Apple Inc. (NYSE:$ AAPL)Drops $300B+ in Tariff- Fueled Sell-OffApple Inc. (NYSE:$ AAPL) faced a massive sell-off on Thursday, April 4th 2025, with its stock closing at $188.38, down $14.81 (7.29%). This marked Apple’s worst trading day since March 2020. The steep drop came after former President Donald Trump announced a new set of tariffs targeting 185 countries, including major U.S. trading partners.

As a result, Apple’s market capitalization fell by more than $310 billion in a single day. These newly imposed tariffs, effective April 9th, include a 10% blanket duty on all imports, with higher rates applied to specific countries. China, Apple’s primary manufacturing hub, will face a combined 54% tariff—34% newly imposed, added to an existing 20% rate.

Other affected regions include the European Union (20%), Vietnam (46%), Taiwan (32%), and India (26%). Analysts consider Apple especially vulnerable to these policies due to its heavy reliance on overseas production, especially in China, where nearly 85% of iPhones are manufactured.

According to Dan Ives of Wedbush, future exemptions to these tariffs may depend on Apple’s efforts to localize its operations within the U.S., a move hinted at by the company earlier this year. However, no details have been confirmed regarding whether Apple’s U.S. expansion plans will qualify for tariff relief. The timing of the policy combined with Apple’s exposure to international supply chains, led to a bear shift in market.

Technical Analysis: Apple Breaks Below Key $197 Support

Apple’s price action shows an impulsive breakdown below the key $197 strong support level. The price is currently trading around $188, trading towards next support at $167 as the immediate support.

A drop below $167 could push the stock lower to a long-term support around $125, which was lastly retested in Dec 2022. On the upside, any recovery would first need to reclaim the broken support at $197, which now acts as resistance. The all-time high around $260 remains far away from reach unless the overall stock market sentiment improves.

Looking ahead, the chart outlines two likely scenarios. In the bullish case, Apple may find support around $167, bounce back and attempt to break above $197, possibly re-establishing it as a support zone.

In the bearish case, failure to hold $167 could push the stock lower to test $125, and if that level breaks, the price may continue downward. The current market outlook suggests a wait-and-see approach, to what happens at key level, as both macroeconomic news and technical levels continue to drive Apple stock lower.

China

"CHINA 50" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA 50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (13400) Thief SL placed at the nearest / swing high level Using the 8H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 12950 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"CHINA 50" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

China: 34% Tariffs Against US, Impact on Forex Market

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about China's response to US Tariffs. China's recent decision to impose 34% counter-tariffs on US products represents a significant development in trade tensions between the world's two largest economies. This move, which will take effect on April 10, is a direct response to the 10% tariffs imposed by the United States. The announcement has already had repercussions on global markets, with stocks recording sharp declines. In this article, we will analyze the motivations behind this decision, its economic implications and the impact on the Forex market.

Motivations Behind the Counter-Tariffs

China's decision to impose counter-tariffs is a strategic response to the aggressive trade policies of the United States. The 10% tariffs imposed by the US are aimed at correcting what is perceived as an unfair trade deficit and protecting domestic industries. However, China sees these tariffs as a threat to its economic growth and the stability of its exports. The 34% counter-tariffs are therefore an attempt to rebalance the trade balance and put pressure on the United States to review its policies.

Global Economic Implications

The imposition of counter-tariffs has economic implications that go far beyond the two nations involved. Trade tensions can trigger a series of chain reactions that affect the global economy in various ways:

Increased Production Costs: Companies that rely on imports of raw materials and components from the United States will see an increase in production costs, which could be passed on to consumers in the form of higher prices.

Slower Economic Growth: Trade tensions can lead to a slowdown in global economic growth, as companies may reduce investment due to economic uncertainty.

Inflation: Rising prices of imported goods can contribute to inflation, reducing the purchasing power of consumers and increasing costs for businesses.

Forex Market Impact

The Forex market, known for its sensitivity to geopolitical and economic events, is not immune to the effects of the trade tensions between China and the United States. Here are some of the main impacts:

US Dollar Volatility: The increase in tariffs could weaken the US dollar, as trade tensions tend to reduce investor confidence. Demand for US goods could decrease, negatively impacting the value of the dollar.

Strengthening of the Chinese Yuan: China could see a strengthening of the yuan, as its economy could be perceived as more stable than that of the United States in this context of trade tensions.

Federal Reserve Monetary Policy: The Federal Reserve could be forced to review its monetary policy, with possible interest rate cuts to mitigate the economic impact of the tariffs. This could further impact the Forex market, increasing volatility.

Conclusion

China's decision to impose counter-tariffs of 34% on US products represents a significant development in the trade tensions between the world's two largest economies. The economic implications of this move are vast and complex, affecting not only national economies but also the global Forex market. Investors and analysts will need to monitor these developments closely to fully understand their implications and adjust their strategies accordingly.

ChinaH Index – Mid-Term Technical OutlookThe ChinaH Index is currently trading at $8,390, after recently rejecting the key resistance level of $9,200, a historically significant zone last tested in 2021. Despite this rejection, the index remains well-positioned within a strong and intact bullish channel, signaling long-term upward momentum.

Current Setup:

We are now observing a short-term relief bounce from $8,390, with potential to retest the $8,700 area. This move is part of a broader technical structure that suggests a healthy pullback phase before resuming long-term growth.

Pullback Scenario:

Following the potential retest of $8,700, the index may enter a correction phase, targeting $7,600 as a core support level—this zone previously acted as resistance in 2022 and is likely to serve as strong structural support heading into mid-2025.

Before reaching $7,600, the first interim support sits at $8,200, a level that previously served as support in 2020 and triggered the recent bounce. If $8,200 fails to hold during the retracement, a deeper correction toward $7,600 would allow for stronger consolidation and improved structural health within the overall bullish channel.

Two Potential Bullish Scenarios After Pullback:

Continuation within the Current Bullish Channel:

A bounce from $7,600 would resume upward momentum.

Primary upside target: $9,700 – a key multi-year resistance zone from 2017–2020.

A clean breakout above $9,700 would confirm a long-term bullish breakout and shift market sentiment decisively.

Formation of a New Bullish Channel:

In the event of prolonged consolidation, price could range between $7,100–$8,700 from September to December 2025.

A breakout in January 2026 would confirm a new ascending structure, offering a refreshed bullish path with long-term upside.

Key Levels to Watch:

Resistance: $8,700 → $9,200 → $9,700 (Major Breakout Zone)

Support: $8,200 → $7,600 → $7,100 (Range Floor if prolonged consolidation)

Summary:

While short-term pullbacks may test market resilience, the underlying bullish structure remains intact. A correction to $7,600 could act as a launchpad for the next major leg higher. Whether through continuation in the current channel or the formation of a new one, the ChinaH Index presents multiple bullish pathways, with $9,700 being the key level that could signal a long-term shift in trend.

Patience and disciplined positioning in the upcoming months will be crucial as we watch for confirmation of the next directional move.

Tencent Holdings LtdIs Tencent Stock a Buy Now?

Tencent posted its third quarter earnings report on Nov. 16. The Chinese tech giant's revenue fell 2% year over year to 140.1 billion yuan ($19.8 billion), which represented its second consecutive quarter of declining revenue since its IPO in 2004. Its net profit rose 1% to 39.9 billion yuan ($5.6 billion). On an adjusted basis, which excludes its investments and other one-time items, its net profit grew 2% to 32.3 billion yuan ($4.5 billion). Those growth rates seem anemic, but Tencent's stock had already been cut in half over the past two years amid concerns about China's tightening regulations, slowing economic growth, and COVID19 lockdowns. So is it the right time to take the contrarian view and buy Tencent as a turnaround play? Let's review its core businesses and valuations to decide.

Tencent generated 31% of its third quarter revenue from its video game business. Domestic games, which include its blockbuster game Honor of Kings, accounted for 73% of that total. The remaining 27% came from overseas hits like League of Legends, Valorant, and PUBG Mobile.Its domestic gaming revenue fell 7% year over year, representing its third consecutive quarter of shrinking revenue, as it grappled with tighter playtime restrictions for minors in China over the past year. Those restrictions also coincided with a temporary suspension on new video game approvals in China, which started last July and ended this April.Its international gaming revenue rose 3% year over year, accelerating from its 1% decline in the second quarter, as new games like Tower of Fantasy and Goddess of Victory: Nikke attracted new players. Unfortunately, its overseas growth still couldn't offset its declining domestic revenue.

As a result, Tencent's total VAS (value-added service) revenue which includes its gaming divisions, social media platforms, and streaming media subscriptions -- declined by 3% in the third quarter but still accounted for more than half of its top line. This core business might gradually stabilize as Tencent expands its international gaming business, but it will likely remain under intense pressure as long as the Chinese government continues to scrutinize the gaming industry.

200$ was one of the biggest support and great opportunity to buying the dip. 300-320$ is a big resistance level for tencent and if bulls win that battle then 350$ is next but

can we back 250 or even 200$ again? YES

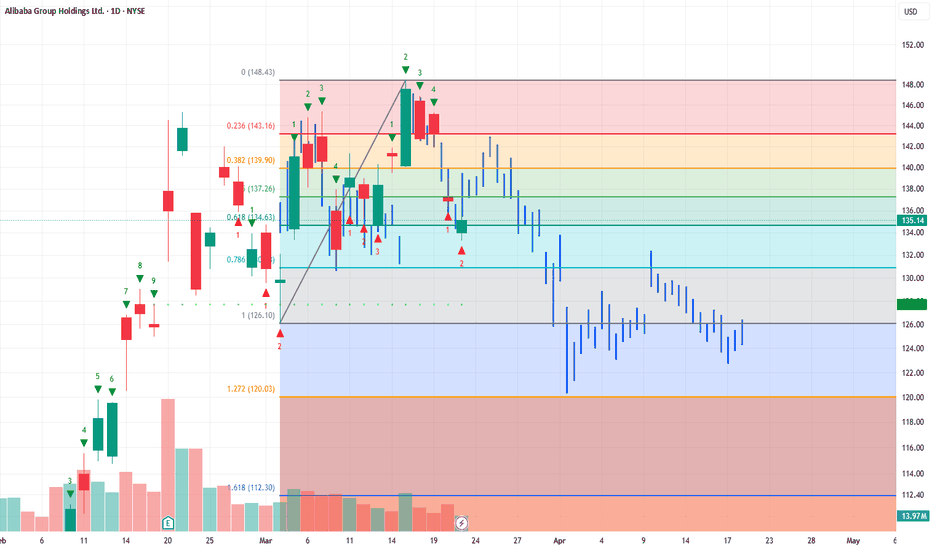

$BABA on its way to $120s into AprilI would honestly be surprised if it doesnt gap down this Monday before the open. The weekly imo, looks like a mess atm and could gap into $120s easy. If it doesn't, I would expect some consolidation for a fall into the First week of April. We're right at the golden pocket retrace at the .618, very common retracement level, if we look at Fibs with a bearish perspective and measure a retrace back to the lower golden pocket at 1.61 fib from highs, $112.30 would be my ultimate target if we can break $126. $126 opens the flood gates to our ultimate target at $112.

CN50 to find sellers at previous support?CHN50 - 24h expiry

Price action looks to be forming a top.

There is no clear indication that the downward move is coming to an end.

Risk/Reward would be poor to call a sell from current levels.

A move through 13500 will confirm the bearish momentum.

The measured move target is 13350.

We look to Sell at 13600 (stop at 13700)

Our profit targets will be 13400 and 13250

Resistance: 13600 / 13650 / 13700

Support: 13500 / 13400 / 13350

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NIO Options Ahead of EarningsIf you haven`t bought NIO before the previous earnings:

Now analyzing the options chain and the chart patterns of NIO prior to the earnings report this week,

I would consider purchasing the 6usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.47.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bullish Play on (BABA) Ahead of Chinese Economic Data & Alibaba (BABA) is forming a triple top pattern near the $142-$145 resistance zone ahead of key economic data releases and potential positive stimulus measures from the Chinese Congress meeting. While a triple top is traditionally seen as a bearish formation, a breakout above resistance could signal strong bullish momentum, fueled by market optimism regarding Chinese economic support and potential tariff relief.

Trade Setup: Long Position on BABA

📈 Entry Point:

Breakout confirmation above $145 (previous resistance).

If momentum is strong, consider scaling in at $143-$144 for an early entry.

🎯 Target Price:

First Target: $155 (short-term resistance from early 2023).

Second Target: $165 (next major psychological level if sentiment remains strong).

🛑 Stop-Loss:

Below $138 (recent swing low and key support zone).

Alternatively, a trailing stop-loss to secure profits as the price rises.

Catalysts Supporting a Bullish Breakout:

1️⃣ China’s Economic Stimulus 🏦

The Chinese government is expected to announce new stimulus measures to support growth, which could boost investor confidence in Alibaba and other Chinese tech stocks.

Potential fiscal easing & liquidity injections may drive funds into large-cap Chinese equities.

2️⃣ Positive Economic Data Expectations 📊

Retail Sales & Industrial Production (March 17, 2025)

Strong numbers would indicate a rebound in consumer spending & manufacturing, benefiting Alibaba’s core e-commerce business.

3️⃣ Tariff Reduction Speculations 🌎

If the Chinese Congress signals progress on easing U.S.-China tariffs, Alibaba could see increased foreign investment & improved profitability.

4️⃣ Technical Breakout Potential 🔍

The triple-top pattern could turn into a breakout if volume surges past resistance ($145).

A move above this level could trigger short-covering & FOMO buying, leading to a quick rally.

What If the Data Disappoints?

If economic data underwhelms, BABA could reject resistance and pull back toward $130-$135.

In this case, waiting for a confirmed breakout before entering long positions is advisable.

📌 Final Thought:

BABA is at a critical inflection point. If economic optimism and stimulus expectations materialize, a breakout past $145 could fuel a strong rally toward $155-$165. Traders should watch for volume confirmation and be prepared to ride the upside while managing risk carefully. 🚀💹

Check out my other ideas about chineese stocks and more:

CHINA 50 Index Cash Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA 50 Index Cash" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (13100) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 14400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"CHINA 50 Index Cash" Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Commodity Outlook: Finding antivenoms in the Year of the SnakeWe are about a month into the Chinese Year of the Snake. The preceding Year of the Dragon (10 February 2024 to 28 January 2025) brought significant momentum to the asset class with broad commodities rising 10%, precious metals rising 36%, industrial metals rising 12%, and even energy and agriculture mustering a late gain (close to 2% each)1. However, the Year of the Snake presents several macro challenges for commodities. Renewed trade protectionism from the US, under the new Trump Administration, is likely to dampen global trade. Additionally, higher bond yields and a strong US dollar create further headwinds for the commodities market. China’s reticence to stimulate big is also holding back the asset class.

Despite these headwinds, we have identified several micro factors that could provide support for certain commodities—what we refer to as our ‘antivenoms’. We remain optimistic about precious metals, aluminium, and European natural gas. Additionally, some of the macroeconomic challenges may ultimately prove less severe than initially anticipated, creating potential upside opportunities for commodities that currently reflect bearish sentiment.

Strong US dollar

The recent strength of the US dollar has historically correlated with weaker commodity prices. While this pattern has been inconsistent post-COVID-19, the dollar's resurgence could once again pressure commodities. Historical data suggests a strong dollar often aligns with declining commodity values.

Trump’s trade policies and market impact

Donald Trump’s return to the presidency introduces uncertainty into trade and commodity markets. Trump's first presidency saw a trade war with China and other nations, negatively impacting global trade and commodity prices. While extreme tariff measures have often been bargaining tactics, the risk of real implementation remains. In his second term, some tariffs were announced and then delayed; at the time of writing, we still have no real guide as to whether they will be implemented or when. This uncertainty is already dampening market sentiment and increasing long-term interest rates, further constraining commodities.

Economic and inflationary concerns

Tariffs could raise inflation in the US while simultaneously depressing global commodity prices due to reduced demand. This dynamic may complicate the Federal Reserve’s (Fed) efforts to control inflation, potentially leading to prolonged high interest rates.

Climate policy reversals

Trump has vowed to withdraw from the Paris Climate Agreement and declared a “national energy emergency,” reversing climate regulations and boosting fossil fuel production. His administration is expected to cancel a $6 billion Department of Energy program aimed at industrial emissions reduction and repeal incentives for electric vehicles. These changes could suppress demand for critical materials used in clean technology, such as base metals.

At the same time, deregulation of oil, gas, and mining operations may increase the supply of key commodities like copper, aluminium, nickel, and cobalt. Major projects, such as Rio Tinto’s copper mine in Arizona, could proceed after years of delays. While immediate production increases are unlikely in 2025, long-term supply growth is possible.

Geopolitical risks and energy markets

A ceasefire between Israel and Hamas, brokered just before Trump's inauguration, has eased some geopolitical risk, though its stability remains uncertain. As we write, a peace deal between Russia and Ukraine is being brokered by the US. Short-term oil price spikes are possible if sanctions are initially tightened to get parties to the negotiating table but, ultimately, we could see easing oil and gas prices if a deal is hashed out.

The US has been pressuring Europe to purchase more American natural gas, but Russia’s LNG shipments to the EU remain significant. A resolution of the Russia-Ukraine war could weaken US leverage in energy negotiations, making Europe less dependent on American gas.

Stricter enforcement of Iranian oil sanctions under Trump could drive oil prices higher. However, OPEC2 members may counteract this by increasing supply, potentially offsetting price gains.

China’s economic strategy and commodity demand

China remains the world’s largest consumer of commodities, yet its recent economic weakness has limited demand growth. Unlike previous economic cycles where China launched large stimulus measures, its current approach focuses on smaller, targeted interventions. The government has stabilised the real estate sector but remains wary of excessive stimulus due to debt concerns.

China is investing heavily in clean technology and renewable energy infrastructure, supporting metal prices despite weak real estate demand. US tariffs on China could accelerate its push toward energy independence, promoting domestic adoption of solar, battery, and electric vehicle technologies.

Trade tensions could escalate into retaliatory actions, such as China restricting exports of critical materials, as seen with gallium, germanium, and graphite in response to semiconductor disputes. Further restrictions could impact global supply chains for energy transition materials.

China’s depreciating Yuan complicates economic policy. The People’s Bank of China has been intervening to stabilise the currency, limiting its ability to cut interest rates. While a policy shift to boost growth led to short-term market gains in 2024, further action remains constrained by currency pressures.

Conclusion

In the Year of the Snake, we are searching for antivenoms to counter the potential threats posed by trade wars, a strong US dollar, and a China that may be unable or unwilling to overcome its economic weakness.

We see strong opportunities in gold, silver, aluminium, copper, zinc and European natural gas, as each of these has compelling drivers that could withstand broader headwinds in the commodity complex.

As policies become clearer, we may find that our fears were overstated, potentially paving the way for a relief rally across the broader commodity complex. Until then, we place our confidence in these antivenoms.

Alibaba - This Chart Is Pretty Beautiful!Alibaba ( NYSE:BABA ) is perfectly respecting structure:

Click chart above to see the detailed analysis👆🏻

With a rally of about +80% within a couple of weeks, Alibaba is clearly showing signs of bulls completely taking over. This pressure was not unexpected though after we perfectly witnessed the major trendline breakout a couple of months ago and a retest of the confluence of support.

Levels to watch: $140, $110

Keep your long term vision,

Philip (BasicTrading)

$CNIRYY - China's CPI DefelationaryECONOMICS:CNIRYY -0.7%

(February/2025)

source: National Bureau of Statistics of China

- China's consumer prices dropped by 0.7% yoy in February 2025, surpassing market estimates of a 0.5% decline and reversing a 0.5% rise in the prior month.

This was the first consumer deflation since January 2024, amid fading seasonal demand following the Spring Festival in late January.

Food prices fell the most in 13 months (-3.3% vs 0.4% in January), dragged by a steep decrease in cost of fresh vegetables (-12.6% vs 2.4%) and a sharp slowdown in pork prices (4.1% vs 13.8%).

Meanwhile, non-food prices edged lower (-0.1% vs 0.5%), as increases in housing (0.1% vs 0.1%) and healthcare (0.2% vs 0.7%) were offset by declines in education (-0.5% vs 1.7%) and transport (-2.5% vs -0.6%).

Core inflation, excluding volatile food and fuel prices, fell 0.1% in February, in contrast to a 0.6% rise in January.

Monthly, the CPI fell 0.2%, shifting from January's 11-month top of a 0.7% rise and marking the first drop since last November.

This fall was also steeper than consensus of a 0.1% decrease.

CHINA FIN MARKETS | Investing in China & AIChina's market resurgence might pose some great opportunities for investors, especially after a long bearish cycle for the global Chinese financial markets.

February 2025 saw a significant shake-up in global markets, with China emerging as a key player driving investor sentiment. The MSCI China Index surged by 11.2% for the month, vastly outperforming the MSCI US Index:

One of the biggest catalysts behind China’s recent rally has been its advancements in Artificial Intelligence (DeepSeekAI being one of the key drivers).

By operating at a fraction of the cost of their US counterparts, such as OpenAI and Meta, DeepSeek's competitive advantage has given China an edge in the AI space, which can be seen in the market confidence.

XIAOMI has been one of the top gainers, largely as they are expanding their market penetration:

Chinese markets in February saw a boost when President Xi Jinping was warmly received by tech industry leaders. A handshake between Xi and Alibaba’s Jack Ma who previously stepped back from the public eye following regulatory crackdowns, was seen as a major gesture of reconciliation between the government and the private sector. This renewed support for private enterprises.

China’s long-term strategy has been paying dividends in high-tech industries. China has increased its global market share in nearly all industries and is outperforming competitors in cost-efficiency, particularly in sectors like copper smelting.

Despite recent gains, China’s stock market has yet to fully recover from its underperformance over the past decade. While the MSCI China Index has risen 34.6% over the past year, long-term returns still lag behind global markets. A US$100 investment in an MSCI World Index tracker in 2010 would have grown to US$480 by early 2024, whereas the same amount invested in an MSCI China Index fund would have only reached US$175.

China’s resurgence has brought a renewed sense of optimism, but investors remain cautious. While AI advancements and low cost of labor have positioned China as a competitive force, historical challenges like regulatory intervention, tariffs and economic instability still loom.

_________________________

Crude Oil: Is There More Downside?Following crude oil’s rebound from its September 2024 low of $65.20, the risk of a reversal remains uncertain amid ongoing bearish pressures.

Key Events This Week:

Chinese deflation risks

OPEC monthly report

US CPI data

Trade war developments

Potential Scenarios:

🔻 Bearish Scenario:

A clean break below $65 could extend losses toward $63.80, a key level that may determine whether the market holds neutral and rebounds or breaks further into a steeper bearish trend towards $62, $60, and $55 (the 0.618 Fibonacci retracement of the 2020–2022 uptrend).

🔺 Bullish Scenario:

If the rebound sustains above $67, resistance levels at $68.70, $70.80, and $72.50 could come back into play.

- Razan Hilal, CMT

Weekly $SPY / $SPX Scenarios for March 10–14, 2025 🔮🔮

🌍 Market-Moving News 🌍:

🇨🇳📉 China's Retaliatory Tariffs 📉: In response to U.S. tariffs, China has imposed up to 15% tariffs on U.S. products, including cotton, chicken, corn, and soybeans. This escalation raises concerns about a potential global trade war, which could negatively impact U.S. exporters and broader market sentiment.

🇪🇺💶 European Fiscal Expansion 💶: Germany has announced significant increases in defense and infrastructure spending, marking a shift in fiscal policy. This move may stimulate European economic growth, potentially affecting U.S. markets through interconnected global trade and investment channels.

📊 Key Data Releases 📊:

📅 Wednesday, March 12:

📈 Consumer Price Index (CPI) (8:30 AM ET) 📈:The CPI measures the average change over time in prices paid by urban consumers for a basket of goods and services, serving as a key indicator of inflation.

Forecast: +0.2% month-over-month

Previous: +0.3% month-over-month

📅 Thursday, March 13:

🏭 Producer Price Index (PPI) (8:30 AM ET) 🏭:The PPI reflects the average change over time in selling prices received by domestic producers, offering insights into wholesale inflation trends.

Forecast: +0.1% month-over-month

Previous: +0.2% month-over-month

📅 Friday, March 14:

🛒 University of Michigan Consumer Sentiment Index (10:00 AM ET) 🛒:This index measures consumer confidence regarding personal finances, business conditions, and purchasing power, providing insights into consumer sentiment.

Forecast: 95.0

Previous: 96.4

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

QUICK LOOK AT A FEW INDICATORS AND INTEREST IN A SERIES?Quick overview testing out the upload from a browser on a ethernet connection computer vs wifi with the desktop downloaded app. Do you find value in this and want to make a regular series? Contact me if so and follow. Esp if your a developer and want to add some videos to your products, free, locked or paid. Im game. Platforms, customization and breaking down analytics is the life. Its what i enjoy and maybe you will too!

Thank you All,

DrawDownKing CME_MINI:ES1!