CNHUSD

Monthly CNHUSDZooming out to the monthly CNHUSD which represents offshore yuan, we have clearly had an exit from the downtrend that has been in place for close to a decade. The big question is, what's next? Right now, I'm seeing the CNH drop out of a rising wedge to potentially retest the downtrend and/or the 72/89 EMA cloud. I've drawn out my best guess on what a retest would look like. Likely a pull back that translates to sideways consolidation on the 72/89 EMA cloud, and then a rally up.

This chart is more interesting from more of the global implications perspective. Will China devalue again as they did in 2015? If the bull scenario plays out here, what would cause a significant increase in demand of CNH and CNY?

Keeping this macro chart on the list of things to watch.

Macro offshore renminbi compared to USDMonthly chart so much more macro. Theoretically, the way this could play out is that it falls out of the rising wedge to retest the 72/89 EMA cloud. After that, its make or break on falling back in line with the broader downward channel or to send it and bounce off that EMA cloud. The interesting note is the implications of what a bounce off the EMA cloud means... foreign countries holding the CNH. Macro-wise, could be signaling a shift in preferred currencies which I would assume would be due to emerging markets dumping the USD in favor of the CNH.

Big speculation. Who knows!

Significant CorrelationThe strength of the Chinese Yuan and equity markets appears to be correlated due to the Chinese's increased trade presence and credit expansion. If price action continues to push below the 200 day EMA we could be likely looking at a bear market.

Could the dollar milkshake theory prove to be correct?

Only time will tell. (Dramatic music engage)

This Is Flaming Dragon ;) Yuan Is Clearly WinningThe Yuan has clearly outpaced the US dollar . Over 8.5% increase in value vs. the USD since the pandemic.

The Euro is also gaining on the USD.

A lot of central bank games going on so it is very difficult to predict where the Yuan will go and if China will be able to sustain its current track.

China in my view will sustain and an 8% in value vs. the US dollar is absolutely possible within the next 6 month.

ridethepig | Tracking CNH Extremely Closely🔸 China Macro Flows 🔸

The point of this configuration is that CNH is influencing the currency, equity and commodity board that can be seen in AUDUSD, NZDUSD, OIL, Gold and everything in-between...USD's cannot make any use of the Yuan devaluation and this has been a threat ever since Saudi unlocked the CNY oil contract.

For those tracking the Long-term Macro Playbook we are reaching the first area of strong support. Now that all the pieces to the global economy are hanging by a thread, it will be difficult to continue betting on the downside in USD until we clear the second chapter in covid. To put simply,

expecting a temporary stop-over till 2021 as markets will have a difficult time from August convincing people to stand as guarantors to CNH till year-end.

The "Giant Panda" has been playing a 🔑 role in sitting on the AUD bid...however, in an ever changing environment the arrival of Covid Chapter II will make things even more complex. Highly recommend digging deeper into the AUDCNH and NZDCNH which are both experiencing the slingshot as widely expected since the start of the pandemic:

📍 AUDCNH

📍 NZDCNH

... As you all know by now the Oil devaluation gave China a third lever to control its C.A surplus - by devaluing the black stuff it was the equivalent of devaluating the Yuan. As long as we get another hammer in Oil then it will offset any upside in CNHUSD, the only way that the U.S. can manoeuvre around this is by pushing up the price of XAU in USD terms.

Why❓

... Well as we can trade GC1 and CL1 in both USD and CNY terms it means the Gold:Oil ratio is indirectly tightening the noose on the petrodollar market.

Despair. It illustrates the unhealthy stance of the energy market and the 'checkmate' from China/Russia. The textbook move involves a pinning of USD and US Equities. We are still not quite there yet where the USD can begin the waterfall devaluation, it will take a Plaza Accord 2.0 to trigger such an event and until the dollar peaks Equities will remain vulnerable to gyrations in risk sentiment.

Those who are betting on the CNHUSD breakdown are also aiming for a retest of support at the March lows in SPX, NQ and DJIA... The USD will still be the safest place to park in Covid Chapter II.

📍 The Dow

📍 Shanghai Comp

Highly recommend tracking CNH in the 'endgame' of the economy cycle. Typically recessions last 5 Quarters in time and it is far from unusual to see 2 or 3 of those Quarters as dead-cat-bounces. If you are still in any doubts of the picture equity promoters are painting, please take a look at Long Bonds which are refusing to subscribe to the V-shaped consensus view.

As usual thanks for keeping the feedback coming 👍 or 👎

ridethepig | Flash Crash In Play For AUDCNH !!A major breakdown ahead of the open as markets catch up to the virus disruptions. AUD and global trade are set to suffer for sometime, it will take a brave man to step against this flow.

On the monetary side, RBA tee'd up a rate cut in April with another in Q3 on the cards. Housing has already done the heavy lifting, will need A LOT more help from elsewhere to create a positive outlook in the near-term for AUD. PBOC in a 'whatever it takes' moment with the printer starting to overheat.

On the technicals, the doldrum 4.7-4.9 range remained intact throughout 2019. Since the new decade we have broken the lower end in the range via coronavirus trigger, a screaming warning for what is cooking globally. We are sitting at key support 4.5 which needs to hold otherwise we have a flash crash in play towards 4.3 - 4.25. Unless buyers step in quickly we are set to lose support on panic. Continue to sell weakness if we lose support.

For those tracking USDCNH :

For those tracking EURCNH :

Lastly, for those tracking Chinese Equities :

Best of luck all those in CNH, risks come from further PBOC intervention although looks like they ran out of time! Thanks all for keeping the likes, comments and charts coming!

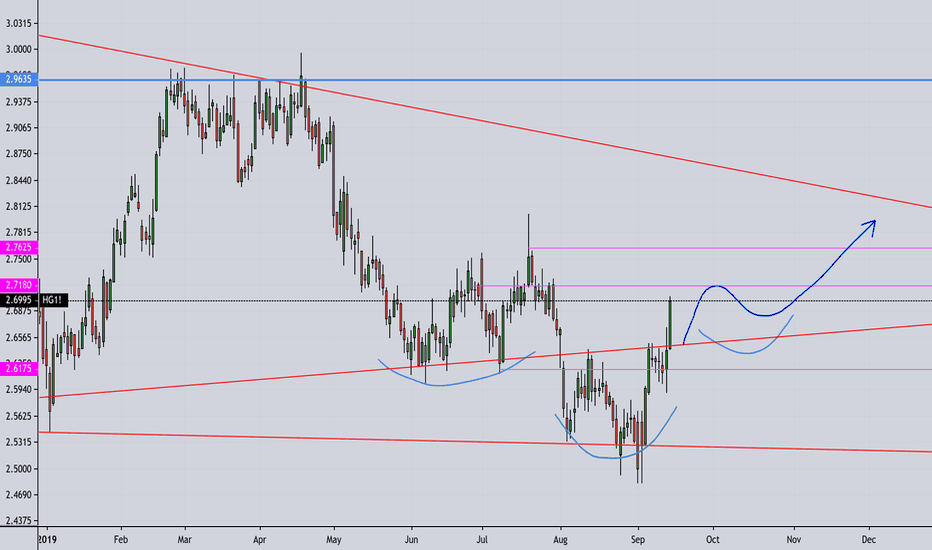

USDCHN, worth the shotThe pattern is a bit unclear, but because the RR is so great i am taking the risk here. Starting small and increasing on the break of the yellow zone. Think we might make a lower high on the daily, so it could potentially drop a lot coming weeks. Making the RR enormous, which makes it worth the risk for me. I am using the stop loss, but in case we move only slightly higher but start to drop again (false breakout), i will probably short it again when that yellow zone breaks.