CL Futures Weekly Trade Setup — June 17, 2025🛢️ CL Futures Weekly Trade Setup — June 17, 2025

🎯 Instrument: CL (Crude Oil Futures)

📉 Strategy: Short Swing

📅 Entry Timing: Market Open

📈 Confidence: 68%

🔍 Model Insights Recap

🧠 Grok/xAI – Bearish due to overbought RSI + price stalling near MAs

🤖 Claude/Anthropic – Bearish pullback expected, despite recent strength

📊 Llama/Meta – Overextended Bollinger Band + RSI = short bias

🧬 DeepSeek – Supports downside via divergence + high volatility

⚠️ Gemini/Google – Bullish thesis based on momentum; diverges from consensus

📉 Consensus Takeaway

While short-term momentum is strong, most models forecast a pullback due to:

🔼 Overbought RSI readings

📈 Price extended well above key moving averages

🧨 High volatility and profit-taking zone near $73–$74

✅ Recommended Trade Setup

Metric Value

🔀 Direction Short

🎯 Entry Price $72.65

🛑 Stop Loss $74.20

🎯 Take Profit $68.80

📏 Size 1 contract

📈 Confidence 68%

⏰ Timing Market Open

⚠️ Key Risks & Considerations

🌍 Geopolitical events or OPEC news can cause unexpected surges

📉 If bullish momentum resumes, upside breakout could invalidate short thesis

📏 Risk management is critical—stick to stop-loss if price breaks above $74.20

🧾 TRADE_DETAILS (JSON Format)

json

Copy

Edit

{

"instrument": "CL",

"direction": "short",

"entry_price": 72.65,

"stop_loss": 74.20,

"take_profit": 68.80,

"size": 1,

"confidence": 0.68,

"entry_timing": "market_open"

}

💡 Watch price action at the open. If oil opens weak or fails to reclaim $73, this short setup has a strong edge.

Cl_f

WTI Crude Oil: Trade Idea Context and SetupOur Long trade idea has already reached its target at 5921.75 in ES futures.

If you missed it, here’s a link to our article from the start of the week:

Note that, our entry was at 5861, while our stop was at 5837 in the example trade idea. The maximum low price was 5835.75 during Monday’s overnight session. Our stops could have been filled given this, however, we want to remind traders that these example trade ideas are for educational purposes, they are not a recommendation. Stops are never meant to dictate exact stop prices. Trader’s should place their stops according to their own risk management plan whether that be a mix of fixed dollar amount and market structure or filtering down to execution time frames to place stops per market generated information and structure.

Today’s Trade Idea: WTI Crude Oil

We will analyze the Long trade idea in WTI Crude Oil, providing both context and setup.

Fundamental Analysis Supporting Our Scenario:

Following the reciprocal tariff announcements, WTI Crude Oil fell to its lowest level of 54.48, a price last seen in 2023.

While equity markets have recovered, crude oil remains subdued—widely attributed to concerns over OPEC+ overproduction.

However, as we’ve previously explained, this interpretation is incorrect. The OPEC+ production increases were planned as early as December 2024, and the rollback of voluntary cuts is primarily aimed at meeting domestic demand within OPEC+ countries.

This uptick in consumption also coincides with seasonal demand from summer and the Hajj pilgrimage in Saudi Arabia.

Additionally, with the reversal of China’s escalatory tariffs and newly signed deals in the Middle East, many analysts have revised their GDP and recession forecasts upward.

We believe this improved economic outlook is yet to be priced in by the oil markets.

Technical Analysis Supporting Our Scenario:

From a technical standpoint, there is a significant resistance zone and key Low Volume Node (LVN) stacked just above the 2025 mCVAL and Q2 2025 mCVAH. The March 2025 Low also sits just above this cluster.

Our analysis projects a potential move from these levels up to the next major area of stacked levels:

• AVWAP from 2025 High

• Yearly 2025 VWAP

• 2025 Mid-Range

This sets the stage for a potential long opportunity in WTI Crude Oil as markets begin to price in shifting fundamentals and technical conditions align.

Key Levels:

• 2025 mCVAL: 63.38

• Q2 2025 mCVAH: 63.21

• AVWAP from 2025 Hi: 66.70

• Yearly 2025 VWAP: 67.44

• 2025- Mid Range: 66.52

Example Long Trade Idea: Probing Liquidity

Time frame: 1 hour or 30 mins

• Entry: 63.50

• Stop: 62.90

• Target 1: 64.37

• Target 2: 66.70

• Risk: 120 ticks

• Reward: 407 ticks

• Risk/Reward Ratio: 3.4R

Important Notes:

• Note that DOE inventories numbers are scheduled today at 10.30 am ET. Watch your risk amid volatility caused by this economic release.

• These are example trade ideas and not financial advice or recommendations.

• The trade idea considers 2 contracts to calculate risk and reward.

• Traders should conduct independent analysis and ensure proper risk management.

• Stop-loss orders are not guaranteed; slippage may occur, resulting in losses beyond predefined levels.

• AVWAP levels are accurate at the time of posting, they may vary as indicator further calculates prices with new volume and price information.

Glossary Index for all technical terms used:

VAL: Value Area Low

VAH: Value Area High

VP: Volume Profile

AVP: Anchored Volume Profile

C: Composite (prefix before VAL, VAH, VPOC, VP, AVP)

mC: micro-Composite (prefix before VAL, VAH, VPOC, VP, AVP)

AVWAP: Anchored Volume Weighted Average Price

NYMEX:CL1!

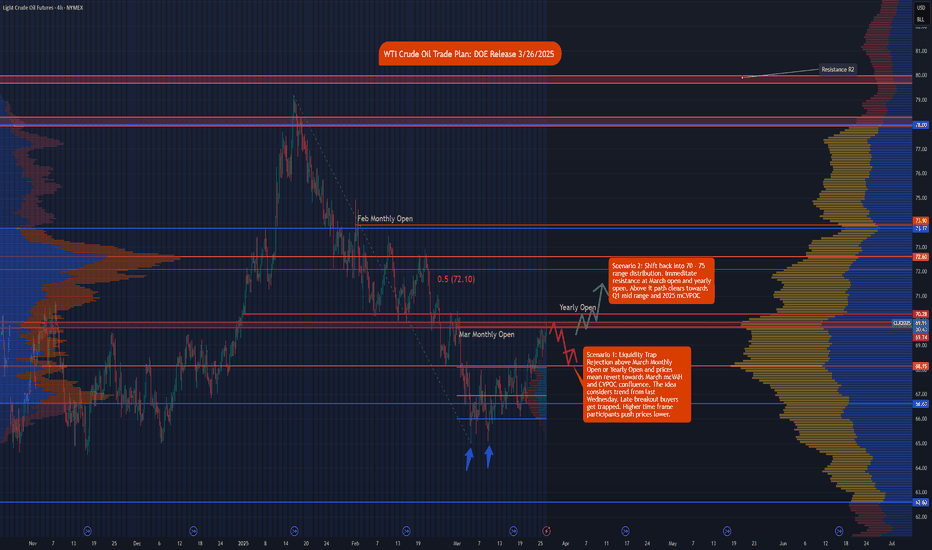

WTI Crude Oil Trade Plan: DOE Release NYMEX:CL1!

In this tradingview blog, we go over our technical setup and trade idea for Crude oil.

It is important to note we also have DOE inventory numbers coming at 10:30 ET.

Once the release has settled in, the trade idea can be framed using either of our two scenarios.

Scenario 1: Liquidity Trap

Rejection above March Monthly Open or Yearly Open and prices mean revert towards March mcVAH and CVPOC confluence. The idea considers the trend from last Wednesday. Late breakout buyers get trapped. Higher time frame participants push prices lower.

An example swing trade idea would be taking a long position once the release has settled and waiting for a pull back around 69.50.

• Entry: 69.50

• Stop: 70.30

• Target: 68.15

• Risk: 80 ticks

• Reward: 135 ticks

• Risk/Reward ratio: 1.69

This is an example swing trade idea that may play out by the end of the week.

Scenario 2: Shift back into 70 - 75 range distribution.

Immediate resistance is at March monthly open and yearly open. Above it the path clears towards Q1 mid-range and 2025 mCVPOC.

An example of a trade idea for this scenario is to wait for a breakout and close of candle on the 30 minutes time frame above yearly open. Wait for a pullback towards 70.28

• Entry: 70.35

• Stop: 69.50

• Target 71.45

• Risk: 85 ticks

• Reward: 110 ticks

• Risk/Reward ratio: 1.29

Please note that these are example trade ideas. Trades are advised to do their own preparation. Stops are not guaranteed to trigger, and losses may be greater than predetermined stops.

Recap: Short below LIS/Yearly Open Crude OilNYMEX:CL1!

Another day and EdgeClear brings you another recap where one of the highlighted scenarios in our weekly plan for WTI crude oil, published on February 24, 2025 , played out as expected.

Our Scenario 3 looked at price discovery extending the 2025 range into Q4 2024 lower distribution. Our analysis indicated an initial move lower bouncing from CVPOC 2022 support. The key was price moving below key LIS/yearly open. We did not see a bearish head and shoulders pattern develop, however, the rest of the plan played out as expected.

Note the price action till Friday, 28th Feb 2025.

We have been consistently providing traders with a roadmap for WTI crude oil with our thoughts and opinions on the market. WTI crude oil is a fundamental product that is affected by several factors, such as: macro, geopolitical, economic, supply, demand, and oil production dynamics.

Our analysis considers these developments along with auction market theory and key indicators that may be important to watch at times. As an example, for our January 13, 2025, blog , we noted increased volume with increased open interest that drove bullish sentiment in crude oil prices. We also highlighted potential short opportunities that played out per our plan.

For last week’s blog, we noted the overall trend in volume and open interest falling, indicating a potential move lower. This combined with multiple tests of our key LIS/ yearly open, strengthened our thesis for further price discovery lower.

In our blog, we have highlighted two key ranges:

$70 - $75 - Q1 2025 Value Area

$65 - $70 - Q4 2024 Lower Distribution

Focus is shifting towards oil market fundamentals i.e., supply, demand, and production outlook.

While headline news may drive short-term and intraday volatility, investors and market participant’s focus will shift towards oil market fundamentals. On March 3rd, 2025, OPEC+ reaffirmed its decision from December 5, 2024, to proceed with gradual and flexible return of 2.2 mbpd voluntary cuts, starting April 1, 2025. It provided a detailed table along with a cautious approach should this decision require any amendments. In our analysis, while trade war and tariff tantrum create uncertainty around demand outlook, any news providing clarity on tariffs will be considered net positive.

WTI Crude Oil CL Futures Weekly Plan AnalysisNYMEX:CL1!

In this tradingview blog, we will refer to our February 18, 2025 weekly trade plan for NYMEX WTI CL futures . Last week, we outlined two potential scenarios, with our primary scenario playing out—though not exactly as expected. Prices reversed lower more sharply than anticipated, offering minimal pullbacks on the 4-hour timeframe. However, when analyzing the hourly chart, our plan aligned well, as prices ultimately reverted to key LIS/yearly open bull support, which also confluences with the 2025 VAL.

We highlighted the following key levels:

2025 mcVPOC: 72.82

Feb 2025 mcVAH: 72.48

2025 mcVAL: 70.56

Yearly Open/ LIS: 70.52

Key Bull Support/ Confluence Zone: 70.52 - 70.12

Scenario 1 stated “Range bound week ahead.” We noted the following:

“In this scenario we expect range bound price action contained within Feb 2025 micro composite Value Area.”

Consistency is key in everything we do. We are creatures of habit. Energy flows where attention goes.

We provide these weekly plans to traders and the wider public to showcase that, instead of strategy hopping, a trader can achieve consistency by sticking to one approach. If that approach is not working, perhaps it is time to go back to the drawing board. Whether that be backtesting, walk-forward optimization or incorporating key market statistics that you have gathered and observed.

The goal of these weekly plans is to provide you with a structured roadmap that you can adapt to your own trading style. In our experience, while there are many ways to approach the market—whether through different indicators or methods for drawing levels and plans—staying consistent in your approach often leads to identifying similar key levels. Volume, price and time leave behind footprints. Although they do not provide a certain future, they can help you stay grounded, accepting the random nature of the markets, thinking in terms of probabilities and perhaps learning more so you can also gain similar insights.

As Bruce Lee said, “I do not fear a man who practiced different kicks a thousand times. I would fear a man who practiced the same kick a thousand times.”

Does our LIS hold? Weekly CL Trade IdeaNYMEX:CL1!

Macro Update:

There are a lot of market moving events taking shape on the macro landscape.

Peace negotiations between warring countries, reciprocal trade tariffs, and a US-Iran nuclear deal.

We need not mention that any of these events may potentially turn market sentiment risk on or risk off. It all depends on how these all unfold.

On the economic front, we have rate decisions from various central banks. Most central banks reiterate cautious cuts and turn hawkish amidst concerns about the rising inflation outlook. Central banks are also pointing towards rising uncertainty on the outlook itself as we mentioned above. It all depends on how events unfold.

WTI Crude Oil Big Picture:

Viewing a weekly full session WTI crude oil chart, we can see 3 weeks of one time framing up on the weekly chart starting Dec 30th, 2024. We then saw a rejection of uptrend and prices reverting to 2024 Value area. We can see four bearish weekly candlesticks from the week starting Jan 20th, 2025. Last week, the price action on the weekly timeframe formed an inverted hammer showing bearish pressure increasing on WTI crude oil. Our key LIS and key bull support show the confluence of multiple market generated levels has held up for the past 3 weeks.

Traders take note that WTI crude oil futures contract has rolled over to April 2025 contract. Symbol: CLJ2025

In addition, DOE WTI inventory numbers will be released on Thursday 11am CT due to US President’s Day on Monday February 17th, 2025.

Key Levels to Watch

Key levels represent areas of interest and zones of active market participation. The more significant a key level, the closer we monitor it for potential reactions and trade setups in alignment with our trading plan.

2025 mcVPOC: 72.82

Feb 2025 mcVAH: 7 2.48

2025 mcVAL: 70.56

Yearly Open/ LIS: 70.52

Key Bull Support/ Confluence Zone: 70.52 - 70.12

Scenario 1: Range bound week ahead

In this scenario we expect range bound price action contained within Feb 2025 micro composite Value Area.

Scenario 2: Risk-off sentiment shift prices below key LIS

In this scenario, we may see a breakdown of our key bull support and Line in Sand. Price moves and stays below yearly open price, providing a possible shift lower towards composite volume point of control (CVPOC).

Micro CME contracts allow for more precise risk management during volatile market conditions. Additionally, you can participate in the CME and TradingView paper trading competition, giving you the opportunity to test your skills in The Leap without risking real money.

Recap: CL and ES Weekly Plan analysis & Key LevelsNYMEX:CL1!

CME_MINI:ES1!

In this trading trading view blog we will refer to our February 3, 2025, weekly trading plans.

Our main idea for ES futures was to get long above yearly open, also our key LIS (Line in Sand). And our main idea for CL futures was to stay short below February monthly open targeting mcVAL and then waiting for an opportunity to get long at our key bullish support zone.

Below we explain our thoughts behind these ideas and how we choose our key levels and the process to create our plan.

ES Trade Idea: Key Levels and Strategies Amid Macro Uncertainty :

From our ES trade plan, scenario 1 played out. The line in sand for long trades was Key LIS/Yearly open. Click on the link above to see how this played out!

Our key levels for the trade idea noted in the blog were:

(mcVAH) micro composite value area high: 6,134.25

Key LIS/Yearly Open: 5,949.25

(mcVAL) micro composite value area low: 5,914.25

(CVAH) Composite Value Area High: 5,924

mcVAH held as an area of initial resistance. Our neutral zone at 6,068.25 - 6,051.50 acted as a zone for pullback after initial push higher. The remaining week was choppy with some days more volatile and playing out per our scenario 1 in our trading plan.

CL Trade Idea: Key Levels & Strategies Amid Volatility:

From our CL trade plan, scenario 1 also played out.

Why we favored this as scenario 1 was due to rejection confirmed at January 2025 mid range. The provided a good short opportunity below Jan 2025 mid or February monthly open towards our key levels as specified in the trading plan. We mentioned the following key levels in last week’s plan.

Micro Composite Value Area High (mCVAH) January 2025: 76.00

January 2025 mid- range: 74.96

February Monthly Open: 74.14

Micro Composite Value Area Low (mCVAL) January 2025: 71.82

Yearly Open: 70.52

2024 Mid- Range: 70.40

mCVAL provided a good target for short trades, while Yearly open and 2024 Mid-range confluence at our key bull support provided a good spot to initiate the long trade idea.

Following a consistent process can help traders stick to a trading approach that can help them achieve consistency. Losses are an inherent part of trading, executing the trade plan also involves weighing which scenario will play out on the hard right edge in real- time. However, our market analysis blogs are aimed to educate traders, showing whatever their methodology or approach, consistency in preparation and having a roadmap of important price levels will help them distinguish between getting caught in noise versus important areas to engage with markets.

Analyzing Our Crude Oil Trade Plan & Key LevelsNYMEX:CL1!

This is our first blog recapping the trade plan from the prior week. In this blog, traders can take a sneak peek into why we choose and plot the levels we do on our charts. However, these are simply our thoughts and ideas on the market—we do not know what will happen. You should carefully consider whether this approach aligns with your own trading strategy and risk tolerance before making any decisions.

Do you struggle with analysis paralysis in your trading? Don’t worry—we will help you develop a process that you can customize and apply to your own market approach.

Markets by nature have randomness and uncertainty built in. Markets move based on the collective psyche of the participants. These footprints left behind by the collective participants analyzed through volume profiling and multiple time frames is what provides us with our selected support and resistance zones.

To help you better understand our chart setup, here’s how we define key zones and indicators:

On our charts, we use color-coded zones to highlight key market levels:

Green zones indicate bull support areas.

Red zones represent bearish support areas.

Blue zones act as neutral zones but serve as important inflection points.

The Line in the Sand (LIS) is a crucial reference point:

A single LIS can be used to validate both long and short trade ideas.

Alternatively, there may be separate LIS levels—one confirming long trades above it and another confirming short trades below it.

Some other terms that you will commonly find in our blogs are:

VPOC (Volume Point of Control): The price level with the highest traded volume within a given volume profile.

VAH (Value Area High): The upper boundary of the value area, typically representing the +1 standard deviation level in the volume distribution.

VAL (Value Area Low): The lower boundary of the value area, typically representing the -1 standard deviation level in the volume distribution.

Value Area: The range where approximately 70% of the total traded volume occurs, falling within one standard deviation of the distribution.

Important and significant levels on our charts are marked. You can see on the crude oil chart, that we consider mid ranges of defined year, quarter, month, week as significant areas of interest and reaction by market participants.

We also give importance to HVN (High Volume Nodes) and LVN (Low Volume Nodes) and how price usually reacts to these visible distributions of high and low volumes on the volume profile.

Our analysis begins with four key questions that guide our market perspective and decision-making process:

What has the market done?

What is it trying to do?

How good of a job is it doing?

What is more likely to happen from here?

These questions are not intended to decipher the reasons behind market movements or predict outcomes based on personal bias. Instead, they provide a structured framework using Auction Market Theory, Volume Profile, and market-generated significant levels to develop a trade plan—whether for the day or the week.

This trade plan does not dictate specific trades to take; rather, it serves as a roadmap, outlining the key areas where we may want to engage with the market.

To illustrate the importance of structured market analysis and preparation, let's review how our recent crude oil trade plans have played out:

Week of January 27, 2025 – Crude Oil Plan Recap :

The initial trade plan played out, but a pullback occurred.

Buyers stepped in, pushing prices back toward the Blue zone (also the LIS for longs and shorts).

Long positions were only valid after confirming a reclaim of the January 2025 mid-range.

Crude oil then moved sharply toward our key bull support zone before rebounding higher.

This completed the trade plan scenario outlined in red.

Week of January 13, 2025 – Key Takeaways :

We identified the start of bullish momentum in crude oil following a long Q4 2024 consolidation.

Two short trade scenarios were outlined, with the first playing out as expected.

Reviewing past trade plans helps traders develop a structured market preparation process.

This analysis was featured in the Editor’s Pick, mapping out key levels and our thought process.

As we mentioned earlier, we do not have a crystal ball but we do have insights when planning for the week. If you are incorporating this weekly plan, please also monitor and be ready to adjust with new information that is provided on the hard right edge.

If you click the play button on most of our trade plans and just consider that week’s price movement, you may notice that our plans have thoughts and efforts put in them.

Crude oil remains on a bearish pathOil prices have fallen noticeably since Trump’s last minute deal to delay tariffs. Yesterday’s rebound on Trump's "maximum pressure" plan for Iran has proven to be short-lived. The negative effect of a US-China trade war on demand, as well as rising global supplies, is what is holding back prices. Even if Trump hadn’t delayed tariffs on Mexico and Canada, when considering both supply and demand factors, the overall impact on crude oil prices may well have been limited anyway. In any event, oil prices extended their losses after the OPEC+ agreed to stick to its policy and raise output gradually from April. Prices have fallen further today on the back of the latest inventories report from the US. A big 8.7 million barrel build was reported, which surprised the market given only a 2.4m build was expected. Against a backdrop of rising OPEC+ supply and the potential for increased non-OPEC supply growth, mainly in the US, the crude oil forecast remains modestly bearish.

From a technical perspective, crude oil remains in a modest downtrend, with WTI consistently forming lower highs since September 2023. A brief breakout above this trend in January met strong resistance just below $80, pushing prices back under the trend line by month-end. With the bearish bias reaffirmed and WTI slipping below the 200-day moving average again, downside risks remain dominant.

In terms of support, the area between $70.00 to $70.70 marks a key battle ground. This is where the price of oil last staged a rally from at the back end of last year. If we see a bounce here, I will then look for that bounce to fade as prices come up to test some key resistance levels…

Key resistance levels to watch include the recently broken support at $72.50, the 200-day average at $74.30 and the psychologically significant $75.00 mark. The bearish trend line hovers around $76.00.

By Fawad Razaqzada, market analyst with FOREX.com

CL Trade Idea: Key Levels & Strategies Amid VolatilityNYMEX:CL1!

With Trade War 2.0 unfolding, managing risk in futures trading is more crucial than ever. One way to mitigate risk is by utilizing micro CME contracts , allowing for more precise risk management during volatile market conditions. Additionally, you can participate in the CME and TradingView paper trading competition, giving you the opportunity to test your skills in The Leap without risking real money.

Crude Oil Futures:

It’s the start of a new month. We saw our last week’s idea “scenario 1” partially play out before prices pulled back higher towards our neutral LIS.

As mentioned above, it is our opinion that current situations and macro news may result in heightened volatility, so it is important to trade what you see and not what you think.

Do not get fixated on your view on the market. Be ready to shift and adapt as the markets evolve on the hard right edge.

Instead of recapping and presenting a macro update today, we will shift our focus on the charts. Looking purely at price, time, volume, and key levels to create a plan for the week.

Key Levels to Watch

Key levels represent areas of interest and zones of active market participation. The more significant a key level, the closer we monitor it for potential reactions and trade setups in alignment with our trading plan.

Micro Composite Value Area High (mCVAH) January 2025 : 76.00

January 2025 mid- range: 74.96

February Monthly Open: 74.14

Micro Composite Value Area Low (mCVAL) January 2025 : 71.82

Yearly Open: 70.52

2024 Mid- Range: 70.40

Scenario 1: Rejection confirmation at January 2025 Mid

Price has attempted to push above January 2025 mid and was rejected. This was a key level of interest to validate longs in our last week’s trade plan. Rejection of this level and price now below monthly open. There is room for prices to shift lower towards mcVAL Jan 2025 and test of key bull support at yearly open and 2024 mid range.

Scenario 2: mcVAL 2025 to act as intermediate support

If we see this level hold, in our opinion, Crude oil may be establishing a new range capped within mcVAH and mcVAL Jan 2025 until we see a break of either side. That said, intra day volatility may increase with headline news impacting prices.

As always it is paramount to manage your risk as losses are an inherent part of trading.

What are you focusing on amid all the headline news? We'd love to hear your thoughts!

Crude Oil Trade Idea: Bounce from Support or Rally to $80?Macro Update

Index futures sold off during overnight trading as market sentiment turned risk-off.

Newswires reported that, after Colombia denied entry to two U.S. deportation aircraft, President Trump announced emergency tariffs of 25% on all Colombian imports, with plans to increase them to 50% next week. Additionally, The Wall Street Journal noted growing support among President Trump's advisors to impose 25% tariffs on Canada and Mexico as early as Saturday to initiate negotiations.

Meanwhile, Chinese startup DeepSeek is challenging U.S. dominance in the AI sector by introducing a low-cost model rivaling OpenAI's o1. This development may intensify geopolitical and economic tensions.

Adding to the unease, Chinese Manufacturing and Non-Manufacturing PMIs missed expectations. Manufacturing PMI came in at 49.1, below the forecast of 50.1. Markets in China and most of Asia will remain closed starting Tuesday for the Lunar New Year holiday, which could lead to lower regional liquidity.

Looking ahead, the week features several high-impact events:

Wednesday, January 29:

Federal Reserve interest rate decision and the first FOMC press conference of 2025.

Bank of Canada interest rate decision.

Thursday, January 30th:

ECB interest rate decision

Preliminary Q4 GDP data (QoQ).

Friday, January 31st:

Core PCE Price Index (Dec).

Crude Oil Futures Update

Our prior trade idea from January 13 played out well, with Scenario 1 materializing. While prices briefly approached $80, crude oil futures have since retreated to trade near the $74 handle.

As we close out January, here’s an updated map of key levels to watch:

Key Observations:

On the chart, we can see a downtrend channel after the recent push higher in crude oil. Our blue zone is our LIS (73.65 - 74 zone).

We see the market pulling back towards the confluence of 2024 VAH, 2024 mid range and 2025 yearly open. This is our key support for bulls to take long trade.

Scenario 1: Down and Back Up

Watch for a pullback toward the key confluence zone from our LIS. A bounce from this confluence zone could offer a strong opportunity for bulls to take long trades, targeting higher levels.

Scenario 2: Rally Toward $80

If prices reclaim the January 2025 mid-range and confirm bullish setups, long trades targeting a move back toward monthly highs in the $80 range may develop.

For risk management during volatile conditions, traders can consider Micro Crude Oil Futures . Managing risk is paramount, as losses are an inherent part of trading.

This week’s data releases, geopolitical developments, and tariff announcements are likely to shape market sentiment. Stay cautious and adapt to new information as it unfolds. Risk management remains the cornerstone of success in volatile markets.

Not confident to incorporate these into your trading plan? Why not incorporate our trade ideas to your trade plan in TradingView and CME’s paper trading competition; “The Leap”.

WTI set for breakdown amid supply, demand concernsAlthough oil prices were trading higher at the time of this writing, it is becoming increasingly difficult to foresee a big rally at this stage, without any supply-side shocks.

WTI's price action has been quite heavy as it continues to make lower lows and lower highs. While it has held its own around the December 2023 levels of around $67.00 to $68.00 area, this could prove to be a temporary respite before we potentially see a bigger breakdown. Not only has oil broken the key $69.30 to $70.00 support range, which is now holding as resistance, sentiment towards oil is increasingly turning bearish amid growing signs of excess surplus from non-OPEC.

Indeed, the oil market is heading for a surplus next year, according to the IEA. The agency is forecasting an excess of over a million barrels per day, mainly due to faltering demand from China. Once the driver of global oil consumption, China has seen demand shrink for six consecutive months, largely as its economy pivots to electric vehicles and high-speed rail.

Growing supplies from the US, Brazil, Canada, and Guyana keep the market well-supplied, says IEA. Demand growth this year and next will stay subdued due to slower economic growth and clean energy transitions.

OPEC+ plans to cautiously restart production, with a 180,000-barrel-per-day increase set for January, though they’ll reassess in December. With supply growth outpacing demand, the market is likely to stay comfortably stocked well into 2025.

Against this backdrop, crude oil looks set for a sharp drop after drifting lower in recent weeks.

By Fawad Razaqzada, market analyst with FOREX.com

COT Strategy - Crude Oil LongsDISCLAIMER: This is not trade advice. This is for educational purposes only to demonstrate how I am looking to participate in this market. There is significant risk involved in trading, do your own homework and due diligence.

COT Strategy

Crude Oil (CL)

My COT strategy has me on alert for long trades in CL again this week. To clarify, this was setup last week also, and triggered me long this week via a CCI divergence long trigger. Based on this weeks COT strategy analysis, I think this is a nice market for further upside and will look to enter again via 18MA & 10H8C MAC entry methods.

COT Commercial Index: Buy Signal.

Net Positioning: Max long of last 3 years - bullish.

Small Spec Index: Buy Signal.

Valuation: Undervalued vs Gold & Treasuries.

Front Month Premium Market.

True Seasonal up to Mid October.

Supplementary Indicators: Stochastic.

Remember, this is not a "Long Now" idea. These indicators are not timing tools. They simply tell us that this market could have a move of some significance to the upside, which we will participate in with a Daily long trigger.

Good luck & good trading.

Smart Money Positioned to LONG Crude Oil - COT StrategyDISCLAIMER: This is not trade advice. This is for educational purposes only to demonstrate how I am looking to participate in this market. There is significant risk involved in trading, do your own homework and due diligence.

COT Strategy

LONG

Crude Oil (CL)

My COT strategy has me on alert for long trades in CL if we get a confirmed bullish change of trend on the Daily timeframe.

COT Commercial Index: Buy Signal

OI Analysis: Generally last few weeks OI has drifted lower while CM's adding to longs - bullish. CM's approaching extreme long positioning, but not quite there yet.

True Seasonal: True seasonal to go up until mid October - bullish.

COT Small Spec Index: Buy Signal

Front Month Premium - Bullish

Supplementary Indicators: %R & Stochastic

Remember, this is not a "Long Now" idea. These indicators are not timing tools. They simply tell us that this market could have a move of some significance to the upside, which we will participate in with a confirmed Daily trend change to the upside.

Good luck & good trading.

Upside Ahead for Crude Oil - COT Strategy LongDISCLAIMER: This is not trade advice. This is for educational purposes only to demonstrate how I am looking to participate in this market. There is significant risk involved in trading, do your own homework and due diligence.

COT Strategy

LONG

Crude Oil (CL)

My COT strategy has me on alert for long trades in CL if we get a confirmed bearish change of trend on the Daily timeframe.

COT Commercial Index: Buy Signal

OI Analysis: Down move since July and recent consolidation has seen CM's getting more long.

Valuation: Undervalued VS GOld

True Seasonal: Strong seasonal tendency for oil to go up to mid October.

Front Month Premium: Front month delivery contracts selling at premium to further out contracts. This is bullish, and is a sign that we could see a commercially driven bull move.

COT Small Spec Index: Buy Signal

Supplementary Indicators: Acc/Dist Buy Signal

Remember, this is not a "Long Now" idea. These indicators are not timing tools. They simply tell us that this market could have a move of some significance to the downside, which we will participate in with a confirmed Daily trend change to the upside.

Good luck & good trading.

$CL_F reached the strong support for an upside wave extension$CL_F is bouncing off the strong upside support 71.50 and that is aligned with the uptrend channel support and the rising uptrend line. We could see a test of the 81.50 resistance in the coming weeks for an upside extension in the third wave.

Oil (CL) Should Continue Lower to Build an Impulsive StructureShort Term Elliott Wave View in Oil (CL) suggests that cycle from 4.12.2024 high is in progress as a 5 waves impulse Elliott Wave structure. Down from 4.12.2024 high, wave (1) ended at 72.48 and rally in wave (2) ended at 84.55. The commodity has turned lower in wave (3) with internal subdivision as another impulse in lesser degree. Down from wave (2), wave (i) ended at 83.07 and rally in wave (ii) ended at 83.45. Oil then extended lower in wave (iii) towards 81.25 and wave (iv) ended at 82.16. Final leg wave (v) ended at 80.81 which completed wave ((i)) in higher degree. Wave ((ii)) unfolded in an expanded flat structure where wave (a) ended at 83.74. Wave (b) lower ended at 80.22, and rally in wave (c) ended at 83.82 which completed wave ((ii)).

Oil has turned lower in wave ((iii)) ended at 76.40 low. The market built an expanded flat correction as wave ((iv)) finishing at 78.60 high and turned lower again. CL broke below wave ((iii)) to end wave ((v)) of 1 at 74.59 low and also we ended wave 1 of (3). Up from wave 1, the market bounce in a zig zag correction ending wave 2 at 78.88 high and starting wave 3 of (3) to the downside. After 5 swings lower, wave ((i)) of 3 completed at 71.67 low and currently we are calling 3 swings higher to end wave ((ii)) pullback before resuming lower. Therefore, we expect further downside to complete wave ((iii)) of 3. Near term, as far as pivot at 78.88 high stays intact, expect rallies to fail in 3, 7, or 11 swing for further downside.

Crude Oil Trade Idea for Next Week - CL CLK2024 USOIL Crude OilThe weekly candle close this week respected the bearish weekly volume imbalance, respected the bearish weekly orderblock, and failed to close above the previous weeks high.

For this reason, I am targeting the PWL as a DOL.

I will be looking for price to trade up into H4 premium arrays and reject from them. Once I see bearish arrays being respected on the H4, I will look for m15 bearish displacement to confirm entry with the PWL as the target.

CL Crude Oil WTI LONGMy bias all week has been for oil to trade to the PWH. So far, I've been given no trigger to get involved.

However, end of NY session saw H4 candle bullish closing disrespecting bearish arrays.

I want to see these levels respected as bullish arrays to then look for m15 bullish displacement long entry.

CL WTI Crude Oil ShortMy weekly bias is for price to trade up to previous weeks highs, but Mondays price action has me leaning towards a pullback before we trade up mid/late week.

Today's candle was quite bearish, so I am looking for price to trade down to Monday's lows, and possibly trade into the untapped lows from several daily candles formed last week.

I want to see price trade into and respect a bearish premium array to trigger me to look for short entry on m5/m15.

CL! | Crude Oil | InformativeNYMEX:CL1!

It has formed an Inverse Head and Shoulders pattern on the 4-hour chart. If it breaks above the bullish line around $79, we can expect a rise to $90 very soon. This expectation is supported by the PPI and CPI data, along with China reopening next week, which will likely push oil prices higher.