Chinesestocks

HUYA | HUYA | Long at $2.61HUYA NYSE:HUYA operates game live streaming platforms in China. This stock got my attention based on the reported fundamentals and price position, but moderate "Chinese delisting" risks exist given the US's new political administration.

Book Value = $3.23 (Undervalued)

Forward P/E = 4.1x (Growth)

Debt-to-equity = 0x (Healthy)

Quick Ratio = 1.56x (Healthy)

Altman's Z Score = <1.8 (Bankruptcy risk is relatively high)

From a technical analysis perspective, the stock price momentum has shifted upward based on the historical simple moving average. The price often consolidates within and slightly outside of this simple moving average band before progressing higher (after a long period of selling). While near term-declines are a risk, a longer-term hold (if the fundamentals do not change and delisting doesn't occur) may pay off given the value, growth, and overall health of the company.

Thus, at $2.61, NYSE:HUYA is in a personal buy zone.

Targets into 2028:

$3.45 (+32.2%)

$5.80 (+122.2%)

JD.cm | JD | Long at $33.16Like Amazon NASDAQ:AMZN and Alibaba NYSE:BABA , I suspect AI and robotics will enhance JD.com's NASDAQ:JD automation in warehousing, delivery, and retail. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NASDAQ:JD has a current P/E of 8.1x and a forward P/E of 1.2x, which indicates strong earnings growth ahead. The company is healthy, with a debt-to-equity of 0.4x, Altmans Z Score of 2.6, and a Quick Ratio of .9 (could be better).

From a technical analysis perspective, the historical simple moving average (SMA) band is still in an overall downtrend but starting to level out (accumulation of share area). It is possible, however, that the price may drop into the $20s to close out the existing price gaps on the daily chart as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NASDAQ:JD is in a personal buy zone at $33.16 (with known risk of drop to the $20s in the near-term).

Targets into 2028:

$44.00 (+32.7%)

$52.00 (+56.8%)

Beginning of the Uptrend for Stock #01Beginning of the Uptrend for Stock #01: 9988 (BABA)

The price has broken out of a consolidation range that lasted approximately two years, supported by a normal volume distribution.

The stock has risen to meet the Fibonacci Extension resistance level of 161.8 at a price of 144 HKD. Currently, it is forming a sideways consolidation pattern on the smaller timeframe, establishing a base structure viewed as re-accumulation.

The 6-month target is set at the Fibonacci Extension level of 261.8, which corresponds to a price of 189 HKD. This target aligns with a price cluster based on the valuation from sensitivity analysis, using the forward EPS estimates for 2025-2026 as a key variable for calculations, along with the standard deviation of the price-to-earnings ratio.

Wait for the Right Moment to Accumulate Shares within the Consolidation Range

Purchase near the support level of the range when the price pulls back. Look for a candlestick reversal pattern as a signal to add to your position.

However, should the price break down to the lower consolidation range, the stock would lose its upward momentum, potentially leading to a prolonged period of consolidation or a deeper pullback to around 90 HKD.

Always have a plan and prioritize risk management.

CHINA A50 Rebound expected.China A50 index (CN50) has been trading within a Channel Down since the October 18 2024 Low and is currently attempting to hold its 1D MA50 (blue trend-line) as Support. If successful, we expect this Bullish Leg to approach the top of the pattern.

The shortest Bullish Leg rise has been +10.94% so a 13900 Target would be well within the risk limits.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BILI Projects to $100Bilibili Inc. is a leading provider of online entertainment tailored for the youth of the People's Republic of China. The company boasts a diverse array of digital offerings, including professionally produced user-generated videos, mobile gaming experiences, and enhanced services like live streaming, occupationally created videos, audio dramas on Maoer, and comics available through Bilibili Comic. Additionally, Bilibili offers advertising solutions, IP derivatives, and various other services. The company is also involved in business and technology development, e-commerce, and the distribution of videos, comics, and games. Established in 2009, Bilibili Inc. is based in Shanghai, China.

Bilibili is currently priced at $20.81, indicating it may be undervalued according to discounted cash flow analysis, which suggests a fair value of $28.84. Although there has been notable insider selling recently, the stock remains 28% below its estimated fair value and is projected to achieve profitability within the next three years, surpassing average market growth rates. While the anticipated revenue growth of 10.2% per year is not as robust as one might hope, it still outpaces the overall US market's growth rate of 8.9%.

$BEKE Inverse head and shouldersKE Holdings Inc. is a publicly traded Chinese real estate holding firm that offers a comprehensive online and offline platform for housing transactions and related services through its subsidiaries. It stands as the largest online real estate transaction platform in China.

Investors commonly refer to the entire operation as "Beike."

The company has garnered financial support from major players like Tencent, SoftBank Group, and Hillhouse Investment.

In August 2020, KE made its debut on the New York Stock Exchange (NYSE), successfully raising $2.12 billion during its initial public offering. On its first trading day, the stock soared by 87%, bringing the company's valuation to nearly $40 billion.

By May 2022, KE expanded its reach by becoming a dual-listed entity, adding its shares to the Hong Kong Stock Exchange.

KE operates two primary businesses: Lianjia and Beike. Lianjia functions as a real estate agency, while Beike serves as an online platform that connects customers with estate agents, including Lianjia. Lianjia is often likened to Redfin, whereas Beike is compared to Zillow.

The company is divided into four key business segments:

1. Existing home transaction services

2. New home transaction services

3. Home renovation and furnishing

4. Emerging and other services

$NTES NETEASE to benefit from Chinese stimulus.NetEase, Inc. is a prominent Chinese internet technology firm established by Ding Lei in June 1997. The company offers a diverse range of online services encompassing content, community engagement, communication, and commerce. It specializes in the development and operation of online games for both PC and mobile platforms, alongside advertising, email services, and e-commerce solutions within China. As one of the largest players in the global internet and video game industry, NetEase also manages several pig farms. Additionally, it features an on-demand music streaming service. Notable video game titles from NetEase include Fantasy Westward Journey, Tianxia III, Heroes of Tang Dynasty Zero, and Ghost II. From 2008 to 2023, the company was responsible for the Chinese versions of popular Blizzard Entertainment games, including World of Warcraft, StarCraft II, and Overwatch. In August 2023, NetEase unveiled a new American studio, spearheaded by veterans from Bethesda and BioWare.

Chinese Internet Stocks on the Edge: KWEB vs. FXI Introduction:

The Chinese internet sector AMEX:KWEB is at a critical juncture when compared to large-cap Chinese stocks AMEX:FXI . The ratio between these two reflects sector leadership—if KWEB outperforms, it signals renewed strength in internet stocks and suggests the sector is leading.

Current Market Context:

Potential Breakdown: The KWEB-to-FXI ratio is teetering near key support. A breakdown here would be a bearish signal for Chinese internet stocks.

Bullish Outlook: However, bulls are closely watching for signs of outperformance from KWEB, which could indicate the start of a new bullish trend.

Higher-Low Formation: If the ratio forms a higher low relative to its long-term trend, it would be a sign of potential strength in the internet sector.

Key Levels to Watch:

Support: Monitor the ratio’s current support level closely. A breakdown below this could lead to increased selling pressure on KWEB.

Resistance: A breakout above recent highs would indicate renewed outperformance and signal a bullish rotation into internet stocks.

Conclusion:

KWEB is at a make-or-break point, and the coming days could determine its fate. If the sector can establish a higher low and break above resistance, it could signal a bullish shift for Chinese internet stocks. Will KWEB lead, or will large-cap Chinese stocks maintain their dominance? Let me know your thoughts in the comments!

Charts:

(Include a chart showing the KWEB-to-FXI ratio, marking key support, resistance, and any signs of higher-low formations.)

Tags: #KWEB #FXI #ChineseStocks #InternetSector #SectorLeadership #TechnicalAnalysis #MarketTrends #China

$BABA Falling wedge breakout on dailyNYSE:BABA falling wedge breakout confirmed with MACD signalling bullish trend.

There's volume gap just above 90 to 94 where price can move very fast.

All sentiment indicator has been very bearish lately which makes me come to conclusion that this was the bottom.

Market was positioning for TRUMP to possibly put on 60% tarrifs on china which doesn't seem to be happening now as Trump has suggested negotiations with President XI

my PT is $99 for BABA in next 3 months

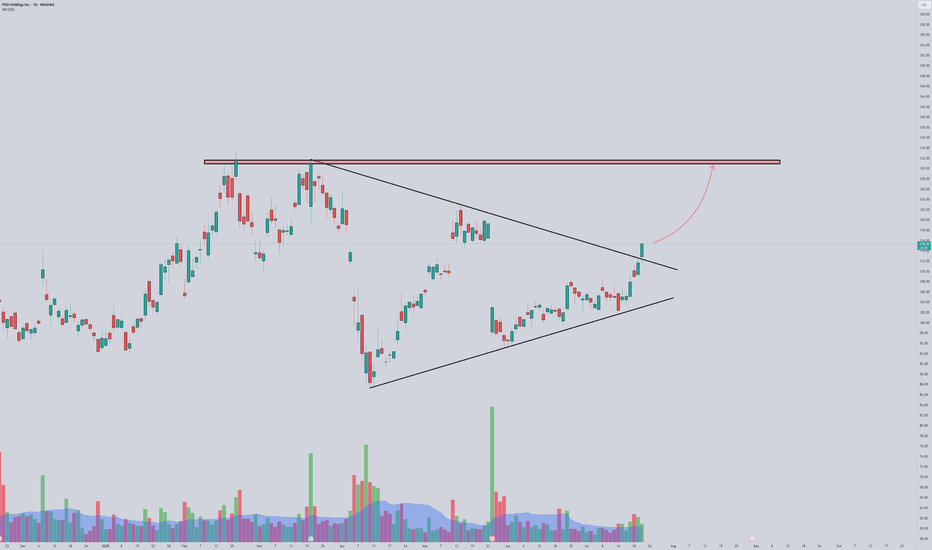

$PDD reversal finally coming for China stocks?PDD set to make a bullish move. Price at trendline going back to May and also at the demand zone from September before October’s parabolic move. RSI, MACD, and STOCH are all curling up and oversold. A break above 102.50 and this will explode higher. Initial PT at 110 and followed by gapfill PT at 114. SL at break and close of bottom trendline.

Xiamen Changelight Soars 108% in Just 16 Days!Xiamen Changelight Analysis:

Xiamen Changelight has seen a phenomenal rally, achieving a stunning 108% gain over the past 16 days. The recent bullish momentum has allowed the stock to achieve all target levels, with each level surpassed in quick succession.

Trade Setup:

Entry Point: $8.11

Stop Loss: $7.86

Target Levels:

TP 1: $8.41

TP 2: $8.90

TP 3: $9.38

TP 4: $9.69

Technical Indicators:

The stock has trended strongly above the Risological dotted trend line, showing a clear uptrend and sustained buying pressure. The price action’s alignment with this trend suggests confidence among buyers and the potential for continuation if volume remains supportive.

Market Sentiment:

The sharp rise in share price reflects strong interest in Xiamen Changelight, potentially driven by fundamental catalysts or broader market trends in its industry. With robust volume supporting the upward movement, the momentum appears sustainable, although some consolidation might occur after such a large gain.

Outlook:

With all targets reached, traders should monitor for any pullback or consolidation phase as new support levels are established. The strong trend could attract further interest, especially if broader sentiment remains positive. Keep an eye on volume and price stability to assess if another leg up is likely in the coming sessions.

CHINA A50 Buy signal couldn't have gone any better!Last time we looked at the China A50 index (CN50) was almost 2 months ago (September 06, see chart below) when we called for a buy opportunity:

As you can see, it couldn't have gone any better as the price rebounded exactly on our mark, hitting our 12100 Target in a matter of days.

Now the index is on a relief consolidation following this enormous rally that broke above the nearly 4-year Channel Down. Every time we had a similar bullish break-out, the market reached at least its 2.0 Fibonacci extension level. As a result, we expect to see 19500 by mid 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JD.COM PT63$ after breaking the long term trendlineJD.com broke the minor trend lines and is heading towards the long term trendline. This level is also enforced by prior highs/lows that acted as pívot points.

If broken, I would expect to extend the final of the third Elliot leg to the 63$ area, then back test the broken trendline, and then attack the ATH again.

Please let me know your thoughts!

Xiaomi (1810): Major Gains, Next Targets and Updated StrategyThe Hang Seng Index and its constituent stocks have been surging higher, with Xiaomi leading the charge 🚀. The setup we had on Xiaomi was quite similar to the one for Alibaba, featuring a tight stop-loss and a high risk-to-reward ratio, which, just like NYSE:BABA , worked out perfectly. Although we aimed to catch the end of wave (ii), we missed the entry by just a few HKD. Despite this, the position is now up an impressive 85% since we initially sent out the entry back in March.

We have taken our first round of profits as we haven't locked in any gains yet, and we have moved our stop-loss to the break-even point. However, we are confident that Xiaomi will not revisit this level for a long time. We took profits upon reaching a key wave 3 extension level. While we expect further gains on the lower time frame, we must also respect what the higher time frame indicates. Whether it's longing wave (iv) or wave 4, the choice depends on whether we are right about the higher or also the lower time frame. On the higher time frame, we anticipate a maximum rise to 30 HKD before we see a significant correction.

We believe there is still substantial upside potential for Xiaomi – it's only a matter of time. We'll keep monitoring both scenarios closely and act accordingly 📈.

China Stocks: What to Expect When Markets Reopen Stocks in Shanghai, Shenzhen, and Hong Kong took off last week and continued their climb on Monday, posting their best single-day rally in 16 years. This surge came after several announcements from Beijing aimed at boosting the country’s economy.

But now, The Shanghai Stock Exchange will be closed from Oct. 1 to Oct. 7 for China’s National Day celebrations, and Hong Kong’s market will also shut on Oct. 1. However, U.S.-listed China ETFs will still be trading, so when the Chinese exchanges reopen on Oct. 7, we could see big moves as global investors get ahead of the Chinese market.

China’s stock market is known for its wild swings, mainly because retail investors make up about two-thirds of the trading. That means we might see some significant volatility once the markets open back up.

CHINA A50 Death Cross to push it lower but buy opportunity lurksThe China A50 index (CN50) completed yesterday a 1D Death Cross following a convincing rejection on the 1D MA200 (orange trend-line) and that should extend the Channel Down to a new Lower Low.

Technically it appears to far to be in good symmetry with the Falling Wedge's previous Bearish Leg, that found a temporary bottom after a -14.76% decline and rebounded to the 0.618 Fibonacci retracement level.

As a result, despite the current weakness, we expect this last push to stop around 11100 - 11000 and then rebound to 12100 (0.618 Fib).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CHINA A50 Rebound expected.The China A50 index (CN50) eventually closed below the 1W MA50 (blue trend-line) last time we looked into it (June 14, see chart below) and hit our 11800 downside Target:

The long-term pattern remains bearish in the form of a Falling Wedge, but right now we expect a medium-term counter-trend rebound similar to the one that followed the May 30 2023 Low and reached the 0.236 Fibonacci extension.

As a result, we turn bullish on this index, targeting 12350 (0.236 Fib and top of the Falling Wedge).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trade Idea: Long on Baidu (BIDU) Overview:

Baidu (BIDU), a leading Chinese tech giant, is currently sitting at multi-year lows. Despite the broader Chinese economy facing challenges, Baidu presents a compelling opportunity due to its strong correlation with the overall Chinese market. The attached chart highlights this correlation, showing BIDU's performance in tandem with the Chinese economy's trends.

Valuation Comparison:

In a market where NVIDIA’s valuation surpasses the combined worth of Germany's and General Motors', opportunities in the Chinese market appear more reasonable. Baidu, with its substantial undervaluation, offers a potential upside that is hard to ignore.

Technological Edge:

A recent study by International Data Corporation (IDC) underscores Baidu's prowess in generative artificial intelligence (GenAI). Baidu’s Wenxin Yiyan and Wenxin Yige, comparable to ChatGPT and Midjourney, respectively, outperformed in categories like question-and-answer comprehension, reasoning, creative expression, mathematics, and coding. This technological advantage positions Baidu as a leader in AI, a crucial growth sector.

Conclusion:

With Baidu trading at significant lows and its robust performance in GenAI, the company is poised for potential growth. The Chinese market, despite its current economic hurdles, offers more attractive valuations compared to the overheated US tech market. This creates a strategic entry point for long positions in BIDU.

This overview provides a snapshot of Baidu’s potential as a strategic investment. If you’re interested in a deeper analysis, drop a comment below, and I’ll prepare a more detailed breakdown.

Trading is like a game of Monopoly—there's strategy, luck, and sometimes you end up in jail! 🎲 Always consult with a financial advisor and do your own research before making any big moves.

CHINA A50 Is this 1W MA50 rebound breaking the bearish trend?On December 21 2023 (see chart below) the China A50 index (CN50) gave us the best buy entry possible on more than 1 year span:

The price increased on this Bullish Leg and a month ago reached the top (Lower Highs trend-line) of the Falling Wedge. At the same time, it broke above the 1W MA100 (green trend-line) for the first time since December 28 2021, giving the first long-term buy signal in years.

Regardless of this signal, the index got rejected at the top of the Falling Wedge and is on a 4 week decline. However it reached this week the 1W MA50 (blue trend-line) again and so far reacted positively by holding it. As long as it holds and closes the 1W candles above it, it is more likely that this will transition into a rebound, which will be the 2nd and final long-term buy signal.

In that case, we expect the index to finally break above the Falling Wedge and stage a long-term pursuit of the 1W MA200 (orange trend-line). Our Target will be 13550 (slightly below Resistance 1).

If however the 1W MA50 breaks (closes candle below it), we will take the small loss and open a sell, targeting 11800 (the 0.5 Fibonacci level), similar to the March 14 2023 decline. The confirmation for this signal will come if the 1W MACD forms a Bearish Cross.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Alibaba - Back to bearish (not)?Hello Traders and Investors, today I will take a look at Alibaba .

--------

Explanation of my video analysis:

After Alibaba broke below the major support trendline in 2021 we saw a massive correction of -75% towards the downside. Alibaba was then retesting another major level, this time a previous support area which is at $60. So far Alibaba stock is still respecting the bearish trendline, but it is just a matter of time until we will see a bullish trading opportunity on this stock.

--------

Keep your long term vision,

Philip (BasicTrading)

Alibaba - Don't forget chinese stocks!Hello Traders and Investors, today I will take a look at Alibaba.

--------

Explanation of my video analysis:

Back in 2020 Alibaba stock created a textbook breakout of an ascending triangle formation which was followed by more continuation towards the upside. Then Alibaba stock topped out in 2021 and we saw a massive decline of -80% from the previous highs. At the moment Alibaba is still in a very bearish market but there is a chance that we will see a reversal in the near future.

--------

Keep your long term vision,

Philip (BasicTrading)

Alibaba - Trading opportunity is finally there!Hello Traders and Investors, today I will take a look at Alibaba .

--------

Explanation of my video analysis:

Almost a decade ago Alibaba stock retested a strong support at the psychological $60 level and reversed significantly towards the upside. Just a couple of months ago Alibaba stock once again retested this support and created an anticipated reversal. If Alibaba stock actually manages to break above the current resistance trendline, we could maybe see a similar rally like we saw in 2015 and the following years.

--------

Keep your long term vision,

Philip (BasicTrading)