CHINA VIRUS IS FAKE NEWS! READ THIS POST & BUY THE MARKET!!!Folks, and our followers...

The Chinese flue is "FAKE NEWS" only meant to cast a shadow over the BOOMING USA Economy and scare the public around the world...!

The SICK Liberals and Dirty Democrats want the USA stock market and stock markets around the world to crash and the USA economy to sink! These people are SICK..!!!

The real statistics you need to know about before selling into this FAKE NEWS China Flu Scam ...

Each year, over 600,000 people die from the FLU...

In 2018 alone, over 80,000 people died from the FLU...

Did we see the market crash in 2018..? NO NO NO..!!!

As of this post, there are ONLY 8 CASES of the dirty China flue in the USA...The FAKE NEWS continues their SICK agenda to try and crash the USA Economy before the 2020 election...!!!

CDC Link...

www.cdc.gov

Public Companies are reporting ROBUST Revenues and Profits, the China Flue is a SCAM...!

BUY THE DIPS BECAUSE UNTIL WE SEE THE DEATH TOLL IN THE USA COME CLOSE, OR PASS 60,000 TO 80,000 DEATHS FROM THE CHINA FLUE, IT'S FAKE NEWS!!!

DO NOT LET THE FAKE NEWS SCARE YOU INTO SELLING.

BUY BUY BUY

Coffee

Coffee has taken a dive, now looks ready to rally againPost the sugar-rush of speculative buyers, the commodity sold off heavily, gapping through a short term uptrend-line. Now the commodity, represented by the ETF JO, looks to be stabilizing at the 38.2% Fibonacci level from the Dec 13 high. Moreover, we see a cluster of moving averages, including the 200day Exponential Moving Average at this level. Given the current risk-on, and dollar-down environment, coffee should be supported moving forward. This sell-off is overdone, and other soft commods such as Cocoa and Sugar have performed splendidly in recent weeks. There is no reason for Coffee not to do the same. I am targeting new near term highs, and a 141% extension from the previous rally off the lows.

Coffee: Supply and DemandIf you like this idea, don't forget to support it clicking the Like Button!

Coffee futures continued to drop, now trading on a strong support area ($115). The price has recently soared ($142) due to Brazil's supply difficulties. On the other hand, I'm expecting Coffe demand to be stable or even grow, supporting the rise of Coffee prices.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Sbux LongAccording to Bloomberg, The Fed Is Entrenched in the Repo Market.

"Since the rate on overnight repo spiked to 10% on Sept. 17 from around 2%, the central bank has been conducting overnight and term repo operations to help rebuild banking reserves, adding $237 billion of liquidity. It’s also prepared to inject up to $490 billion around Dec. 31."

Since, the market is held up by the fed, I looked around for some safe stocks to go long on and Sbux seems like a good safe bet.

if we get a pullback to $88 today, i would get an entry and see if we could potentially reclaim ATH at $99.72 in the next two weeks.

especially since majority of the white girl index is hitting All Time Highs, Why can't Starbucks?

Stoploss around $86

Take profit $91

max target 99

Coffee is on a rise! It must be the caffeine I have just closed out a +8% trade and I am going long again.

The initial fundamentals where:

Brazillian drought

US-China trade war increasing agriculture exports out of Brazil

Weak $BRLUSD

Although some of these fundamentals are starting to wane, the technicals continue to show that Coffee has more to go

KC, Coffee C Futures - Symmetrical Triangle on Coffee FuturesICEUS:KC1!

Commodities are very volatile assets that can generate excellent profits if traded with discipline and awareness of their volatility.

In this case we are monitoring the compression of the price that is represented by the symmetrical triangle pattern, often symptom of potential breakout with subsequent trend.

We have set the alerts and we are waiting.

www.theice.com

Starbucks: The selling isn't over.Starbucks is being under heavy selling pressure since the start of September having fallen over -12% since its All Time High. This is not alarming for long term investors as the rise since July 2018 has been extremely aggressive (that aggressive that the Monthly chart is still bullish with RSI = 67.474, MACD = 8.570, Highs/Lows = 8.7721), but the selling isn't over yet.

According to its long term set up since 2012, the price always touches the MA50 on the 1W chart (illustrated with blue) after a market peak. Currently that is at 77.50, within the 81.65 - 73.65 range made after the % decline of the last 2 ATH falls. We expect that to be the Demand Zone for the stock and is where we are turning into long term buyers again towards a target value above 100.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

LONG KC!1 / Coffee Futures til year end 2019Fundamentals seem to be aligning up just perfectly (BRL strength coming up, current cyclical low yield year, solid to steadily growing global demand etc.),

all the while the until-recently uber bearish chart already started to brighten significantly - to me at least!

Reasons enough for a cautiously bullish view of things.. and for me to open a small position :P

Tell me what yall think!

Coffee: Boom. Roasted!This is an excerpt from the Parallax Weekly premium report originally published July 15, 2019.

"The net-positioning in coffee has surged, and the percentile metric is not suggesting it’s extremely overdone even though the one-year z-score is well above 2.

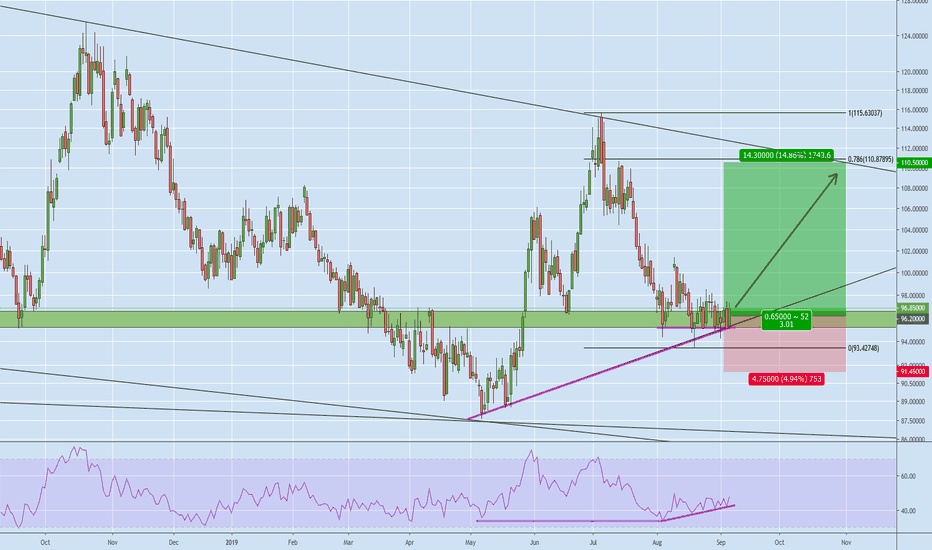

The problem now is that coffee prices have declined from $116 to $106 with net-longs still in charge. There is uncertainty surrounding frost that effected the Brazilian crop. Contingent on crop damage estimates, record production expectations into 2020 and price/net-positioning divergences, the bearish case for coffee @ 96 is created."