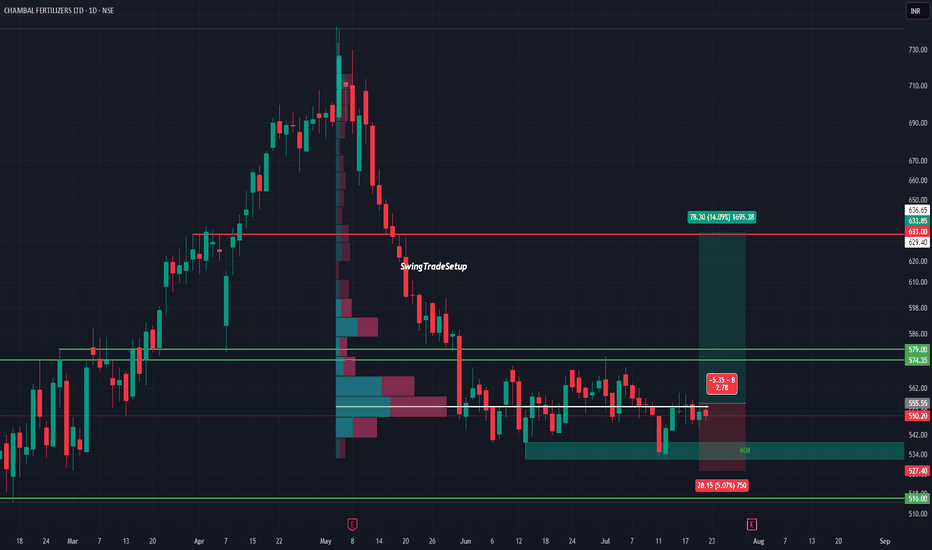

CHAMBAL FERTILISERS LTD – Potential Bottoming Out‽CHAMBAL at Demand Zone | Volumes story

After a steep fall from 730 to 516, Chambal is now consolidating in a critical demand zone backed by visible volume activity. This range has previously triggered price reversals, and now history might repeat.

The stock is respecting the support between 527–516, forming a potential base. On the upside, a clean breakout above ₹555.55 can unlock a near-term target of 633+, a move of over 14%.

The risk-to-reward ratio remains attractive with a tight invalidation below ₹527, while the volume profile suggests accumulation in this range.

Technical View :

• Major support: ₹516–527

• Breakout trigger: ₹555.55

• Upside target: ₹633–636

• Risk below: ₹527

• Volume profile: Dense node suggests buyer interest

Valuation :

• PE: ~10.3 (undervalued vs peers)

• Dividend Yield: ~6.5% (steady income potential)

• Promoter Holding: 60.62% (strong & stable)

• No recent equity dilution

• DII/FII: Activity neutral, could turn if technical align

A good mix of fundamentals, attractive valuation, and technical structure makes this a stock to keep an eye on. If it crosses ₹560 with volume, it may kick off a short-term trend reversal.

This chart is for educational use only and not a buy/sell recommendation.

Chambalfertilisers

CHAMBLFERT - Chambal Fertilizers Ltd. (Daily chart, NSE) - LongCHAMBLFERT - Chambal Fertilizers Ltd. (Daily chart, NSE) - Long Position; short-term swing research idea.

Risk assessment: High {volume & support structure integrity risk}

Risk/Reward ratio ~ 3.41

Current Market Price (CMP) ~ 594

Entry limit ~ 592 on May 27, 2025

1. Target limit ~ 610 (+3.04%; +18 points)

2. Target limit ~ 625 (+5.57%; +33 points)

3. Target limit ~ 650 (+9.80%; +58 points)

Stop order limit ~ 575 (-2.87%; -17 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

BULLISH"LONG-TERM INVESTMENT IN CHAMBAL FERTILIZERS (6-9 MONTHS)📊 Long-Term Opportunity: NSE:CHAMBLFERT (6-9 Months)

🔍 Overview:

Chambal Fertilizers presents a 📈 bullish opportunity for long-term investors, supported by strong technical patterns and sectoral growth potential. With a favorable risk-reward ratio and government focus on 🌾 agriculture, this stock could deliver significant returns in the next 6-9 months.

🚀 Key Opportunity Highlights:

1️⃣ 📌 Entry Point:

A breakout above ₹510 (expected before 22/01/2025) signals the start of a major uptrend.

2️⃣ 🛑 Stop-Loss:

Maintain a stop-loss at ₹485 to protect your capital.

3️⃣ 🎯 Targets:

🟡TP1 (Short-Term): ₹551 – A critical resistance level with high likelihood of being reached.

🟡TP2 (Mid-Term): ₹610 – A strong intermediate target for potential gains.

🟡TP3 (Long-Term): ₹710 – Final target achievable within the 6-9 month timeframe

4️⃣ 📊 Technical Setup:

Head & Shoulders Pattern indicates strong bullish potential.

Support from trendlines and moving averages aligns with an upward trajectory.

5️⃣ 📅 Fundamental Catalyst:

Budget 2025 and government focus on agriculture create a 🌟 favorable backdrop for growth in this sector.

🌟 Why This Opportunity Stands Out

📐 Strong Technical Setup: Clear patterns support bullish momentum.

📅 Budget-Driven Growth: Agriculture-focused policies could act as a major growth driver.

⚖️ Balanced Strategy: Defined entry, stop-loss, and targets create a well-structured opportunity.

⚠️ Note: This is a high-potential opportunity but should be pursued with proper risk management. Always consult your financial advisor before making investment decisions.

🔴 Disclaimer

I am not SEBI-registered, and this analysis is shared for educational and informational purposes only. Stocks and securities are subject to market risks, and past performance is not indicative of future results.

Please read all levels, key highlights, and the associated risks carefully before making any investment decisions.ensure alignment with your investment goals and risk appetite.

If you really like this idea...leave a coment below...

Like,share,subscribe @Alpha_strike_trader

SWING IDEA - CHAMBAL FERTILIZERSChambal Fertilizers , a leading manufacturer of fertilizers and agri-products in India, is presenting a compelling swing trade setup with strong technical indicators.

Reasons are listed below :

Break of Cup and Handle Pattern : A classic bullish continuation pattern indicating potential for a significant upside.

Bullish Marubozu Candle : A strong bullish marubozu candle on the weekly timeframe highlights sustained buying pressure.

500 Zone Breakout : The price is attempting to break above the 500 resistance zone after consolidating near its all-time high, signaling strength.

Prolonged Consolidation Breakout : The stock is breaking out of a consolidation phase spanning over 3 years, suggesting a fresh trend initiation.

Target - 675

Stoploss - weekly close below 440

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

chambalfert: after a breakout in conoslidation phaseChambal fertilizer: gave solid breakout on 20 june, after that it was in good consolidation and sideways move,

Now there is a strong resistance of around 540, once that is taken out nicely we may see a good rally towards 570-600.

disclaimer: we are not sebi registered, only for educational purposes.

SWING IDEA - CHAMBAL FERTILISERChambal Fertilisers , a prominent player in the fertiliser industry, has recently garnered attention for its intriguing price action and technical indicators, prompting a closer examination for potential trading prospects.

Reasons are listed below :

Recent price action witnessed a breakthrough of the strong resistance zone at 350 levels, indicating a potential shift in market sentiment towards bullish momentum.

A bullish engulfing candle on the weekly timeframe signals a bullish reversal, suggesting a possible uptrend ahead.

The price aligns closely with the 0.382 Fibonacci retracement level, providing added support to the bullish outlook.

After over two years of consolidation, the stock has finally broken out of this range-bound behavior, indicating a change in trend dynamics.

Recording its highest close in eight weeks, Chambal Fertilisers trades above the 50 and 200 exponential moving averages (EMA), indicating strong bullish momentum.

Consistent higher highs in the price action suggest a sustained uptrend.

Notable upticks in trading volumes accompany recent price movements, indicating heightened investor interest and potential for significant price moves.

Target - 415 // 480 // 515

StopLoss - weekly close below 340

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

CHAMBAL Fertiliser analysisCHAMBAL Fertiliser on a daily time frame

CUP chart pattern

Monthly and Weekly RSI above 60 levels

Daily, 75 mins and 15 mins RSI declining

It should retrace the neckline levels to retest the levels.

If you calculate the retracement, it should retrace between 23.6 to 38.2%.

You can notice unusual volume on a break-out candle.

Unfolding Waves in Chambal Fertilisers: Bullish Path AheadAn analysis of Chambal Fertilizers using Elliott Waves, we can observe an interesting progression in the stock's price movements on a weekly cycle. The chart has completed the initial waves I through IV, and it is currently unfolding wave V, signaling a strong potential for a bullish trend ahead. Let's delve deeper into the details of this wave analysis.

Weekly Cycle

Wave V: We are observing the unfolding of wave V on the weekly cycle. This wave is showing potential for further upside as the stock completes its final wave in the longer timeframe.

Subdivision of Wave V: Within wave V, the stock has already completed waves (1) and (2), and it is now unfolding wave (3).

Wave (3) of Wave V

Progression within Wave (3): In the ongoing wave (3) of V, we've seen waves 1 through 4 completed, and the current focus is on wave 5 of (3).

Hourly Timeframe

Progression within Wave 5 of (3) of V: In this specific timeframe, wave 5 has already seen the completion of sub-waves ((i)), ((ii)), ((iii)), and nearly all of wave ((iv)). This suggests we are likely at the end of wave ((iv)), poised for wave ((v)).

Elliott Waves Fundamentals

Wave Counts: The stock's progression through each wave provides valuable insights into potential market behavior. The typical characteristics of an impulsive wave, as seen in the unfolding of wave V, include strong, directional movements, which are followed by corrective waves.

It’s essential to apply appropriate risk management techniques, such as setting stop losses, to mitigate potential downsides. Be cautious in managing your exposure and avoid over-leveraging.

This analysis is purely for educational purposes and should not be taken as investment advice. Always conduct your own research and consult a financial professional before making any investment decisions. Remember, market conditions can change rapidly, and past performance does not guarantee future results.

This analysis aims to provide an overview of the potential trajectory of Chambal Fertilisers based on Elliott Waves. It's always important to stay vigilant and adjust your approach as new information becomes available. Happy trading!

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

CHAMBLFERT - Result factorChambal Fertilisers & Chemicals Ltd is engaged in production of Urea from its own manufacturing plants.

52nd week High/Low: 516/261

Market Cap: 12817cr

ROCE: 23.4%

PE Ratio: 9.90

Debt to Equity: 1.02

Sales - UP

Sep 2021: 4479

Jun 2022:7291

Sep 2022: 8587

Net Profit - DOWN

Sep 2021: 506

Jun 2022: 342

Sep 2022: 274

EPS - DOWN

Sep 2021: 12.16

Jun 2022: 8.21

Sep 2022: 6.59

Buying Range: 304 - 293

If price moves up from current level 311 would be a good price to get into this counter, keeping a stop below 293.

One can look for a Target of 366 in the short term.

The stock had hit its 52nd week low on 01.07.2022 before reaching the levels of 366.

Since then the stock has witnessed a selling pressure making it an attractive option to buy at support levels.

EMA 200:344.60

EMA 100: 335.60

EMA 50: 327.40

EMA 20: 323.40

EMA 9: 321.14

CMP: 308.05

Another factor that could give a strong reversal.

CHAMBLFERT breaking the trend.Chamblfert has given enormous returns over the period of time but looks bearish over the short period. The stock have given the breakout a few days ago, but could not sustain the breakout. Chambal fertilizer has broken a supporting trend line and the budget brings a negative impact on the fertilizer industry.

If the stock closes down below the trend line, we can see quick movement toward the downside and stock achieving our target.

Only for information and education purpose

Please consult your advisor before investing

Chambal Fertilizer Why this trade..??

1.Head & Shoulders pattern

2. Rejection at Fib 50% level

Reasons mentioned in the chart.

Disclaimer : This view is for educational purposes only and it's my personal.Please Consult your financial advisor before attempting any trade.We're not responsible for your profits or losses.