CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/JPY aka "Swiss vs Japanese". Based on my unique blend of 🔥technical traps + fundamental pressure points🔥, we've built the perfect blueprint to rob this pair at its weakest moment.

💣 Our target? The overhyped bullish zone — oversold, consolidating, and ripe for reversal. This is where institutional bulls camp, and we’re about to hit ‘em where it hurts.

🎯 Trade Setup Breakdown (Bearish Bias)

🎯 Entry Point:

The heist begins at 183.800 — wait for a neutral level breakout and prepare your sell orders.

💥 Recommended play:

Place Sell Stop just below the breakout confirmation.

For pros: use Sell Limit orders above MA or at pullback zones (15m/30m chart) near recent swing highs/lows — layer in using DCA style to catch premium entries.

🔔 Pro Tip:

Set alerts at the breakout zone. Don’t sleep on the move — timing is key in every robbery.

🛑 Stop Loss Strategy

"Yo listen! This ain't no demo drill!"

SL = 185.500 (4H swing high wick)

Place SL ONLY after breakout confirms — no pre-breakout SLs, no pre-heist drama.

Adjust SL based on risk %, lot size, and number of entries you're stacking.

If you’re reckless, go wild. But don’t say I didn’t warn you. You’re dancing with the FX devil here.

📉 Target Exit Zone

TP = 181.500

But real thieves know: If the heat gets heavy, vanish early. Escape before the target if price action warns you.

Survive > Greed. Always.

🔍 Macro Market Intel for Our Heist Plan

CHF/JPY is in a Bearish narrative, aligned with:

🧠 Fundamental Shifts

🏦 Macro Trends (Swiss deflation concerns + Japanese carry trade dynamics)

📉 Commitment of Traders (COT) Data

🌦️ Seasonal & Intermarket Correlation

🧭 Sentiment, Risk Flows & Future Pricing Models

🗞️ Before you break in, read the news, study the reports, watch the market smoke signals.

🚨 Trading Alert (News Protocol):

📢 Important: News releases = wild volatility. Stay smart:

No new trades during high-impact releases

Use trailing SLs to protect bagged profits

Adjust sizing to dodge unnecessary exposure

💖💥 Support the Robbery Plan 💥💖

Smash that 🚀BOOST button if you're vibing with the Thief Trading Style.

Every click helps build the strongest robbery crew in the FX game. This ain't luck — it's strategy, timing, and execution. 💪📈🎯

I'll be back soon with another market heist plan — stay sharp, stay paid. 🐱👤💼📊

Chfjpyanalysis

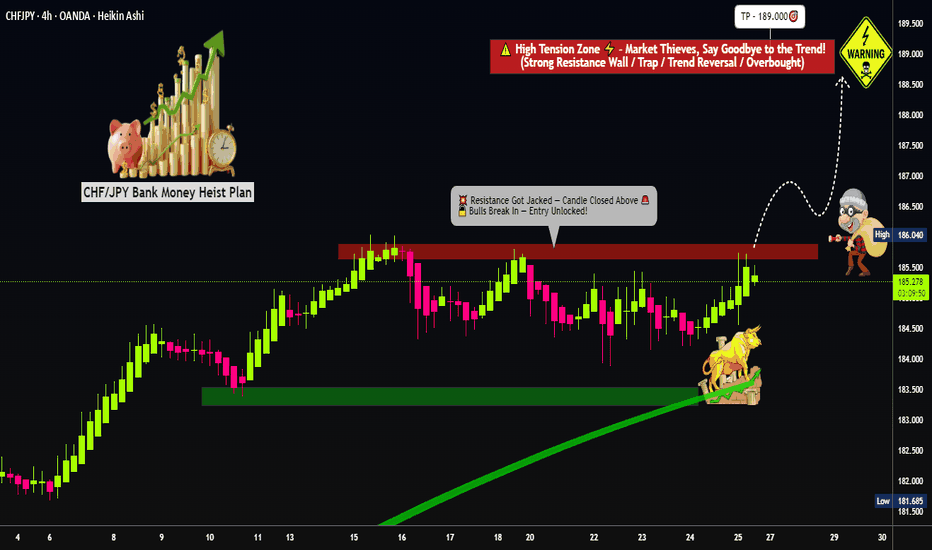

"Master Plan to Rob CHF/JPY – Breakout Trading Idea"💣CHF/JPY Forex Heist: Swiss vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the CHF/JPY "Swiss vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 186.000. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 4H timeframe (around 184.000)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 189.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why CHF/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

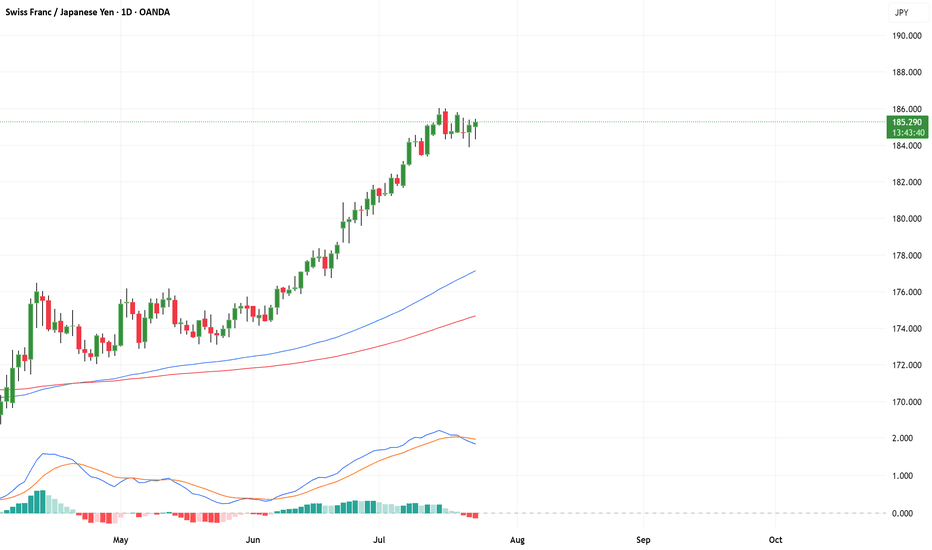

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves, much like we see in late December.

From a structural standpoint, this pair looks seriously overextended and ripe for a sharp pullback — with potential downside targets around 180 and 178 over the coming weeks.

If I were a bull, I’d want to see a clear break and weekly/monthly close above 186 before considering further upside.

As it stands, I’m gradually building into a short position, eyeing that 180 handle as my first key level.

Let me know your thoughts in the comments — agree, disagree, or seeing something I’m not?

*This is my personal analysis shared for educational purposes only. Always do your own research — never blindly follow anyone’s trades.*

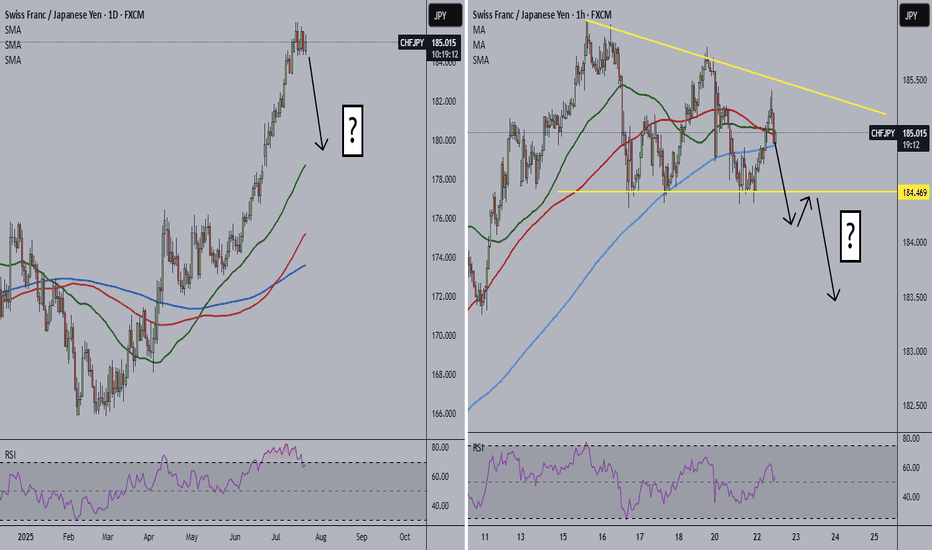

CHFJPY Alert!

🚨 CHFJPY Alert 🚨

Don't catch a falling knife... 🔪 However, price always returns to moving averages, and CHFJPY could be starting its descent.

Personally, I think price may form one last bullish move up and then come crashing down. However, the 1-hour is forming a descending triangle. A break below the triangle could be the start of the daily retracement.

Thoughts?

CMCMARKETS:CHFJPY

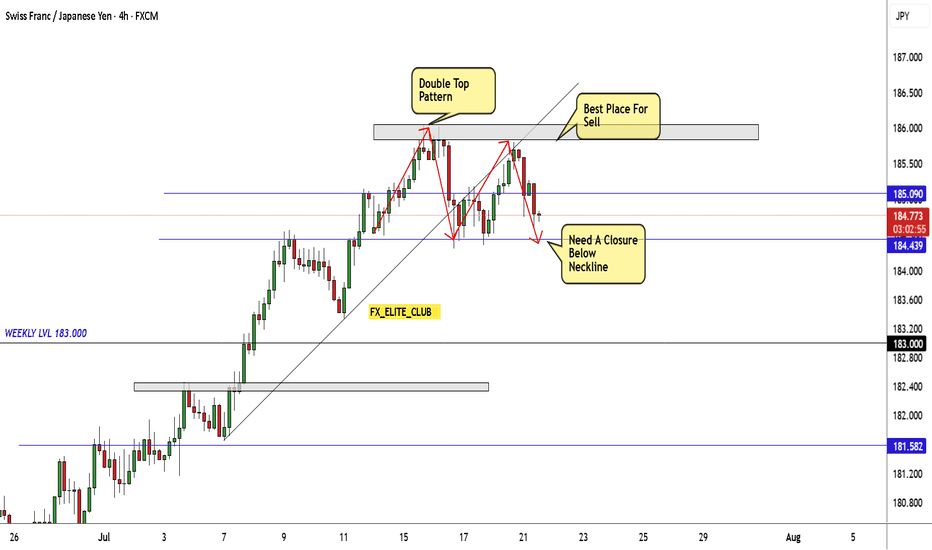

CHF/JPY Creating Double Top Reversal Pattern , Ready To Sell ?Here is my opinion on CHF/JPY 4H Chart , if we take a look we will see that the price moved tp upside very hard without any correction and now finally we have a reversal pattern but still not confirmed , so we have 2 places to sell this pair , first one is highest one around 185.800 To 186.000 and the second one if the price confirmed the pattern and closed below the neckline then we can enter a sell trade and targeting the nearest support . if we have not a closure below the neckline to confirm the pattern then this setup not valid .

Bullish CHF/JPY Heist! Risk vs. Reward Setup💰 SWISS-YEN BANK HEIST! 🚨 CHF/JPY Bullish Raid Plan (Risk & Reward Setup)

🌟 Attention Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to loot!"

🔎 THIEF TRADING ANALYSIS (CHF/JPY)

Entry (📈): "The Bullish Loot is LIVE!"

Buy limit orders within 15-30min pullbacks (recent swing lows/highs).

Aggressive? Enter anywhere—heist mode activated!

Stop Loss (🛑): Recent swing low (wick) – adjust based on your risk & lot size!

🎯 Target: 186.300 (High-risk Red Zone – Police Resistance!)

Overbought? Reversal risk? Bears lurking? Yes. But thieves play smart!

🏴☠️ SCALPERS & SWING RAIDERS:

Scalp ONLY Long (Use trailing SL to lock profits).

Low on ammo? Join swing traders for the big heist!

📡 FUNDAMENTAL BACKUP (Why This Heist?)

Bullish momentum in play (check COT, Macro, Sentiment).

News Alert (⚠️): Avoid new trades during high-impact news—trail your SL!

💥 BOOST THE HEIST!

Hit 👍 LIKE & 🔄 SHARE to strengthen our robbery squad!

More heists coming—stay tuned! 🚀

⚠️ DISCLAIMER:

Not financial advice. Risk = Reward. Adjust SL/targets based on your strategy. Market conditions change—adapt or get caught!

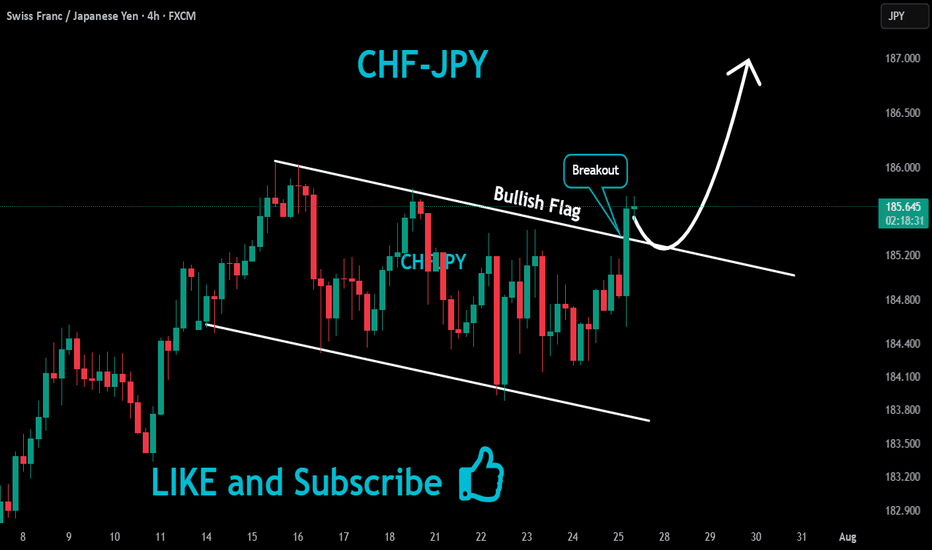

CHF/JPY in Strong Uptrend – Clear Buy Opportunity!Hi traders!, Analyzing CHF/JPY on the 30-minute timeframe, price is currently continuing a strong bullish trend, breaking above recent consolidation and showing momentum to the upside.

🔹 Entry: 183.429

🔹 Take Profit (TP): 184.429

🔹 Stop Loss (SL): 183.341

Price is respecting the 21 EMA and riding it upwards, indicating strong bullish momentum. The RSI is also in the overbought zone, but still climbing, which confirms buyer strength. This setup aligns with the trend continuation and offers a favorable risk-to-reward ratio.

A breakout above the minor resistance and the clear structure of higher highs and higher lows support the bullish idea. Watch for possible reactions near 184.429, where price may face short-term resistance.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

CHFJPY July Setup: Bearish Reversal Brewing from RSI ExtremesCHFJPY is setting up for a clean bearish reversal heading into July.

📌 Here's the breakdown using Vinnie’s Trading Cheat Code System:

✅ RSI OB Zone triggered – momentum stretched

✅ Trendline exhaustion forming near key resistance (~178.00)

✅ Waiting on Confirm Sell or MACD cross to validate entry

✅ First targets at 174.00 and 170.60 (prior demand zones)

The pair is showing signs of topping after a strong JPY selloff and CHF strength surge. If risk-off flows hit, CHFJPY could unwind fast.

Watching for lower timeframe triggers to scale in. Will update once confirmation hits.

🧠 Powered by:

Cheat Code Confirm Alerts

CC Trend Indicator

RSI OB/OS

MACD Momentum Roll

Drop a comment if you’re watching this too — let’s track it together.

"CHF/JPY Bullish Trap? We’re Stealing Profits Anyway!"🔥 Swiss-Yen Bank Heist: Bullish Loot Grab! (CHF/JPY Master Plan) 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting a bullish heist on the CHF/JPY "Swiss-Yen" Forex Bank. Follow the strategy on the chart—long entry is our golden ticket! Target? The high-risk Red Zone—where police traps, overbought signals, and bearish robbers lurk. But we’re sneaky thieves… and we always get the loot! 🏆💸

📈 Entry: "The vault is wide open!" Swipe bullish gains at any price—the heist is LIVE!

Pro Tip: Place buy limit orders within 15-30 min (swing lows/highs).

🛑 Stop Loss:

Thief-style SL at recent 4H swing low (174.100) (Day/scalping trade)

Adjust based on your risk, lot size, and multiple orders.

🎯 Target: 177.200 (Time to cash out!)

🧲 Scalpers: Eyes here! 👀

Only scalp LONG.

Big money? Charge in! Small budget? Join swing traders and execute the robbery.

Trailing SL = Your money’s bodyguard. 💰

Why CHF/JPY?

Bullish momentum fueled by:

Fundamentals (COT reports, macro trends)

Sentiment + Intermarket analysis (Check our bioo for deep dives! 🔗👉👉👉)

⚠️ Trading Alert: News = Chaos! 📰🗞️🚫

Avoid new trades during major news.

Trailing stops = Profit protector.

💖 Support the Heist!

Smash the Boost Button! 💥

Strengthen our robbery squad. Steal profits daily with the Thief Trading Style! 🏆💪🚀

Stay tuned—another heist drops soon! 🤑🐱👤🤩

CHFJPY is in a Bearish StructureHello Traders

In This Chart CHFJPY HOURLY Forex Forecast By FOREX PLANET

today CHFJPY analysis 👆

🟢This Chart includes_ (CHFJPY market update)

🟢What is The Next Opportunity on CHFJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

#CHFJPY: Next Target 180 or Beyond! Get ReadyCHFJPY is extremely bullish this week. The price has risen above 175 as of today, primarily due to the strong USD economic data and the BOJ’s decision not to change interest rates. We anticipate a steady bullish move.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#CHFJPY: Last Idea +200 pips, Another 500+ Remanning Hey there!

Our CHFJPY trade is going swimmingly, with a +200 pips move already under our belt. We’re expecting the price to keep climbing and potentially reach 185 or more. Feel free to set your own take profit and stop loss based on your own trading strategy. We’re just sharing this exciting opportunity with you.

Good luck and happy trading! 😊

We really appreciate your unwavering support! ❤️🚀

If you’d like to lend a hand, here are a few ways you can contribute:

- Like our ideas

- Comment on our ideas

- Share our ideas

Cheers,

Team Setupsfx_

CHFJPY Update I Short from Supply Zone Fulfilled Welcome back! Let me know your thoughts in the comments!

** CHFJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

CHFJPY Daily Analysis – Potential Rounded Top Reversal🧠 Key Insights:

Price is approaching strong resistance near 180.355, aligning with historical highs.

A rounded top formation is visible, signaling potential bearish reversal.

A break above 180.355 would invalidate the bearish setup (marked “Invalid” on chart).

---

🔻 Bearish Scenario:

If rejection occurs at resistance:

✅ TP1: 170.145

↪ Horizontal support; prior consolidation zone.

✅ TP2: 160.352

↪ Major demand area; long-term support.

Entry can be considered on confirmation signals (e.g. bearish engulfing, divergence, or rejection wicks).

---

❌ Invalidation:

A daily candle close above 180.355 invalidates this setup and may signal continued bullish momentum.

---

✅ Summary:

CHFJPY is at a key resistance zone and showing signs of a possible top. If bearish confirmation forms, targets lie at 170.145 and 160.352. Use proper risk management and wait for confirmation before entering.

---

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with a licensed financial advisor before making any trading decisions.

CHFJPY I Technical & Fundamental Forecast Welcome back! Let me know your thoughts in the comments!

** CHFJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

From Cup and Handle to W Formation for CHF/JPY but target 186.04Initially, we saw a Cup and Handle form on CHF/JPY.

The price however, never broke above the Brim level, and instead formed a W Formation.

So now that we have a W Formation, it kind of changes the analysis but only in the breakout pattern form.

So now we will wait for the price to break above the Neckline of the CHF/JPY.

The rest of the analysis remains the same.

Price>20 and 200

Target 186.04

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF/JPY "Swissy vs Yen" Forex Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Swissy vs Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Resistance breakout (176.300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (174.300) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 179.000 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸CHF/JPY "Swissy vs Yen" Forex Bank Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CHFJPY Analysis – Bearish Rejection at ResistanceCHFJPY pair is showing signs of exhaustion near a strong resistance zone just under 176.00. With price action printing multiple rejections and forming lower highs, the setup favors a bearish bias heading into mid-Q2 2025. With Japanese yen sentiment strengthening despite market doubts and Swiss inflation data showing stagnation, the technical picture is aligning with macro fundamentals for a potential drop.

📊 Technical Outlook (Daily Chart)

Key Resistance Rejected:

Price failed to sustain above 175.75–176.15 area, a strong historical resistance.

Multiple rejection wicks highlight bearish pressure at this level.

Bearish Structure:

Rising wedge and flag breakdowns have preceded the current move.

The chart shows a projected bearish leg forming, with three potential targets marked by green support zones.

Support Levels to Watch:

172.61 – Minor structure and neckline support.

171.00 – Key horizontal zone; likely the first major test.

168.50–166.50 – Final bearish targets based on previous structure and price consolidation.

Bearish Trade Plan (as indicated):

Entry zone: ~174.80–175.50 (after a confirmed lower high or breakdown).

Stop: Above 176.15 (structure invalidation).

TP1: 172.60

TP2: 171.00

TP3: 168.50

Final TP: 166.50

🌐 Fundamental Drivers

Swiss Inflation (April 2025):

Swiss CPI was flat MoM and YoY (0.0%), reflecting weak price momentum

Core inflation remained modest (+0.1%), reducing pressure on SNB to tighten policy.

JPY Sentiment & Positioning:

COT data shows record net-long JPY positions, suggesting strong speculative interest

Analysts warn of overbought sentiment, but dovish BoJ policy continues to suppress JPY bears for now.

Macro Context:

Risk-off sentiment or yield curve steepening could favor the yen further.

CHF may weaken if Swiss data continues to underwhelm.

✅ Summary

CHFJPY has rejected strong resistance, and both technical and macro indicators suggest a pullback is likely. A break below 172.60 could open the door to deeper declines toward 168.50–166.50 in the coming weeks.

CHFJPY Technical AnalysisThis CHF/JPY 1-hour chart represents a bearish setup with a short position already marked, showing a clear entry point, stop loss, and two take-profit levels (Target 1 and Target 2). The trader appears to be capitalizing on a breakdown from a minor consolidation near the 174.9–175.0 zone, which previously acted as support.

Price has decisively broken below that support, and is now trading around 174.63, with rejection wicks confirming selling pressure just beneath the old support turned resistance. The current candle structure suggests a weak recovery attempt, likely a bearish retest of the breakdown zone, forming what resembles a bear flag or descending channel pullback.

The Bollinger Bands are starting to widen after a squeeze, with the price now below both the 20-period moving average and the lower band, reinforcing bearish momentum. The RSI confirms this bias, currently sitting below the midline (around 38), indicating weakening bullish strength and possible oversold territory—but without divergence, which keeps the short bias intact.

Volume supports this move, as selling volume spiked on the initial breakdown, while the following green candles show diminished buying effort. This divergence between price action and volume is typical of a bearish continuation setup.

The first target sits around the 174.00 level — a round number and previous demand area. The second target is deeper, around 172.88, which likely corresponds to a higher time frame demand or order block. If momentum builds below 174.00, especially with sustained volume, the move toward Target 2 is plausible.

Overall, this trade assumes a continuation of bearish momentum, following a failed bullish attempt, with risk managed just above the broken structure. The setup hinges on the breakdown holding, making the 174.9–175.0 zone critical: any strong reclaim above it invalidates the bearish thesis.

CHFJPY Rejection from Multi-Year ResistanceCHFJPY recently rejected strongly from the 176.15 resistance zone, a level that has historically acted as a ceiling since mid-2023. After a parabolic rise into this resistance, we’re now seeing early signs of a bearish reversal pattern, indicating sellers may be regaining control.

Key Technical Levels:

Current Price: 173.19

Resistance Zone: 176.15 – 177.07 (multi-year highs)

Bearish Targets:

🎯 TP1: 171.00 – psychological and structural support

🎯 TP2: 168.50 – previous demand zone

🎯 TP3: 166.50 – strong horizontal support area

Invalidation: Daily close above 176.15 would nullify the bearish setup.

📉 Bearish Confluence Factors:

✅ Price rejection from historical resistance

✅ Formation of lower highs on the lower timeframe

✅ Overbought conditions following a strong rally

✅ Potential double-top or head & shoulders formation developing

📌 Strategy Outlook:

Bias: Bearish below 176.15

Entry Trigger: Break below recent minor swing low (~172.80)

SL: Above 176.15

Targets: 171.00, 168.50, and 166.50

🧠 Fundamental Angle (Contextual Support):

CHF strength may be peaking amid fading safe-haven flows

JPY might strengthen if global risk sentiment worsens or yields decline

Possible SNB caution on an overly strong franc could weigh on CHF

BoJ policy stance still favors volatility in yen pairs, but CHFJPY is heavily extended and due for correction

📌 Conclusion:

CHFJPY appears to be in the early stages of a technical pullback after reaching key resistance. If momentum builds below 172.80, expect bearish continuation toward 168.50 and possibly 166.50 in the coming weeks.