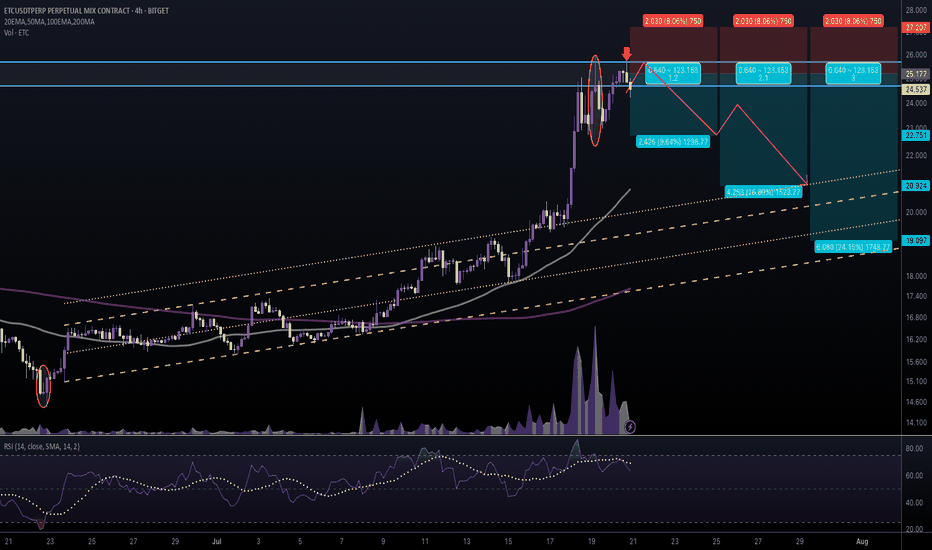

#ETCUSDT #4h (Bitget Futures) Ascending channel retestEthereum Classic printed two evening stars in a row, looks locally topped and ready for correction towards 50MA & 200MA supports.

⚡️⚡️ #ETC/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.0%

Entry Zone:

24.679 - 25.675

Take-Profit Targets:

1) 22.751

2) 20.924

3) 19.097

Stop Targets:

1) 27.207

Published By: @Zblaba

CRYPTOCAP:ETC BITGET:ETCUSDT.P #4h #EthereumClassic #PoW #L1 ethereumclassic.org

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +48.2% | +84.5% | +120.7%

Possible Loss= -40.3%

Estimated Gaintime= 1-2 weeks

CLASSIC

XAUUSDWe have two scenarios in the analysis: either a rise in the form of a trend, a staircase, or a deep correction and taking the buy zone. We wait for the deep correction of the market and taking the buy zone. However, if it rises in the form of a staircase, we will renew the entry, but in the event of any entry, geopolitical situations end the analysis and we analyze another analysis or another renewal.

#ETCUSDT #1D (Bybit) Descending wedge breakout & retestEthereum Classic regained 50MA support and seems to be heading towards 200MA resistance, probably after a pull-back.

⚡️⚡️ #ETC/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (3.0X)

Amount: 4.6%

Current Price:

20.620

Entry Targets:

1) 19.256

Take-Profit Targets:

1) 24.837

Stop Targets:

1) 16.459

Published By: @Zblaba

CRYPTOCAP:ETC BYBIT:ETCUSDT.P #1D #EthereumClassic #PoW ethereumclassic.org

Risk/Reward= 1:2.0

Expected Profit= +86.9%

Possible Loss= -43.6%

Estimated Gaintime= 1-2 months

LINK - Bullish Control Soon...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After rejecting the $20 round number, LINK has been in a correction phase in the shape of a falling channel marked in orange.

Currently, LINK is hovering around a strong structure, support and round number $10.

🏹 Once the orange channel is broken to the upside, we will expect the next bullish phase to start leading to a movement towards the $20 mark again.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ETC/USD Main trend. Fractal cyclic structureLogarithm. Time frame 1 week. The main trend.

Duplicated on the exchange OKX, a little added to understand the logic and accuracy, as on the exchange poloniex, there is no liquidity. If something happens to have an idea on a more liquid exchange. As this cryptocurrency is interesting.

Major trend. Channel. Publication 01 2023

Linear Now in Moment.

Local now at the moment.

Locally. Let me remind you that from the main zone of the cryptocurrency set (horizontal channel) the average price is now exactly +84%. Compared to other assets, during the transition from the accumulation phase to the participation phase (Dow), the price did not increase very much compared to other cryptocurrencies. That is, a conditionally lagging asset.

A triangle is forming . In a localized rising set trend. From this zone, about 40-50% left to the rounded bottom resistance zone (final accumulation phase).

Then it will be business as usual, on stocks or liquid cryptocurrencies. Breakout of resistance, perhaps not immediately, but that's not the point. After breakout, consolidation, then re test and news negative/positive. Confirmation, and the beginning of strong, conditionally irrevocable impulsive movements into the zone of “news perspective of this blockchain”.

This is when ETH will be above or near $10,000. This will be its first consolidation — a partial reset before being pulled into the final reset (distribution) price zone. In this consolidation, not up to the maximum prices, the progenitor of expensive ether, that is, ETC, as before, will surprise everyone with an aggressive news background. With a high degree of probability, all speculative games, as in the last cycle during pumping, will be “slightly wavy”. Don't forget to sell and don't be greedy...

For those who are not traders at all. So which of the hamsters has iron balls, throw in a couple of hundred dollars and forget it, conditional retention without trading for 9, 13 and 19 months. Sold in 3 parts (optional). But, if you don't sell, you will get scared between these market pumping “time zones” and sell everything during the “fear”. If there is profit in advance, then it “warms the soul” and the feeling of lost profits will not play a cruel joke.

Money management. Leave a third of the invested money in dollars, for additional purchases, in case there is a spill in the market (only 1 significant, sharp, unexpected). Ignore everything else, there will be enough coins to earn money. If the dollars are not spent and the price flies away, do not buy crypto candy wrappers, but buy a gift for your loved ones.

I am sure that many hamsters , when a trend allows absolutely everyone to make money, will imagine that they are real traders and decide to increase the number of coins. I am 99.9% sure that on futures (your psychology is known in advance) if you take inadequate risks, you will lose all coins up to half the maximum price.

⚠️ Adequately evaluate your skills and behavior . Therefore, for some people who are relatively poor but want to become rich, very quickly, it is better not to trade or even be interested in the market until the market is in the distribution cycle, that is, the highs (late 2024 and 2025). Otherwise, each local peak (as always) in a growing trend will be perceived as the end, and when the end comes, on the contrary, as not yet a maximum.

$ETC may have another leg down to 20.00 area on 4hHere on BME:ETC , we can see a lot of down pressure on the 4h time frame

The 1st and 3rd targets was already achieved as is indicated over the numbered pink arrows as this targets were from the downtrend above

Now, it looks like a downtrend flag is forming inside the yellow area

This flag is giving us another 2 more down targets the coincide with the floor of yellow channel and another blue support down there

So here we have a lot of confluences that indicate this downward pressure will happen

As CRYPTOCAP:BTC is still going sideways and there is some form of cooling down this last days, is much plausible that BME:ETC will have a final last drop on targets number 2 and number 4

LUNA Classic $0.00 00 88 | Back in BiznazLuna is no different from any crypto

it just proved that players are man for himslef

and OGs were rooting for this to fail as it OVERSHADOWED the pioneer in the space

now it's got a Big Brother to take this to better days

Ethereum Daily ForecastEthereum, alongside Bitcoin and Dogecoin, is one of those cryptocurrencies that are well-known even outside of the crypto community. And it is for a good reason — Ethereum is one of the most feature-rich and interesting blockchains out there.

Ethereum ETH/USD ends the trading week at 1623 and continues to move within the correction and bullish channel. Moving averages indicate a bullish trend for ETH/USD. Prices have broken through the area between the signal lines downwards, which indicates pressure from cryptocurrency sellers and a potential continuation of the fall from current levels. At the moment, we should expect an attempt to develop a price fall and a test of the support level near the 1505 area. From where we can again expect a rebound upward and continued growth in the rate and value of Ethereum with a potential target above the level of 2235.

Technically:

Stabilzing above 1665 will support rising to get 1721 and above it 1865

But, now the price will move depending on the parallel channel, So as long as the price trades inside the channel it means has a abearish trend to reach 1543 adn under it 1447

timefrmae daily

Ethereum Bulls to Target $2,100 on Easing Recession Fears Cryptocurrencies have also been seen by some investors as a speculative hedge against inflation and the Fed's plans to curb inflation could weigh on the broader cryptocurrency sector.

On Friday, ETH joined the broader crypto market in a bullish session, gaining 6.28% to end the day at $1,996.

US economic indicators and staking statistics supported an ETH return to $2,000.

However, the technical indicators remained bullish, signaling a return to $2,100.

BIAS SHORT- and MIDTERM BULLISH

Stong Supports 1594 D-POC AND 1034

NEXT WEEK IS IMPORTANT

A PULLBACK TO 1034 WITH LOW VOLUME MEANS THE BULLS

WILL DISTIBUTE THEIR POSITIONS AND MOBILIZE TO ATTACK THE BEARS VERY AGRESSIVELY

A PULL BACK WITH HIGH FAT THICK LONG VOLUME MEANS BEARS

GONNA TAKE FULL CONTROL OF THE MARKET AND SEND ETHEREUM TO THE DEEPEST LEVELS POSSIBLE

LOSING OF 1034 MEANS CRYSTAL CLEAR ABSOLUTE BEAISH TREND

ON THE SAME TIME THIS ZONE IS A LOW VOLUME AREA: IF VOLUME IS INCREASING IN THIS AREA AND THE BULLS DO NOT ANSWER AGGRESSIVELY AND QUICK, we will ceate a midtem sideways and consolidating area: WHAT DOES THAT MEAN?

WELL THE BULLS TRY TO TAKE PARTIAL POFITS OR COMPENSATE THEI LOSSES WHILE SELLERS AND BEARS WILL ACCUMULTAE MORE CAPITAL AND LIQUIDITY TO PRESS DOWN THE COIN

THEN 1034 WILL BECOME THE FIST BUT VERY STRONG RESISTANCE!

MY 8Q STRATGY: 6Qs ae bullish 2Qs neutral: bUT THE MOST IMPORTANT AND LAT CONFIRMATION IS BEARISH

I CALL THIS BULL/BEAR TRAP DESTROYER!!!

AND SEE YOURSELF THE PAST RESULTS!!!! AMAZING HUH?

WELL UNTIL THIS LAST CONFIRMATION IS RED I TRADE THE BEARISH SETUP: GOING SHOT NEAR OF THE HIGH

AND PUTTING A VERY TIGHT STOP AT AROUND 2180USD!

WHY?

BECAUSE THE 2093 THE CONFLUENCE WEDGE LINE IS VERY IMPORTANT TRIGGER

THAT ALMOST WORKS AS SUPPORT AND RESISTANCE!

BREAKING ABOVE 2096+ pullback and holding above this area+ High volume means BULLISH SET UP. Better: Use divergence if pullback

(SEEL PULLBACK SCENARIO in PINK)

You must have highe highs and higher lows and then take the move after the 2nd HH and HL

Stop. I give more rooms to trae and try to myake it very difficult for the maket to hit me.

You Stop. DEPENDS ON YOU RISK AVERSION ;CAPITAL SIZE;ACCOUNT SIZE;LOT SIZE

But I recommand ALWAYS TO WORK WITH STOPS !!!ALWAYS!!! AS PROTECTION YOUR CAPITAL IS THE MOST IMPORTANT LAW AND RULE OF SUCCESSFULL TRADING!!!! EVER!NEVER!

A mixed start to the day saw ETH slip to an early low of $1,876. Steering clear of the First Major Support Level (S1) at $1,858, ETH rallied to a late afternoon high of $2,000. ETH broke through the Major Resistance Levels to end the day at $1,996.

US Jobs Report Eased Recession Jitters but Leave Fed Rate Hikes Subdued

It was a busy Friday session for the global financial markets. The all-important US Jobs Report drew interest ahead of next week’s US CPI Report.

Nonfarm payrolls jumped by 253k in April versus a forecasted 180k increase. In March, nonfarm payrolls rose by 165k. Significantly, average hourly earnings were up 4.4% year-over-year versus 4.3% in March. Economists forecast average hourly earnings to increase by 4.2%.

As a result of the better-than-expected NFP number, the US unemployment rate fell from 3.5% to 3.4%. Economists forecast the unemployment rate to rise to 3.6%.

The Jobs Report eased recessionary fears, supporting riskier assets. However, market bets on a 25-basis point Fed interest rate hike in June remained subdued. According to the CME FedWatch Tool, the probability of a 25-basis point June interest rate hike rose from 0.0% to 8.5%. The Jobs Report did wipe out bets of a June rate cut, with the chances of a rate cut falling from 9.2% to 0.0%.

While the combination of easing recessionary fears and subdued bets of another Fed rate hike delivered support, sentiment could change on Wednesday. The US CPI Report has to show softer inflation to keep the Fed hawks silent.

USDCAD - Wait For The Trigger ↘️Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

on Daily: Left Chart

USDCAD is retesting a resistance zone in blue so we will be looking for sell setups on lower timeframes.

on H1: Right Chart

USDCAD is forming a head and shoulders pattern but it is not ready to go yet.

🏹 For the bears to take over, we need a momentum candle close below the gray neckline.

Meanwhile, until the buy is activated, USDCAD can still trade higher inside the resistance or even break it upward.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

🔥 ETC Moving To Bear Market ResistanceETC is one of the many alts who's currently underperforming the market. However, that doesn't mean that there's not trades to make.

I'm looking at the top dotted resistance line as a target. With continued market strength we might break out of the resistance, but that's something for later.

$ETC/BTC 1W (#Binance) Symmetrical triangle on supportEthereum Classic is pulling back to 200MA and has been forming a falling wedge, placing an opportunist bid sounds like a plan.

⚡️⚡️ #ETC/BTC ⚡️⚡️

Exchanges: KuCoin, Binance

Signal Type: Regular (Long)

Amount: 4.4%

Current Price:

0.000941

Entry Targets:

1) 0.000885

Take-Profit Targets:

1) 0.001387

Stop Targets:

1) 0.000684

Published By: @Zblaba

Risk/Reward= 1:2.5

Expected Profit= +56.7%

Possible Loss= -22.7%

$ETC #ETCBTC #EthereumClassic #PoW #Dino

SPX + VIX Major Market Bottom Set Up: If not here, where?Confirmation of Major Market Bottom: Clean Bottom in June plus a retest today that corresponds with extremely oversold conditions by most metrics, Tech @ Long-Term Support & Rates and USD extremely overbought-

June Bottom- Volume Spike @ low of positive px action on the SPX, with the VIX vol Spike on Negative Px action- Both confirmed with follow thru px action following weeks.

Retest: Long way to go today but a close on SPX Greater than 50%(~3650.50 atm) of todays range combined with a close Less than 50% of todays range on the VIX(~32.80 atm), creates a strong probability of a bounce which could turn into a major market bottom Odds get better if we get a volume spike as well today.

Conclusion: Great spot to get Long risk assets for investors of with a time Horizon longer than 1 day.

Luna classic next target Luna classic has risen from the dead.

1.2 percent burn on all Luna classic buys could push this coin to 1 dollar.

In the next 2 years

2 ways we can do this staying as cheap as possible so the burns blow through the coins..

Or as the price doubles so does the volume. The burns will take the same time to decrease circulating coins.

Also 7 percent of all all coins right now are being stakes which also decreases circulating supply.

Right now we are creating a flag pattern with the break out zone around the 7th which is the day the vote takes place on the 1.2 percent burn.

Breakout will take us to the next fib of around .00039

ETH Classic - ShortHello Traders and Investors,

ETC had a good run, but the top is in for it. HNS on the 5 minute which should push the price down to the closest support. A rebound back up to the neckline is possible after the first support is touched. But a continue in decline of the price is expected.

Let me know what you think.