CHFUSD

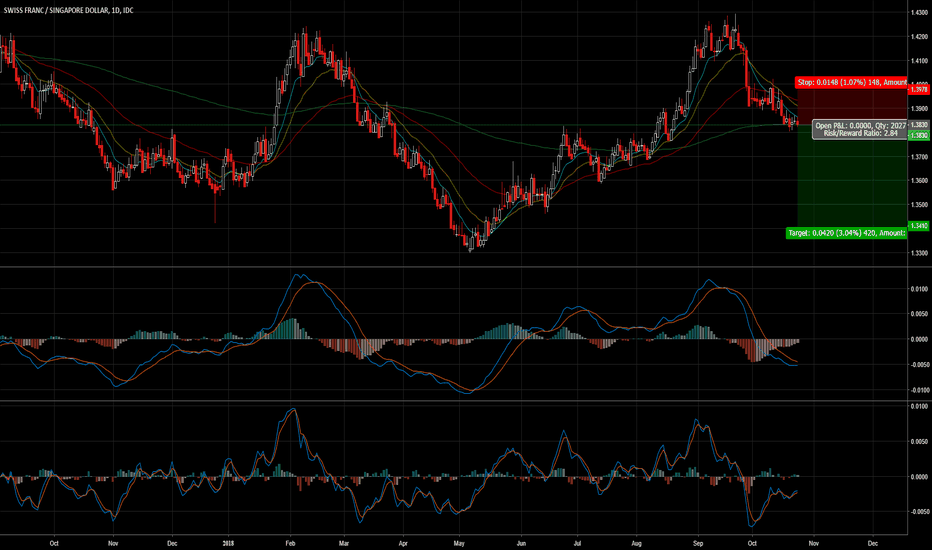

CHF/SGD - 250 Pips + Opportunity LONG TERMCHF/SGD is weak and we can expect it to continue it's bearish trend further below on the long term this next few weeks *as long as the 50 EMA holds as resistance on the daily timeframe.

It may make some pullbacks up but it is nothing to worry about as long as it never finds support. The reasonw why I leave my SL higher than the 50 EMA just in case.

This is a long term trade and the TP target may get changed during the run as the pair makes its move and let's us know how it's doing.

The full range and duration of the trade could be up to 2 months.

I personally have risked 3% on this pair.

Remember, you're not in trading for the quick profits but for the long term gains.

Trade safe.

09072018 USDCHF Long - Basis of Candle Trading - Candle forms major structure, and works as future pivot.

- The strength of such support area could be measured how high the price followed by the candle signal has reached

- we take another candle signal (i.e. Bullish Engulfing or Big Green Candle) as point of entrance

- Take profit :)

Weekly support - Long term buy opportunityThe price has rebounded just below the first 0.9964 support on the 1W chart and according to the monthly RSI = 47.462, STOCH= 45.454 and Highs/Lows = 0, should rise towards the first Resistance at 1.0591. Our target is 1.0469 where the SL will be moved in profit in order to chase after the Resistance extensions safely.

USDCHF trade channel and price directionUSDCHF H3 chart

You can see the area where you can trade above. The direction in which the blue line breaks accelerates the price movements in that direction.

The formation shows you will fall down. You can see that formation on the daily chart at below.

***This information is not a recommendation to buy or sell. It is to be used for educational purposes only.***

I'm sorry for the impaired expression..Just watch the chart, not what I write. :)

PS make sure you give me a like, If you LIKE this analysis .... If you like most of my analyzes, FOLLOW me .

USDCHF Daily Chart

CHFUSD: Maybe a good time to swap your account currency for CHFI think having a cash position in CHF makes sense here, so, if your margin accounts have $USD as default cash/balance currency, I'd reccomend swapping it for $CHF. I see a potential continuation of the monthly uptrend in the Swiss Franc, which would send this pair easily 15% higher within a year.

Best of luck,

Ivan Labrie.

CHFUSD: Swiss Franc going sideways from hereIn this chart I analyze the recent uptrend in the Franc. It appears to have ran into a wall, where the election day's low and the Brexit low sit, as well as a massive volume level, which will take time to break. I'd rather be flat here, and wait, we can look to buy dips in this or the Euro, or Gold or Silver probably meanwhile. This can serve as a hedge against our long positions in equities. I still see opportunity on the long side, not so much in the index, but in undervalued securities.

Good luck,

Ivan Labrie.

Forex Market Analysis And Trading Tips Sorry guys....... the USD/JPY went horribly wrong, let me make up for it with this one!

The primary trend of USD/CHF is bearish on charts and price is trading below the trend line in its hourly chart. In four hourly chart the price is sustaining below 200 day SMA and below resistance of 50 day SMA indicating downtrend of the pair. It is having an important resistance at the level of 0.98250 and support at the level of 1.0000. If it breaks its resistance level on the downside and sustains below it then we can expect it to show further bearish movement in the pair.

INDICATORS:-

MACD is sustaining in its negative zone indicating the bearish trend in the pair.

RSI is sustaining near its selling zone indicating the upcoming bullish trend in the pair.

STRATEGY:

USD/CHF is looking bearish on charts for next few trading session. One can go for sell on lower level strategy for this pair for intra day to mid term positions in it.

www.tradingsignalreviews.com