Cleanchart

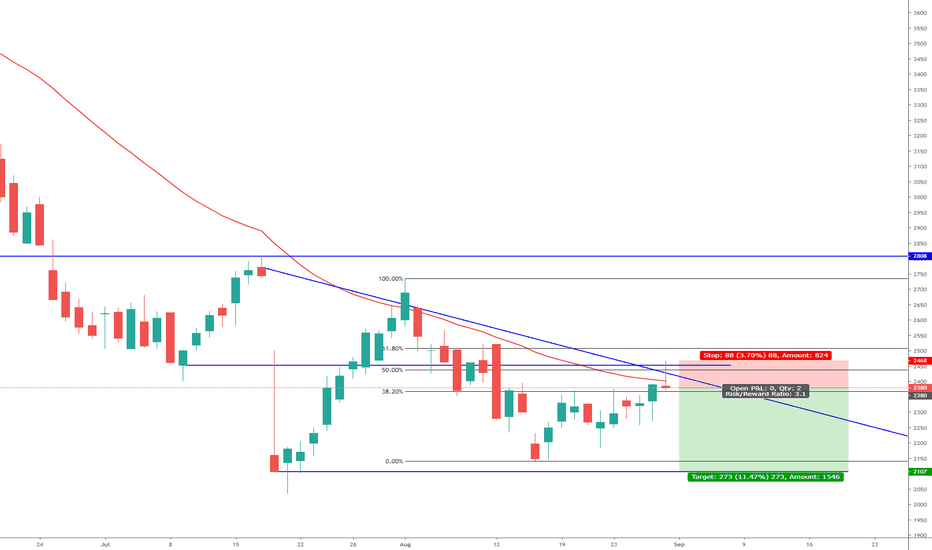

US2000 Downtrend ContinuationPrice action analysis identified US2000 downtrend continuation and short opportunity. Reversal pin bar trigger, confluence with; weekly downtrend, rejection of falling channel resistance, rejection of 50 WMA, rejection of previous horizontal support/resistance and rejection of 38% fib. Trade subject to price rising into sell limit pending order.

ASC Asos Short Opportunity Price action analysis identified LSE:ASC (ASOS) downtrend continuation and short opportunity. Reversal pin bar candle trigger, confluence with; rejection of falling trend line, rejection of 50% fib retracement, rejection of 50 WMA and rejection of previous support becomes resistance.

GBP/AUD: Potential +240 pips - Long waiting for a retestDear Traders all around the world!

If you like my work feel free to leave a like and follow not to miss any of my trades!

GBP/AUD is currently approaching EQ and has formed a bullish 12H OB on it's way up.

Therefore I'm anticipating a Long position at a bullish OB + 200-MA retest while aiming for our bearish OB.

ETH/USD: Expected breakout - 250% ROI potentialIn addition to our previous ETH/USD analysis that we just published this chart focuses on the daily.

Don‘t forget to leave a like and follow as it keeps me going:)

Forming a clear high with higher-lows is usually a strong buy signal especially if the asset is consolidating between the 200-MA and 200-EMA. Managed to hold POC with three daily candles so a breakout is expected soon.

Will take partial profit at $268-307-334 while aiming for even higher prices.

Invalidation below $182 while breaking our bullish OB.

Leverage: 5x

R/R: 2.9 - 6.1

GBPUSD long 170pipsI am looking to go long on GBPUSD for 170 pips.

The previous week closed as a bullish hammer rejecting off my weekly resistance showing a probable reversal. On daily price is as plenty bullish momentum as it approaches a resistance and descending trendline. Before entry I will be waiting for price to breakthrough and retest this zone. On 4H I can see price has consolidated in the zone before and that price may be forming a cup and handle formation in which I will be using to find entry if the pattern is complete.

My trade will look similar to this:

BUY GBPUSD @ 1.2580

SL @ 1.2530 (50)

TP @ 1.2750 (170)

R:R = 3.4 : 1

Take profit being my next weekly resistance which lines up nicely with weekly 20EMA (previously used as dynamic resistance).

AUDUSD Long(ish) term SHORT with a small drawbackEntry : Top of the trendline

SL : 0.25 - 0.40%, preferably above the previous high

TP1 : For people that are looking to lock in profits, locking them in at a 1:2 Risk Reward ratio (0.80%) is great if you're not keen on waiting + dont want to risk get stopped out at break even.

TP2 : Bottom of the downtrend channel which is atleast 2%, dependant on how long it will take to get there the approximate profit is around 2.50% or more.

If you get in at the top of the trendline (considering the price even goes there), make sure to set a stop loss at break-even or 0.05% from your entry IF the market moves the direction we're hoping for

Clean charts

Potential GBP/USD Short 1HR Entry Head & Shoulders FormationI have been doing some analysis on the GBP/USD Pair ever since the USD Strength over the past week or so. We can see this should continue with a clear head and shoulders formation on the 1HR timeframe as price is getting sqeezed. There is alot of confluences with this trade. We can see the short term trendline being respected. A beautiful 38.2% Fib Touch which was also respected this indicates that price movement could be really fast. We must wait for price to confirm the market bias to the downside with a break of the head & shoulders neckline and close below. The first target profit will be 1.28665 and the second will be 1.28243. Tight stoploss of 10-15 pips.