Bitcoin Hits $40,000, It Will Recover —Name Your AltcoinSorry, there is a typo there on the title, I meant to say: Bitcoin hits $114,000, soon to recover.

As you can see from our trading range, Bitcoin just went beyond the lower boundary and hit a new low, the lowest since 10-July but there is good news. There isn't room for prices to move much lower, this is part of the consolidation phase.

The first low happened 25-July and notice the high (bear) volume. The second low happens today and we have lower volume compared to 25-July, but Bitcoin hit a lower low. This reveals that the bearish move is already weak and losing force. It also reveals the fact that Bitcoin is about to recover.

Also notice the RSI, 2H. It hit oversold recently and went the lowest in a long while. Reversals tend to happen when the RSI becomes oversold.

Bitcoin is testing the lower boundary of the trading range, when this happens, the action reverses and moves back up. Prepare to see Bitcoin back above $120,000. It is normal and it will happen... But it is wise to give the market a few days. 5-August was bad last year. It gets bad but it also marks the bottom. Once the bottom is hit, growth long-term.

— Name Your Altcoin

Leave a comment with the altcoins you are holding now and I will do an analysis for you. The altcoins will also recover and we are witnessing just a small retrace. Hold strong as this is the most important part. We will have a very strong new bullish wave develop within days.

As Bitcoin moves to test support, it will reverse to test resistance next. Which one is your top altcoins choice?

Thank you for reading.

Namaste.

Chart Patterns

AUDUSD: Bearish Continuation from broken supportThe current setup is a clean example of a trend continuation play. Price recently broke decisively below a structure zone, this break and retest now flips the narrative, what once was a buy zone is now an opportunity for short entries.

Following the aggressive move down, price now began pulling back into that broken zone. The move appears corrective rather than impulsive, characterized by a slower, more rounded structure typical of pullback leg. This is classic behavior in continuation setups: fast drop, slow retrace, and then potential for the next leg lower.

The projected move targets a retest of the swing low at 0.63800. That level is significant, it's a level where prior demand reacted strongly and now it serves as the next probable magnet for price.

What makes this continuation trade high probability is the sharpness of the prior bearish impulse as it signals intent. The market seems to be in a controlled bearish sequence, where sellers dominate momentum and retracements offer fresh entries for trend followers.

The structure and zone alignment all point in the same direction continuation lower, not reversal.

Let me know in the comments what you think

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Inside a Candle: How to Read Hidden Order Flow Without a DOM

Difficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is for traders who want to understand the “story” behind a candle’s shape — and learn to spot aggressive buying/selling, absorption, and traps without needing footprint or order book tools.

🔵 INTRODUCTION

Most traders see candles as static shapes — green or red, big or small. But each candle is a battlefield of orders . Even without access to a DOM or volume footprint, you can still extract valuable information from just the candle's body, wick, and context .

🔵 ORIGINS: WHERE CANDLESTICKS COME FROM

Candlestick charts trace back to 18th-century Japan, where rice traders needed a way to visualize price movements over time. A legendary trader named Munehisa Homma , who traded rice futures in Osaka, is credited with developing the earliest form of candlestick analysis.

Homma discovered that price wasn’t just driven by supply and demand — but also by trader psychology . He created visual representations of market sentiment by tracking:

The opening and closing price of rice

The highest and lowest price reached during the session

This system became known as the “Sakata rules,” and it laid the foundation for many patterns still used today — such as Doji, Engulfing, and Marubozu.

Western traders only began using candlesticks widely in the 1990s, when analyst Steve Nison introduced them to the broader financial world through his book Japanese Candlestick Charting Techniques.

Today, candlesticks remain one of the most powerful and intuitive ways to visualize order flow, momentum, and market psychology — even without a Depth of Market (DOM) or depth of book.

In this article, you’ll learn how to read hidden order flow by analyzing:

Wick length and positioning

Body-to-range ratios

Candle clustering and sequences

🔵 HOW A CANDLE FORMS

Before you can read a candle, you need to understand how it comes to life . A single candle represents the full auction process during its time window.

Here’s how it builds, step by step:

Candle opens — this is the open price .

As price moves up during the session → the high] updates.

As price moves down → the low] updates.

The final traded price when the time closes → this becomes the close price .

The wick = price areas that were tested but rejected

The body = where the majority of aggressive trades occurred

If buyers push price up quickly but sellers slam it down before the close — the candle will have a long upper wick and close near the open, revealing seller absorption.

Understanding this flow helps you recognize traps, fakeouts, and reversals in real time.

🔵 CANDLE BODY: WHO'S IN CONTROL

The body of the candle reflects the result of the battle between buyers and sellers. A wide body with minimal wicks means dominance and commitment.

Big body, small wick → clear conviction

In an uptrend: buyer aggression

In a downtrend: panic or aggressive selling

Small body, long wicks → indecision, absorption, or trap

Often appears near tops/bottoms

Indicates both sides were active but neither won clearly

www.tradingview.com

🔵 WICKS: THE SHADOWS OF REJECTION

Wicks are not just “leftovers” — they show where price was rejected after being tested.

Long upper wick = seller presence or absorption at highs

Long lower wick = buyer defense or trap spring

Double wick = liquidity sweep / false breakout

Use wick direction to spot:

Failed breakouts

Smart money traps

Exhaustion candles

🔵 HIDDEN ORDER FLOW PATTERNS

1️⃣ Absorption Candle

A large wick with little movement afterward — shows that big orders absorbed market pressure.

2️⃣ Trap Candle

A candle that sweeps above/below a key high/low and closes opposite — classic smart money fakeout.

3️⃣ Imbalance Candle

Large-bodied candle that closes near the high/low with no wick on the other end — implies one-sided aggression (and often leaves an imbalance).

🔵 CLUSTERING & SEQUENCES MATTER

Never read a candle alone. The sequence of candles tells the full story:

3+ rejection wicks near resistance? Liquidity building before breakout or trap

Bearish engulfing after long upper wick = smart money selling into retail buying

Tight-range dojis + volume spike = compression before expansion

Context + volume + structure = hidden flow decoded.

🔵 PUTTING IT TOGETHER: A REAL EXAMPLE

Price breaks above previous high

Candle closes with long upper wick and smaller body

Next candle opens, dumps fast, leaving imbalance behind

Buyers trapped — move likely to continue down

This is how you read order flow from candle anatomy .

🔵 TIPS FOR MASTERY

Use a lower timeframe (1M–5M) to see microstructure

Watch how wicks behave near S/R or OBs

Confirm with volume spikes or delta-style indicators

Use replay mode to slow down the story and study cause/effect

🔵 CONCLUSION

Every candle is a message. You don’t need expensive tools to read order flow — just your eyes, context, and curiosity.

Learn to see candles not as symbols, but as evidence of behavior . Absorption, imbalance, and traps are all visible if you look closely.

GOLD: Be careful, It's More Complex Than it SeemsGOLD: Be careful, It's More Complex Than it Seems

After the NFP data came in at 73k vs. the expected 110k, the market reacted aggressively to the US dollar. Today, the US dollar was affected on two fronts.

One was the NFP data and the other was the mess that President Trump is creating with his tariffs against many countries. Uncertainty regarding the future impact of the tariffs remains high and unknown.

After the NFP data GOLD reacted aggressively against the US dollar by breaking easily two small structural areas towards 3315 and 3334. A possible correction is expected before gold moves further to 3370; 3400 and 3400, as shown in the chart.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

BITCOIN - Price can turn around and start to move upHi guys, this is my overview for BTCUSD, feel free to check it and write your feedback in comments👊

The price reversed its prior downtrend with a decisive breakout from a falling channel.

This breakout triggered a strong upward impulse, which then began to consolidate into a large symmetrical pennant.

However, the price recently failed to hold the lower support trendline of this pennant and broke to the downside.

The asset is currently trading just below this broken trendline, in what appears to be a liquidity grab.

To continue upwards, buyers must now overcome the immediate resistance located at the $116300 level.

I expect that this breakdown was a fakeout, and the price will soon reverse, break through the $116300 resistance, and continue its rally toward the $121000 target.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BITCOIN → From consolidation to distribution. Market weaknessBINANCE:BTCUSDT.P is moving from consolidation to a correction phase. The price broke through the support zone of 114.5–115.5, closing within the Friday trading session in the sell zone...

Previous idea from July 22: BITCOIN → Consolidation and compression to 116K. Correction?

The fundamental background is shifting to neutral, the hype has temporarily ended, and there are no bullish drivers yet. And for the health of the market, a correction is needed. Bitcoin is breaking the neutral consolidation structure. The previous trading session closed below the support range, which generally indicates market weakness. Despite the global bullish trend, Bitcoin is moving from consolidation to a correction phase, with 112K - 110.5K serving as points of interest in this case. Before the fall, liquidity may be captured in the 114K - 114.800 zone.

Resistance levels: 114.05, 114.85, 115.67

Support levels: 112.03, 110.48

After a strong movement, the market may enter a correction or local consolidation, during which it may test the specified resistance zones before continuing its downward movement to the zone of interest and liquidity at 112 - 110.5.

Best regards, R. Linda!

BTC HUGE DROP TO 113,400$ - BIG CRASH !*Sorry for posting to late as I am between a trip in Malaysia.*

Details:

Entry: Now - 117,000 $

Target Price: 113,410 $

Stop loss: 119,460 $

Trade Ideas:

Market creating a flag pattern here. Though its not only the logic we have some secret logics here and indicators which I shared in the VIP.

What is required to Join VIP?

- Nothing just you have to share 10% of your profit with us at the end of the month which you earned from our signals. Yeah this is just the requirement, trade where ever you like your favorite broker or else you don't need to pay fees first or create account thru our link.

Trade Signal:

I provide trade signals here so follow my account and you can check my previous analysis regarding BITCOIN. So don't miss trade opportunity so follow must.

BINANCE:BTCUSDT BINANCE:BTCUSDT.P BINANCE:BTCUSD

Bitcoin stop loss hunting end, entry for Long is now!!Hi on this chart that may happen with more than 70% possibility we have one of the easy setups and strategy which i call it FAKEOUT&LIQUIDTY this happen usually near trendline support or range zone support or even resistance and after a possible fakeout usually market kick sellers or Buyers and then with high volume market reverse.

I saw High volume and Fake breakout in my mind and i think it can be one of those times so we open long and lets now wait for this 1:2(Risk:Reward) signal to play.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

MRVL Massive 15-Years Symmetrical Breakout Targets AheadMarvell Technology (MRVL) has just completed a monumental breakout from a 15-years symmetrical triangle, a rare and powerful long-term accumulation structure. This type of macro consolidation typically precedes a major directional expansion, and in this case, the breakout confirmed bullish continuation.

Currently, MRVL is forming a rising channel structure, with price bouncing cleanly from the lower boundary confirming demand and the continuation phase of the macro move.

The 1:1 projection from the symmetrical triangle gives us a clear target trajectory, with the final leg potentially extending to $229, aligning perfectly with the upper boundary of the rising channel.

In the short to mid-term, the ideal buyback opportunity rests near $67.50, should the market retest previous breakout support or the lower boundary of the channel once more. This zone offers asymmetric risk-to-reward potential for long-term investors and swing traders alike.

Key Targets

📈 $67.50 – Buyback Opportunity Zone

📈 $229 – Rising Channel Top / 1:1 Expansion Target

A breakout this large is no coincidence, it’s backed by years of price compression and institutional positioning. Now is the time to watch closely.

📩 Drop your view in the comments and share your stock requests for quick analysis.

Only stock assets will be accepted under this post.

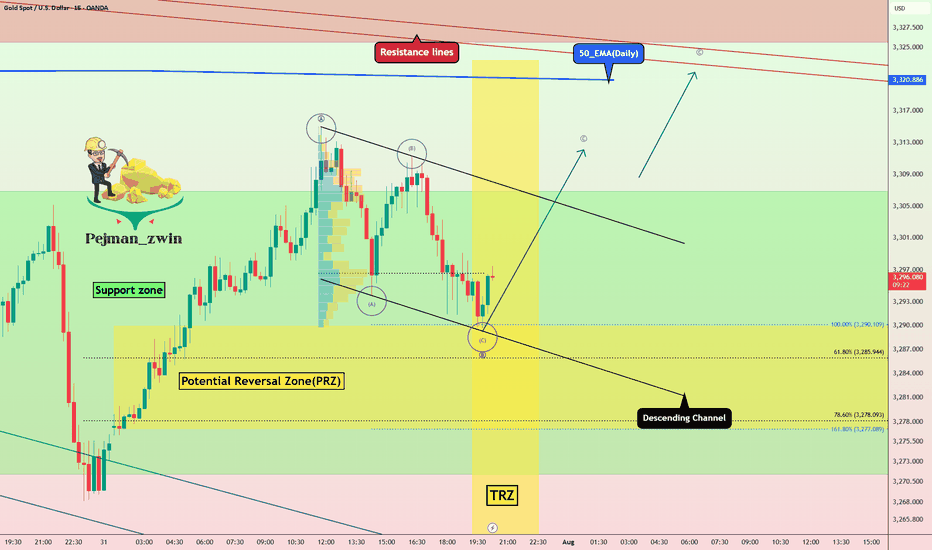

Gold in PRZ + TRZ: Is a Bullish Reversal Brewing(Short-term)?Gold , as I expected in yesterday's idea , fell to the Potential Reversal Zone(PRZ) and started to rise again .

Today's Gold analysis is on the 15-minute time frame and is considered short-term , so please pay attention .

Gold is currently trading in the Support zone($3,307-$3,275) and near the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , it seems that Gold can complete the microwave C of wave B at the lower line of the descending channel.

I expect Gold to trend higher in the coming hours and rise to at least $3,311 .

Note: Stop Loss (SL) = $3,267

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

USDJPY 30Min Engaged (Bullish Reversal Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Reversal : 147.450

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

Euro bounce from buyer zone and start to move upHello traders, I want share with you my opinion about Euro. After a prolonged upward trend which formed a large rising wedge, the EURUSD faced a significant rejection from the seller zone near the 1.1685 resistance level. This failure to continue higher marked a key turning point, exhausting the bullish momentum and initiating a new bearish market phase. This new phase has since taken the form of a well-defined downward channel, within which the price has been undergoing a series of downward corrections and impulses. The most recent market action has been a sharp downward fall, accelerating the price's descent towards a critical area of historical significance. Currently, the pair is approaching the major support level at 1.1400, which also constitutes a strong buyer zone where demand has previously stepped in. The primary working hypothesis is a long, counter-trend scenario, which anticipates that the current bearish momentum will be absorbed by the strong demand within this buyer zone. A confirmed and strong rebound from this 1.1400 support area would signal a potential temporary bottom and the start of a significant upward correction. Therefore, the tp for this rebound is logically set at the 1.1600 level, a key psychological and technical point that represents a realistic first objective for a bounce of this nature. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

ETH at Critical Resistance + Liquidation Zone | Time to Short?Today I want to analyze Ethereum ( BINANCE:ETHUSDT ) on the 1-hour time frame . Is there a short position opportunity?

Please stay with me.

Ethereum is currently trading near a Heavy Resistance zone($4,390-$3,950) , Cumulative Short Liquidation Leverage($3,983-$3,878) and the $4,000 ( round number ). $4,000 could be a psychological number to sell .

In terms of Elliott Wave theory , Ethereum appears to have completed the main wave 3 at $3,860 and is currently completing the main wave 4 . The main wave 4 could have a Double Three Correction(WXY) or Expanding Flat(ABC/3-3-5) , with the Expanding Flat structure being more likely .

One of the reasons why shorting Ethereum could be better than shorting Bitcoin right now is that ETHBTC ( BINANCE:ETHBTC ) is currently trading above the ascending channel and is likely to correct to Fibonacci levels .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Ethereum to drop to at least the Potential Reversal Zone(PRZ) and attack the Support lines ( Second target ) .

Cumulative Long Liquidation Leverage: $3,591-$3,543

CME Gap: $3,461-$3,417

Note: Stop Loss: $4,023

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Insider Selloff + Liquidity Sweep🔻 PENGU/USDT TRADE IDEA 🔻

📣 Hey CandleCraft crew!

Today we’re diving into a chilly little bird that flew a bit too close to the heat. 🐧 PENGU pumped hard — but when team wallets start dumping $17M worth of tokens, that’s not bullish, that’s suspicious. Think iceberg ahead.

🔥 TRADE SETUP

Bias: Short

Strategy: Insider Selloff + Liquidity Sweep

Entry: $0.036 – $0.038

SL: $0.041

TPs: $0.030, $0.025, $0.018

Why?

– HTF sweep of liquidity above $0.04

– Insider wallet moved 485M tokens to exchanges

– LTF CHoCH + RSI breakdown

– Price hovering under 20-day EMA with weakening volume.

Candle Craft | Signal. Structure. Execution.

GBPJPY: Strong Bullish Reversal from Demand ZoneGBPJPY has bounced sharply from a key demand zone, indicating renewed bullish momentum. The pair continues to follow the broader bullish bias in GBP crosses, with JPY weakness driven by the Bank of Japan's dovish policy stance.

Technical Analysis (4H Chart)

Pattern: Bullish rejection from the 195.30–195.50 demand zone.

Current Level: 195.58, rebounding from strong support, setting up for a potential upward leg.

Key Support Levels:

195.34 – immediate demand zone and critical support.

194.90 – deeper backup support if a pullback occurs.

Resistance Levels:

197.31 – near-term resistance and first upside target.

199.72 – extended target if bullish continuation strengthens.

Projection: As long as 195.34 holds, GBP/JPY could push toward 197.31, with potential for 199.72 if GBP strength persists.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

GBP: Supported by the BOE’s cautious but tight stance due to persistent inflation pressures.

JPY: Remains fundamentally weak, with the BoJ avoiding major policy tightening while intervention threats only provide short-term support.

Risk Sentiment: Mild risk-on conditions favor GBP over safe-haven JPY.

Risks:

BoJ FX intervention could temporarily strengthen JPY.

A dovish BOE shift could slow GBP momentum.

Key Events:

BOE policy updates and UK CPI.

BoJ commentary and risk sentiment indicators.

Leader/Lagger Dynamics

GBP/JPY is a leader among JPY pairs due to GBP’s volatility and strength. It often outpaces EUR/JPY and CHF/JPY, making it a key pair for JPY sentiment shifts.

Summary: Bias and Watchpoints

GBP/JPY is bullish, with price rebounding from the 195.34 demand zone. Upside targets are 197.31 and 199.72. Watch for BOE communication, BoJ intervention signals, and global risk sentiment for confirmation of the move.

HelenP. I Euro will rebound from trend line to $1.1600 pointsHi folks today I'm prepared for you Euro analytics. A structural review of the chart shows a clear change in market character. The previous long-term upward channel has been broken, and the price has since entered a corrective phase, currently guided by a descending trend line. This decline has brought the asset towards a critical area of interest: the major horizontal support zone between 1.1400 and 1.1360. My analysis for a long, counter-trend position is based on the potential for a strong bullish reaction from the confluence of this historical support zone and the descending trend line. I believe that as the price reaches this intersection, the current selling momentum is likely to be absorbed by significant underlying demand. The main condition for this scenario is a clear and forceful rejection of lower prices from this zone, which would signal that buyers are stepping in to defend this critical level. A confirmed bounce would likely initiate a significant relief rally, and therefore, the primary goal for this move is set at the 1.1600 level, a logical first target for a corrective bounce of this nature. If you like my analytics you may support me with your like/comment.❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BTC DOMINANCE UPDATE- So, all elements are annotated throughout the graphic, like always.

- Timeline.

- Older Top Dom (2021) (red doted line).

- New Top Dom (2025) (red line).

- Some supports ( Orange Line ).

- Some Bottoms ( Green Lines ).

- Most important in chart : Fibonnacci Retracements.

- After this chart, I’ll drop links to my older BTC dominance posts.

- Not much to say, just look at the chart :

- In 2021, BTC.D formed a double top because Bitcoin spiked twice and hit two all-time highs.

- That doesn’t mean BTC.D will behave the same way in 2025. I don't expect another double top, but who knows.

- We could see a retracement down to the 45–47% range. That would likely signal the start of a new bear market.

- For now, i don’t see the end of the bull run yet. I’m mostly waiting for a strong BTC push in price, a fast dip in BTC Dominance, and the kickoff of Altseason.

— it’s going to be wild and fast! Just my personal opinion.

Stay Safe !

Happy Tr4Ding !

GBPUSD: Overextended move meets with supportAfter a steep and aggressive sell-off, price has tapped into a clear zone. This recent move wasn't gradual: it was impulsive and sharp, which tells us one key thing: exhaustion is likely.

The overextension into it without any meaningful pullback typically highlights imbalance, where price moves ahead of structure and becomes vulnerable to correction. But price doesn’t move in straight lines forever. Markets that fall too quickly tend to burn out just as fast. When such aggressive pushes meet with a clean, resistance like this one, they often trigger the exact opposite, a snapback correction.

I am now watching for signs of absorption and accumulation. This could play out in the form of sideways candles, wick rejections, or a sudden reversal spike. These are early signs that smart money might be stepping in.

My projected target would be toward the 1.33700 area, from the last impulsive drop. It’s a classic mean reversion setup, not just technical but psychological. Traders who chased the move late may find themselves trapped, fueling the correction as they’re forced to exit.

GOLD - Price can fall to support level and then start to riseHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

The price was consolidating for an extended period inside a wide, horizontal range.

A strong bullish impulse eventually broke the price out above the resistance of that flat channel.

This breakout move created a new significant high before sellers forcefully rejected the price downwards.

This rejection marked the beginning of the current falling wedge pattern, which has guided the price lower since.

The decline within the wedge has now brought the asset down to a critical historical support zone at $3285.

I expect that this key support will hold, causing a reversal and a new rally that targets the $3345

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Solana Update · Retrace, Bears & The Bullish BiasSolana had a retrace in May. Notice the 19-May date on the chart. This retrace produced four weeks red. The bullish move that led to this retrace lasted 6 weeks. The last rise lasted five weeks and the current retrace might last only two weeks, can be less.

We are seeing Solana rising but this rise is not a one-time off event, this is a trend that is developing. An uptrend as a long-term phenomena is different to a short-term bullish moves. A short-term move tends to be really fast, one strong burst and that's it. A long-term move is different. Instead of seeing 2-3 candles and Solana trading at $1,000, we see dozens and dozens of candles with prices slowly rising. There are strong fluctuations but the end result is always up. And that's how you see the fluctuations on the chart.

Solana moved up and then immediately started to retrace. Then another rise and another retrace again. This retrace will end and prices will continue to grow long-term. The bulls are in. The bull market is on. Solana, Bitcoin, Crypto and the rest of the Altcoins market is going up.

Namaste.

Third Quarter 2025 Nigerian share picks Update....Percentage Up!Here's a summary and update on the third quarter 2025 Nigeria stock picks based on the price comparison between July and August - 1month:

Q3 2025 Trading View: Nigerian Stock Picks Update

Strong Performers with Significant Gains:

BUACEMENT: Up 48%, showing strong momentum as a cement sector leader.

DANGSUGAR: Increased by nearly 37%, notable growth in the sugar sector.

ELLAHLAKES: Shares rose over 36%, a promising performer.

DANGCEM: Cement stock up about 20%, continuing solid growth.

ETRANZACT: Up 24%, showing steady improvement in the tech/payment sector.

MULTIVERSE: Grew by 24%, indicating healthy gains in diversified tech.

NB: +28.8%, good growth for the banking/finance sector.

Moderate or no Growth:

ARADEL: Small increase of about 1%, steady but minimal movement.

HMCALL: Stable with a minor 1.4% increase, remaining consistent.

TRANSPOWER: No price change, holding steady for now.

Overall Market Sentiment:

Average gain across all picks is approximately +22%, a strong positive trend overall.

Indicates a bullish sentiment on these carefully selected third-quarter stocks.

Opportunity exists to take advantage of higher momentum sectors like cement, sugar, and tech/payment companies.

Trading Takeaway:

The Q3 2025 picks demonstrate robust growth potential, especially in key sectors like construction materials and tech/payments. Conservative performers provide portfolio stability while high growth stocks offer upside. Continual monitoring for volume and market news is recommended to capitalize on gains and manage risks moving forward.

#DATA (SPOT) BINANCE:DATAUSDT

#DATA/ USDT

Entry range (0.01500- 0.01600)

SL 4H close below 0.00.01498

T1 0.0180

T1 0.0198

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.