BTS/USDT - Breakout soon - 4H- Price level above green Ichimoku clouds => Bullish

- Ichimoku clouds in the near future are becoming more thick => More difficult to break down

- Symmetrical triangle => ndicating breakout tonight

- RSI => Still looking bullish with higher lows, going up & not currently in oversold level.

We know that breaking downwards is becoming increasingly difficult due to the ichimoku indicator, while the symmetrical triangle is soon to unfold. This gives bias for an upwards breakout.

TARGETS

- .16$

- .17$

- .20$

Take profit slightly below target.

Also keep in mind, BTC started moving again. This can make the crypto market more volatile & unpredictable.

Clouds

Ichimoku entry XRAYthis one's a little weird on the ichimoku front, as the base and conversion lines shared values ever since earnings, but it does count as a cross when it popped over today. Meanwhile there's a lot to like about this chart; nice boost after earnings that persisted without giving back ground, and now momentum is building behind it (i think this is what Ichi is finding here). So if not a pop, it looks like most likely we'll see steady upward creep, which we don't mind harvesting for a few days. We'll hope to get out around $64

Ichimoku entry ANTMStrong momentum here, looking for continuation based on the leading span crossover. GO ANTMAN

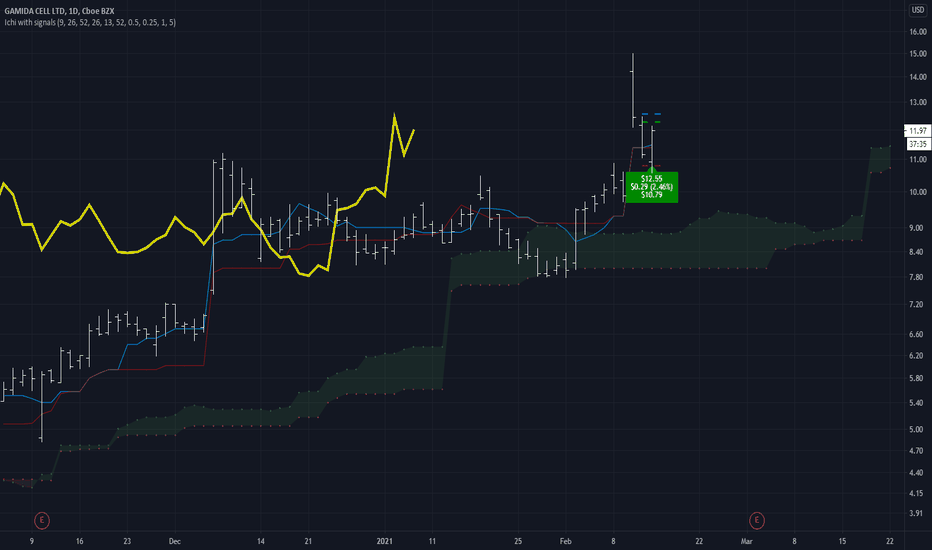

Ichimoku entry GMDAI'm a little biased against this type but we've seen a few go really big lately so let's go for it.

Ichimoku entry TOTrevisiting exit strategy yet again. I now think 0.5/0.1/1 is the way to go. That super tight stop loss def seems like more of a stop profit in most cases.

BTCUSD - H4 : CURRENTLY IN THE MIDDLE OF THE CLOUDS...H4 : Currently in the middle of the clouds and below the Mid Bollinger Band and Kijun-Sen !

As mentioned earlier in my D1 analysis, the H4 clouds support zone, so far, worked perfectly

well in rejecting 5 times breakout attempts...

Current price action is showing a sideways move between Tenkan-Sen level on the downside

and MBB & Kijun-Sen on the upside.

Therefore, on short term, those area should be watch at very carefully as a breakout of one of those

area will show the direction for the upcoming trading period.

The clouds should also be considered as a good indicator as we should see soon or later either an upside or

a downside breakout.

For the time being, recent and current price action is likely to trigger a downside breakout of the clouds.

In order to monitor intermediate price action in waiting the next H4 closing, watch carefully H1 and M15

to get early signal of change in the expected bearish scenario.

Have a nice weekend, have fun, all the best and take care

Hope my analysis bring you some added value in your trading decision and if you like it, many thanks to give me a like

and also add me in your following list.

BTCUSD - D1/H4 - MID BOLLINGER BAND AS THE LEADING INDICATOR !D1 : Mid Bollinger Band remains "THE" leading indicator.

Indeed, after having closed, before yesterday above MBB, the failure, yesterday to confirm it, triggered a new selling pressure

and as a result, the previous bullish candle has been neutralized by a bearish engulfing pattern yesterday which close below MBB;

Today's ongoing candle is pointing to the SOUTH, currently below both Kijun-Sen and Tenkan-Sen having already reached an intraday

low of 46294 early this morning.

In order to neutralise this ongoing bearish price action, BTC should at least recover firstly above KS @ 48200 and then much more important

above MBB @ 50019 and expecially hold and stay above it.

It is not a surprise that MBB coincides roughly with the psychological level of 50'000, former support level which becomes now the new resistance

level to break !

In this time frame, once again, today's closing will be very important.

H4 : Currently trying to breakdown the support line of the downtrend channel.

Clouds worked well so far as support zone in rejecting a first breakout attempt.

Globally picture remains heavy and for the time being on this time frame, it looks more

a SELL on rally than a BUY on dips.

In order to neutralise the downside risk in this time frame, BTC need, firstly to recover above the resistance line of the downtrend

channel and secondly above MBB and hold above it

As usual watch H1 and M15 to get intermediate clue in shorter time frames.

Have a great trading day and please, if you like my analysis, do not forget to like it and add my on your following list.

Ironman8848

Ichimoku entry STLDMaking a pretty drastic change in the exit strategy; well, same strategy just tightening up the stdDev multipliers a LOT. new stop loss is going to be just 10% what it was, trailstop activation trigger is cut in half, and trail stop is going from 0.25 to 0.1. These are all configurable in the script.

been doing some backtesting and it seems like this tactic of getting out much faster in all cases will yield to bigger overall gains even though i'll probably miss even more big runners.

BTC - H1/M15 - FAILURE TO BREAKOUT MBB !!!H1 : Nice recovery seen over the last couple of hours.

Facing tough resistance to break (MBB @ 47975) and clouds resistance area too !

Watch carefully the next candle (s) to check if there is enough momentum to upside breakout.

Watch indicators for signals.

M15 : The ascending triangle detected early this morning has been validated by a first breakout, then

pullback towards the triangle resistance line and then upside move again.

Nevertheless, the fact that on H1, BTC missed to move above MBB put this ascending triangle on hold,

waiting confirmation if we will hold above the clouds which is now the new very short term support

coupled also with MBB (currently @ 476159

Technical indicators are pointing to the South again...

CONCLUSION :

Watch very carefully price action on M15 OVER THE COMING PERIODS FOR VALIDATION OR INVALIDATION !!!