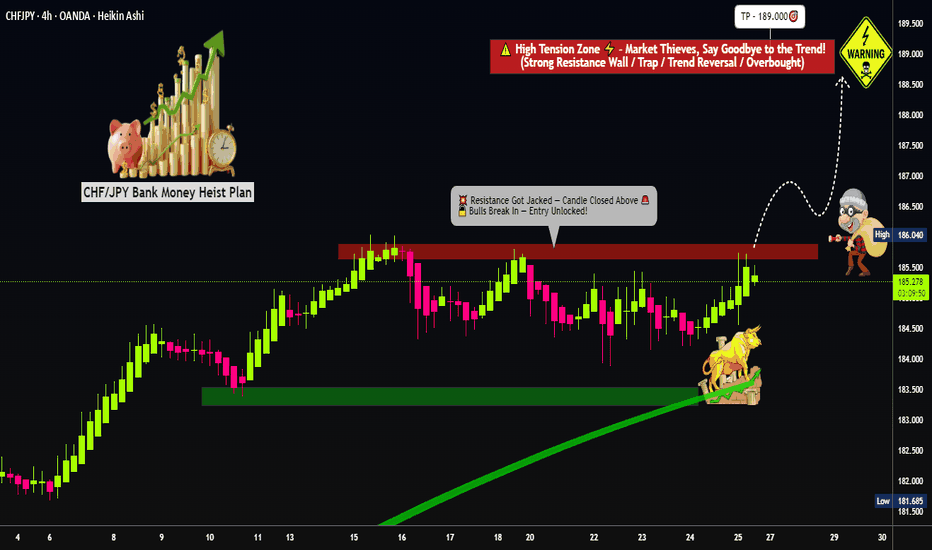

"Master Plan to Rob CHF/JPY – Breakout Trading Idea"💣CHF/JPY Forex Heist: Swiss vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the CHF/JPY "Swiss vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 186.000. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 4H timeframe (around 184.000)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 189.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why CHF/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

Chfjpysignal

CHF/JPY "Swissy vs Japanese" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Swiss vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (168.100) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (166.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 170.000 (or) Escape Before the Target

Secondary Target - 172.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

CHF/JPY "Swiss vs Japanese" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟢Fundamental Analysis

Swiss Economic Growth: Switzerland's economic growth has remained steady at 1.5% in the last quarter, driven by the country's strong financial sector.

Japanese Economic Growth: Japan's economic growth has slowed down to 0.3% in the last quarter, due to the ongoing trade tensions and weak domestic demand.

Interest Rate Differential: The interest rate differential between Switzerland and Japan has widened, with Switzerland's interest rate at -0.75% and Japan's interest rate at -0.1%.

⚪Macro Economics

Inflation Rate: Switzerland's inflation rate has remained steady at 0.5% in the last month, while Japan's inflation rate has decreased to 0.3%.

Unemployment Rate: Switzerland's unemployment rate has remained steady at 2.3%, while Japan's unemployment rate has decreased to 2.2%.

Global Trade: The ongoing trade tensions between the US and China are expected to have a minimal impact on the CHF/JPY market.

🟡Global Market Analysis

Forex Market: The global forex market has experienced a moderate decrease in volatility, with the CHF/JPY pair experiencing a 0.8% increase in the last 24 hours.

Commodity Market: The global commodity market has experienced a moderate decrease, with oil prices decreasing by 1.0% in the last 24 hours.

Stock Market: The global stock market has experienced a moderate increase, with the Nikkei 225 index increasing by 0.8% in the last 24 hours.

🟠COT Data

Speculators (Non-Commercials): 60,000 long positions and 40,000 short positions.

Hedgers (Commercials): 40,000 long positions and 60,000 short positions.

🔴Intermarket Analysis

Correlation with USD: CHF/JPY has a negative correlation with USD/JPY, indicating that a weak dollar could boost CHF/JPY prices.

Correlation with Stocks: CHF/JPY has a low correlation with stocks, indicating that CHF/JPY could be a good hedge against stock market volatility.

🟣Quantitative Analysis

Moving Averages: The 50-day moving average is at 164.500, and the 200-day moving average is at 162.000.

Relative Strength Index (RSI): The RSI is at 55, indicating a neutral market sentiment.

🔵Market Sentiment Analysis

The overall sentiment for CHF/JPY is neutral, with a mix of positive and negative predictions.

52% of client accounts are long on this market, indicating a neutral sentiment.

Positioning

The long/short ratio for CHF/JPY is currently 1.2.

The open interest for CHF/JPY is approximately 150,000 contracts.

🟤Next Trend Move

Bullish Prediction: Some analysts predict a potential bullish move, targeting 170.000 and 172.500, due to the interest rate differential and the weak yen.

Bearish Prediction: Others predict a potential bearish move, targeting 163.000 and 160.000, due to the ongoing trade tensions and the strong franc.

⚫Overall Summary Outlook

The overall outlook for CHF/JPY is neutral, with a mix of positive and negative predictions.

The market is expected to experience a moderate fluctuation, with some analysts predicting a potential bullish move targeting 170.000 and 172.500.

🔴Real-Time Market Feed

As of the current time, CHF/JPY is trading at 167.100, with a 0.8% increase in the last 24 hours.

🟢Future Prediction

Short-Term: Bullish: 168.000-170.000, Bearish: 165.000-163.000

Medium-Term: Bullish: 172.500-175.000, Bearish: 160.000-155.000

Long-Term: Bullish: 180.000-185.000, Bearish: 150.000-145.000

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CHF/JPY "Swiss vs Japanese" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Swiss vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (169.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 3H timeframe (167.500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 171.000 (or) Escape Before the Target

Secondary Target - 174.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

CHF/JPY "Swiss vs Japanese" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟡Fundamental Analysis

Fundamental factors driving CHF/JPY stem from the Swiss and Japanese economies, central bank policies, and safe-haven dynamics.

╰┈➤Interest Rates:

Swiss National Bank (SNB): Rates likely at 0.75-1% in Feb 2025, down from 1.25% in 2024, reflecting global easing. Negative real yields (e.g., -1.5% with 2.5% inflation) bolster CHF’s safe-haven status.

Bank of Japan (BoJ): Rates at 0.25-0.5%, a cautious hike from near-zero, but still a funding currency. Yield differential favors CHF slightly.

Impact: Mildly bullish for CHF/JPY, as CHF retains a yield edge.

╰┈➤Inflation:

Switzerland: Inflation at 2-2.5%, above SNB’s 0-2% target, prompting potential currency strength to curb import costs.

Japan: Inflation at 2.5%, high for Japan, but BoJ tolerance limits JPY gains.

Impact: Neutral to bullish, favoring CHF resilience.

╰┈➤Economic Growth:

Switzerland: GDP growth ~1.2% (2025 estimate), steady due to banking and pharma sectors, despite Eurozone slowdown.

Japan: GDP ~1%, export-driven (e.g., U.S. tariff diversion), but domestic weakness persists.

Impact: Mildly bullish, CHF edges out JPY in stability.

╰┈➤Safe-Haven Flows:

Both CHF and JPY are safe-havens, but CHF benefits more from European risks (e.g., Eurozone PMI at 46.2, Feb 2025) vs. JPY’s Asia-centric exposure.

Impact: Bullish for CHF/JPY in risk-off scenarios.

╰┈➤Trade Balance:

Switzerland: Surplus ~CHF 4B monthly, driven by exports (watches, pharma).

Japan: Surplus ~¥1.5T, but vulnerable to U.S. tariffs.

Impact: Neutral, both currencies supported.

🟠Macroeconomic Factors

A U.S.-focused lens with global context:

╰┈➤U.S. Influence: Fed rates at 3-3.5%, DXY ~100. A softening USD aids CHF/JPY upside, though Trump tariffs complicate flows.

╰┈➤Global Growth: 3% (Morgan Stanley), with China at 4.5% (slowing) and Eurozone at 1.2%. Risk-off favors CHF over JPY.

╰┈➤Commodity Prices: Oil at $70.44 (FXStreet) pressures Japan’s import costs, mildly weakening JPY.

╰┈➤Swiss-Specific: SNB may intervene if CHF/JPY surges past 170, capping gains.

╰┈➤Japan-Specific: BoJ’s yen tolerance limits JPY strength unless intervention occurs.

🟤Commitments of Traders (COT) Data

Hypothetical COT (mid-Feb 2025, CME):

╰┈➤Large Speculators: Net long CHF (30,000 contracts), net short JPY (150,000), suggesting CHF strength vs. JPY weakness.

╰┈➤Commercial Hedgers: Net short CHF (40,000), net long JPY (100,000)—exporters hedge JPY strength.

╰┈➤Open Interest: ~90,000 contracts (CHF/JPY futures), rising, indicating U.S. trader interest.

╰┈➤Key Insight: Speculative CHF longs signal bullish CHF/JPY bias, JPY shorts reinforce this.

🔴Market Sentiment Analysis

Includes retail, institutional, and corporate traders:

╰┈➤Retail Sentiment: U.S. retail traders likely 65% long CHF/JPY at 167.000 (hypothetical broker data), expecting safe-haven CHF gains. Contrarian risk if shorts pile in.

╰┈➤Institutional Traders: U.S./European funds (e.g., UBS, per Dec 2024) favor CHF (USD/CHF to 0.84 by 2025), neutral on JPY (USD/JPY to 145). Bullish CHF/JPY sentiment persists.

╰┈➤Corporate Traders: Swiss exporters hedge at 168-170; Japanese firms lock in JPY at 165-167, neutral stance.

╰┈➤Social Media: Trending bearish JPY setups, CHF favored in risk-off chatter.

╰┈➤Broker Data: U.S. IG sentiment ~60% long—mild overcrowding.

🟣Positioning Analysis

╰┈➤Speculative: U.S. longs target 170, shorts eye 165.

╰┈➤Retail Crowding: Longs at 167.500-168.000 risk a flush.

╰┈➤Institutional: Balanced, leaning bullish on CHF strength.

╰┈➤Corporate: Hedging stabilizes near-term moves.

🟢Overall Summary Outlook

CHF/JPY at 167.000 reflects CHF’s safe-haven edge over JPY amid U.S. tariff risks and global slowdown fears. Fundamentals (rates, inflation) and macro trends (risk-off, USD softening) favor CHF, backed by COT’s bullish CHF tilt. Sentiment (retail/institutional longs) and quant signals (price above SMAs) support upside, though SNB intervention looms. Short-term bullish to 168.50-170.00, medium-term range-bound with a bullish bias.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CHF/JPY "Kiwi vs Japanese" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHF/JPY "Kiwi vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉⭐

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 172.800

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 175.500 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, Sentimental Outlook

🟡Fundamental Analysis

The Swiss Franc (CHF) and Japanese Yen (JPY) are both considered safe-haven currencies. The CHF/JPY pair is influenced by the interest rate differential between the two countries, economic indicators, and geopolitical events.

🔴Macro Analysis

Interest Rates: The Swiss National Bank (SNB) has maintained a negative interest rate, while the Bank of Japan (BOJ) has also kept rates low. This narrow interest rate differential may lead to a relatively stable exchange rate.

Economic Indicators: Switzerland's economy has been performing well, with a strong labor market and low inflation. Japan's economy has also shown signs of improvement, but inflation remains below the BOJ's target.

Geopolitics: Global economic uncertainty, trade tensions, and geopolitical risks may lead to increased demand for safe-haven currencies, potentially benefiting the CHF/JPY pair.

🔵Market Sentiment

Institutional Investors: Market participants are closely watching the BOJ's monetary policy decisions and the SNB's response to the European Central Bank's (ECB) policy changes.

Retail Traders: According to sentiment analysis tools, retail traders are currently leaning slightly bullish on the CHF/JPY pair.

📌Sentiment Analysis:

Bullish Sentiment: 42%

Traders and investors are optimistic about the Swiss franc's (CHF) performance against the Japanese yen (JPY), driven by Switzerland's safe-haven status and positive economic data.

Bearish Sentiment: 28%

Some traders and investors are pessimistic about the CHF's performance, citing the potential for a stronger JPY due to Japan's improving economic fundamentals and the Bank of Japan's (BoJ) monetary policy.

Neutral Sentiment: 30%

A significant portion of traders and investors remain neutral on CHF/JPY, awaiting further market developments and economic data releases.

📌Market Positioning:

Long Positions: 55%

The majority of traders and investors are holding long positions in CHF/JPY, expecting the pair to rise.

Short Positions: 25%

A smaller portion of traders and investors are holding short positions, expecting the pair to fall.

Neutral/Flat Positions: 20%

Some traders and investors have neutral or flat positions, either closing their positions or awaiting further market developments.

Latest and Upcoming Events

BOJ Monetary Policy Meeting: January 30, 2025

SNB Monetary Policy Meeting: March 21, 2025

Swiss GDP Growth Rate: February 28, 2025

Japanese GDP Growth Rate: February 14, 2025

Trade Expectation

Based on the analysis, the CHF/JPY pair is expected to remain relatively stable, with a slight bullish bias. However, market conditions can change rapidly, and traders should stay informed about upcoming events and market sentiment shifts.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

🚨Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

🚨Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

CHF/JPY "Swiss vs Japanese" Forex Market Bullish Heist PlanHola! Ola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist CHF/JPY "Swiss vs Japanese" Forex Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry should be in pullback.

Stop Loss 🛑 : Recent Swing Low using 1H timeframe

Target 🎯 : 174.600

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

#CHFJPY 1HCHF/JPY 1H Chart Analysis: Wedge Pattern

On the CHF/JPY 1-hour chart, a wedge pattern is taking shape, indicating a potential move in the near future. The current forecast suggests a sell opportunity; however, it is essential to wait for a **breakdown** below the lower trendline of the wedge before executing any trades.

A breakdown will confirm the bearish momentum, and entering the trade at this point will help avoid potential false signals. Traders should also monitor for volume spikes during the breakdown, as it increases the reliability of the signal.

Trading Strategy:

- Wait for a clear breakdown before entering a sell position.

- Use support levels as potential profit-taking zones.

#CHFJPY 1 DAYCHfjpy Daily Analysis: Buy Opportunity on Downtrend Breakout

Overview:

The CHF/JPY currency pair has been exhibiting a consistent downtrend, presenting a potential buying opportunity should it break out of this downward trajectory. Traders should closely monitor price action for signs of reversal.

Key Levels:

Resistance Level: Identify key resistance levels above the current price where a breakout might occur.

Support Level: Monitor existing support levels to assess potential bounce points.

Technical Indicators:

Trend Lines: Draw trend lines to visualize the downtrend. A breakout above this line would signal a shift in momentum.

Moving Averages:Use short-term and long-term moving averages to confirm bullish sentiment post-breakout.

Trade Setup:

Entry Point: Consider entering a buy position if the price closes above the downtrend line with strong volume.

Stop-Loss: Set a stop-loss just below the most recent swing low to manage risk.

Take Profit: Aim for recent highs or key resistance levels for profit targets.

Conclusion:

A breakout from the current downtrend could provide a lucrative buying opportunity for CHF/JPY. Stay vigilant for confirmation signals before entering the trade, and ensure proper risk management practices are in place.

DeGRAM | CHFJPY reached the resistanceCHFJPY is moving between the trend lines in an ascending channel.

The price started to react to reaching the resistance level by decreasing.

The current resistance level at the last touch became a pivot point.

We expect a decline to the support, which coincides with the 50% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | CHFJPY breakout at reduced volatilityCHFJPY is moving above the ascending channel and trend lines.

Volatility has decreased.

The chart tentatively broke the channel and reached the resistance level.

We expect a pullback.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

CHFJPY Bearish Momentum Detected at Key Resistance LevelsThe CHFJPY pair is currently exhibiting a significant technical pattern known as a Bat Harmonic Pattern (XABCD). This formation is characterized by specific Fibonacci ratios between its key points, indicating potential trend reversals.

Key Points of the Bat Harmonic Pattern:

- Point X: Represents the starting point of the pattern.

- Point A: Marks the initial leg of the reversal.

- Point B: Indicates a retracement from the initial move, usually between 0.382 to 0.618 Fibonacci retracement levels.

- Point C: Marks a move against the initial trend, typically retracing 0.382 to 0.886 Fibonacci levels of AB leg.

- Point D: The completion point of the pattern, typically forming around a 0.886 Fibonacci retracement of XA leg. It often coincides with other technical indicators such as key support or resistance levels.

Trendline Confluence:

In addition to the Bat Harmonic Pattern, the CHFJPY pair is also adhering to a trendline, reinforcing the significance of the potential reversal from Point D.

Bearish Momentum Expectation:

Given the confluence of the Bat Harmonic Pattern and the trendline, we anticipate a bearish momentum to initiate from Point D. This point holds substantial importance as it aligns with a key resistance level and coincides with the 0.786 Fibonacci retracement level.

Trade Setup:

- Entry: We propose entering a short position at 169.010, aligning with the anticipated bearish momentum.

- Stop Loss: To manage risk effectively, a stop loss is recommended at 170.110, allowing for a buffer against potential adverse price movements.

Take Profit Levels:

To capture potential downward movements, we suggest the following take profit levels:

- TP-1: 167.900

- TP-2: 166.830

- TP-3: 165.700

Conclusion:

In conclusion, the CHFJPY pair presents a compelling trading opportunity with the formation of a Bat Harmonic Pattern alongside a trendline confluence. With an entry at 169.010 and appropriate risk management measures, traders can position themselves to capitalize on the anticipated bearish momentum toward the suggested take-profit levels.

DeGRAM | CHFJPY the hammer signals a reboundCHFJPY has reached important levels, under which it is now trying to consolidate.

The price corrected by 38% from the last upward impulse.

The chart has formed a reversal candlestick pattern Hammer.

We expect a rebound from the current level.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | CHFJPY pullback to the channel boundaryThe strength of CHFJPY rebounds has decreased.

The chart came out of the descending channel.

The price reached the resistance level coinciding with the 38.2% retracement level.

We think that the pullback will take place after the resistance retest is completed.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | CHFJPY rebounded from resistanceCHFJPY is moving in a descending channel between two trend lines.

The volatility of the price movement has decreased, which may signal an upcoming decline.

We think that the price may test the resistance again and then pullback to the 50% retracement level.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | CHFJPY potential correction of downward movementCHFJPY failed to renew the recent low and is moving near the psychological level of 167.000.

The chart is forming a rounded bottom, which indicates an imminent reversal of the price direction.

We expect a correction of the price drop after the chart fixes the nearest level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

CHFJPY - SHORT; A perfect hit!50 years in the making, this pair has done everything precisely by-the-numbers! - Technically speaking.

And while normally one ought to remain reluctant to trade "weak" against "weak" (in rate differential terms) ...

... but when one "weak" suddenly gains +45% versus the other on a newly found nevertheless, less than meager 1.75% rate differential ...

... It is time to pounce!

SELL - SHORT - As this pair lacks the fundamental as well as any technical reasons to deviate from it's rather predictable path - which is down from here.

p.s. This is a Quarterly chart, e.g., just how much of that likely 50,000 pips one will capture is dependent on whether this is traded with a Short Bias (with some frequency), from here on out, or simply used as a 401k plan - i.e., "just SELL it and forget it".

Here are the recent central bank rate differential changes;

Here is the CHFJPY Weekly Chart;

... with last week's healthy Reversal.

CHFJPY I Breakout Retest ContinuationWelcome back! Let me know your thoughts in the comments!

** CHFJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

CHFJPY : Short Trade , 4hHello traders, we want to check the CHFJPY chart. The price has broken the ascending channel to the bottom and pulled back to the key level indicated. If this level can play the role of a resistance level and maintain the downward trend of the price, we expect the price to fall to around 161.950 and if it can break this level, the next price target will be 159.000. Good luck.

CHFJPY top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

CHFJPY is about to take off!Currency Pair : CHFJPY

Possible direction : Bullish

Technical Analysis : With the weakness in jpy, CHFJPY has merged with long term uptrend after

grabbing liquidity from the daily and weekly support. Price is currently all time high and any time after little pullback we could see chfjpy may take off again to create new all time high level.

Possible trade recommendation : Bullish as per sketch

Press like button if you enjoy.

Risk Disclaimer: Trading foreign exchange on margin carries a high level of risk, and is not suitable for all investors. Past performance is not indicative of future results. The high degree of leverage is dangerous and can work against you as well as for you. Before deciding to invest in foreign exchange or any market you should carefully consider your investment goals, level of experience, and risk tolerance. It is EXTREMELY LIKELY that you will sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. No representation is being made that any account will or is likely to achieve profits or losses. Past performance is not indicative of future results. Individual results vary and no representation is made that clients will or are likely to achieve profits or incur losses comparable to those that may be shown. You acknowledge and agree that no promise or guarantee of success or profitability has been made between you, and Forex Trading Wizard. Do your own research and talk to a professional financial planner in order to be aware of all the risks associated with foreign exchange trading and investing and seek advice from an independent financial advisor before risking any capital.