CHR/USDT Major Breakout! Bullish Momentum Ignites🧠 Complete Technical Analysis:

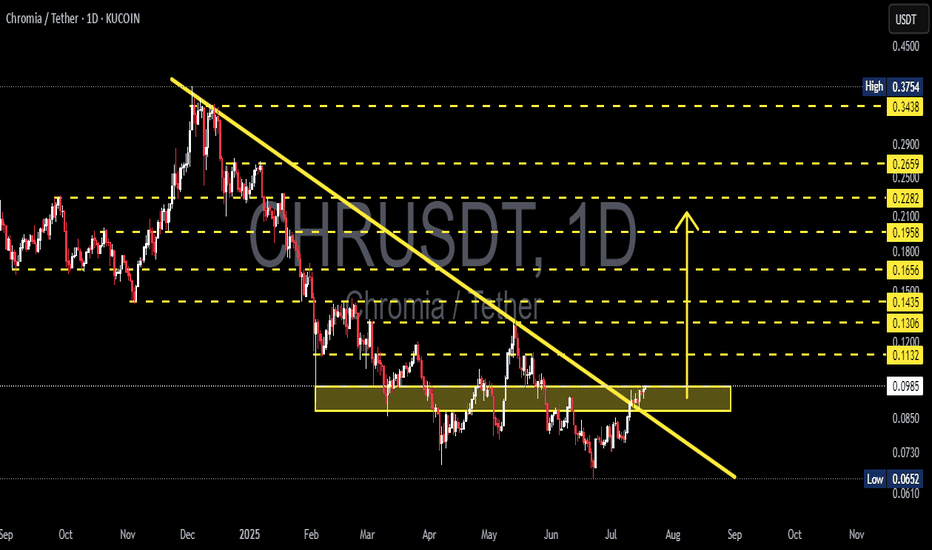

After months of being trapped in a prolonged downtrend since December 2024, Chromia (CHR) has finally shown signs of awakening. The price has successfully broken out of a major descending trendline, while also breaching a critical consolidation resistance zone between $0.093–$0.098 (highlighted in yellow).

This breakout not only indicates a potential trend reversal, but also opens the door for a medium-term bullish rally if sustained.

📊 Structure and Pattern Highlights:

Descending Trendline Breakout: CHR has decisively broken out of the long-standing bearish structure.

Validated Accumulation Zone: The $0.075–$0.098 range has proven to be a strong accumulation base after multiple tests.

Layered Horizontal Resistances: A clear ladder of resistance levels awaits as price pushes upward.

Potential Bullish Patterns: With a healthy pullback and higher low, CHR could form an Inverse Head and Shoulders or a Bullish Flag continuation pattern.

📈 Bullish Scenario:

If CHR can hold daily candle closes above the $0.098 breakout zone, the following targets come into play:

Target Level Description

$0.113 Breakout confirmation zone

$0.120 Psychological mini-resistance

$0.130 Historical horizontal resistance

$0.143 Previous local top

$0.165 Key breakdown level

$0.180 – $0.228 Medium-term target range with historical supply

$0.265 – $0.290 Strong resistance area from past distribution

$0.343 – $0.375 Long-term bullish target

💡 Note: If buying volume increases and BTC remains stable or bullish, these targets become increasingly realistic.

📉 Bearish Scenario:

However, if this breakout turns out to be a fakeout, CHR may fall back below the $0.093 zone and retest:

$0.085 (minor support)

$0.075 (base support)

As low as the demand zone around $0.065–$0.070

📌 Candle close and volume confirmation are critical. Avoid chasing price without solid validation!

📎 Conclusion & Strategy:

> CHR/USDT is currently at a pivotal moment. This breakout from a multi-month downtrend signals a potential trend reversal and a medium-term opportunity for swing traders and position holders.

📈 Trading Strategy Suggestion:

Entry: After a successful retest of the $0.095–$0.098 zone

Stop Loss: Below $0.085

Take Profit: Scale out at resistance levels listed above

#CHRUSDT #Chromia #CryptoBreakout #TrendReversal #AltcoinSeason #TechnicalAnalysis #CryptoTrading #BullishPattern #BreakoutSignal #ChartSetup

Chranalysis

#CHR (SPOT-INVEST) IN ( 0.1300- 0.1500) T.(0.7900) SL(0.1248)BINANCE:CHRUSDT

#CHR/ USDT

Entry( 0.1300- 0.1500)

SL 3D close below 0.1248

T1 0.3000

T2 0.4300

T3 0.5600

T4 0.7900

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI #FIL #GLMR #ATOM #LTC #MANA #ONT #TLM #SLP #ROSE #NEO #EGLD #CHR

#CHR (SPOT) IN ( 0.1800- 0.2100)T.(0.7900) SL(0.1732)BINANCE:CHRUSDT

#CHR/ USDT

Entry( 0.1800- 0.2100)

SL 1D close below 0.1732

T1 0.3000

T2 0.4300

T3 0.5600

T4 0.7900

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI #FIL #GLMR #ATOM #LTC #MANA #ONT #TLM #SLP #ROSE #NEO #EGLD #CHR

CHRUSDT.1DAs I delve into the technical analysis of the CHR/USDT daily chart, it becomes apparent that the market is navigating a critical juncture, reflected by several technical indicators and price actions.

Market Overview:

The current price of CHR/USDT is $0.2556, witnessing a decrease of 3.15% in the latest trading session. This negative movement needs careful examination against the backdrop of the broader market trends and key technical levels.

Trend Analysis:

The price has been following a descending trend, as indicated by the downward sloping line that connects the series of lower highs. This trend suggests persistent bearish pressure. Observing this, I note that any strategic decision will need to consider the potential continuation or reversal of this trend.

Support and Resistance Levels:

S1 at $0.2024: This level serves as the immediate support. The price's proximity to this level suggests it might soon play a crucial role in either halting the decline or, if breached, accelerating the bearish momentum.

R1 at $0.3332: This is the current resistance level. A breach above this could indicate a potential reversal or at least a pullback within the ongoing bearish trend.

Technical Indicators:

Relative Strength Index (RSI): The RSI stands at 49.97, hovering just below the neutral 50 threshold, indicating a balance between buying and selling pressures. This neutral stance may shift if external market forces or fundamental changes impact trader sentiment.

Moving Average Convergence Divergence (MACD): The MACD line is slightly above the signal line but very close, suggesting a marginal bullish momentum in the short term. However, the proximity of these lines also signals a potential change could be imminent.

Volume Analysis:

While not explicitly shown, the volume associated with price movements would provide deeper insights. Increasing volume on downtrends confirms bearish strength, while decreasing volume may indicate weakening bearish momentum.

Strategic Trading Advice:

In my current strategy, maintaining a cautious stance is prudent. I would monitor the S1 level closely for any signs of a breakdown. A decisive close below this support could open positions for a short, targeting further declines. Conversely, any bullish reversal signals, especially a sustained move above R1, would necessitate a reevaluation of the bearish bias, potentially shifting to a more bullish or neutral trading strategy.

Conclusion:

The CHR/USDT pair presents a complex trading environment where careful monitoring of key technical levels and indicators is essential. The proximity to critical support suggests that the next few trading sessions could be pivotal. As always, incorporating stop-losses and closely watching market developments will be key to navigating this volatile environment effectively.

CHRUSDT.1DThe daily chart for Chromia (CHR/USDT) shows that the asset has been trading within an ascending channel, indicating a bullish trend. However, the recent price action has dipped towards the lower boundary of the channel, currently at $0.3283, which could be a crucial support level (S1) at $0.2409.

The resistance level (R1) has been established at around the previous high of $0.5029. The RSI is slightly bearish at 41.81, and the MACD is below the signal line, both indicating that there might be more bearish momentum in the short term.

Traders might look for buying opportunities near the lower boundary of the ascending channel with a stop loss below S1, aiming for R1 as a short-term target. If the price breaks below the channel, it could signal a potential reversal of the bullish trend. It would be wise to wait for a clear signal such as a breakout or a bounce from key levels with confirming volume before making a trade decision.

CHRUSDT.4HBased on the provided market data, the CHR/USDT pair is currently priced at 0.1163 USDT. The Relative Strength Index (RSI) for 4 hours, 1 day, and 7 days are 55.46, 52.51, and 50.75 respectively, all of which are near the neutral 50 mark indicating that the market is neither overbought nor oversold.

The Moving Average Convergence Divergence (MACD) for 4 hours is slightly negative at -0.0009, while it is positive for 1 day at 0.0025, and negative for 7 days at -0.0065. This suggests a mixed trend with short-term bearishness and mid-term bullishness.

The Bollinger Bands (BB) for 4 hours, 1 day, and 7 days are 0.1178, 0.1257, and 0.1314 respectively. The current price is below the mid-line of the Bollinger Bands in all three periods which suggests a bearish trend.

The support levels for the next 4 hours, 1 day, and 7 days are 0.1130, 0.1067, and 0.1072 respectively, while the resistance levels are 0.1172, 0.1247, and 0.1225 respectively.

In conclusion, the market for CHR/USDT is currently showing a mixed trend with short-term bearishness and mid-term bullishness. However, the RSI values suggest that the market is stable and not in overbought or oversold condition. Investors should keep a close eye on the MACD and Bollinger Bands for any signs of trend reversal. As always, it's recommended to use a combination of different indicators and not rely on a single one for trading decisions.

CHRUSDTThis is a 4H frame analysis for CHRUSDT As you can see, the price is in its supply zone and can show a reversal again and bring the price back to the previous support zone. However, we can see signs of upward momentum in the daily timeframe, so wait for the price to break the resistance line or the complete line and then enter the trade or wait for the price to have a pullback after the signs of decline and then enter the trade.

Chromia (CHR) Forms Double Bottom Pattern!💎 Chromia make a double bottom pattern formation. CHR USDT has been steadfastly maintaining a significant support level setting the stage for potential price movements. A key milestone to watch out for is the breakout of the neckline.

💎if the neckline breaks successfully it could trigger a powerful breakout and price move toward strong resistance.

Disclaimer: This is Not Financial Advice ❗️ Trade at Your Own Risk ⚠️

CHR/USDT 4HOUR UPDATEWelcome to this quick CHR/USDT analysis.

I have tried my best to bring the best possible outcome me in this chart.

Reason of trade :- CHR/USDT is bullish trend conform retest buy the dip and green zone

Entry:- buy green zone

Traget:- 25% to 30%

Stoploss:-100 moving average downside candle close

Remember:-This is not a piece of financial advice. All investment made by me is under my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Happy trading.

Sorry for my English it is not my native languages

Do hit the like button if you like it and share your charts in the comments section.

Thank you...