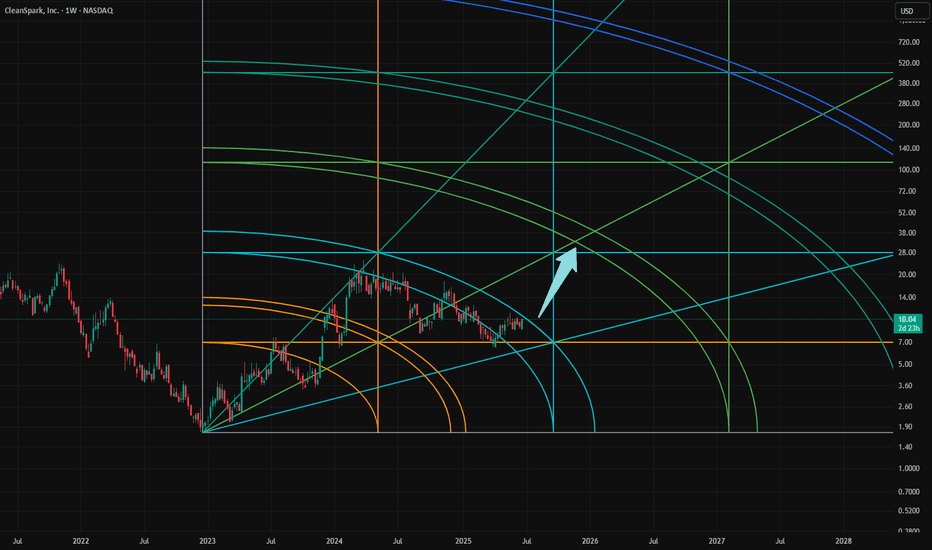

$CLSK Trapped between Critical Resistance and Support?NASDAQ:CLSK Shot through the weekly 200EMA and hit the weekly pivot resistance and was rejected into the High Volume Node (HVN) just below.

If the count is correct we should see price breakthrough in wave 3 after some consolidation and continue up after wave 2 tested the .618 Fibonacci retracement and HVN as support.

Heavy resistance HVN coupled with the R1 pivot at $20.40 will prove another challenge to overcome. Ultimately, if the count is correct AND Bitcoin doesn't tank we can expect a challenge of the all time highs up at $60.

I already closed partial take profit myself at the weekly pivot on a recent trade and will be looking to go long again to the those targets. Make sure to always be taking profits on the way as nobody has a Crystal ball!

RSI is currently printing a bearish divergence on the weekly so we need to see that negated.

Analysis is invalidated below $6.

Safe trading

CLSK

Mega bull trend starts now, CLSKIn short:

1) Goldencross soon to be triggered.

2) too see how the stock could perform (with accumulated, low 200dma), we can look in 2023. It peaked in mid July. After explosive rally in november.

3) 13$ levels is the 50% fibonacci..

4) 1st Elliot wave - people are skeptical. 2nd - woohoo. 3rd wave - fomo.

//Advancing in relative strength (CLSK/SPX).

//Small cap ( AMEX:IWM ) outperformance due to rate cut cycle (starts in September). Evidence is yesterday broadening rally.

//52WH is at november 18$. Expect a gamma squeeze?

position based on probabilities. I never make targets (future is unknown).

🥂

CLSK Finally Ready for a strong move up?Price printed a textbook motif wave 1 and ABC wave 2 correction ending at the 61.8 Fibonacci retracement golden pocket and High Volume Node (HVN) major support.

Price continues to flirt with weekly 200EMA and looks ready for another test as resistance on the local chart.

The weekly pivot still looms above but if price is in a macro wave 3 we should punch through these resistances over the next few weeks and head towards long term target of $80.

Wave 2 can extend all the way $1.80 before invalidation, though the lower prices goes, the lower the probability of the analysis being correct

Safe trading

CleanSpark Inc. (NASDAQ: CLSK) Stock Analysis and ForecastCleanSpark Inc. (CLSK) recently experienced a pullback from the $11.09 level, closing at approximately $9.36 at the end of last week’s trading session. This movement may indicate the formation of another lower low, aligning with the current broader market sentiment.

Upon reviewing the technicals, particularly the ascending trendline, the following entry strategy is proposed for potential trading opportunities:

Entry: $9.36

Stop Loss: $8.47

Take Profit 1: $12.00

Take Profit 2: $12.50

As always, it’s crucial to approach trading decisions with caution and implement appropriate risk management strategies.

Reason: The analysis is based on recent price action and technical patterns, but market conditions and external factors can shift trends unexpectedly.

If you found this analysis helpful, please like, comment, and share.

AMERICA'S BITCOIN MINER: CLEANSPARKThe chart for Ethereum Futures is showing a promising inverse head and shoulders pattern. This indicates a potential turnaround for the struggling bitcoin mining industry. It appears that miners are behaving more like altcoin investors rather than taking a leveraged stance on Bitcoin. This shift suggests that their fortunes are more closely tied to the performance of Ethereum rather than Bitcoin itself.

Here’s what you should be aware of: CleanSpark (#CLSK), is set to be added to the S&P SmallCap 600 index on March 24.

This index features smaller publicly traded companies in the U.S. that have a market cap exceeding $1 billion and fulfil certain financial requirements.

Being included in this index may enhance CleanSpark’s visibility, boost its trading volume and liquidity, and draw in more institutional investors.

CleanSpark is the second crypto miner to be added to the index after peer Marathon Digital was added to the list last year.

Companies in the index typically benefit from increased trading volume and improved liquidity, making their shares more accessible to a broader pool of investors.

"CleanSpark's inclusion enhances visibility within the investment community," CEO Zach Bradford said in the announcement. “Our inclusion enhances visibility within the investment community and gives us an opportunity to demonstrate the value of being a pure play, vertically integrated Bitcoin mining company and making exposure to our model more broadly available."

CleanSpark operates bitcoin mining facilities across the U.S., focusing on energy efficiency and cost-effective power sources. The company has expanded its operations over the past year with the acquisition of peer GRIID Infrastructure.

Crypto Miner CLSK longterm patternBullish "march" if all factors hold true?

ie NVDA look weak-ish.

Falling yields would be nice.

Trump told his crypto team to investigate BTC reserve question within 100 days. That's now around April.

www.investing.com Markets pricing 1st rate cut around June.

Look into longterm macd potential.

Another CLSK Idea! (15-20 USD)I dont care about this description stuff anymore lol

So here is a nice small one..

I think we are in a 5 wave up currently and that

we are in the making of a W-shape upwards!

It won't be straight up but I would be beyond

surprised if we are not at 20+ into Q1-Q2 2025

Of course this is ONLY an idea, please be careful

NFA DYOR!!!

CLSK could end 2024 at 17-20 dollars (NFA)Hello Tradingview people!

Before i explain my idea... I just want to make it clear this is an idea and nothing more!

If NASDAQ:CLSK doesn't do this specific pattern I'm showcasing, then don't come crying to me (Do your own research before investing)

Anyway, As you can see on the chart I'm showcasing for y'all, this pattern has worked multiple times in the past and is even known to be the CLSK "bottoming pattern" for the most part.

Again this is an idea and nothing more, but if this does play out i could personally see CLSK being at 17-20 dollars EOY (maybe) and 2025 Q3-Q4 30-50 dollars .

NFA DYOR <<<-------

What do you all think? Comment down below without being rude (ty)

UPVOTE if you like the idea of course.

CLSK is making a VERY BULLISH pattern (NFA)Hello Tradingview community!

As always: If this pattern I'm showcasing doesn't work as predicted..

then please don't come crying to me (ty) -> NFA DYOR

I don't even have to say anything.. the chart perfectly explains itself!

Yes we can go down a bit more.. BUT WOW!!

if this is not bullish i dont know what is honestly

NFA DYOR - be careful

CLSK breakout above 18 is IMMINENT!Diamond reversal pattern on CLSK…crypto miners from MARA to RIOT and others all showing strong buy rates per my algo.

Expect breakout to new relative highs within next several sessions.

Looking for a move to 18-20$ before 12/13 on CLSK in particular. great play for in-the-money options play imo

$CLSK Potential Movement (11/11/24)The gift that keeps on giving: $CLSK! Unfortunately, it was closed for trading today, but we’ll see what unfolds when the market reopens on Monday.

Key support levels to watch are the previous higher high and break of structure at $13.27 and again at $13. These are solid points for when we kick off trading on the 11th. For resistance, we’re moving to the daily chart, with our next level all the way up at $14.92!

As always, trade with discipline and lock in those profits!

David

Diz-Plin Trading

The Case for MinersBTC is now entering its final form. As I see it, the period beginning now and progressing over the coming months is likely to be the most rapid and vicious ascent of this entire market cycle beginning from the post-FTX lows. This cycle shall also culminate in Bitcoin's long-awaited rise to its greatest potential: accumulation on a global sovereign scale.

Thus, the time to pay attention and allocate to BTC beta, especially miners, has reached its apex. I'm a bit late to this post as I have already positioned in several miners, namely CLSK and WULF, but plan to finish accumulating shares and long calls rapidly. The best entries tend to be on daily closes above previous monthly or quarterly highs, especially when the previous monthly candle was a doji or hammer, indicating accumulation and downtrend exhaustion. This is precisely what we just saw with the candle of the month of September 2024, and I entered on the first daily close above its $10.47 high.

This post is generally for made for posterity and on the eve of a possible daily close confirming a textbook H&S bottom. While the measured move of this patter coincides with the yearly POC around ~$16-17, and it may well see some trouble accepting there, I plan to hold the majority of my longs into the 1st fib extension at $35, and, depending on conditions, will leave some to run to the 2nd extension around $52. RSI indicates that we haven't even entered the bull market phase of this run. Have fun and good luck to all - exciting times lie ahead!

#Cleanspark before price escalation #Bitcoin #crypto #clskAs Bitcoin begins to break out, equities should also pick up and be boosted to new highs. The first interim target is USD 17 and later USD 21.

The previous all-time high was USD 43 and would be very likely if the Bitcoin price were to exceed USD 85,000 + X.

Greetings from Hanover

Stefan Bode

CleanSpark Rockets: All Targets Hit in 15-Minute Long TradeTechnical Analysis: CleanSpark – 15-Minute Timeframe (Long Trade)

CleanSpark showed strong bullish momentum, reaching all profit targets after entering the long trade at 9.06. This trade has concluded successfully with all targets achieved, confirming a solid upward trend.

Key Levels

Entry: 9.06 – The long position was entered following a clear bullish signal.

Stop-Loss (SL): 8.81 – Risk management was placed below the entry point.

Take Profit 1 (TP1): 9.37 – First target met, validating the initial bullish trend.

Take Profit 2 (TP2): 9.87 – Continued buying interest drove the price to the next target.

Take Profit 3 (TP3): 10.37 – The uptrend remained intact, hitting the third profit level.

Take Profit 4 (TP4): 10.68 – Final target achieved, confirming the trade's success.

Trend Analysis

The price remained well-supported by the Risological Dotted trendline, indicating strong upward momentum. Each target was hit as the price steadily moved in the long direction, with minimal retracement.

CleanSpark’s long trade demonstrated the power of catching the upward trend early. With all targets hit, this trade stands as an excellent example of precision and market timing.

CLSK, a point of no return once it reverse to the UPSIDE.CLSK monthly data is conveying huge accumulation / net buying from the 3.0 levels. This level has been no question the most important order block level where buyers converge.

A prospect of a generous upward momentum from this price level will be inevitable.

Spotted at 3.5

TAYOR.

Be mindful on safeguarding capital, always.

-----------

Related Fundamental News:

Cleanspark boosts mining capacity with new machinery worth HKEX:145 Million.

👉 The US-based cryptocurrency miner NASDAQ:CLSK (Cleanspark Inc) purchased 45,000 units of the Antminer S19 XP CRYPTOCAP:BTC mining machines for $144.9 million.

👉 The current computing power of CleanSpark is 6.7 EH/s, while the installation of the new equipment is expected to push it to 13 EH/s.

👉 According to the deal, the manufacturer will distribute 25,000 units in August, while the remaining 20,000 should arrive in September. CleanSpark plans to deploy all of them at its mining facility in Sandersville, Georgia.

👉 CleanSpark CEO Zach Bradford said the Antminer S19 XP is “the most power-efficient bitcoin mining machine available in the market today” and raised hopes it will turn into a “key component” for the company’s operations.

👉 He explained that the multi-million purchase and the delivery of first-class machinery is part of the firm’s strategy prior to the Bitcoin halving that is expected to occur in the spring of 2024.

👉 The pivotal event, reducing the rate at which new coins are created, will cut block rewards in half – from the current 6.25 BTC to 3.125 BTC. Many experts believe the process will fuel a price surge of the primary cryptocurrency, similar to previous occasions.

CLSK most important chart and targets! (NFA)Hello Tradingview community!

As always: If this pattern I'm showcasing doesn't work as predicted..

then please don't come crying to me (ty) -> NFA DYOR

I think from a chart perspective this is our MOST important chart for NASDAQ:CLSK

As you can see.. these "channels" got respected all the way up and down

What are the targets? Well I have highlighted some for you on the charts -

but honestly these prices can change a lot since it depends on when

CLSK hits those lines... So stick to watching the lines and not the

highlighted prices I've put onto the chart.

What do I personally think will happen?

Well i believe we either go in the short term down to 7.5-8 dollars OR

we recover here and 10 dollars is coming soon.

How about EOY?

Well because i'm fairly bullish on CLSK and the chart shows it's possible

I believe CLSK will be 14 dollars to even 20+ (lines on the chart)

How about 2025?

Well again, from my personal perspective i believe CLSK could be

Q1-Q2 2025: 30-40 dollars and potentially Q3-4 2025: 50+ dollars

Of course -> NFA DYOR it's very important you WATCH the lines

and don't just follow hopium.

CLSK: 2 targets I'm watchingHello Tradingview community!

As always: If this pattern I'm showcasing doesn't work as predicted..

then please don't come crying to me (ty) -> NFA DYOR

Alright I'll make this message very short cause I don't have time to write a

whole book atm (sorry) -

the chart explains itself = If we keep riding this channel we could see

anything from low 6s (lowest part of channel) to the middle line at

8ish.. IF we break the channel though I'm expecting 12-13 dollars.

NFA DYOR

NASDAQ:CLSK