CNC

CNC EARNINGS TRADE IDEA – JULY 25, 2025

⚠️ CNC EARNINGS TRADE IDEA – JULY 25, 2025 ⚠️

💊 Healthcare Pressure + Missed Guidance = Bearish Setup for AMC

⸻

📉 Sentiment Snapshot:

• 🚨 Last quarter: Broke 100% beat streak

• 📉 Thin margins + rising medical costs

• 💬 Analyst bias: Neutral to Negative

• 🧮 Fundamentals Score: 4/10

⸻

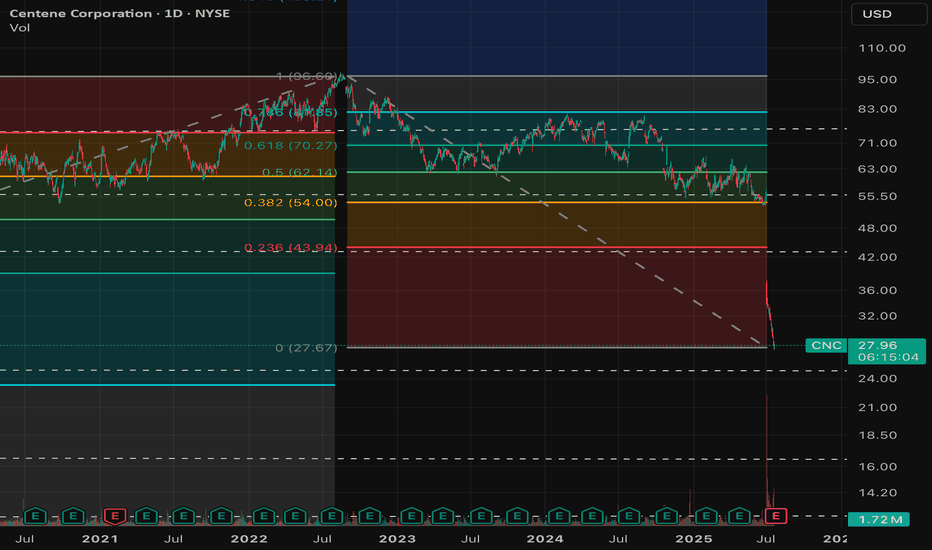

📊 Technical Breakdown:

• 📍 Price: $26.76 (below 50DMA of $48.12)

• 📉 RSI: 32.4 = Oversold but still trending down

• 🛑 Testing 52W Low @ $26.25

• 🔻 Volume = 2.67x Avg → Heavy Distribution

⸻

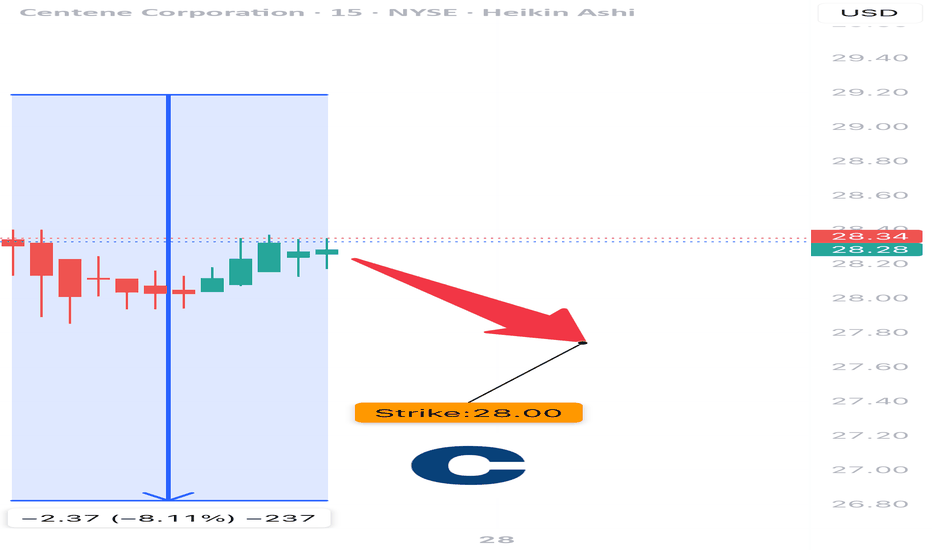

🧠 Options Flow Insight:

• 🛡️ Heavy institutional put activity @ $28

• ⚠️ Weak call interest = bearish skew

• 📉 IV crush possible post-earnings

• Options Score: 6/10

⸻

🧬 MACRO CONTEXT:

• Rising sector costs crushing providers

• VIX < 15 = complacent market, sharp reactions possible

⸻

✅ TRADE IDEA:

🎯 CNC $28 PUT (0DTE)

💵 Entry: $0.20

🎯 Profit Target: $0.60 (3x 💥)

🛑 Stop Loss: $0.10

📅 Expiry: Today (July 25, 2025)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings (AMC)

📆 Close trade within 2 hours post-earnings

⸻

📍 RISK REMINDER:

• Theta decay will be brutal if flat

• Watch for volatility and potential IV crush

• Ideal exit zone = stock retests $26 support

⸻

💡 Weak guide = collapse risk.

👍 Like & repost if you’re tracking CNC puts tonight!

#CNC #EarningsPlay #PutOptions #HealthcareStocks #OptionsTrading #0DTE #EarningsTrade #TradingView #SPX #GammaRisk

Math isn't mathing! Long $CNC for earnings- I'm taking contrarian stance on NYSE:CNC as fears are overdone.

- NYSE:CNC has cash in hand around14 billion and market cap is around 13.5 billion.

- I call bullshit on the market. Math isn't mathing.

- Company isn't going bankrupt. There are headwinds but they will navigate the headwinds and return capital to investors.

- This is not a startup coming out of no where. It has 2 decades of experience navigating difficult times than this in the past be it GFC, Dot Com crash, Covid crash or other bureaucratic hurdles.

Centene Corp | CNC | Long at $35.00Centene Corp NYSE:CNC is a healthcare enterprise providing programs and services to under-insured and uninsured families, commercial organizations, and military families in the U.S. through Medicaid, Medicare, Commercial, and other segments. The stock dropped almost 40% this morning due to recent challenges, such as a $1.8B reduction in 2025 risk adjustment revenue and rising Medicaid costs (leading to withdrawal of 2025 earnings guidance). However, the company has a book value near $56, debt-to-equity of 0.7x (healthy), a current P/E of 5x, and a forward P/E of 9x.

It may be a few years before this stock recovers. But the price has entered my "crash" simple moving average area (currently between $32 and $36) and there is a price gap on the daily chart between $32 and $33 that will likely be closed before a move higher. Long-term, and potentially a new political administration, new life may enter this stock once again as the baby boom generation requires more healthcare services. But holding is not for the faint of heart...

Thus, at $35.00, NYSE:CNC is in a personal buy zone with a likely continued dip into the low $30s or high $20s before a slow move higher (where I will be accumulating more shares). Full disclosure: I am also a position holder in the $60s and cost averaging down.

Targets into 2028:

$45.00 (+28.6%)

$54.00 (+54.3%)

Centene Corp | CNC | Long at $65As a managed health care company, Centene Corp NYSE:CNC doesn't get much attention. However, it is an undervalued growth stock. It's been a workhorse historically for slow and steady financial returns with a 3%+ dividend. The biggest dips along my selected moving average have been into the blue lines - which it recently tested. While the stock may close the gap near $62 is the near future, it's a personal buy at $65.

Target 1 = $78.00

Target 2 = $95.00

Updated Swing Trading Watchlist - Pullback OpportunitiesHello Traders,

As we dive deeper into our trading strategy inspired by Mark Minervini, I'm excited to share a detailed analysis of our updated watchlist:

www.tradingview.com

This list is meticulously curated, focusing on stocks poised for potential pullback entries, suitable for short to medium-term trades. Here’s what we’ve analyzed:

Selection of Stocks in Strong Uptrends: Our primary filter is selecting stocks exhibiting strong uptrends over the past weeks or months. We use specific criteria like stocks trading above their 50-day and 200-day moving averages, a sign of enduring strength. Additionally, we look for stocks outperforming the market index, indicating relative strength.

Volume Analysis During Pullbacks: We observe the trading volume during pullbacks. An ideal scenario is a pullback on lower-than-average volume, suggesting a lack of selling pressure. A sudden increase in volume can sometimes signal capitulation, which might lead to a potential reversal.

Key Support Levels and Technical Indicators: Stocks approaching critical support levels, such as major moving averages or historical support zones, are of high interest. We combine this with technical indicators like the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) to gauge oversold conditions and potential bullish divergence.

Price Action and Chart Patterns: We're scrutinizing price patterns that align with Minervini's SEPA (Specific Entry Point Analysis) criteria. This includes looking for stocks forming bases, tight consolidations, or exhibiting orderly pullbacks without significant volume spikes. Flags, pennants, and narrow range days near support areas are particularly noteworthy.

Sector and Market Sentiment Analysis: Understanding the current market sentiment and sector rotation plays a crucial role. Stocks in leading sectors or those showing resilience in a weak market are preferred. We also consider the broader market trend and economic indicators to assess the overall risk environment.

Risk Management and Entry Points: Each stock on our watchlist comes with a predefined risk management plan, including stop-loss levels and potential entry points. We're waiting for a reversal signal, such as a high-volume rebound off a support level or a break of a short-term downtrend line, to initiate positions.

Earnings and Fundamental Check: While our focus is on technical analysis, we don't ignore fundamental aspects. We check upcoming earnings dates and ensure that the stocks have solid fundamentals, aligning with Minervini's preference for quality stocks.

Conclusion : This watchlist represents a blend of technical prowess and strategic foresight, aiming to capitalize on pullback opportunities in strong stocks. Remember, the key to successful swing trading lies in timing, precision, and risk management.

Stay alert for real-time updates as these setups evolve. Let's capture the market's rhythm together!

CNC At Important LevelCentene NYSE:CNC fired off a signal on this morning's open at a "50 in 50" level. The most important level is the COVID Low to All Time High 50% Retracement which for the last few weeks price has been testing. This is an important multi-year level that the stock price needs to hold to continue to retest the all time high.

To reduce the initial risk on this trade I will drill down to the swing trading timeframe price action. Here we see the last few weeks with an overshoot of the support, price recapture the major 50% level, and now do a short term 50% Retracement around that level. Holding within this range sets up for a long term bullish move off the Supports.

CNC: ON WATCH FOR A $25 MOVECNC:

CNC is now retesting a multi-year resistance around $75. The resistance line has started in August 2018.

The trend is up.

Resistances are made to be broken and a stock that breaks through a multi-year resistance level can lead to a significant rally. It's often even better if the resistance level is at the stocks all-time high since there is no overhead resistance.

I will be looking for a break and weekly close above 75 to enter a long swing position.

This one is for patient investors/traders.

If we break, I would target a 1st target of $100.

Trade safe!

$CNC Centene Corporation Health Care ServicesI like the stock long over the resistance line. You can see that the price is currently knocking on the door of a previous high made all the way back in August of 2018. I think it's time for a catch up here. CNC has lagged it's sector in both price performance and valuation.

$CNC Centene Corporation. Health Care Services.

Trailing P/E: 17.11

EPS Growth:

Last Q vrs Same Q Prior: +1,387.50 %.

Trailing 12 Months vs Prior: +111.62 %

Morgan Stanley and Oppenheimer both have out perform ratings on the stock.

I like the stock long over $75.00 with a minimum upside of the 0.618 Fib extension ($103) witch is about the full peak to trough move from the resistance line to the bottom in October 2019.

Good one for the watch list.

CNC $5.8 Price TargetBeautiful Canadian stock.

Looking at a +$1.4 on a per spike basis.

We know the value in nickel - for the potential EV market.

If you want to set a stop, do it at $2.5 so that you don't lose out in a potential sub 3 dollar dip. I would buy more, you only lose once you sell :)

$5.5+ price target.

Love it long. Will be buying at either 3.25, or at 3.5 on its way back up. And of course again at supports, and again below support up to $2.5

You're welcome in advance.

*Not a financial advisor.

**Don't judge me on my winners. Judge me on my losers, because there are so few.

$CNCIts possible price can bounce off trend line support. The support has been pretty strong. It does look as though price is forming an H&S as well so be cautious and let price develop. If price does bounce off its possible price can head towards resistance possibly forming an ascending triangle. Its also possible price can break through trend line support and sell off some.

CNC Rejection Between 61 - 64 Critical For ReversalFurther price rejection(s) between 61 & 64 could see Centene Corporation Stock Price rally towards the upper trendline of the corrective bullish wedge (or above)...

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades