“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

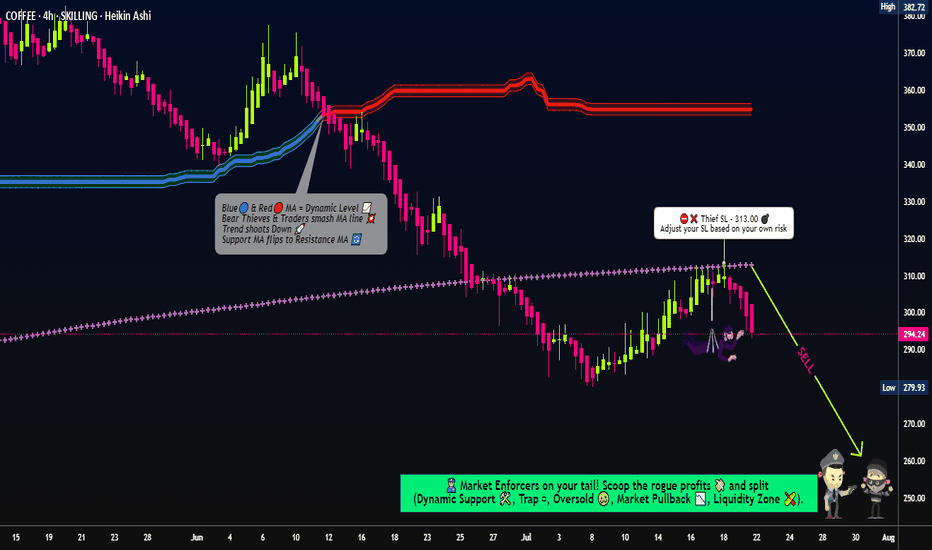

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

COFFEE - My Commodity of ChoiceI've laid out a plan I'm looking at on one of my favorite commodities - COFFEE ☕😍

What makes it so hard is the predictability of the weather - nearly impossible for the future. However, it is odd to see that the price still bonces at key support and resistance zones, almost like any "stock". Which tells me regular market trading still applies despite the odd weather event.

The reason Coffee has fallen so hard over the past few months is supply - due to extremely favorable weather conditions, coffee supply is more than demand. Resulting, as market dynamics goes, in a drop of price.

It's unfortunate though that my favorite pack of beans at the supermarket has not gone down - weird how that works 🙄 I like a medium roast, Columbia single origin.

It's dropped -33% already, but I can clearly see the market structure entering bearish phase after the bullish phase, peak (the new high) and now likely a multi-month bearish season. The question is just where the price can bottom for such a well loved commodity.

I looked at past cycles, not too long ago we dropped roughly 44% during the bearish cycle, taking 2-3 years to move into accumulation before another impulse wave up. That places a target for entry exactly in the highlighted zone around $250ish.

But I wouldn't get too greedy on my favorite commodity, buying orders can't be too low either. This would likely have to be a multiyear hold. Pepperstone sells coffee on cash contract but I usually do futures. Pity that I didn't get in sooner, bullish cycles is also at least a 2 year journey. I'll sell when the weather is bad 😅

Next up? Chocolate for sure...

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot.

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high/low on the 4H timeframe (~380.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 315.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉🔗 (Check our bi0 for liinks!)

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (400.00) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 335.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

☕"COFFEE" Commodities CFD Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Will Coffee Remain an Affordable Luxury?Global coffee prices are experiencing a significant upswing, driven primarily by severe supply constraints in the world's major coffee-producing regions. Adverse weather conditions, notably drought and inconsistent rainfall linked to climate change, have crippled production capacity in Brazil (the largest arabica producer) and Vietnam (the largest robusta producer). Consequently, crop yield forecasts are being revised downwards, export volumes are shrinking, and concerns over future harvests are mounting, putting direct upward pressure on both arabica and robusta bean prices worldwide.

Adding complexity to the situation are fluctuating market dynamics and conflicting future outlooks. While recent robusta inventories have tightened, arabica stocks saw a temporary rise, sending mixed signals. Export data is similarly inconsistent, and market forecasts diverge significantly – some analysts predict deepening deficits and historically low stocks, particularly for Arabica, while others project widening surpluses. Geopolitical factors, including trade tensions and tariffs, further cloud the picture, impacting costs and potentially dampening consumer demand.

These converging pressures translate directly into higher operational expenses for businesses across the coffee value chain. Roasters face doubled green bean costs, forcing cafes to increase consumer prices for beverages to maintain viability amidst already thin margins. This sustained cost increase is impacting consumer behaviour, potentially shifting preferences towards lower-quality coffee, and diminishing the price premiums previously enjoyed by specialty coffee growers. The industry faces significant uncertainty, grappling with the possibility that these elevated price levels may represent a new, challenging norm rather than a temporary spike.

COFFEE Brewing upwardsBull case for Coffee is already well understood and price action confirms string upward trend.

Technicals: Broken above channel, on supprt, bull pennant forming, declining volume. All bullish signals. Gap at $359 possible target on downwards break. Target $500-600. Possible squeeze higher if big players caught short. Price action indicating possible parabolic blow off.

Fundamentals: Much already priced in. Current dryness in Brazil and damage to 2025 and 2026 crops not fully proceed, market hopeful rains will come and save crop. Harvest beginning approx May 2025 will possibly give some selling pressure, but until then stocks are tight and physical market showing no signs of further weakness.

"COFFEE" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (370) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (400) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 340 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"COFFEE" Commodities CFD Market is currently experiencing a Neutral trend (higher chance to 🐻🐼Bearishness)., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Coffee Futures Outlook: Potential Corrections Ahead After HistorCoffee futures have experienced a strong upward movement, breaking their all-time high and unlocking Fibonacci-based mirroring and projection targets. However, the manner in which the price reached this level—overextended and distanced from its moving averages—combined with last month’s candlestick signaling selling pressure, suggests a high probability of corrective movements in the coming months. Should a pullback occur, it will be crucial to monitor how the price reacts upon testing the 20-period moving average.

Are coffee futures starting to show some signs of correction?With coffee futures soaring this year due to supply issues, we are finally seeing some signs of a possible slowdown in the upwards movement. Is this just a temporary correction, before another possible leg of buying? What do you think?

MARKETSCOM:COFFEEC

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

The Coffee Code: A Short Opportunity Hidden in Plain SightThere is a difference between seeing the market and truly understanding it. Most traders react. The enlightened anticipate.

This week, the COT strategy has illuminated a setup so clear, yet so overlooked, that only those who understand the deeper language of the markets will act. Coffeewhispers a warning, and few are listening.

The Codes Have Been Revealed:

🔻 Code 1: Commercials' COT Index – The real insiders, the ones who move markets, are at a bearish extreme. The last time we saw this setup? A major reversal followed.

🔻 Code 2: Positioning Extremes – Large specs are at an all-time high in longs. When the herd rushes in, exits become crowded.

🔻 Code 3: Advisor Sentiment – The so-called “experts” are euphoric. When advisors scream bullishness while commercials quietly stack shorts, it’s a sign. A big one.

🔻 Code 4: Valuation – Coffee is severely overvalued relative to Gold, Treasuries, and the Dollar. The weight of reality will soon press down.

🔻 Code 5: ADX Over 60 – A high ADX signals a trend’s climax. The moment it rolls over is the key to this code triggering the move.

🔻 Code 6: Seasonality – Mid-February to March? Historically, a time of decline. The cycle repeats for those who see it.

🔻 Code 7: Cycles Colliding – Multi-timeframe cyclical pressure is now aligned against coffee.

The rarest and most powerful force in motion.

Additional indicators confirm it. Distribution. Divergences. Ultimate Oscillator. Williams ProGo. %R sell zones. Every signal is flashing red.

And yet, most will hesitate. Most will ignore the signs. They will wait until it's too late.

The question is not whether the opportunity exists. It’s whether you can see it.

If you understand what’s written here, you already know what comes next.

If you don’t... then perhaps it’s time we talked.

Disclaimer

The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments.

Trading financial markets involves significant risk, including the potential loss of capital. Past performance is not indicative of future results. You are solely responsible for your trading decisions and should conduct your own research or consult with a licensed financial advisor before making any financial decisions.

The creator of this content assumes no liability for any losses or damages resulting from reliance on the information provided. By engaging with this content, you acknowledge and accept these risks.

Acknowledgment

The strategies and concepts taught in this class draw significant inspiration from the works and teachings of Larry Williams, a pioneer in trading and market analysis. His groundbreaking research and methodologies have shaped the foundation of modern trading education.

While this class incorporates Larry Williams’ principles, the content has been adapted and presented to reflect my own understanding and application of these ideas. Full credit is given to Larry Williams for his original contributions to the field of trading.

COFFEE // on the way upThe market is long on every timeframe, and broke the last clean H1 breakdown, so the weekly target fibo 138.2 level is valid again.

KEEP IT SIMPLE!🏄🏼♂️

———

Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key levels where significant momentum originated.

Level colors:

Daily - blue

Weekly - purple

Monthly - magenta

H4 - aqua

Long trigger - green

Short trigger - red

———

Stay grounded, stay present. 🏄🏼♂️

<<please boost 🚀 if you enjoy💚

Coffee KC - Why I see $390 and $470 as possibleThe Medianlines project the most probable path of price. It's not a fortunetelling tool. It's a technical tool which is based on serious statistical research.

So, what I do when I use it is, using statistical proven evidence on a graphical basis, supported by a definite trading framework.

Why do I pound on these information?

Because it's important to understand what Medianlines aka Pitchforks are based off, and what they are good for in trading. No "Magic", just a tool that helps a trader/TA in it's daily Job.

ANALYSIS OF COFFEE

The up-sloping white Fork shows us the most probable path of price. It's up. Price blew through the Center-Line, found support, and advanced even more to the upside from there.

Then we have the slanted yellow dashed lines.

What are they?

Many say this is a action/reaction thingy.

Others say, it's a timing tool.

I say, it's both.

The way I use it, it takes in the angle from the last real high, and the low of the pullback from it. Then I go back to the last low before the new high. This creates an Angle, and a width. Combined it gives us not only a potential timing, but with the dynamic of price movement also potential resistance/support.

So, we can see where we got such signals - where the orange circles are. The second one intersects very nicely with the Center-Line of the white Fork. I observe this "incident" often when I use them.

Back to Coffee...BRB §8-)

We see the time/price line intersecting with the 1/4 line of the Fork. I expect a reaction there - even a pullback back to the Center-Line is possible from there.

But if price also blows through this level, then I know that the next Target will be the Upper-Medianline-Parallel.

So, there we have it.

I hope you can take away some knowledge from this post and thanks for all the boosting and following folks.

Are Global Coffee Markets Brewing a Crisis Beyond Price?In an unprecedented turn of events, the coffee industry faces its fifth consecutive season of demand surpassing production, driving prices to their highest levels in nearly half a century. This isn't merely a story of market dynamics – it's a complex narrative where climate change, shifting consumption patterns, and agricultural sustainability converge to reshape the future of the world's favorite beverage.

The situation has reached a critical juncture as major producing regions struggle with severe weather disruptions. Brazil's drought-stricken Arabica crops and Vietnam's weather-battered Robusta production have created a perfect storm in the market. Volcafe's dramatic reduction of its 2025/26 Brazilian production forecast by 11 million bags underscores the severity of these challenges. China's 60% surge in coffee consumption over five years adds pressure to an already strained supply chain.

Perhaps most concerning is the structural nature of these challenges. Traditional growing regions, from Kenya's prestigious AA bean farms to Brazil's vast coffee plantations, face existential threats from climate change. The delicate balance required for premium coffee production – specific humidity levels, temperature ranges, and rainfall patterns – is increasingly difficult to maintain. One industry expert notes that suitable growing areas continue to shrink, suggesting current market pressures may become the new normal rather than a temporary disruption.

This convergence of factors presents both challenges and opportunities for investors, industry stakeholders, and consumers alike. As major producers like Nestlé and J.M. Smucker announce price increases for 2025, the industry stands at a crossroads. The future of coffee will likely be defined not just by how we manage immediate supply challenges, but by how we adapt to an*56C3VFGBHd innovate within these new environmental and market realities.

COFFEE - UniverseMetta - Signal#COFFEE - UniverseMetta - Signal

D1 - Formation of potential 3rd wave.

H4 - Securing behind the channel line + possible retest of the level, through the 3rd wave. You can try to enter from these levels or wait for the breakout of the 1st wave. Stop behind the maximum of the 1st wave.

Entry: 328.66 - *320.11

TP: 307.55 - 293.16 - 279.62 - 257.96

Stop: 344.60

Can Coffee's Future Brew a Global Economic Storm?In the high-stakes world of global commodities, coffee has emerged as an unexpected harbinger of economic complexity, revealing how climate volatility can transform a morning ritual into a geopolitical and financial chess game. The current market is experiencing unprecedented turbulence, with Arabica coffee prices surging over 80% in 2024, shattering decades-old records and signaling a profound disruption in one of the world's most beloved agricultural products.

This dramatic price escalation is not merely a statistical anomaly, but a stark illustration of interconnected global systems under extreme stress. Brazil and Vietnam, the twin titans of coffee production, have been ravaged by climatic extremes—from the most severe drought in 70 years to unpredictable rainfall patterns—creating a perfect storm that threatens not just coffee supplies, but exposes the fragile underbelly of global agricultural supply chains. Leading traders like Volcafe are projecting an unprecedented fifth consecutive year of supply deficits, a scenario that challenges traditional market resilience and demands innovative strategic responses.

Beyond the immediate economic implications, this coffee crisis represents a microcosm of broader challenges facing our increasingly complex and climate-vulnerable global economic ecosystem. As major manufacturers like Nestlé begin to signal potential price increases and package reductions, consumers and businesses alike are forced to confront a fundamental question: How do we build sustainable, adaptable systems in an era of escalating environmental uncertainty? The coffee market's current volatility is not just about a potential price hike in your morning brew, but a compelling narrative about resilience, adaptation, and the intricate dance between human enterprise and natural systems.

For the astute observer and strategic thinker, this coffee market disruption offers a compelling lens through which to examine broader economic trends. It underscores the critical importance of diversification, technological innovation, and proactive risk management in an era where climate change is no longer a distant threat, but an immediate and transformative economic reality. The story of coffee in 2024 is more than a commodity report—it's a provocative invitation to reimagine our understanding of global economic interdependence.

Coffee Is Getting ExpensiveCoffee is in a massive rally on tight Brazil crop fears and if we take a look at the weekly chart, we can see it trading impulsively higher with space for more gains until it fully completes a five-wave bullish cycle by Elliott wave theory, just watch out on short-term 4th wave pullbacks.

Basic Impulsive Bullish Pattern shows that Coffee can be trading in subwave "iii" of 3 of (3) of a five-wave bullish impulse of different degrees, so more gains can be seen after short-term 4th wave pullback.