Coal

Coal India - C&H pattern breakout with volume confirmationToday stock has given breakout in C&H pattern with good volume confirmation.

Stock has finally surpassed 161 hurdle and able to close above it with 162.65 price.

One can go long with SL of 143 and target of 190.

Apart from this Coal india's result is on Monday and hope that result will be on favourable side.

If any one want to go with more security than one can put SL at 159rs.

Energy - ARCHModel has given entry signals for Arch Resources:

- Arch Resources, previously known as Arch Coal, is an American coal mining and processing company. The company mines, processes, and markets bituminous and sub-bituminous coal with low sulfur content in the United States. Arch Resources is the second-largest supplier of coal in the United States, behind Peabody Energy.

- We expect a boom in the energy and industrials sectors, due to an increase in global industrial output to meet initiatives.

- We are very excited about opportunities in the energy and commodities sectors, as we believe a macro turn is approaching in the nearest future.

- Technically appears to be rising to the top of its channel, after testing channel support with a spring.

GLHF,

DPT

Disclaimer:

We absolutely do not provide financial advice in any shape or form. We do not recommend investing based on our opinions and strongly cautions that securities trading and investment involves high risk and that you can lose a lot of money. Loss of principal is possible. We do not recommend risking money you cannot afford to lose. We do not guarantee future performance nor accuracy in historical analyses. We are not registered investment advisors. Our ideas, opinions and statements are not a substitute for professional investment advice. We provide ideas containing impersonal market observations and our opinions. Our speculations may be used in preparation to form your own ideas.

Coal Forecast - Bullish till 21st June 2021The coal has a high chance to make all time high this time. My forecast it can reach US$ 131 or around it. But it will take months from now to make it happen. My focus now is for the next weeks till June 2021, coal apparently will go higher. Though, market will undergo a slight correction but not deep. The target for this upward coming is around 108.45. The bullish trend is very strong right now, and market does need only little time to go downward.

So, be a positive thinking and think to buy only now for coal.

Cheers,

COAL - Will it breakout? One commodity that I follow regularly is coal. For the reason, it influence a lot with mining stocks. The bearish trend of coal ended on Nov 2020 last year. Strong support that holds this market is 71.81-70.41. After breaking out that zone, price consolidating and forming box range corrective structure. For the last 14 weeks, price moving inside that box zone.

Now, the question is, with the recent upward movement, will it breakout the box range structure and continue the bullish trend?

To answer that, I count on the behavior of price towards the S/R. And I see price now breaks short term moving average and closed beautifully with strong body candlesticks (reflects strong buying power). This gives me a hint that maybe...just maybe, this time, the correction already get the bottom and this means, breakout can happen anytime now.

And where it will go after breakout?

112.14 (already marked on my chart)

Psst. Let me tell you a secret. Profits will be on mining business as long as coal price above US$70. And what is the price of coal now?

If profits released on this April 2021 for mining stocks, what will happen to the price?

Coal price rally higher, profits of mining business released and mining stocks ready to be traded.....

ADRO - Trading ModeHere is my analysis for Adaro Energy . Technically, ADRO is still in an uptrend indicated by a higher high has been formed.

I'm looking for a lower high which is quite interesting because there is a high traffic area indicated by a multiple demand area (green zone).

Kindly do your own research and use money management while entry this position.

#disclaimer

coAL INDIA TRADE SETUP

COAL INDIA SHOWING WEAKNESS AT 136.55

SHORT FOR TARGET OF T1- 128 T2- 124 ( TRIPLE BOTTOM FORMATION AT 136.55)

SL ABOVE 137

IF THE PRICE SUSTAINS ABOVE 136.55 GO LONG!

FOR TARGET OF T1- 140 T2- 145 ( LOOK FOR WEAKNESS/ STRENGTH NEAR THE YELLOW TRENDLINE ).

KEEP THE PRICE ACTION IN MIND AND TRADE ACCORDINGLY.

Coal India turning BLACK REDCoal India has been very bearish on Daily time frame and is not able to give price action movement of bullish nature. Thus a recent break of support line and testing its once it is now going to test it second time, though the prob. falls in the second time for retracement but still a price action confirmation can lead us for a short entry.

This thing could go straight to penny land. Broke the support. You have no idea how low this thing can go. Coal business is dead and will be dead for the next 100 years. Stay of commodities that have no future but had a good run. Get into commodities that have to do with green energy because thats where the next 100 years is going to be.

9.5p-10p 1st target - 20p/25p 2nd target - swing / investmentProject going forward.

Ncondezi will receive between $40m-$60m for back costs & development depending on final tariff agreement

JDA signed with GE & CMEC

Higher low set & should head north from here on swing up.

Fundamentals intact & once tariff agreed and numbers are shown this will do most likely 300-400% in a day!

I bought a few times so have average about 5.8p roughly.

Scott Fletcher now with 16% of holding.

Proactive interview coming...this month. News?

$WHC Whitehaven Coal approaching key support lvl. Will it hold? Whitehaven Coal approaching key support level. Will it hold?

Fundamental is not looking good due to labour shortages and bushfire disruption.

It is below all moving averages and other technical indicators are showing it most likely to go lower towards the key support line of $2.49.

Not financial advice but If I was holding, it is time to sell and buy something else.

Demand will go up..."Speculators are people with better than average foresight that step in as buyers when there is an excess in supply, store commodity, and then release the commodity when there is a drop in supply (or rise in demand)" (Nicholas Kaldor, economist)

Here, there is the possibility of profiting from having this better than average foresight.

Simply looking at the truth about the climate hoax, intuitively we might think it's not that hard, how does it make someone so special?

Well the majority, the brainwashed herd, as usual, is falling for it. They are the average.

Speculating is more complicated than buying Oil right now and selling in a few years when demand goes up. And doesn't have to be this way too it can be taking quick long trades over and over. Plus demand could not go up for many reasons.

Each time power thirsty control freak politicians tried to stop "greedy speculators from profiting" the result was devastating. As in people starving (but at least mean speculators didn't profit from selling expensive food to hungry people), as in people on the US east coast burning fuel to warm the pool they don't even use since it was so cheap with a forced price while people on the freezing west coast are dying because there is not enough fuel to heat themselves up (and since the prices are fixed there is no profit to be made no trader is going to buy on the east and sell to the west).

Help make the world a better place and get a cut for doing it right.

This is how I'll build this idea:

1- A few facts that go against the climate change narrative

2- What keeps the demand low? Where will all this demand come from?

3- When will prices go up? Where is the bottom?

1- A few facts that go against the climate change narrative

I can't make a big demonstration here it would be a whole book.

I'm just going to keep it simple and list a couple of facts.

Disproving things the conspiracy club says, and showing they are dishonest (or just stupid).

a. Windmills

I started softly, with arguable info. Time to bring the big guns out.

Brace yourselves, an upside down brain moment is coming.

b. Desertification/deforestation/death of plants

****************

Wondered why the CO2 charts go down every summer?

Who would have thought? Increasing the levels of plant food in the air makes plant grow bigger and multiply more.

Not only they get more food to eat (which is around all time low for the planet more on that later), but also more water, as they do not need to open up as much to catch what little co2 is available, they retain more water.

Bet you never heard of this:

www.nasa.gov

The Sahel too is getting greener.

****************

c. Polar bears & Walrusses

d. Too much co2 for earth to handle

All time low...

e. Earth cannot survive rising temperatures

Do people actually believe those comical claims?

I'm pissing myself when I look at the actual data and then see moronic clowns like Al Gore act all serious and tell every one to repent or the world is going to end soon.

Oh by the way, remember, we only have 10 years left, just like 10 years ago we only had 10 years left, and 20 years ago too we only had 10 years left honk honk.

And millions of sheep in the street demonstrating to "save the planet". I just cringe. All I see are gullible sheep that didn't bother looking at the facts. Same old, same old...

f. Rising temperatures are due to rising co2 levels.

Looking at the co2 levels and temperature we can notice periods where co2 is very high and temperature very low, and periods of millions of years with low co2 and high temperature. This does not mean it does not have some impact of course.

But it is yet another fact that puts the narrative into question.

Propagators of the climate hoax are so dishonest, they draw charts to make them look as correlated as possible.

Let's look at data since 1880:

Which one looks more correlated...

g. Firing "deniers" and rewarding alarmists

Plenty of examples of this you can find. Most academic that dare to speak up are retired or close to retirement and have nothing to lose.

Ah also, science in general has a "replication" problem at the moment. This means herd mentality.

It has always existed (the person that discovered tectonic plates was openly ridiculed when he presented his findings)

But from what I heard it got bigger today.

h. 97% of climate scientists agree

This comes from:

- Some dude with 0 background, that runs an alarmist blog, did a google research and he says he found 97% of papers in the results that were mentionning climate change were not arguing about something or agreeing with certain things (I kid you not that's it)

- A poll sent to scientists asked them "do you think temperatures have been rising since 1900" and "do you think humans have produced co2". Or some insane questions like this, something similar. Of course every one answered yes!

THIS. THIS is what they base their assumption on. THIS is what they use to convince people that every scientist agrees with the WHOLE narrative and toxic marxist ideas.

They just keep lying, it's so disgusting. Lies lies more lies. It never ends. "But it's for a good cause" is what they are thinking.

i. Wildfires are increasing.

The chart climate clowns show you:

The chart they don't want you to see:

It's not all! Ready for the ultimate pun?

j. Sea level worrying rise

In the past 100 years sea levels have rising 10 inches! Very worrying! Soon we will all be flooded!

I could go on, there is so much on this. I still haven't find 1 claim that was some sort of lie.

2- What keeps the demand low? Where will all this demand come from?

Something that hit the price hard was discovering Saudi Arabia had massive reserves.

But what reasons would there be for demand to go up? I'll try covering the main reason, without going too much into details.

a. Cars

In NA EU JP there are about 500 to 800 cars per person.

China is at 180 cars/person (and on an uptrend), India is at 22, uptrend too.

Almost 3 billion people live there.

x Electric cars won't replace fuel cars, and even if they did the electricity would have to come from somewhere...

It would actually use up more fossil fuels with electric cars.

"Visionaries" have been claiming electric cars would take over oil cars for 100 years. Actually probably ever since far more efficient fuel cars replaced electric cars. You can go and find headlines from 1950 with "electric cars are the future".

b. Meat consumption.

It's going to rise. In china it is rising. It requires energy. Simple.

c. Earth population.

Oil Coal Gas supply = constant.

Earth population = predicted to keep rising.

Supply constant, demand up. No brainer.

d. Africa.

1.3 billion (and rising rapidely) people live in Africa.

Nigeria alone is home to 200 million.

When African nations stop having such toxic regulations and become more business friendly, and/or realise the climate change narrative is a hoax (they started questionning europe and complaining about not being allowed to have their own industrial revolution like europe did), their energy consumption is going to go 100 fold.

With the internet everywhere now, every one has access to the truth if they desire (even with google hiding results some people can find out the truth and spread the word)

===> So in conclusion, with supply remaining constant, or perhaps making small improvements, and demand being multiplied (1 billion people in the west at peak consumption, 3 billion in SEA at mid consumption and 1.5 billion in Africa soon more at very low consumption), we can guesstimate that demand will be multiplied by 2, 3, 5, maybe even more.

It is also possible that countries invest heavilly in hydroelectricity and nuclear, which are great, and we won't run out of those. But it is very doubtful that there will be so much of those that it will counter the massive rise in demand of the next decades.

e. Reserves are not infinite.

I don't know how much we have left. Probably the "only 70 years left" are lies. So I'll skip this point.

3- When will prices go up? Where is the bottom?

Who knows?

At some point, there should be an uptrend.

When some new regulations hit, big laws affecting hundreds of millions of people, maybe Congo started a plan to build 100 power plants, or China & India dropped of the Paris accord scam (they promised they would keep raising their emissions at the same rate they already had), with the intention of sending their fossil fuel usage up the roof, etc, then, the price of affected energy sources can go spiking +15% in a day as reaction to the news.

Right now alarmist are doing their best to push the price down but I don't really see big sudden moves down happening.

Will be riskier to short than buy imo.

Seems logical prices will stagnate or drop for now, but the bears really are doing everything they can (lie) to keep prices low without that much success, eventually the forces of demand from Asia will take over and prices will trend up.

Recently (since 2007) there have been big advancements in fracking technology, which has helped lower prices. This is "short term", it drops the price during the short term, but the long term underlying realities are still present, so there was a surge in supply, and its getting more constant now, with demand slowly creeping up.

Once Africa joins the party, or even if India accelerates their development, demand will go boom boom.

And one has to wonder, how much can extraction tech advance? At some point there are physical limits no?

More research is needed, maybe oil exporters have 10 times the production capacity they are using now.

But this is enough for this idea.

Lol maybe someone will make a scanner that sees oil and we'll see the whole Arabia peninsula covered in several kilometers deep reserves of Oil and every one will feel their head spin watching this.

Just keep an eye on what's happening. We'll see it progressively develop, and there will be plenty of buying opportunities.

Also, there are going to be investment opportunities... In energy companies, in Africa perhaps...

I’m almost ALL-IN enCore Energy Corp !Around €10.000.000 marketcap, 138 million total outstanding shares, an all-star team (probably the best for a smaller company) and 200-400 million lbs of uranium below their feet, while sold the biggest US based uranium resource in history for about €1.250.000.000 (more than 120x enCore’s current value). I’m truely obsessed by this company and having a big stake, farout my biggest holding. Will see a 20-100x or more within 3-5 years, very very little risk

METC - Bullish Run Possible If BreakoutRamaco Resources, Inc. engages in the operation and development of coal mining properties. The firm deals with metallurgical coal in central and southern West Virginia, southwestern Virginia, and southwestern Pennsylvania. Its portfolio consists of Elk Creek, Berwind, RAM Mine, and Knox Creek. The company was founded by Randall W. Atkins in August 2015 and is headquartered in Lexington, KY.

P/E Current

6.37

P/E Ratio (with extraordinary items)

6.00

P/E Ratio (without extraordinary items)

7.95

Average Recommendation: BUY

Average Target Price: 7.69

SHORT INTEREST

494.2K 08/15/19

Trump the Great! (Or Not)Trump has been in Office for 921 days. He campaigned on bringing back old industries like steel and of course 'clean' coal. He lived up to his promises of lifting and removing thousands of environmental regulations and laws. So what are the results?

....................1/20/09 - 1/20/17..............1/20/09 - 7/30/11..............1/20/17 - 7/30/119 ..........

ETF .............. OB %chg after 8 Years..............OB Days in Office 921..............TR Days in Office 921

SLX .............. 55.58%............................144.79%............................-7.35%

KOL .............. 1.18%..............................281.81%...........................-2.80%

XLE .............. 69.18%..............................73.26%..........................-15.62%

TAN .............. -74.91%..............................-7.66%...........................63.31%

SPY .............. 181.42%...............................9.84%...........................32.63%

QQQ .............. 340.81%............................106.47%...........................57.23%

XHB .............. 218.83%.............................54.52%............................22.74%

Lessons to be taken. 1. Regulations can help keep smaller players out of your industry, thus reducing competition - Hence 'drill baby drill' not always a good thing.

2. No one believes or want our 'clean' coal. 3. The masses are smarter than the select elite few who deny climate change and are investing in solar.

CLDP: A Very Cheap Earnings PlayPer TradingView, Cloud Peak Energy's Next E.R. Is This Friday

I think this stock has some pretty good looking T.A.

- OBV is kissing a critical resistance level.

- Chaikin Oscillator had an explosive move up from its' low on this daily timeframe. It seems ready to test the 0 line soon.

- It's broken overhead resistance on higher volume than we've seen it trading at recently, so good news of any sort that drives buying volume into the name could easily propel this thing up.

I also like the fact that Rennaisance Technologies has continued to add to their position in the name over the past few quarters.

I'm throwing this one out there as an E.R. play as well because at its last close of 0.074200 today, you could get a good amount of shares with a maximum loss of seven cents on each 'bet'.

Could be a floozie, but I figured most of the adventurous E.R. players out there should at least get a peak at this.

I'm currently holding no position but will be looking at tomorrow's action for a possible entry.

Trade Safe,

- dros

www.androstrades.com

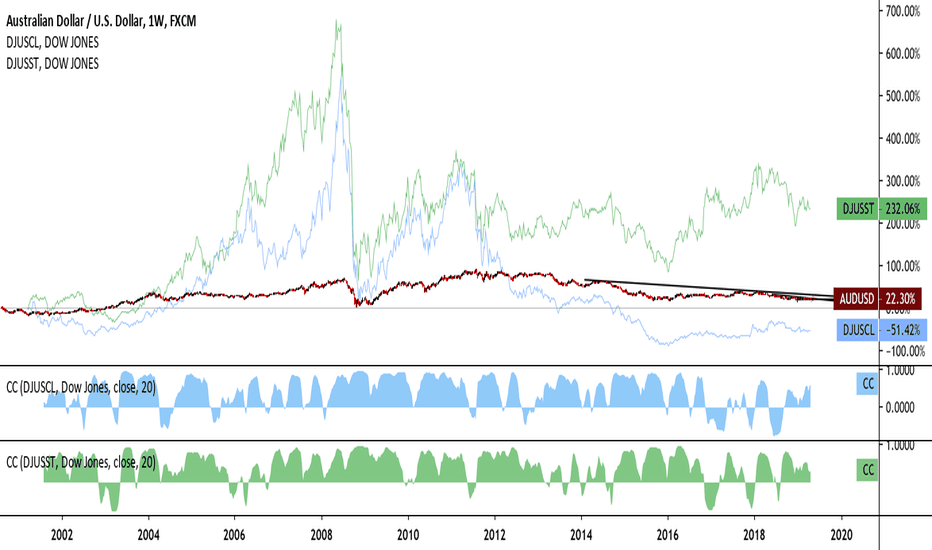

Correlations Between AUDUSD, Coal, and Iron OreI've been taking quite a deep look at the relationship between correlatives of the Australian dollar lately. There's no question that this deep dive would be remiss without looking at correlation coefficients between AUDUSD and that of commodities it exports, primarily iron ore and coal. The chart really speaks for itself. Aussie dollar sees strength when coal and iron prices are up, weakness when its down. Pretty simple. Not much more to say beyond that, but the implications for this relationship are quite fundamental to several questions vis-a-vis the Australian economy such as financial diversification, their reliance upon Chinese imports, not to mention the environmental tolls the Aussies have suffered from global carbon emissions. All issues, public policy or financial, must recognize this important financial relationship before going forward to reassess any changes to the economy that come down on it. At the very least, the implications of these correlations need to be recognized.