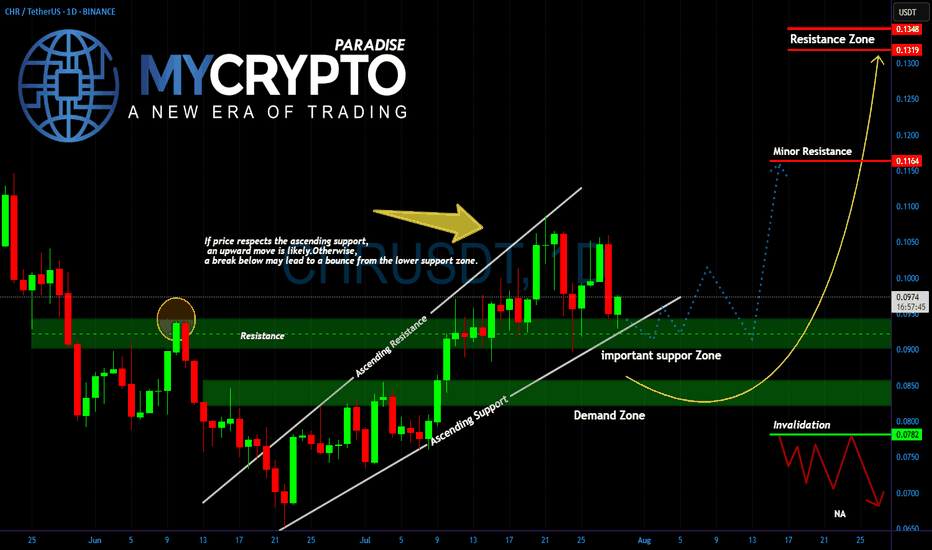

CHR Is About to Explode or Collapse Are You Ready for the Next BYello Paradisers, did you notice how #CHRUSDT is now testing the exact zone we warned about earlier? After weeks of climbing inside a clean ascending channel, the price is now sitting right on top of a critical support area. This is no coincidence what happens here will determine the next major wave.

💎The structure remains bullish as long as #CHR respects the ascending support trendline and the horizontal zone around 0.0900. This region, previously a strong resistance, is now acting as key support. If the bulls step in from here, we could see a sharp rebound toward the minor resistance near 0.1169. A confirmed breakout above that could open the path toward the upper resistance zone between 0.1320 and 0.1351.

💎But don’t get too comfortable. A clean break below this support zone would shift momentum back to the downside, dragging price toward the deeper demand area between 0.0840 and 0.0800. If the structure fully collapses and price breaks below 0.0782, we’d treat that as a clear invalidation of the bullish case, and a much lower range could open up.

For now, CHR remains in a waiting zone. It’s the reaction here that will give us the signal. Let the price come to you don’t chase it.

MyCryptoParadise

iFeel the success🌴

CHRUSDT

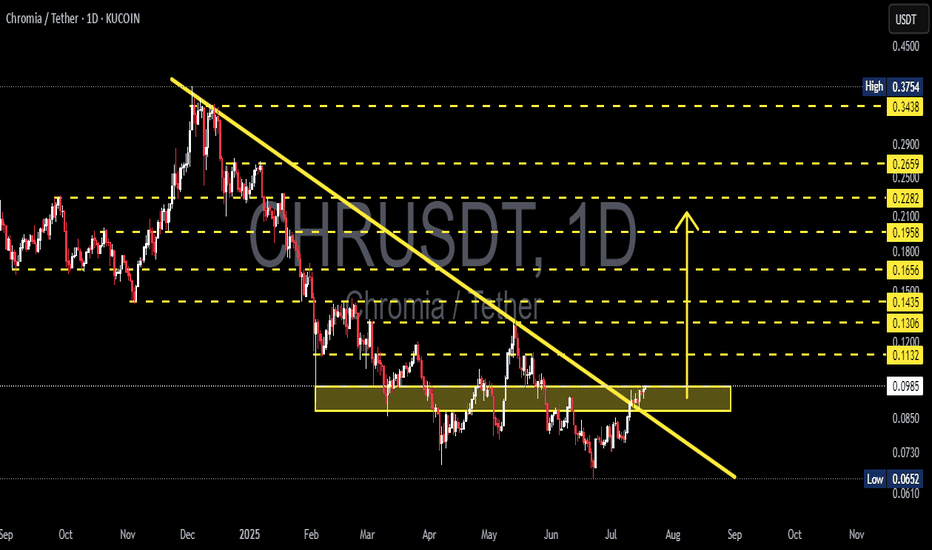

CHR/USDT Major Breakout! Bullish Momentum Ignites🧠 Complete Technical Analysis:

After months of being trapped in a prolonged downtrend since December 2024, Chromia (CHR) has finally shown signs of awakening. The price has successfully broken out of a major descending trendline, while also breaching a critical consolidation resistance zone between $0.093–$0.098 (highlighted in yellow).

This breakout not only indicates a potential trend reversal, but also opens the door for a medium-term bullish rally if sustained.

📊 Structure and Pattern Highlights:

Descending Trendline Breakout: CHR has decisively broken out of the long-standing bearish structure.

Validated Accumulation Zone: The $0.075–$0.098 range has proven to be a strong accumulation base after multiple tests.

Layered Horizontal Resistances: A clear ladder of resistance levels awaits as price pushes upward.

Potential Bullish Patterns: With a healthy pullback and higher low, CHR could form an Inverse Head and Shoulders or a Bullish Flag continuation pattern.

📈 Bullish Scenario:

If CHR can hold daily candle closes above the $0.098 breakout zone, the following targets come into play:

Target Level Description

$0.113 Breakout confirmation zone

$0.120 Psychological mini-resistance

$0.130 Historical horizontal resistance

$0.143 Previous local top

$0.165 Key breakdown level

$0.180 – $0.228 Medium-term target range with historical supply

$0.265 – $0.290 Strong resistance area from past distribution

$0.343 – $0.375 Long-term bullish target

💡 Note: If buying volume increases and BTC remains stable or bullish, these targets become increasingly realistic.

📉 Bearish Scenario:

However, if this breakout turns out to be a fakeout, CHR may fall back below the $0.093 zone and retest:

$0.085 (minor support)

$0.075 (base support)

As low as the demand zone around $0.065–$0.070

📌 Candle close and volume confirmation are critical. Avoid chasing price without solid validation!

📎 Conclusion & Strategy:

> CHR/USDT is currently at a pivotal moment. This breakout from a multi-month downtrend signals a potential trend reversal and a medium-term opportunity for swing traders and position holders.

📈 Trading Strategy Suggestion:

Entry: After a successful retest of the $0.095–$0.098 zone

Stop Loss: Below $0.085

Take Profit: Scale out at resistance levels listed above

#CHRUSDT #Chromia #CryptoBreakout #TrendReversal #AltcoinSeason #TechnicalAnalysis #CryptoTrading #BullishPattern #BreakoutSignal #ChartSetup

#CHR Is gearing up for an update ?#CHR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0788.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0750, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0793

First target: 0.0820

Second target: 0.0843

Third target: 0.0861

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#CHR READY TO NEW EXPLODE !#CHR

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.0474, acting as strong support from which the price can rebound.

Entry price: 0.0756

First target: 0.0768

Second target: 0.0785

Third target: 0.0810

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#CHR Ready For Another Leg Down? Key Levels to Watch Yello, Paradisers! #CHR is showing upside probability, but this is just a setup before the next brutal leg down? Here’s why the current move by #Chromia could be the calm before the storm:

💎#CHRUSDT is trading around $0.0819, and on the 4H chart, the price is developing within a potential Leading Diagonal Formation. But here's the catch: for the diagonal to be valid, Wave 5 must exceed Wave 3, which hasn’t happened yet. So, the structure remains incomplete and vulnerable.

💎As of now, the 5th wave is still in play, but momentum is fading fast. A Bearish Divergence on the MACD histogram is flashing early warnings. If it intensifies, it could drag #CHRUSD down before Wave 5 completes, leading to a premature breakdown and invalidation of the pattern.

💎The resistance zone between $0.089-$0.97 remains key. A break and sustained hold above this level would invalidate the bearish scenario, potentially triggering a short squeeze up toward $0.1000+. But unless that happens, bears are still in control of the structure.

💎On the downside, a confirmed breakdown below the $0.0740 support will signal the failure of the diagonal and likely accelerate the drop toward the next major support at $0.0610, where we anticipate the next Swing Low. A valid bearish breakout below needs to be backed by increasing selling pressure and market weakness.

Play it safe, respect the structure, and let the market come to you!

MyCryptoParadise

iFeel the success🌴

#CHR/USDT#CHR

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.0956.

Entry price: 0.1000

First target: 0.1036

Second target: 0.1067

Third target: 0.1100

#CHR (SPOT-INVEST) IN ( 0.1300- 0.1500) T.(0.7900) SL(0.1248)BINANCE:CHRUSDT

#CHR/ USDT

Entry( 0.1300- 0.1500)

SL 3D close below 0.1248

T1 0.3000

T2 0.4300

T3 0.5600

T4 0.7900

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI #FIL #GLMR #ATOM #LTC #MANA #ONT #TLM #SLP #ROSE #NEO #EGLD #CHR

#CHR (SPOT) IN ( 0.1800- 0.2100)T.(0.7900) SL(0.1732)BINANCE:CHRUSDT

#CHR/ USDT

Entry( 0.1800- 0.2100)

SL 1D close below 0.1732

T1 0.3000

T2 0.4300

T3 0.5600

T4 0.7900

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI #FIL #GLMR #ATOM #LTC #MANA #ONT #TLM #SLP #ROSE #NEO #EGLD #CHR

CHR Set to Skyrocket? Potential 43x to 165x Ahead!▍Reason 1:

BINANCE:CHRUSDT is perfectly replicating the price structure from the last bull run.

You can refer to the points I marked (1-7) in the chart.

In the last cycle, point 7 marked the lowest point before the price surged 84x.

▍Reason 2:

Since January 2021, CHR has been forming a multi-year symmetrical triangle, and it's now approaching the end of this pattern.

According to triangle consolidation theory, this means a major breakout is imminent.

Considering that altcoin season is also approaching (I've attached my previous analysis below), CHR is very likely to explode upwards!

▍Price Target Projections:

1. Fibonacci Target (marked in the chart) suggests a target of $6.6, representing a 43x increase from the current price.

2. Triangle Breakout Target (marked in the chart) suggests a potential high of $25, an incredible 165x from the current price!

I don’t think this bull run will deliver 100x+ gains, but with this potential, isn’t it worth getting in now?

for more future script 'guesses' like this!

#CHR/USDT Ready to go higher#CHR

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.2390

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2410

First target 0.2510

Second target 0.2628

Third target 0.2748

Is CHR gearing up for an ATH update?We see a triangle with an attempt to break it and further exit behind the ATH update! Given that one of the investors is a subsidiary of XRP, this project could be part of the future of XRP as it is itself implied as a modular blockchain. We're also entrenched above 50 EMA, a 1B+ capitalization and a $1.2 price is just around the corner.

Horban Brothers.

Will #CHR Bulls Step Up or Are We Facing a Breakdown?Yello, Paradisers! Can the #CHRUSDT bulls gather enough momentum to break out of the descending channel? Let's look at the latest analysis of the #Chromia:

💎After a steady 5-6 month downtrend, #CHR is nearing a crucial decision point as it approaches a major demand zone at $0.1523. This level has historically triggered a bounce, but the question is—can the bulls seize this moment to spark a reversal and finally break out of the descending channel?

💎For #CHRUSDT to set the stage for a breakout, the bulls need to reclaim internal resistance at $0.242—a key level that once served as strong support but has now turned into a significant obstacle. A breakout here, particularly with rising trading volume and support from the 20 EMA, could signal a shift in momentum, paving the way for a rally to the next major resistance.

💎However, if the bulls fail to maintain upward pressure, we could see a pullback to that critical demand zone at $0.1523, potentially retesting the recent breakout point. Failure to hold this level may lead to a slide toward the $0.124-$0.134 range.

💎The real danger, however, lies at $0.124. If this support level does not hold, bears are likely to take back control, potentially initiating a deeper correction and deflating any hopes for a short-term bullish recovery.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

#CHR/USDT#CHR

The price is moving within a 12 hour descending channel pattern, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 0.2000

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 0.2365

The first target is 0.2690

The second target is 0.3180

The third goal is 0.3744