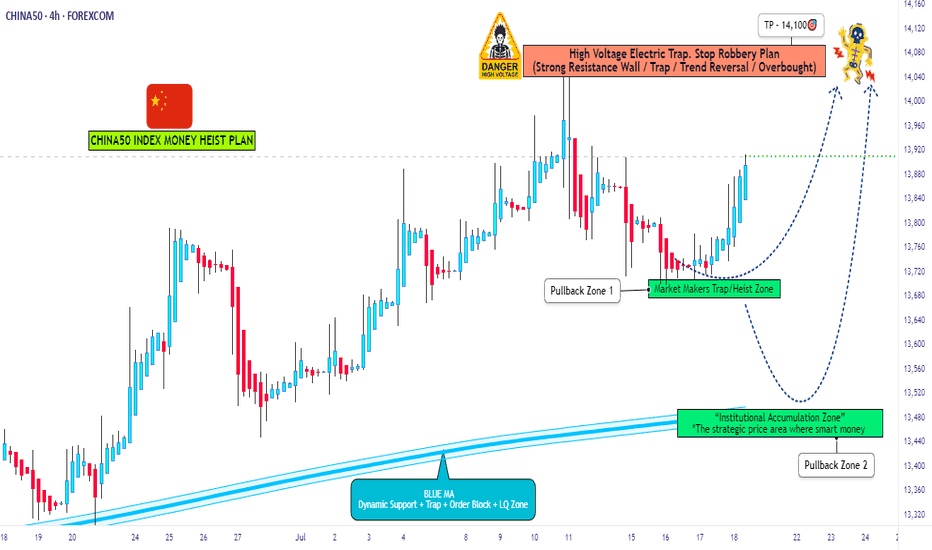

China50 Target Locked | Long Setup via Thief Strategy🏴☠️ CHINA50 Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the CHINA50 Index CFD like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 0.63700 after MA pullback

📍 Zone-2 Buy: Near 0.62800 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 13540 (4H swing low)

⛔ SL for Pullback-2: 13350

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 14100

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

CHINA50 shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

Chinatech

BIDU 1D: triangle breakoutBIDU 1D: triangle breakout + real-world AI deployment boosts bulls

Baidu (BIDU) breaks out of a triangle within a falling channel on the daily chart, with solid volume, reclaim of the 50MA, and approach to the 200MA. $90.09 flips into support. Targets stretch to $105.47 / $113.68 / $124.06 (Fibo levels).

Fundamentally, Car Inc just launched a robo-car rental service powered by Baidu’s Apollo unit. Fully autonomous, bookable for 4 hours to 7 days — this is not future tech, it’s live now. With a $32.6B market cap and low P/E (~12), BIDU looks positioned for revaluation if sentiment shifts.

Tactical setup: entry by market or retest of $90, stop below $82.

When the robot drives customers - you just drive the trade.

"CHINA50 Money Heist: Will You Join the Gang or Get Robbed?"🚨 CHINA50 HEIST ALERT: Bullish Loot & Trap Escape Plan! 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting the ultimate heist on the CHINA50 Index Cash market! Our master plan focuses on a long entry—targeting the high-risk Red Zone (overbought, consolidation, potential reversal). Beware: Bears are lurking, and traps are set! 🏆💸 Book profits fast, stay wealthy, and trade safe! 💪🎉

🔓 ENTRY: The Vault Is Open – Swipe the Bullish Loot!

Buy Limit Orders: Place within 15-30min (recent swing low/high).

Alert Recommended! Don’t miss the heist.

🛑 STOP LOSS: Escape Route

Set near the latest swing low or below 4H MA (~13150.00).

Adjust based on risk, lot size, and multiple orders.

🎯 TARGET: 13840.00 (or Run Before It Hits!)

Scalpers: Only long-side plays! Use trailing SL to lock profits.

Swing Traders: Execute the robbery plan patiently.

📡 MARKET INTEL: Why CHINA50 is a Bullish Target

Fundamental Drivers: Macro trends, COT data, geopolitics, sentiment.

Intermarket & Index-Specific Factors in play.

👉 For full analysis, check the linkss below! 🔗🔗

⚠️ TRADING ALERTS: News & Position Safety

Avoid new trades during high-impact news.

Trailing SL is a MUST to protect profits.

💥 BOOST THE HEIST! Hit Like & Follow!

Support the plan → More profits → Easier robberies! 💰🚀

Stay tuned for the next heist! 🤑🐱👤🤩

"CHINA50" Index CFD Market Bullish Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (13300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 4H timeframe (13000) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 13800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"CHINA50" Index Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Phantom Heist: Sniping CHINA50 Longs for Epic Loot!🌍 Salutations, worldly wealth seekers! Ola! ✨

Dear Coin Conquerors & Chart Corsairs, 💸⚔️

Crafted in the 🔥 Phantom Trader’s cauldron of technical wizardry and fundamental finesse 🔥, behold our cunning plot to pillage the “CHINA50” Index Market. Follow the chart’s secret map, zeroing in on long entries. Our prize? Slip away near the treacherous ATR Red Zone, where overbought whispers, consolidation, reversals, and ambushes lurk, with bearish bandits poised to strike. 🦹♂️💰 “Secure your loot and treat yourself, traders—you’re a force to be reckoned with!” 🎊💥

**Entry 📊**: The vault’s cracked open! Seize the bullish bounty at current prices—the heist is on!

For precision strikes, set buy limit orders on a 15 or 30-minute chart at the latest swing low or high. Pro move: activate chart alerts to stay ahead of the game!

**Stop Loss 🛑**:

📍 Phantom SL planted at the recent swing low on the 8H timeframe (13500.00) for day or swing trades.

📍 Tweak SL to match your risk appetite, lot size, and open orders.

**Target 🎯**: Eye 14350.00—or vanish early if the market gets slippery!

🧨 **Scalpers, keep your wits!** 👁️: Stick to long-side scalps. Deep pockets? Dive in now! Lighter funds? Join swing traders for the caper. Use trailing SL to protect your treasure 💎.

💴 **CHINA50 Market Raid (Swing Trade Snapshot)**: Hovering in neutral territory with a bullish flicker, fueled by pivotal market tides. ☝

📰 **Uncover the full story**: Dive into Fundamental Signals, Macro Trends, COT Insights, Geopolitical Waves, Sentiment Cues, Intermarket Links, Index Drivers, Positioning, and Future Targets for the complete intel! 👉🔗🌎

⚠️ **Trade Warning: News & Position Strategy** 🗳️🚨

Market-moving news can stir chaos like a storm. Safeguard your gains:

- Avoid new trades during news drops.

- Use trailing stop-losses to lock profits and defend open positions.

💪 **Fuel our plunder!** 💥 Hit the Boost Button 💥 to supercharge our profit-grabbing game. Join the Phantom Trading Style crew and stack riches daily with flair. 🏅🤝🚀

Rendezvous at the next market ambush—stay sharp! 🤑🐆🎯

"CHINA 50" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA 50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (13400) Thief SL placed at the nearest / swing high level Using the 8H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 12950 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"CHINA 50" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

ChinaH Index – Mid-Term Technical OutlookThe ChinaH Index is currently trading at $8,390, after recently rejecting the key resistance level of $9,200, a historically significant zone last tested in 2021. Despite this rejection, the index remains well-positioned within a strong and intact bullish channel, signaling long-term upward momentum.

Current Setup:

We are now observing a short-term relief bounce from $8,390, with potential to retest the $8,700 area. This move is part of a broader technical structure that suggests a healthy pullback phase before resuming long-term growth.

Pullback Scenario:

Following the potential retest of $8,700, the index may enter a correction phase, targeting $7,600 as a core support level—this zone previously acted as resistance in 2022 and is likely to serve as strong structural support heading into mid-2025.

Before reaching $7,600, the first interim support sits at $8,200, a level that previously served as support in 2020 and triggered the recent bounce. If $8,200 fails to hold during the retracement, a deeper correction toward $7,600 would allow for stronger consolidation and improved structural health within the overall bullish channel.

Two Potential Bullish Scenarios After Pullback:

Continuation within the Current Bullish Channel:

A bounce from $7,600 would resume upward momentum.

Primary upside target: $9,700 – a key multi-year resistance zone from 2017–2020.

A clean breakout above $9,700 would confirm a long-term bullish breakout and shift market sentiment decisively.

Formation of a New Bullish Channel:

In the event of prolonged consolidation, price could range between $7,100–$8,700 from September to December 2025.

A breakout in January 2026 would confirm a new ascending structure, offering a refreshed bullish path with long-term upside.

Key Levels to Watch:

Resistance: $8,700 → $9,200 → $9,700 (Major Breakout Zone)

Support: $8,200 → $7,600 → $7,100 (Range Floor if prolonged consolidation)

Summary:

While short-term pullbacks may test market resilience, the underlying bullish structure remains intact. A correction to $7,600 could act as a launchpad for the next major leg higher. Whether through continuation in the current channel or the formation of a new one, the ChinaH Index presents multiple bullish pathways, with $9,700 being the key level that could signal a long-term shift in trend.

Patience and disciplined positioning in the upcoming months will be crucial as we watch for confirmation of the next directional move.

CHINA 50 Index Cash Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA 50 Index Cash" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (13100) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 14400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"CHINA 50 Index Cash" Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

ChinaH Index: New Era of Economic Power and Market DominanceIn the current global economic shift, China is emerging as the leading force across multiple sectors, including economy, corporations, artificial intelligence, quantum technologies, and international alliances. With the U.S. facing economic struggles, including growing national debt, loss of investor confidence, and strained alliances, China is solidifying its position as the world's dominant economic power.

At $8,900, the ChinaH Index is in a strong bullish channel, following an impressive 34% rally from $6,700 on January 11 to its current level. Moving forward, there are two key scenarios that could play out:

Scenario 1: Healthy Pullback Before Resuming Growth

After reaching $9,000, the index could experience a natural correction to $7,600, allowing for a stronger consolidation phase.

This level would provide a solid base for the next bullish breakout, targeting $10,000 by mid-2025.

Scenario 2: Market Overextension and Historical Price Repetition

If the bullish momentum overextends, we could see a push toward $9,400–$9,800, representing a 44% rise, similar to past price movements.

The $9,700 level is a historically significant support zone from 2017–2020, making it a critical battleground for further gains.

A successful break above this level could send the index soaring toward $10,000 by July 2025, further reinforcing China’s dominance in the new global order.

Key Levels to Watch

$8,000 Support → A strong base in the new world economy. If it holds, further upside is likely.

$9,700 Resistance → A critical level from 2017–2020, which, if broken, confirms a long-term bullish shift.

$10,000 Target → A key psychological and technical milestone expected by mid-2025.

Conclusion: The ChinaH Index Reflects China’s Growing Global Influence

With shifting global economic dynamics favoring China, the ChinaH Index is positioned for long-term growth. If $8,000 holds, a breakout beyond $9,700 could confirm China’s continued financial dominance, leading to a potential target of $10,000 by July 2025. The next few months will be crucial in determining whether the market corrects before resuming its bullish trajectory or pushes straight toward new highs.

CHINA’S TECH SURGE—AI HYPE, HOT MONEY, AND LINGERING DOUBTSCHINA’S TECH SURGE—AI HYPE, HOT MONEY, AND LINGERING DOUBTS

(1/9)

Big News: China’s tech sector is on fire 🔥📈 in 2025, driven by AI breakthroughs and a softer regulatory vibe from Beijing. Hong Kong’s Hang Seng Index is up 13% YTD, outpacing the S&P 500 (+4%). Is this a tech golden age or a speculative bubble? Let’s break it down! 🚀

(2/9) – STOCKS IN FOCUS

• Alibaba: +50% (Hong Kong) 💥

• Xiaomi: +35% 📱

• Baidu: +30% 🔍

• BYD: +25% 🚗

The Hang Seng Tech Index has soared 30% since mid-January, hitting a 3-year high 🎉. Trading volumes are through the roof!

(3/9) – WHY THE SURGE?

• DeepSeek’s cost-effective AI model sparks global buzz 🤖

• Alibaba’s AI partnership with Apple + Jack Ma’s reappearance with Xi Jinping 🇨🇳

• Beijing hints at easing its tech crackdown, boosting investor confidence 💸

(4/9) – ‘HOT MONEY’ DRIVING THE RALLY

• Speculative capital—“hot money”—from hedge funds and retail traders fuels the boom 💨

• Trading volumes spike, but big institutional investors (pension funds, etc.) stay cautious 🧐

• Analysts warn: Momentum, not fundamentals, is driving this rally 📉

(5/9) – AI BREAKTHROUGHS: REAL OR HYPE?

• DeepSeek’s AI model hailed as a game-changer, but details are thin 🤔

• Social media buzz calls it a “bull market” for Chinese tech 🐂

• Critics say it’s more sentiment than substance—China’s history of overpromising looms large ⚠️

(6/9) – REGULATORY REPRIEVE OR TEMPORARY TRUCE?

• Xi Jinping meets tech leaders, signaling a thaw after years of crackdowns 🏛️

• Investors scour photos for clues—Alibaba and Tencent back in favor? 📸

• Skeptics question if it’s a genuine shift or a short-term tactic to prop up the economy 😬

(7/9) – RISKS VS. REWARDS

• Risks: Geopolitical tensions, trade tariffs, and competition from Western tech (e.g., Nvidia’s $589B drop) 🌍

• Rewards: If AI delivers and Beijing stays supportive, Chinese tech could dominate globally 🌟

• The rally’s fate hinges on sustainability—will the gains stick? 🤝

(8/9) – Will China’s tech surge last?

1️⃣ Yes—AI and policy shifts will fuel a new golden age.

2️⃣ Maybe—Short-term gains, but long-term doubts remain.

3️⃣ No—Speculative bubble will burst soon.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

China’s tech rally is a wild ride 🌍—AI hype, “hot money,” and a regulatory truce are driving stocks sky-high. But with big investors on the sidelines and risks aplenty, it’s a fragile boom. Will Beijing and AI deliver, or is this another fleeting frenzy? Stay tuned! 💪

Bullish China Tech in Short TermChina theme seems too beaten down but looks like Chinese Tech will pop up in short to medium term.

Entry : 36

Stop Loss: 34.50

Exit: 48 to 54 Range (Depending on how the trade unfolds)

Time: End of Feb 2025

This could be a good 25-30% gain.

All the best.

Marketpanda

Disclaimer: The information provided is for general informational and educational purposes only, and does not constitute financial, investment, or legal advice. None of the content shared should be relied upon as the sole basis for making investment decisions. Prior to making any financial or investment decisions, it is strongly recommended that you consult with a qualified financial advisor, accountant, or other professional who is familiar with your individual circumstances and risk tolerance. Any reliance you place on the information presented is strictly at your own risk, and we are not responsible for any losses, damages, or liabilities resulting from your investment or trading activities.

CHINA 50 Index Market Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist CHINA 50 Index Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 2h timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

CHINA 50 Index Money Heist Plan on Bullish SideHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist CHINA 50 Index based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 1h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

CQQQ May 7th TTR UpdateTheTradersRoom is very long #CQQQ from much lower levels and looking to hold this one till at least we see 2-3x gains on it.

We have entered it first days of Feb and very happy with the result.

China is recovering and Im expecting a perfect inversion alignment to QQQ here into the end of the next year.

It was a clear breakout from the downtrend channel last week. If the broken channel gets tested from above, it will be a perfect opportunity to add into our long position.

All Roads Lead to China $KWEB $CQQQNo government is performing at a higher level than China's. The biggest risk is they take Taiwan. If that happens any investment you have there could get frozen or could get banned or could get out right stolen. That said I think they take Taiwan by election eventually because even there it is close. There is a big pro China population in Taiwan most people do not talk about.

The upside is if over the next 20 years they become more rule of law, more into developing their own tech. Overtime the market will give them a better multiple and will gain trust in China. Trust right now is lower than its been in a couple decades. It might improve a lot over time depending on their policy and actions. Obviously they could also gain if there's more mistrust of the USA's rule of law if it goes that way in the next couple decades too.

Google vs Apple; How Android will kill Apple.Fact;

- Apple (iPhone, etc.) is entirely (100%) sourced from China;

- Google (Android) is 100% sourced from S. Korea & Japan.

1) Considering the abject population collapse - and massive DE-industralization!! - of China, it will take YEARS for Apple to relocate it's entire supply chain. (To N. America?) E.g. Apple will be lucky to bring out a new iPhone every other year - even that being overly optimistic.

2) Barring an outright armed conflict between S. Korea and Japan (very unlikely) Google's supply chain should be just fine, mostly unaffected by the coming Chinese de-urbanization and de-industrialization. (... which China will be forced to endure in order to feed the *** 800 million Chinese ***, which is what will be left in that country, by 2035.)

When will this purported Chinese population collapse and total de-industrialization begin?? ... You are in it!

(It is well worth to pay attention to it because it will (continue to) be spectacular!!)

Simultaneously, the technical picture is also very favorable for the upside, in this spread.

BEKE reversal momentumBEKE, KE Holdings, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China is bullish after the chinese government pledged to support markets

80.75Bil revenue in 2021.

52 Week Range 7.31 - 61.39

I see a reversal to $20.50 short term.

NTES Price TargetPrice target for NTES is $84.

All the Chinese stocks are primed for a strong recovery after China`s top administrative authority said it would work to stabilize the stock market and boost economic growth!

Traders are expecting the Chinese government would support the stock market like the FED did in the US.

BEKE Price TargetPrice target for BEKE is $19.

All the Chinese stocks are primed for a strong recovery after China`s top administrative authority said it would work to stabilize the stock market and boost economic growth!

Traders are expecting the Chinese government would support the stock market like the FED did in the US.

JD Price TargetPrice target for JD is $62.

All the Chinese stocks are primed for a strong recovery after China`s top administrative authority said it would work to stabilize the stock market and boost economic growth!

Traders are expecting the Chinese government would support the stock market like the FED did in the US.

CWEB Weekly Options PlayDescription

CWEB has been working it down from its ATH since FEB of this year, and has gotten stopped up in the congestion pattern.

I have been watching it to pick a direction to enter a position and it looks like it finally has broken to the downside.

I have been using Long Puts in all my short positions because I do not want to cap my downside potential to leave it open for fat tail scenarios in the current market environment.

Call Debit Spread

Levels on Chart

SL > 17.5

This level marks an all-time low in the security.

*Stops based off underlying stock price, not mark to market loss

The Trade

BUY

12/17 16P

R/R & Breakevens vary on fill.

The long call is placed ATM for highest chance of profit at expiration.

12/17 is all I'm willing to go with for expiration because I do not want to pay the extra premium to push it out to January.

Manage Risk

Only invest what you are willing to lose