Super set of oscillators by Thomas DeMark!Dear friends!

I continue describing oscillators developed by Thomas DeMark.

In my previous articles, I have already explained such tools as

TD REI and TD POQ (look here ).

In this post I’ll continue describing technical tools developed by Thomas DeMark.

TD DeMarker I

I’d like to start with the TD DeMarker I indicator. It is similar to TD REI and aims to distinguish between trend and non-trend movements in the market, and then, having determined the trend, it searches for reversal points depending on how the indicator reacts to oversold and overbought levels.

Its calculation technique is very simple. TD DeMarker I compares the current and the previous trading day’s highs according to the following algorithm:

1. Calculate the TD DeMarker I numerator

• If the current bar’s high is higher or equal to the previous bar’s high, the difference is calculated and added to the numerator.

• If the current bar’s high is lower than the previous day’s high, then zero value is assigned to that bar. Next values of the difference between the highs for each bar are added to the numerator over a series of 13 consecutive bars.

• If the current bar’s low is equal or less than the previous price bar’s low, then the difference between the previous day’s low and the current low are the numerator.

• If the low of the current bar’s is greater, a zero value is assigned to the nominator at this bar. The next values of the difference between the lows for each bar are added to the numerator over 13 consecutive bars.

2. Calculate the denominator of TD DeMarker I equation

• You add the value in the denominator to the sum of the differences between the lows in the same period.

3. Calculate TD DeMarker I = divide the numerator by the denominator.

• As a result, we get a value that will move in the range from zero to 100 in the form of a fluctuating 13-period line. At the same time, the overbought zone will be above 60, and the oversold zone will be below 40.

Now, let’s find out how this indicator’s signals are interpreted

A buy signal should satisfy the following conditions:

1. DeMarker I must not be below 40 for more than 13 bars

2. The bar’s close at the signal level should be lower than the low of one or two bars ago

3. The bar’s close at the signal level must be lower than the previous bar’s open or close.

4. The open of the next bar following the assumed reversal bar must be less than or equal to the close of any of the two previous bars.

5. The asset must be trading higher than at least one of the two previous closes.

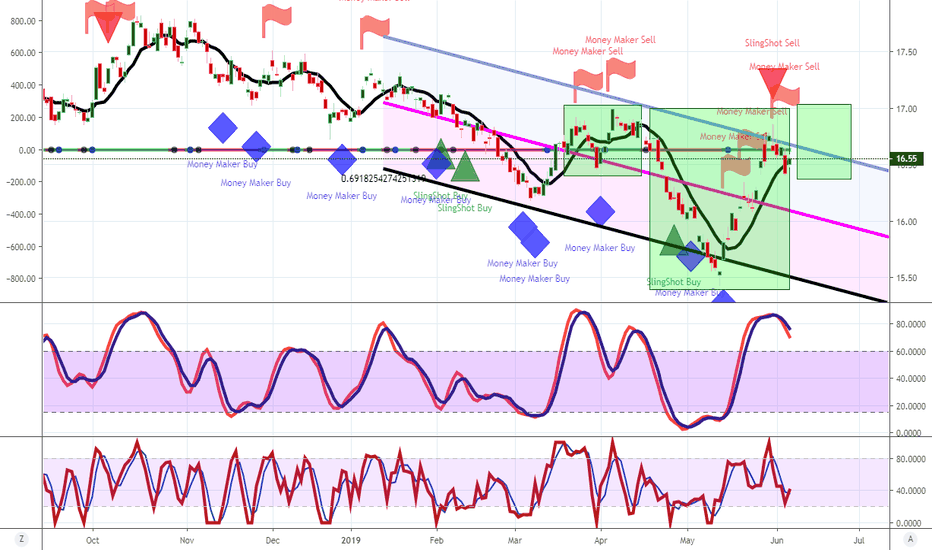

As an example, I’ll take the BTCUSD market situation that has recently occurred. It is clear from the above chart that the BTCUSD was in the overbought zone (above 60) from the start till the end of May. Afterwards, the price rolled down below 40 and the indicator entered the oversold zone.

Immediately after that, we look for a point where the bar features the low before price exits the oversold zone.

Finally, when the price went beyond the oversold zone on June 13, we can easily identify the low in the period when the ticker had been below 40, according to TD DeMarker I.

Now, we can analyze the continuation pattern based on the above conditions.

1. The DeMarker I indicator was below the level of 40 for not more than 13 bars - in our case it was only 5 days;

2. The bar’s close under the red arrow is lower than the previous bar’s low (blue dots are above than the red dotted line).

3. The close of the bar below the arrow is lower than the previous bar’s open and close (blue dots are far lower than the previous bar).

4. The next bar’s open following the reversal bar is equal to the previous bar’s close (there are no gaps).

5. The asset is trading higher than the previous bars’ close levels. Furthermore, when the indicator exited the overbought zone, the price had been already trading above all the previous bars’ close levels.

Therefore, one could have safely entered a buy trade at the current level when the new bar of June 14 opened (I marked it with a red cross in the chart).

As we already know, this signal reached the target and provided the opportunity to gain on the BTCUSD movement up to the high at 14 000 USD.

I should note that when a buy signal is not confirmed, that is, the five conditions above are not met, there is still a signal, but it is a sell signal. Although such a sell signal cannot be as strong, it can be a confirmation for bearish signals of other indicators.

There is a good example in the chart above. It displays bitcoin’s all-time high at 20 000 USD.

After the DeMarker I had been in the overbought zone for quite a long time, it moved into the oversold zone, and so, we start counting and see how long the price will be in this zone.

Finally, there is the following situation:

1. DeMarker I was not below the level of 40 for more than 13 bars, in this case it was 12. So, this condition is satisfied.

2. The close of the bar under the red arrow is lower than the previous bar’s low (blue dotetd line is below the red dotted line). This condition is also satisfied

3. The close of the bar under the arrow is lower than the previous bar’s open and close. This condition is also met.

4. The open of the bar following the reversal bar is equal the close of the previous bar (there are no gaps). This condition also confirms the bullish scenario.

5. The asset is trading above the previous close levels. This condition is not met.

It is clear from the above chart the bar following the oversold zone (marked with a red arrow) went down lower than the close levels of the previous two bars, and, moreover, it was trading below the close level of the two bars preceding the reversal bar.

Therefore, the last condition is not satisfied, and so, we have the reasons to assume that there is a real reversal of the bullish trend.

Now, let us study the sell signals.

The following conditions must be met:

1. A sell signal should meet the following conditions:

2. The indicator must be above level 60 for at least six bars.

3. The signal bar’s close must be above the previous bar’s open and close.

4. The open of the bar following the signal must be equal or higher than the close of any of the two previous bars.

5. The asset must be trading below one of the previous close levels.

As soon as all these conditions are satisfied, it can be interpreted as a sell signal.

TD DeMarker II

The above chart presents an example of the Bitcoin bullish trend reversal in December 2017, after which there started a long-tern bearish trend. Let us analyze this situation as a bearish signal. When the bar marked with a red cross was forming, the DeMarker I indicator leaves the overbought zone and goes below level 60. Therefore, it is the case for looking for a sell signal within the zone, where the price was above level 60 (the zone is highlighted with green in the chart).

The red arrow highlights the bar that closed higher than the highs of the previous two bars, and so, higher than the previous bar’s open and close (in the chart, it is marked by the purple dotted line on December 17 that is above the green line). The next bar, following the one with the red arrow, also meet the condition and opens above the close of the second-last bar. Finally, there is the trend reversal signal and the opportunity to take the profit on December 20 (it is the bar marked with the red cross in the chart). However, this indicator, like other technical tools, may send false signals. To filter the entry signal, it is recommended to apply TD DeMarker II as a supplementary tool.

TD DeMarker II

Unlike the TD REI and TD DeMarker I, which compare the price highs and lows with those of one bar ago, TD DeMarker II analyzes a number of price ratios to measure the pressure of buyers and sellers.

Let us study the calculation formula of the TD DeMarker II.

Calculate the numerator:

1. Calculate the difference between the current bar’s high and the previous bar’s close.

2. Add the result to the difference between the current bar’s close and its low.

3. Distract the previous value from the current bar’s high

4. Sum up all the values. If there is negative result, assign a zero value to it.

Calculate the denominator:

1. Add the difference between the current bar’s low and the previous bar’s close to the numerator.

2. Add the result to the difference between the current bar’s high and its close (this value defines the selling pressure).

The buy and sell signals of this indicator work under the same conditions as for the TD DeMarker I, so, I won’t enumerate them again. I have already many times mentioned that, if multiple buy or sell signals are at the same place, the signal becomes much stronger. As it is clear from the above chart, a buy signal sent by the TD DeMarker II (green cross) matches to the one sent by the TD DeMarker I (red cross), which in combination confirms the sell signal and enhances it.

TD Pressure

DeMark suggests that the price action is directly affected by the supply/demand ratio. As the price change is often preceded by a change in trading volume, DeMark suggests measuring the speed of changing in the trading volume along with the speed of price changes. In addition, according to DeMark, these parameters are more important for the current bar, rather than for the complete bars. In general, these values determine the buying pressure on the market, which is calculated by subtracting the current bar’s open from the its close and dividing the result by the price range of this bar.

The result is multiplied by the trading volume of the current period and is added as a progressive total to the indicator value.

Finally, we have an indicator that shows buying pressure. For example, if the bar’s open is equal to its low, and the bar’s close is equal to its high, then the trading volume will be on side of buyers, and the indicator will display a strong rise of buying pressure. And vice versa, if the bar’s open and close coincide, even a greater trading volume won’t affect the indicator, as the market will be balanced, and the bulls’ power will be roughly equal to that of bears.

The indicator’s band moves from 0 to 100%, and the overbought and oversold zones, like for the indicators, described above, are the zones above 60 and below 40 respectively. The buy and sell signals sent by this indicator are interpreted in the same way as those sent by TD DeMarker I and II. Besides, this indicator is also a confirming one, and when it coincides with other signals, it confirms the indicated direction.

You see in the above chart that the signal sent by the TD pressure (yellow cross) matches to the signals sent by the DeMarker I and the DeMarker II (red and green crosses respectively), which means that the sell signal is true.

TD Rate of change (TD ROC)

TD ROC is an integral component of TD Alignment but can also be used in isolation as an overbought/oversold indicator.

It is thought to be quite simple and is determined by dividing the close of the current price bar by the close of twelve price bars earlier.

Although it is pretty simple, this indicator is quite efficient. According to Thomas DeMark, the bears’ zone is below 97.5. Bulls zone is above 102.5. Therefore, when the indicator is in a narrow band between 97.5 and 102.5 the market is in balance.

So, this indicator helps you identify the market sentiment at any moment.

But this is not its primary advantage. You can employ this indicator in technical analysis and draw the common patterns and trend lines. The chart above shows how a triangle worked out. A strong momentum, marked with a red arrow, draws the indicator beyond the triangle, which means that the market lost balance and started moving in the bullish trend.

Next, after the triangle was broken out and the bullish trend started, we build trend lines according to the common rules; in the bullish trend, the trend is outlined along the support line (red line), in the bearish trend -along the resistance lines (green line).

It is clear from the chart above that the breakout of these lines and entering the bear zone send a sell signal (red cross) in early July. Afterwards, we build the trend line along the resistance levels sand expect until the price breaks it through and enter bullish zone. Finally, in the mid-July, there is such a buy signal, marked with green cross in the chart.

Next, there is a strong growth in the bullish trend that is marked with the red trend line. The breakout of this line sends a signal to take profit, and entering bearish zone again signals the trend weakness.

As you see from the chart above, the indicator broke through the green trendline in late July but it hasn’t entered the bullish zone, and so, there has been no buy signal so far.

Another signal that really matters when using this indicator is the signal of convergence and divergence.

These signals are rarely sent by this indicator, but they are usually quite accurate, especially in long-term timeframes.

There is a clear divergence in the above chart. When the price is growing, the indicator is declining, which signals the trend exhaustion. In early July, the price couldn’t break through the previous high, thus confirming the direction of the indicator (marked with a circle).

Finally, as I have already said, the indicator went down below the trend line, which sends a strong sell signal; however, as you know, the bearish correction didn’t work out, so, for an accurate forecast, it important to employ all the DeMark's tolls together.

TD Alignment

Just for this purpose, to combine all the tools together, the TD Alignment indicator was developed.

TD Alignment is a composite indicator that combines the following five TD oscillators to measure buying and selling pressure:

1. TD DeMarker I

2. TD DeMarker II

3. TD Pressure

4. TD Rate of Change

5. TD Range expansion Index (this indicator is described here)

Each of these indicators has its own distinct method of measuring overbought/oversold conditions. TD Alignment is based on the values of all the above indicators according to the principle, where the final result is determined of the number of indicators in an oversold condition, overbought and equilibrium.

In addition, to calculate the TD Alignment, there were defined the following overbought/oversold zones:

Overbought/Oversold

1. TD DeMarker I - 60/40

2. TD DeMarker II - 60/40

3. TD Pressure - 82/12

4. TD Rate of Change - 101/99

5. TD Range expansion Index - 40/-40

Therefore, when the TD DeMarker enters the oversold zone, 1 is added to the total result. If the indicator enters the equilibrium zone, between 60 -40, a zero value is assigned, if it is below 40, 1 is subtracted from the total value.

Based on the same principle, all the indicators are calculated, and finally, there is the TD Alignment value that is moving between -5 and +5. -5 is reached when all the indicators are in the oversold zone, and +5 is associated with the case when all the indicators are in the overbought zone.

Unfortunately, I failed to find the TD Alignment in free access, so I had to write everything on my own. I must admit there may be errors in calculations, nonetheless, it performs quite well during testing. As you see, the main benefit of this indicator is showing the cases when the market reaches the extremes of the overbought/oversold zones.

In the above chart, I highlighted these levels from +4 to +5 and from -4 to -5.

When the indicator reaches this zone, it is obvious that the price will start correction soon and so you should take a corresponding decision on either taking profit or entering a trade. In addition, the indicator shows the market sentiment currently dominating; if it is above zero, bullish sentiment is dominating, if it is below zero, the market is bearish.

Buy or sell signal here must meet the same 5 conditions, described for TD DeMarker at the beginning of the article, the only difference is that you need to count the number if bars above or below zero.

Based on my own experience, I would add one more condition, the sixth one, to be met for entering a buy or a sell trade. A buy/sell signal is confirmed when the TD Alignment indicator breaks through zero level (red dots) only provided that the indicator hit the overbought/oversold zone before.

In the above chart, I tried to illustrate that, after the indicator hits green or red zone, i.e. overbought or oversold zone, the sixth condition is satisfied. So, when the indicator breaks through or rebounds from the zero level, there is a buy or a sell signal (according to the market sentiment, I marked the entry signals with green and red arrows). A red thumb down marks the levels where the market doesn’t reach the zones indicated above, and so, the condition is not met and the buy or sell signal is false; I marked false signal with the red crosses in the chart.

However, not everything is that perfect, because this indicator is rather sensitive and so, it sends quite many false signals. That is why, I do not recommend employing this indicator alone, rather, it should be used together with other DeMark's tools so that it will be more efficient.

I will describe other useful DeMark's indicators and explain how to apply them to BTCUSD trading in my next articles.

Subscribe not to miss the continuation!

I wish you good luck and good profits!

Change

Change Chart on KuCoin Fully Mapped (1800%+ Target)Change (CAG) Overview

Investing commission-free

Why don't people invest? The answer is always the same - too complicated, too expensive, and who has the money for it anyway?

Change enables users to invest just €10 into cryptocurrencies. No minimum balances, no commission when buying or selling Bitcoin, and no unfair barriers. All possible by secure blockchain technology and the smartphone in your pocket.

Source: Changeinvest.com

Here we have the full chart for Change (CAGBTC)

To the left we find the All-Time High (ATH).

Once the top was hit, prices started to drop for long.

To the right we have a new All-Time Low (ATL).

Once we hit bottom, the only place left to go is up. The only difference here is that the ATL is not yet confirmed as prices can still go lower.

As soon as CAGBTC moves above EMA10, we switch the potential from bearish to bullish.

This is not financial advice.

Thanks a lot for reading.

Namaste.

VIX Change in-sight: Cloud SquaredHere is the 'Ichimoku Cloud ' indicator shown for the VIX .

Although this indicator offers a surplus of signals I wanted to point out a 2nd cloud that can be found between the, ' Conversion Line ' and the, ' Base Line .' * The importance of this 2nd cloud is that when price enters it's range, the (price) direction is likely to change. * Aside from that, the cloud commonality is that price being below these clouds concludes a downtrend and the price being above the clouds concludes an uptrend).

*THUS (if these calculations are correct), the VIX is heading UP* GOOD LUCK!

CAD/CHF SELL SIGNAL Hey tradomaniacs,

welcome to another free trade-plan .

Important: This is meant to be a preparation for you. As always we will have to wait for a confirmation.

Market Sell: 0,71030

Stop-Loss: 0,71400

Target 1: 0,70630

Target 2: 0,70405

Target 3: 0,70175

Stop-Loss: 37 pips

Risk: 1%

RIsk-Reward: 2,4

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

ACB's Dilemma: To accumulate and rise? Or fall and delist?ACB is at a critical price point at this time. The price action is still feeling the very strong downward trend that is pointing directly to $0 by no later than May.

In order to even potentially reverse this brutal downtrend, ACB must first accumulate and confirm the end of the downtrend. An accumulation channel between $1.16 and $2.75 is potentially in the midst of forming, and ACB will likely move around this price range in the coming months until some volatility and volume decides to push it either way.

We will get a better confirmation that the accumulation channel has likely formed if the downward trend lines are broken to the upside, while the price holds above $1.16. (in other words, ACB has to maintain above $1.16 by the close of Friday March 20 while never having a week that closed below $1.16 until then)

The weekly 20HMA indicator has the possibility of indicating the end of the Bear Market once it starts moving in a positive direction. Confirmation of the Bullish retracement is only highly likely once three criteria are met: weekly OBV closing higher than its 20MA, weekly 20HMA moving in a positive direction whilst acting as support, and ACB’s weekly price closing above the $2.75 resistance of the accumulation channel with strong volume. During retracement, ACB may retrace to its 0.618 Fib ratio of around $6.82 as the top of its retracement. Otherwise, if ACB cannot meet all three of these criteria, ACB is likely to maintain the accumulation channel between $1.16 and $2.75 for months.

If ACB closes below $1.16 on the weekly, it is likely to drop further into the lower accumulation area of $0.12 to $0.60 for several months and risk being delisted from the NYSE.

TLDR: ACB has to move sideways before it can move up, or else it will continue to fall. I have presented specific details above that may indicate when the selling pressure has potentially stopped and sideways movement is likely.

I will try to keep updates pertaining to this idea as the market provides new information in the coming months. I would appreciate any feedback or comments regarding this idea.

EURNZD bis short, Trend Change, Trend Line, Market ManipulationHello Traders !

Chart Analysis:

As we can see on the daily time frame market has formed an overall Up Trend. We are currently at the top of the Trend Line and also there we can see a nice Supply Zone. From here I expect the price to go down. I also marked a resistance Level which we also could reach due to market manipulation. So be aware of these Fake Outs. Trade with Price Action Confirmation and wait for valid candle stick closes in order to be more sure. But this depends on your trading plan. So stick to it.

As possible target I marked the Demand Zone which also at the bottom of the Trend Line. This setup would be a nice Swing Trade and of course you could scalp it.

That was my Idea and I hope you did like it. Please leave a LIKE if you like my Content that I share with you. In the comment section you can tell my your view and ask questions.

Thank you and we will see next time

- Darius.

USDJPY LONGOn higher time frames (monthly / weekly) UJ is showing a triangle pattern, with a ranging / sideways market confirmed by the 50 EMA, we have no overall long term bias in terms of trend. Moving onto smaller timeframes, on the daily we have an ascending channel with a ranging market between the S&R, Now on the 4hr we have a rejection of the support, a break of the short term down trend and what looks to be like a confirmation of trend change forming from a 4hr 50 EMA retest. Currently waiting on a rejecting from the 4hr 5o EMA and a bullish 4hr open which will give us confirmation of a trend change which will then give us room for a long position to our 4hr resistance which is the upper phase trend line on the daily ascending channel. Lower TF long bias for UJ currently, especially with current USD strength being shown across majors, this strength will more than likely provide the retest and rejection of the 50 EMA we require to enter.

Walking the xyz(w)- jungles. #2 I need proof! Do you wish to see some proof too?

Walk with the General through the garden of Xyz,

and nail every correction ever happened to XRP

under the moon...

As I explained in the previous idea #1,

we can observe exactly 11 waves long correction wave model.

This is one of the most widely encountered correction patterns

in the crypto market on higher timeframes.

This I tell you based on my experience(saw lots of

these complex price depressions on the real charts),

and Elliot agrees too.

Let's make sure that we've counted every important

little fractal. Because in order to see the picture

the trader's way, we gotta fist know EXACTLY,

in what fractal position we're in

(relative to the parent trend, parent's parent trend, e.t.c...).

I've tried out lots of possible combinations,

but only really the 11 waves xyz(w)xyz(w)xyz did the trick,

without any hard confrontations against the Elliot's Theory.

Where are we headed?

What is thy proof, Witcher?!

Let's walk with me along these xyz jungles...

You will see!

-Targets, General?

-Not yet, my friend. We have to confirm this root prognosis first.

Give me a couple more days, will think of something.

Now I'm out of the cigarettes. See you later, then. Gotta doping myself

these tense days... The pump is coming...

-Bye.

----------------------------------------

Thank you very much for reading and following!

I only hope that you've found this quick walk under the moon

refreshing and started considering finally longing that,

which rarely anyone was brave enough to long for the past 2 years!

Wait for the new confirmations and the

next articles on XRP in the following days! bb!

Moon profits to ya'all!

Bears, beat it! Full picture. All scenarios.Yes, for the past few weeks we have gathered and brainstormed a lot of confusing signals.

Neither the bears nor the bulls truly feel save as of this moment, as we are probably on the verge

of trend changing or forming a continuous months-long flat.

We can safely say, that is not a simple task to forecast the price movements in these conditions!

Every newborn candle right now can either grow as trend-killer for the bears or

a sophisticated killer-trap for the bulls.

The market has never been so tense.

While some believe that the price has finally touched the bottom at 6500,

others continue to spread bear lies(we'll see, no pushing)!

In the past we have experienced two massive "pumps", both rocketing bitcoin price

up to 10-20K+ region.

It took me some time to become able to distinctively see the wave pattern

that now you can easily identify with your eyes on the above chart.

We are dealing with two great short periods of capitalizing the bitcoin market,

followed by two periods of depression. Well, after every pump(dump)

there must come a correction of the price - that is the law.

Basically, it's the only statement all traders in the world agree with =)

Thanks to the days of my uninterrupted focused observation of BTCUSD charts

I can now distinctively tell all the waves and their retrospective relations

inside both correction structures that were built after the 1st and the 2nd Great pumps.

As many of you know, market loves resembling historical data.

The most simple and straightforward way of analyzing the market -

looking for the patterns and wave models in the historical data

that look a lot like current market situation.

Then you simply collect a pool of vectors, calculate your arithmetic

averages and voila! Now you can tell a specific possibility values for

some pattern to occur in the future, or the probabilility of the price reaching X price.

(This data is the only data we can actually get out of technical analysis).

---------------------------------------------------------------------------------------

That was not the story I wanted to tell you, yet. Now the big guns are coming in...

Here's two simple ideas:

"the correction of the second pump should evolve with about the same dynamics

that the correction experienced after the first investment rally evolved with,

if the recapitalization happens in the same market conditions".

"the complex dynamics of cryptomarket de-recapitalization is based on the

economic cycles, common nature cycles, performance of the capital redistribution bottlenecks,

exchange providers... While isolated, any capitalization model with the same input

parameters will produce 100% equal result."

And here's the big news: the second depression is about to end(has ALREADY gone through

all evolution stages we observed in the first giant correction ever). For good!

It is most logical to expect the new great market pump after seeing

the same market picture on Jan 1 2020 as on Jan 15 2019 .

I'm presenting you with the exact correction model that both great depressions

strictly followed during their evolution, thus proving the bulls right

for the medium/long term trading.

First of all, you must remember, that these two giant corrections were formed

in somewhat different market conditions, and we can not expect

to see the same pattern without changes again and again and again, right?

But wait 'till you chew up this data and swallow it liquid!

After "cleaning the noise", I was able to identify the correction model

that is building up right now(finishing, actually) and both corrections fall

perfectly within the laws of this correction model.

Yes, we are experiencing ABSOLUTELY the same correction pattern forming

that we have already seen after the first pump!

When I finally saw this c.model I had no more bearish thoughts left in my brain no more.

We are going up. Bitcoin has grown, a lot of new technologies/sites/companies/people

were introduced to the btc infrastructure all over the world.

Is is hard to believe that bitcoin whale-shorters have now the power to seriously

drop the price. Well, they tried! They have brought us down to 6.5k twice< of course if they

want to -they will drop it even further but with a very high expenses level.

The "all-time" 3k bottom and the same correction dynamics(compared to the previous depression),

plus the good-looking fundamentals along with the obvious infrastructure growth

signal us that it is not a very probable scenario in which the price drops anywhere close to the previous 3k bottom.

-------------------------

xyzwxyzwxyz - 11 waves Correction Model.

It is hard to distinguish these wave models, but once you do,

you won't have the bearish thoughts left on BTCUSD anymore...

...for months.

Why is it so hard to identify this pattern in both corrections?

That is THE GOLDEN question.

And I have a suggested answer...

First of all let's clear something up. We can not expect the second depression period

last the same amount of time. Why? Because when the traders have the previous same-situation

chart layout before their eyes - they think much more faster and the complex processes of

liquidity redistribution evolve faster, less time needed for the market to react to a certain change..

Just like that, the previous depression lasted 12 months,

and I strictly believe that 6 months of correction evolution this time is more than enough

for the BTC to become oversold and fully finish its big-cycle correction model.

And to prove this point of view let's look at the charts...

--------------------------------------------------------------------------

1. Both corrections have the exact same layout and the very much resembling 11 waves

correctional architecture (the exact same, really).

2. Both corrections have a bearish triangle placed at wxyzw(purple).

3. Both corrections have a falling bullish wedge placed at their ends on the very last

z waves.

4. The dimensions that both corrections follow are very much alike.

6. Both the very last x waves of these corrections end with a small

but very distinctive pattern - expanding bullish wedge(purple curved line),

P.S. kind of, maybe we should call it a simple xyz zigzag, as these figures

seem to be heavily deformed by the bullish pressure.

7. For both "expanding bullish wedges" we can observe STRONG

classic bullish divergences on RSI 14/56(class A divergences)

and Stochastic(class A + class C divergences).

Are you still in doubt? Then read the next part... This one is for the skeptics.

-----------------------------------------

You may ask: "now, wait a minute... what about the differences?"

1. Once again - it would be not smart at all to expect the market to evolve

while following the exact same c.model with exactly the same dimensions.

Nevertheless, that is exactly what happened, if you look closely at

each and every wave and analyze it.

2. The pen-penultimate wave "x". This wave is much deeper than it's shorter and

weaker twin from the first ever pump's correction.

Guess now, what did all the bears do when they have had realized that the current correction

strictly follows the previous depression wave c.model? Of course they dumped the market!

They knew that the masses would most probably be dropping this wave,

'cause that is exactly what has had happened before.

This is obvious, right?

3. Yes, this notorious penultimate(10th) wave "y".

This wave from the second depression is much higher that the same wave

from the first depression?

But what does it tell us? - Exactly the opposite thing(the same, really)!

First of all -

Secondly - during the first depression this wave got a minuscule amount of

volume coming(and the previous one too).

Thus the small wave height - the bulls were very protective(in the first depression),

no one entered the market, the shock of the depression period

kept'em afraid to invest big - there was simply NOT ENOUGH DATA on this asset's performance.

This behavior weakly signals that the 6000-6500 is the bottom(Sep 7 2018, it wasn't 3k yet).

And what happens when traders start to see the exact same correction pattern

happen again? They will try to buy at the dips of the very last waves of this correctional

model. Thus, when it has had become clear that the pattern was screaming in their face "BUY"(Oct 21 2019)

al lot of traders saw it and called into requisition. Of course they tried to buy this dip and pumped the

price. Maybe some big investors pumped it, while observing the very same c.model.

(Please, don't mind me speculating, I may be wrong here).

So we dumped harder, but then we even much more harder pumped.

The masses synchronized(a lot of traders predicted those two waves.

And why does why the very last wave look the same?

Once again they panicked and suspended most trading,

in order to be safe from a "crazy" deformed wave,

that they created themselves, when the market was so predictable.

(This predictability - the real power source behind the future 3rd Great Pump,

as well as both previous pumps).

Anyway, as for me, this abnormally dumped "x"(9th wave) and high penultimate(10th) wave "y"

seem even more like a confirmation of the proposed theory.

It only proves that the market should follow already well-known

correction models, while influencing their evolution with this

retrospective psychology link channel from the past.

4.That's it. Both corrections follow the same law, the very same(very basic, actually) xyzwxyzwxyz

correctional waves model. Nothing has dramatically changed.

Even counterclockwise - It is just another cycle, and

we are bullish to the bones now.

The current market state:

The historical data:

----------------------------------

Forecast?

While this may seem like a super-heavy bullish confirmation, we should not forget,

that the market doesn't read out ideas and follow them nor it repeats itself,

drawing the same patterns. And even more - many economic and political processes

are able to change the whole retrospection, making this chart obsolete.

Whatever we saw as an impulse we may see as a smaller part of the correctional flow,

and vice versa.

Still, I believe Bitcoin will follow its bullish trend like a 1000ton train.

Yes, there will be lots of dips, and, probably, even new bottoms.

But the chart can not lie - the price has discovered its median.

--------------------------

Warning... (The following is IMHO and it is me thinking aloud, it may even

be just my sick fantasy, so be free to discuss and criticize(am I paranoid? NO ONE TO TELL!).

This is a warning about whale-marketmaker's way of thinking.

They do and they WILL put some branches in your forward bicycle wheel, always!

How? For example the high penultimate wave "y"(10th wave)... Yes, they may pump

in the dip of the correction and the new wave would be much higher the expected height.

Yes, they may even dump(that's their favorite dish for the past year).

Imagine them observing all this beautiful picture. I'm sure there's a lot of whales that would

benefit from dumping the price down to 6800-6900 to form the complete inverse head n shoulders.

Or they may wanna test the bottom again... then don't be surprised when with the help of

order books bombardment with a massive amount of sell orders some whale drops the price below 7k.

The Bears are still strong and have a good position, considering that there's still no explicit

trend reversal confirmation.

Yes, the market looks like it's about to flip. And no, we don't really know if it will.

But if you do know anything about trading, you shouldn't not call yourself a true bear or a true bull right now.

Because in THESE conditions - the safer trade is not trading at all ,

or trading with strategies that work well in the flat conditions(trying to bounce inside the range 6900-7600),

I personally try to avoid such an unstable market.

----------------------------

FORECAST.

So here is a forecast based on technical analysis, careful consideration of all the factors my mind

could process, my eyes could find, fundamental analysis, news, other analytics proposes and ideas...

BASE Scenario A. - The price is going to surge sooner or later. The current correction model formed suggests

that the whole xyzwxyzwxyz complex correction is completely finished and we are

about to see the new trend formation. If this scenario plays out -

we may even observe a prolonged impulse, bringing us up into the overbought zone,

and a giant fractal structure binding the 2 known Great Pumps, the following depressions and

the new group of impulses(yet to be formed) into a Giant Impulse, promising long-term

capitalization pump. Is it true? I believe so. Time will tell.

Anyway, there are other probable subscenarious:

Subscenario a. - The price experiences an uplifting breakout(with almost no

new bearish candles, quickly transforming into a massive impulse,

lifting us up to at least 7700, with possible reaching up to 8200/10000 and even higher.

Subscenario b. - We first observe a small correction(maybe a fake dump,

to bring down all the bulls with their SLs) down to 6800-6900 first.

Then experience the impulse I've been forecasting for many days in a row.

(Tripple bottom formation or inverse head and shoulders on 1D).

Subscenario c. - We may get ourselves another depression continuation and

observe a 15 waves c.model being formed out of the current 11 waves correction. (Doubt that)

Subscenario d. - we experience a long and boring months-long flat.

Bulls and bears both burning in the frames of the narrow flat-range.

Then we finally experience the IMPULSE!

------------------------------

P.S. Bitcoin isn't going anywhere. So no more 6k(av.probability). No more 3k(high.probability).

And definitely no more 1k for years(I say only some global disaster is able to kill BTC now)!

I'm glad to hear any feedback!

The last days I was a little bit confused myself, closed some open "buy" positions,

in order to protect myself from this market. So don't be surprised if you see 1 or 2 bearish

ideas published by me. They are all based on days of raging research.

And they are legit too(I suppose so). But this chart is the final masterpiece in the series

of my publications on BTCUSD. Bitcoin shows such a text-book price action,

BTCUSD is quickly(relatively fast, of course) growing with new bullish impulses formed.

Now we should only wait for a clear confirmation. And go full buy-in)

Sorry for the wall of words - there have been a lot of thinking going on these days...

Check out my previously published ideas, if you must.

They are all pieces of a single puzzle and relate to each other.

$12 or $8 dollars after... for Afterpay - Double Top TBCHi All,

At a price to revenue ratio of 36:1 at the time of writing, this is one hot stock! But is it really worth it?

We clearly have a formation, but not confirmation, of a double top pattern for APT. We have a clear and solid rejection at the 28.50 zone and a 10% plus drop following. I don't think things are looking good for APT, not necessarily fundamentally speaking (besides the ratio), as I know a lot of people are bullish on this stock but at least from a technical analysis perspective, one has to ask are we about to witness a major trend change with APT?

Now the supporting TA;

Double top pattern

As already mentioned, this is a yet to be confirmed pattern. The break of the middle trough between the peaks @ 20 dollars would confirm the pattern. The red arrows provide us with a possible drop range that we might expect. The larger the variance from peak to middle trough, the larger the expected trend reversal, and this is in fact supported by the underlying trend line established from April 2018, certainly a significant trend change IF confirmed. This alone of-course is not enough, and we do have additional supporting indicators below.

RSI

We have a bearish divergence on the RSI, with a down trend quite clear. The last pump to the second peak was not accompanied by wider market participation, and this trend seems as though it will continue. RSI would confirm at this stage that APT is currently out of steam. A cross of the trend line with accompanying price action would invalidate this indicator.

MACD & Histogram

MACD is showing signs of turning to negative cycle. Interestingly the strength of the recent up trend seems to be quite great albeit short and quick as Histogram clearly shows. This would support the RSI indicator reading and might suggest the last pump was really led by a few bulls, and not wider traders/investors. MACD and histogram fall in line with a double top scenario.

MA's

We can see the last pump pulled back our 7 day MA's over the 50 but has failed with the 20. It does not look like its going to cross especially with the drop we had following the second peak. The 7 day is largely going to indicate where we head from here. Both 20 and 50 are some what flat lining. Interestingly, the major trend reversal suggested by the double top would not only include a down break of the 18 month trend line, but also the 200 day MA. All confirmations of major trend reversal. The MA's do tell a similar story as the above indicators and fall in line with a possible double top scenario.

VPVR

Our volume profiles strongly support the above TA and Double top possibility. Our value zone is below the 18 dollar mark, with the final significant profile in this zone stopping around 11.37. Below this we find the next significant profiles 8.13 and below. These targets do also coincide with FIB levels as the 23.6 sits at that 11.37 dollar zone. Failure for this too hold would give us an 8 dollar possible buy zone target.

Ichimoku Clouds

Its looking like we are going to break again, and we can see trend change confirmed with this indicator.

Summary

We have a very strong case for a double top pattern with most indicators falling in line with the same scenario. A break below 20 dollars would provide us with this confirmation and I think things might get a little ugly from there. Important FIB levels also all coincide with critical pattern events, 78.6 current support, 61.8 double top resistance line, 23.6 assumed target . I think it will be a great buy opportunity, around that price technically speaking, but accompanying fundamentals should also be closely monitored with APT in the coming weeks. 36:1 price to revenue ratios are simply not sustainable, and it is not unfathomable that we see an APT stock lower than 8 dollars.

SELL / STOP TARGETS

Stop loss @ $20.

Profit taking above highly suggested.

The above is not financial or trading advice but possible mitigations if this scenario were to unfold.

BUY / LONG TARGETS

Target 1 @ $12

Target 2 @ $8 and below.

The above are also tentative as even at these prices we still have quite a large price to revenue ratio. Technically however we could see a bounce from these point and accompanying TA at the time would have to confirm any possible trade.

Confirmation

Support @ $20 fails.

Invalidation;

New high created > $29 with a clear and strong candlestick close.

Again, in the long term this stock might be a great performer, but the analysis would suggest we are due for a trend change.

Thanks guys, leave a comment and let me know your thoughts,

Traders-Corner

***

Any trading advice provided has been prepared without taking into account your objectives, financial situation or needs. Before acting on the information provided you should consider the appropriateness of the information, having regard to your objectives, financial situation and needs. You should seek professional personal financial advice before making any financial or investment decisions.

All investment and trade decisions, no matter how well investigated, involve risk.

***

Head 'n shoulders appearing with LTC daily !?The latest candle hasn't finished yet to define the begin of the right shoulder.

Also I'm not sure if the Neckline may increase with the classical 'Head 'n Shoulders' Pattern.

Nonetheless, if 'Point A' gets crushed, I would be very careful. It could be the begin of a long term downtrend.

The price of eur/usd is moving now!The price of eur/usd is moving now! It stopped below the dynamic resistance identified by the EMA20 daily. So it did not complete the movement that we expected this week. The analysts had expected a slight decline in the US dollar against the other majors because of the FED conference, the announcement of the pay slips of the non-agricultural sector and the level of unemployment.

The price is going to look for the static resistance set around 1.13 on this pair. For after the announcement of Trump on the new duties that will be imposed on China, the USD has strengthened again. We close at Break Even the bullish position that we had opened on EURUSD.

Technical point of view

The main trend remained unchanged. The final target is reachable within a few months among the static supports set at 1.10-1.08. There wasn't the rebound we expected, is now very likely that it will continue in this downtrend.From here (1.12) the price should start to go down and re-test the non-key static support at 1.112 within a few sessions. Once tested and broken to the downside there will be confirmation of a channeling on the part of this change projected to the downside. Here the price will bounce between the upper and lower side until it reaches the minimum of the period which will presumably be the area around 1.08.

Fundamental point of view

Even the fundamental scenario supports this view. The European Central Bank will continue to adopt an expansive policy, devaluing the Euro. The FED does not intend to take steps back by cutting rates and reviewing its monetary policy.

Trading ideas

The price of eur/usd is moving now and the possible TPs that we will set for this pair are: -the first one on the support of the 1.112.-the second on that of the 1,104.-the third on the final target at 1.08 and coinciding with 78.6% of the Fibonacci retracement. The analysis will be invalidated at the break of the resistance zone in the 1.146 area.

GBP/NZD - Change of Trend!Hello traders,

After breaking the channel we can see the price made a higher high wich confirms the change of trend.

We will now wait for a small correction before looking for Long Opportunities near the yellow area in the chart.

As always we dont enter without confirmation and wait for bullish price action.

We can enter this trade with a very good risk reward after confirmation aiming for around 400 PIPS!

If you like my analysis feel free to leave a like or comment below,

Rodrigo FAC

EURCHF: Possible Reset TradeHey guys,

i hope your Monday is going well and we want to share our opinion on the EURCHF. A few ideas before we took good profits on the sell side (linked below) and now after 3 level of bearish momentum with a divergence low we are looking for a buy. Price already made its way up and now is in a consolidation mode marked in yellow box. Our take profit is at the last high.

Happy Trading.

DXY: Happy Halloween Hey guys, wishing everyone a great day.

Yesterday there was halloween and we opened a short at the beginning of the week on the Dollar Currency Index. Price is dropping hard since yesterday. We are already under the bullish trend line and a big daily bearish candle indicates more down side. In 24h will be the NFP so it could happen that price moves back to the top to retest it and then totally fall down..

We are up +50 pips and excited for tomorrows news. Will keep you guys updated.

GBPUSD: DayTrade Part Two Hey everyone.

Check out the our last idea about the GBPUSD short trade for better understanding this one. Price dropped nearly to the same level where GBPUSD started its bullish run, where its holding the same level for a few hours now. Going into Asian we do not expect price to move much, but in the early morning somewhere before London or inside the session, we will be waiting for another last fake out to the downside. Looking to the left we see a wick and we are waiting for something like this in this scenario too. This is where we enter our long position with stops below the lowest level of this whole wave.

Good luck.