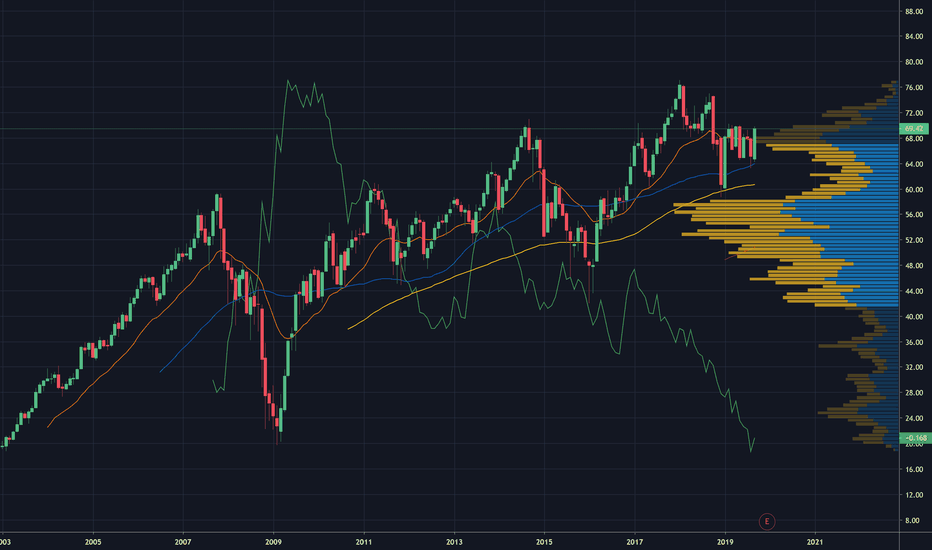

CM - Double BottomsA large Up channel

Price right now is looking to push to the limit and hit the top of the up channel

Once this is hit price may be rejected and pushed back down to the bottom or out of the up channel

This will also be observed as a double bottom pattern , comparable to one seen earlier in prices evolution

Short term bullish

CM

CIBC | 40% Short Trade SetupConfirmation: 99.65 (weekly candle)

Invalidation: Local high

Type of Trade: Countercyclical (EMA50 above EMA200)

Target: 56.46

TF: Weekly

Leverage: 2x

Pattern: 1) monthly rising wedge reversal with 2) break of weekly support, and 3) break of major support line.

Monthly view:

RY (RBC BANK) | Watch For Rejection and New DowntrendRY has filled a gap created back at the beginning of 2018 and we also see a potential large double top formation on the daily and weekly timeframes that is being formed by rejection. This is an opportunity to position short for a new downtrend on the lower timeframes, looking for support on the 8/1 Gann and as low as the 4/1 Gann.

On the larger timeframe, don't forget Steve's trade (targets are my own though):

PS. Some Index funds might be worth shorting as well.

Steve Eisman's Canada TradeSteve Eisman (depicted as Marc Baum in The Big Short movie) has publicly revealed the institutions he is shorting in anticipation of the next wave of credit normalization. They include RBC, CIBC, Home Capital Group, and Laurentian Bank. Steve has not revealed his targets or how far exactly the trade will go, so the estimates on the chart are my own.

As you know, I have been establishing net short positions on numerous banks around the world since the end of last year.

CIBC Hitting Major Daily S/R LevelTaking a look at the daily chart CIBC TSX:CM to see that it could be at a very decisive point around the $104 area. Price hit a major horizontal that acted as a strong resistance turned strong support with price hitting that level on multiple occasions with subsequently massive price movement to follow.

* If price breaks this S/R level with conviction I will look to enter on a pullback to the S/R level

* If price bounces off this level this week I would cautiously enter a long position with a stop just below the S/R level

Considering the current market conditions and with this being the third retest of the S/R Level coupled with the 100EMA/200EMA bearish cross I'm inclined to favour the bearish scenario over the bullish in this case.

Trade Wisely,

Chloster

STOCKS IM BUYING THIS WEEKI think last week's pullback in equity markets was a good thing. The market got overheated and it gave us a reminder that stocks don't always rise. Memories and patience are short in the finance industry especially with some recent trends (blockchain) skewing people's perception that building wealth gets built overnight. Not the case, in the past 50 years of the SP500's history, it has NEVER had a stretch of over a year without a 5% correction or more. So relax, this is not doomsday, it is the ebbs and flows of Mr. Market playing his tricks.

Here is the list of stocks I'm buying or adding a position too.

- Icahn Enterprises (see earlier post)

- Scott's Miracle Grow (post coming this week)

- Bank of Nova Scotia

- Bank of Montreal

- Citigroup

- Home Capital Group (post coming next week)

- Canadian Imperial Bank of Commerce

- Valeant Pharmaceuticals

- Equifax

BNS, BMO, CM are banks I own in a fund and will simply be buying more of the fund (FIE.TO), but BNS and BMO are the two banks I would buy, if you go back one year and look at the worst performing Canadian bank, it's a pretty safe bet that the next year will be better. As well: www.theglobeandmail.com

I apply this same rationale to Citigroup , one of the less fortunate American banks from last year.

EFX was a stock I bought down around $90 when it sold off following a security breach announcement. I think the firm, fundamentally, is strong and will continue to regain ground. VRX is also one of those contrarian stock picks, after some allegations a couple of years ago for fraud and insider trading, I think they've found their bottom. They've also started to pay off debt which is never a bad thing for a recovering company.

I'm in the process of putting a valuation on HCG and SMG and will make a post in the coming week, this will be a buy and hold value-pick. I'm liking what I'm seeing so far.