $0.11 . Such a move would reverse current bullish momentum, causing traders to reassess expectations as bearish sentiment overtakes the altcoin’s rally.

CFXUSDT | Sellers Still in ControlI’ve seen this pattern before. CFXUSDT is still under pressure from strong sellers , and nothing has shifted yet to flip the bias.

The red box remains a key resistance. Until that level is clearly broken and turns into support with a proper retest, there’s no reason to look bullish .

If you're patient and wait for structure to shift, you’ll avoid the traps most traders walk into.

“I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break in the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long.”

This is how high win rates are built . Not by guessing, but by reacting to confirmation.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

CFXUSDT Forming Falling WedgeCFXUSDT is showing signs of a strong bullish continuation as it emerges from a falling wedge pattern — a setup often considered a reliable reversal signal in technical analysis. As depicted in the chart, the price has been compressing within the wedge, gradually forming higher lows and now attempting a breakout from the resistance trendline. The recent green candles and growing volume suggest bulls are taking control, setting the stage for an upside move. With momentum building, traders could be looking at a potential 40% to 50% surge if the breakout sustains.

Conflux (CFX) has been gaining attention due to its unique position as a high-throughput, scalable blockchain that facilitates cross-border data and value transfer, particularly between China and the global crypto community. As regulatory clarity improves and Conflux continues to expand its ecosystem through partnerships and integrations, market sentiment has shifted in favor of the project. This renewed investor confidence is visible in the technical structure forming on the CFXUSDT chart, as smart money begins to accumulate.

The breakout target aligns with a previous high, indicating that this could be more than just a short-term rally. If volume continues to support the price action, CFX could rally toward the $0.12–$0.13 zone, which marks a critical resistance area. This creates a favorable risk-reward environment for both swing traders and position holders eyeing medium-term gains. Technical traders should watch for confirmation above the wedge and continuation candles backed by volume to validate the move.

Overall, CFXUSDT looks primed for a strong upward movement, supported by bullish technicals and increasing investor interest in the Conflux network. As the project remains fundamentally strong and gains traction in the Web3 space, this may be an opportunity to capitalize on a promising mid-cap altcoin.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

TradeCityPro | CFXUSDT A Wild Week of Volatility Ahead?👋 Welcome to TradeCityPro Channel!

Let’s dive in and analyze another altcoin in the market, CFX, which is likely to experience a highly volatile week ahead, offering great trading opportunities.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

🕒 Weekly Time Frame

CFX stands out as an older coin with prior bull-run experience. It’s trading above last year’s lows and hasn’t experienced steep declines.

Yesterday, we analyzed this coin briefly, but today, we’ll go into more detail. Unlike most altcoins that began their bullish moves from their lowest levels, CFX has already started its upward trajectory from 0.1219.

Fibonacci analysis shows that 0.1219 aligns with the 50% retracement level—a significant support both in Fibonacci terms and Dow Theory. After forming a range around this level and breaking the 0.1810 trigger, the coin moved toward its first target at 0.2596.

However, we were rejected at 0.2596 and even lost the critical support at 0.1087, dropping to the next support at 0.0647. Currently, it appears we’re pulling back to the key 0.1087 level.

📊 Daily Time Frame

On the daily chart, CFX was in a ranging box, forming higher lows. A breakout above 0.1851 was accompanied by a strong entry candle with buyer momentum, an RSI entry signal, and volume confirmation. Stop-loss was set at the daily low of 0.14.

If you followed this trigger, you’re likely in profit despite the current red daily candle. This correction is healthy, as an uptrend without pullbacks or red candles is often unsustainable.

After breaking the daily box between 0.1046 and 0.1230 and losing its support with an engulfing candle, we experienced a downward move to 0.0647. From there, sellers effectively exited the market, and buyers showed strength. After breaking 0.0823, we formed higher highs and lows. Now, after breaking 0.1046, we can consider buying for spot, with the main trigger being a break of 0.1230.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

CFX/USDT BREAKOUT ALERT

CFX/USDT BREAKOUT ALERT

CFX/USDT has already broken out of the bull flag pattern and is showing bullish momentum. Since a bull flag is typically a continuation pattern, this breakout suggests the potential for further upside.

However, if the price drops back into the flag structure, it could turn out to be a fakeout. Watch closely to see if the breakout holds or fails.

Key point:

Sustained price action above the breakout = bullish confirmation

Drop back inside the flag = potential fakeout

Stay alert and manage risk accordingly.

#CFX/USDT#CFX

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the decline with a break below.

We have a support area at the upper limit of the channel at 0.0815.

Entry price: 0.0815

First target: 0.0788

Second target: 0.0763

Third target: 0.0740

#CFX/USDT#CFX

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.0950

Entry price 0.1000

First target 0.1033

Second target 0.1073

Third target 0.1123

CFX roadmap (3D)By analyzing the complete CFX data, it can be observed that wave C of a larger structure has been completed.

Wave C formed a triangle, and its final wave, wave E, has also been completed.

It is expected to remain bearish in the long term and eventually deliver good returns from the green zone in the future.

A daily candle closing above the invalidation level will invalidate this outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#CFX/USDT #CFX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.1455

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.1500

First target 0.1570

Second target 0.1660

Third target 0.1743

#CFX/USDT#CFX

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.1242

We have an upward trend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.1485

First target 0.1621

Second target 0.1770

Third target 0.1955

CFX Analysis: Potential Breakout After Double Bottom Formatationhello guys!

Double Bottom Formation: The price has established a solid support zone around $0.1504, forming the base of a double bottom pattern. This structure indicates buyer strength and the potential for upward movement.

Target Level: The breakout target is set at $0.1564, which aligns with a previous resistance zone. This level represents the next hurdle for the bulls.

Two Scenarios:

Scenario 1: A direct continuation of the bullish momentum towards the $0.1564 level.

Scenario 2: A pullback to retest the neckline ($0.1504-$0.1510 area) before a potential rally to the target.

Stop Loss Placement: A break below $0.1483 would invalidate the bullish setup, making it a suitable stop-loss level for risk management.

___________________

Strategy:

For Long Positions: Enter on a breakout above $0.1539 with a target of $0.1564. Alternatively, wait for a retest of the neckline before entering.

Risk Management: Place a stop-loss below $0.1483 to limit downside risk.

CFXUSDT: Is the Next Big Pump Brewing in the Blue Box?CFXUSDT Analysis Promising Setup with Volume Increase

CFXUSDT is showing strength with a notable volume spike. This could be a solid opportunity if the price reaches the blue box.

Highlights:

Volume Increase: Strong market activity supports the bullish potential.

Blue Box Entry: I plan to enter near the blue box with a stop below the most recent low.

For Risk-Reward Seekers: Those looking for higher risk-to-reward setups can wait for upward breaks in lower time frames within the blue box for confirmation.

Key Observations:

"The blue box is very carefully picked using volume footprint, volume profile, cumulative delta volume, and liquidity heatmap. When trading this zone, I will look for buyers and upward market structure breaks in lower time frames for confirmation."

This setup has potential, but as always, wait for confirmation before acting. 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🎯 DEXEUSDT %180 Reaction with %9 Stop

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

#CFX Ready For a Massive Move Above Or Not? Key Levels to Watch Yello, Paradisers! Has #Conflux just kicked off its next bullish run or is this a fakeout waiting to trap traders? Let’s dive into the latest move in #CFXUSDT:

💎#CFX has recently broken out above the descending resistance of the broadening wedge—a major technical milestone. This breakout signals potential bullish momentum, with the price now eyeing key resistance zones for confirmation of a sustained move upward.

💎The immediate challenge for #Conflux lies at the $0.26-$0.29 supply wall. A daily candle close above this level would validate the breakout and likely trigger an extended bullish rally. Beyond this, the next target sits at the $0.4500–$0.5500 major resistance zone, where stronger profit-taking and selling pressure are expected.

💎If #CFXUSD manages to conquer the $0.2900 barrier, bullish momentum could carry it toward $0.6500 or even higher, establishing a new trend for long-term traders. Keep an eye on volume—an uptick in buying activity would confirm the strength of this breakout. In case of a pullback, immediate support lies at $0.1720, with a critical demand zone around $0.1356. As long as CFX holds above these levels, the bullish structure remains intact, and any dip into this zone could present an attractive re-entry point for buyers.

💎If #CFX closes below $0.1356, this would invalidate the bullish breakout, signaling potential downside. Such a scenario could drive prices toward $0.1000 or lower, erasing recent gains and catching overleveraged bulls off guard.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

TradeCityPro | CFXUSDT Analysis: Don’t Fear the Red Candles!👋 Welcome to TradeCityPro Channel!

Let’s dive into the first day of the week where we’ve seen red candles and minor corrections. This is a good time to review our coins and prepare our triggers.

🌍 Market Overview

Before analyzing CFX, let’s take a quick look at Bitcoin. It faced a strong rejection at 100,400 and printed a significant red candle. But what should we do in such cases? For now, nothing. The trend remains bullish, and Bitcoin dominance is also correcting.

If Bitcoin’s dominance continues to drop and forms a lower high on the daily timeframe while the market remains bullish, keep an eye on the charts for potential altcoin entries. This scenario could signal the start of a bull run.

🕒 Weekly Time Frame

CFX stands out as an older coin with prior bull-run experience. It’s trading above last year’s lows and hasn’t experienced steep declines.

Yesterday, we analyzed this coin briefly, but today, we’ll go into more detail. Unlike most altcoins that began their bullish moves from their lowest levels, CFX has already started its upward trajectory from 0.1219.

Fibonacci analysis shows that 0.1219 aligns with the 50% retracement level—a significant support both in Fibonacci terms and Dow Theory. After forming a range around this level and breaking the 0.1810 trigger, the coin moved toward its first target at 0.2596.

For further targets, use Fibonacci extensions from the same 0.5 range. Once 0.5171 is broken, potential targets include 0.7385, 1.21, and 2.26.

If you entered at 0.181, holding your position is advised. For re-entry, consider buying after the 0.2596 breakout with a stop-loss at 0.1219. RSI confirmation above 76.18 would also validate the entry.

📊 Daily Time Frame

On the daily chart, CFX was in a ranging box, forming higher lows. A breakout above 0.1851 was accompanied by a strong entry candle with buyer momentum, an RSI entry signal, and volume confirmation. Stop-loss was set at the daily low of 0.14.

If you followed this trigger, you’re likely in profit despite the current red daily candle. This correction is healthy, as an uptrend without pullbacks or red candles is often unsustainable.

For re-entry, consider buying after the 0.2596 breakout with a stop-loss at 0.14. Alternatively, a pullback to 0.1851 with confirmation from a bullish candle could also provide a good entry point.

🕒 4-Hour Time Frame

Let’s discuss how you could have entered positions earlier. After the 0.1905 breakout, a bullish engulfing candle (covering the prior two candles) marked the entry trigger. The stop-loss was set below the previous low, ensuring a secure long position with a good risk-reward ratio.

But would you really use a 14% stop-loss in futures trading? Yes, in volatile conditions like this, a larger stop-loss ensures safety and increases win rates. It’s better to risk 1% with higher win rates than repeatedly hit small stop-losses, which could harm your trading psychology.

📈 Long Position Trigger

wait for the 0.2596 breakout or RSI returning to its range, coupled with momentum confirmation in lower timeframes.

In bullish markets, an RSI recovery from oversold levels and breaking above 30 can also serve as an early long trigger.

📉 Short Position Trigger

For shorts, I still advise against them. For example, shorting the 0.2412 breakdown with a stop-loss at 0.2596 would’ve only offered a 1:1 risk-reward ratio, going against the primary trend.

💡 BTC Pair Insight

Against Bitcoin, CFX has held its 0.00000164 support and found strength. After breaking the 0.00000294 trigger, the coin is expected to deliver its main moves in the USDT pair. If the market remains bullish, CFX could showcase significant upward momentum.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | CFX : Breaking Out of Consolidation👋 Welcome to TradeCityPro!

In this analysis, I’m going to review the CFX coin. After consolidating for a long time within a box between 0.1147 and 0.1903, the price has finally broken the upper boundary of the box and is moving upward.

📅 Daily Timeframe: Multiple Resistances Above the Price

On the daily timeframe, after breaking 0.1903, the price gained strong bullish momentum, and a significant amount of buying volume entered the market. However, upon reaching the first resistance at 0.2572, the price failed to break through and is now consolidating below this level.

✨ The RSI oscillator is exiting the Overbuy zone. If it manages to remain or re-enter the Overbuy zone, the price could continue its upward movement.

📈 In case of a breakout above 0.2572, the next resistances will be 0.3564 and 0.5125. If the price manages to stabilize above these levels, the next target will be 1.0368, which represents the ATH resistance of this coin.

🔽 Correction Scenario

The first support level is at 0.1903, and the next one is at 0.1147, which is the final stronghold for buyers to maintain the price.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️