CHFJPY On The Rise! BUY!

My dear friends,

My technical analysis for CHFJPY is below:

The market is trading on 183.63 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 184.54

Recommended Stop Loss - 183.16

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHFJPY

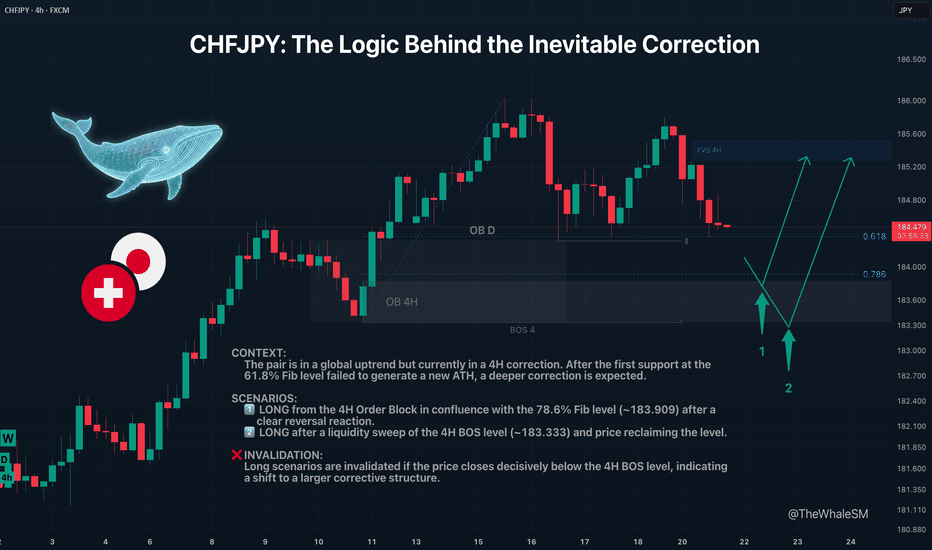

CHFJPY: The Logic Behind the Inevitable CorrectionCHFJPY recently bounced from what seemed like a perfect support level. Many likely saw this as a buy signal. But when the price failed to make a new high, it sent a clear warning: the correction isn't over yet.

This analysis dives into why that first bounce was a trap and where the next institutional levels are waiting below—the ones with the real fuel for the next major move up.

The CHFJPY pair continues its long and strong global uptrend . However, the market cannot move in one direction indefinitely without pullbacks; sooner or later, corrections occur. Large capital, or "Whales," who are the most important market participants, need to refuel with liquidity to continue their advance and to shake off piggybacking competitors. Right now, CHFJPY is in a 4H structure correction .

The first target for this correction was the 61.8% Fib level and a daily order block. The price did show a reversal reaction from them, but it lacked enough liquidity to create a new ATH, and the price continued its corrective movement. The next target for the correction will be the 78.6% Fibonacci retracement level at ~183.909, in conjunction with a 4H order block . This move will also sweep liquidity from the low of July 16th.

Two Potential Long Scenarios

SCENARIO 1: Entry from the 78.6% Fib Level & 4H Order Block

The first long entry scenario will be triggered by a clear reversal reaction from this support confluence.

► Setup Condition: Price must reach this zone, mitigate the order block, and close decisively above the 78.6% level, showing strength. An entry will require LTF confirmation (a BOS or the beginning of LTF order flow).

► Invalidation: If the 78.6% level is broken and the price closes below it, this scenario is invalid. In this case, the 4H order block itself will act as liquidity, and an attack on the 4H structure's break level (BOS 4) will likely occur.

SCENARIO 2: Entry After a Deeper Liquidity Sweep

This path becomes active if the first scenario fails.

► Setup Condition: A liquidity sweep with a candle wick below the 4H BOS level (183.333), with the price then closing back above this level. The final confirmation would be the start of a new order flow on a lower timeframe.

► Invalidation: A decisive close below the 4H BOS level will invalidate all long scenarios and will signal that the correction is shifting to a higher timeframe structure.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this wonderful, advanced TV community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always use a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

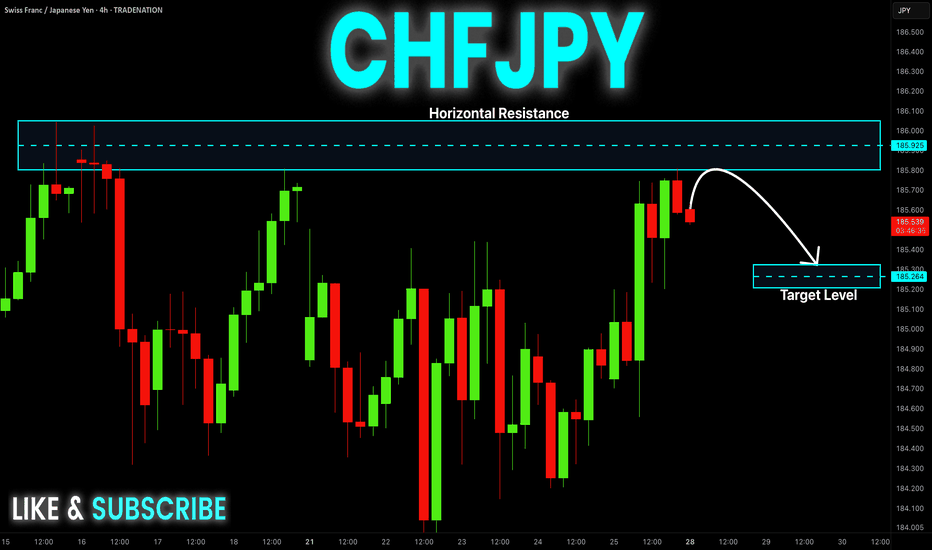

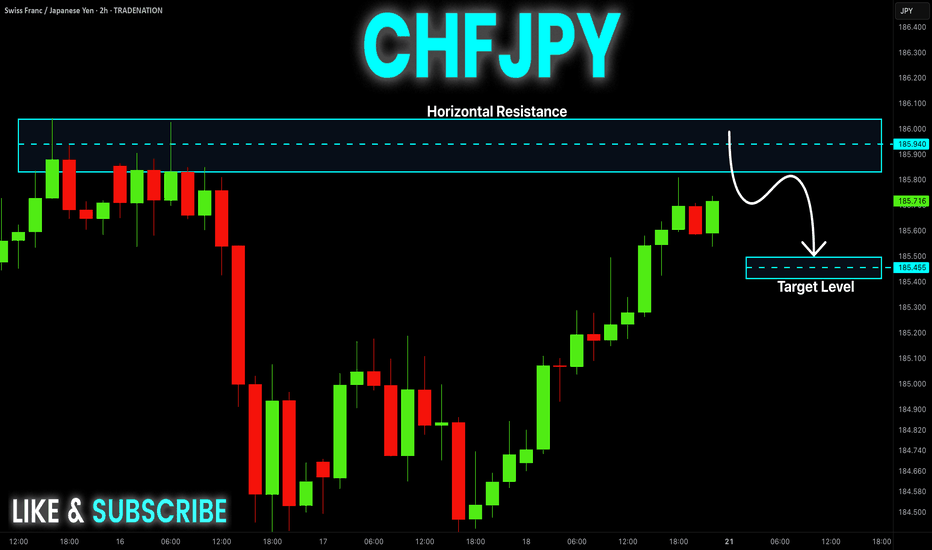

CHF_JPY LOCAL SHORT|

✅CHF_JPY has been growing recently

And the pair seems locally overbought

So as the pair is approaching a

Horizontal resistance of 186.000

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

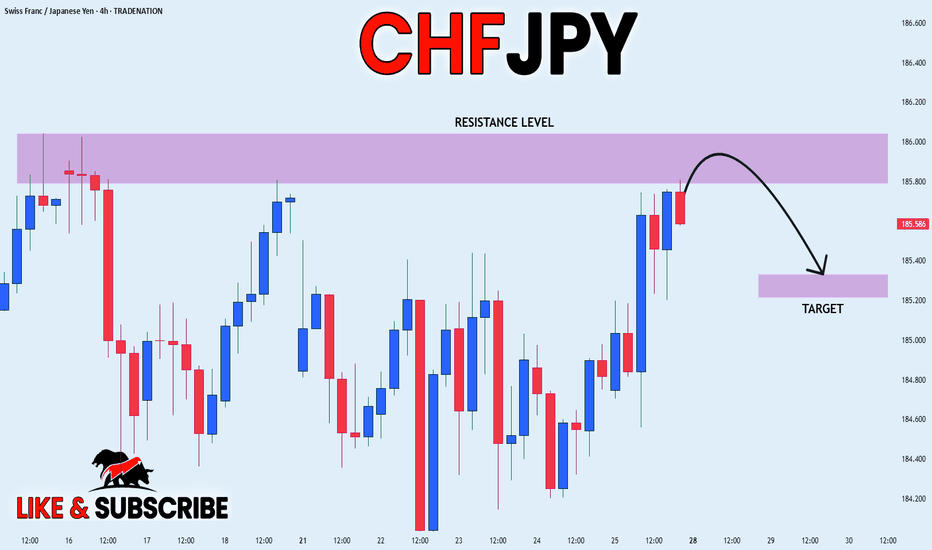

CHFJPY: Bearish Continuation is Expected! Here is Why

The price of CHFJPY will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CHF_JPY RISKY LONG|

✅CHF_JPY has retested a key support level of 182.800

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 183.700 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

The BB upper band is nearby so CHF-JPY is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 183.703.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

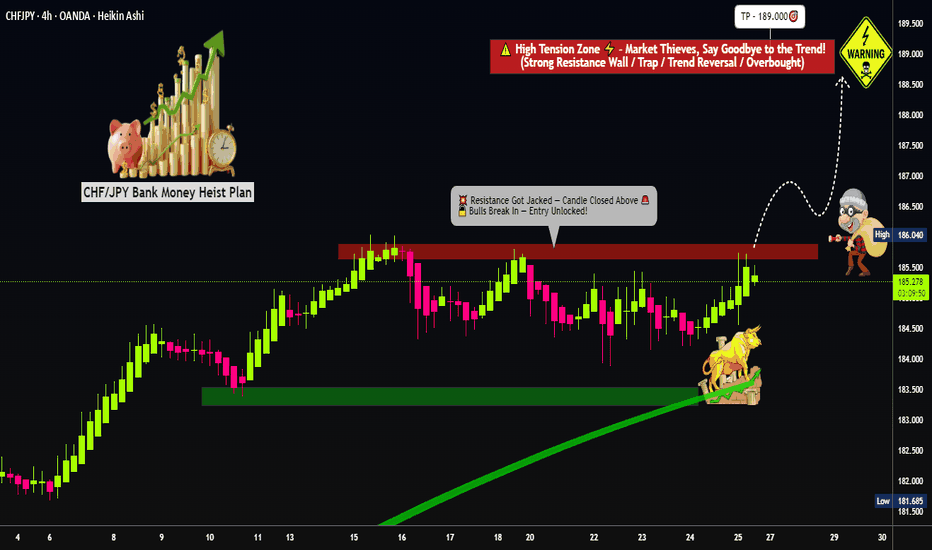

CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/JPY aka "Swiss vs Japanese". Based on my unique blend of 🔥technical traps + fundamental pressure points🔥, we've built the perfect blueprint to rob this pair at its weakest moment.

💣 Our target? The overhyped bullish zone — oversold, consolidating, and ripe for reversal. This is where institutional bulls camp, and we’re about to hit ‘em where it hurts.

🎯 Trade Setup Breakdown (Bearish Bias)

🎯 Entry Point:

The heist begins at 183.800 — wait for a neutral level breakout and prepare your sell orders.

💥 Recommended play:

Place Sell Stop just below the breakout confirmation.

For pros: use Sell Limit orders above MA or at pullback zones (15m/30m chart) near recent swing highs/lows — layer in using DCA style to catch premium entries.

🔔 Pro Tip:

Set alerts at the breakout zone. Don’t sleep on the move — timing is key in every robbery.

🛑 Stop Loss Strategy

"Yo listen! This ain't no demo drill!"

SL = 185.500 (4H swing high wick)

Place SL ONLY after breakout confirms — no pre-breakout SLs, no pre-heist drama.

Adjust SL based on risk %, lot size, and number of entries you're stacking.

If you’re reckless, go wild. But don’t say I didn’t warn you. You’re dancing with the FX devil here.

📉 Target Exit Zone

TP = 181.500

But real thieves know: If the heat gets heavy, vanish early. Escape before the target if price action warns you.

Survive > Greed. Always.

🔍 Macro Market Intel for Our Heist Plan

CHF/JPY is in a Bearish narrative, aligned with:

🧠 Fundamental Shifts

🏦 Macro Trends (Swiss deflation concerns + Japanese carry trade dynamics)

📉 Commitment of Traders (COT) Data

🌦️ Seasonal & Intermarket Correlation

🧭 Sentiment, Risk Flows & Future Pricing Models

🗞️ Before you break in, read the news, study the reports, watch the market smoke signals.

🚨 Trading Alert (News Protocol):

📢 Important: News releases = wild volatility. Stay smart:

No new trades during high-impact releases

Use trailing SLs to protect bagged profits

Adjust sizing to dodge unnecessary exposure

💖💥 Support the Robbery Plan 💥💖

Smash that 🚀BOOST button if you're vibing with the Thief Trading Style.

Every click helps build the strongest robbery crew in the FX game. This ain't luck — it's strategy, timing, and execution. 💪📈🎯

I'll be back soon with another market heist plan — stay sharp, stay paid. 🐱👤💼📊

CHF-JPY Short From Resistance! Sell!

Hello,Traders!

CHF-JPY keeps trading in

An uptrend and the pair

Is locally overbought so after

The pair hits the horizontal

Resistance level of 186.000

We will be expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF_JPY RISKY SHORT|

✅CHF_JPY is going up now

But a strong resistance level is ahead at 186.036

Thus I am expecting a pullback

And a move down towards the target of 185.329

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

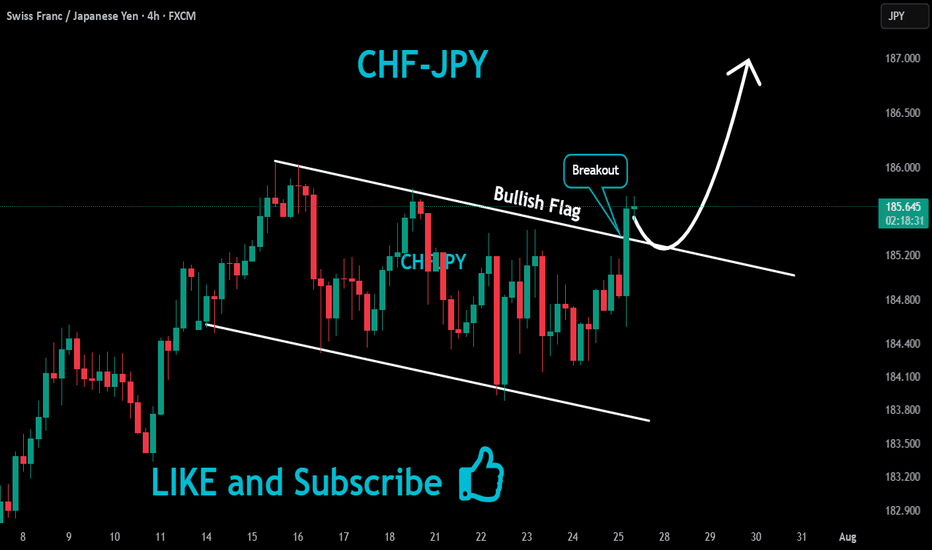

"Master Plan to Rob CHF/JPY – Breakout Trading Idea"💣CHF/JPY Forex Heist: Swiss vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the CHF/JPY "Swiss vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 186.000. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 4H timeframe (around 184.000)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 189.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why CHF/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

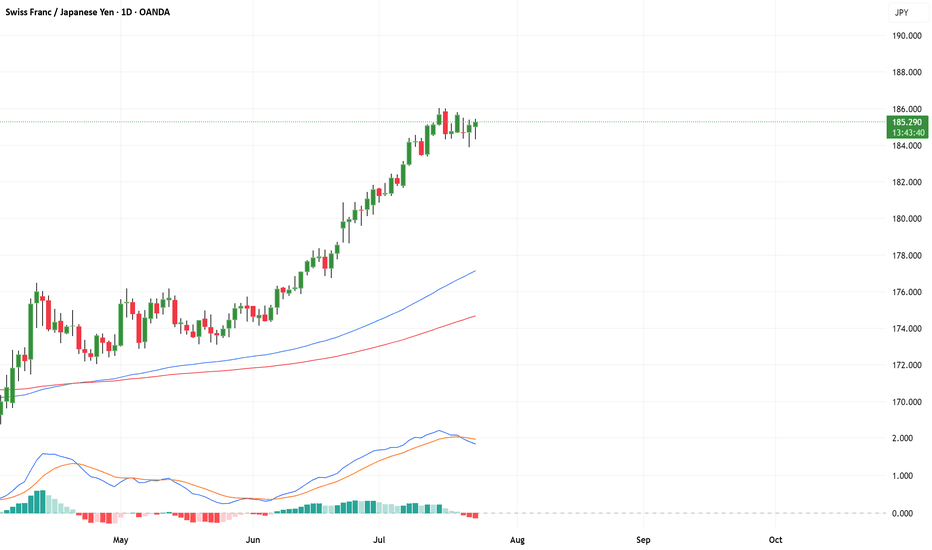

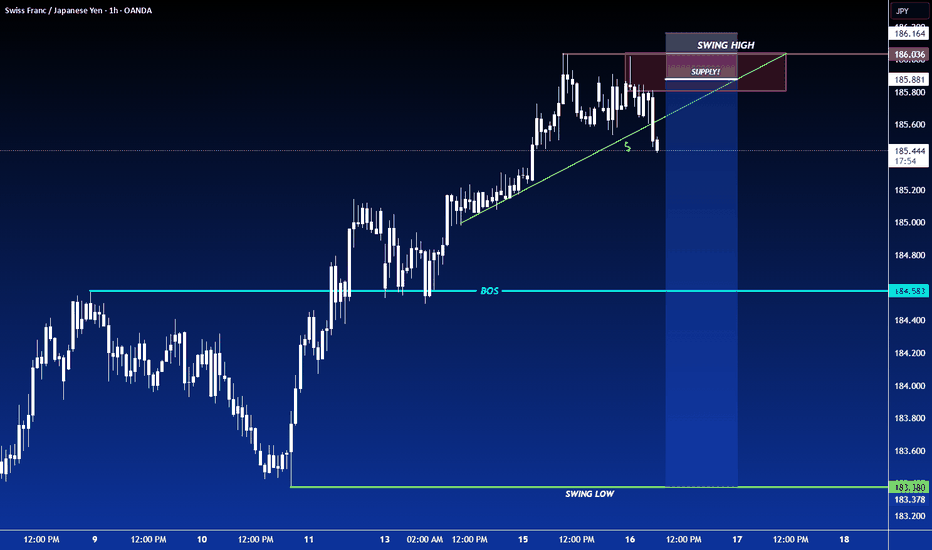

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves, much like we see in late December.

From a structural standpoint, this pair looks seriously overextended and ripe for a sharp pullback — with potential downside targets around 180 and 178 over the coming weeks.

If I were a bull, I’d want to see a clear break and weekly/monthly close above 186 before considering further upside.

As it stands, I’m gradually building into a short position, eyeing that 180 handle as my first key level.

Let me know your thoughts in the comments — agree, disagree, or seeing something I’m not?

*This is my personal analysis shared for educational purposes only. Always do your own research — never blindly follow anyone’s trades.*

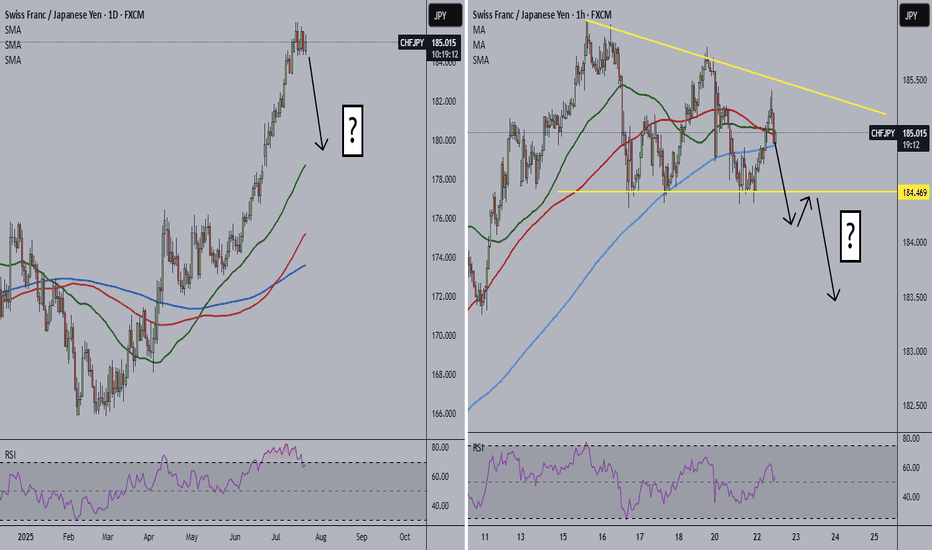

CHFJPY Alert!

🚨 CHFJPY Alert 🚨

Don't catch a falling knife... 🔪 However, price always returns to moving averages, and CHFJPY could be starting its descent.

Personally, I think price may form one last bullish move up and then come crashing down. However, the 1-hour is forming a descending triangle. A break below the triangle could be the start of the daily retracement.

Thoughts?

CMCMARKETS:CHFJPY

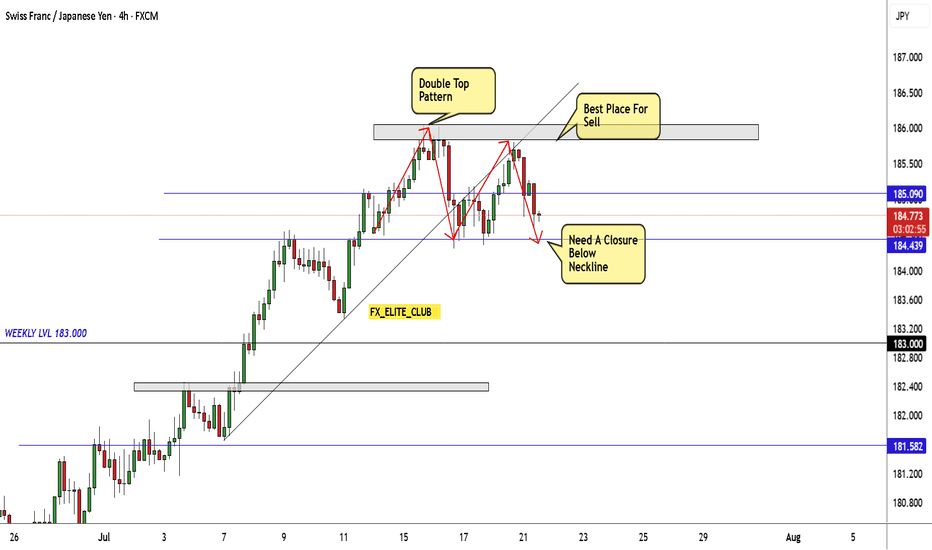

CHF/JPY Creating Double Top Reversal Pattern , Ready To Sell ?Here is my opinion on CHF/JPY 4H Chart , if we take a look we will see that the price moved tp upside very hard without any correction and now finally we have a reversal pattern but still not confirmed , so we have 2 places to sell this pair , first one is highest one around 185.800 To 186.000 and the second one if the price confirmed the pattern and closed below the neckline then we can enter a sell trade and targeting the nearest support . if we have not a closure below the neckline to confirm the pattern then this setup not valid .

CHF-JPY Resistance Ahead! Sell!

Hello,Traders!

CHF-JPY keeps growing in

An uptrend and the pair is

Locally oversold so after the

Retest of the horizontal

Resistance of 186.000

From where we will be

Expecting a local bearish

Pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

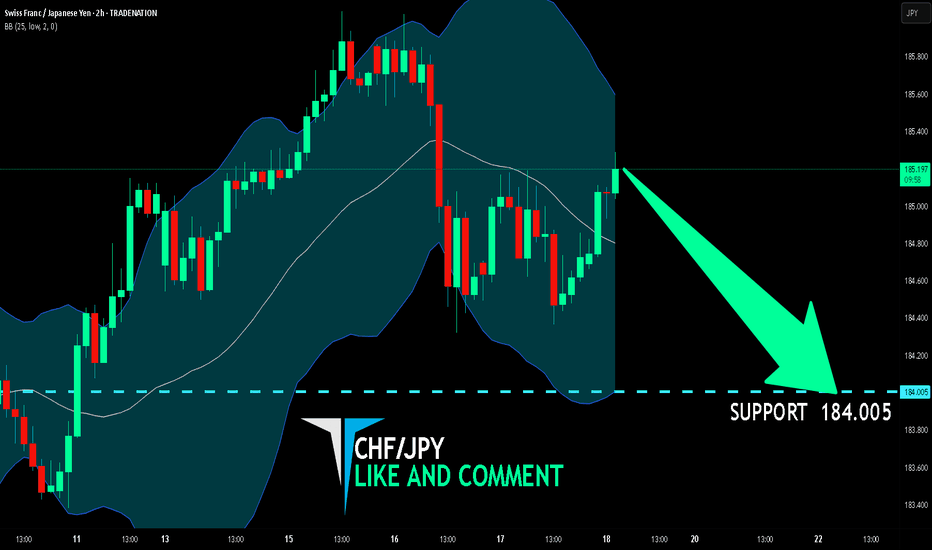

CHF/JPY BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

CHF/JPY pair is in the uptrend because previous week’s candle is green, while the price is evidently rising on the 2H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 184.005 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bullish CHF/JPY Heist! Risk vs. Reward Setup💰 SWISS-YEN BANK HEIST! 🚨 CHF/JPY Bullish Raid Plan (Risk & Reward Setup)

🌟 Attention Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to loot!"

🔎 THIEF TRADING ANALYSIS (CHF/JPY)

Entry (📈): "The Bullish Loot is LIVE!"

Buy limit orders within 15-30min pullbacks (recent swing lows/highs).

Aggressive? Enter anywhere—heist mode activated!

Stop Loss (🛑): Recent swing low (wick) – adjust based on your risk & lot size!

🎯 Target: 186.300 (High-risk Red Zone – Police Resistance!)

Overbought? Reversal risk? Bears lurking? Yes. But thieves play smart!

🏴☠️ SCALPERS & SWING RAIDERS:

Scalp ONLY Long (Use trailing SL to lock profits).

Low on ammo? Join swing traders for the big heist!

📡 FUNDAMENTAL BACKUP (Why This Heist?)

Bullish momentum in play (check COT, Macro, Sentiment).

News Alert (⚠️): Avoid new trades during high-impact news—trail your SL!

💥 BOOST THE HEIST!

Hit 👍 LIKE & 🔄 SHARE to strengthen our robbery squad!

More heists coming—stay tuned! 🚀

⚠️ DISCLAIMER:

Not financial advice. Risk = Reward. Adjust SL/targets based on your strategy. Market conditions change—adapt or get caught!

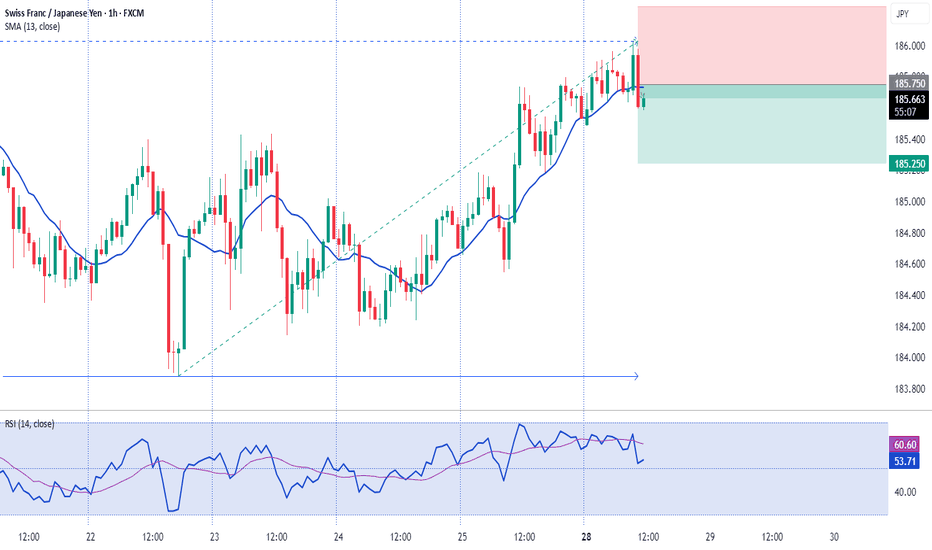

CHFJPYCHFJPY price is in a very bullish trend. At the current price, there may be short-term selling. Therefore, if the price cannot break through 185.34, it is expected that the price will drop. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are going short on the CHF/JPY with the target of 179.028 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CHF/JPY in Strong Uptrend – Clear Buy Opportunity!Hi traders!, Analyzing CHF/JPY on the 30-minute timeframe, price is currently continuing a strong bullish trend, breaking above recent consolidation and showing momentum to the upside.

🔹 Entry: 183.429

🔹 Take Profit (TP): 184.429

🔹 Stop Loss (SL): 183.341

Price is respecting the 21 EMA and riding it upwards, indicating strong bullish momentum. The RSI is also in the overbought zone, but still climbing, which confirms buyer strength. This setup aligns with the trend continuation and offers a favorable risk-to-reward ratio.

A breakout above the minor resistance and the clear structure of higher highs and higher lows support the bullish idea. Watch for possible reactions near 184.429, where price may face short-term resistance.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.