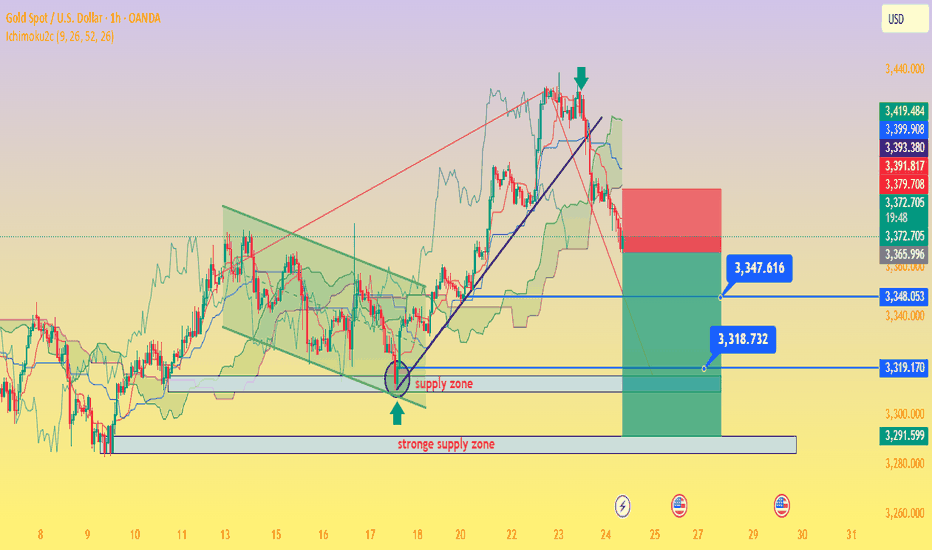

Gold (XAU/USD): Supply Zone Rejection & Bearish Breakdown Chart Breakdown:

Supply zone rejection: Gold revisited the “supply zone” (light green/grey area) and failed to break above — a classic signal of seller dominance.

Uptrend invalidated: A sharp rise (steep black trendline) ended with a peak marked by the green arrow, followed by a decisive breakdown.

Ichimoku Cloud test: Prices slipped through the Ichimoku components, reinforcing the shift to bearish sentiment.

Potential targets: The red/green risk‑reward box highlights a short position, targeting ~3,347 then ~3,318 levels (blue labels) as initial support zones.

Strong supply base: The extensive grey zone below marks a "stronger supply zone" — this could cap any modest bounce and keep the downtrend intact.

🔍 Interpretation:

Bias: Bearish — sellers have taken control after a failed breakout.

Strategy: Short on rallies toward the mid‑green/red box (~3,373–3,380), targeting ~3,347 first and then ~3,319. Watch for support at the strong supply region (~3,292) for potential reversal or consolidation.

Risk management: Keep stop above the red zone—above recent highs (~3,380+) to limit risk.

🚀 In a nutshell: After failing to break supply and losing its short‑term uptrend, gold appears poised for a pullback. The next key levels to watch are ~3,347 and ~3,319—where buyers might step back in, or the downtrend continues toward the deeper supply base.

Chart Patterns

Gold (XAU/USD) in Symmetrical Triangle – Short‑Term Squeeze,Price Structure & Technical Setup

Gold is consolidating within a symmetrical triangle, showing lower highs and higher lows—a classic precursor to breakout in either direction

Fxglory Ltd

+5

TradingView

+5

Babypips.com

+5

TradingView

+2

Babypips.com

+2

TradingView

+2

.

Trendlines converge tightly around $3,326–$3,334, hinting at imminent directional acceleration

Investopedia

+4

TradingView

+4

TradingView

+4

.

🎯 Key Levels & Targets

Scenario Trigger Confirm Area Targets Stop Loss

Bullish Breakout above $3,344–$3,350 $3,369 → $3,396 → $3,422–$3,550 ~$3,340

Bearish Breakdown below ~$3,326–$3,320 $3,320 → $3,300 → $3,297 → $3,255 ~$3,335–$3,340

A breakout above $3,344–$3,350 validated with volume may drive prices toward $3,400+, with extended targets up to $3,550 or higher in bullish conditions

Traders Union

Time Price Research

.

A drop below $3,326–$3,320 risks further decline, targeting $3,300, $3,297, and eventually $3,255 if breakdown momentum builds .

📉 Market Context & Drivers

U.S. dollar strength, easing safe-haven demand, and optimistic trade sentiment are constraining gold’s upside unless breakout forces emerge .

Key upcoming catalysts: FOMC guidance, U.S. macro data (GDP, inflation), and geopolitical developments—their tone could tip the bias direction .

⚙️ Trade Rules & Risk Management

Wait for a confirmed breakout or breakdown—do not trade mid-range.

Confirm break with at least one close outside the triangle and rising volume .

Position sizing: Risk 1–2% per trade, adjust stop-loss to price structure ($8–$15 depending on volatility).

Take profits in stages: scale out at minor milestones (first targets), trail stop for extended targets.

Avoid chasing price within the middle of the triangle—risk/reward is unfavorable.

🧠 Why This Plan?

Follows textbook symmetrical triangle trading methodology: entry on breakout, stop beyond pattern opposite side, projection based on triangle height .

Aligns with broader outlook: bearish unless convincing upside breakout appears, consistent with analyst consensus hedging current bull exhaustion and wait‑and‑see on policy signals .

✅ Summary

Gold is coiling inside a tight triangle range near $3,326–$3,334, with breakout potential identified to either side:

Bullish breakout over $3,344–$3,350 targets up to $3,550 or beyond.

Bearish breakdown under $3,326–$3,320 risks slide towards $3,300–$3,255.

Wait for confirmation, apply disciplined risk controls, and let volume validate the move.

#PENGU #PENGUUSDT #PENGUINS #LONG #AMD #PO3 #Analysis #Eddy#PENGU #PENGUUSDT #PENGUINS #LONG #AMD #PO3 #Setup #Analysis #Eddy

PENGUUSDT.P Scalping Long Setup

This Setup & Analysis is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP )) "PO3"

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note: The price can go much higher than the specified target and have a very good pump.

Be successful and profitable.

LTC- LitCoin - This is how a Fake Break on Fib looks like This is how a Fake Break on Fib looks like using Weis Wave with Speed Index

Reading the Daily Cha rt

1. Fib Location - Sellers could enter here

2. Largest Up volume wave after a while - also sellers could be hidden in there.

3. Increasing PVR (progressing volume rate) = as we approve the top more volume comes in (sellers)

4. This up wave has the highest Speed Index 10.0S of all the up waves in the trend, that's a HTMU (hard to move up = sellers)

5. The highest PVR bar =sellers

6. Another Abnormal Speed Index 25.5 S - that's another HTMU = more sellers on the up move, price cannot progress upward anymore.

7. and finally down we go with a PRS signal.

All the ingredients for the Short were there. Reading Weis Wave with Speed Index is like reading a book, page after page, until you reach to the last page that the writer has kept the surprise, the only difference is that this is never ending chart book with many stories. This was the story of LTC for now. I think this story has not ended yet and continue to drop to another Fib, the details on the 1HR!.

I hope you enjoy this chart reading lesson using Weis Wave with Speed Index.

DOGEUSDT Technical Analysis – Bullish Reversal Anticipated DOGEUSDT Technical Analysis – Bullish Reversal Anticipated

🔍 Key Technical Zones:

Support Zone: $0.1990 – $0.2015

Strong bullish reactions noted from this level in previous attempts.

Confluence with volume accumulation on the left (as seen in the Volume Profile).

Signifies a strong demand zone where buyers are stepping in.

Resistance Zone / Target: $0.2220 – $0.2240

Previous structural high and supply zone.

Marked as the first major liquidity area.

Also aligns with imbalance and CHoCH (Change of Character), a common SMC concept.

🔄 Market Structure:

CHoCH (Change of Character) marked multiple times, indicating attempts by bulls to reclaim structure.

Recent price action shows accumulation near support.

Sideways consolidation suggests potential for a bullish breakout.

Liquidity sweep of recent lows could indicate that smart money is accumulating positions before a move higher.

🎯 Trade Setup Idea:

Entry Area: Between $0.2000 – $0.2060 (inside the support zone)

Target: $0.22396 (as marked)

Stop Loss: Below $0.1980 (below the visible support range)

🔧 Indicators and Tools Used:

Volume Profile (VRVP): Shows most volume traded around $0.205 – $0.207, indicating strong positioning from market participants.

Smart Money Concepts (SMC): CHoCH and liquidity concepts signal potential accumulation and reversal.

Price Action Analysis: Clean swing structure with support-resistance rotation visible.

📌 Conclusion:

DOGEUSDT is currently trading in a range-bound structure with a bullish bias from the support zone. If the price sustains above $0.205 and breaks above minor resistance, the upside target of $0.22396 is likely. This setup is supported by strong volume accumulation and smart money structure shifts.

In-depth Analysis of the Gold Bull-Bear Game on August 4th:

I. Gold's Current Core Contradiction

Bull Support Factors

Weak non-farm payroll data reinforces expectations of a Fed rate cut, with the market betting on an over 80% probability of a September rate cut.

Risk Aversion: Although the tariff extension has not yet been finalized, the market remains concerned about escalating trade frictions, and gold is in high demand as a safe-haven asset.

Technical Breakout: Friday saw a strong breakout above the 3340-3350 resistance zone, with the daily chart showing a positive enveloping negative trend. Short-term bullish momentum prevails.

Potential Short-Term Opportunities

Monthly Top Signal: Consecutive high-level doji candlesticks with long upper shadows suggest medium-term selling pressure.

Fundamental Bearish Hidden Dangers:

The Fed's independence remains, and Powell may not cut interest rates prematurely due to pressure from Trump.

II. Key Technical Signals

1. Weekly Level: Range Unbroken

The 3268-3438 range persists, currently nearing its upper limit, so be wary of a pullback.

Bollinger Bands are converging, with the MA5/MA10 convergence signaling an approaching market reversal window.

2. Daily and short-term cycles: Overbought correction needs

After Friday's surge: 4-hour/1-hour RSI is overbought, the Bollinger Band opening is unsustainable, and a technical retracement is needed.

Key positions:

Resistance: 3376 (previous high) + 3385 (Fibonacci expansion level);

Support: 3340 (top and bottom conversion) + 3315 (bull defense line).

3. Triangle convergence pattern:

If it opens high and breaks through 3376 on Monday, August 4, it may test 3400; if it opens low and falls below 3340, it will look down to 3315-3280.

III. Operation strategy for next week on August 4

(1) Response to three opening scenarios

Scenario 1: Opening high (above 3370)

Strategy: Short in batches in the 3376-3385 area, stop loss at 3400, target 3340→3315.

Logic: Positive overdraft + technical overbought, betting on a pullback.

Scenario 2: Flat opening (around 3360)

Strategy: If the price rises from 3366 but does not break through, go short with a light position, stop loss at 3376, target 3340; if it falls below 3340, go short and look at 3315.

Alternative: If the support at 3340 is effective, go long, stop loss at 3330, target 3360.

Scenario 3: Low opening (below 3340)

Strategy: Go long in the 3338-3340 area, stop loss at 3325, target 3360; if it breaks through 3315, go short.

(2) Mid-term layout

Short opportunity: Go short in the 3385-3400 area, stop loss at 3420, target 3245 (monthly support).

Buy opportunity: If the price falls back to 3315-3280 at the beginning of the week and stabilizes, go long in the mid-term, stop loss at 3260, target 3400.

IV. Risks and Warnings

Beware of institutional manipulation: Friday's late-day surge may be a trap for buying; beware of a flash crash at Monday's opening.

Data disturbance: Pay close attention to the speeches of Fed officials. If inflation rebounds or hawkish remarks are made, it will be bearish for gold.

Undetermined trend: The market is still volatile and unilateral trends need to wait for confirmation of a breakthrough in the range.

Conclusion

Short-term: Prioritize shorting in the 3370-3385 area, and enter long positions in the 3340-3315 area when appropriate, maintaining strict stop-loss orders.

Mid-term: The monthly bearish pattern has not changed, and above 3385 is the ideal entry point for short positions.

Key Strategies: "Don't chase long positions during strong resistance; don't sell short during deep declines; follow the trend after a breakout; exercise caution in controlling the market."

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

AVAX - Rejected at Range High, Now Testing Mid-Zone SupportAVAX just printed a textbook range rejection from the $26–27 resistance zone, which has capped price action since April. After rejecting the 50/100 EMA cluster, price is now testing mid-range support around $21.50 — a level that has historically offered short-term bounce opportunities or clean breakdown setups.

📌 Key Zones:

Top Resistance (~$26.50–27): Strong sell zone — multiple rejections

Mid-Range (~$21.50): Currently being tested for a possible bounce

Bottom Support (~$18.20–19): Range base with prior reversal history

📉 Reclaiming the EMAs could suggest another trip toward the highs, but failure to hold $21.50 opens the door to a deeper move toward $19 — or even a range breakdown if broader momentum weakens.

This chart highlights the importance of range trading structure — clean rejection up top, bounce attempt in the middle, and final line in the sand at the bottom.

Trade Idea Scenarios:

Bullish: Bounce + reclaim of $23.50 EMAs = long toward $25+

Bearish: Breakdown below $21.50 = short toward $19 or lower

How are you playing this range? 👇

GBPUSD: Bearish Momentum vs. Fundamental Repricing – Key LevelsGBPUSD is at a critical juncture, balancing a clear technical breakdown with a fundamental backdrop favoring near-term volatility. The pair has slipped from its rising wedge structure and is now testing key retracement zones while markets reprice expectations for Fed rate cuts after weak US jobs data. Traders are closely watching whether this bearish momentum will extend toward the 1.3128 support or if a rebound from oversold conditions could trigger a corrective bounce.

Technical Analysis (8H Chart)

Pattern: Clear breakdown from a rising wedge, confirming bearish bias.

Current Level: Price sits near 1.3278, struggling to reclaim the 1.3300 resistance zone.

Key Support Zones:

1.3128 (61.8% Fibonacci retracement) – main bearish target.

1.2945 (78.6% retracement) – extended downside target if selling pressure deepens.

Resistance Levels:

1.3300 (immediate resistance, prior support now flipped).

1.3380 (secondary resistance if a retracement rally occurs).

Projection: Likely bearish continuation toward 1.3128, with a potential retest of 1.3300 before continuation.

Fundamental Analysis

Bias: Bearish in the short term, but Fed policy and risk sentiment remain key drivers.

Key Fundamentals:

USD: Weak NFP (73K), higher unemployment (4.2%), and downward revisions boost Fed cut bets (~75% for September), typically a USD-negative factor.

GBP: BOE maintains a cautious stance due to sticky inflation but lacks clear hawkish conviction as growth slows.

Tariffs: US tariffs add a mild negative weight on GBP trade sentiment.

Risks:

Hot US CPI could slow Fed cut bets, supporting USD.

Hawkish BOE comments could limit GBP downside.

Global risk sentiment shifts could either favor USD (risk-off) or weaken it further (risk-on).

Key Events:

US CPI and PPI for USD direction.

BOE policy updates and UK CPI.

US jobless claims and Fed commentary.

Leader/Lagger Dynamics

GBP/USD is a lagger, mainly reacting to USD shifts. However, its moves directly influence GBP crosses such as GBP/JPY and GBP/CHF.

Summary: Bias and Watchpoints

GBP/USD remains in a bearish phase, targeting 1.3128 with a potential corrective bounce toward 1.3300 first. The primary driver is the technical breakdown, while fundamentals add volatility around US CPI and BOE policy. If CPI surprises lower, the bearish outlook could reverse into a short-term rebound; if CPI is hot, downside momentum could extend. You should monitor USD-driven events closely as GBP/USD sets the tone for broader GBP movements.

Interest Rate Cutting Cycle - Opportunity?LendingTree is well positioned to benefit from a declining interest rate environment. As the rates fall, consumer appetite for refinancing, mortgages and personal loans typically surge. This is likely to boost TREE's lead generation revenue.

The company's recent revenue pick up in recent quarters indicates early signs of this rebound and the chart has recovered from its Head and Shoulders drop. We have a reclaim of the POC and an imminent death cross.

Trading at a historically low valuation, do you believe TREE can scale quickly in renewed customer demand? It's highly likely IMO. This is high up on my watchlist.

Not financial advice, do what's best for you.

GBPJPY ready to drop?GBPJPY has printed a weekly bearish engulfer with a cross over of a weekly doji and price rejected from a weekly and monthly resistance line. As price is rejecting from a very important monthly and weekly resistance level, it is highly likely price may continue to drop to weekly support level.

As 4H timeframe showing a strong head and shoulder with rejection below, we may see continuation with strong trend.

Upon price action confirmation, a sell trade is high probable.

ETH 4H Mid-Zone BounceETH on the 4H

ETH found support right at the midpoint between the 0.382 and 0.236 Fib levels — exactly at yesterday’s close.

Price closed above the BB center, and the SMA is also holding above it — early signs of recovery.

RSI formed a double bottom in the oversold zone and has now crossed above its moving average.

MACD is about to flip bullish.

I remain bullish and still holding my long, but with tight risk management.

Always take profits and manage risk.

Interaction is welcome.

EURUSD Current Market Situation Technical Analysis Current Market Situation

The chart displays a Double Top pattern, a strong bearish reversal signal that often indicates the start of a downward move.

The price has already broken the neckline, and it is now approaching a retest of both the neckline and the broken trendline, which serves as a critical resistance area for potential bearish continuation.

Key Zones

Neckline Retest Zone: Around 1.1600, acting as immediate resistance.

Trendline Retest Zone: Between 1.1670 – 1.1700, serving as an additional resistance level to confirm the bearish bias.

Potential Scenarios

✅ Bearish Scenario (Preferred):

If price respects the retest zones and fails to break higher, we may see a decline toward:

Target 1: 1.1500

Target 2: 1.1400

Target 3: 1.1300

⚠ Bullish Scenario (Alternative):

A clear breakout and daily close above 1.1700 would invalidate the bearish outlook and could lead to a bullish reversal.

Conclusion

The market structure currently favors the bears.

Rejection from the neckline or trendline retest zones will provide a strong confirmation for sell positions.

⚠️ Trade at your own risk – We are not responsible for any losses.

EURUSD Will Go Lower! Sell!

Here is our detailed technical review for EURUSD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.158.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.153 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EPIC/USDT 1H Setup – Bearish Flag Breakdown Incoming? We’re currently observing EPIC/USDT on the 1-hour chart, and the price action is following a classic bearish structure.

🔹 The trend remains strongly bearish overall.

🔹 The market is currently in a retracement phase, forming a new Lower High (LH).

🔹 A clear bearish flag pattern has formed, typically signaling continuation to the downside.

🔹 Once price breaks the Lower Low (LL) support, we expect bearish momentum to resume.

📌 Trade Setup Breakdown:

Pair: EPIC/USDT

Timeframe: 1H

Trend: Bearish

Divergence: None

Pattern: Bearish Flag

Bias: Bearish

Strategy: Sell Stop at LL Breakout

🔻 Entry Price (EP): 1.662

🔴 Stop Loss (SL): 1.938

🟢 Take Profit (TP1): 1.386

⚖️ Risk:Reward Ratio: 1:1

💼 Why This Setup Works:

✅ Clear bearish flag within a downtrend

✅ Retracement forming Lower Highs — classic continuation structure

✅ Breakout of LL confirms bearish momentum

✅ Clean risk-to-reward structure with tight SL and precise TP

💬 What’s your take on EPIC/USDT?

Do you see the same continuation forming? Share your thoughts below 👇

🔔 Don’t forget to follow me for more clean, high-probability trade setups, patterns, and price action plays. Let’s trade smart together! 💹

#EPICUSDT #CryptoTrading #BearishFlag #PriceActionSetup #CryptoAnalysis #1HChart #TrendContinuation #TechnicalSetup #TradeSmart #CryptoSignals #BearishStructure #SellSetup #RiskReward #TradingStrategy #ChartPatterns #BreakoutTrade #CryptoBearish #TradingViewIdeas #CryptoTraders #TradeWhatYouSee #SmartEntry #SwingTradeCrypto #CryptoCommunity #AltcoinAnalysis

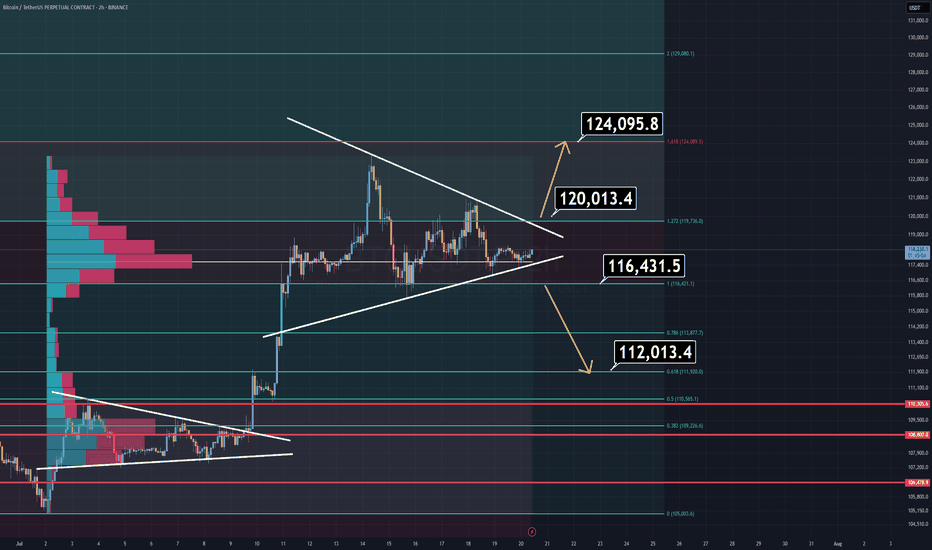

BTC Analysis (2H)Bitcoin is currently consolidating within a symmetrical triangle, suggesting indecision in the market. However, a breakout is imminent — and when it comes, it will likely be sharp.

🔹 Bullish Scenario:

A breakout above $120K would likely lead to a new All-Time High near $124K.

🔹 Bearish Scenario:

A breakdown below $116,400 opens the door for a quick drop toward the $112K–$110K zone, which should be considered a buy opportunity.

⚠️ Pro Tip:

There’s a volume imbalance just below the $116.4K level. If price breaks below it, the move down may be faster and more aggressive than expected — so plan accordingly.

Regardless of short-term volatility, the macro trend remains bullish, and Bitcoin will rise again.

Thanks for reading.

Bitcoin Free Value Gaps UPDATE - near filled next level down

As mentioned previously, these are traditionaly used to find Entries into a market and so far, this has been the case again.

We have dipped to 112K so far and as yu can see, we can go to 103K with ease, should this be allowed by the Bulls.

I will say, the SOPR (Spent Output Profit Loss ) chart has offered a Bull wanting caution flag..

And yet, on the lower time frames, it has just also posted a Good Bull entry point.

This indicates Excellent entry points, Buying opportunities

Yes, PA may drop lower yet, but not massive ones.

It is an excellent example of ow to "Scale in"

Do not use all your money in one trade. Use 20%, wait, see where thelmarket goes. Buy again when ready.

This way, once your lowest Buy price goes into profit, it also starts to cancel out he losses on the other, higher priced Buys....and by the time all your recent buys are in profit, you are exponentially getting better profits.

For me, I am waiting to see if we arrive at the 110K zone before starting this, once the current FVG is filled.

Have a noce sunday

Bullish

Description

Hi traders

I think after the fake break that happened last week at 3280, we should be ready to move higher with a target of 3430-3450 and if the fundamentals are impressive, even a break of the previous high.

Of course, the resistance zone of 3385-3405 is in the way of the price.

I hope that the analysis I am providing is accurate and effective.

Possible positions this week

A:Suitable prices for BUY positions

1)3345-3340

2)3174-3150

B:Suitable prices for SELL positions

1)3385-3405(Of course, with approval from the market and the type of candles)

This is just an analysis and everyone is responsible for their own work.

Hoping for a good and profitable week.