Bitcoin Weekly Seal at the Threshold 122K - No Gaps, No Retreat.⊣

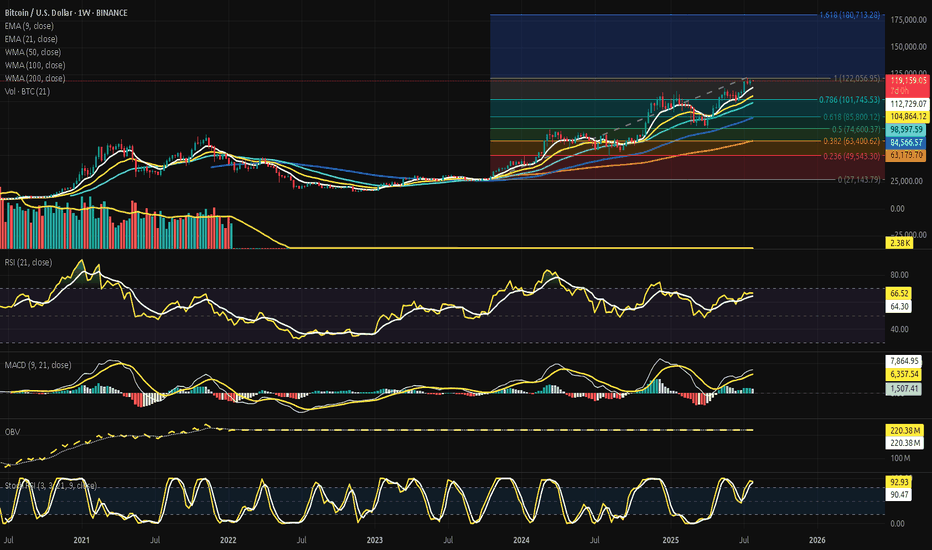

⟁ BTC/USD - BINANCE - (CHART: 1W) - (Jul 27, 2025).

◇ Analysis Price: $119.374,00.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1W):

▦ EMA9 - ($112.771,21):

∴ The weekly close remains above the EMA9, preserving short-term bullish structure;

∴ The EMA9 continues rising at a consistent slope, reflecting sustained upward momentum;

∴ A retracement to this level would represent the first defensive support on a tactical pullback.

✴️ Conclusion: EMA9 acts as a dynamic short-range support and trend continuation marker.

⊢

▦ EMA21 - ($104.883,22):

∴ Price remains notably above the EMA21, confirming structural strength in medium-term trend;

∴ The EMA21 was previously retested during consolidation in Q2 2025;

∴ A weekly close below it would indicate a structural loss of momentum.

✴️ Conclusion: EMA21 confirms medium-term bullish bias as long as preserved.

⊢

▦ WMA50 - ($98.605,81):

∴ WMA50 serves as a major cyclical support and remains untouched since early 2024;

∴ The gap between price and WMA50 indicates strong extension, yet risk of mean reversion rises;

∴ This level aligns with a prior demand zone around ($95K–$100K).

✴️ Conclusion: WMA50 is a latent demand zone - strategic if market reverts from exhaustion.

⊢

▦ WMA100 - ($84.570,72):

∴ This weighted average aligns with the 0.382 Fibonacci level;

∴ A long-term correction toward this band would reflect the depth of macro pullbacks in previous cycles;

∴ Currently distant from price action, but structurally significant if macro volatility increases.

✴️ Conclusion: WMA100 anchors mid-cycle recalibrations and aligns with retracement symmetry.

⊢

▦ WMA200 - ($63.181,79):

∴ The 200-week WMA remains far below price and untouched since early 2023;

∴ This is the ultimate structural support in secular bull cycles;

∴ If revisited, it signals macro-level capitulation or black swan scenario.

✴️ Conclusion: WMA200 holds the foundational line of long-term structural integrity.

⊢

▦ Fibonacci Retracement - (Range from 0 = $27.143,79 to 1 = $122.056,95):

∴ 0.000 = $27.143,79 - Genesis base from Apr 2025 cycle;

∴ 0.236 = $49.543,30 - Psychological line of control in late 2023;

∴ 0.382 = $63.400,62 - Aligned with long-term moving averages;

∴ 0.500 = $74.600,37 - Symmetry pivot of current macro-leg;

∴ 0.618 = $85.800,12 - Golden pocket lower bound;

∴ 0.786 = $101.745,53 - Golden pocket upper edge and structural resistance pre-breakout;

∴ 1.000 = $122.056,95 - Current cycle high (resistance zone);

∴ 1.618 = $180.713,28 - Projected extension target for parabolic continuation.

✴️ Conclusion: Key retracement zones for tactical reactions lie at (0.786 - $101.7K) and (0.618 - $85.8K); upside breakout target confirmed at (1.618 - $180K).

⊢

▦ Volume + EMA21 - (Last: 2.38K BTC):

∴ Volume is stable and slightly rising compared to prior weekly sessions;

∴ No high-volume sell candles indicate panic or exit;

∴ EMA21 on volume shows baseline liquidity remains active.

✴️ Conclusion: Healthy volume confirms orderly continuation rather than climax or exhaustion.

⊢

⨀ II. Momentum & Pressure Indicators:

▦ RSI (21) + EMA9 - (66.71 / 64.34):

∴ RSI approaches the 70-level but remains below overbought territory;

∴ EMA of RSI confirms rising internal strength;

∴ No divergence is observed - internal price energy remains aligned with upward momentum.

✴️ Conclusion: RSI signals strong but not overheated momentum - bulls still in control.

⊢

▦ MACD (9, 21) - (MACD: 7,887.99 | Signal: 6,362.06 | Histogram: +1,525.93):

∴ MACD histogram remains green, showing continuation of bullish trend;

∴ The spread between MACD and Signal is positive and expanding again;

∴ No bearish crossover threat imminent at current slope.

✴️ Conclusion: MACD structure reinforces bullish pressure - trend still intact.

⊢

▦ OBV + EMA9 - (OBV: 220.38M):

∴ OBV remains in an uptrend, supporting price action;

∴ EMA overlay shows no divergence or flattening;

∴ Volume accumulation remains healthy, confirming underlying conviction.

✴️ Conclusion: OBV supports continuation - no signs of distribution.

⊢

▦ Stochastic RSI (3,3,21,9) - (%K: 93.68 / %D: 90.72):

∴ Both %K and %D lines are in the overbought zone (>90);

∴ Crossovers are still bullish but nearing potential exhaustion zone;

∴ Caution warranted for short-term momentum correction.

✴️ Conclusion: Overbought levels reached - watch for tactical slowing, though no reversal confirmed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The weekly chart exhibits a structurally intact bull trend, confirmed by the alignment and spacing of EMA's and WMA's across all horizons (short, mid, long);

∴ Fibonacci retracement levels delineate critical reaction zones, with (0.786 - $101.745,53) and (0.618 - $85.800,12) serving as dominant retrace supports in the event of a tactical correction;

∴ The presence of a projected (1.618 extension at $180.713,28) offers a sacred path forward should price breach and sustain above the current high of $122K.

∴ Momentum oscillators (RSI and MACD) continue their upward thrust without divergence, but the Stochastic RSI warns of temporal exhaustion - a typical hallmark before consolidation or rotation;

∴ Volume structure is stable and non-climactic, suggesting continuation rather than blow-off;

∴ No sign of distribution via OBV - accumulation remains intact.

✴️ Conclusion: The market remains within the upper chamber of the Fibonacci spiral. Tactical cooling is possible due to overextension in the momentum field, but no structural damage is observed. A controlled retrace into the golden pocket would be both acceptable and ritualistically symmetrical. The path to $180K remains open, but guarded.

⊣

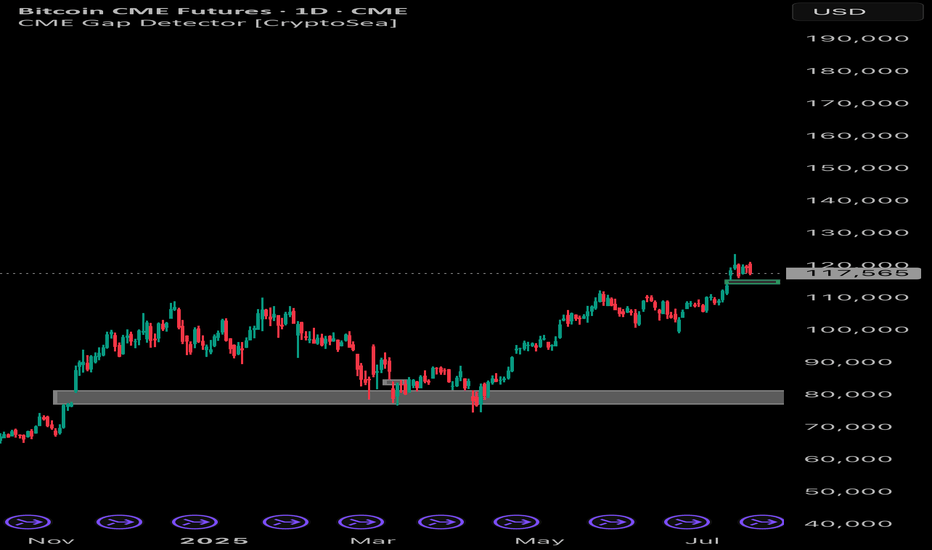

⟁ BTC/USD - CME Futures BTC1! - (CHART: 1D) - (Jul 27, 2025):

◇ Current Price: $120.785.

◇ Chart Link:

⊣

▦ CME Futures GAP - Observation & Ritual Closure:

∴ The current chart shows a clustered consolidation near $120K–$121K with no immediate upper gap visible;

∴ The last prominent CME Gap was filled during the late June run-up and early July vertical move;

∴ No new gap formed during the weekend-to-weekday open for the last 3 sessions - continuity is intact.

✴️ Conclusion: There is no unfilled CME Gap between the current price and previous sessions. All recent discontinuities appear ritually sealed. Attention now turns to potential downside gaps from rapid bullish impulse moves around ($104K–$108K), which could remain structurally unfilled - unless tactically challenged during correction.

⊢

🜎 Strategic Insight - CME Oracle:

∴ The lack of open CME Gaps suggests a clean technical field - no magnet effect pulling price backward in the short term;

∴ The compression near $121K may precede either an explosive breakout toward the Fibonacci extension ($122K / $130K+), or serve as a false plateau before a tactical flush;

∴ Absence of gaps also removes "gap fill" traders from immediate relevance, allowing price to move freely based on liquidity and macro flows.

✴️ Conclusion: The CME chart confirms no active gravitational pull downward - the battlefield is neutral and favorably clean for bullish continuation, pending macro and liquidity alignment.

⊢

∫ III. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + 9EMA - (All Exchanges):

∴ Exchange inflows remain significantly suppressed, with no spikes above 75K BTC since Q4 2023, despite the price nearing $120K;

∴ The 9EMA of inflows is stable and near local lows, showing no abnormal movement toward exchanges;

∴ Historically, spikes in inflow coincide with distribution, fear, or profit-taking, none of which are currently present on a structural level.

✴️ Conclusion: The on-chain exchange inflow behavior confirms low distribution pressure at current highs. The lack of elevated Bitcoin deposits into exchanges indicates conviction among holders and the absence of a mass selloff attempt, even near critical Fibonacci resistance.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ While price consolidates near its cyclical high, exchange inflows remain muted, echoing behavior observed during earlier phases of strong market conviction (e.g., late 2020);

∴ This suggests the market is not preparing for heavy liquidation;

∴ The silence of inflows reinforces the tactical hypothesis that current price action is organic and not panic-driven, preserving the ritual path toward ($122K/$180K).

⊢

⧉ IV. Contextvs Macro-Geopoliticvs - Interflux Economicvs:

▦ US-EU Trade Accord: 1(5% Unified Tariff Across All Sectors):

∴ The United States and the European Union have reached a comprehensive trade agreement, averting escalation: a 15% unified tariff will apply across most EU exports to the US, down from a threatened 30%;

∴ Exceptionally high 50% tariffs remain on steel and aluminum, while some industries such as automotive, semiconductors, and pharmaceuticals will be capped at 15%;

∴ Zero-tariff exemptions have been granted to strategic sectors, including aerospace, select chemicals, semiconductor equipment, agricultural products, and critical raw materials;

∴ In return, the EU has committed to invest $600 billion in US infrastructure and tech, and to purchase $750 billion worth of US energy and defense products over three years.

✴️ Conclusion: The trade pact imposes moderate cost adjustments for key industries but restores transatlantic stability. Although friction remains in sensitive sectors, the agreement prevents global trade disorder and enhances strategic economic visibility.

⊢

🜎 Strategic Insight - Macro Oracle:

∴ The accord mitigates systemic trade risk and clears geopolitical uncertainty, which would otherwise impair market confidence in risk-on assets;

∴ Predictable tariffs (15%/50%) reduce abrupt inflationary shocks, enhancing macroeconomic forecasting and central bank policy latitude;

∴ Massive EU commitments in energy and defense inject transatlantic liquidity and strengthen demand for US dollar-based assets;

∴ While European manufacturers face pressure, the global system benefits from lower volatility and restored economic symmetry;

∴ This opens room for speculative and structural capital to flow more confidently into high-volatility instruments, including crypto assets.

✴️ Conclusion: The macro backdrop reinforces the sacred bullish path - a re-alignment of order in the West, combined with non-disruptive trade stabilization, lays the groundwork for continuation of liquidity-driven risk flows. Bitcoin stands to benefit as a speculative vessel in a structurally stable yet monetarily dynamic environment.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Tactically Watchful:

∴ Price remains above all critical EMA's and WMA's on the 1W chart;

∴ Fibonacci structure is intact, with the $122K high acting as ritual resistance and the (0.786 / 0.618 zone ($101K / $85K) as sacred fallback;

∴ Momentum indicators (MACD, RSI) sustain positive bias with no divergences;

∴ CME Futures show no unfilled gaps - the field is clean, allowing strategic extension.

✴️ Conclusion: The macrostructure supports continuation higher into the sacred extension zone ($130K–$180K), with short-term vigilance warranted due to overbought Stoch RSI and reduced volume velocity.

⊢

▦ Tactical Range Caution:

∴ Upper Limit: $122.056 - Cycle high and Fibonacci 1.0;

∴ Mid Guard: $112.770 - EMA9;

∴ Structural Support: ($101,745 - 0.786) Fib retrace;

∴ Golden Anchor: ($85.800 - 0.618) Fib retrace.

✴️ Conclusion: As long as price remains above $101K, the bullish code remains sealed. Breach of $85K would unlock deeper structural reassessment.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ The week closes at the threshold of the Fibonacci (1.0 mark - $122.056), beneath a ceiling forged by time and belief;

∴ All technical layers are aligned, yet the silence in the inflow, the clean CME field, and macro equilibrium whisper a rarer truth - no storm is seen, but no wind is promised;

∴ This is the zone of the Watcher - where action becomes hesitation, and hesitation becomes discipline.

✴️ Strategic Note & Final Seal: Do not confuse absence of danger with presence of opportunity. A vertical structure with no threat below can still falter from within. This is a time not to act, but to remain unshaken.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

Cmegap

CME Gap: $115.8K–$116.8K Target or Trap?There’s a clear gap between $115,800 – $116,800 on the Bitcoin CME Futures chart. Historically, BTC tends to revisit and fill these gaps. Will we see a pullback to close it before the next move up? 📊

🧠 Watching price action closely around this zone. Share your thoughts below! 👇

$BTC 5-Wave Impulse > ABC Correction > CME GapCRYPTOCAP:BTC appears to be headed towards an ABC correction after this impulsive 5-wave move to the upside

Would be a great opportunity to fill the CME gap ~$114k

Lines up perfectly with the 50% gann level retracement to confirm the next leg

don't shoot the messenger..

just sharing what i'm seeing 🥸

Ethereum - ETH - Heading towards the CME Gap - 3200 Target+ After a significant crash, Ethereum has shown a strong recovery.

+ A large CME gap exists between $2,880 and $3,270.

+ Historically, 90% of CME gaps tend to get filled sooner or later.

+ Current price action suggests Ethereum is heading directly toward this gap.

+ High probability that the CME gap will be filled during this move.

+ Next target for ETH: $3,200.

Stay tuned for more updates.

Cheers,

GreenCrypto

CME Gap Aligns with 4h 200 EMAThe CME Gap around 5710-5730 is beginning to align with the 4h 200 EMA.

4h RSI has been diverging bearish 3 times with each leg up within the channel above.

Also, a breakdown of that channel has measured moves down that align with both the 4h 50 and 200 EMA:

- 50 EMA an 0.5x measured move down

- 200 EMA a 2.5x measured move down

Pre-req on targeting the gap is a breakdown of the parallel channel shown above, and then loss of the 4h 50 EMA.

Good luck!

EURUSD – CME Gap and 0.786 Fib Align at Key Demand ZoneEURUSD has been trading with a strong bullish tone recently, breaking through previous resistance levels with conviction. However, after the latest impulse move to the upside, the market is now showing signs of exhaustion. Price has begun to pull back in a controlled manner, creating a potential opportunity for a deeper retracement into a more favorable area of interest. This kind of pullback is typical after an aggressive rally, and right now, there’s clear evidence that price may need to revisit lower levels before any further continuation higher.

Technical Confluence at Its Best:

Below the current range, there is a high-probability demand zone that combines three powerful elements: a well-respected historical support area, a CME gap that was left unfilled during the previous rally, and a 0.786 Fibonacci retracement from the latest bullish leg. These levels don’t just sit close to each other, they stack right on top of one another, forming a dense pocket of liquidity and technical confluence. The market often gravitates toward these types of zones to rebalance price and fuel the next directional move.

Short-Term Bearish Setup – Let Price Come to You:

The expectation is for price to dip lower in the short term. This would allow the market to tap into the unfilled CME gap and sweep the liquidity resting below the current structure. Traders who went long late in the move are likely to have their stops sitting just beneath recent lows, and this sets the stage for a classic inducement and stop hunt scenario. Price doesn't need to collapse, just a healthy retracement into this confluence zone to rebalance and refill the inefficiency before the real move begins.

Bullish Reversal Expectations:

Once price fills the CME gap and reaches into the 0.786 Fib retracement level, the focus shifts back to bullish. If the market holds this support cleanly and shows early signs of strength, like a displacement back above short-term structure or a strong engulfing candle, this could signal the beginning of a new upward leg. Given the context and momentum from the previous rally, it’s reasonable to anticipate a strong reaction that could drive price back toward the recent highs or potentially even higher.

The Psychology Behind the Setup:

This type of setup is a textbook example of how smart money operates. Price leaves a gap, traders pile in on the breakout, and then the market retraces to fill the imbalance and shake out weak hands before resuming the trend. Understanding the logic behind the CME gap, the liquidity below price, and how the Fib level ties everything together gives this setup depth. It’s not just about lines and zones, it’s about how liquidity flows through the market and how structure sets up to trap and reward.

Conclusion:

Patience is key. Rather than chasing the bullish momentum at current levels, the plan is to wait for price to revisit the zone where the CME gap, historical support, and the 0.786 Fib level align. That’s where the real value lies. If the reaction from this zone is clean and confirms strength, it offers a high-probability entry for the next leg up. No need to force anything, let the market come to you, then execute with precision.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Ethereum - CME Gap fill before going up ?Ethereum has formed a classic CME Gap between $1,707 and $1,765, following a strong breakout. CME gaps, especially over the weekend, are statistically likely to be filled before the next major move.

We’re watching for a retest of this gap zone with a potential bounce at the lower boundary, creating a solid long entry opportunity.

Entry: 1,710–1,725 (inside the CME gap)

TP1: 1760

TP2: 1800

TP3: 1900

SL: 1,667 (below gap & invalidation of bullish structure)

Like and support us for more such idea.

Cheers

GreenCrypto

Bitcoin - CME Gap fill before going up ?Bitcoin CME Futures have formed a clear CME Gap in the $91,600 – $93,400 zone (highlighted in blue). Historically, these gaps tend to get filled before the price resumes its trend.

Price may dip into the gap zone (91,800–93,400) to fill the imbalance.

We have a entry around the lower part of the gap ($91,800–$92,200).

Stop loss: Below $91,500 to invalidate the setup.

After the gap fill, we can expected strong bullish continuation

Entry: 91600

TP1: 92800

TP2: 93500

TP3: 94500

SL Below 90500

Like and support for more ideas.

Cheers

GreenCrypto

A New ( But small ) Bitcoin CME Gap has arrivedDue to price rise in Bitcoin over the weekend, we have just opened up a new Bitcoin CME Gap.

ALL previous Gaps are Filled.

CME GAPS ALWAYS GET FILLED

So, we may see PA return to fill this gap.

the only time Gaps do not get filled is when in a Major Bull Run

We are not in one yet.

These are excellent places to put buy orders.

ETH1! (Ethereum Futures - CME) Analysis Based on Gap Filling📉📈 ETH1! (Ethereum Futures - CME) Analysis Based on Gap Filling

On the daily chart of Ethereum Futures (ETH1!) on the CME, three significant price gaps can be observed. Historically, these gaps tend to get filled over time. Based on market cycles, we estimate that around 200 days remain until the end of the crypto bull cycle, after which the bear cycle may begin.

🔹 Key CME Gap Levels:

🔸 Lower Gap: $1450 - $1550 (Largest Gap)

🔸 Mid Gap: $2550 - $2625

🔸 Upper Gap: $2900 - $3200

📌 Trade Setup Suggestion:

✅ Entry: $1480

⛔ Stop Loss: $1300

🎯 Target: $3200

🔥 Risk management and confirmation signals using price action are recommended. If the price reacts at the $2550 - $2625 level, partial profit-taking could be a good strategy.

🧐 What do you think about this analysis? Do you also expect these gaps to be filled? 🤔👇

#Ethereum #ETH #CME #Crypto #Futures #TechnicalAnalysis #TradingView

ETH has two pending CME Gaps#ETH #Analysis

Description

---------------------------------------------------------------

+ ETH has two pending CME future gaps to filled.

+ First gap is around 2900-3400 range and second gap is around 2500-2600 range.

+ Sooner or later these CME gaps will get filled. I'm expecting Gap2 get filled in this or next month and Gap 1 in the second or third quarter.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

Bitcoin, Mind The Gap (85,720) The massive move initiated from Trumps tweet Sunday about the Crypto Strategic Reserve has left a massive gap on the Bitcoin Futures Chart. Gaps tend to get fill sooner rather than later, with a high 90% hit rate on gaps getting filled.

We could see a pullback this week to fill the gap with another run up following back above 90k to save the weekly close ... again.

We see confluence with the golden pocket (0.6128 - 0.65 Fib) here on that retracement and also the most amount of volume (VPVR) being traded there.

A final test of the demand below 90k, which if shown as support, will lead us back into the range of 90k to 110k.

CYCLE 4 | CME GAP: Bull Cycle Period First Major Pull Back?Quick post to address BTCs expected potential first major pull back into this bull run period...

BULL MARKET PULL BACKS

Historically, BTC during its bull market enjoys pull back which ranged from 15% to as much as 30%-40% in prior markets. This is essential for trader participants in the market to take profits, allow BTC to retest low levels and prove new heights are sustainable before ranging to new higher price levels.

The first pull back historically for BTC post the start of the 'Bull Run' phase of BTCs 4 year cycle is traditionally the largest pull back opportunity and historically been the best short term buying opportunity in the Bull Run (NOT FINANCIAL ADVICE).

We can expect a 30-40% correction for this pull back based on historic bull market period examples (Let me know in the comments below if you would like me to detail consistent price behaviour during BTC bull run periods in a future post).

ARE WE AT THIS POINT NOW OF THE CYCLE? WHAT ARE THE INDICATORS SAYING?

As highlighted by the RED arrow on the chart, a number of the indicators like to monitor on the weekly chat are suggesting bearish divergences and fading momentum exists with the current price action. This is calling for a cooling off period of the market.

CME GAP

Historically, BTC has had a tendency to want to 'close' open gap, created by weekend trading of BTC that does not align with equities that follow the traditional 'No Trading' over the weekend policy of Traditional Financial instruments. Hence crypto ETFs which align with these policies (such as the CME Futures chart as seen in this chart) can create 'GAP' between the open (Monday) and close (Friday) candles.

To understand CME gaps, please take the time to review the details discussion in the earlier post.

The orange BOX shows the below CME gap target that BTC price may range towards to close.

NOTE: this box has been listed as Partially Closed as the open Monday candle of the gap did go below before rising during the weekly candle but did no dip past the close of the previous weekly candle.

21W EMA & 20W SMA

Historically, a fully developed healthy bull market for BTC has required periodic retesting and holding of these moving averages. A close of the CME gap at this point of the market would also satisfy this historic trend for BTC.

ORANGE TREND LINE

Bears if eager to continue the 'close the CME gap' trend will need to convince the market by first exceeding the orange trend line. Currently this allows BTC to complete a 10 to 12% correction while also taking the price below the key psychological 100K price level, without phasing the bulls conviction to charger higher.

* Holding the Orange Trend Line Scenario: we want to see price bounce and conviction from the bulls to push BTC to higher highs. The goal for Bears would be to achieve the measured move up to 180K. This would most potentially shorted the bull run (time prospective) and potentially cap our ATH for this cycle early; creating a distribution zone similar to the 2021 cycle top.

* Breaking below the Orange Trend Line Scenario: If we break the Orange Trend Line then Bulls will concede ground to the MA levels (allowing the CME gap to also close). Bulls will write this off as a market reset and holding support at these levels will entice Traders to take positions needed to drive BTC up sustainably to the next higher level(s).

Losing the MAs would ask serious questions to the intent of BULLs and the sustainability of the market moving forward this bull run.....

BITCOIN FILLED CME GAPToday BTC might have bounced-off a 5 months away gap.

OPPORTUNITY :

Ideal buy was in the now filled CME GAP.

We might revisit these price, so 79100$ remain a good spot for a BUY/LONG alert.

General buy zone is from 72.5k$ to 85k$ and should last until approximately mid April .

TARGETS :

Ideal sell would be 136425$ in late July (23/07).

Probable sell zone go from 130k$ to 160k$ and should span from early June to early August .

MAXIMAL $ TARGET :

- There is still a chance for a powerful leg up, in the event of prices nearing 200k$ , profit will have to be taken regularly and without restraint.

MINIMAL $ TARGET :

- A faillure to break above last ATH, so 110k$ is definitely a partial sell price (and will react).

MAXIMAL time TARGET :

- All positions (including altcoins) should be closed before October 2025.

Based on

Chart Tools :

- Fibonacci levels from Retracement and Extension

- Expansion/Consolidation periods durations tendencies from this bullrun

- Regression over time of said periods

- Percent change of said Expansions periods

Statistical Arguments :

- Past Bitcoin cycles (2016 & 2021) general seasonality

- Coinglass's Bull-Market-Peak-Signals had 0/30 indicators showing a top

Fundamentals :

- Optimistic US inflation

- Peace negociations

- Pro-business policies

- Blockchain technology usage growth

- Bitcoin & major crypto adoption in finance

Bias :

- Up-trend intact

- No hard corrections compared to previous bullrun

- I guess i could use some profit

BTC1! short idea with open gap fill and catching a quick longAs you might know, open gaps have a fill-rate of 90-95%. Additionally the open CME-gap (1W-basis) has much confluence with important technical levels for support and it lies in the middle of two zones where enormous amounts of USDT-inflows came into the market.

1. the 2024-range (Q1 - Q3)

2. the 2025-range (Q1 at least)

Where the new neckline also is, the new support that became resistance appeared. It might also be a good strike for smart money to know that above the biggest orderblock of 2024 support has developed more strength and consequence. So why you don't give it a try to retest it?

Here a maximum of buying pressure should lead to a strong bounce of BTCUSD towards a new alltime-high, if and as long as global liquidity rises again. But if not, at least inflation should do half of the bullish job for BTCUSD and a "sideways up" would be my - historically BIASed - expectation.

It begins with a shorter short. In the end it might be a very, very quick longer long because of my expectation of rising buying pressure with huge volume delta for the bulls below 78k.

Strong attractor to $BTC price around 88kWe can see a beautiful confluence of technicals around 88k

1- Blue dotted line; multiyear (since 2021) strong resistence trend

2- Orange dashed line; recently reseted volume-weighted average price

3- Green tick line; exponential moving average from last 200 12h periods

4- Purple arrow down; target from shoulder-derivated triangle

5- Green fine line; important multiyear Fibonacci-circle level

If this important resistence made of lots of confluences doesn´t hold, we will see the CME gap closed after price plunges to the marked orange square

Let's talk about CME📈In most cases, BTC is likely to move upward and fill the green CME gap section. This could lead to significant movements in altcoins, potentially triggering the next phase of the bull run and the start of an alt season.

📉However, in the worst-case scenario, if BTC breaks the critical $90K support zone, we could expect a continuous downturn, possibly filling the red CME gap. If this second scenario unfolds, altcoins are likely to experience substantial losses, and the first stage of the alt season may be missed.

📌In the first scenario, if the alt season starts BTC will continuously try to breaks the $90K super support zone. Setting stop losses becomes very important at this stage.

Mean Reversion CME GAP at FOMC -> Pump until BOJ Rate DecissionHello guys! I will share a mean reversion idea on Bitcoin with you today.

I expect Bitcoin to close the CME Gap, that got made at the beginning of the week. Currently we are very close to starting the recovery process. The CME Gap closing aligns very good with a mean reversion to the 50EMA on the 4hr timeframe. This could be an indication for a trend continuation of Bitcoin to the upside until friday when the Bank of Japan (BOJ) will decide their rate policy. We will look into the chart from a new perspective on friday so take this trade idea as a short term one. I mentioned in the chart that we have an unrecovered pink vector candle at the top. This could be an good area to aim for in the reversal process to take profit. With good execution this could be an good trade from 102k to 108k. Me personal, I don't think we will see a rate cut and if so only a small one. So nothing that will shake the markets to hard. I hope.

Trade SAFE!

BITCOIN head and shoulder pattern + CME GAPBitcoin appears to be forming a potential Head and Shoulders pattern, which is a commonly recognized bearish reversal structure in technical analysis.

If this pattern fully materializes, it could lead to a corrective move, possibly targeting the price gap in the $77,000–$80,000 range. This level may act as a magnet for price action, fulfilling a technical gap-filling scenario often observed in market dynamics.