CHF/USD Weekly Forecast: Falling Wedge Breakout Towards TargetMarket Overview: Bullish Reversal in CHF/USD

The Swiss Franc (CHF) / U.S. Dollar (USD) currency pair has recently broken out of a Falling Wedge pattern, signaling a bullish trend reversal. This breakout is significant as it suggests the end of a prolonged downtrend and the beginning of a new upward momentum. Traders who capitalize on this pattern could benefit from potential long opportunities.

This analysis will cover the chart pattern, key levels, trading setup, risk management, and market sentiment, providing a comprehensive professional breakdown of the CHF/USD price action.

1. Chart Pattern: Falling Wedge – Bullish Breakout

A Falling Wedge is a well-known bullish reversal pattern that forms when price action creates lower highs and lower lows, but the slope of the highs is steeper than the lows. This leads to a narrowing structure that suggests sellers are losing strength, paving the way for a bullish breakout.

Pattern Characteristics:

✔ Prior Downtrend: The CHF/USD pair was in a sustained bearish trend before forming the wedge.

✔ Converging Trendlines: Price action squeezed into a wedge formation, showing decreasing volatility.

✔ Breakout Confirmation: The price successfully broke above the wedge resistance, signaling a shift in market sentiment.

✔ Retest Possibility: Price may revisit the breakout zone before continuing its uptrend.

A breakout from a falling wedge typically leads to a sharp bullish rally, making this a high-probability trading opportunity.

2. Key Technical Levels: Support & Resistance

Support Zones (Buying Interest):

🔵 1.0835 – 1.1000: This zone has acted as strong support where buyers stepped in aggressively.

🔵 1.1071 – 1.1095: A short-term support level that aligns with recent price action, making it a critical stop-loss area.

Resistance Zones (Profit Targets):

🔴 1.1483 – 1.1550 (Primary Resistance): Price has struggled at this level previously, making it the first target for a bullish move.

🔴 1.1600 (Major Resistance): If the uptrend continues, this level will act as the next major challenge.

🔴 1.1909 (Extended Target): A long-term resistance level where price has historically reversed.

3. Trading Strategy & Entry Setup

Now that we have identified the breakout and key levels, let’s design a strategic trading plan.

📌 Entry Points for Long Trades:

✅ Aggressive Entry: Buy at the current price after the breakout, expecting continuation.

✅ Conservative Entry: Wait for a retest of the wedge breakout zone or support near 1.1071 – 1.1095 before entering long.

📌 Stop-Loss Placement (Risk Management):

❌ Stop below 1.1071: This level is a strong support area, and a break below it may invalidate the bullish setup.

❌ Alternative Stop below 1.1000: A safer option for long-term traders to avoid stop-hunting.

📌 Take-Profit Levels:

🎯 Target 1: 1.1483 – 1.1550 (Primary Resistance Zone)

🎯 Target 2: 1.1600 (Stronger resistance where partial profits can be booked)

🎯 Target 3 (Extended): 1.1909 (For swing traders holding positions longer)

📌 Risk-Reward Ratio:

A proper Risk-to-Reward (R:R) ratio of at least 1:2 should be followed for efficient trade management. This means:

Risking 50 pips to gain 100 pips (or more) for profitable trading.

4. Market Sentiment & Confirmation Signals

✔ RSI (Relative Strength Index):

Above 50? Bullish confirmation.

Near 70? Overbought zone, potential pullback.

✔ MACD (Moving Average Convergence Divergence):

Bullish Crossover? Strengthens buy signal.

Divergence? Confirms price momentum.

✔ Volume Analysis:

High volume on breakout? Confirms strong buying interest.

Low volume? Beware of false breakout.

✔ Fundamental Factors:

Swiss National Bank (SNB) Policy: If SNB maintains dovish policies, CHF could weaken, pushing CHF/USD higher.

US Federal Reserve Stance: A strong USD could slow CHF/USD gains.

5. Conclusion & Trading Plan

🔹 Summary of Trade Setup:

✅ Bullish breakout from Falling Wedge – high-probability long trade

✅ Retest of breakout zone may offer better entry

✅ Major support at 1.1000 – 1.1071

✅ Targeting 1.1550 – 1.1909 range

🚀 Final Trading Plan:

📌 Buy CHF/USD above 1.1100 – 1.1150

📌 Stop-loss below 1.1071

📌 Take Profit 1: 1.1550

📌 Take Profit 2: 1.1600

📌 Take Profit 3 (Swing Trade): 1.1909

📢 Pro Tip:

Always confirm breakout volume before entering.

Monitor economic events affecting CHF & USD.

Use proper risk management (1-2% of account per trade).

📊 Final Verdict:

🔥 CHF/USD is in a bullish setup after breaking out from a Falling Wedge. Traders should look for buy opportunities on pullbacks while targeting resistance levels. 🚀

CHFUSD

CHF/USD – Rising Wedge Breakdown | Bearish Setup The CHF/USD (Swiss Franc to US Dollar) 15-minute chart is currently displaying a classic Rising Wedge Pattern, which is widely recognized as a bearish reversal pattern. This setup signals weakening bullish momentum and an increased probability of a price breakdown. The chart provides a clear sell trade setup, with key levels including entry, stop loss, and target, making it a structured and well-defined opportunity for traders.

🔹 Key Technical Elements on the Chart

1️⃣ Resistance Level (Sell Zone)

📌 Location: Near 1.1350 – 1.1360

📌 Significance:

This level represents a strong supply zone, meaning sellers have consistently pushed prices down from this area.

Price attempted to break through this zone multiple times but was rejected, reinforcing the bearish outlook.

It serves as the upper boundary of the rising wedge, confirming its role in restricting upward movement.

Traders should be cautious of any false breakouts above this level before confirming a bearish move.

2️⃣ Support Level (Demand Zone)

📌 Location: Near 1.1295 – 1.1305

📌 Significance:

This level has historically acted as a demand zone, where buyers stepped in to push prices back up.

However, the formation of the rising wedge suggests weakening demand at this level.

Once the price breaks below this support zone, it confirms a bearish trend continuation.

3️⃣ Rising Wedge Pattern (Bearish Setup)

📌 Pattern Characteristics:

The rising wedge is a bearish continuation pattern that typically signals an upcoming sell-off.

Price moves inside a narrowing upward-sloping range, where buyers lose strength while sellers gradually gain control.

The lower trendline (dotted black line) has been providing support, but as price struggles near resistance, a breakdown becomes likely.

Once price breaks below the wedge, the pattern confirms a strong bearish move.

📌 Why Is This Important?

This pattern indicates that buyers are losing momentum, and a shift toward bearish control is taking place.

The expected move is a sharp downward breakout, leading to lower price levels.

4️⃣ Trendline Support (Breakdown Confirmation)

📌 Location: The dashed black line below price action

📌 Significance:

This trendline acted as a rising support, keeping price within the wedge.

A clean break below this trendline confirms the bearish breakout.

The breakdown is expected to be followed by increased selling pressure and higher trading volume.

📉 Bearish Trade Setup (Short Position Strategy)

Based on the rising wedge breakdown, traders can consider the following sell trade setup:

✅ Entry Point: Sell below 1.1325 (Confirm breakdown with volume)

✅ Stop Loss: Above 1.1356 (To avoid false breakouts)

✅ Target 1: 1.1295 (First support level)

✅ Target 2: 1.1275 (Deeper downside potential if momentum continues)

🛠 Trade Rationale (Why Take This Trade?)

🔸 Bearish Price Action → Price is rejecting resistance and forming a lower high, signaling weakness in the uptrend.

🔸 Pattern Confirmation → The rising wedge has a high probability of breaking downward, leading to a sharp decline.

🔸 Risk-Reward Ratio → The setup provides a favorable risk-to-reward ratio, as traders can manage risk efficiently by placing a stop loss above resistance.

🔸 Volume Analysis → If selling volume increases upon breakout, the move becomes more reliable.

📊 Market Outlook & Final Thoughts

🔹 Bearish Scenario:

If price breaks below 1.1325, expect a strong decline toward 1.1295 and potentially lower.

A sharp move downward could accelerate selling pressure, targeting 1.1275 in an extended move.

🔹 Bullish Reversal Risk:

If price closes back above 1.1356, the bearish setup is invalidated.

Traders should exit shorts if price reclaims the resistance level.

🚨 Final Verdict: Bearish Breakdown Expected!

📉 Short Setup Activated – Targeting 1.1295 🚀

📊 Watch for Volume Confirmation Before Entering!

CHF/USD – Double Bottom Reversal Setup - Trading SetupComprehensive Analysis of CHF/USD 4-Hour Chart

The CHF/USD 4-hour chart presents a technical trading setup based on a Double Bottom reversal pattern, combined with trendline support and key resistance levels. This pattern suggests a potential bullish breakout if key resistance is cleared. Below is a professional breakdown of the chart, covering the market structure, pattern formation, and a strategic trading setup.

1️⃣ Market Structure & Trend Analysis

The overall market structure suggests that CHF/USD has been in an uptrend, as indicated by the ascending trendline that has consistently provided support. The price has recently tested a key support zone twice, forming the Double Bottom pattern, which is known for signaling a trend reversal or continuation of an uptrend.

The dashed trendline connecting higher lows confirms the bullish momentum.

As long as the price stays above this trendline support, the bullish bias remains valid.

A break below the trendline would indicate a possible reversal or a deeper retracement.

The most critical observation here is that the price is respecting both the trendline and horizontal support zone, which increases the likelihood of a breakout in the upward direction.

2️⃣ Double Bottom Pattern Formation

The Double Bottom pattern is clearly formed at a strong demand zone, reinforcing the idea that buyers are stepping in to prevent further declines.

The first bottom was formed after a rejection from the 1.1250 - 1.1290 support zone.

The price then attempted to recover but faced resistance at 1.1350 - 1.1400, which now acts as the neckline of the pattern.

The second bottom was formed at approximately the same price level as the first, confirming the validity of the pattern.

A Double Bottom pattern is considered bullish, but confirmation is required through a breakout above the neckline resistance (1.1350 - 1.1400). If the price successfully breaks this level, it will indicate that buyers have regained control and the price is likely to move higher.

3️⃣ Key Support and Resistance Levels

In this setup, there are three crucial price zones: support, resistance, and the target area.

The support zone, located around 1.1250 - 1.1290, is where buyers stepped in to push the price higher. This level is crucial because it provided strong demand during the formation of the Double Bottom.

The resistance level at 1.1350 - 1.1400 serves as the neckline of the pattern. A breakout above this level would confirm the bullish trend continuation, while rejection could lead to another retest of support.

The target area is projected around 1.1500 - 1.1550, based on the measured move of the Double Bottom formation. This is the price level where traders may start taking profits if the bullish breakout occurs.

4️⃣ Trade Execution Plan

To take advantage of this potential setup, traders should focus on three key aspects: entry, stop-loss placement, and take-profit levels.

Entry Strategy

Aggressive traders can enter a long position above 1.1350, anticipating an immediate breakout.

Conservative traders may wait for a break and retest of the 1.1350 - 1.1400 zone, which would act as a confirmation for a sustained bullish move.

Stop-Loss Placement

A logical stop-loss should be set below 1.1138, which is beneath the Double Bottom formation and trendline support.

If the price drops below this level, it would invalidate the bullish setup and signal a potential trend reversal.

Profit Targets

The first target zone lies around 1.1450 - 1.1500, where traders may consider securing partial profits.

The extended target zone is 1.1550, which aligns with the expected measured move of the Double Bottom pattern.

5️⃣ Risk Management & Final Considerations

Since this setup is based on a strong trendline support and bullish pattern, risk management is essential to protect against fake breakouts or sudden trend reversals.

Traders should monitor price action near the 1.1350 - 1.1400 resistance zone. A strong bullish candle closing above this area increases the likelihood of a successful breakout.

If the price fails to break out and starts moving lower, it may indicate that sellers are still in control, which could lead to a deeper correction toward 1.1200 or lower.

6️⃣ Summary & TradingView Idea

This CHF/USD 4-hour chart presents a high-probability bullish setup based on a Double Bottom reversal at a strong support zone. The key confirmation level to watch is 1.1350 - 1.1400, which, if broken, will likely push the price toward 1.1500 - 1.1550.

Entry: Buy above 1.1350 or after a breakout retest.

Stop Loss: Below 1.1138 to avoid false breakouts.

Take Profit: First target at 1.1450 - 1.1500, extended target at 1.1550.

This setup provides a favorable risk-to-reward ratio, making it a strong potential trading opportunity. However, traders should always wait for confirmation signals before entering a position. 🚀

Trading Setup for CHF/USD – Triple Bottom Breakout Strategy📌 Chart Pattern: Triple Bottom with Trendline Breakout

This CHF/USD chart showcases a triple bottom formation, a bullish reversal pattern that signals a potential uptrend after three consecutive lows at a strong support level. The price action respects this support zone and attempts a trendline breakout, suggesting a shift in momentum from bearish to bullish.

📊 Full Chart Breakdown & Professional Analysis

1️⃣ Key Levels & Structure:

✅ Support Level (1.1300 - 1.1270):

The price has tested this region three times, indicating strong buying interest.

This forms a triple bottom, a reliable reversal pattern in technical analysis.

✅ Resistance Zone (1.1400 - 1.1420):

The price previously reversed from this zone, making it a key short-term resistance level.

✅ Target Level (1.1457):

A breakout above resistance could drive the price toward this measured move target, representing a 1% potential gain.

✅ Stop Loss (1.1269):

Placed below the support zone to minimize risk in case of a breakdown.

2️⃣ Price Action & Trendline Breakout:

📌 Triple Bottom Formation:

Price hits the same support level three times, signaling strong demand.

Each bounce from support indicates a gradual weakening of bearish momentum.

📌 Trendline Breakout:

The price broke a downward-sloping trendline, suggesting a potential bullish move.

A successful retest of the trendline could confirm further upside.

📌 Expected Move:

Scenario 1: Price confirms the breakout, retests, and moves toward resistance.

Scenario 2: If resistance is broken, price targets the next major level at 1.1457.

3️⃣ Trading Strategy – How to Trade This Setup?

🎯 Buy Entry:

Enter long after a confirmed breakout and retest of the trendline.

📉 Stop Loss:

Below 1.1269 (beneath triple bottom support) to limit downside risk.

🎯 Take Profit Targets:

Target 1: 1.1400 (Resistance Area)

Target 2: 1.1457 (Measured Move Projection)

💡 Risk-Reward Ratio:

Favorable risk-reward ratio of 1:3, making it an attractive setup for traders.

4️⃣ Market Psychology Behind This Move:

Bears losing strength: Multiple failed attempts to break support indicate sellers are exhausted.

Bulls gaining momentum: Trendline breakout shows buyers are stepping in with confidence.

Breakout confirmation: If resistance breaks, a strong rally toward 1.1457 is likely.

📌 Summary: Bullish CHF/USD Trade Idea

🔹 Pattern: Triple Bottom + Trendline Breakout

🔹 Entry: Buy on retest confirmation

🔹 Stop Loss: 1.1269

🔹 Target: 1.1400 & 1.1457

🔹 Risk-Reward: Favorable 1:3 setup

🚀 This is a high-probability trade setup with strong technical confirmation, making it a great opportunity for breakout traders! 🚀

CHF/USD Bullish Cup Formation | Support & Breakout Target Pattern Formation: Bullish Cup & Handle Breakout Setup

The price action on this CHF/USD 1-hour chart exhibits a Cup & Handle pattern, which is a well-known bullish continuation setup. This pattern suggests that buyers are gradually gaining control and a breakout could be imminent.

1️⃣ Understanding the Cup Formation

The cup shape (curved blue line) signifies a gradual accumulation phase, where price initially declined, formed a rounded bottom, and then started recovering.

This indicates that buyers are regaining momentum after a consolidation period.

The lowest point of the cup formed around March 16, from where the price began a steady upward move.

2️⃣ Key Support & Resistance Levels

Support Level: The strong demand zone is established around 1.1300 - 1.1320, as shown by multiple price bounces.

Resistance Level & ATH (All-Time High): The price struggled to break 1.1450 - 1.1470, indicating a major resistance zone where sellers previously took control.

3️⃣ Handle Formation & Pullback

After reaching resistance, the price formed a slight retracement (small descending wedge), which created the handle of the pattern.

The pullback was necessary to clear short-term overbought conditions before a potential breakout attempt.

4️⃣ Trading Strategy & Price Projection

🔹 Entry & Breakout Confirmation

If CHF/USD breaks above 1.1450 - 1.1470 with volume confirmation, this will validate the Cup & Handle breakout.

A confirmed breakout suggests further upside momentum toward 1.1570 - 1.1600, aligning with the pattern’s measured move.

🔹 Stop-Loss Placement

A logical stop-loss should be placed below the handle’s low (~1.1300 - 1.1320), in case of a false breakout or sudden market reversal.

🔹 Target Projection Based on Pattern Measurement

The height of the cup (~200 pips from bottom to resistance) is projected upwards from the breakout level.

This results in a take-profit target of 1.1575 - 1.1600.

5️⃣ Additional Technical Confluences

✅ Trendline Support: The price is respecting an ascending trendline, indicating continued higher lows and bullish sentiment.

✅ Bullish Momentum: The series of higher lows confirms a strong uptrend, favoring buyers.

✅ Potential Fakeout Risks: A failed breakout below 1.1300 could invalidate the bullish outlook, leading to a deeper retracement.

6️⃣ Final Thoughts: Is This a Good Setup?

📌 Overall Bias: Bullish ✅

📌 Breakout Confirmation Needed: Above 1.1450 - 1.1470

📌 Target: 1.1570 - 1.1600 🎯

📌 Risk Management: Stop-loss below 1.1300

If CHF/USD sustains momentum above resistance, traders can anticipate a strong bullish rally toward the projected target. However, it’s essential to wait for confirmation before entering long positions. 📈🔥

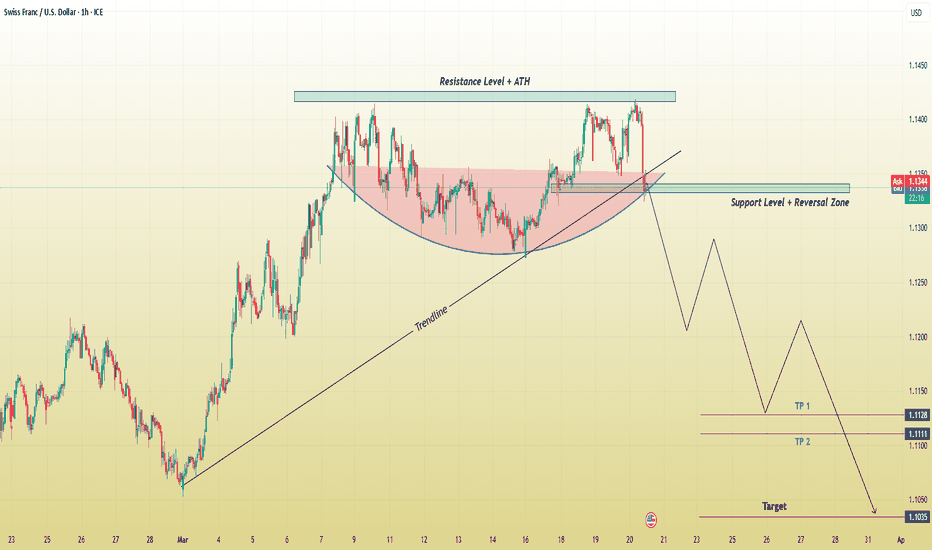

CHF/USD Bearish Reversal: Trendline Break Strong Sell-Off!his CHF/USD (Swiss Franc/U.S. Dollar) 1-hour chart showcases a bearish trading setup, signaling a potential downside move after a failed breakout at a key resistance level. Below is a comprehensive breakdown of the chart, highlighting key technical elements, potential trade setups, and risk management considerations.

1. Identified Chart Pattern – Cup & Handle (Failed Breakout)

The chart initially formed a Cup and Handle pattern, a bullish continuation setup where:

The rounded bottom (cup) indicated accumulation and a gradual shift in trend from bearish to bullish.

The handle consolidation represented a minor pullback before a potential breakout.

However, the pattern failed to hold its bullish momentum. Instead of continuing higher, the price was rejected at the resistance level (ATH – All-Time High), signaling a shift in sentiment.

2. Key Technical Levels

Resistance Level + ATH (All-Time High)

The price reached a significant resistance zone (marked in blue), aligning with an all-time high (ATH) level.

Multiple rejections at this level indicate strong selling pressure, making it a potential distribution area where smart money is offloading positions.

Support Level + Reversal Zone

After rejection from the resistance, the price retraced to a critical support zone, previously acting as a demand area (buyers stepping in).

A break below this level confirms bearish momentum, increasing the likelihood of further downside movement.

Trendline Break – Bearish Confirmation

The trendline (marked in black) represents the primary uptrend support that guided price movement.

The break below this trendline signals a loss of bullish strength, increasing the probability of a trend reversal rather than a continuation.

3. Projected Price Movement – Bearish Scenario

Given the trendline break and rejection from resistance, the chart suggests a bearish wave with the following expectations:

A retest of the broken trendline and support zone before continuing downward.

Lower highs and lower lows formation – confirming a new downtrend.

A potential drop towards key downside targets (marked as TP1, TP2, and the final target).

Take Profit (TP) Targets:

✅ TP1 (1.1128): A minor support level where price may find temporary buying interest.

✅ TP2 (1.1111): A more significant support area that previously acted as demand.

✅ Final Target (1.1035): The ultimate downside objective, aligning with a major support zone and historical price action levels.

Stop-Loss Placement (SL):

📍 Above the broken trendline OR the recent swing high, ensuring protection against false breakouts or retracements.

4. Trade Execution & Risk Management

Entry Strategy (For Short Positions)

🔹 Aggressive Entry: Enter short immediately after the support zone break.

🔹 Conservative Entry: Wait for a retest of the support-turned-resistance area for confirmation before shorting.

Risk-Reward Ratio Consideration:

A properly placed stop-loss above resistance ensures a favorable risk-to-reward ratio.

Ideal ratio: 1:2 or better, meaning potential reward should be at least twice the risk.

5. Market Sentiment & Possible Alternative Scenario

While the primary outlook is bearish, traders must remain flexible and monitor price action closely:

If price reclaims the support zone and breaks above resistance, it invalidates the bearish setup, shifting momentum back to bullish.

A sustained close above the trendline could trap early sellers, leading to a short squeeze rally back toward resistance.

6. Final Thoughts

🔹 Bearish Bias: This setup favors downside movement due to trendline break, resistance rejection, and market structure shift.

🔹 Key Levels to Watch: Support zone retest, trendline confirmation, and target levels.

🔹 Risk Management is Essential: Using stop-loss protection and proper trade sizing to mitigate potential losses.

Conclusion: High-Probability Bearish Setup

🚀 The CHF/USD pair has shifted to a bearish structure after failing to break its ATH resistance. The breakdown of the trendline and key support level suggests a strong sell-off towards the 1.1035 target. Traders should look for short opportunities on pullbacks while managing risk effectively.

Would you like me to refine or simplify any part of this analysis for your TradingView post? 📉🔥

CHF/USD Trading Idea – Bearish Reversal from Key ResistanceThis CHF/USD chart presents a compelling bearish setup, suggesting that the pair may be headed for a decline after facing strong resistance. The price action has followed a technical breakout and retest pattern, with a clear rejection from a well-defined resistance level.

Traders looking for short-selling opportunities should take note of the key price zones, support levels, and overall market structure before making a move. Let’s break it down in detail.

🔍 Chart Breakdown: What’s Happening?

1️⃣ Falling Wedge Breakout & Bullish Push

The price was consolidating inside a falling wedge, a pattern that typically signals an eventual breakout to the upside.

The breakout led to a strong bullish move, pushing the price toward a well-established resistance zone around 1.1414.

After breaking out, the pair made a significant upward run before stalling at this key resistance.

2️⃣ Key Resistance Level Holding Strong

The price touched the resistance zone but failed to break above it.

This rejection indicates that sellers are stepping in, absorbing the buying pressure.

The market is showing early signs of bearish momentum, hinting at a potential downtrend.

3️⃣ Projected Bearish Move: Lower Targets in Sight

If the current rejection holds, the price is likely to fall toward the nearest support levels:

✅ TP 1 (Take Profit 1): 1.1271 → First major support level, likely to be tested soon.

✅ TP 2 (Take Profit 2): 1.1201 → A deeper retracement if selling pressure increases.

✅ TP 3 (Take Profit 3): 1.1055 → Final downside target if the bearish trend extends further.

4️⃣ Stop Loss Placement – Risk Management

To manage risk, the ideal stop loss should be placed slightly above the resistance level at 1.1414.

This protects against potential false breakouts and unexpected market shifts.

📉 Trade Strategy – How to Approach This Setup?

🔸 Entry Point: Look for a confirmed rejection of the resistance level (e.g., bearish candlestick patterns like engulfing, shooting star, or pin bars).

🔸 Stop Loss: Place above 1.1414 to avoid getting caught in a short squeeze.

🔸 Take Profit Targets:

First TP at 1.1271

Second TP at 1.1201

Final TP at 1.1055 for extended downside moves

⚠️ Important Notes for Traders:

✔ Wait for Confirmation: Don’t rush into a short trade. Look for a strong bearish candle closure or a retest before entering.

✔ Be Aware of News Events: Economic releases, interest rate decisions, and major USD-related news can impact price movement.

✔ Monitor Market Sentiment: If USD strengthens, this setup is even more likely to play out.

🧐 Final Thoughts – High Probability Short Setup?

✅ Why This Trade Looks Strong:

The technical pattern is playing out perfectly, with a clear resistance rejection.

The risk-to-reward ratio is favorable, with well-defined entry, stop loss, and take profit levels.

The overall market structure supports a potential downside move if price continues respecting resistance.

📢 Bottom Line : If price remains below the 1.1414 resistance, this trade setup could provide an excellent opportunity for short-sellers targeting lower support levels. 🚀 Stay patient and wait for confirmation before pulling the trigger!

CHF/USD 4H Analysis - Potential Bearish Reversal Setup

🔹 Market Structure & Price Action:

The price has been trending upwards inside a rising channel, forming higher highs and higher lows.

Recently, price tapped into a key resistance zone (black box), indicating a potential reversal.

A possible bearish correction could unfold from this level.

📉 Bearish Scenario:

If the price fails to hold the resistance, a bearish rejection could drive price downward.

The first major support target aligns with the previous demand zone around 1.10700.

A further drop could test the 1.09100 support area, as shown in the green zones.

📈 Bullish Alternative:

A break and hold above resistance could invalidate the bearish setup and signal further upside movement.

🔻 Trading Plan:

Sell bias near resistance with confirmations (e.g., rejection wicks, bearish engulfing, trendline break).

Targeting the marked support levels.

Invalidation if price breaks and closes above the resistance.

USD/CHF Approaching Key Resistance – Potential Reversal Ahead?Analysis & Description:

The USD/CHF pair is currently testing a **strong resistance zone**, which previously acted as a significant **supply area**. Price has approached this **key level**, and a potential **rejection** could lead to a bearish move.

#### **Key Observations:**

✅ **Resistance Area (Supply Zone):** Price is retesting a previously respected **resistance** zone.

✅ **Bearish Setup:** If the price fails to break above the **0.90607 level**, a **reversal** could take the pair lower toward the **target area**.

✅ **Volume Confirmation:** Increasing volume near resistance indicates potential selling pressure.

### **Trading Plan:**

📉 **Bearish Scenario:**

- A rejection at **resistance** could lead to a move down toward **0.89267**, aligning with previous support.

- **Stop-loss** can be placed above **0.90607** in case of a breakout.

⚠️ **Bullish Risk:**

- If the price **breaks and holds above the resistance**, the bearish setup could be invalid, and further upside may occur.

### **Final Thought:**

USD/CHF is at a **crucial decision point**. Traders should **watch price action closely** for confirmation of either a **breakout or a rejection** before making a move! 🚨📊

Swiss Franc can exit from pennant and try to break support levelHello traders, I want share with you my opinion about Euro. Looking at the chart, we can see how the price some time ago broke the support level, which coincided with the buyer zone and rose a little higher, after which CHF made a retest to the 0.8840 level. Then, the price entered an upward pennant and made at once strong impulse up from the support line to the current support level, which coincided with the support area, but when CHF reached this level, it made a fake breakout and fell below. After this, the Swiss Franc in a short time rose back to the 0.9000 level and broke it, after which continued to move up. But soon, the price rebounded down to the support area, where it some time traded and then rose to the resistance line of the pennant. Next, CHF turned around and declined back to the support area, where at the moment, it continues to trades near the support level and line of pennant. In my opinion, the Swiss Franc can rise from the support line to almost the resistance line of the pennant and then rebound down to 0.8935 points, thereby exiting from this pattern and breaking the current support level. Please share this idea with your friends and click Boost 🚀

Swiss Franc can exit from pennant and continue fall to 0.8700Hello traders, I want share with you my opinion about Swiss Franc. Looking at the chart, we can see how the price reached the resistance line of the downward channel, after which CHF rebounded down and declined to the support line of the channel, breaking the 0.8635 level, which coincided with the buyer zone. Then the price turned around and entered the pennant, where it made a strong impulse up to the resistance level, exiting from the downward channel and breaking the 0.8635 level one more time. After this CHF broke the 0.8820 level, which coincided with the seller zone, but soon it turned around and fell back and some time traded very close to the resistance level. Later, the price started to grow back and in a short time, CHF reached the 0.8820 level again, broke it, and rose to the resistance line of the pennant. But soon, the price rebounded from this line and declined to support line of the pennant, thereby breaking the 0.8820 resistance level again. After this, the price bounced from the support line and rose to the resistance line of the pennant, where, at the moment, CHF continues to trades near. In my opinion, the Swiss Franc can fall to the support line, after which it at once will bounce to the resistance line and then CHF can make an impulse down, thereby exiting from the pennant. For this case, I set my target at the 0.8700 level. Please share this idea with your friends and click Boost 🚀

USDCHF | COULD BE A GOOD SELL TRADE? Hey Traders!

I believe USDCHF has a good chance to fall further it's currently sitting above the daily 200 moving average, crossed the 20 on the 4h, if we see the squeeze pattern break to the downside it will continue its strong bearish trend. We also have a previous rising wedge and H&S pattern not yet touched, which could have some weight on top of the overall analysis. 📈✅

Manage your risk accordingly, I would say every 20 pips take some money, and adjust SL as needed per your strategy.

CHF Hits Highest Against Dollar Since 2015 Amidst Possible US De

As you may already know, the Swiss Franc (CHF) has recently reached its highest level against the US Dollar (USD) since 2015. This surge in CHF's value can be attributed to a combination of factors, including growing concerns over the US economy potentially slipping into a deflationary phase.

While it is essential to approach such market movements cautiously, it is worth considering the potential opportunities arising from this situation. Given the current uncertainty surrounding the USD, diversifying your currency portfolio by including CHF and other strengthening currencies against the dropping dollar might be prudent.

Please note that the purpose of this idea is not to make predictions or provide financial advice but rather to highlight an emerging trend that could impact forex trading. It is crucial to conduct thorough research, analyze market conditions, and consult with your trusted financial advisors before making any investment decisions.

In light of these recent developments, I encourage you to stay vigilant and closely monitor the ongoing market dynamics. By staying informed and adapting your strategies accordingly, you can position yourself to capitalize on the opportunities arising from currency fluctuations.

Remember, the forex market is highly volatile, and success often lies in being well-informed and prepared. I urge you to exercise caution, maintain a disciplined approach, and consider the potential risks of trading decisions.

CHFUSD Double Top on Resistance LevelA potential sell signal on the CHF/USD currency pair has emerged due to the formation of a double top pattern on a resistance level. This pattern indicates a potential reversal of the previous upward trend and suggests that a downward movement could follow. Traders considering this setup may look for a target price of 1.0996 and set a stop-loss order at 1.1567 to manage potential risks.

The double top pattern is characterized by two peaks of similar height, with a trough between them, forming a resistance level. This pattern suggests that the market has attempted to break above the resistance level twice but has failed, indicating a potential shift in sentiment and a possible trend reversal. Traders often see this as an opportunity to enter a short position and take advantage of the anticipated downward movement.

To implement this sell signal effectively, traders may consider entering a short position on the CHF/USD pair once the price breaks below the trough (the support level) between the two peaks. This would confirm the pattern and provide an entry point for the trade. Setting a target price at 1.0996 indicates an expectation of the price moving towards that level.

Looking forward to read your opinion about it!

USDCHF will break the downtrend line🚀USDCHF was able to break the upper line of the Rectangle pattern.

I expect USDCHF to break the downtrend line with the help of the uptrend line and at least go up to the 🔴 resistance zone (0.91420 CHF- 0.9100 CHF) 🔴.

🔅U.S.Dollar/Swiss Franc ( USDCHF ) 4-hour time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

USDCHF escape from falling with Falling Wedge✈️USDCHF is moving near important support lines (weekly time frame) as well as an important 🟡Price Reversal Zone(PRZ)🟡.

It also seems that USDCHF has succeeded in forming a Falling Wedge pattern .

In addition, if we look at the MACD indicator in the daily time frame, the Regular Divergence(RD+) between the MACD and the price is clearly visible.👇

I expect USDCHF to move towards the downtrend line after breaking the upper line of the falling wedge pattern and then break it and start to bump.

🔅U.S.Dollar/Swiss Franc ( USDCHF ) Daily time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.