Chartanalysis

Bull Trap Confirmed: GBPUSD's 8% Rally Faces ExhaustionLets Face it we had a great 6 months already clocking 60%+ Returns already.

And after sitting ducks for almost 2 months now we finally have a trade.

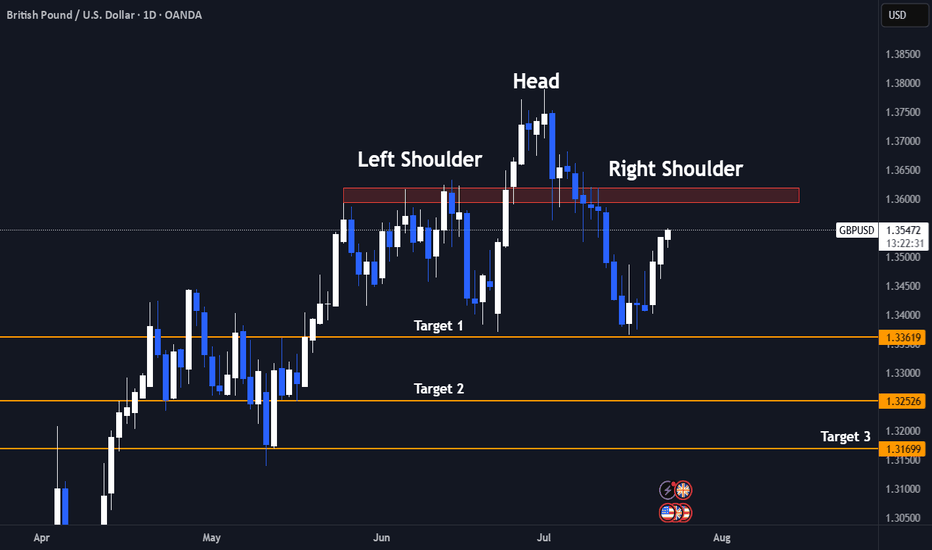

- Its a very self explanatory chart

- Trading at resistance

- Head & Shoulder pattern

And the best part the right shoulder is still yet to be formed! My favourite type of entry.

1.It gives a better risk reward ratio (1:7 expected)

2.Better Entry (No long red candles)

3. And even if the pattern fails it we may still reach the neck line which is target 1.

Entry Criteria

- A Red candle at the entry Line Marked

- Stoploss Above the Entry Candle

Target 1- 1.3361

Target 2- 1.3252

Target 3- 1.3169

Keep Your Risk Reward Intact! Not An investment Advice

Analysis BTC/USD Daily ChartAnalysis BTC/USD Daily Chart

**Chart Overview (Daily Timeframe)**

**Current Price**: \~\$114,937

**EMA 7**: \$116,896 (short-term)

**EMA 21**: \$116,561 (medium-term)

**Trendline**: Price is testing the long-term ascending trendline

**Key Zones:**

* **Support 1 (S1)**: \~\$110,000

* **Support 2 (S2)**: \~\$102,000

* **Immediate Resistance Zone**: \~\$116,000–\$120,000

**Bullish Scenario**

**Conditions**:

* Price **holds above the ascending trendline**

* A strong **bounce from current level (\~\$115K)** or a reclaim above **\$116K**

**Buy Setup**:

* **Entry**: \$115,000–\$116,000 (if bounce confirmed)

* **Stop-loss**: Below \$114,000 or the ascending trendline

* **Targets**:

* TP1: \$120,000

* TP2: \$125,000

* TP3: \$132,000+

**Confirmation**:

* Bullish candle formation near the trendline

* Reclaim of EMAs (especially EMA 7)

**Bearish Scenario**

**Conditions**:

* Price **breaks below the ascending trendline** and **closes below \$114K**

* Rejection from \$116K zone with a strong red candle

**Sell Setup**:

* **Entry**: Below \$114,000 (on confirmed breakdown)

* **Stop-loss**: Above \$116,000

* **Targets**:

* TP1: \$110,000 (S1)

* TP2: \$105,000

* TP3: \$102,000 (S2)

**Invalidation**:

* Quick recovery above \$114.5K and trendline reclaim = possible fakeout

**Bias**

**Neutral to Bullish**, as price is **at trendline support**.

Watch closely for **price reaction at current levels** for the next directional trade.

XAUUSD Gold Trading Strategy August 1, 2025

Yesterday's trading session, gold prices recovered to the 3315 area and then continued to decrease to the 3281 area. Currently, gold prices are fluctuating quite unpredictably due to the impact of tariff news and investor confidence.

Basic news: The Federal Reserve FED continues to maintain the federal funds benchmark interest rate in the range of 4.25% - 4.50%, in line with policy since 2025. Chairman Powell did not give any signal about the next interest rate cut on September 16 - 17.

Technical analysis: After falling sharply to the 3269 area, gold prices are showing signs of recovery. In the current downtrend channel, there has been a higher bottom than the bottom at H1. We can see that if the bullish pattern at H1 is confirmed, combined with the reversal candlestick appearing at H4, the possibility of gold bouncing back to reach the resistance area of 3330, even 3350 is completely possible. In the weekend trading session, we will wait at the support zones to trade.

Important price zones today: 3280 - 3285 and 3269 - 3274.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3283 - 3285

SL 3280

TP 3288 - 3300 - 3310 - 3330.

Plan 2: BUY XAUSD zone 3269 - 3271

SL 3266

TP 3274 - 3284 - 3300 - 3320.

Wish you a safe, favorable and profitable trading day.🥰🥰🥰🥰🥰

Gold (XAU/USD) on the 1‑hour timeframeGold (XAU/USD) on the 1‑hour timeframe

Chart Structure & Bias

* Price remains trapped in a **rising channel** (\~\$3,328–3,333), pressing against resistance near **\$3,340–3,345**.

* Short-term momentum is bearish: both EMA 7 and EMA 21 sit above current price, with declining volume signaling weakening buyer strength.

* Overall trend leans neutral‑to‑bearish until market clears key zones decisively.

Trade Scenarios

**Bearish Breakdown (Preferred)**

* **Trigger:** Break and close below channel support (\~\$3,326).

* **Targets:** Initial drop toward **\$3,320**, then **\$3,300**, and possibly lower if momentum intensifies.

* **Invalidation:** Price pushes back above **\$3,333–3,335**, negating bearish structure.

**Bullish Breakout (Conditional)**

* **Trigger:** Clean breakout and sustained close above **\$3,342–3,345**.

* **Targets:** Upward stretch toward **\$3,355–3,360**, and if strong, **\$3,367–3,375+**.

* **Invalidation:** Fails to hold structure—retesting from above back beneath **\~\$3,338**.

Macro Drivers & Market Conditions

* Caution prevails pre‑Fed decision and ADP / GDP releases—market awaits cues on interest rate direction.

* Safe‑haven demand has softened as global trade sentiment improves, while U.S. dollar strength continues to cap upside in gold.

* Analysts favor **sell‑on‑rise positioning**, bumping up potential for controlled pullbacks.

Verdict

Gold is consolidating in a tight upward channel, showing short-term bearish pressure. The **bearish breakdown scenario holds the edge** unless price convincingly clears above **\$3,345** on strong volume, which could flip bias. A confirmed break below **\$3,326** sets the stage for downward moves toward **\$3,300** or lower.

"BTC Sweeps Liquidity – Eyeing 115K Reclaim?""BTC Sweeps Liquidity – Eyeing 115K Reclaim?"

🔍 Technical Analysis – BTC/USD

On the 1H chart, Bitcoin (BTC) is currently displaying a textbook smart money structure, with price action following key institutional footprints.

🔑 Key Observations:

Liquidity Grab at Weak Low

Price dipped below the local support (~112,500), sweeping sell-side liquidity and tapping into a possible reversal zone.

Rejection from Demand Zone (Support Area)

A strong reaction occurred right at the support level, suggesting buyer interest is still present.

Order Block & Fair Value Gap

A visible Fair Value Gap (FVG) sits above current price action, aligning with an Order Block near the 115,000 level — this is a key magnet for price to rebalance.

Target Zone

Immediate upside target is 115,000, where an order block lies. If price reaches that level, expect potential short-term resistance or reversal.

Break of Structure (BOS) Confirmations

Multiple BOS and CHoCHs indicate bearish-to-bullish attempts, but the current structure still needs confirmation above 113,500+ for bullish continuation.

🧠 Conclusion & Expectation:

BTC has swept liquidity to the downside and may now seek to fill the FVG and revisit the 115K order block. However, confirmation is required — watch for bullish engulfing candles, volume spikes, or a CHoCH above 113,500.

“Smart money doesn’t chase — it waits for liquidity, then repositions. BTC may be following the same script.”

AUD/USD Bearish Breakout – Retest & Sell Continuation SetupAUD/USD (Australian Dollar vs. US Dollar)

Likely a 4H (4-hour) timeframe based on candlestick density and scale.

---

2. Structure & Patterns:

Rising wedge/ascending channel: Already broken to the downside.

Breakout zone: Around 0.6480–0.6500, clearly marked and now acting as resistance.

Retest confirmed: Price returned to the broken zone, touched resistance, and dropped.

Ichimoku Cloud: Price is below the cloud → strong bearish signal.

Downward projection: You’ve drawn a possible bearish path with lower highs and lower lows.

---

3. Key Support & Target Levels:

✅ Current Price (as per chart):

Around 0.6468

🎯 Target Points (as per your drawing):

1. First Target Point → 0.6400

This aligns with previous minor support.

2. Second Target Point → 0.6370

Likely based on a Fibonacci or historical support level.

---

✅ Clear Trade Setup Summary:

Component Value

Direction Sell (Short)

Entry 0.6475–0.6485

Stop-Loss 0.6520

TP1 0.6400

TP2 0.6370

---

📌 Conclusion:

You are currently in a bearish setup after a breakdown from a rising structure. The market structure favors lower prices with clearly marked TP1 at 0.6400 and TP2 at 0.6370. Your entry zone (0.6475–0.6485) is technically sound, especially if there's a minor retracement.

Let me know if you want:

A Fibonacci analysis

RSI/MACD confirmation

BTC/USDT Bearish Continuation SetupChart Identification:

Timeframe: Likely 1H or 4H

Pair: BTC/USDT

Indicators: Ichimoku Cloud

Pattern: Price broke down from cloud resistance and is retesting previous support

Setup: Bearish continuation with consolidation before next leg down

---

✅ Trade Setup (Sell):

🔹 Entry Point:

Sell Entry: Below 113,500.84

This level marks the neckline of a small consolidation zone.

Wait for clean candle close below this level.

---

🎯 Target Levels (Take Profit):

1. TP1: 110,955.16

Previous minor support

2. TP2: 108,091.84

Key support/demand area

---

🧠 Optional Confirmation:

You can wait for:

Bearish candlestick pattern at 112.1K zone

Rejection of retest near 113.7K–114.3K (top of cloud)

---

📌 Summary:

> BTC/USDT Short Setup

🟢 Entry: Below 113,500.84

🎯 Target 1: 110,955.16

🎯 Target 2: 108,091.84

Bearish bias as price remains below the Ichimoku cloud and shows signs of continuation.

Decentraland: Where Are the Bulls?Decentraland’s MANA has recently struggled to sustain the upward momentum of wave iii in orange. Nonetheless, our primary scenario remains that this move should eventually push the altcoin above the $0.40 resistance level. Overall, we anticipate the full five-wave orange sequence could extend beyond the next key threshold at $0.85 before the larger blue wave (i) reaches its peak. Conversely, our 25% likely alternative scenario still allows for a new wave corrective low below the $0.19 support.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Colgate Palmolive – A Safe Haven Stock for Long-Term InvestorsThere are two chart of Colpal.

COLPAL is moving in well defined parallel channel with support near at 1750-1850.

COLPAL is taking support on Ema with near at 2050-2150.

COLPAL is taking support near its AVWAP zone, which lies between ₹1800–₹1900.

If this level is sustain then we may see higher prices in COLPAL.

Thank You !!

Dow Jones Industrial Average (DJI) – 1H Chart Analysis 1. Structure: Broad Range Consolidation

Price remains within a wide horizontal range between 45,137 resistance and 43,792 support. This shows indecision and distribution at highs.

2. Key Rejection Zone

The yellow zone around 45,001–45,137 acted as a strong supply area. Multiple rejections indicate heavy selling interest here.

3. Mid-Zone Compression

Current price is hovering just below 44,765 resistance — acting as a decision point. Break above it may retest the supply zone; rejection could send price lower.

4. Demand Holding at 44,280

The strong bounce from 44,280.25 shows buyers defending this demand zone. It's the key support to watch for bulls.

5. Next Play

Bullish: Break and hold above 44,765 targets 45,001–45,137.

Bearish: Failure leads to 44,280, then 43,973 → 43,792.

Neutral bias unless a clean breakout confirms direction.

BTCUSD – Descending Channel or Bullish Flag?BINANCE:BTCUSDT – Market Maker’s Game Inside a Descending Channel

Timeframe: 2H | MJTrading View

Market Structure Overview:

Bitcoin recently printed a new ATH at $122,000 after a parabolic run from the previous ATH at $111,937.

Since then, price has been consolidating inside a descending channel, which could act as a bullish flag in higher timeframes.

Liquidity pools are clearly formed:

Above $122K – resting stops of late shorts.

Below $115K–$114K – weak long stops and untapped demand near the Order Block (OB).

Key Levels & Liquidity Zones:

Upside:

$122K Liquidity Pool → If swept, could trigger momentum towards $124K–$125K.

Downside:

$116K OB → First defensive zone for bulls.

$112K Strong Support → Aligns with previous ATH breakout base.

Market Maker’s Dilemma:

If you were a market maker… which liquidity pool would you hunt first?

Price is coiling tighter within the channel, and both scenarios are possible:

Upside Sweep → Rapid breakout above $122K to clear shorts, then potential continuation.

Downside Sweep → Sharp drop into $116K–$112K liquidity, flushing longs before any recovery.

⚡ MJTrading Insight:

This is the classic market maker compression – first sweep likely determines direction.

Patience here is key; let the liquidity tell the story.

#BTCUSD #Bitcoin #Liquidity #SmartMoney #PriceAction #MJTrading #ChartDesigner #CryptoAnalysis

Psychology Always Matters:

US Dollar Index (DXY) Chart Analysis – 1H TimeframeUS Dollar Index (DXY) Chart Analysis – 1H Timeframe

This chart shows the **US Dollar Index (DXY)** with key price zones, trendlines, and EMA indicators. Here's a detailed analysis:

**Key Observations:**

* **Price:** Currently trading near **98.41**

* **EMAs:**

* **EMA 7** = 98.373 (short-term trend)

* **EMA 21** = 98.356 (medium-term trend)

* **Trendline:** Uptrend line still intact, acting as dynamic support

* **Volume:** Steady, no strong breakout yet

* **Support Zones:** 98.20 – 98.35

* **Price Structure:** Consolidating above support and EMAs after a pullback from highs

**Bullish Scenario**

* If price **holds above EMAs and the green support zone (98.20–98.35)**

* **Breakout above 98.50** would confirm strength

* Targets:

→ **98.70**

→ **99.00+** if trendline support continues to hold

* EMAs are aligned bullishly (7 above 21) – good sign for continued upward trend

**Bearish Scenario**

* If price **breaks below 98.20 and closes under the trendline**

* Watch for rejection near 98.50 followed by strong red candle

* Downside targets:

→ **97.80**

→ **97.60**

* A breakdown below the ascending trendline = trend shift confirmation

**Conclusion**

* **Bias:** Bullish as long as DXY stays above 98.20 and trendline

* **Invalidation:** A break and close below 98.20 + trendline = bearish shift

Gold (XAU/USD) 1H Chart AnalysisGold (XAU/USD) 1H Chart Analysis

**Current Trend:** Consolidation within a range

**Price:** \$3,335–\$3,336

**Indicators:**

* EMA 7: \$3,336.92

* EMA 21: \$3,339.36

* Price trading slightly below both EMAs – **short-term bearish pressure**

---

### 🔍 **Key Levels**

* **Resistance Zone:** \$3,344–\$3,348

* **Support Zone:** \$3,324–\$3,328

---

### 📊 **Trade Scenarios**

#### **Bullish Breakout Scenario**

* **Confirmation:** Clean breakout and candle close above **\$3,348**

* **Buy Entry:** Above \$3,348

* **Targets:**

* TP1: \$3,360

* TP2: \$3,372+

* **Invalidation:** Price falls back below \$3,344 after breakout (fakeout risk)

#### **Bearish Breakdown Scenario**

* **Confirmation:** Break and close below **\$3,324**

* **Sell Entry:** Below \$3,324

* **Targets:**

* TP1: \$3,312

* TP2: \$3,296

* **Invalidation:** Reclaim above \$3,328

---

### ⚖️ **Bias**

Neutral to Bearish until a clear breakout occurs. Monitor volume and candle strength near the support/resistance zones for trade confirmation.

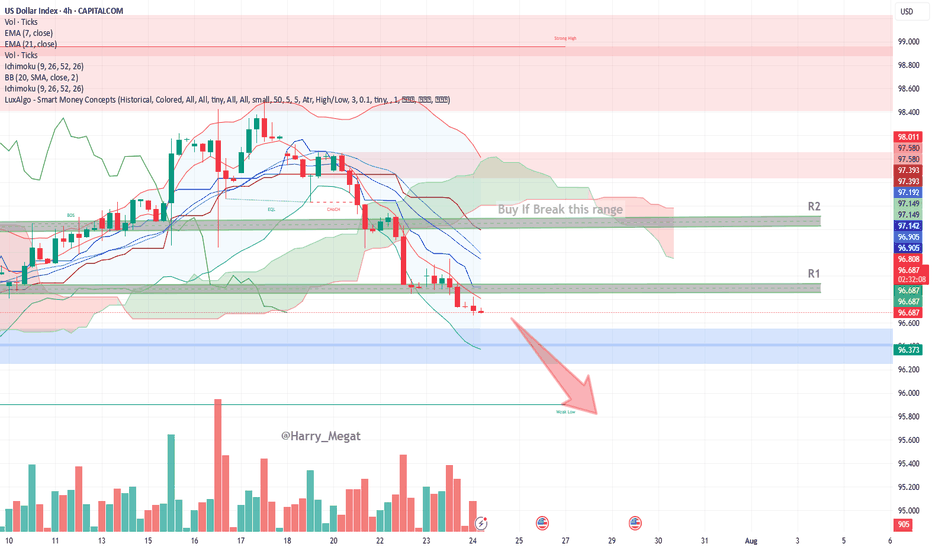

US Dollar Index (DXY) – 4H Chart AnalysisUS Dollar Index (DXY) – 4H Chart Analysis

**Current Trend:** Bearish

Price trades below EMAs, Ichimoku Cloud, and within a bearish channel.

#**Bearish Scenario (Favorable)**

* **Conditions:**

* Price remains below EMA 7 & 21

* Stays under Ichimoku Cloud and 96.812 resistance (R1)

* Lower lows forming, bearish momentum increasing

* **Confirmation:**

Break below **96.37 (blue zone)**

* **Target:**

* TP1: 96.00

* TP2: 95.60 (next weak support)

**Bullish Scenario (Reversal)**

* **Conditions:**

* Price must break above **96.81 (EMA 7 + resistance)**

* Break above **R1 → 96.90**, and then above **R2 → 97.14–97.19**

* Bullish candles close above the Ichimoku cloud

* **Confirmation:**

Break and retest of **97.20**

* **Target:**

* TP1: 97.39

* TP2: 97.58 (key structure)

* TP3: 98.00 (major resistance)

**Bias:** Bearish unless DXY breaks above **97.20** with strong volume and bullish structure.

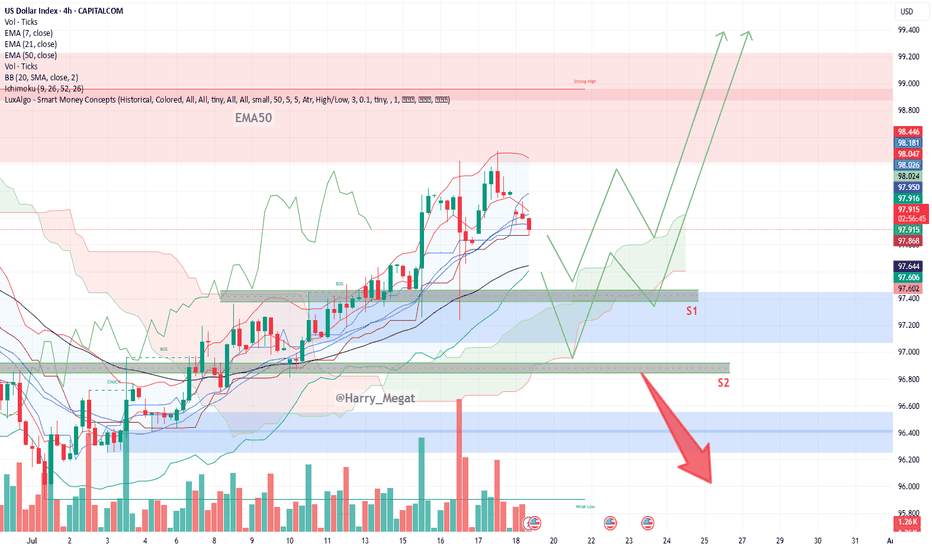

DXY Chart Outlook: Trend, Support, and Price Objectives**DXY Chart Outlook: Trend, Support, and Price Objectives (Reworded Analysis)**

**Trend Overview**

* The DXY chart reflects a **clear upward trajectory**, characterized by a sequence of **ascending highs and higher lows** — a classic sign of bullish momentum.

* Currently, the price is **retracing toward the 50-day EMA**, which appears to be holding as **dynamic support**.

* Two important **horizontal support zones** are marked:

* **Support 1 (S1):** \~97.400 (aligned with EMA-50)

* **Support 2 (S2):** \~96.800 (a deeper correction level)

**Projected Price Zones**

* **Near-Term Objective:** **98.800 to 99.000**

* A rebound from the EMA or S1 could send price higher toward this zone, continuing the current bullish structure.

* **Mid-Term Target:** **99.200 to 99.400**

* If the price successfully clears the 99.000 resistance, further bullish continuation could aim for this intermediate target range.

* **Extended Target:** **100.000+**

* A sustained breakout beyond 99.400 could open the path toward **psychological resistance at 100.000**, possibly higher on strong momentum.

**Support Zones to Watch**

* **S1 (97.400):** This level coincides with the 50-day EMA and represents a **first line of defense**.

* **S2 (96.800):** Should the price fall below S1, this secondary level could provide **stronger support** and potential bounce opportunity.

**Risk Management**

* Consider placing a **protective stop** just below S2 — around **96.500** — to safeguard against a potential trend reversal or deeper correction.

**Summary**

* The DXY remains **technically bullish**, with potential upside targets at **98.800**, **99.400**, and eventually **100.000+**.

* Traders can monitor **S1 and S2** for potential entries or trend confirmation.

* A **breakdown below 96.500** would invalidate the bullish setup and warrant caution.

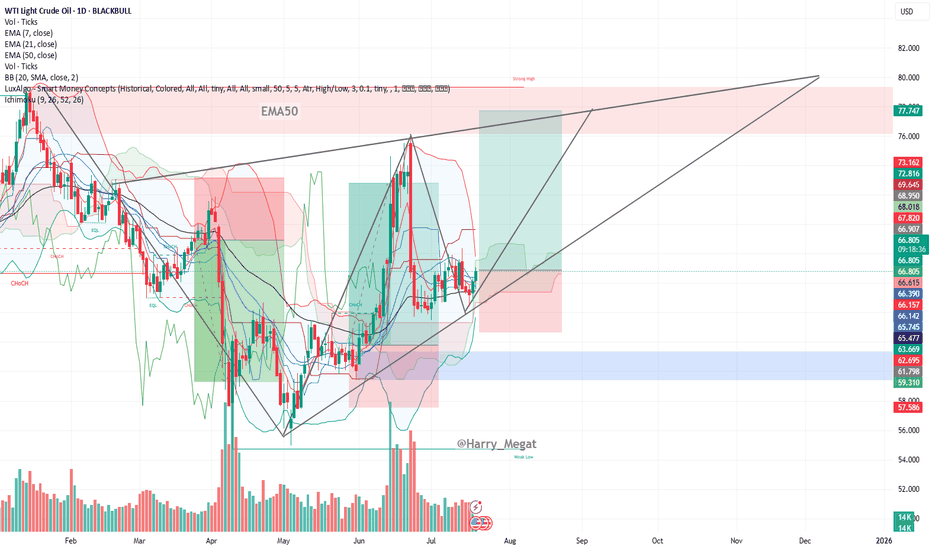

WTI Crude Oil Daily Chart Analysis (symmetrical triangle)WTI Crude Oil Daily Chart Analysis

**Trend & Structure:**

* The chart displays a **symmetrical triangle** formation, signaling a **potential breakout setup**.

* Price is currently trading around **\$66.78**, gradually rising from its recent consolidation.

* **Higher lows** and **lower highs** indicate a tightening range, which usually precedes a sharp move.

**Support & Resistance:**

* **Support Zone:** Around **\$65.47–\$66.15**, marked by the 50 EMA and prior price reactions.

* **Resistance Levels:**

* **\$68.95** – Short-term resistance and previous peak.

* **\$72.81** – Strong horizontal resistance.

* **\$77.75–\$80.00** – Projected upper trendline zone of triangle.

**Moving Averages (Bullish Setup):**

* EMA 7: **\$66.15**

* EMA 21: **\$66.14**

* EMA 50: **\$65.47**

* All EMAs are aligned in bullish order (7 > 21 > 50), confirming **bullish momentum**.

**Volume Insight:**

* Volume remains relatively steady; a spike in volume with breakout from the triangle would confirm trend continuation.

**Trade Setup Suggestion (based on chart):**

* **Breakout Buy Idea:** If price breaks above **\$68.95–\$70**, potential upside to **\$77–\$80**.

* **Invalidation:** A break below **\$65** would invalidate the bullish structure.

**Conclusion:**

WTI crude oil is trading within a symmetrical triangle, supported by bullish EMAs and tightening price action. A breakout above \$69 could trigger a bullish rally toward \$77–\$80. Keep an eye on volume confirmation and geopolitical headlines that can impact oil fundamentals.

$AI they sleep, i eat. Quiet danger..Hello,

Name has been on my watch for a week or so now, finally just sitting back and getting to a multi analytical chart.

To begin: Yes, I see the head and shoulders pattern forming, scary, I know. Aside from that just zoom out, this name has traded in this range for 1,200 days... the range of $20 to $30 with some bumps in the $40's and low $20's with taps in the teens. This name is quiet, not a loud player like other AI tickers. Something smells fun here. I'm going to be gearing in some $40 calls for 2026. I may risk 20% of my port here. I feel confident in this one, I do. The name is holding good support in the low $20 range and there are a lot more green candles than red. I know other names are getting more attractive like BBAI, you still have SMCI, CRWV, NVDA and so forth, which is fine, means nothing. This was a meme name type of stock about a year ago. I believe this will go on a run towards $50. If you have patience, $50 calls for 2027 would be appropriate and at a fair price for a swing and a possible short squeeze. For those who want to play the shorter term volatility $40 calls for Jan. 2026.

Good luck.

WSL.

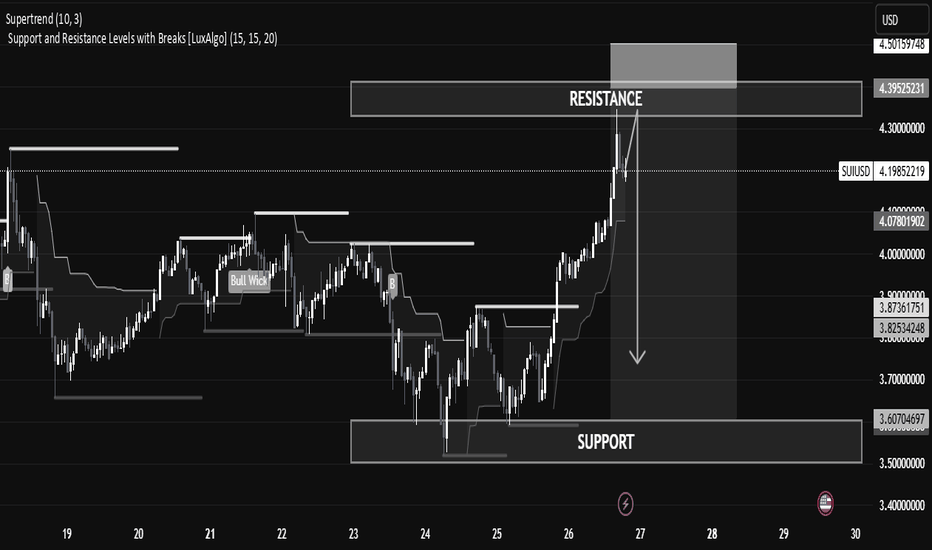

SUI/USD Technical Analysis – Potential Reversal Zone IdentifiedSUI/USD Technical Analysis – Potential Reversal Zone Identified

The current SUI/USD price action shows a strong bullish impulse reaching into a well-defined resistance zone, suggesting a potential pullback or reversal in the short term.

🔍 Key Levels

Resistance Zone: Between 4.30 – 4.39 USD, currently being tested after a strong bullish run. This is a historical supply area where price previously reversed.

Support Zone: Found between 3.60 – 3.70 USD, where price consolidated and accumulated before initiating the current rally.

Current Price: 4.2044 USD, slightly below the resistance zone, showing early signs of rejection.

📊 Technical Indicators & Structure

Supertrend (10,3): Bullish signal still active, suggesting trend strength, though traders should be cautious near resistance.

Break of Structure (BoS): Clean upward breaks suggest buyer dominance, but profit booking or sell-side liquidity may emerge near resistance.

Volume & Momentum: Impulse candles show strength, but volume tapering near resistance could indicate exhaustion.

📘 Educational Perspective

This setup highlights the importance of trading within key zones:

Buying at support, where demand is strong.

Monitoring resistance for signs of exhaustion or reversal patterns like wicks, doji, or bearish engulfing.

Risk Management Tip: In such cases, aggressive traders might short from resistance with tight stops, while conservative traders wait for confirmation (e.g., break and retest of the support or resistance).

DOGE/USDT Technical Analysis – Breakout AnticipationDOGE/USDT Technical Analysis – Breakout Anticipation

As of the current market structure, DOGE/USDT is showing signs of a potential bullish reversal from the demand zone (support), aiming toward the projected target at 0.27253 USDT.

🔍 Chart Structure & Price Action

Support Zone (0.21873 – 0.22568): The price has previously respected this area, making it a strong demand zone where buyers stepped in.

Resistance Zone (0.27756 – 0.29000): A key supply zone where previous rallies halted. This is the ultimate test for bulls after the breakout.

Current Price (0.23743) is showing consolidation above the support, suggesting accumulation before a move.

🧠 Technical Indicators

Supertrend Indicator: Currently flipping to bullish (10,3 settings), indicating potential upside continuation.

Volume Profile (VRVP): Shows high volume nodes around the support level, confirming strong interest from institutional players or large orders.

Market Structure: A higher-low is forming, indicating early signs of a bullish market shift.

🎯 Target

The projected move towards 0.27253 USDT aligns with previous price action and supply zone interaction. A clean breakout from the current consolidation could fuel momentum toward this level.

🎓 Educational Insight

This setup reflects the principles of Smart Money Concepts (SMC):

Price tapping into demand before impulse moves.

Liquidity grab at lows.

Break of structure (BOS) to the upside could trigger continuation.

Traders can learn the value of combining structure-based trading with volume analysis to improve entry precision and confidence.