Chaos

Btcusd try to break new resistant or Continew sell? we counting.Hello there, from my word. all analysis is opinion. some times we lose some time we win.

my analysis for finding momentum. so far time 13/8-23:00 till 15/8-00:00. price market consistent grow to rectracement level 38.20% .this place nice to make pending sell below 38.20%,

or how about price go to 23.60%? it same like 38.2%. unless. price at $6600 above resistance line.

possible this a balance line for H1 and 4H.

how if going down?

btcusd will continue sell if pass 100% fibonacci .

this will take 3-7 day happen.

otherwise , this is the only TA, if have disagree can be intouch soon ..

Just the Bridesmaid cheering for the BrideThis is a nice movement upwards for ETH, BUT if you look at a daily chart it is just a minor move, that might be part of a higher high. On top of that it was made when bitcoin was making a all time high. So will ETH move higher, or will it go home and cry into a bucket of ice cream? I will leave the more technical analysis to the actual Pro's. This is just my humble opinion.

Rudimentary Elliott Wave Analysis for GOLD - Long TradeThis is another basic Elliott Impulse Wave pattern applied to a long-term long trade idea for Gold. This analysis is very similar to my Siacoin Elliott Wave idea but applied to a different asset class, so I've linked that idea in case you want to check that out and compare the two. This chart is over a 15+ year period and should be treated as a long-term investment strategy. This idea will remain valid unless price crosses below the $1035 mark, which is the top of wave 1 and will invalidate the entire pattern. If you look closely at the naked chart, and I strongly encourage everyone to do so, you will see that the bottom of wave 4 comes very close to the top of wave 1. During that period, price came down to within $6 - 7 of the top of wave 1, but price did not touch that number. This is very important as often waves come very very close to being invalidated but are not. From that point, price has bounced again ans formed a higher low, suggesting the beginning of wave 5. There are many different ways to make entry and manage risk in this trade, and this time I'll leave that the discretion of the individual. Gold price gapped up about $20 on market open Sunday evening and this is also encouraging, as the market has been recently rangebound. The $1250 mark is very significant, as this is a leverage point for mining corporations where in the COSTS of mining an ounce of gold become profitable, and those corporations begin to mobilize their assets in the pursuit of profits, which has a self-reinforcing effect on the price of gold. Be wary of paper gold schemes and vehicles that involve a lack of physical or legal possession of the underlying asset. Contracts for Difference are derived from the price of the underlying asset but trade in their own markets and are thus subject to their own price movements. Happy Hunting Everyone.

Fibonacci steps that could mean nothing, what do you think?This chart is a little confusing at first.

Each colored pair of lines represent each correction. If you draw Fibonacci retracement between the pairs, the black pair is the first, green the second and blue third. Each correction only makes it to the 38.2 line of the previous correction. The red pair marks a possible scenario for a fourth correction, with the bottom near the 60-65 area.

This was just a pattern i saw when drawing far to many Fibonacci lines on the chart.

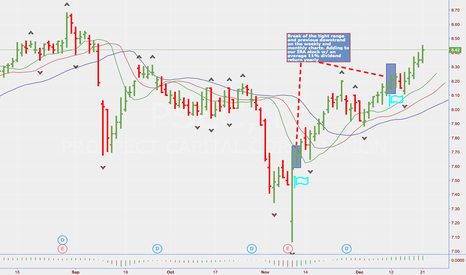

Wynn Resorts (WYNN) Trade Idea 4.25.2017With Wynn Resorts (WYNN) continuing a relatively strong uptrend its bullish reversal move on 2/27/2017, the ticker pulled back almost to a closeout point at its middle offset moving average.

But opportunity struck today with the only open risk remaining on earnings. The stock pulled a large momentum move as we scanned following our loss on Netflix (NFLX). We liked the less than $4 risk for the stock and were willing to take the gap risk on earnings giving us an overall proprietary rating of MODERATE based upon price to stop-loss, institutional sentiment, and the projections for the quarter. The main risk that has caused WYNN to be quite the volatile stock in the past couple of years is its Macau operation and the controversy that has since simmered.

We actually like Wynn for a long term investment due to the healthy dividend it pays and the constant purchases of stock by Steve Wynn himself since the company went public.

See more from our link on our Profile page

$NVDA $5 of Risk OpportunityIf you didn't notice the bullish reversal on 3/7, then another entry was on 3/17 for a long position. The trailing stop is $5 of risk, not too shabby. $NVDA is one of our favorites for a Skip-strike butterfly trade, especially if you want an OTM position for higher risk reward (due to the price fluctuation and strike hits).

Our youtube post on our site discusses the trade as well.

Citigroup (C) A Great Candidate For A Downside SpreadAlthough the banking sector has largely had a rally since the Presidential election, regulatory headwinds and near-term fundamental outlook and projections have seemed bleak for Citigroup’s growth potential. Long-term, the stock is a great purchase at a somewhat discounted price to its recent trading, but for our swing strategy, the latest break to the downside into a possible downtrend or consolidation is an opportunity for us.

If you’re looking for a 1:1 risk/reward trade with a skewed probability curve starting at roughly 62% chance of success to earn 100% ROI, then Citigroup is a gem in this turbulent market. Actually, we found this trade while scanning due to possibly having to close for a loss on our recent Alphabet (GOOG) trade due to management’s screw-up on an epic scale regarding extremist videos and advertisements on Youtube .

Anyways, here’s the trade we see:

Current stock price $58.46

Buy X Puts; 13 Apr 17 Exp; 58.50 Strike

Sell X Puts; 13 Apr 17 Exp; 58 Strike

Max Return on Risk/ROI: ~100%

Fun times.

We're Going Long GOOG For A BargainAlphabet's (GOOG) stock has been trending upward for quite awhile, and we've

been keeping a close eye on it. We've raised our risk level on most of the

massively expensive tech stocks due to our views on the overinflated prices

from the "Trump Trade" since the election. Already, our speculation of the

market correction seems to be in-effect dependent on the next few days'

price action with the S&P 500 ETF (SPY).

But in the meantime, we think the short term outlook for Google is bullish,

and this evinced itself when it continued its uptrend with the break of the

last up-fractal at $836.26 on Friday, March 9th. Although the option

liquidity is not our most favorite spread width, we saw a recent catalyst

occur as well with the introduction of Gmail money which will likely crush

the likes of Venmo and potentially Paypal.

Not to mention, Alphabet's subsidiary Waymo filed suit against Uber for stealing trade secrets through one of Uber's recently acquired autonomous car companies "Otto". After reading the details of what the suit entails, it revolves around a former Google employee stealing designs of proprietary LIDAR technology and using it for his autonomous truck startup (which Uber acquired). The lawsuit will likely be a hefty sum, and due to the somewhat "smoking gun" Alphabet has from email traffic showing the design in question, the odds favor Alphabet in winning the proprietary suit down the road.

From a fundamental standpoint, the Google news about the Gmail money concept will likely drive upward sentiment to execute a further uptrend following strategy. So how are we getting this at a discount?

Here's the trade:

Buy 3x Puts; 7 Apr 17 Exp; $845 Strike $10.04

Sell 6x Puts; 7 Apr 17; $850 Strike $12.37

Buy 3x Puts; 7 Apr 17; $852.50 Strike $13.85

Max Risk: $495.00

Max Sweet-Spot Reward: ~$855.00

Max Reward Passed $852.50 Strike: $255.00

Our trailing stop will follow our middle moving average currently at $825.14

and moving upward.

Why The Market Is Due to Crash in 2017 or 2018Those who do not learn from history are bound to repeat it. To us, 2017 is starting to look more and more like 1999-2001, with some B.S. from 2007 sprinkled in. Our evidence to support the argument is pretty substantial, but the only weakness lies in how long the music can continue to play. We don’t like to make predictions of stocks or market direction in-general, but when something smells like a turd, it’s usually a turd.

Our first point: Margin debt amounts are higher than they’ve ever been in history. Okay, so what’s the trigger? A short term consolidation. As in musical chairs, those buying into the market while it’s running are going to come out on the plus side, and man has it run since December. But what happens when news such as the potential for hiccups in conservative policy cause a halt to the speculative run that’s happened while Trump has been in office? The music stops. As a retail investor and trader, I can account personally for this, as margin is needed for your average investor who makes <$100,000 per year to buy into index funds like SPY when they’re over $200 per share. Even more so, who wouldn’t want to leverage themselves to buy into a higher risk equity or stock that has been in a >40% run, since December? The stock market is a rich man’s/woman’s game, and margin leverage is needed in order for traders to attempt to even make a dent in their account growth. When investment banks, commercials, news, or whatever are pitching “growth” securities, some of which trade at a price multiples times their revenue (ahem, Amazon (AMZN)), then the frenzy continues with financing until the music eventually stops. Then the proverbial #$#@ hits the fan.

Those who have bought on margin wind up closing their positions out of fear of losing more than they can afford, or worse, they wake up only to receive the margin call, not including their interest payments on the short term loan. Once that 2-3 day market consolidation happens, the market will likely tank back to where it was at least in December, if not further over the course of about a month due to fear.

Our second point: household debt has increased substantially, specifically with student loans and auto loans since 2007 and 2008 according to the Fed. Since the irresponsible banking sector’s sub-prime mortgage issuance up until the 2007 crisis, regulations forced the banks to seek other forms of interest revenue. Enter student loans and car loans. There’s a reason why car loan terms have increased from 4 years to almost 7 or 8 years since the mid-2000s. It’s easy money, and it’s tempting for the unassuming car buyer to want their monthly payment to be lower, not knowing they end up underwater at the end of the loan (not to mention the car likely being in terrible condition by the end of the 7 years). Not only are the banks responsible for this “free money” but also the auto companies themselves by allowing their lending arms to generate interest payments to their receivables as a hedge against lower sales figures.

As for student loans, it’s all in the numbers. The new President’s plan is a cap at 12.5% (an increase in 2.5%) of the borrower’s income, with debt forgiveness in 15 years with full payments. An average student loan is ~$10,000/year (in state) and ~$23,000/year (out of state). That’s $40,000 at a bare minimum at the end of the student’s enrollment. The average salary coming straight out of undergraduate programs is $50,000 a year, capped at $70,000-$80,000 for most jobs if the individual doesn’t have a Masters.

Read the rest of this article on our site from our Tradingview homepage.

AAPL Buy or Short Opportunity If You're Late to the PartyWe've been riding the Apple run-up train ever since late January, with arguably the cleanest uptrend since Summer 2015 that made your average weekly call option trader a boatload of cash. While we've been redesigning our site heavily due to customer feedback, we've been executing our trades on the side, and AAPL is no exception.

But be forewarned, no trend lasts forever, especially when viewing daily chart price action. AAPL's uptrend has held strong with very little sign of weakness due to the "Trump Trade", but our trailing stop is moving upward knowing we're due for a close at a rather substantial profit soon.

But you may ask "What if I want to buy AAPL now?". Well, I'd tell you to have patience. Why? Because, when utilizing our system we take into account supply/demand of an equity at a certain price, as according our chart, we've established one such support/resistance point at $140.27. If AAPL closes above that price point without any reversal signs given, we'd probably at least trade a bull option spread. I wouldn't buy the stock outright at that price simply because of AAPL's valuation being many times earnings, and the substantial downside risk and possible correction to come.

Even more to the downside, there's likely going to be a down-fractal support point formed at the $137.05 mark, and if the price corrects to the level or below, look to buy some deep ITM puts or trade a bearish skip-strike butterfly (Broken-Wing) Option Spread.

One other point to make is earnings happening next month. AAPL is one of the highest risk equities to trade during earnings, and from personal experience, can make or break your trade if you're just now coming in on a big move like this one from the past couple of months.

$KTOS Best Value Buy Opportunity PotentialKTOS has gotten a lot of attention on television lately, but we don't think it's buy at the moment. Fundamentally, the company's exposure in Unmanned systems as well as Directed Energy makes them a contender long-term, as these are the two fastest growing subsectors within future defense capabilities. The latest news exposure and positive earnings news last quarter blew the stock up, but we maintain the opinion that major profit taking on a relatively risky stock will drive the price downward in the short term and allow for a buy opportunity for a long term hold.

A Gold Trade Gone Well*WE'VE ACCIDENTALLY BEEN PUBLISHING PRIVATE IDEAS*

The fundamentals for Gold is looking bullish, and our trade we made back in the beginning of February has performed well using our first draft of the FriendlyTrend Signal. Our initial 5x contract entry at 1221 is not at an above-breakeven stop loss, and the spike up w/ a close allowed for a 4x contract entry with a fill at 1249.

We'll trim off some profits at the 1280 mark if prices rice to that height. Otherwise, the stop loss is currently trailed to the 1222 mark and onward.

Check out our site on our Tradingview profile for more of our trades.

Successful $OAS Credit Spread TradeWe opened this position about 30 days ago and played the time premium after the huge up move in oil prices. Our initial risk was $200 for a total collection of $50.

Bearcoin, 4H Gartley and Ending Diagonals.Looks like bitcoin is about to get another big wave down, this should bring us under $200 within the coming days.

On this chart, you can see that we have a pretty nice bearish Gartley pattern (www.investopedia.com). Along with 2 Elliott Wave Ending Diagonals, one is Wave C of a flat (red lines) which I believe to be either part of Wave E or Wave 2, the other is Wave v of C (yellow lines). This makes for a very bearish chart setup, along with the bearish divergences on the AO and AC on multiple time-frames. This is probably a great time to start opening up short positions against the trend to hold for the next few days.

Targets are difficult to make at this point, but the blue arrow shows a good target for the end of Wave 3, if it develops in such a way. Otherwise, we may have our first stop around 1200CNY for Wave 1.

The reason I am changing my count now is because Wave 1/D looks distinctly impulsive, so there is a chance instead of this being a 12H triangle, like my linked charts predicted, it could actually be a Triple Three Correction, ending at Wave C. Either way this is a very bearish set-up with a tight stop-loss. My strategy is to open shorts with stops set and go have fun for the next couple days while bitcoin bites the curb. Remember it helps to keep your eyes OFF the prize ;)

"Do your work, then step back, the only path to serenity" -Lao Tzu

Bitcoin forming horizontal triangle? (Elliott Wave Analysis)The best advice I could ever give anyone about the market is to "Want What the Market Wants." Do not want what you want , that will produce anxiety and doubt. Align your personal beliefs with that of the market and then trading will flow like a calm river of success.

So that raises the question: What does the market want? On a weekly timeframe, the market has been trending down for some time now, and my indicators are still saying the weekly trend is DOWN. Solidified by the fact that we failed to break the weekly up fractal at 310, which would have changed the weekly trend from DOWN to UP. Bearing in mind the larger trend, we come to the 12H chart:

On this chart, I have labeled what I believe to be the most sensible Elliott Wave count that I came up with, which is a bearish horizontal triangle. Here are a couple of reasons why this count makes the most sense to me:

Wave A is most likely a three

Wave C momentum is relatively weak compared to Wave A

Wave A fractal top is still in-tact.

Fibonacci Time and Price targets are within normal guidelines for Waves A, B, & C

The predictive targets for triangles are relatively hard to develop, however, on my chart I have made an attempt at predicting the end of Wave c of D and wave E. Wave E in particular is very difficult to target, however, once it is completed we will definitely get a major swing down into the 100s or possibly double digits. I have labeled on my chart with green, yellow, and red dashed lines possible major support levels. Which one we will stop at I am uncertain of until we are closer to that point. However, there is a high probability we will stop at or near one of those lines based on Fib extension targets.

Once this chart is resolved we could end up getting another one of Bitcoin's famous Moons™ I think this is actually more likely to be the final doom that I mentioned in my first chart. My time-targets for the end of the major cycle degree Wave 4 start around April 20th, that doesn't necessarily mean that is when we are going to begin the major uptrend, but it is likely that once we've gone past that date that bitcoin will be ready for the next major cycle Wave 5, which will happen sometime before the end of the time target in August. My guess is that we start the next Moon™ in June.

Important Note: This chart is INVALID if we break 294 and particularly 310.

USDJPY ShortWilliams: The alligator's mouth is horizontal but points sightly down - closed - asleep. Momentum is approaching zero. It's been a while since a new high. The RSI is pointing downward below 50. Expect a nice move down - a significant correction to the dollar bull market...could be several months. Sell on a break of 115,842.

Bollinger: bands (20ma) are narrowing and at the lower end of normal width...minimum volatility. The price is below the 20 day MA and has been for a while. The bands point down. The latest daily candle looks weak - may be a gravestone at end of day. The last time price was above the bands was more than month ago. Price has been below the bands twice in that time.

BTC ELLIOT WAVE: BIG PICTURE & COUNTING GUIDEThere's a lot of confusion in Bitcoin right now, but the reality is simple: there was a big Elliot wave downward, and now we're in the corrective phase of that wave.

The Elliot wave is not a model or a tool -- it's a psychological phenomenon. It's the product of the behavior of a population of people reacting to an event (or series) and its unfolding. Therefore, it's the way markets move. It's the assertion that markets are moderately predictable because markets are made up of people, and people are predictable. (Events are generally not predictable, however!) It asserts that the market isn't about to move out of step -- an overnight drop to $175 -- unless a major new event occurs.

The following chart is by request. It shows the basic wave count of the major move since August from $620~.

I've used the tools developed by Bill Williams (New Trading Dimensions, Trading Chaos 1&2) to give a basic demonstration of how to count the wave. His methods and tools are the "training wheels" version of wave counting. The main two tools used are THE ALLIGATOR and the AWESOME OSCILLATOR.

TYPO: First five WAVES finished at red-line cross (3 impulse, 2 corrective)

BOOKS: The Wave Principle (Frost & Pretcher), Trading Chaos (both editions--which are very different) (Bill Williams), New Trading Dimensions (Bill Williams)