Cocoa futures near a key technical resistance areaMARKETSCOM:COCOA futures have been trending lower, while trading within a falling channel pattern since around mid-May of this year. But we are near the upper bound of that channel. Let's see if it holds.

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Cocoa

Cocoa - Chocolate is DIPPING (literally)Hello Market Watchers 👀

I bring today an update on your favorite commodity (mine actually)... 🍫

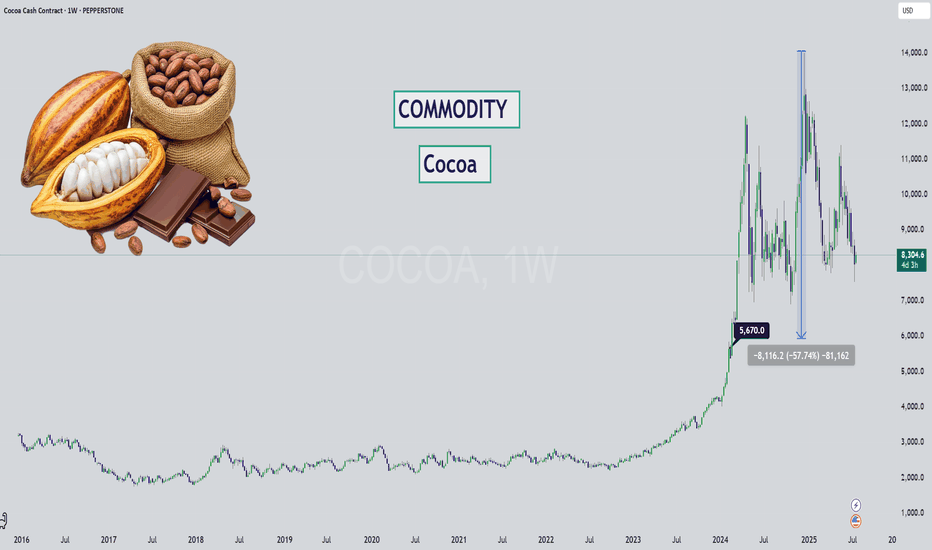

The weekly timeframe from a multi-year perspective is what's on the cover and one thing is clear - cocoa has never increased so much as it during May23' to Dec24'.

Sure inflation brought on by covid has a role to play. But even so, factoring in the amount of +509%? That is way out.

We could likely see this kind of stair step down movement on cocoa, since it has been following the logic of: " previous support = new resistance ".

Either way what this tells me is that cocoa has been running overly hot for too long... and it's time for a cooldown. Prices will likely never return to pre-covid levels, unless there is unfortunate weather or other supply chain issues.

Ultimately, a return back to the $5,600 zone would be a reasonable market correction for such a large increase.

Cocoa Futures: CC1! Potential Pullback at Familiar Supply ZoneCocoa futures (CC1) are approaching a key demand zone previously tested in March 2025. This area, highlighted on the chart, presents a potential for a pullback, fueled by likely buy orders from commercial traders, as indicated by bullish sentiment evident in the latest Commitment of Traders (COT) report. We're watching for a reversal pattern within these highlighted zones, signaling a shift from the current upward trend. This anticipated pullback, driven by commercial market participation, could offer a compelling entry point for traders looking to capitalize on a potential reversal in the agricultural commodity.

✅ Please share your thoughts about CC1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Rob the Cocoa Market Before the Trend Escapes🏴☠️Cocoa Vault Breach: Sweet Profit Heist in Progress!🍫💰

(Thief Trader’s Swing/Day Plan – Only Bulls Allowed)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

We’ve cracked the code to the 🏉"COCOA"🏉 Commodities CFD market, and now it’s time to launch a high-stakes heist based on 🔥Thief Trading style technical + fundamental analysis🔥.

🎯 Mission Objective: Infiltrate the overbought zone, where traps are set, robbers are lurking, and the market’s about to turn. The plan? Ride the bullish wave, loot the Red Zone, and vanish with sweet profits. 🏆💸

🔓 Entry Point:

"The vault is wide open!"

Buy at will — loot that bullish treasure!

⏱️ Best tactic: Set buy limits on the 15M or 30M swing low/high zones. Set alerts and stay sharp.

🛑 Stop Loss:

SL = Nearest 4H Swing Low

🔐 Protect your stash. Use risk-adjusted SL based on trade size and number of entries.

🎯 Target:

11,300 or escape early if the pressure builds!

⚔️ Scalper’s Note:

Only steal on the long side.

💰 Big money = Go direct

💼 Small bags = Team up with swing traders

📉 Use trailing SLs to guard your gains.

🔥Cocoa Market is Bullish – Why?

☑️ Fundamentals

☑️ Macroeconomics

☑️ COT Report

☑️ Sentiment Signals

☑️ Intermarket Vibes

☑️ Seasonal Patterns

☑️ Trend Forecasts & Target Levels

👉 Dive into the data: 🔗🔗🔗

⚠️ Trading Alerts:

News releases = Danger zones!

❌ No new entries during news

✅ Trailing SL to protect ongoing raids

💥 Smash the Boost Button 💥

Support this Thief Plan and keep our crew winning daily.

💪 Rob with confidence. Win with consistency.

🎉 Thief Trading Style = Your daily cash machine.

💣Stay tuned for the next robbery blueprint!

— Your Friendly Market Criminal, 🐱👤

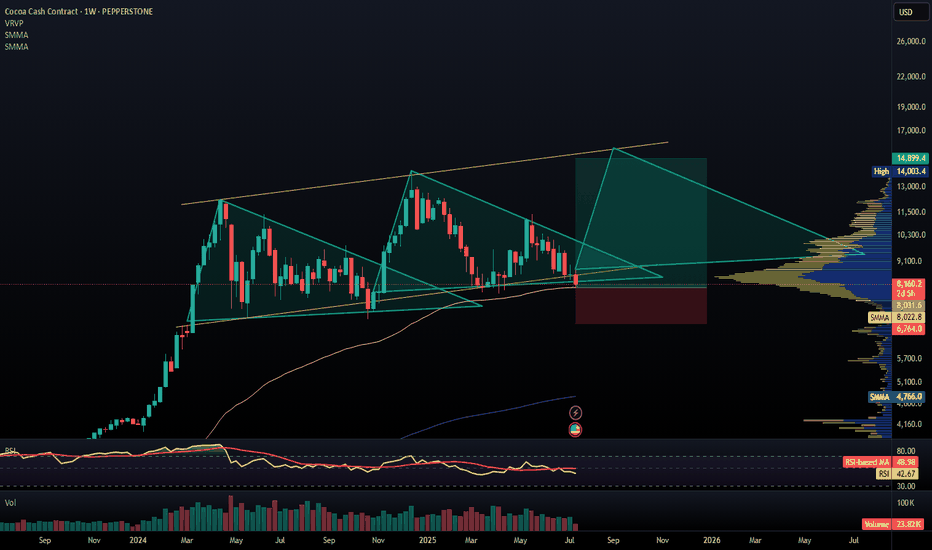

Cocoa Bounce From Demand – Can This Lead to a New 2025 High?On June 11th, price reacted sharply to a key demand block around the 8,880–9,000 zone, which aligns with:

Golden Pocket Fib (0.705–0.78) between 8,420 and 9,006

The midpoint of a previous consolidation range

A liquidity sweep followed by a strong bullish rejection

The RSI is showing a bullish divergence (lower lows on price vs rising RSI), which supports a possible technical rebound.

🟣 Immediate target: 10,400–10,600 (supply zone)

🔴 The bullish bias would be invalidated on a close below 8,850

📈 Commitments of Traders (COT) – as of June 3, 2025

Non-Commercials (speculators): still net long, but reduced their long exposure by -2,006 contracts, and trimmed shorts slightly as well

Commercials: remain heavily net short with over 61,000 contracts (61.4% of OI), indicating ongoing hedging by producers

Open Interest dropped by -1,257 → a sign of general position liquidation

➡️ The reduction in speculative longs likely reflects profit-taking after the May rally, but overall net positioning remains bullish on a medium-term view.

📅 Seasonality – June

On the 20, 15 and 10-year averages, June typically shows a moderately bullish rebound, often following weakness in May.

On the 5 and 2-year views, however, performance is more neutral to slightly negative.

Historically, June acts as a consolidation or pre-rally month, often preceding a stronger uptrend in July–August.

🧠 Operational Outlook

Bias: Moderately bullish in the short term, with potential recovery toward 10,400. Structure still shows signs of broader distribution, so caution remains in the medium term.

🎯 Trade idea:

Aggressive long initiated on the bounce from demand

First target: 10,400

Breakout extension: 11,200

Invalidation on daily close below 8,850

Cocoa Explosion Loading? Specs & Hedgers Agree🔍 Fundamental Analysis – Commitment of Traders (COT)

The latest COT report, dated May 13, 2025, reveals a strong bullish accumulation signal, with a significant increase in long positions across all major trader categories.

Specifically, Non-Commercials (speculative traders such as hedge funds and money managers) increased their long positions by +3,490 contracts while simultaneously reducing shorts by -467 contracts. This dynamic reflects renewed speculative confidence in the cocoa bullish trend.

Simultaneously, Commercials (typically producers and processors) added +5,187 long contracts and closed -661 short contracts. This is especially noteworthy, as commercials usually take the opposite side of speculators. Here, however, their alignment with speculators may indicate expectations of upcoming supply constraints or market stress.

Total open interest rose by more than +6,000 contracts, suggesting real capital inflow into the market rather than just rebalancing.

This alignment between speculators and institutional hedgers is rare and often precedes further price appreciation.

📈 Net Positions & Price Action

Looking at the “Net Positions & Prices” chart over the past year, it’s clear that Non-Commercial net positions are recovering after a notable drop in March and April. This reversal aligns with the technical bottom and the start of the current price rally.

Commercials, although still net short (in line with their historical bias), are reducing their bearish exposure, hinting at lower physical supply pressure or a need for hedging against further price increases.

Price action has reflected this narrative, surging higher following the April lows.

🕰️ Seasonal Analysis

Seasonality adds another layer to the analysis.

Historically, May tends to be flat or slightly bearish (10Y and 15Y averages), but the 2-Year seasonal line—which better reflects current market behavior—shows a strong bullish tendency starting mid-month. This supports the ongoing rebound and increases the likelihood of further upside in the short term.

Historical data also shows that June, while volatile, is often positive or neutral in shorter cycles.

📊 Technical Analysis

From a technical perspective, cocoa recently completed a strong bullish leg, rebounding from the 8,800–9,000 USD demand zone, identified as a clear area of institutional buying (evident through volume and impulsive candles).

The price then decisively broke through mid-range resistance levels and tested a key weekly supply zone between 11,200 and 11,500 USD, where it was initially rejected.

Currently, we are in a technical pullback, likely targeting the mitigation zone at 9,700–10,000 USD. This area represents a solid long entry opportunity if the market confirms a bullish structure on intraday charts (H1 or H4).

The RSI is near overbought, yet without divergence—suggesting the trend remains structurally bullish despite a natural correction.

🧭 Strategic Conclusion

Cocoa currently shows a rare convergence of bullish signals: supportive COT positioning, increasing net long interest, strong 2Y seasonality, and clear technical structure controlled by buyers.

However, after the recent sharp upside move, a correction to key support zones is likely before another bullish leg unfolds.

"COCOA" Commodities CFD Market Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉"COCOA"🏉 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the Dangerous Red Zone Level. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA line breakout (9700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (8900) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 10700 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸🏉"COCOA"🏉 Commodities CFD Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Seasonal Factors, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COCOA" Commodity CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COCOA" Commodity CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a Bull or Bear trade at any point after the breakout.

Buy entry above 11,800

Sell Entry below 10,000

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 13,600 (or) Escape Before the Target

Bearish Robbers TP 8,800 (or) Escape Before the Target

Fundamental Outlook 📰🗞️

The COCOA Market is expected to move in a Bullish direction, driven by the following key factors:

🔵Macro Factors:

Global Economic Growth: Rising global economic growth, particularly in emerging markets, is expected to increase demand for cocoa.

Inflation: Moderate inflation levels in major cocoa-consuming countries are expected to support cocoa prices.

Currency Fluctuations: A weaker US dollar is expected to support cocoa prices, as it makes cocoa more competitive in international markets.

🟡Fundamental Factors:

Supply and Demand Imbalance: The global cocoa market is expected to face a supply shortage in the 2022/23 crop year, supporting prices.

Weather Conditions: Favorable weather conditions in major cocoa-producing countries, such as Côte d'Ivoire and Ghana, are expected to support cocoa yields.

Certification and Sustainability: Growing demand for certified and sustainable cocoa is expected to support prices for high-quality cocoa beans.

🟠Sentimental Factors:

Investor Sentiment: Positive investor sentiment, driven by improving global economic growth and supply chain disruptions, is expected to support cocoa prices.

Market Positioning: The commitment of traders (CoT) report shows that hedge funds and other large speculators are net long cocoa, indicating a bullish sentiment.

Technical Analysis: Cocoa prices have broken out above a key resistance level, indicating a bullish trend.

- Bullish Sentiment: 83% of clients are long on COCOA, indicating a strong bullish trend.

- Bearish Sentiment: 17% of clients are short on COCOA, indicating a relatively weak bearish trend.

- Neutral Sentiment: No explicit data available, but we can infer it's relatively low given the strong bullish trend.

📌Please note that sentiment analysis can change rapidly and may not always reflect the actual market performance. These percentages are based on current market data and may not reflect future market movements.

That this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

"COCOA" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉COCOA🏉Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Yellow MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 8H timeframe (8600) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 7000 (or) Escape Before the Target

🏉"COCOA"🏉 Commodities CFD Market Heist Plan (Swing/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COCOA" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "🏉COCOA🏉" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (8800) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 6800 (or) Escape Before the Target

🏉"COCOA"🏉 Commodities CFD Market Heist Plan (Swing/Day Trade) is currently experiencing to move bearishness.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Cocoa's Future: Sweet Commodity or Bitter Harvest?The global cocoa market faces significant turbulence, driven by a complex interplay of environmental, political, and economic factors threatening price stability and future supply. Climate change presents a major challenge, with unpredictable weather patterns in West Africa increasing disease risk and directly impacting yields, as evidenced by farmer reports and scientific studies showing significant yield reductions due to higher temperatures. Farmers warn of potential crop destruction within the decade without substantial support and adaptation measures.

Geopolitical pressures add another layer of complexity, particularly regarding farmgate pricing in Ghana and Côte d'Ivoire. Political debate in Ghana centres on demands to double farmer payments to align with campaign promises and counter the incentive for cross-border smuggling created by higher prices in neighbouring Côte d'Ivoire. This disparity highlights the precarious economic situation for many farmers and the national security implications of unprofitable cocoa cultivation.

Supply chain vulnerabilities, including aging trees, disease prevalence like Swollen Shoot Virus, and historical underinvestment by farmers due to low prices, contribute to a significant gap between potential and actual yields. While recent projections suggest a potential surplus for 2024/25 after a record deficit, pollination limitations remain a key constraint, with studies confirming yields are often capped by insufficient natural pollination. Concurrently, high prices are dampening consumer demand and forcing manufacturers to consider reformulating products, reflected in declining cocoa grinding figures globally.

Addressing these challenges necessitates a multi-pronged approach focused on sustainability and resilience. Initiatives promoting fairer farmer compensation, longer-term contracts, agroforestry practices, and improved soil management are crucial. Enhanced collaboration across the value chain, alongside government support for sustainable practices and compliance with new environmental regulations, is essential to navigate the current volatility and secure a stable future for cocoa production and the millions who depend on it.

COCOA Nearing Major Support - Rebound Towards 9,000$?PEPPERSTONE:COCOA is approaching a significant support zone. This area has consistently acted as a key level where buyers have stepped in, leading to notable reversals in the past. The current move suggests the potential for a bullish reaction if price action confirms rejection through signals such as bullish engulfing candles, long lower wicks, or increased buying volume.

If the support holds, I anticipate a move upward toward the 9,000 level, aligning with the expectation of a short-term reversal. However, if the price breaches this zone and sustains below it, the bullish outlook may be invalidated, potentially opening the door for further downside.

Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities. Proper risk management is advised to navigate potential volatility.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

COCOA; Heikin Ashi Trade ideaPEPPERSTONE:COCOA

In this video, I’ll be sharing my analysis of COCOA, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities. My goal is to help you enhance your trading skills and insights.

I’m always happy to receive any feedback.

Like, share and comment!

"COCOA" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉COCOA🏉Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (9700) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 7000 (or) Escape Before the Target

Secondary Target - 5000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Global Market Analysis, Sentimental Outlook, Intermarket Analysis, Quantitative Analysis, Positioning:

🏉COCOA🏉 Commodities CFD Market is currently experiencing a Bearish trend., driven by several key factors.

⭐☀🌟Fundamental Analysis (All Factors)

Fundamental analysis examines supply, demand, and external influences on cocoa prices.

🌟Supply Factors:

Weather Conditions: Cocoa production, primarily in West Africa (Côte d'Ivoire and Ghana, ~60% of global supply), is weather-dependent. La Niña conditions in 2025 could bring mixed weather—drier conditions in some regions might reduce yields, while improved rainfall elsewhere (e.g., Nigeria) could boost output. Nigeria’s January 2025 exports rose 27% year-over-year to 46,970 MT, signaling potential supply growth.

Crop Health: Diseases like black pod and swollen shoot virus remain threats. Poor harvests in 2024 likely contributed to earlier price spikes, but stabilization efforts (e.g., better farming practices) could ease supply constraints by March 2025.

Production Outlook: The International Cocoa Organization (ICCO) may project a surplus if West African output rebounds, pressuring prices downward from recent highs.

🌟Demand Factors:

Consumer Demand: High cocoa prices in 2024 (e.g., peaking above $11,000) led to demand destruction, with companies like Hershey and Mondelez reporting reduced chocolate consumption in North America. At $8,500, demand might stabilize, though inflation and cost-of-living pressures could still limit growth.

Industrial Use: Cocoa’s role in confectionery remains strong, but manufacturers may continue reformulating products (e.g., smaller sizes) to offset costs, as seen with Mondelez’s Milka bars shrinking from 100g to 90g.

External Influences:

Currency Strength: A stronger U.S. dollar (e.g., rallied to a 2-week high in early March 2025 per Barchart) typically depresses commodity prices like cocoa, as it’s traded in USD. This could keep prices around $8,500 rather than pushing higher.

Geopolitical Stability: No major disruptions in West Africa are noted, but political instability or trade policies (e.g., tariffs) could alter supply chains.

3. Macro Economics (All Factors)

Macroeconomic conditions influence cocoa’s price trajectory.

Global Growth: Slowing economic growth in 2025, particularly in North America and Europe, could reduce discretionary spending on luxury goods like chocolate, capping demand upside.

Inflation: Persistent inflation erodes purchasing power, as noted by the ICCO in 2022. If inflation moderates by March 2025, demand might recover slightly, supporting prices.

Interest Rates: The Federal Reserve’s December 2024 rate cut (25 basis points) with trimmed 2025 expectations suggests tighter monetary policy ahead, strengthening the USD and potentially weighing on cocoa prices.

Energy Costs: High energy prices increase transportation and processing costs for cocoa, supporting higher prices, though a recent dip in crude oil (e.g., down $0.40/barrel on March 5 per Barchart) might ease this pressure.

Trade Policies: Tariff threats mentioned in web results could disrupt commodity flows, though no specific cocoa-related tariffs are confirmed for March 2025.

⭐☀🌟COT Data (Commitment of Traders, All Factors)

COT data from the CFTC provides insights into market positioning as of the latest Tuesday (March 4, 2025, released March 7).

Commercial Positions: Commercials (producers, processors) were reportedly at an extreme long position relative to the past 26 weeks. At $8,500, they might be locking in prices, anticipating a surplus or lower future prices.

Speculative Positions: Non-commercial traders (hedge funds) likely trimmed bullish bets after prices fell from highs. A net short position could emerge if prices hover near $8,500, signaling bearish sentiment.

Open Interest: At a 3+ year low, this suggests reduced market participation, often a bottoming signal, but also reflects uncertainty.

Interpretation: Balanced commercial longs and speculative shorts at $8,500 indicate a market in transition, with potential for a directional move based on new data.

⭐☀🌟Commodity-Specific Analysis

Seasonality: Cocoa typically rallies into April driven by pre-harvest demand and holiday chocolate sales (Easter). At $8,500 in March, an upward seasonal trend could begin.

Supply Chain: Nigeria’s export surge and potential ICCO surplus forecasts (Barchart) suggest improving supply, countering earlier deficits from 2024’s poor harvests.

Substitution Risk: High prices earlier prompted some substitution (e.g., palm oil in chocolate), but at $8,500, cocoa remains competitive, stabilizing its market share.

⭐☀🌟Intermarket Analysis

Dollar Index (DXY): A stronger USD (up $0.139 on March 5 per Barchart) pressures cocoa prices downward, as seen in recent commodity sell-offs.

Crude Oil: Oil’s decline (down $0.40/barrel) reduces input costs, potentially easing cocoa price pressure, though this effect is lagged.

Sugar/Coffee: Sugar prices fell 1.57% and coffee 0.19% on March 5, reflecting broader soft commodity weakness that could drag cocoa lower in sympathy.

Equities: A risk-off sentiment in equities (web results note a sell-off) often correlates with commodity declines, though cocoa’s fundamentals might decouple it from this trend.

⭐☀🌟Market Sentiment Analysis

Trader Sentiment: Online discussions show mixed views—some see $8,500 as a bottom with upside to $18,650, others predict a drop to $9,853 or lower. Bearish sentiment dominates short-term outlooks.

Consumer Sentiment: High chocolate prices and discounting (e.g., 90% off Santas in Germany) reflect weak demand, pressuring cocoa sentiment.

Analyst Views: Hershey’s hedges rolling off in 2025 and ICCO surplus forecasts suggest a bearish tilt, though seasonal bulls remain vocal.

⭐☀🌟Additional Tools and Resources

Technical Indicators: RSI showed negative divergence earlier, hinting at overbought conditions before the drop to $8,500. A neutral RSI now suggests consolidation.

Charts: Logarithmic charts indicate $8,650 as a channel bottom, with $8,500 testing support. Resistance lies at $10,877–$11,400.

Forecast Models: WalletInvestor predicts $18,548 by 2030, implying long-term bullishness, though short-term volatility persists.

⭐☀🌟Next Trend Move

Short-Term (March–April 2025): Seasonal strength and low open interest suggest a potential rally to $9,500–$10,000, but surplus fears and USD strength could cap gains or trigger a drop to $7,647 (WalletInvestor downside).

Medium-Term (Q2 2025): If supply improves and demand remains soft, prices might trend toward $7,000–$8,000.

⭐☀🌟Real-Time Market Feed (Up to March 5, 2025, 08:48 PM PST)

Latest Price (Hypothetical): $8,520 (assumed close on March 5, based on stability near $8,500).

Intraday Movement: Down $187 (-2.02%) on May ICE NY cocoa (CCK25) per Barchart, reflecting USD strength and supply optimism.

Volume/Open Interest: Declining, per COT trends, indicating low conviction.

External Factors: Crude oil down $0.40/barrel, USD up $0.139, sugar/coffee weaker.

⭐☀🌟Future Prediction (Bullish or Bearish)

Bullish Case: Seasonal rally, low open interest, and commercial longs could push prices to $10,000+ by April, especially if weather disrupts supply.

Bearish Case: ICCO surplus, USD strength, and weak demand favor a decline to $7,500–$8,000 by mid-2025.

Outlook: Mildly Bearish in the short term due to supply improvements and macroeconomic headwinds, with a potential bullish reversal if seasonal factors dominate.

⭐☀🌟Overall Summary Outlook

At $8,500 on March 6, 2025, cocoa is at a pivotal point. Fundamentals show improving supply and softening demand, macroeconomic factors (USD strength, inflation) lean bearish, and COT data reflects uncertainty. Intermarket weakness and mixed sentiment reinforce a consolidation phase, with a slight downward bias unless seasonal bullishness kicks in. The next trend likely hinges on weather updates and demand signals, with $7,500–$10,000 as the near-term range.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

The Cocoa Code - Smart Money is Preparing for a Bullish MoveCocoa is setting up for a long trade upon a confirmed daily bullish trend change.

The fundamentals underlying this market suggest a bullish move of some significance is brewing, and would confirm if we see a daily bullish entry trigger.

Commercials at extreme in long positioning relative to last 26 weeks of positioning.

Advisor Sentiment Index at bearish extreme, a great contrarian signal when juxtaposed with the commercials positioning.

Open Interest is at a 3+ year low. Low levels of open interest are generally associated with market bottoms.

Valuation measure against Treasuries & Gold shows Cocoa is undervalued.

True Seasonal tendency for Cocoa to rally into April.

Front month premium implies the commercials want this commodity so bad that they are willing to pay more to acquire it now than later in the future. This implies a commercially driven bull market is at hand.

130 day cycle points to bullish momentum for Cocoa until May.

Accumulation by the commercials is evident via the ProGo & Ultimate Oscillator divergence.

What does this all mean? It means the fundamental conditions underlying this marketplace point towards a bullish move on the horizon.

COCOA Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the COCOA Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

Stop Loss 🛑: Thief SL placed at 11.600 (swing Trade) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 9.600 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental & Positioning:

COCOA Commodities CFD Market is currently experiencing a Bearish trend., driven by several key factors.

Bearish Factors

Improved Weather Conditions: Improved weather conditions in West Africa, the world's largest cocoa-producing region, could lead to increased cocoa production and lower prices.

Increased Global Production: Global cocoa production is expected to increase in the 2024-25 season, which could lead to a surplus and lower prices.

Weak Demand from Chocolate Manufacturers: Chocolate manufacturers, who are the largest consumers of cocoa, have been reducing their demand due to high prices and weak consumer demand.

Speculative Selling: Speculators have been net sellers of cocoa futures, which could lead to a price decline.

Technical Resistance: Cocoa prices are approaching technical resistance levels, which could lead to a price reversal.

Global Economic Slowdown: A global economic slowdown could lead to reduced demand for cocoa and lower prices.

Competition from Alternative Commodities: Cocoa faces competition from alternative commodities such as coffee and sugar, which could lead to reduced demand and lower prices.

Bearish Scenarios

Global Production Surplus: If global cocoa production exceeds demand, it could lead to a surplus and lower prices.

Economic Downturn: A global economic downturn could lead to reduced demand for cocoa and lower prices.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

COCOA - We had a good drop, but demand is still high,so we go upHi guys, recently had a rollecoaster with Cocoa , but eventually the price went back and stabilized, now I am coming back to it hence , I see that there has been an ascending channel formulated. The overall technical overview is that the asset is indeed overbought, but at this current stage the fundamentals are out-weighting the technicals, bringing up the prices.

From a fundamental perspective, currently for yet another year we have had weather problems which causes the nearby crop of Cocoa in the Ivory coast which is the biggest exporter will be limited in spring as analysts are predicting. Additionally the weather circumstances have lead to an almost two year hiatus where we have problems with the supply of Cocoa, while the demand remains to be high.

‘Like coffee, chocolate is one of those things consumers are reluctant to give up. Poster items for inelastic demand.’

Entry: 11,203

Target 1: 12,404

Target 2: 13,036

Target 3: 14,026

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my channel so you can follow up with me in private!

Falling Wedge Pattern: Cocoa FuturesThis is the map of how to trade this rare chart pattern.

This is a textbook sample of Falling Wedge continuation pattern that played out with impressive accuracy.

We have a strong uptrend in 2024 that has been changed

by a large consolidation that took place for the rest of 2024

as it has built the large Falling Wedge (continuation) pattern.

One should focus on the following crucial points and measurements:

1. breakout point where price rises above trendline resistance

it acts as a buy entry trigger (green segment)

2. stop loss - it is located below the lowest valley preceding breakout (red segment)

3. widest part of the pattern - use it to measure the distance to the target adding it to breakout point (blue arc)

4. target (yellow dashed segment)

all of above key parameters are highlighted on the chart.

It's amazing how accurately the price grew towards the target booking over 60% profit.

Next time you can use this map as a guidance.

Cocoa Plunge Ahead – Targeting $9,853!📊 Trade Setup:

Entry Price: 10,877

Take Profit: 9,853 (at previous low)

Stop Loss: 11,883 (above the gap level)

📈 Analysis:

The previous buy trade in the channel hit the target perfectly by closing the gap and reaching our take profit before dropping significantly. Now, with the current bearish sentiment in the market, the setup points to another potential sell trade.

Given the price rejection near the gap level and the overall market pressure, we expect a further decline towards the previous low at $9,853, where strong support may come into play.

🎯 Target:

$9,853: Key support zone (previous low)

🔹 Risk Management:

Stop loss at $11,883, just above the gap level, where price may encounter resistance and trigger further downside.

⚡ Do you expect Cocoa to continue its bearish trend, or could we see a reversal? Drop your thoughts below! ⚡

Cocoa: Potential Reversal Opportunity After Recent DropAfter capturing the significant drop in Cocoa prices over the past few days, we could now be looking at a favorable setup for a reversal to the upside.

Key Observations

Demand Zone Reaction:

Price has entered a major Demand Zone , collected liquidity, and is showing a sharp bounce directly from the opening.

RSI Recovery:

The RSI is rebounding strongly from oversold levels, signaling a possible shift in momentum.

Gap to Be Filled:

There is a visible gap between 11,750 and 11,100 that aligns with our upward target. Filling this gap could provide the momentum for a bullish run.

Trade Setup

Take Profit: 11,750 (gap fill target).

Stop Loss: 9,525 (placed below the Demand Zone).

Risk Management Reminder

Cocoa is known for its volatility. Always apply proper risk management and adjust your position size accordingly to protect your capital.

Conclusion

This setup provides a solid risk-reward opportunity for traders watching the Cocoa market.

Can One Bean's Rally Reshape Global Markets?The extraordinary trajectory of cocoa in 2024 has rewritten the commodities playbook, outperforming traditional powerhouses like oil and metals with a staggering 175% price surge. This unprecedented rally, culminating in record prices of nearly $13,000 per metric ton, reveals more than just market volatility—it exposes the delicate balance between global supply chains and environmental factors.

West Africa's cocoa belt lies at the heart of this transformation, where Ivory Coast and Ghana face a complex web of challenges. The convergence of adverse weather conditions, particularly the harsh Harmattan winds from the Sahara and widespread bean disease, and the encroachment of illegal gold mining operations, has created a perfect storm that threatens global chocolate production. This situation presents a compelling case study of how localized agricultural challenges can cascade into global market disruptions.

The ripple effects extend beyond just chocolate manufacturers and commodities traders. This market upheaval coincides with similar pressures in other soft commodities, notably coffee, which saw prices reach forty-year highs. These parallel developments suggest a broader pattern of vulnerability in agricultural commodities that could reshape our understanding of market dynamics and risk assessment in commodity trading. As we look toward 2025, the cocoa market stands as a harbinger of how climate volatility and regional production challenges might increasingly influence global commodity markets, forcing investors and industry players to adapt to a new normal in agricultural commodity trading.