Gold Weekly Recap – Week 27 (30 Jun – 04 Jul)🟡 XAUUSD | MJTrading

Overview

Gold (XAUUSD) staged a significant recovery this week after retesting a critical support zone. Price action reflected strong buying interest at lower levels, followed by consolidation near mid-range resistance.

🔹 Key Levels:

Strong Support Zone: 3,246 – 3,250

Weekly Low: 3,246.35 (30 June)

Weekly High: 3,365.77 (3 July)

Closing Price: ~3,343

🔹 Price Action Summary:

✅ Early Week Retest & Reversal

After the prior week’s decline, gold opened the week near the major support area around 3,246. This zone acted as a strong demand pocket, triggering a swift rejection and initiating a bullish reversal.

✅ Sustained Rally to Resistance

Price climbed steadily, riding the 15-period EMA to reach the weekly high of 3,365.77 on 3 July. This move represented a nearly 4% recovery off the lows, fueled by renewed safe-haven flows and short covering.

✅ Midweek Consolidation

Following the rally, gold entered a sideways consolidation phase between 3,340 and 3,365. EMA flattening reflected a pause in momentum as traders assessed the next directional catalyst.

✅ Late-Week Pullback

Toward the end of the week, price tested the 3,310–3,320 area before modestly bouncing into the Friday close. Overall, the market maintained a cautiously bullish tone while holding above the prior support.

🔹 Technical Perspective:

🔸 Bias: Cautiously Bullish

Price defended the strong support and printed a higher low structure.

Sustained closes above 3,300 maintain the bullish outlook.

🔸 Near-Term Resistance:

3,365–3,390 remains the immediate supply zone to monitor for breakout attempts.

🔸 Key Support:

The 3,246–3,250 area continues to be the primary downside line in the sand.

🔹 Special Note – 4th July US Bank Holiday

Trading volumes were notably lighter on Thursday, 4th July, due to the US Independence Day holiday. This contributed to reduced liquidity and muted volatility, with many traders and institutions off desks. The thinner market conditions likely influenced the late-week pullback and consolidation, as participation was limited heading into the weekend.

🔹 Sentiment & Outlook

The decisive rebound from support suggests that buyers are defending value zones aggressively. However, failure to close the week above 3,365 leaves gold vulnerable to another retest of mid-range levels if fresh catalysts don’t emerge.

Traders should watch for:

A clean breakout above 3,365 to confirm continuation higher.

Any sustained weakness below 3,300 as a signal of fading bullish momentum.

🧭 Next Week’s Focus:

Monitoring whether the consolidation evolves into accumulation or distribution.

Watching for a breakout or deeper pullback

Reactions to upcoming economic data

EMA alignment: If the 15 EMA continues to track above the 60 EMA, it supports a bullish bias.

Chart Notes:

The main chart highlights this week’s action, while the inset provides a fortnight overview of the broader decline and recovery for context.

Thank you for your time and your support...

🚀🚀Boost it if you like it (Thanks)🚀🚀

#Gold #XAUUSD #GoldTrading #Forex #Commodities #TechnicalAnalysis #PriceAction #TradingRecap #MJTrading #GoldForecast #MarketReview #WeeklyRecap #TradingView

Chartanalysis

$SNAP -- accumulation $8 into $9. big move brewing into earningsHello, extensive chart here: Daily and Weekly. Looking at this name I like the setup here. The Daily and Weekly chart shows strength in this area, $8 to $9 with heavy accumulation and support. The Weekly chart shows about 13 weeks of this bottoming area with tons of buying from previous years as well. NYSE:SNAP has earnings July 25th and I will be looking to enter $10 calls with a date of 8/15. The premiums could spike just into earnings since it is a popular name to play around that time and it has plenty of daily volume. The SMA and EMA on the weekly honestly is my target -- it is a big sell zone. We are in the liquidity area and have been. Will be starting a position on these contracts this coming week. This name should see $10 with relative strength but my first target is mid $12 before earnings. I would like to shed some contracts into the earnings date and see if we can make an extra buck or two on profited contracts so when earnings comes it can be a risk free stress free play.

WSL.

Polkadot: Bottom Already in?Given Polkadot’s recent sharp rebound toward resistance at $3.66, we consider it 35% likely that magenta wave alt. has already bottomed at $3.02. This would be confirmed by a meaningful breakout above said $3.66 level. Our primary scenario, however, still calls for lower lows as part of wave – with a break below the same $3.02 support.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

USDJPY 4-Hour Technical Analysis (Smart Money Concept Breakdown)📈 Overall Market Structure Overview:

The chart reflects a multi-phase Smart Money playbook, consisting of:

Bullish channel structure

Breakout followed by liquidity sweep

Supply zone flip to demand

Price mitigation and structure shift

Anticipated reaction zone for upcoming move

🔎 Phase-by-Phase Analysis:

🧱 1. Ascending Channel Formation

Price was moving upward in a controlled bullish ascending channel, suggesting institutional accumulation with planned distribution above highs.

The channel breakout was the first significant liquidity event, where early breakout traders were baited.

💧 2. Fakeout and Supply Interchange into Demand (Ellipse Zone)

Once the channel broke, price sharply reversed, retracing into a previous supply zone.

However, institutions defended this zone, flipping it into a demand area.

This behavior, marked with the blue ellipse, signals “Supply Interchange in Demand” – a core SMC concept.

Here, orders were absorbed

Liquidity was trapped below

A bullish push confirmed institutional intent

🎯 3. Previous Target Hit – Completion of Bullish Leg

Price made a strong rally from the demand zone, hitting the previous target near 147–148 zone.

This bullish leg created a Major Break of Structure (BOS) confirming bullish dominance at that phase.

⚠️ 4. Distribution Begins: Shift in Momentum

After reaching the Major BOS area, price failed to hold higher levels.

A decline followed, indicating distribution by smart money.

The reaction was sharp and consistent, creating lower highs, signaling weakness.

🔄 5. Minor CHoCH Formation – Early Reversal Signal

A Minor Change of Character (CHoCH) occurred around the 144.000–143.000 area.

This is a key transition, where smart money transitions from bullish intent to potential bearish delivery.

📦 6. Next Target Zone – Bullish POI (Point of Interest)

The chart identifies a next target demand zone around 141.800–141.200, marked in green.

This zone:

Holds unmitigated demand

Sits below a recent liquidity pool

Aligns with past support

This is where Smart Money could re-enter, offering a long opportunity if a bullish CHoCH or BOS forms from that zone.

📊 Trade Scenarios & Forecast:

🔻 Bearish Short-Term Play (Sell Setup):

If price respects current resistance (144.500–145), and a lower high forms:

Short entry opportunity

Target: 142.000–141.200 demand zone

Confirmation: Strong bearish candle, CHoCH below minor support

🔺 Bullish Reversal Play (Buy Setup):

At the demand zone:

Look for bullish reaction + CHoCH or BOS

Long entry potential

Target: Retest of 144.000 or even 147.000 if liquidity allows

🔐 Smart Money Tactics in Play:

Liquidity Engineering:

Price trapped both bulls (at highs) and bears (below ellipse zone)

Supply into Demand Flip:

A classic trap where supply becomes a launchpad for bullish delivery

Minor CHoCH:

Early signal of intent change

Next POI (Point of Interest):

Potential reaccumulation zone below major liquidity grab

🧠 Educational Takeaway:

This analysis illustrates:

Why breakouts are often traps without confirmation

How to identify real institutional zones

The role of CHoCH/BOS in planning ahead

Importance of waiting for price to come to your levels, not chasing

⚠️ Risk & Caution:

News catalysts can cause deviation from technical levels

Always use stop loss and proper risk management

SMC is about patience and precision, not prediction

✅ Summary:

USDJPY is showing early signs of a smart money distribution and a potential pullback toward demand.

Watch closely for confirmation at the key zone (141.800–141.200) before engaging long. Until then, short setups on rallies may be favorable.

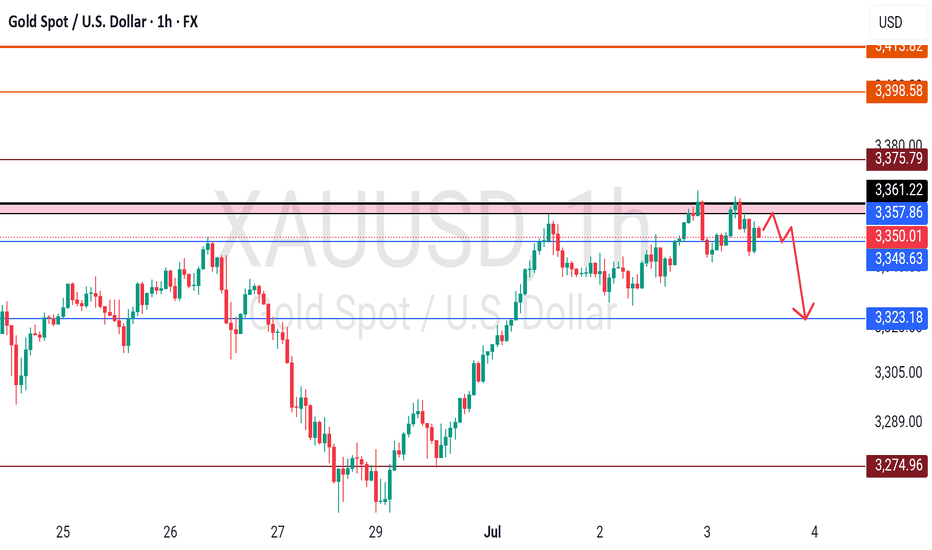

GOLD 1H – Breakout Retest or a Fragile Bullish Hope?👆🚀Boost it if you like it... (Thank you) 🚀👆

Gold has finally broken out above the descending trendline that has capped price for weeks. We’ve already seen Leg 1, an impulsive rally from the strong support zone, and a textbook retest of the broken trendline.

If bulls hold this level, a Leg 2 continuation could unfold.

Key Factors to Watch:

✅ Strong demand zone fueling the first leg up

✅ Clean breakout and retest of descending resistance

✅ Price still hovering around EMAs (15/60)

⚠️ However, the structure is fragile – lack of follow-through could trap late buyers

⚠️ If price loses the retest area decisively, sellers may reclaim control

Trading Insight:

This is a fascinating setup for bulls—but don’t fall in love with it. Stay adaptive. The market doesn’t owe us a second leg higher. Manage risk carefully and remember: probabilities, not certainties.

Trade Safely...

#MJTrading

#Gold #XAUUSD #TradingView #TechnicalAnalysis #BreakoutTrading #SupportResistance #PriceAction

Ethereum: Eyeing New Highs?Ethereum has surged recently and continues rising in turquoise wave B. The next target is a break above the June high, with potential upside to resistance at $4,107. A direct breakout above this level (27% probability) would suggest green wave alt. ended in April. However, our main scenario expects a reversal below $4,107, with turquoise wave C likely dragging ETH into the Long Target Zone between $935.82 and $494.15 to complete wave .

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

$BTC Price Showing a Bullish Flag Pattern & Breakout see chart..CRYPTOCAP:BTC Price Breakout of Bullish Flag Pattern. I'm guess it's going to the next Price Zone $115K and if Breakout thank going $122K price zone.

I was telling some coins that was saying Multiple Profit and now coins are driving on the way. There are coin is ETH, BNB, XRP, SOL, TRX, TON, SUI, ADA, ICP, ARB, XLM.

Ric Edelman Urges Up to 40% Crypto Allocation, Predicts Bitcoin Surge to $500K

Top advisor Ric Edelman recommends investors allocate up to 40% to crypto, forecasting Bitcoin could reach $500K with rising institutional demand.

Ric Edelman advises investors to allocate 10% to 40% of their portfolios to crypto, based on their risk tolerance.

Edelman predicts Bitcoin could reach $500,000 if just 1% of global assets shift into the cryptocurrency sector. His endorsement is viewed as a major TradFi signal, given his $300 billion asset management influence in the advisory industry.

Ric Edelman, the founder of Edelman Financial Engines and DACFP, has recommended investors shift a significant portion of their portfolio to cryptocurrency. In a recent whitepaper, Edelman advised allocating between 10% and 40% to crypto, depending on individual risk tolerance.

This guidance marks a break from the conventional 60/40 stock-to-bond portfolio model, which he believes is no longer practical in a rapidly advancing economic environment.

According to Edelman, conservative investors should hold 10% in crypto, moderate investors 25%, and aggressive investors 40%. He cited technological advancements and increased life expectancy as reasons to move away from traditional investment formulas. He emphasized that ignoring crypto means betting against an asset class that has outperformed all others over the past 15 years.

Bitcoin Price Could Hit $500,000 with Minimal Asset Shift

Edelman also presented a bullish projection for Bitcoin, suggesting it could reach $500,000. He explained that a 1% allocation of the $750 trillion in global assets toward Bitcoin would inject $7.5 trillion into the market. Based on current valuations, this inflow could significantly drive the asset’s price. He underlined this estimate as simple arithmetic based on supply and demand trends.

Edelman pointed to growing institutional interest and policy changes as key drivers for crypto’s rise. He highlighted that Tether, a major stablecoin, reported $13 billion in profits last year, surpassing companies like McDonald’s and Ford. He also noted that a pro-crypto political climate, especially following Donald Trump’s reelection, is setting favorable conditions for digital assets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

Apple: More Room to RunWe still allow more room for Apple’s magenta wave (B) to extend upward before wave (C) takes over, pulling the stock toward the low of green wave . Thereafter, green wave should start (above $168) and initiate the next advance, lifting the stock toward resistance at $260.10. A break below $168, however, would activate our alternative scenario, in which blue wave alt.(IV) targets a deeper low (32% probability).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

PRZ at 0.6600? | Watching for Reversal from Channel Top👆🚀Boost it if you like it... (Thank you) 🚀👆

Pair: AUD/USD Timeframe: 4H Bias: Short-term bearish Custom Term: PRZ (Possible Reversal Zone) = 0.65696

📈 Technical Structure:

AUD/USD is trading within a well-respected ascending channel, with price currently hovering near 0.6570. The upper boundary of the channel aligns closely with the PRP zone at 0.6600, which also coincides with:

A prior supply zone (visible on higher timeframes).

Confluence of the 15 EMA (0.65692) and 60 EMA (0.65534) flattening out.

Psychological round number resistance.

Entry: 0.65700

Stop: Above 0.66064 (channel breakout invalidation)

Target 1: 0.6540

Target 2: 0.6500

Risk/Reward: ~1.8

(Warning: This is an early entry )

🧠 Psychology Insight:

The PRP concept helps frame trades around areas of emotional overextension—where traders may overcommit to a breakout. By identifying these zones in advance, you stay objective and avoid reactive decisions.

PRZ: Possible Reversal Zone

#AUDUSD #PRZ #Forex #TechnicalAnalysis #ChannelTrading #ReversalZone #PriceAction #MJFX #TradingPsychology #ToughButSuccessful

City Union Bank ' s Key level | Breakout |This is the Daily Chart of City Union Bank .

CUB has formed a Broadening Wedge pattern on the daily chart, with a breakout near the ₹200 support zone. Post breakout, the pattern suggests potential upside targets of ₹274 and ₹310

On the 4-hour chart, the stock has formed a Head and Shoulders pattern, with a breakout at ₹190, which has already been retested. The first target of the pattern has been achieved, while the next potential target is ₹250.

Thank You !!

GBP/USD Slides with Fiscal WorriesGBP/USD edged lower toward 1.3625 in Asian trading, pressured by a sharp selloff in UK government bonds and growing fiscal concerns.

Gilts suffered their biggest drop since October 2022 after the government’s decision to cut welfare benefits and mounting doubts over the Chancellor’s political future.

Marc Chandler, Chief Market Strategist at Bannockburn Global Forex LLC, noted: “The drop isn’t limited to the British Pound, UK gilts are also under heavy selling. It seems to be a broader crisis of confidence in the Labour government.”

Resistance is at 1.3675, while support holds at 1.3570.

EUR/USD Steady Near 1.1800 as Fed Cut Bets RiseEUR/USD held steady for a second session near 1.1800 in early Thursday trading. The pair could gain momentum as the US dollar weakens on rising expectations of a Fed rate cut after ADP data disappointed.

June’s ADP Employment Change showed a surprise 33,000 drop, its first decline in over two years, well below forecasts of 95,000. May’s figure was also revised down to a 29,000 gain.

Attention now turns to the upcoming US Nonfarm Payrolls, Average Hourly Earnings, ISM Services PMI, and S&P Global US PMI.

Key levels: Resistance at 1.1830; support at 1.1730.

JPY Steadies, Trade Optimism Counters Dollar WeaknessThe Japanese yen held near 143.7 against the dollar on Thursday, stabilizing after recent losses, supported by improved trade sentiment and a weaker greenback.

Japan reiterated its aim for a fair trade deal with the US, though Trump raised pressure by threatening tariffs up to 35% on Japanese imports over low US rice and car sales. Meanwhile, a finalized US-Vietnam deal added to market optimism.

The yen also found support as investors awaited key US jobs data, which could increase the odds of a Fed rate cut.

Key levels: Resistance at 145.70; support at 143.55.

NVIDIA: More Room in Wave BNvidia’s strong rally over recent weeks lifted the stock above resistance at $153.13. Despite a brief pullback on Tuesday, we still expect beige wave B to extend toward $178.39. Afterward, beige wave C should initiate a substantial correction, likely finding its low above $81.98 to complete blue wave (IV). If Nvidia rallies directly through $178.39, that would support our alternative view that blue wave alt.(IV) has already bottomed (37% probability).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

SUI: Closing in on the Target Zone?SUI should continue closing in on our blue Target Zone between $2.27 and $1.72. We expect blue wave (ii) to complete there, ideally above support at $2.02, before the next move higher kicks off in wave (iii). However, because the June 22 low came within just $0.03 of our zone, we must consider the possibility that blue wave alt.(ii) has already concluded. In that case, a direct breakout above resistance at $3.60 could follow (33% probability).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Copper is gonna to complete the 2nd leg??Hi all trading lovers and copper buyers...

Seems that after BREAKOUT from Descending Triangle and Pullback to breakout level, price is going to complete the 2nd BULLISH Leg in Weekly uptrend with a round level target (5.5555)...

(Pullback could be a bit deeper...)

PLEASE NOTE THAT IS ONLY AN ANALYSIS AND COULD BE WRONG...

MARKET IS BASED ON POSSIBILITIES AND UNCERTAINTIES...

MANAGE YOUR RISK...

#Forex #Trading #Analysis #Copper #Chart #Spike #Wedge #Uptrend

Failed Breakout Sets the Stage for Bullish Continuation"Boost it, if you like it (Thanks)"

Gold is showing resilience after a failed breakout attempt, bouncing strongly off the 3,250 support zone. This 4H chart suggests bulls are regaining control, with momentum building toward the next key resistance.

🔍 Technical Breakdown:

Failed Breakout (Failed MTR Structure): Price briefly dipped below the trendline but reversed sharply, invalidating the bearish move.

Dynamic Support: The ascending trendline near 3,250 has held firm, reinforcing bullish structure.

EMA Structure:

15 EMA: 3,323.84

60 EMA: 3,331.61 Price is now trading above both EMAs, signaling bullish momentum.

Current Price: 3,339.0

Target: 3,434.34 – the first major resistance zone before ATH retest.

🧠 Market Psychology:

This setup reflects a classic “shakeout” – weak hands were flushed out below support, only for price to reclaim the level with strength. This often precedes a strong directional move as confidence returns.

🎯 Trade Setup:

Entry: On a confirmed break above 3,345–3,350

Stop Loss: Below 3,325

TP1: 3365

TP2: 3385

Final TP(x): 3,434.34

⚠️ Watchlist:

Monitor price action near 3,360–3,370 for signs of rejection or continuation.

A clean break above 3,434 opens the door for an ATH retest.

#MJTrading

#Gold #XAUUSD #TechnicalAnalysis #TradingView #FailedBreakout #SupportAndResistance #EMA #BullishSetup #PriceAction #ForexTrading #GoldBulls #MarketPsychology

Tesla: Back on Track?Tesla has resumed downward momentum, aligning with our primary scenario and moving away from resistance at $373.04. As part of the ongoing turquoise wave 5, we expect continued selling pressure: it should break below the $215.01 support. This would complete magenta wave (3) of the current bearish impulse. A reversal back above $373.04 – and especially a breach of $405.54 – would force us to adopt the 38% likely alternative scenario. Under this count, the correction low of blue wave alt.(II) would be already in, and Tesla would now be rallying in wave alt.(III) .

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Possible MTR in Play (TBC)Gold has printed a textbook structure for a potential Major Trend Reversal (MTR) off the ATH zone, with a clean rejection and a shift in character. The descending trendline from the top aligns with lower highs, while the ascending base from April is now under pressure.

📌 Key Levels to Watch:

3,280.0 – neckline of the potential MTR

3,250.00 – psychological magnet and structural support

3,000.00 – major downside target if the reversal confirms

🧠 “Markets top on euphoria, not logic.” If price breaks and retests the neckline with momentum, the MTR thesis gains traction. Until then — TBC.

#XAUUSD #Gold #MajorTrendReversal #MTR #PriceAction #TechnicalAnalysis #GoldBears #ATHRejection #TrendShift #MJTrading