Chfjpylong

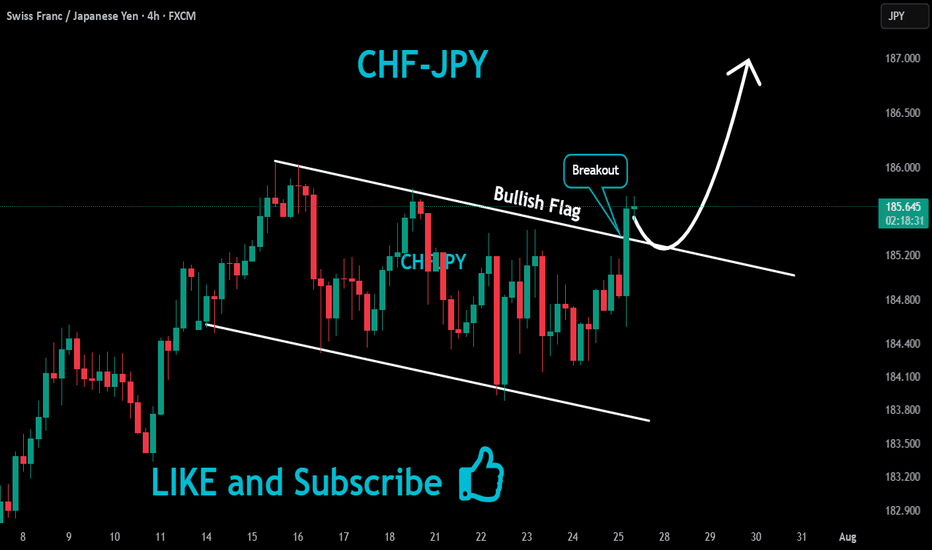

Bullish CHF/JPY Heist! Risk vs. Reward Setup💰 SWISS-YEN BANK HEIST! 🚨 CHF/JPY Bullish Raid Plan (Risk & Reward Setup)

🌟 Attention Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to loot!"

🔎 THIEF TRADING ANALYSIS (CHF/JPY)

Entry (📈): "The Bullish Loot is LIVE!"

Buy limit orders within 15-30min pullbacks (recent swing lows/highs).

Aggressive? Enter anywhere—heist mode activated!

Stop Loss (🛑): Recent swing low (wick) – adjust based on your risk & lot size!

🎯 Target: 186.300 (High-risk Red Zone – Police Resistance!)

Overbought? Reversal risk? Bears lurking? Yes. But thieves play smart!

🏴☠️ SCALPERS & SWING RAIDERS:

Scalp ONLY Long (Use trailing SL to lock profits).

Low on ammo? Join swing traders for the big heist!

📡 FUNDAMENTAL BACKUP (Why This Heist?)

Bullish momentum in play (check COT, Macro, Sentiment).

News Alert (⚠️): Avoid new trades during high-impact news—trail your SL!

💥 BOOST THE HEIST!

Hit 👍 LIKE & 🔄 SHARE to strengthen our robbery squad!

More heists coming—stay tuned! 🚀

⚠️ DISCLAIMER:

Not financial advice. Risk = Reward. Adjust SL/targets based on your strategy. Market conditions change—adapt or get caught!

CHF/JPY in Strong Uptrend – Clear Buy Opportunity!Hi traders!, Analyzing CHF/JPY on the 30-minute timeframe, price is currently continuing a strong bullish trend, breaking above recent consolidation and showing momentum to the upside.

🔹 Entry: 183.429

🔹 Take Profit (TP): 184.429

🔹 Stop Loss (SL): 183.341

Price is respecting the 21 EMA and riding it upwards, indicating strong bullish momentum. The RSI is also in the overbought zone, but still climbing, which confirms buyer strength. This setup aligns with the trend continuation and offers a favorable risk-to-reward ratio.

A breakout above the minor resistance and the clear structure of higher highs and higher lows support the bullish idea. Watch for possible reactions near 184.429, where price may face short-term resistance.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

#CHFJPY: Next Target 180 or Beyond! Get ReadyCHFJPY is extremely bullish this week. The price has risen above 175 as of today, primarily due to the strong USD economic data and the BOJ’s decision not to change interest rates. We anticipate a steady bullish move.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#CHFJPY: Last Idea +200 pips, Another 500+ Remanning Hey there!

Our CHFJPY trade is going swimmingly, with a +200 pips move already under our belt. We’re expecting the price to keep climbing and potentially reach 185 or more. Feel free to set your own take profit and stop loss based on your own trading strategy. We’re just sharing this exciting opportunity with you.

Good luck and happy trading! 😊

We really appreciate your unwavering support! ❤️🚀

If you’d like to lend a hand, here are a few ways you can contribute:

- Like our ideas

- Comment on our ideas

- Share our ideas

Cheers,

Team Setupsfx_

CHF/JPY "Swissy vs Yen" Forex Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Swissy vs Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Resistance breakout (176.300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (174.300) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 179.000 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸CHF/JPY "Swissy vs Yen" Forex Bank Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CHFJPY Analysis – Bearish Rejection at ResistanceCHFJPY pair is showing signs of exhaustion near a strong resistance zone just under 176.00. With price action printing multiple rejections and forming lower highs, the setup favors a bearish bias heading into mid-Q2 2025. With Japanese yen sentiment strengthening despite market doubts and Swiss inflation data showing stagnation, the technical picture is aligning with macro fundamentals for a potential drop.

📊 Technical Outlook (Daily Chart)

Key Resistance Rejected:

Price failed to sustain above 175.75–176.15 area, a strong historical resistance.

Multiple rejection wicks highlight bearish pressure at this level.

Bearish Structure:

Rising wedge and flag breakdowns have preceded the current move.

The chart shows a projected bearish leg forming, with three potential targets marked by green support zones.

Support Levels to Watch:

172.61 – Minor structure and neckline support.

171.00 – Key horizontal zone; likely the first major test.

168.50–166.50 – Final bearish targets based on previous structure and price consolidation.

Bearish Trade Plan (as indicated):

Entry zone: ~174.80–175.50 (after a confirmed lower high or breakdown).

Stop: Above 176.15 (structure invalidation).

TP1: 172.60

TP2: 171.00

TP3: 168.50

Final TP: 166.50

🌐 Fundamental Drivers

Swiss Inflation (April 2025):

Swiss CPI was flat MoM and YoY (0.0%), reflecting weak price momentum

Core inflation remained modest (+0.1%), reducing pressure on SNB to tighten policy.

JPY Sentiment & Positioning:

COT data shows record net-long JPY positions, suggesting strong speculative interest

Analysts warn of overbought sentiment, but dovish BoJ policy continues to suppress JPY bears for now.

Macro Context:

Risk-off sentiment or yield curve steepening could favor the yen further.

CHF may weaken if Swiss data continues to underwhelm.

✅ Summary

CHFJPY has rejected strong resistance, and both technical and macro indicators suggest a pullback is likely. A break below 172.60 could open the door to deeper declines toward 168.50–166.50 in the coming weeks.

CHFJPY Rejection from Multi-Year ResistanceCHFJPY recently rejected strongly from the 176.15 resistance zone, a level that has historically acted as a ceiling since mid-2023. After a parabolic rise into this resistance, we’re now seeing early signs of a bearish reversal pattern, indicating sellers may be regaining control.

Key Technical Levels:

Current Price: 173.19

Resistance Zone: 176.15 – 177.07 (multi-year highs)

Bearish Targets:

🎯 TP1: 171.00 – psychological and structural support

🎯 TP2: 168.50 – previous demand zone

🎯 TP3: 166.50 – strong horizontal support area

Invalidation: Daily close above 176.15 would nullify the bearish setup.

📉 Bearish Confluence Factors:

✅ Price rejection from historical resistance

✅ Formation of lower highs on the lower timeframe

✅ Overbought conditions following a strong rally

✅ Potential double-top or head & shoulders formation developing

📌 Strategy Outlook:

Bias: Bearish below 176.15

Entry Trigger: Break below recent minor swing low (~172.80)

SL: Above 176.15

Targets: 171.00, 168.50, and 166.50

🧠 Fundamental Angle (Contextual Support):

CHF strength may be peaking amid fading safe-haven flows

JPY might strengthen if global risk sentiment worsens or yields decline

Possible SNB caution on an overly strong franc could weigh on CHF

BoJ policy stance still favors volatility in yen pairs, but CHFJPY is heavily extended and due for correction

📌 Conclusion:

CHFJPY appears to be in the early stages of a technical pullback after reaching key resistance. If momentum builds below 172.80, expect bearish continuation toward 168.50 and possibly 166.50 in the coming weeks.

CHF/JPY "Swiss vs Yen" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Swiss vs Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (172.500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (169.700) Day / swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 175.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CHF/JPY "Swiss vs Yen" Forex Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

Detailed Explanation 🗣️

Point 1: Fundamentals balance CHF stability 🛡️ with JPY’s inflation-driven gains 🔥, but CHF edges out due to resilience 💪.

Point 2: Macro favors CHF’s safe-haven status 🛡️ over JPY’s debt-laden economy 📉.

Point 3: Global risk-off tilts toward CHF 🌍, though JPY holds as a secondary safe haven ⚖️.

Point 4: COT data supports CHF bullishness 📈, with institutional backing 🏦.

Point 5: Intermarket gold 🏅 and equity trends 📉 reinforce CHF strength 💪.

Point 6: Quantitative neutrality ⚖️ suggests a breakout is imminent, likely upward 📈.

Point 7: Sentiment leans bullish 📈, driven by institutions 🏦, with retail caution 🤔.

Point 8: Trends project short-term gains 🚀, medium-term consolidation ⚖️, and long-term uncertainty 🔮.

Point 9: Bullish outlook reflects CHF’s dominance in current conditions 📈.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CHF/JPY "Swiss-Yen" Forex Bank Heist Plan (Day / Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Swiss-Yen" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 4H timeframe (169.500) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 172.300

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CHF/JPY "Swiss-Yen" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CHFJPY I Wait for Correction and More GrowthWelcome back! Let me know your thoughts in the comments!

** CHFJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

CHFJPY is in a Bearish Structure after Breaking the SupportHello Traders

In This Chart CHFJPY HOURLY Forex Forecast By FOREX PLANET

today CHFJPY analysis 👆

🟢This Chart includes_ (CHFJPY market update)

🟢What is The Next Opportunity on CHFJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

#CHFJPY 4HCHFJPY (4H Timeframe) Analysis

Market Structure:

The price has successfully broken out of the downtrend resistance line, indicating a potential shift in market sentiment from bearish to bullish. This breakout suggests that buyers are gaining strength and may push the price higher.

Forecast:

A buy opportunity is anticipated following the breakout. It is advisable to watch for a potential retest of the broken resistance line, which could now act as support, for additional confirmation.

Key Levels to Watch:

- Entry Zone: Consider buying after a confirmed breakout and potential retest of the previous resistance turned support.

- Risk Management:

- Stop Loss: Placed below the retest level or recent swing low to manage risk.

- Take Profit: Target the next key resistance levels for potential upside gains.

Market Sentiment:

The breakout from the downtrend resistance signals bullish sentiment. Confirmation through price action or candlestick patterns will strengthen the probability of an upward move.

CHF/JPY "Swissy vs Japanese" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Swiss vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (168.100) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (166.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 170.000 (or) Escape Before the Target

Secondary Target - 172.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

CHF/JPY "Swiss vs Japanese" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟢Fundamental Analysis

Swiss Economic Growth: Switzerland's economic growth has remained steady at 1.5% in the last quarter, driven by the country's strong financial sector.

Japanese Economic Growth: Japan's economic growth has slowed down to 0.3% in the last quarter, due to the ongoing trade tensions and weak domestic demand.

Interest Rate Differential: The interest rate differential between Switzerland and Japan has widened, with Switzerland's interest rate at -0.75% and Japan's interest rate at -0.1%.

⚪Macro Economics

Inflation Rate: Switzerland's inflation rate has remained steady at 0.5% in the last month, while Japan's inflation rate has decreased to 0.3%.

Unemployment Rate: Switzerland's unemployment rate has remained steady at 2.3%, while Japan's unemployment rate has decreased to 2.2%.

Global Trade: The ongoing trade tensions between the US and China are expected to have a minimal impact on the CHF/JPY market.

🟡Global Market Analysis

Forex Market: The global forex market has experienced a moderate decrease in volatility, with the CHF/JPY pair experiencing a 0.8% increase in the last 24 hours.

Commodity Market: The global commodity market has experienced a moderate decrease, with oil prices decreasing by 1.0% in the last 24 hours.

Stock Market: The global stock market has experienced a moderate increase, with the Nikkei 225 index increasing by 0.8% in the last 24 hours.

🟠COT Data

Speculators (Non-Commercials): 60,000 long positions and 40,000 short positions.

Hedgers (Commercials): 40,000 long positions and 60,000 short positions.

🔴Intermarket Analysis

Correlation with USD: CHF/JPY has a negative correlation with USD/JPY, indicating that a weak dollar could boost CHF/JPY prices.

Correlation with Stocks: CHF/JPY has a low correlation with stocks, indicating that CHF/JPY could be a good hedge against stock market volatility.

🟣Quantitative Analysis

Moving Averages: The 50-day moving average is at 164.500, and the 200-day moving average is at 162.000.

Relative Strength Index (RSI): The RSI is at 55, indicating a neutral market sentiment.

🔵Market Sentiment Analysis

The overall sentiment for CHF/JPY is neutral, with a mix of positive and negative predictions.

52% of client accounts are long on this market, indicating a neutral sentiment.

Positioning

The long/short ratio for CHF/JPY is currently 1.2.

The open interest for CHF/JPY is approximately 150,000 contracts.

🟤Next Trend Move

Bullish Prediction: Some analysts predict a potential bullish move, targeting 170.000 and 172.500, due to the interest rate differential and the weak yen.

Bearish Prediction: Others predict a potential bearish move, targeting 163.000 and 160.000, due to the ongoing trade tensions and the strong franc.

⚫Overall Summary Outlook

The overall outlook for CHF/JPY is neutral, with a mix of positive and negative predictions.

The market is expected to experience a moderate fluctuation, with some analysts predicting a potential bullish move targeting 170.000 and 172.500.

🔴Real-Time Market Feed

As of the current time, CHF/JPY is trading at 167.100, with a 0.8% increase in the last 24 hours.

🟢Future Prediction

Short-Term: Bullish: 168.000-170.000, Bearish: 165.000-163.000

Medium-Term: Bullish: 172.500-175.000, Bearish: 160.000-155.000

Long-Term: Bullish: 180.000-185.000, Bearish: 150.000-145.000

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CHFJPY - Short after BOS !!Hello traders!

‼️ This is my perspective on CHFJPY.

Technical analysis: Here we are in a bearish market structure from daily timeframe perspective, so I look for a short. Price filled the imbalance and rejected from bearish OB. On H4 price formed regular divergence for sell, so after BOS I will open the trade.

Like, comment and subscribe to be in touch with my content!

CHFJPY - Potential short idea !!Hello traders!

‼️ This is my perspective on CHFJPY.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect price to continue the retracement to fill the imbalance and then to reject from bearish OB + institutional big figure 171.000.

Like, comment and subscribe to be in touch with my content!

CHFJPY - Short after filling the imbalance !!Hello traders!

‼️ This is my perspective on CHFJPY.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I want price to go a little bit higher to fulfill the imbalance and then to reject from bearish OB + institutional big figure 173.000.

Fundamental news: On Friday (GMT+2) we will see results of Interest Rate in Japan, news with high impact on currency.

Like, comment and subscribe to be in touch with my content!

CHF/JPY Long Trade: Riding the Symmetrical Triangle BreakoutHi Traders ! I entered a long position on the CHF/JPY 15-minute chart, based on a potential bullish breakout from the symmetrical triangle formation. Here's my analysis:

1. Rising support and bullish pressure: The lower trendline shows higher lows, signaling accumulation and a likely breakout to the upside.

2. Moving Averages: The EMAs are tangled, but the 200 EMA (red) has consistently acted as dynamic support during consolidation.

3. RSI: The RSI is rebounding from the 50 level, indicating renewed buying momentum.

📈 Entry: Around 172.224.

🔴 Stop Loss: Set at 171.710, just below the triangle support.

🟢 Take Profit: Positioned at 172.674, using the triangle's height projected upwards as a target.

This trade offers a solid risk/reward ratio with strong technical backing. Now, I’ll monitor the volume and wait for a breakout confirmation to validate the move.

Does this align with your trading style, or would you tweak anything further? 🚀

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Trading involves significant risk, and you should carefully consider your financial situation before making any decisions. Past performance is not indicative of future results.