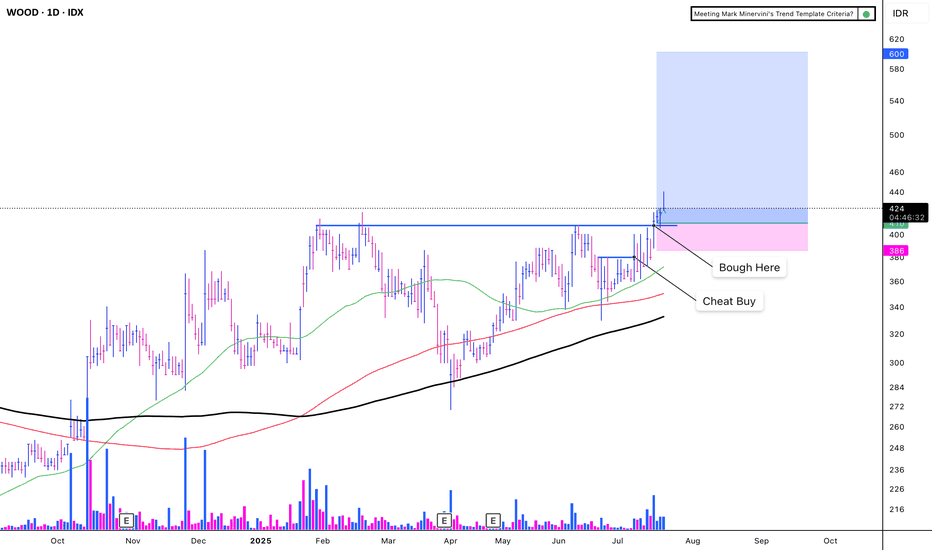

WOOD - CUP WITH HANDLEIDX:WOOD - CUP WITH HANDLE

(+):

1. Low risk entry point

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (85).

8. Carbon sales increase 503%

9. Price breakout with VCP criteria

EPS Growth:

a. Quarterly QoQ: -13.24%.

b. Quarterly YoY: +68.81%.

c. TTM YoY: +49.09%.

d. Annual YoY: +33.27%.

(-)

Trump Implements a 32% Increase in Tariffs on Indonesia

The market is volatile due to the ongoing war

CNH

SHORT NZD/CNH 8H Investment Opportunity

Hello, I am trader Andrea Russo and today I want to talk to you about a SHORT investment opportunity on the NZD/CNH exchange rate.

Trade Details

The trade starts at the 4.40 area with a Stop Loss (SL) at 4.44 and a Take Profit (TP) at 4.21.

Market Analysis

Currently, the NZD/CNH exchange rate is around 4.381. The recent performance of the NZD has shown some volatility, influenced by economic factors such as inflation in New Zealand and trade policies. These elements have contributed to creating a context of uncertainty that could favor a decline in the exchange rate.

Trading Strategy

The proposed strategy involves entering a SHORT position at 4.40, anticipating a decline towards the level of 4.21. The Stop Loss at 4.44 is used to limit losses in case the market moves against our prediction. This setup offers a good risk/reward ratio, making the trade interesting for traders looking for short-term profit opportunities.

Final Thoughts

This trading opportunity requires careful risk management and constant monitoring of market conditions. The volatility of the NZD/CNH exchange rate can offer good profit opportunities, but it is essential to be prepared to react quickly to changes. It is advisable to stay updated on economic news and events that could affect the market.

Happy trading!

US-China Trade War: Impacts on Financial Markets

The trade war between the United States and China has reached unprecedented levels, with the imposition of reciprocal tariffs that are upsetting the global economic balance. China has recently increased tariffs on American products up to 50%, while President Trump has temporarily suspended tariffs for three months, trying to negotiate with other nations. This scenario is generating strong volatility in the financial markets and profoundly affecting the Forex market.

Analysis of the Impacts on Financial Markets

Stock Markets: The main world stock exchanges are recording significant fluctuations. Asian and European indices have suffered drastic drops, reflecting investor uncertainty.

Raw Materials: The price of oil and precious metals shows instability, with oscillations that reflect global nervousness. Gold, considered a safe haven, is gaining ground, exceeding the threshold of 3,000 dollars.

Economic Sectors: Sectors such as technology and agriculture are particularly hard hit, with export restrictions and rising production costs.

Impact on Forex

The trade war is directly impacting the currency market:

US Dollar (USD): The dollar is coming under pressure due to economic uncertainty and recession fears in the United States. The Federal Reserve may be forced to cut interest rates further.

Chinese Yuan (CNY): The yuan is under pressure, with the risk of lower exports to the US and a slowdown in Chinese economic growth.

Safe Haven Currencies: The Swiss Franc (CHF) and the Japanese Yen (JPY) are gaining ground, as investors seek stability amid global volatility.

Commodity Currencies: The Australian Dollar (AUD) and the Canadian Dollar (CAD) could be negatively impacted by fluctuations in international trade.

Forex Strategies for Traders

In a context of high volatility, traders must adopt targeted strategies:

Constant Monitoring: Follow the developments of the trade war and the decisions of central banks.

Diversification: Invest in safe haven currencies to reduce risk.

Technical Analysis: Use analysis tools to identify trading opportunities based on market movements.

Risk Management: Set stop-loss and take-profit to protect capital.

This situation requires attention and flexibility from traders, who must adapt their strategies to the new market dynamics. If you need further insights or a specific analysis on a currency, I am here to help!

CAD/CNH SHORT Investment Opportunity

Hello, I am Forex Trader Andrea Russo and today I want to share with you a short trade on CAD/CNH.

In the world of Forex, every open position tells a story of analysis and strategic choices. This time I decided to focus on a short position on the CAD/CNH currency pair, with a particular focus on risk management and achieving the objectives set.

Trade details:

Entry Price (Entry Point): 5.09402

Stop Loss (SL): 5.10417

Take Profit (TP): 5.06362

Being a short position, my goal is to capture a potential decline in the Canadian dollar against the Chinese yuan. I set a Stop Loss at 5.10417 to limit any losses and a Take Profit at 5.06362 to ensure a profitable exit if the market moves as expected.

Why CAD/CNH?

This currency pair offers an interesting dynamic related to macroeconomic factors from Canada and China, including export data, monetary policies and global market movements. Technical analysis highlights patterns that justify a potential downtrend, ideal for a short position.

Conclusion

Forex trading requires discipline and patience, but every trade is an opportunity for growth and learning. I will continue to monitor the market and update you on the evolution of this position. Don't forget: risk management is always the priority!

AUDCNH SELL 4H

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about an interesting strategy for the AUDCNH currency cross.

Currently, the AUDCNH exchange rate is at a value of 4.61195, and I have identified a selling opportunity based on technical and fundamental analysis. My strategy involves a short entry at this level, with a stop loss (SL) placed at 4.63500, which represents a potential loss of 0.50%. My profit target (TP) is set around 4.55, aiming for a significant bearish movement.

Technical Analysis

The AUDCNH is showing signs of weakness, with a key resistance that has formed near the 4.63500 level. Technical indicators, such as the RSI and the MACD, suggest a possible bearish reversal. Furthermore, the price is below the major moving averages, confirming a bearish trend.

Fundamental Analysis

From a fundamental perspective, the Australian dollar may be under pressure due to weak economic data and a less hawkish monetary policy by the Reserve Bank of Australia (RBA). On the other hand, the Chinese renminbi is benefiting from relative economic stability and targeted stimulus policies.

Trading Strategy

Entry: 4.61195

Stop Loss: 4.63500 (-0.50%)

Take Profit: 4.55 (approximately)

This setup offers an attractive risk/reward ratio, making it a potentially profitable strategy for traders looking for opportunities in the Forex market.

China-US Tariffs: Impact on Forex

Hello, I am professional trader Andrea Russo and today I want to talk to you about a hot topic that is shaking up global markets: the introduction of new tariffs by China towards the United States and the impact that this news is having on the Forex market.

A New Chapter in the US-China Trade War

For weeks, the investment world has been monitoring the evolution of tensions between two of the world's largest economies: the United States and China. After months of negotiations, China has decided to implement new tariffs on US products, intensifying the trade war that began a few years ago. The news had an immediate effect on global markets and, as always, Forex is one of the markets most sensitive to these geopolitical developments.

Direct Impact on USD Currency Pairs

The US dollar (USD) suffered a strong backlash after the announcement. In fact, the tariffs can reduce US exports to China, negatively affecting the US trade balance and fueling uncertainty among investors. The immediate result? A weakening of the dollar against several currencies.

The most affected currency pairs were:

EUR/USD: The euro gained ground, rising to levels not seen in weeks. Economic uncertainty resulting from tariffs has prompted investors to flee to currencies deemed safer, such as the euro.

GBP/USD: The British pound followed a similar trajectory, gaining against the dollar. Although Brexit remains a hot topic, the weakness of the dollar has given the British currency some respite.

USD/JPY: The Japanese yen, traditionally considered a safe haven, benefited from the uncertainty, appreciating against the dollar. A flow of capital into Japan was a direct result of the change in risk perception.

Effects on the Chinese RMB

The Chinese currency, the renminbi (RMB), has also fluctuated significantly. While China is trying to limit the effect of tariffs on its domestic market, the market response has been cautious. In particular, investors are preparing for a possible controlled devaluation of the renminbi, with the intention of maintaining the competitiveness of Chinese exports, which could suffer from higher tariffs.

The Role of Central Banks

Another factor that cannot be ignored in this context is the approach of central banks. The US Federal Reserve (Fed) could decide to review its monetary policies to counter the negative effects of tariffs on the dollar. We could see an easing of monetary policy or even a reduction in interest rates, unless the Fed wants to contain the rising inflation caused by tariffs.

On the other hand, the People’s Bank of China (PBoC) could be forced to take measures to support the Chinese economy. The possibility of a currency intervention could have significant effects not only on Forex, but also on other asset classes such as commodities and stock markets.

How to Capitalize on the Situation in Forex Trading

The developments surrounding the US-China trade war are a boon for Forex traders, provided they are able to carefully monitor the news and react quickly. Here are some strategies to consider:

Breakout Trades: The news of the tariffs has triggered significant movements, and experienced traders can look to enter breakout trades on the most volatile currency pairs. This involves looking to enter long or short positions when a currency pair breaks out of certain support or resistance levels.

Risk-Based Strategies: The uncertainties surrounding the trade war can force traders to be more selective in their trades. Careful risk management strategies, such as risk-reward ratios and stop-loss orders, are essential to navigate the turbulent waters.

Monitoring Central Bank Statements: Any signals from the Fed or the PBoC are crucial. Traders should be prepared to react quickly to any changes in monetary policies, as they can immediately impact the value of the currencies involved.

Final Thoughts

China’s decision to impose new tariffs on the United States marks a new phase in the trade war between the two economic powers. In an already volatile Forex market, this move adds further uncertainty, with the USD likely to face a period of weakness while other emerging currencies, such as the renminbi, could suffer mixed effects.

Happy trading to all.

Andrea Russo

Why dips appear favourable for AUD/USD bullsTrump's reluctance immediately sign an executive order to implement tariffs on China has allowed the yuan to rise against the US dollar. And where the yuan goes, AUD/USD tends to follow these days. And give AUD/USD has already seen an extended move to the downside, some bullish mean reversion is surely due.

The weekly RSI reached oversold ahead of a false break of the 2022 low, and a bullish divergence also formed on the daily RSI. A higher low has formed on prices, and I suspect AUD/USD is due at least one more leg higher.

Bulls could seek dips towards 0.621 or the 10/20-day EMAs in anticpation of a move up towards the August low, a break above which brings 65c into view near the high-volume node (HVN) from the decline from September to January.

Matt Simpson, Market Analyst at City Index and Forex.com

This is why AUD/USD bears need to watch USD/CNHBets are back on for the RBA to cut, with markets having now fully priced in three 25bp cuts beginning in April. Weak GDP was the culprit, which leaves the Aussie susceptible to further weakness should incoming data continue to deteriorate. However, Aussie bears may also need to factor the yuan into the equation.

USDCNH: Triangle Pattern Targets 8.03 Consolidation on the weekly chart has shaped the well-known Triangular pattern (yellow).

Watch the breakout of the upside barrier around 7.3650 for confirmation.

The target is located at the height of the widest part of Triangle added to the upside of the pattern. It's 8.03 CNH/$1

Just a quick note on the outlook for Chinese yuan futures...Exploring the "Condor" : A Look at the Chinese Yuan Futures

In the realm of option trading, the term "Condor" refers not to a bird of prey, but to an intricate options strategy known for its non-directional nature. This strategy, aptly named after the wide-winged condor, involves positioning four options at once, aiming to profit from low volatility in the underlying asset. The essence of the Condor strategy lies in its ability to limit both gains and losses, creating a balanced risk-reward scenario for traders who anticipate movement and price consolidation before expiration date in certain market range.

Recently, a significant portfolio was recorded on the CME exchange, with an expiration date set for October 4, 2024. This portfolio is noteworthy not only for its size but also for the expectations of its owner. The belief is that the price of the Chinese yuan futures will hover between 7.25 and 7.45, a range.

The implications of this portfolio are manifold. For one, it reflects a sentiment that could influence other traders' strategies and market expectations. Additionally, it highlights the importance of understanding options strategies like the Condor, which can be pivotal in navigating the Forex market, especially when dealing with currencies like the Chinese yuan.

As we look ahead, we will undoubtedly keep a close eye on this portfolio, analyzing its performance from the yuan's impact. Forex Traders might (better say "should") consider this a bellwether for future movements, making it a focal point for those looking to gauge market sentiment.

A stronger yuan could spell trouble for USD/JPYA downtrend has formed on USD/CNH since it failed to retest the 2022 high in September. Since then, a lower high, aggressive selloff and a bearish continuation pattern (rising wedge) has formed on the daily chart. The rising wedge projects a downside target towards the cycle lows ~7.1.

If the yuan continues to depreciated (lower USD/CNH), it could prompt other Asian currencies such as the Japanese yen to also depreciate, in order to remain competitive with trade. And as USD/JPY is approaching 152 - a level it failed to test due to BOJ intervention (and subsequent concerns of another intervention) - there's a reasonable chance that USD/JPY may struggle to break above 152.

For now, USD/CNH looks ripe for a move lower given the double top / rising wedge around the 50% retracement level, and bearish momentum picking up. Bears could have a stop above the cycle highs and target the lows around 7.1. But if the Fed begin to drop dovish clues further out, it could also break below 7.1 and head for 7.0.

CNY! Happy Chinese New Year! PEPPERSTONE:USDCNH

Oh, I cannot contain my excitement for this year's Chinese New Year of "Dragon"! 🐉 I mean, who wouldn't be absolutely thrilled to experience the exact same joyous celebrations as last year? And guess what? The depreciation trend of CNY? Oh, it's not going to miraculously reverse itself, not a chance! It's almost as if the Chinese government's awe-inspiring market manipulation is gracefully reaching its magnificent climax. And of course, we can all look forward to those enchanting SWAP contracts being wrapped up right on schedule after Chinese New Year. It has become such a charmingly predictable tradition, hasn't it? Like clockwork, year after year. 🙃

Now, if I gaze into my mystical crystal ball, I foresee a breathtaking future for the Chinese New Year. In the short term, hold onto your hats as the price pirouettes within the thrilling range of 7.21 and 7.17. 🧐 But wait, there's more! In the mid term, it will be up to 7.36, the peak in last year. Long term, prepare yourselves for a heart-stopping ascent to the dizzying heights of 7.78 to 7.81.🧐 Of course, we couldn't possibly fathom it going any higher than that. Why, you ask? Well, it's an absolute enigma why the mother country would ever contemplate lowering the rate of the son, especially when the HKDUSD stands at a jaw-dropping 7.8. It's like an intricate puzzle wrapped in a perplexing riddle, don't you think? 🤭

Yes, the macroeconomic world is teetering on the edge of its seat, eagerly awaiting the news that will come to the rescue of the oh-so-precious property market! I mean, what else could possibly save the day? Whispers and rumors abound about lower interest rates, an astonishing metamorphosis of the 5% public housing policies into a mind-boggling 30%, and let's not forget the grand abolishment of Xi's policy, "house is for living but not for making money". 🤭 Oh, but that's not all! Hold onto your hats as only newly planned developments are bestowed the privilege of borrowing money. Isn't it just splendid? But wait, there's more excitement brewing! Brace yourselves as the government magnanimously increases their securing guarantee for property lending. 🍒 Can you even begin to fathom the magnitude of this? We're talking trillions upon trillions of USD equivalent CNY being injected into the market. It's like a magical elixir that will undoubtedly solve all the property market woes. What could possibly go wrong under Xi's visionary policy? 😛

Ladies and gentlemen, get ready for a spectacular show this year. It's going to be one for the books! What are we waiting for? Wish all luck with you.

HAPPY LUNAR NEW YEAR! 😛

A Traders' Week Ahead Playbook – Hasta la vista rate hikes It’s a central bank bonanza this week, where a good number of these meetings are ‘live’, and where we should see further tightening. The Fed meeting is not a live one (they won't raise rates), but it will get central focus, as it always does.

While swaps markets for a number of counties price a hike this week, and a risk of another in November, residual slowing in demand could feasibly result in this being a week of semantics; a week we look back at and see the last delivered rate hike, ringing the bell on an aggressive tightening cycle.

Making that call through this cycle has been for the brave or those without reputations to lose. However, the sharp decline in interest rate and bond volatility is testament to the idea that the distribution of central bank interest rates is no longer normalised (the market sees an equal chance of hikes or cuts) and is now firmly skewed towards cuts. We can look at rate cuts underway/emerging from LATAM central banks, which we see as a canary in the coal mine for G10 FX – yet, while we’re heading in that direction, unless we get a strong deceleration in demand or a strong tightening of financial conditions, then cuts in DM are a Q224 story.

What to do with the USD this week? The US-exceptionalism story remains central and highly supportive of the USD and that won’t change this week. That said, China is improving, and sentiment is looking to turn, so if USDCNH can head to 7.2000 then I’d be more comfortable calling a USD tradeable sell-off. USD positioning is incredibly rich.

Other themes that are front and centre:

· Crude and its march towards $100

· EURCNH – is this bear trend ready to kick on?

· Was Friday’s 1.8% decline in the NAS100 a one-day affair driven by options flow or is there more vol in store?

· Can US 5yr real rates break out above 2.22% (TradingView code: TVC:US05Y-FRED:T5YIE) - will this be taken poorly by risk?

· Will sentiment towards China turn more positive? Could this see AUD outperform?

The marquee event risks for traders to navigate:

FOMC meeting (Thursday at 04:00 AEST) – In theory, the FOMC meeting should be a low-volatility affair, but it is a risk that needs to be managed. There is very little chance the Fed hike rates, so the focus should fall on the bank’s economic and fed funds projections. Counter to the actions we saw from the ECB last week, the Fed should raise its 2023 and 2024 growth forecasts, while lowering its inflation forecasts. We should see the median projection for the 2023 fed funds rate (the so-called ‘dot plot’) remaining at 5.6%, offering the bank the flexibility to hike again in November, should the data warrant it.

We should see the median 2024 fed funds projection remain at 4.6%, but there is a risk this projection/’dot’ increases by 25bp, which would cement a higher-for-longer stance. We could also see the long-run dot, currently at 2.5%, taken higher. Should the 2024 ‘dot’ be pulled higher, then we could see rate cuts for 2024 being priced out, the USD finding renewed buying interest and equity indices under pressure.

BoE Meeting (Thursday 21:00 AEST) – The BoE should hike by 25bp to 5.5% with nearly all 54 economists (surveyed by Bloomberg) calling for a hike and swaps pricing this outcome at an 82% probability. This could very well mark the last hike the BoE make in the cycle. The BoE will also announce an increased pace of Quantitative Tightening from October 23 to September 2024.

GBP was one of the worst performers in our FX universe last week, with GBPUSD eying a move into 1.2300, while GBPMXN fell 3.6%, falling for 7 days in a row. GBPCAD has also had a strong move lower into 1.6750 and I favour selling rallies into 1.6820.

BoJ meeting (Friday – no set time) – There is no chance of a hike from the BoJ at this stage, and after Gov Ueda clarified late last week that the bank was not looking to move away from Negative Interest Rate Policy (NIRP), one questions if this meeting will cause any movement at all in the JPY or JPN225. National CPI (due earlier at 09:30 AEST) could be more interesting, with expectations of 3% headline CPI (from 3.3%) and 3% on core CPI.

Swiss National Bank (SNB) meeting (Thursday 17:30 AEST) – The SNB should hike by 25bp to 2%, with the market pricing this outcome at 68%. CADCHF has been ripping higher of late, so I would use any dips from a 25bp hike to initiate new longs. GBPCHF tests its recent range lows of 1.1085, so one maybe due for a technical bounce off these levels, although given the event risk in both currencies it wouldn’t surprise to see a range break that holds.

Norges Bank meeting (Thursday 18:00 AEST) – The Norwegian Central Bank should hike by 25bp, but this is fully priced and expected by the market. The Norges Bank are another central bank that could be calling it a day on hikes after this last effort. The NOK seems lost at present and missing a spark and has diverged significantly from the rally in Brent crude. NOKJPY is a case in point, where traders can look at the daily and see range trading the play.

Riksbank Meeting (Sweden) meeting (Thursday 17:30 AEST) – The Riksbank should hike by 25bp to 4% with the markets pricing a hike at 100%.

South Africa Central Bank (SARB) meeting (Thursday) – While S.A core inflation is still too high at 4.7% the SARB should leave rates unchanged at 8.25%.

CBT (Turkey) Central Bank meeting (Thursday 21:00 AEST) - expected to hike 500bp to 30%

Brazilian Central Bank (BCB) meeting (Thursday 07:30 AEST) – The BCB should cut the Selic rate by 50bp to 12.75%, although we may see some skew in the voting towards 75bp. USDBRL eyes range lows of 4.8500, and I favour BRL and MXN longs.

Other key data points that could influence

UK CPI (20 Sept 16:00 AEST) – the market looks for UK headline CPI to come in at 7.1% (from 6.8%), and core CPI to fall to 6.8% (from 6.9%). The market may put more weight on the core CPI measure, where the outcome could affect pricing for the BoE meeting a day later – it would, however, require a huge downside miss to warrant a pause at this week's BoE meeting.

UK S&P manufacturing and services PMI (22 Sept 18:30 AEST) – We saw a big downside surprise in the prior UK service PMI read, which proved to be a key influence in the liquidation of GBP longs. The market expects manufacturing PMI to come in at 43.4 (from 43.0) and service PMI at 49.0 (49.5) – if the outcome comes in below sombre expectations, the GBP could be sold hard.

EU manufacturing and services PMI (22 Sept 18:00 AEST) – expectations for EU manufacturing PMI sit at 44.0 (from 43.5) and services PMI sit at 47.7 (from 47.9). Weak numbers, especially in the service data could bring out further EUR sellers, with EURUSD currently holding the 31 May swing low of 1.0635 – a closing break here puts 1.0516 in play.

Mexico CPI (Friday 22:00 AEST) – the market eyes headline CPI at 4.48% yoy (from 4.6%) and core at 5.77% (from 5.96%). The market sees Banxico cutting rates in December, so this CPI print could play into those expectations and move the MXN,

ECB speakers – The key players on the ECB rollout this week and could move the dial – we hear from Villeroy, Lagarde, Elderson, Schnabel, Lane, Guindos.

USD/CNH looks set for its next leg higherUSD/CNH remains in a soliud uptrend on the daily chart and, after consolidating around the June highs and forming a bullish hammer at 7.25, the swing low appears to be in. A bullish range expansion day broke the bearish resistance line, and bulls could seek to enter upon any pullbacks towards yesterday’s low for a tigher long entry.

The bias remians bullish above Last weej’s hammer low, and we could now be heade for 7.35 or the 2022 high.

A small bulish hammer has also formed on the 1-hour chart. A conservative target projected from the recent leg higher suggests 7.32 for bulls, whilst if we use the run up from 7.27 it projects a target atound 7.34.

USD/CNH Extends Gains Amid Firmer US Dollar and Geopolitical...USD/CNH Extends Gains Amid Firmer US Dollar and Geopolitical Tensions

The USD/CNH currency pair has been making significant strides, extending its gains for the fifth consecutive day during the Asian session on Friday. Trading around 7.3530, the pair is now approaching the resistance confluence at 7.3590. Simultaneously, the onshore Yuan (CNY) has reached a 16-year high at 7.3462 against the US Dollar (USD). These developments underscore the current strength of the USD, which has been bolstered by a consistent stream of positive economic data from the United States.

Firm USD Supported by Upbeat Economic Data

The recent performance of the USD can be largely attributed to the string of encouraging economic indicators emerging from the US. Notably, on Thursday, the release of data revealed that as of September 1, Initial Jobless Claims in the US had decreased to 216,000, a notable drop from the previous figure of 229,000. These numbers defied market expectations, which had anticipated an increase to 234,000. Furthermore, US Unit Labor Costs for the second quarter (Q2) surged to 2.2%, up from the previous reading of 1.6%, contrary to the expectation that they would remain unchanged.

These impressive economic figures have lent support to the USD, instilling confidence among investors and traders. As a result, the USD has continued to gain strength, influencing its performance against various other currencies, including the Chinese Yuan.

Geopolitical Tensions in Focus

In addition to the currency market dynamics, geopolitical developments are also impacting the USD/CNH pair. The upcoming G20 leaders' summit in New Delhi, scheduled to commence this Saturday, has garnered significant attention. US President Joe Biden is set to participate in the event, but notably absent from the guest list is Chinese President Xi Jinping.

Xi Jinping's decision not to attend the summit raises questions about the state of US-China relations. The absence of both leaders at a crucial global forum signifies the persisting strain in their bilateral relationship. It's worth noting that this comes amid ongoing tensions surrounding issues like trade, technology, and human rights, further complicating diplomatic efforts between the two superpowers.

The exclusion of China's top leadership from the summit may contribute to the prevailing geopolitical uncertainty, and the market will closely monitor any developments that could impact the global economic landscape.

Conclusion

The USD/CNH's recent winning streak, driven by a stronger US Dollar and reinforced by positive economic data, highlights the ongoing shifts in the currency market. As the pair approaches key resistance levels, traders and investors will closely watch for potential breakout opportunities. Simultaneously, the geopolitical backdrop, marked by the absence of President Xi Jinping at the G20 summit, adds an extra layer of complexity to the situation, underscoring the intricacies of global diplomacy and their potential influence on currency markets.

Our preference

The upside prevails as long as 7.26750 ( 78.6% Fibo ) is support.

USD/CNH - potential swing trade longUSD/CNH remains within an established uptrend on the daily chart, and the US02Y-CN02Y spread has reached a new cycle high to suggest upside pressure could be building on USD/CNH.

Prices have retraced and are now trying to build a base around the June highs. Bulls could seek dips around the cycle lows with a stop below 7.25 in anticipation of a move to 7.35, the 2022 high or beyond.

Chinese Yuan Price Action Setting Up For a Potential CollapseWe have a huge Void below us and the Yuan has Rallied away from this Void before, but it appears to now be making a Lower High with Hidden Bearish Divergence on Both the RSI and MACD; If the Yuan Breaks Below the B point of this Potential Crab BAMM which also happens to be The Confirmation Line of what would then also be a 3 Falling Peaks Pattern, we will very likely then see Downwards Acceleration Towards the 1.618 Fibonacci Extension Below to Complete the Harmonic Pattern

The case for a Weaker Yuan

The most recent Caixin Manufacturing PMI dipped below 50, landing back in contraction territory after two prints above the 50-mark. As the world's top exporter, China is acutely sensitive to fluctuations in both exports and manufacturing numbers. Historically, we've seen periods of Yuan devaluation during times of contracting Manufacturing PMI and exports as China works to invigorate export demand. With the latest PMI number trending lower, it's worth pondering whether this signals a movement toward a weaker Yuan.

A more detailed examination of Chinese economic data presents some reasons for concern. Chinese export-related economic data has collectively taken a downward turn. This could stimulate further Yuan weakening as the government strives to reinvigorate exports.

Moreover, as the world's second-largest oil importer, lower oil prices gives China additional leeway in weakening its currency, as the ripple effects of higher oil prices are tempered.

From a technical perspective, the CNH is teetering on the edge of the 200-day moving average, and prices have once more nudged above the 0.382 Fibonacci retracement level.

Meanwhile, in a shorter timeframe, we notice price action breaking out of the ascending triangle and nearing the top of the wedge pattern.

With the USD breaking to the upside coupled with the potential for a weakening Yuan, we think this makes the case for a higher USDCNH. Taking a risk-managed long at the current level of 6.9520, a prudent stop 6.8930 and take profit level at 7.0900. A Standard Size USD/Offshore RMB (CNH) Futures represents 100,000 USD. Prices are quoted in RMB per USD, each 0.0001 per USD increment equal to 10 CNH.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

Difference - China Yuan and Offshore Yuan The Chinese yuan, also known as RMB, is the official currency of China. It is used both onshore in mainland China and offshore in international markets.

The offshore yuan, also known as the CNH (Chinese yuan - Hong Kong), is the version of the yuan that is traded outside of mainland China. It is traded in offshore financial centers, such as Hong Kong, Singapore, and London. The offshore yuan is not subject to the same restrictions and regulations as the onshore yuan.

The main difference between the onshore and offshore yuan is that the onshore yuan is subject to capital controls imposed by the Chinese government, while the offshore yuan is not subject to these same restrictions. This means that the offshore yuan is more freely tradable and can be used for a wider range of international transactions, such as international trade and investment, while the onshore yuan is more restricted in its use.

Offshore Yuan -

Standard-Size USD/Offshore RMB (CNH)

Outright:

0.0001 per USD increment = 10 CNH

MICRO USD/CNH FUTURES

0.0001 offshore Chinese renminbi per USD

CNH Option

Google search:

USD/CNH Monthly Options Contract Specs - CME Group

Google search

Frequently Asked Questions: USD/CNH options - CME Group

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

'Can China’s Long-Term Growth Rate Exceed 2–3 Percent?' SummaryThis is a summary of Michael Pettis' 'Can China’s Long-Term Growth Rate Exceed 2–3 Percent?' carnegieendowment.org

As the text was quite long, this summarizes some critical points.

China's high investment share of GDP and growing debt burden are interrelated, stemming from an investment-driven growth model that began in the 1980s when the country needed significant investment in infrastructure, urban property development, and manufacturing facilities. High domestic investment required high domestic savings, leading to a rapid savings increase by constraining household consumption and income growth. Policymakers now recognize the need to rebalance China's economy towards domestic consumption.

High investment levels initially benefited the Chinese economy, as productive investment grew at the fastest pace in history. However, a successful development model should make itself obsolete, and China has closed the gap between its actual investment level and the level its businesses and workers can productively absorb. As productivity benefits of additional investment decline, more investment begins to generate less economic value than the value of employed resources. This can be observed in China's increasing debt numbers.

Countries that followed this growth model experienced a period of rapid, sustainable growth with stable debt levels, followed by a period of rapid, unsustainable growth driven by a surging debt burden. China entered this phase around fifteen years ago. Therefore, the investment share of China's GDP must decline sharply in the next few years, as the conditions that made high investment levels sustainable no longer exist. Historical precedents suggest that reducing the investment share of GDP to a sustainable level is better for the economy's long-term health, growth, and stability.

In this context, rebalancing the Chinese economy will require significant adjustments in its economic structure. Beijing must focus on boosting domestic consumption, though this would likely result in a decline in China's annual GDP growth to around 2-3 percent for many years. The current investment share of GDP is extraordinarily high, making it difficult to reduce it without significantly affecting overall economic activity.

Policymakers in Beijing have increasingly called for an expansion in the role of consumption, but there are significant political constraints in implementing such policies. Rebalancing would require consumption to grow faster than GDP and GDP to grow faster than investment. This implies transferring income from governments and businesses to households, a process that has not yet seen concrete proposals.

The decline in growth will be unevenly distributed, with local governments bearing the brunt of the adjustment while ordinary Chinese people experience less impact. This also means that sectors of the global economy that depend on Chinese investment growth will be more affected, while those reliant on Chinese consumption will be less impacted.

China's investment share of GDP currently stands at around 42-44 percent, which is unsustainable in the long run. For the purposes of this analysis, it is assumed that China should reduce its investment share to 30 percent over ten years, a level typical of rapidly developing economies. As investment declines, the consumption share of GDP must rise.

Michael presents five scenarios under which China can rebalance its economy:

A. Rebalance with a surge in consumption: China's consumption would need to grow by 6-7% annually, while investment grows by 0-1% annually, resulting in a GDP growth rate of 4% over ten years. However, this requires politically difficult income transfers from local governments and wealthy individuals to households.

B. Rebalance while maintaining current consumption growth rates: Consumption growth would remain at 3-4%, with investment contracting by 1-2% annually. This would lead to an average annual GDP growth rate of 1.5% over ten years.

C. Rebalance with a sharp decline in consumption growth: If consumption growth drops to 1-2% annually, the investment must decline by nearly 3% annually, leading to flat GDP growth.

D. Rebalance with a sharp contraction in GDP: This scenario involves a short-term, severe GDP contraction but is considered politically disruptive and unlikely.

E. Rebalance over a much extended period: If China takes 15-20 years to rebalance, with consumption growth at 3-4% annually, GDP growth will drop to 2% and 2.5%, respectively.

Key points include the limited ways China can rebalance, the difficulty in maintaining a high investment share indefinitely, and the necessity of a surge in consumption growth for a more balanced economy. Rebalancing will involve slower GDP growth without faster consumption growth, driven by significant and politically challenging income transfers.

In conclusion, China's rebalancing process will require significant adjustments in its economic structure. The country must reduce its reliance on investment and increase the role of consumption in driving growth. However, the political constraints and the impact on various sectors of the economy make this a challenging task for policymakers. The five scenarios presented illustrate the complexities of the rebalancing process and emphasize the need for a well-thought-out and carefully executed strategy.

China's future economic health depends on its ability to navigate these challenges and transition to a more sustainable growth model. Beijing must strike a delicate balance between addressing political constraints and implementing policies that promote consumption growth while minimizing the negative impacts on various sectors and local governments.

Moreover, the global economy is intricately connected to China's growth trajectory. As China undertakes the rebalancing process, the repercussions will be felt in sectors reliant on Chinese investment and consumption. Businesses and governments worldwide must closely monitor the situation and adapt to these changes.

This analysis highlights the importance of understanding the complexities of China's rebalancing process and its implications for the Chinese and global economies. As China grapples with these challenges, the world must brace itself for the changes arising from this monumental shift in the world's second-largest economy. Only time will tell if China's rebalancing efforts will successfully pave the way for a more stable and sustainable economic future.