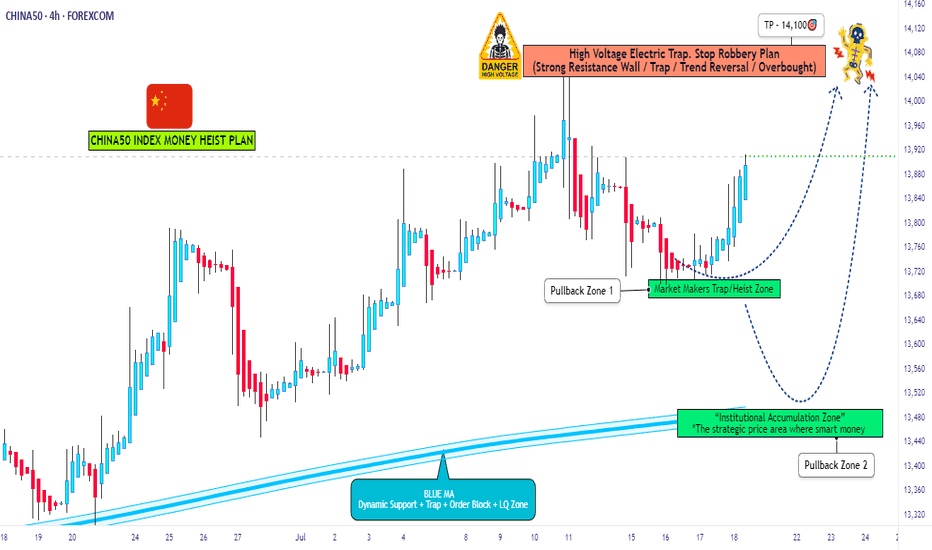

China50 Target Locked | Long Setup via Thief Strategy🏴☠️ CHINA50 Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the CHINA50 Index CFD like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 0.63700 after MA pullback

📍 Zone-2 Buy: Near 0.62800 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 13540 (4H swing low)

⛔ SL for Pullback-2: 13350

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 14100

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

CHINA50 shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

Chinaetf

"CHINA50 Money Heist: Will You Join the Gang or Get Robbed?"🚨 CHINA50 HEIST ALERT: Bullish Loot & Trap Escape Plan! 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting the ultimate heist on the CHINA50 Index Cash market! Our master plan focuses on a long entry—targeting the high-risk Red Zone (overbought, consolidation, potential reversal). Beware: Bears are lurking, and traps are set! 🏆💸 Book profits fast, stay wealthy, and trade safe! 💪🎉

🔓 ENTRY: The Vault Is Open – Swipe the Bullish Loot!

Buy Limit Orders: Place within 15-30min (recent swing low/high).

Alert Recommended! Don’t miss the heist.

🛑 STOP LOSS: Escape Route

Set near the latest swing low or below 4H MA (~13150.00).

Adjust based on risk, lot size, and multiple orders.

🎯 TARGET: 13840.00 (or Run Before It Hits!)

Scalpers: Only long-side plays! Use trailing SL to lock profits.

Swing Traders: Execute the robbery plan patiently.

📡 MARKET INTEL: Why CHINA50 is a Bullish Target

Fundamental Drivers: Macro trends, COT data, geopolitics, sentiment.

Intermarket & Index-Specific Factors in play.

👉 For full analysis, check the linkss below! 🔗🔗

⚠️ TRADING ALERTS: News & Position Safety

Avoid new trades during high-impact news.

Trailing SL is a MUST to protect profits.

💥 BOOST THE HEIST! Hit Like & Follow!

Support the plan → More profits → Easier robberies! 💰🚀

Stay tuned for the next heist! 🤑🐱👤🤩

"CHINA50" Index CFD Market Bullish Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (13300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 4H timeframe (13000) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 13800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"CHINA50" Index Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Phantom Heist: Sniping CHINA50 Longs for Epic Loot!🌍 Salutations, worldly wealth seekers! Ola! ✨

Dear Coin Conquerors & Chart Corsairs, 💸⚔️

Crafted in the 🔥 Phantom Trader’s cauldron of technical wizardry and fundamental finesse 🔥, behold our cunning plot to pillage the “CHINA50” Index Market. Follow the chart’s secret map, zeroing in on long entries. Our prize? Slip away near the treacherous ATR Red Zone, where overbought whispers, consolidation, reversals, and ambushes lurk, with bearish bandits poised to strike. 🦹♂️💰 “Secure your loot and treat yourself, traders—you’re a force to be reckoned with!” 🎊💥

**Entry 📊**: The vault’s cracked open! Seize the bullish bounty at current prices—the heist is on!

For precision strikes, set buy limit orders on a 15 or 30-minute chart at the latest swing low or high. Pro move: activate chart alerts to stay ahead of the game!

**Stop Loss 🛑**:

📍 Phantom SL planted at the recent swing low on the 8H timeframe (13500.00) for day or swing trades.

📍 Tweak SL to match your risk appetite, lot size, and open orders.

**Target 🎯**: Eye 14350.00—or vanish early if the market gets slippery!

🧨 **Scalpers, keep your wits!** 👁️: Stick to long-side scalps. Deep pockets? Dive in now! Lighter funds? Join swing traders for the caper. Use trailing SL to protect your treasure 💎.

💴 **CHINA50 Market Raid (Swing Trade Snapshot)**: Hovering in neutral territory with a bullish flicker, fueled by pivotal market tides. ☝

📰 **Uncover the full story**: Dive into Fundamental Signals, Macro Trends, COT Insights, Geopolitical Waves, Sentiment Cues, Intermarket Links, Index Drivers, Positioning, and Future Targets for the complete intel! 👉🔗🌎

⚠️ **Trade Warning: News & Position Strategy** 🗳️🚨

Market-moving news can stir chaos like a storm. Safeguard your gains:

- Avoid new trades during news drops.

- Use trailing stop-losses to lock profits and defend open positions.

💪 **Fuel our plunder!** 💥 Hit the Boost Button 💥 to supercharge our profit-grabbing game. Join the Phantom Trading Style crew and stack riches daily with flair. 🏅🤝🚀

Rendezvous at the next market ambush—stay sharp! 🤑🐆🎯

CHINA50 CFD Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CHINA50 CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (13100.0) then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 13600.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🟡Fundamental Analysis:

The Chinese government's stimulus measures have managed to partially stabilize the economy, but the threat of tariffs poses a significant risk.

China's manufacturing activity has rebounded, with the Caixin PMI reaching 50.3, its highest level in seven months.

🟠Macro Economic Analysis:

The ongoing trade tensions between the US and China are a significant risk factor for the Chinese economy.

The threat of tariffs poses a risk to China's export outlook and trade balance.

🟢COT Analysis:

Institutional traders are currently net long on the China 50 Index, indicating a bullish sentiment.

🔴Sentimental Analysis:

Retail traders are currently bearish on the China 50 Index, with a sentiment ratio of 45% bullish to 55% bearish.

Institutional traders are currently bullish on the China 50 Index, with a sentiment ratio of 60% bullish to 40% bearish.

🔵Institutional Trader Positioning:

Institutional traders are currently net long on the China 50 Index, with a positioning ratio of 62% long to 38% short.

🟤Retail Trader Positioning:

Retail traders are currently net short on the China 50 Index, with a positioning ratio of 55% short to 45% long.

Please note that these percentages are approximate and based on general market sentiment. They should not be taken as investment advice.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

CHINA 50 Index Market Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist CHINA 50 Index Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 2h timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

CHINA 50 Market Money Heist Plan on Bullish Side.Hello! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist CHINA 50 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 1h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

CQQQ May 7th TTR UpdateTheTradersRoom is very long #CQQQ from much lower levels and looking to hold this one till at least we see 2-3x gains on it.

We have entered it first days of Feb and very happy with the result.

China is recovering and Im expecting a perfect inversion alignment to QQQ here into the end of the next year.

It was a clear breakout from the downtrend channel last week. If the broken channel gets tested from above, it will be a perfect opportunity to add into our long position.

China: Back to the Grind (SHORT)China:

Morgan Stanley scenario:

Chinese stock indexes could plunge by another 20% from current levels over the next six to 12 months — and potentially remain lower for much longer if the hypothetical stress scenario persists.

China’s GDP could slow drastically, averaging 2% growth in 2023.

More than 11 million people could lose their jobs, likely sending the urban unemployment rate above 7%. Construction, accommodation and catering would see the most job cuts.

China ETF GXC struggles to break outAfter an intra-week V shape recovery, with a strong weekly candle, the GXC is now range bound (as seen in the daily chart) attempting to breakout of the range. The Daily technicals are bullish and supportive, as the weekly technicals are somewhat coiling.

We might have to wait a bit more on this one... Needs to break clean of 92.50.

GXC... perhaps it is timeSo, the double tailed candles on the weekly chart only resulted on a week of downside, but the second week proved resilient.

The daily chart shows the spike down blowout and the immediate recovery. This indicates very strong support at about 98-100. The new interim support at 102 is holding too.

Now, I expected the lack of liquidity and sentiment to push lower, accentuated by the Chinese New Year absence of market participants. But this appears to be a subtle bullish hint that once the two week holiday is over, this dragon will fly... am expecting a test of the daily 55EMA, maybe even popping over the resistance (white line). Daily technicals are supportive.

GXC still BEarishWeekly GXC chart looks bearish with technicals and candlestick ending with a sandwich like stack with a lower low and lower close.

The downside support target appears to be quite a way off, about 10% down from current.

Daily chart (right) is at a previously marked Buy Zone, but MACD is pushing down more. Price now has a gap resistance to close. Let's see if it can work that out. Meanwhile, very obvious that a lower low is indicating more momentum to downside than not.

I like GXC... but seems that it is not yet.

China ETF GXC - the music ain't overRecently, the China market had dived on regulatory action over the past couple of weeks. It hit a low point way out of range, and then bounced back technically. And the past week saw a range bound attempt to break out. This attempt failed to extend the rally higher out of the range, but instead fell down to the range support. In the process, it left a gap support and held above this in a range.

The weekly chart has a rather unique candlestick pattern, where a long tailed hammer body is engulfed by a down candle. This is ominously bearish.

The Daily chart is no better, with a failed breakout, and a gamp down to follow through, ending the week at support with ailing technicals.

A revisit to the last low is due...

More downside incoming!