Chfanalysis

Could we see a bounce off major support?Price is in a large ascending channel suggesting there might be bullish momentum pushing prices up. Our pivot is at 0.8822 which is a pullback support level - if price were to bounce from this level, we could see it rise towards the 1st resistance at 0.8877 which is a recent major swing high resistance.

If price were to break the pivot, we could see it drop towards the 0.8777 support level which has seen prices bounce off multiple times in the past.

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

⭕️BUY EURCHF at the best place and time 😉 ❗️🔰You can see the analysis of Euro to Swiss Franc in 30 minutes time frame (EURCHF_ 30 min)🔍🧨

💥If the price can break the line of Downward trend🖤 and Resistance🧡 to the top and stabilize❗ above it, it can have an upward trend until the SUPPLY zone🚀🔺

Do you think this analysis can be profitable❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

_______📈TRADER STREET📉________

⭕️SELL AUDCHF ; Its time to sell❗️🔰You see the analysis of the AUDCHF in one hour ( AUDCHF , 1H) ❗️🔎

🔰SELL AUDCHF at 0.70590

✅TP ; 0.69900 (+69 pips)

❌SL ; 0.71000 ( - 41 pips)

📊R/R ; 0.59(This number is derived from the division of Risk to Reward and must always be less than one, and the less it is, the better🧐)

🔰SELL AUDCHF at 0.70590

✅TP ; 0.68970 (+162 pips)

❌SL ; 0.71000 ( - 41 pips)

📊R/R ; 0.25(This number is derived from the division of Risk to Reward and must always be less than one, and the less it is, the better🧐)

🔰Due to the presence of the price in the range of sales supply in this region, the goal of confluence of white uptrend line and orange support line seems to be low risk.👌

In case of breaking the white uptrend line, there is a possibility of further downtrend and it is likely that the orange support line and demand range and white uptrend line will decline.❗️❗️

⚠️⚠️Please observe capital management and open a low volume transaction❗️❗️

I hope this analysis is useful for you🙏🏻🌹

📌Please introduce the "TRADER STREET" to your friends 🙏🏻

_______________________📈TRADER STREET📉________________________

⭕️SELL AUDCHF ; Its time to sell❗️🔰You see the analysis of the AUDCHF in one hour ( AUDCHF , 1H) ❗️🔎

🔰SELL AUDCHF at 0.70590

✅TP ; 0.69900 (+69 pips)

❌SL ; 0.71000 ( - 41 pips)

📊R/R ; 0.59(This number is derived from the division of Risk to Reward and must always be less than one, and the less it is, the better🧐)

🔰SELL AUDCHF at 0.70590

✅TP ; 0.68970 (+162 pips)

❌SL ; 0.71000 ( - 41 pips)

📊R/R ; 0.25(This number is derived from the division of Risk to Reward and must always be less than one, and the less it is, the better🧐)

🔰Due to the presence of the price in the range of sales supply in this region, the goal of confluence of white uptrend line and orange support line seems to be low risk.👌

In case of breaking the white uptrend line, there is a possibility of further downtrend and it is likely that the orange support line and demand range and white uptrend line will decline.❗️❗️

⚠️⚠️Please observe capital management and open a low volume transaction❗️❗️

I hope this analysis is useful for you🙏🏻🌹

📌Please introduce the "TRADER STREET" to your friends 🙏🏻

_______________________📈TRADER STREET📉________________________

USDCHF Breaking ResistanceUSDCHF Breaking Resistance

USDCHF recently broke its resistance at 0.9465

The next psychological resistance is at 0.9500, a break in this level will take tha pair to 0.9532 (Channel Resistance)

If 0.9500 will not break, a short term pullback at 0.9460 will be a key price at the 4H timeframe.(Trendline Retest)

If 0.9460 will not hold price may go down and consolidate near the 0.9400 level. (Trendline Structure Break)

For this week, I expect USDCHF price will consolidate between 0.9500 - 0.9400 level.

CHF/JPY could PUMP NOW!Hey tradomaniacs,

The market is really choppy looking at equities. It looks like the tec-hype is currently over as we see a suffering Nasdaq, while indicies with a worse performance last year are rising (DAX30).

This is causing a mixed cashflow and so a little bit of chaotic forex-market, which is testing our patience.

I`m currently looking for CHF-Trades as there is still much uncertainy in the market which is likely to look for safe havens such as Bonds, JPY and CHF.

Since YIELDS continue to rise, a BOND-DEAL is still very risky as new distributed bonds are providing more profits with rising yields, which is by the way why we have this inverted correlation.

JPY and GOLD/SILVER are bad alternatives to bond as there are suffering due to the rising yields. A good alternative would be CHF and I expect it to move up soon if uncertainy continues.

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

EURCHF ShortHi Traders,

The market has broken the structure and it has on retesting the broken support turning resistance, moreover, the pair is on downtrend and it should be fine to sell this from this level; bear in mind that it's on the last days of the year, maybe trend is changing and this could be a fake breakout and it is an indication that the market finished its downtrend; if this breakout works and goes downtrend then this analysis is valid, if not and the market closes above the resistance, we may cancel the trade and open a long position.

Here is the setup:

EURCHF Sell at 1.08631

Stop Loss at 1.09076

Target Profit at 1.09076

Good Luck and Happy New Year everybody!

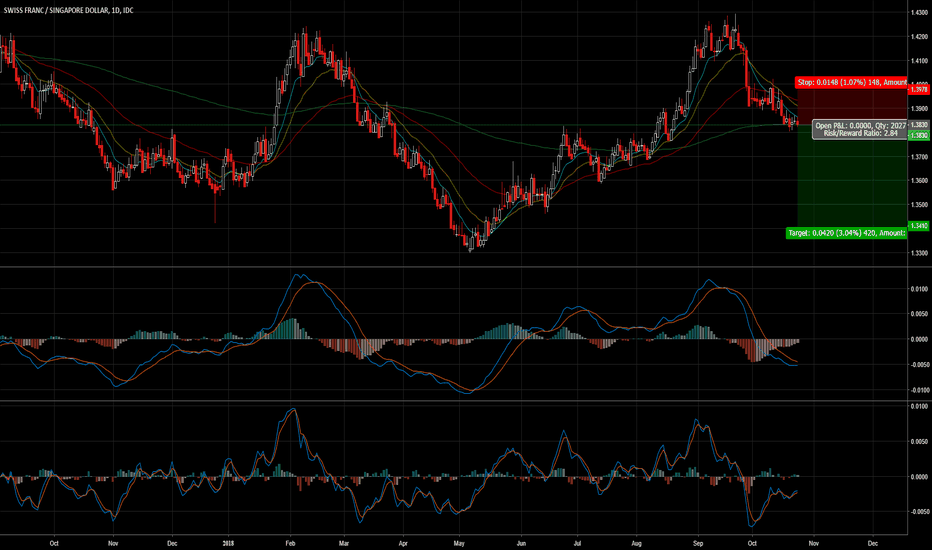

CHF/SGD - 250 Pips + Opportunity LONG TERMCHF/SGD is weak and we can expect it to continue it's bearish trend further below on the long term this next few weeks *as long as the 50 EMA holds as resistance on the daily timeframe.

It may make some pullbacks up but it is nothing to worry about as long as it never finds support. The reasonw why I leave my SL higher than the 50 EMA just in case.

This is a long term trade and the TP target may get changed during the run as the pair makes its move and let's us know how it's doing.

The full range and duration of the trade could be up to 2 months.

I personally have risked 3% on this pair.

Remember, you're not in trading for the quick profits but for the long term gains.

Trade safe.