WTI Crude Oil: Trade Idea Context and SetupOur Long trade idea has already reached its target at 5921.75 in ES futures.

If you missed it, here’s a link to our article from the start of the week:

Note that, our entry was at 5861, while our stop was at 5837 in the example trade idea. The maximum low price was 5835.75 during Monday’s overnight session. Our stops could have been filled given this, however, we want to remind traders that these example trade ideas are for educational purposes, they are not a recommendation. Stops are never meant to dictate exact stop prices. Trader’s should place their stops according to their own risk management plan whether that be a mix of fixed dollar amount and market structure or filtering down to execution time frames to place stops per market generated information and structure.

Today’s Trade Idea: WTI Crude Oil

We will analyze the Long trade idea in WTI Crude Oil, providing both context and setup.

Fundamental Analysis Supporting Our Scenario:

Following the reciprocal tariff announcements, WTI Crude Oil fell to its lowest level of 54.48, a price last seen in 2023.

While equity markets have recovered, crude oil remains subdued—widely attributed to concerns over OPEC+ overproduction.

However, as we’ve previously explained, this interpretation is incorrect. The OPEC+ production increases were planned as early as December 2024, and the rollback of voluntary cuts is primarily aimed at meeting domestic demand within OPEC+ countries.

This uptick in consumption also coincides with seasonal demand from summer and the Hajj pilgrimage in Saudi Arabia.

Additionally, with the reversal of China’s escalatory tariffs and newly signed deals in the Middle East, many analysts have revised their GDP and recession forecasts upward.

We believe this improved economic outlook is yet to be priced in by the oil markets.

Technical Analysis Supporting Our Scenario:

From a technical standpoint, there is a significant resistance zone and key Low Volume Node (LVN) stacked just above the 2025 mCVAL and Q2 2025 mCVAH. The March 2025 Low also sits just above this cluster.

Our analysis projects a potential move from these levels up to the next major area of stacked levels:

• AVWAP from 2025 High

• Yearly 2025 VWAP

• 2025 Mid-Range

This sets the stage for a potential long opportunity in WTI Crude Oil as markets begin to price in shifting fundamentals and technical conditions align.

Key Levels:

• 2025 mCVAL: 63.38

• Q2 2025 mCVAH: 63.21

• AVWAP from 2025 Hi: 66.70

• Yearly 2025 VWAP: 67.44

• 2025- Mid Range: 66.52

Example Long Trade Idea: Probing Liquidity

Time frame: 1 hour or 30 mins

• Entry: 63.50

• Stop: 62.90

• Target 1: 64.37

• Target 2: 66.70

• Risk: 120 ticks

• Reward: 407 ticks

• Risk/Reward Ratio: 3.4R

Important Notes:

• Note that DOE inventories numbers are scheduled today at 10.30 am ET. Watch your risk amid volatility caused by this economic release.

• These are example trade ideas and not financial advice or recommendations.

• The trade idea considers 2 contracts to calculate risk and reward.

• Traders should conduct independent analysis and ensure proper risk management.

• Stop-loss orders are not guaranteed; slippage may occur, resulting in losses beyond predefined levels.

• AVWAP levels are accurate at the time of posting, they may vary as indicator further calculates prices with new volume and price information.

Glossary Index for all technical terms used:

VAL: Value Area Low

VAH: Value Area High

VP: Volume Profile

AVP: Anchored Volume Profile

C: Composite (prefix before VAL, VAH, VPOC, VP, AVP)

mC: micro-Composite (prefix before VAL, VAH, VPOC, VP, AVP)

AVWAP: Anchored Volume Weighted Average Price

NYMEX:CL1!

Cl_1

Planning the Trade: Crude Oil Scenarios in a Shifting Macro LandNYMEX:CL1!

In volatile times, both opportunities and risks increase. Traders gain the ability to be more selective, adapting to new market regimes by adjusting risk and trade management strategies. Key tools in this process include indicators such as the Average True Range and Close-to-Close volatility sigma bands. April 20, 2020: A historic day, WTI Crude Oil prices traded negative for the first time, and we have yet another volatile April.

"If you fail to plan, you are planning to fail." Preparation is essential before taking on the market head-on.

Many participants choose to stay on the sidelines when volatility exceeds 1 standard deviation. Others, however, see this as an opportunity—adapting their risk per trade, adjusting targets, and refining trade management. Reducing position size can be an effective way to manage periods of heightened volatility.

This Week's Trade Idea: Crude Oil

We'll be reviewing Crude Oil price action with updated levels, fresh insights, and framing a trade plan with an example idea for reference.

Key Levels:

• April Monthly Open: 70.75

• 2025 mCVPOC: 71.13

• Yearly Open: 69.64

• 2024 Mid: 69.52

• 2025 Developing Mid: 66.52

• 2025 mCVAL: 65.08

• March 2025 Low: 64.37

• 2022 CVAL: 61.60

• 2024 Low: 59.91

The recent announcement of reciprocal tariffs, coupled with OPEC+ production plans (though scheduled earlier), and the rising uncertainty around a possible recession, have collectively weighed on demand expectations—resulting in a significant decline in oil prices. Although the 2024 low was reclaimed and prices have remained above this level, the sustainability of this recovery remains uncertain.

Scenario 1: Push Higher Towards 2025 Mid

In this scenario, we anticipate prices closing above March lows. Price then pushes higher toward the 2025 developing mid-range, re-entering the 2025 micro composite value area (mCVA).

Example Trade Idea:

• Timeframe: Hourly

• Setup: Wait for a candle close above March lows. Look for a pullback reaction off the 2025 Value Area Low (VAL).

• Entry: 64.50

• Stop: 64.00

• Target: 66.50

• Risk: 50 ticks

• Reward: 200 ticks

• Risk/Reward Ratio: 4R

________________________________________

Scenario 2: Range-Bound Price Action

In this scenario, the March low acts as strong resistance, aligning with the 2025 mCVAL. Price reverts lower towards the 2022 CVAL.

Example Trade Idea:

• Setup: Watch for signs of buyer exhaustion near March lows. If sellers regain control, look for a move back down toward 2022 CVAL.

• Timeframe: Hourly

• Entry: 64.00

• Stop: 64.40

• Target: 62.00

• Risk: 40 ticks

• Reward: 200 ticks

• Risk/Reward Ratio: 5R

________________________________________

Important Notes:

These are example trade ideas provided for educational purposes and are not intended as trade recommendations. Traders should perform their own analysis and thorough preparation before entering any positions.

Please be aware that stop losses are not guaranteed to trigger at the specified levels, and actual losses may exceed predetermined stop levels.

________________________________________

Glossary:

• VA: Value Area

• VPOC: Volume Point of Control

• VAL: Value Area Low

• C: Composite (used as a prefix: VA, VAL, VAH, VPOC, etc.)

• mC: micro Composite (used as a prefix: mCVA, mCVAL, etc.)

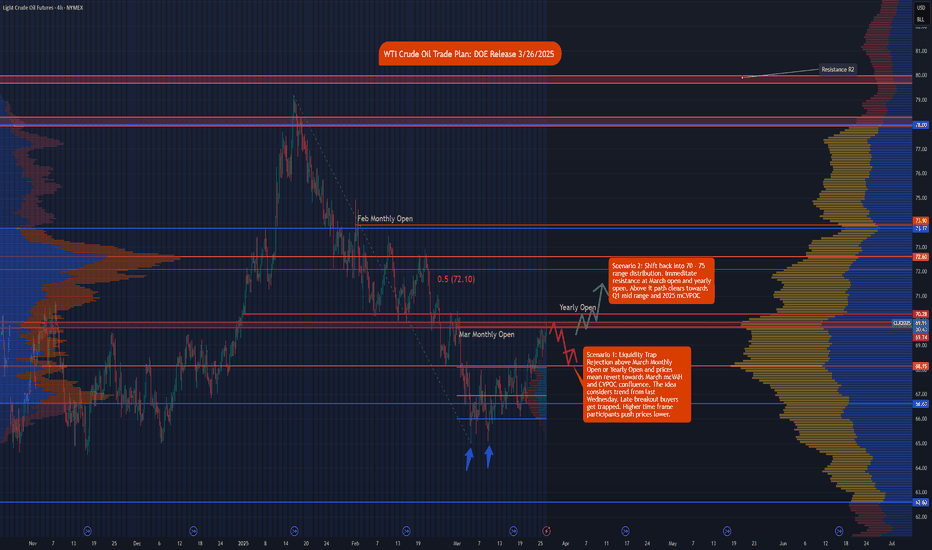

WTI Crude Oil Trade Plan: DOE Release NYMEX:CL1!

In this tradingview blog, we go over our technical setup and trade idea for Crude oil.

It is important to note we also have DOE inventory numbers coming at 10:30 ET.

Once the release has settled in, the trade idea can be framed using either of our two scenarios.

Scenario 1: Liquidity Trap

Rejection above March Monthly Open or Yearly Open and prices mean revert towards March mcVAH and CVPOC confluence. The idea considers the trend from last Wednesday. Late breakout buyers get trapped. Higher time frame participants push prices lower.

An example swing trade idea would be taking a long position once the release has settled and waiting for a pull back around 69.50.

• Entry: 69.50

• Stop: 70.30

• Target: 68.15

• Risk: 80 ticks

• Reward: 135 ticks

• Risk/Reward ratio: 1.69

This is an example swing trade idea that may play out by the end of the week.

Scenario 2: Shift back into 70 - 75 range distribution.

Immediate resistance is at March monthly open and yearly open. Above it the path clears towards Q1 mid-range and 2025 mCVPOC.

An example of a trade idea for this scenario is to wait for a breakout and close of candle on the 30 minutes time frame above yearly open. Wait for a pullback towards 70.28

• Entry: 70.35

• Stop: 69.50

• Target 71.45

• Risk: 85 ticks

• Reward: 110 ticks

• Risk/Reward ratio: 1.29

Please note that these are example trade ideas. Trades are advised to do their own preparation. Stops are not guaranteed to trigger, and losses may be greater than predetermined stops.

Recap: Short below LIS/Yearly Open Crude OilNYMEX:CL1!

Another day and EdgeClear brings you another recap where one of the highlighted scenarios in our weekly plan for WTI crude oil, published on February 24, 2025 , played out as expected.

Our Scenario 3 looked at price discovery extending the 2025 range into Q4 2024 lower distribution. Our analysis indicated an initial move lower bouncing from CVPOC 2022 support. The key was price moving below key LIS/yearly open. We did not see a bearish head and shoulders pattern develop, however, the rest of the plan played out as expected.

Note the price action till Friday, 28th Feb 2025.

We have been consistently providing traders with a roadmap for WTI crude oil with our thoughts and opinions on the market. WTI crude oil is a fundamental product that is affected by several factors, such as: macro, geopolitical, economic, supply, demand, and oil production dynamics.

Our analysis considers these developments along with auction market theory and key indicators that may be important to watch at times. As an example, for our January 13, 2025, blog , we noted increased volume with increased open interest that drove bullish sentiment in crude oil prices. We also highlighted potential short opportunities that played out per our plan.

For last week’s blog, we noted the overall trend in volume and open interest falling, indicating a potential move lower. This combined with multiple tests of our key LIS/ yearly open, strengthened our thesis for further price discovery lower.

In our blog, we have highlighted two key ranges:

$70 - $75 - Q1 2025 Value Area

$65 - $70 - Q4 2024 Lower Distribution

Focus is shifting towards oil market fundamentals i.e., supply, demand, and production outlook.

While headline news may drive short-term and intraday volatility, investors and market participant’s focus will shift towards oil market fundamentals. On March 3rd, 2025, OPEC+ reaffirmed its decision from December 5, 2024, to proceed with gradual and flexible return of 2.2 mbpd voluntary cuts, starting April 1, 2025. It provided a detailed table along with a cautious approach should this decision require any amendments. In our analysis, while trade war and tariff tantrum create uncertainty around demand outlook, any news providing clarity on tariffs will be considered net positive.

WTI Crude Oil CL Futures Weekly Plan AnalysisNYMEX:CL1!

In this tradingview blog, we will refer to our February 18, 2025 weekly trade plan for NYMEX WTI CL futures . Last week, we outlined two potential scenarios, with our primary scenario playing out—though not exactly as expected. Prices reversed lower more sharply than anticipated, offering minimal pullbacks on the 4-hour timeframe. However, when analyzing the hourly chart, our plan aligned well, as prices ultimately reverted to key LIS/yearly open bull support, which also confluences with the 2025 VAL.

We highlighted the following key levels:

2025 mcVPOC: 72.82

Feb 2025 mcVAH: 72.48

2025 mcVAL: 70.56

Yearly Open/ LIS: 70.52

Key Bull Support/ Confluence Zone: 70.52 - 70.12

Scenario 1 stated “Range bound week ahead.” We noted the following:

“In this scenario we expect range bound price action contained within Feb 2025 micro composite Value Area.”

Consistency is key in everything we do. We are creatures of habit. Energy flows where attention goes.

We provide these weekly plans to traders and the wider public to showcase that, instead of strategy hopping, a trader can achieve consistency by sticking to one approach. If that approach is not working, perhaps it is time to go back to the drawing board. Whether that be backtesting, walk-forward optimization or incorporating key market statistics that you have gathered and observed.

The goal of these weekly plans is to provide you with a structured roadmap that you can adapt to your own trading style. In our experience, while there are many ways to approach the market—whether through different indicators or methods for drawing levels and plans—staying consistent in your approach often leads to identifying similar key levels. Volume, price and time leave behind footprints. Although they do not provide a certain future, they can help you stay grounded, accepting the random nature of the markets, thinking in terms of probabilities and perhaps learning more so you can also gain similar insights.

As Bruce Lee said, “I do not fear a man who practiced different kicks a thousand times. I would fear a man who practiced the same kick a thousand times.”

Does our LIS hold? Weekly CL Trade IdeaNYMEX:CL1!

Macro Update:

There are a lot of market moving events taking shape on the macro landscape.

Peace negotiations between warring countries, reciprocal trade tariffs, and a US-Iran nuclear deal.

We need not mention that any of these events may potentially turn market sentiment risk on or risk off. It all depends on how these all unfold.

On the economic front, we have rate decisions from various central banks. Most central banks reiterate cautious cuts and turn hawkish amidst concerns about the rising inflation outlook. Central banks are also pointing towards rising uncertainty on the outlook itself as we mentioned above. It all depends on how events unfold.

WTI Crude Oil Big Picture:

Viewing a weekly full session WTI crude oil chart, we can see 3 weeks of one time framing up on the weekly chart starting Dec 30th, 2024. We then saw a rejection of uptrend and prices reverting to 2024 Value area. We can see four bearish weekly candlesticks from the week starting Jan 20th, 2025. Last week, the price action on the weekly timeframe formed an inverted hammer showing bearish pressure increasing on WTI crude oil. Our key LIS and key bull support show the confluence of multiple market generated levels has held up for the past 3 weeks.

Traders take note that WTI crude oil futures contract has rolled over to April 2025 contract. Symbol: CLJ2025

In addition, DOE WTI inventory numbers will be released on Thursday 11am CT due to US President’s Day on Monday February 17th, 2025.

Key Levels to Watch

Key levels represent areas of interest and zones of active market participation. The more significant a key level, the closer we monitor it for potential reactions and trade setups in alignment with our trading plan.

2025 mcVPOC: 72.82

Feb 2025 mcVAH: 7 2.48

2025 mcVAL: 70.56

Yearly Open/ LIS: 70.52

Key Bull Support/ Confluence Zone: 70.52 - 70.12

Scenario 1: Range bound week ahead

In this scenario we expect range bound price action contained within Feb 2025 micro composite Value Area.

Scenario 2: Risk-off sentiment shift prices below key LIS

In this scenario, we may see a breakdown of our key bull support and Line in Sand. Price moves and stays below yearly open price, providing a possible shift lower towards composite volume point of control (CVPOC).

Micro CME contracts allow for more precise risk management during volatile market conditions. Additionally, you can participate in the CME and TradingView paper trading competition, giving you the opportunity to test your skills in The Leap without risking real money.

COT Strategy - Crude Oil LongsDISCLAIMER: This is not trade advice. This is for educational purposes only to demonstrate how I am looking to participate in this market. There is significant risk involved in trading, do your own homework and due diligence.

COT Strategy

Crude Oil (CL)

My COT strategy has me on alert for long trades in CL again this week. To clarify, this was setup last week also, and triggered me long this week via a CCI divergence long trigger. Based on this weeks COT strategy analysis, I think this is a nice market for further upside and will look to enter again via 18MA & 10H8C MAC entry methods.

COT Commercial Index: Buy Signal.

Net Positioning: Max long of last 3 years - bullish.

Small Spec Index: Buy Signal.

Valuation: Undervalued vs Gold & Treasuries.

Front Month Premium Market.

True Seasonal up to Mid October.

Supplementary Indicators: Stochastic.

Remember, this is not a "Long Now" idea. These indicators are not timing tools. They simply tell us that this market could have a move of some significance to the upside, which we will participate in with a Daily long trigger.

Good luck & good trading.

CYCLICAL ANALYSIS - Crude Oil to Go Up To Mid OctoberDISCLAIMER: This is not trading advice. This is for educational and entertainment purposes only to show how I view this market. Trading involves real risk. Do your own due diligence.

My COT strategy has Crude Oil SETUP for longs if we get a TRIGGER (Confirmed bullish trend change). But what do cycles have to say about this long trade idea?

Cycles suggest that we should see an up move in Crude Oil until Mid October/Early November.

I look at many interesting things:

-Using the DOW Arab Titans 50 index as a leading indicator of where Crude Oil may trade to.

-The annual cycle of oil is strong and should not be ignored. It too is supportive of taking a long until mid October.

-The Decennial cycle is supportive of a bounce in oil into mid October.

-Major economic cycles & temporary trading cycles are also indicating an upmove could be imminent for oil.

-Lastly, we see that the previous most similar year of price action (2019) suggests oil could move higher into October/November.

TO BE CLEAR: This does not mean I am going long blindly, I wait for entry TRIGGER (18 MA, 10h8c MAC, Divergence). This market did already trigger via divergence last Wednesday via the CCI (Commodity Channel Index) divergence confirmation.

If you have any questions about my cyclical analysis, feel free to shoot me a message.

I hope you had a good start to your week.

And as always...

Good Luck & Good Trading.

Upside Ahead for Crude Oil - COT Strategy LongDISCLAIMER: This is not trade advice. This is for educational purposes only to demonstrate how I am looking to participate in this market. There is significant risk involved in trading, do your own homework and due diligence.

COT Strategy

LONG

Crude Oil (CL)

My COT strategy has me on alert for long trades in CL if we get a confirmed bearish change of trend on the Daily timeframe.

COT Commercial Index: Buy Signal

OI Analysis: Down move since July and recent consolidation has seen CM's getting more long.

Valuation: Undervalued VS GOld

True Seasonal: Strong seasonal tendency for oil to go up to mid October.

Front Month Premium: Front month delivery contracts selling at premium to further out contracts. This is bullish, and is a sign that we could see a commercially driven bull move.

COT Small Spec Index: Buy Signal

Supplementary Indicators: Acc/Dist Buy Signal

Remember, this is not a "Long Now" idea. These indicators are not timing tools. They simply tell us that this market could have a move of some significance to the downside, which we will participate in with a confirmed Daily trend change to the upside.

Good luck & good trading.

CL Crude Oil WTI LONGMy bias all week has been for oil to trade to the PWH. So far, I've been given no trigger to get involved.

However, end of NY session saw H4 candle bullish closing disrespecting bearish arrays.

I want to see these levels respected as bullish arrays to then look for m15 bullish displacement long entry.

CL WTI Crude Oil ShortMy weekly bias is for price to trade up to previous weeks highs, but Mondays price action has me leaning towards a pullback before we trade up mid/late week.

Today's candle was quite bearish, so I am looking for price to trade down to Monday's lows, and possibly trade into the untapped lows from several daily candles formed last week.

I want to see price trade into and respect a bearish premium array to trigger me to look for short entry on m5/m15.

Central Banks 101: Don't fight institutional financeCentral banks have considerable power in the foreign currency market. Central banks are primarily responsible for long-term inflation management while also contributing to the general stability of the financial system. When deemed appropriate, central banks will act in financial markets in accordance with the previously specified "Monetary Policy Framework." Forex traders hoping to profit from the consequent currency fluctuations closely watch and anticipate the policy's implementation. What Is the Function of a Central Bank? [/b Central banks are self-governing entities that help governments throughout the globe manage their commercial banking sectors, establish central bank interest rates, and ensure financial stability throughout the country's financial system. Central banks have an impact on financial markets in a variety of ways, including, but not limited to, the following:

The procedure by which governments purchase and sell government securities (bonds) on the open market in order to boost or reduce the quantity of money in the banking system is referred to as open market operations (OMO). In order to boost or depress economic activity, the monetary policy committee establishes the central bank rate, often known as the discount rate or the federal funds rate. While it may seem contradictory, an overheated economy leads to inflation, which central banks strive to keep at a controllable level.

Responsibilities of the Central Bank

Central banks were founded to serve the public interest and carry out a mission imposed by the government. While duties vary by country, the following are the primary tasks in each: Achieve and maintain price stability : Central banks are in charge of keeping their own currencies' exchange rates stable. This is accomplished by keeping inflation at a manageable level across the economy.

Improving financial system stability: To reduce systemic risk in the financial sector, central banks subject commercial banks to stress testing. Adopt the following measures to promote an economy's balanced and long-term growth: Fiscal and monetary stimulus are the two most common approaches for a government to boost its economy. Two means for achieving this objective are fiscal policy (government expenditure) and monetary policy (interest rates) (central bank intervention). Central banks may use monetary policy to try to boost the economy by lowering interest rates when governments' budgetary resources are exhausted.

Fourth , central banks are responsible for overseeing and regulating financial institutions for the good of the public.

Lower unemployment: Central banks may be interested in lowering unemployment in addition to maintaining price stability and encouraging long-term growth. One of the purposes of the Federal Reserve System is to achieve this. Central banks also serve as lenders of last resort in a number of situations. A government with a low debt-to-GDP ratio that is unable to raise money via a bond auction may be able to borrow from the central bank to meet a short-term liquidity need. Investor trust in the financial system is boosted by the presence of a central bank that serves as a lender of last resort. Investors have greater trust in governments' capacity to pay their debt commitments as a result of decreased borrowing rates.

Eurodollar Short into UK Open | Pre Euro open we see some stiff rejection right around the key-level identified when fCentral banks have considerable power in the foreign currency market.

== ==

📢 Signal#:3

🏦 OrderType: Sell

💱 Symbol: EURUSD 🇪🇺🇺🇸

📈 OpenPrice: 1.13056

🎯 Old TP: 0.00000

🎯 New TP: 1.12009

Crude Oil setup to rally to new highs - $USOIL $CL $CL_1 $XOMAside from Crypto, I've had the most success in the last decade trading crude based on a combination of technical analysis (classical charting) and trading the news (economic indicators, such as OPEC releases).

Between March - June 2021, Crude oil prices formed a cup and handle that concluded with price reachings its target just above $75. Price then corrected, forming a triangle that turned into a bear trap as sellers sold the breakdown before price rallied back into the consolidation.

From failed moves come fast moves.

Over the last 6 weeks, price has formed an inverted H&S. Having occured after a downside break and failure, this is an immediate buy signal with fast upside price implications. Oil is a fun and scary market to trade because of the volatility and liquidity combined with leverage opportunities.

Be safe,

j

How far down Crude Oil will go?Crude oil pulled back sharply from 75.30 resistance level. Now bouncing from trend line drawn from March to May lows. Until it reclaims 69.75 and stays above, downward pressure continues. If 65.30 fails to hold, next support at 64 and at last 61.50. Close below 61.50 more downside possible. Other levels as marked.

The Technicalities of Key Levels (Institutionalization)This was made for someone asking for the key-levels on GJ and where they are. I hope this shows how powerful waiting for rejections and consolidation around institutional prices can give us high probability trades. The goal is to analyze from top to bottom, gathering the price action data in order to tally up confluences. For stop placements, the 4-hour chart will be the lowest in which we find SL points above lower swing highs and below higher swing lows.

Turning analysis into trades..

When performing analysis across the daily and weekly timeframes on a Sunday night for instance or analyzing the daily charts at the end of every trading day, the first important pieces of data to pick out are key level price points and candlestick formations. You’re looking for patterns, that might serve as clues for the next directional movement of any specified currency pair.

Price action, moving averages and key levels are displayed on the longer-term charts and these are generally the most significant and strongest. It’s best to take note of these levels at the end of each trading day or morning and then plot them on the charts using the charting tools available in your trading software of choice. Keeping a notepad at hand helps to keep track of the organizational breakdown of your selected currency pairs. Beginning traders should start out with six or seven pairs, then strip each one down, labeling the bullish and bearish indicators for each one on every time frame, starting with the monthly and working your way down to the 2-hour chart.

Timeframe rules are the basic building blocks of all other trading strategies, so it’s important to have a good understanding of them before moving on to more complex methods. Keep it simple, learn the rules, make notes and work with the price action that the market delivers through the charts. In this sense it can be helpful to remind yourself that trading is essentially a financial game between the bulls and bears – the optimists and pessimists in the market – both of whom have the same goal of earning a profit but who achieve it through different means.

Key level placement

Support and resistance levels are one of the most important technical factors in trading. “Key levels” are certain prices for a currency pair which may support the price below the current market level or a price which may resist above the current market level. Support acts as a floor and resistance acts as a ceiling, both of which are “barriers of price.” .

For example, the chart above displays various support and resistance zones. These key levels are major support and resistance areas; they are strong price points which the pair has reacted to a number of times. Currencies tend to react to these specific price points with a surprising degree of consistency. The market can either bounce or break upon the approach of a key level. Many beginning traders struggle due to not drawing key levels onto their charts accurately. Support and resistance are the absolute foundations which hold the ground for various other price action applications. Once a support level has been broken and the bears take control, the price often (but not always) pops back up to that same level from underneath in order to “retest” it once more before a continuation to the downside, and vice versa. Your job as a trader is to pick as side in this battle between support and resistance forces – between bulls and bears. If you pick the right side, then you will make money; of course, you pick the wrong side you will lose it.