Bitcoin Cheat Sheet 2020!!First off, give this a like/follow - let's get this information out to as many people as possible! We can see the 2019's cheat sheets were very critical for the market.

2019 Cheat Sheet 1 - (3 Month Contracts) -

2019 Cheat Sheet 2 - (6 Month Contracts) -

Now, 2020's cheat sheet, explained.

Index for 2020's Cheat Sheet:

First Purple line is CME futures launch date. 18th Dec 2017. From then on, the purple lines in December are the anniversary of it. Clearly it's created a top, and our bottom's so far.

First Red line is NYE. From then on, each Red line in Dec/Jan cross over is a new year.

Dark Green to Dark Green is Jan 2020 CME contracts duration found on ticker: BTCF20 (First Trade 28th Oct 2019 - Last trade 31st Jan 2020) Settlement date 03 February 2020.

Yellow to Yellow is Feb 2020 CME contracts duration found on ticker: BTCG20 (First Trade 2nd Dec 2019 - Last trade 28th Feb 2020) Settlement date 02 March 2020.

Orange to Orange is Mar 2020 CME contracts duration found on ticker: BTCH20 (First Trade 30th Sep 2019 - Last trade 27th Mar 2020) Settlement date 30 March 2020.

Dark Blue to Dark Blue is Apr 2020 CME contracts duration found on ticker: BTCJ20 (First Trade 16th Dec 2019 - Last trade 24th Apr 2020) Settlement date 27th April 2020.

Teal to Teal is May 2020 CME contracts duration found on ticker: BTCK20 (First Trade 16th Dec 2019 - Last trade 29th May 2020) Settlement date 01 June 2020.

Green to Green is June 2020 CME contracts duration found on ticker: BTCM20 (First Trade 30th Dec 2019 - Last trade 26th Jun 2020) Settlement date 29th June 2020.

Black to Black is July 2020 CME contracts duration found on ticker: BTCN20 (First Trade 3rd Feb 2019 - Last trade 31st Jul 2020) Settlement date 3rd August 2020.

Pink to Pink is Dec 2020 CME contracts duration found on ticker: BTCZ20 (First Trade 16th Dec 2019 - Last trade 24th Dec 2020) Settlement date 3rd Jan 2022.

Dark Grey shaded area in May is the Bitcoin estimated halving date range.

Horizontal Lines are Major Fib's.

Gold lines = Golden Ratio (38.2% or 61.8%).

Black lines = Fib levels (0.0%, 0.225%, 0.5%, 0.775% and 1.0%).

Purple lines = Custom Fib (0.1112% and 0.888%).

Trend lines are from major levels of support/resistance from highs and lows of $BTC on $XBT's chart.

The point of this chart is to map the effectiveness of these dates. History shows volatility dries up as we get close to them, and gets very volatile shortly after them.

I hope this helps you make, or save a few dollars this year!

Cme!

M1 Monthly SPX SP500 - Correction neededSPX volumes are issued from the 500 spots tickers, this special ticker is made by Trading View.

-Bear divergence on oscillators

-VWMA55 (volume weighted MA) under MA55, same for 144, 233 are getting closer > confirmation of bearish volume trend, when price is going up (volume bear divergence)

-price stoped its progression on the historic channel central zone

-Rising wedge confirmed ?

Than you.

BTC- Accumulation modeThis week is nothing but reverse bart patterns and scam wicks!

I guess this is the result of decreased liquidity caused by the slowly declining volume during the consolidation phase.

Bitmex is trading below 2 billion volume as of now, yet open interest is on the slow ascending trend. This tells me the accumulation is taking place possibly by big fishes.

In addition, volatility is slowly ticking up as well.

Other signs to pay attention to- CME open interest and volume going up + Backwardation + USDT premium going up

As we all now, low volume is a precursor to the high volatility move... As long as 8.4k is defended, I will continue my buy on the dip mode!

New CME gapChart made a new CME futures gap between 8765 and 8865. This gap will be closed either before the dump, or after the dump is over and price bounce above 8k. I'd prefer to see it untouched until BTC hit 8k, as this will be more bullish and promising. In case price first go up and then down, there will be less "reasons" to come back.

Bitmex/Binance has a little different numbers, but close. Zone from 8150 to 8300 represents strongest support for bullish bounce. 8000 obviously can be wicked within that move as well. If bullish bounce scenario won't happen, price may retrace further to 7555 - 7700 zone. That still leaves the big picture positive, while switching BTC into consolidation period that will take longer time to resume and build new uptrend.

How brokers provide zero commission trading? You've probably heard of many zero commission trading platforms being established.

Robinhood is probably the most well known one, actually.

Historically, brokers have made their money by facilitating trades in the market between buyers and sellers and collected a fee for their extremely hard work...

Since markets have become larger, with greater trading volume and more participants, commissions per trade have fallen drastically, and the industry has had to change for your poor broker to earn a living.

With the rise of the smartphone, this has led to brokers being able to target a new type of trader...

This trader tends to be less informed than a professional...

Trading off a phone...

A lack of experience...

And more of a gambling mentality rather than understanding what is truly driving markets.

Firms have realised that.

'Commission free' is a marketing tool, and a very good one.

See, what is happening now is that market makers and dealers - and by extension, exchanges - are willing to pay brokers for their uninformed clients' order flow.

High frequency trading firms, such as Citadel, Apex, Renaissance, Virtu and DRW conduct market making on extremely low timeframes, providing liquidity to exchanges - that's their primary goal - and exchanges pay them rebates based on volume for doing so - note the chart of the CME Group above.

Their share price has increased massively since high frequency trading (market making) has driven 'liquidity' to the exchange.

Since their business is focused around volume, they welcome HFTs providing liquidity and therefore do not mind paying them volume based rebates - HFTs are kind of like introducing brokers.

But what's a market maker?

Market makers are delta neutral.

They do not necessarily care about the direction of a market, they simply want to sell higher at the bid and buy at a lower offer, thus capturing the 'spread' (the difference between the bid and the offer).

By paying brokers for the uninformed flow, this means that they believe they can capture asset misvaluations, and therefore turn a profit.

And it's very lucrative business.

Robinhood recently got fined for not routing orders adequately to allow for best execution for clients.

The adverse selection that they committed is an example of how a client can be at detriment.

However, it isn't necessarily bad to trade with a zero commission broker, since your explicit costs can be low (although implicit - the costs you don't see - could be higher and likely are).

What matters massively is their execution policy and whether you are being filled at the bid or offer that the market will allow you, or if you're receiving the price that the broker wishes you to get as part of their routing relationships with market makers.

The former is good, the latter is bad!

I hope that's cleared up a bit for you...

CME Gap Hasn't Closed YetA bounce in the area was to be expected, but hold your horses. It hasn't closed yet.

The gap is shown on by the green shaded box.

On Bitfinex and Binance it bounced around $7675, which uncoincidentally was the gap low on CME. BUT this level has not yet been reached on CME.

In other words, many traders placed long orders around $7675, but it seems they didn't adequately compensate for the price differences between exchanges and the CME. A small gap still remains, and so does the incentive for CME to push the price back down.

Bitcoin low week on week of bitcoin futures anniversaryPrice has come down to test the 6-7k support level, potentially ready to bounce.

Price has made an inverse head and shoulders pattern into this zone.

The right shoulder bounced off the 62 fib retracement from the head.

The head occurred the week of December 15, the anniversary of the creation of bitcoin futures contracts (Price found its high around 20k and low of 3k the week of dec 15 2017 and 2018 respectively).

Volumes are low, indicating a potentially big move coming.

The cftc commitment of traders reports showed institutions to add to their longs and remove some shorts over the holidays. Still net short about 2 to 1, but the shift in positioning could indicate short term bullishness.

Looks like it could be a big year, the halvening is coming up in May and Facebook and Starbucks are planning on releasing their own digital currencies sometime in 2020.

The fear of wwIII and run up in gold may act as catalysts to get price moving very soon as well.

I expect price to come up to challenge resistance around the 10-11k levels. Potentially run further up to all time highs, or get rejected and fall to test the 3-4k support. But 10k is my next stop.

CME Futures Open Gap| BTC Correction ?Hello Traders,

Today’s chart update will be on the CME Futures chart, which has an open gap that with a high degree of certainty will get filled.

Points to consider,

- Trend topping out

- Structural resistance hit

- Support zone being tested

- Stochastics projected down

- RSI approaching support

- Increase in bear volume

- EMA’s crossing bearish

The trend seems to be topping out as BTC has evident volume climax bars at a very key technical level, the structural resistance. The support zone is currently being tested, must hold for a confirmation of the S/R flip.

Stochastics is currently projected downwards, can stay in lower regions for an extended period of time, however lots of stored momentum to the upside. RSI is approaching its support, in neutral territory, this support will help determine direction of the trend.

There is a clear influx of bear volume, signalling that seller are currently in control as price failed to break resistance. The EMA’s are on the verge of crossing bearish if current support level does not hold.

Overall, in my opinion, BTC will fill the open gap sooner rather than later, this is very evident in historic price action.

What are your thoughts?

Please leave a like and comment,

And remember,

“Trading doesn't just reveal your character, it also builds it if you stay in the game long enough.” Yvan Byeajee

Monthly CME Borders for GBPUSD JanuaryHello dear traders,

Here we have CME Mohtly levels based on option contracts + strong Monthly levels based on my analisys which is taken from other sources :)

1- Remember that by the end of the CME mothly level's expiration price will come back to that range in 80%

2- Blue zones are very strong reversals for mid-term trading!

Good Luck :)

Monthly CME Borders for EURUSD January Hello dear traders,

Here we have CME Mohtly levels based on option contracts + strong Monthly levels based on my analisys which is taken from other sources :)

1- Remember that by the end of the CME mothly level's expiration price will come back to that range in 80%

2- Blue zones are very strong reversals for mid-term trading!

Good Luck :)

CME FUTURES Gap needs to get filled!There's a CME futures gap around 7665$ to 7723$ that needs to get filled. I think BTC will have a pull back to this price and then it will start going up again. I'm bearish short term although we had a nice momentum but I think there's a pullback coming and after that we'll break higher resistances.

The CME Is Destroying BitcoinBitcoin was on target to reach an all time high of $28,000 for Jan. 2018. Unfortunately, this event coincided with the beginning of the Bitcoin futures market. Bitcoin has never been up since. People think that since it went from $3500 in Jan of '19 to over 10k in June that it had an increase in value, it didn't, it is down -63% from its' all time high. Today price is at $7400, exactly 1/4 of it's actual price of $30,000. Today Bitcoin is selling in Iran for $28,000 (actual price). Another interesting fact about the futures market, you can't take delivery of Bitcoin upon expiration. The only purpose of the futures market is the slow bleeding and destruction of Bitcoin.

Zoom outThis is just one of the possible scenarios, no1 is sure what will happen, so keep that in mind.

Recently we had a parabolic advancement, they usually retrace more than 80 proc in any markets. There is an unfilled gap at spike from 4 - 4.7k, having is coming in April, 86 proc BTC already mined. Whales need to accumulate as many BTC as possible from retailers, easiest way is to induce market capitulation. Keep in mind that derivatives market (futures, perpetual contracts..) is 18x bigger than spot market and has a huge impact.

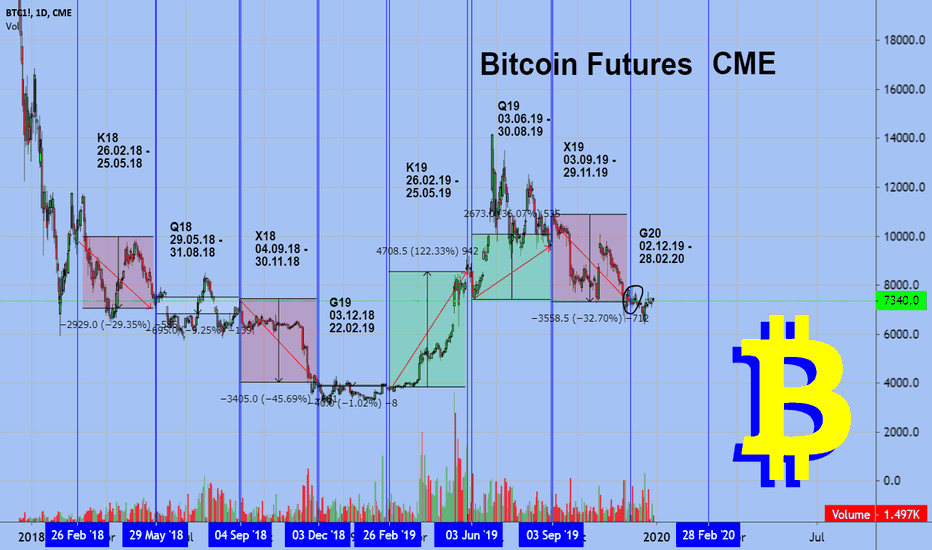

Bitcoin Futures CMEOn December 15, two years ago, the largest American company CME Group launched Bitcoin futures.

CME is the only one who provides the opportunity to trade bitcoin futures in the United States and they are the first to enter the territory of derivatives instrument for the cryptocurrency market and now they have no competitors.

CME futures are one of the most manipulative instrument on the cryptocurrency market.

And the opening and closing of their futures suggests when the bottom will be.

December 15, 2017. two contracts were opened

3 months until March 29 - opening price 20631 - closing price 7070

6 months until June 29 - opening price 20631 - closing price 5800

Before bitcoin futures, large players did not have a high-quality tool for the global short market - and the Chicago exchange provided this opportunity

After 3 months, bitcoin fell by 67%

The market go up a little, but by the close of the 6-month contract, the market fell by 71%

On July 2, another 6-month contract was opened and closed on December 28

40%

detailed table of the start and end dates of all contracts.

CME does not save this data, for this you can like it under the chart

docs.google.com

And the most interesting

I think you remember the growth of November 25-26 at $ 3000 up

If you look a little in the table, then you can see the contract F20 from 10.28.19 to 01.31.20 - the conclusion from this until January 31 we will not see a price above 9200

On December 16, the first annual price contracts were opened in the $ 6,600 zone and I am sure this factor will push the price up

But already today, December 30 will be open semi-annual contracts M20 12/30/19 - 06/29/20

And today, a two-year contract opens and this fact will also push the price up.

Perhaps someone doubts that the price of bitcoin in 2 years will be lower than 7000? write a comment

Best regards EXCAVO

BTC correction in downtrend channelBTC propably doing only correction in downtrend, last pushes up provided price to daily resistance area on weak volume. if we cross 7600-7800 on good volume, we can talk about double bottom, but like we said, volume is tolow. on lower tfs we can see forming potential rising wedge with descendingvol = setup to change trend (not confirmed yet) , also we have fresh CME GAP to around 7230 wich is also indicator adding more propabilities for atleast small move down.

On daily we are still in dontrend channel under important MA's 100 and 200 , so sticking all together, seems like last moves up are only correction in downtrend, not reversal trend.