CINF

CINF: A Good Pullback Trading Opportunity-INTRODUCTION-

Cincinnati Financial Corporation has been moving in an ascending channel since 2020 summer after its recovery from the pandemic economic shock. Last month, the price has reached a new high at the $142.50 level. After reaching a new high, the price retraced and retested the suport level of $120. From the support level, the price has formed a potential double top pattern, making a neckline area at around the $126 level.

-TRADING PLAN-

The price has reached a new high; therefore, we will plan to buy the pullback. Currently, we are watching for a breakout from the neckline of the double bottom pattern. After a clear breakout, we will place our buy limit orders at the neckline level to capture the retest. Our buy target is set at the previous high of $142.50 level.

Check out our previous trend-following stock trading ideas below :)

$CINF (Cincinnati Financial Corp) - Long to $160 Here is the analysis behind my latest stock purchase $CINF (Cincinnati Financial Corp)

PE Ratio (Trailing) = 5.42

ROE = +29.9%

ROA = +11.4%

ROIC = +10.9%

Solid data there and then the cash situation looks very strong. cash flow is growing but capital expenditures are not meaning the free cash flow is growing in recent years with the most recent 12 months bringing in 1.65 billion

We have 947 million in total cash and 905 million in total debt so this is a well balanced company from that aspect. Considering the debts are well managed and the growing cash flow inline with the average growth of just over 7% for the last 10 years, this to me looks like a strong company that is currently undervalued.

I believe the intrinsic value of this stock to be at $160 based on the current fundamental data

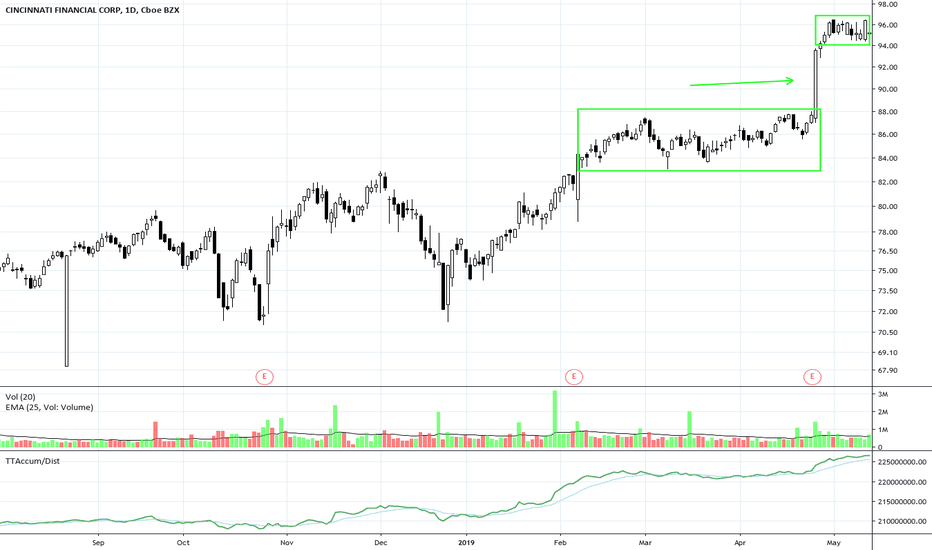

CINF Platform Pattern Hidden AccumulationCINF is an S&P 500 index component. The chart shows a platform sideways pattern typical of Dark Pool hidden accumulation. This was followed by a long white candle that was not HFT driven. The stock is now in another consolidation, at a new high with more hidden accumulation.