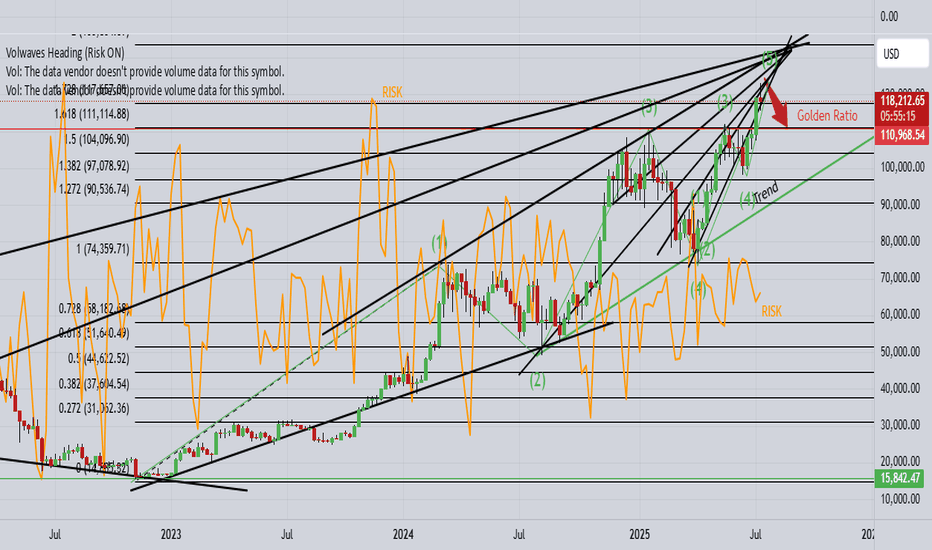

BTCDOM : Near to breakout from trendline resistanceBitcoin dominance is nearing a breakout from trend line resistance. Keep a close watch as a breakout from here could lead to a short-term market correction, negatively affecting altcoins. Stay cautious with your long positions and use proper stop loss strategies.

KEEP A CLOSE WATCH ON IT

Chart Patterns

NZD-JPY Local Long! Buy!

Hello,Traders!

NZD-JPY is retsting a

Strong horizontal support

Level around 87.044 and

As the pair is locally

Oversold we will be expecting

A local rebound and a move

Up on Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$BTC needs a massive diaper change....BTC is crossing key technical points, pointing clearly in an bearish trend. The trend will likely accelerate and potentially aggressively. I have been through several turns, not financial advise and always do your due diligence, but for those who are up: sell and and don't get emotional about BTC, unless there is a clean / clear support levels. Crypto bros will be eating rice and beans very soon and still be trying to FOMO crypto. This could be way worse than FTX!

Stay safe and for signal support levels use UltraAlgo to avoid wasting time trying to find support / resistance levels.....best of luck!

Is Litecoin finally ready to pop for real this time? 1600% gainAs many of you have been, I'm watching crypto prices closely since the BTC jump to $123k, waiting for the next move. Well, today we see that move and the entire market is blood red, except for...

Litecoin.

The patiently waiting little brother of the "big 3", waiting for his time to grow up and shine. Well today I'm impressed, mr. Litecoin is the only green coin in my entire Watchlist.

Zooming in on the chart: there’s a clean, rounded cup and a crisp handle forming, and that handle looks like it’s already breaking out. If Bitcoin can hold the $112K level, I think this could be the start of some serious moves from LTC.

The perfect bull flag that's formed on the chart has good volume too.

That blue line coming down is a long term trendline, and price is consolidating above it.

Still thinking about that "1600%"?

If you zoom out, there's a massive descending wedge forming since 2014 (11 years!!!). If Litecoin finally breaks out of it, the first fib level (.236) is at .01275BTC, that's 1600% up from here.

We'll see.

BTC | Swing Plan UpdatePrice failed to break out above 1D supply and sharply rejected, losing key 4H demand at $117,300.

HTF demand at $109,000 (1D FVG + BOS + S/R) is the next major area of interest—this is where I’ll look for fresh swing setups if the market flushes further.

No need to rush new positions until a clean setup prints or levels are reclaimed.

Plan:

Wait for price to test $109,000 zone before considering a swing long.

Only consider LTF scalp longs if we reclaim the 4H BOS at $118,300.

Stay flat until high-probability entry, let the market show its hand.

BTCUSD looking for corrective drop towards $111K!1). "Indecisive" weekly Doji retail candle! 2). Price rejection off higher times! 3). Risk indicator is heading south! 4). Trump said "BUY!" 5). There appears to be a cluster of "BUY" orders around $114$K as typically, price drops to trigger those orders!

NZD/JPY: Bearish Breakdown from Ascending ChannelNZD/JPY has decisively broken below its ascending channel, signaling a shift from bullish structure to bearish momentum. This move aligns with fundamental headwinds for NZD and the potential for JPY strength amid intervention risks and global risk-off sentiment.

Technical Analysis (4H Chart)

Pattern: Breakout from ascending channel support confirms a bearish reversal.

Current Level: 87.12, trading below the broken trendline with strong selling pressure.

Key Support Levels:

86.00 – first bearish target and immediate support zone.

84.60 – extended bearish target if momentum continues.

Resistance Levels:

88.04 – previous support turned resistance.

89.06 – upper boundary and invalidation zone for bearish bias.

Projection: Price is expected to retest 86.00, and if broken, further decline toward 84.60 is likely.

Fundamental Analysis

Bias: Bearish.

Key Fundamentals:

NZD: Pressured by global tariffs and risk-off sentiment.

JPY: Supported by potential FX intervention from Japan’s Ministry of Finance and safe-haven demand.

US Data Impact: Weak NFP boosted Fed cut bets, but risk-off flows strengthen JPY against risk currencies like NZD.

Risks:

China stimulus or a risk-on shift could lift NZD.

Lack of BOJ action may weaken JPY temporarily.

Key Events:

RBNZ policy outlook.

BOJ comments or intervention signals.

US CPI influencing global risk sentiment.

Leader/Lagger Dynamics

NZD/JPY is a lagger, reacting to risk sentiment and JPY moves, with JPY strength leading the pair lower.

Summary: Bias and Watchpoints

NZD/JPY is bearish, with a clear technical break from its ascending channel. The pair targets 86.00 initially and 84.60 on extended downside. Key watchpoints include BOJ FX policy, RBNZ stance, and global risk sentiment, especially if markets move deeper into risk-off mode.

XRP 1H – 21% Decline Off the HighAfter hitting a strong resistance near $3.75, XRP has been in a steady downtrend, losing over 20% from its peak. The chart shows clear lower highs and a strong descending resistance line capping every bounce. Price action remains bearish, but short-term momentum (via Stoch RSI) shows signs of being oversold — hinting at a potential relief bounce.

To flip bias, bulls would need a clean break of the trendline and reclaim the $3.15–$3.25 area. Until then, lower highs + sustained sell volume = caution for longs.

📌 20.6% decline

📌 Downtrend intact

📌 Momentum diverging — bounce or continuation?

This setup is primed for a mean-reversion or further breakdown — stay reactive, not predictive.

OEX /SPX Bullish wave 5 pattern crossroads The chart posted is the sp 100 I am posting it as we are now at the crossroad for bull or bear count .We have rallied to .786 as I will show and have a wave a x 1.27 = c at the .786 High But if we break above 5922 in the Cash SP 500 There is NOTHING to stop it from reaching a target of 3005 in the OEX where wave A up or wave 1 x 1.618 = wave C Top or wave 3 in the SP 500 WAVE A or WAVE 1 up 5481 - 4835 = 646 x 1.618 =1045 plus wave B low or wave 2 5102low= 5102plus 1045 =6147.22 The exact high . This is the reason I took the loss and moved LONG .Best of trades WAVETIMER

RNDR/USDT at a Critical Turning Point: Golden Pocket as the Key?✨ Overview:

Render Token (RNDR) is currently testing a crucial support zone — the Golden Pocket Fibonacci Retracement between 0.5 (3.616) and 0.618 (3.385). This zone not only represents a significant retracement level but has historically acted as a strong demand area, often serving as a springboard for major price reversals.

---

🧠 Detailed Technical Analysis:

🔸 Support Zone & Golden Pocket

Price has retraced back to the 0.5 – 0.618 Fibonacci zone, a high-probability reversal area.

This zone has acted as a demand base multiple times since February 2025.

How the price reacts here will likely define the next major trend direction.

🔸 Market Structure

The overall structure shows a mid-term downtrend, marked by lower highs and lower lows.

However, the current price action shows slowing bearish momentum, indicating potential hidden accumulation.

A potential double bottom pattern could be forming, hinting at a bullish reversal if confirmed.

---

📈 Bullish Scenario:

1. Strong Rebound from the Golden Pocket

Watch for bullish candlestick patterns (e.g., pin bar, bullish engulfing) near $3.38–$3.61.

Initial resistance levels: $4.16 – $4.72

If broken, mid-term targets could extend to $5.47 – $6.68

2. Double Bottom Confirmation

A confirmed double bottom with a neckline breakout around $4.16 would greatly strengthen bullish momentum.

3. Increased Buying Volume

A spike in volume during the rebound would validate bullish sentiment and potential trend reversal.

---

📉 Bearish Scenario:

1. Breakdown Below the Golden Pocket

If the price breaks below $3.385 with strong volume, we could see a move down toward $2.77, the next significant support.

2. Weak Bounce / Lower High

A failed breakout above $4.16 may indicate a bearish continuation after a temporary relief rally.

---

📌 Summary:

RNDR is currently at a technically sensitive zone. The Golden Pocket between $3.38 and $3.61 is the key area to watch. A strong bullish reaction could signal the start of a trend reversal, while a breakdown could trigger further downside continuation. Traders are advised to wait for clear confirmation via price action before committing to any strong positions.

---

🔖 Key Levels to Watch:

Level Description

3.38 – 3.61 Golden Pocket (Potential Buy Zone)

4.16 Minor Resistance

4.72 Bullish Breakout Trigger

5.47 – 6.68 Mid-Term Reversal Targets

2.77 Strong Support if Breakdown Occurs

---

🧩 Chart Patterns Observed:

Potential Double Bottom – early bullish reversal signal.

Golden Pocket Reaction Setup

Descending Structure – still intact but weakening.

---

🔍 Trade Ideas:

🔄 Wait-and-see approach: Wait for clear bullish confirmation on daily candles.

🎯 Aggressive Long Entry: Around 3.40–3.60 with a tight stop-loss.

⚠️ Short Opportunity: If a strong breakdown below 3.38 occurs with volume confirmation.

#RNDR #RenderToken #RNDRUSDT #CryptoAnalysis #GoldenPocket #FibonacciRetracement #DoubleBottom #PriceAction #SupportResistance #AltcoinSetup #CryptoSignals #TechnicalAnalysis

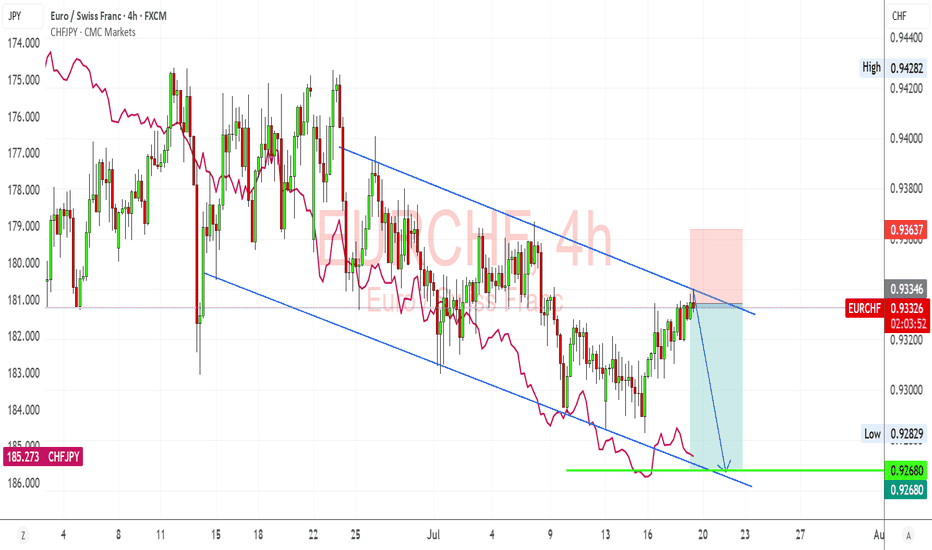

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

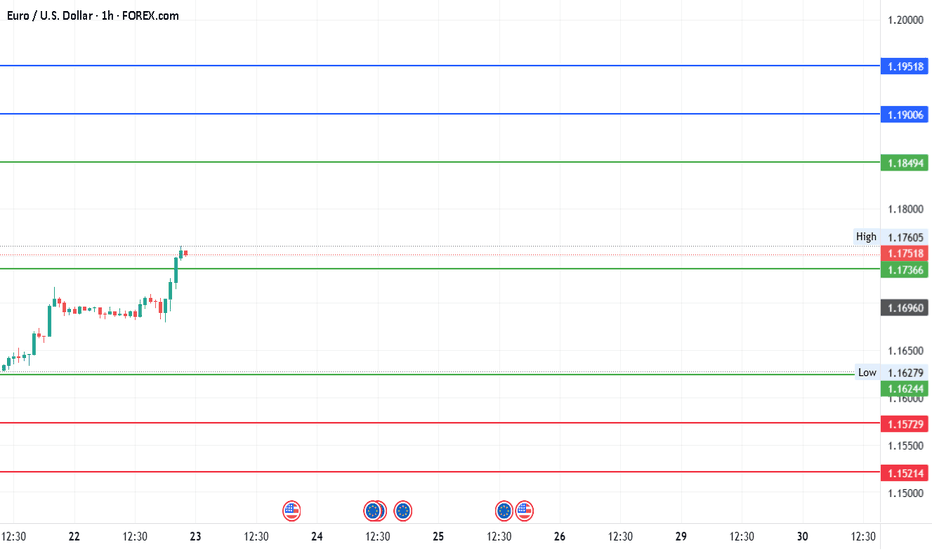

#EURUSD - Pivot Point is 1.174Date: 22-07-2025

#EURUSD - Current Price: 1.175

Pivot Point: 1.174 Support: 1.162 Resistance: 1.185

Upside Targets:

Target 1: 1.190

Target 2: 1.195

Target 3: 1.203

Target 4: 1.211

Downside Targets:

Target 1: 1.157

Target 2: 1.152

Target 3: 1.144

Target 4: 1.136

#TradingView #Forex #Currency #StockMarket #Investing #Trading #EURUSD

#TechnicalAnalysis #SotockCharts #Finance

#PivotPoints #SupportResistance

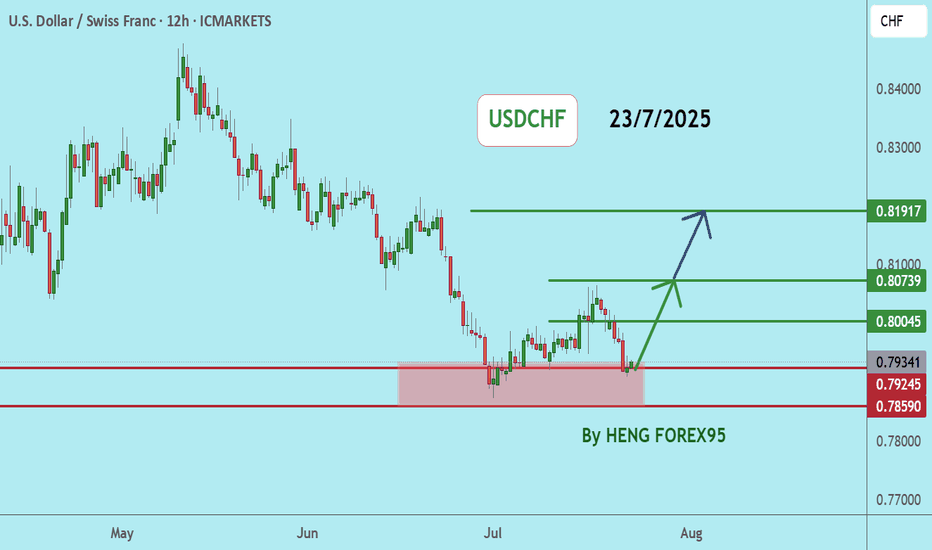

USDCHFUSDCHF price is near the main support zone 0.79245-0.78590. If the price cannot break through the 0.78590 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

Graphite India (1M TF) - Big Technical Base ►NSE:GRAPHITE

⚙️ Materials: Commodity Cycle Turnaround

(Green energy metals, China recovery)

Sector context: India’s rising graphite demand (e.g. electrode expansion for steel, battery material on horizon) aligns well with Graphite India’s positioning.

►Graphite India is the largest producer of graphite electrodes in the country and one of the largest in the world.

At the time of charting NSE:GRAPHITE PA was at 550

PA in 1D TF has bounced from Support

Trend 1M TF: Long-term Symmetrical 📐triangle formation since 2018 highs — price now testing upper trendline

Monthly shows range‑bound to mild consolidation since topping near ₹623 and bouncing around ₹540‑560.

Multi-year consolidation forming a textbook volatility squeeze, often a precursor to explosive directional moves. Volume compression inside the triangle suggests strong hands accumulating.

Candlestick structure: Bullish engulfing-type recovery candle forming off the trendline support. Breakout Energy above 586 = potential energy. A monthly close👀 above the downtrend line may unlock significant upside ⇗ momentum.

Daily MACD turning positive, weekly and monthly crossovers 🟢suggest building momentum.

Monthly Resistance line 762🔴 Pivot line 🔵611 Support🟢512

₹575–586 is the breakout threshold. Above the pivot and away ⇗

Post-break, next projection target : ₹900 (≈+60%), followed by ₹1,300. (Text Book)

📊 Fundamental Alignment

🔋 EV Battery Anode Narrative: Global lithium/graphite demand surging → Graphite India well-positioned as key electrode supplier.

🌍 China Supply Risks = India graphite players gain global relevance.

💼 FIIs Inflow: Recent uptick (+1.7%) hints at sectoral re-rating in anticipation of capex cycles and commodity upturn.

📉 Valuation Context: After steep de-rating post-2018, current price offers favorable risk-reward compared to earnings expectations and sector re-alignment.

► Graphite electrodes are the main heating element used in an electric arc furnace

extremely high levels of heat generated in EAF.

Graphite electrodes are divided into 4 Types: RP Graphite electrodes, HP Graphite electrodes, SHP Graphite electrodes, UHP Graphite electrodes.

► Needle coke👀 is a key ingredient in the production of graphite electrodes for electric arc furnaces (EAFs) in the steel industry.

🧰 Strategic Outlook

►we'll follow this trade closely and within incoming week we'll up a close up view of 4h TF

Bias: Strongly Bullish on breakout; Neutral if it stalls below ₹550.

Targets: ₹900 (swing), ₹1,300 (positional)

ideal for swing/long-term portfolio adds

Alternate Case: Breakdown below🔻₹480 negates pattern; re-evaluate around ₹400 for demand re-entry.

Always DYOR

See you on the other side

💡 Reflective Close:

“What if true breakouts don’t come from hype — but from time, patience, and the quiet work of smart money preparing long before headlines catch up? Are you watching the price, or are you watching the behavior behind the price?”

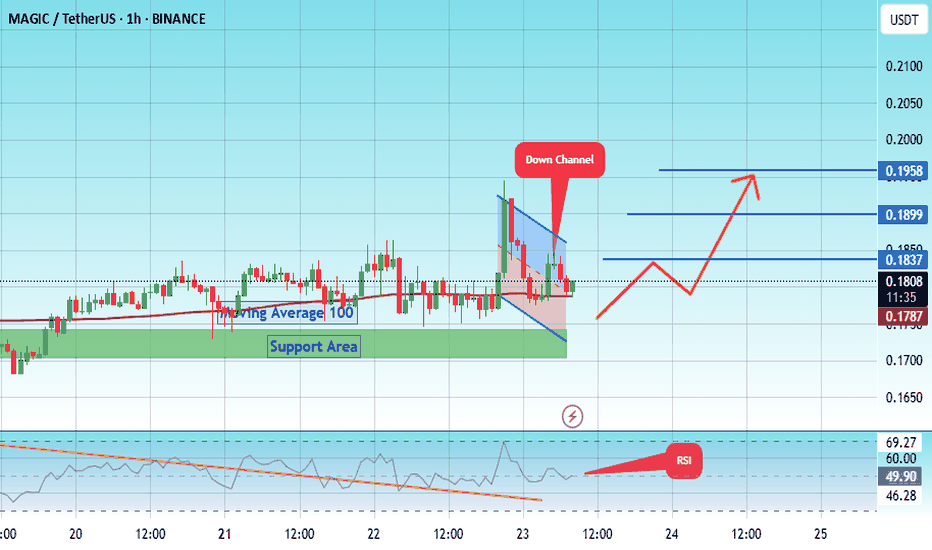

#MAGIC/USDT#MAGIC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.1474.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.1700, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1800.

First target: 0.1837.

Second target: 0.1900.

Third target: 0.1958.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

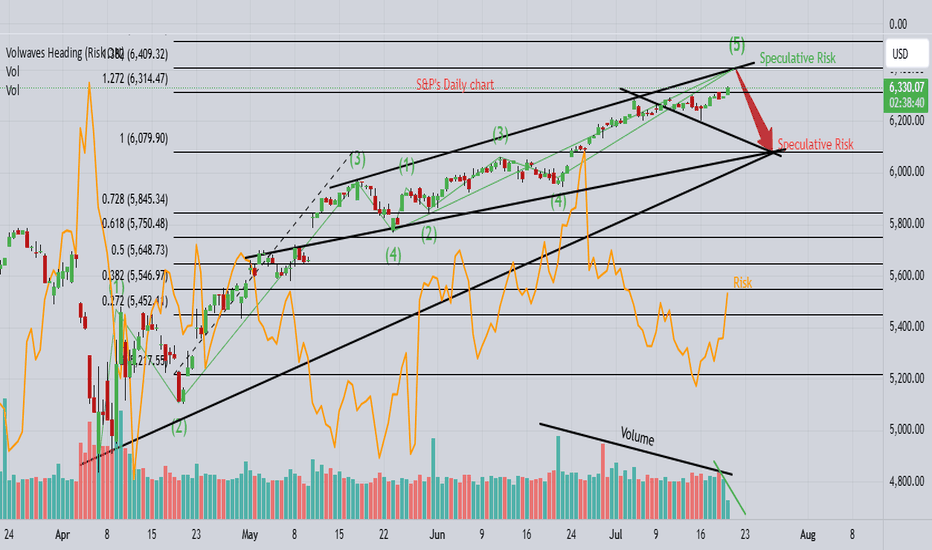

S&P's "hugely overbought" towards 6375!1). Position Volume dropping! 2). Big institutions (Banks & Insurance) have backed off on higher Risk positions! 3). Huge resistance at .728 fib & trend! 4). Trump tariff talk is likely adding to a fall as well! 5). We're looking for a "SELL" trade @ 6375, since buying is too risky at the moment...Good Luck!

Meme Coin Liquidity Trap📣 Hey CandleCraft fam, remember this one?

We nailed the previous BONK long — while it didn’t tag the absolute top, it delivered us a clean, sharp profit right out of the gate. Now? The story has flipped. Meme energy is fading, funding flipped, and the structure’s screaming reversal. Let’s see how this short idea plays out. 🐶💨

The dog barked loud — BONK went full meme mode with a 203% pump… but now it’s giving off that “walk of shame” energy. 🐶 RSI tanked, funding flipped, and it’s bleeding liquidity. Who let the dogs out? Probably market makers.

🔥 TRADE SETUP

Bias: Short

Strategy: Meme Coin Liquidity Trap

Entry: $0.0000355 – $0.0000370

SL: $0.0000400

TPs: $0.000030, $0.000025, $0.000020

Why?

– Overextended meme coin pullback

– Funding rate negative = longs bleeding

– OI down 35%, RSI from 85 → sub-50

– Price hovering under 20-day EMA support

Candle Craft | Signal. Structure. Execution.