“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

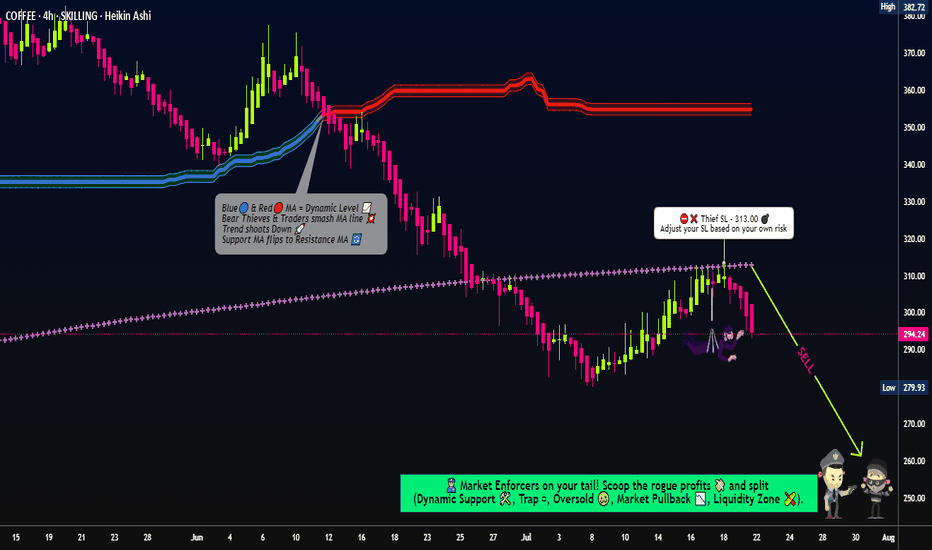

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee_trade

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot.

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high/low on the 4H timeframe (~380.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 315.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉🔗 (Check our bi0 for liinks!)

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (400.00) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 335.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

☕"COFFEE" Commodities CFD Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (370) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (400) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 340 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"COFFEE" Commodities CFD Market is currently experiencing a Neutral trend (higher chance to 🐻🐼Bearishness)., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

The Enigma of Robusta: Why is Coffee's Unsung Hero So Valuable?Robusta coffee, a resilient and versatile bean, has played a pivotal role in the global coffee market. Despite its often overlooked status, Robusta has experienced a significant surge in value in recent years. This article explores the factors driving the rising prices of Robusta coffee, including increased demand, supply chain disruptions, and climate change. By understanding the challenges and opportunities facing Robusta, we can better appreciate its enduring significance in the global coffee industry.

Introduction

The global coffee market has witnessed a steady rise in demand, leading to a corresponding increase in prices for both Arabica and Robusta beans. While Arabica often takes center stage, Robusta, a less celebrated but equally essential bean, has also experienced a notable appreciation in value. This article delves into the reasons behind Robusta's ascent, examining the factors that have contributed to its growing prominence.

Factors Driving Robusta Coffee Prices

Several key factors have converged to push Robusta coffee prices upward:

Increased Demand: The global appetite for coffee has expanded significantly, particularly in emerging markets. This rising demand, coupled with a limited supply, has created upward pressure on prices.

Supply Chain Disruptions: Weather-related challenges, geopolitical tensions, and logistical constraints have disrupted supply chains, leading to shortages and higher costs.

Climate Change: Climate change has exacerbated weather-related events, such as droughts and floods, impacting coffee production and driving up prices.

Shifting Cultivation Patterns: Some farmers have shifted their focus to more profitable crops, reducing the overall supply of Robusta coffee.

The Enduring Value of Robusta

Despite the challenges it faces, Robusta Coffee continues to hold significant value. Its resilience, versatility, and unique flavor profile make it a sought-after commodity. As a cornerstone of the global coffee market, Robusta plays a crucial role in meeting consumer demand and supporting the livelihoods of millions of farmers.

Conclusion

The rising prices of Robusta coffee can be attributed to a combination of factors, including increased demand, supply chain disruptions, and climate change. While the future of coffee production faces challenges, Robusta's enduring value and adaptability position it as a resilient force in the global coffee market. By understanding the factors driving price increases and exploring innovative solutions, we can ensure the continued sustainability and enjoyment of this beloved beverage.

Coffee - SHORTSeasonal tendencies are working against this, paired with U$D pressures as those continue to build.

Beyond that, world production is in steady decline with visible crisis levels looming on the horizon (within a decade). This is mostly due to radically increased UV levels in coffee growing regions, paired with a rapidly declining global work force.

Coffee price keeps the negativity – AnalysisCoffee price provided more negative closings by consolidating below 178.00 resistance, to start reacting to the major indicators by declining towards 159.40, expecting to continue forming negative crawl and attempt to touch 154.00, while breaking this obstacle will extend trades towards 147.10 to face the historical support that appears on the chart, assuring the importance of monitoring its behavior to manage to detect the next main trend.

What’s brewing with coffee futures?Like most commodities, London coffee futures saw a massive price uptrend in 2021. However, since the beginning of 2022, it's finally cooled off to an eight and half month low. As a silver lining, perhaps more interesting price action is currently heading our way.

With a very sharp fall during the last two weeks of February it's since consolidated, trading between $2,000 and $2,200 per metric tonne. As of writing, London robusta coffee futures (LRC) are trading at $2,099 per metric tonne.

For London coffee futures, May is typically a ranging month with price starting to pick up towards the second half of June. More often than not, highs of the year are made during the June and July months. However, seasonal trends will be butting up against the possibility that coffee prices are still overextended from 2021’s price hike.

Where could coffee prices reasonably head?

Looking at the daily chart with the Awesome Oscillator indicator, we can see some slight divergence. In spite of its undescriptive name, the Awesome Oscillator details trends and shifts in momentum. On the chart above, can see that the indicator is showing signs of a shifting momentum since the first week of March. With price consolidating, the indicator has slowly crept back up to its zero line, failing to keep correlation to the actual price and trend of the price chart. This could be a suggestion that price may make its way towards June and July highs. If so, the bigger question is if it will actually create the yearly high as well before making its way back down.

In respect to fundamentals, it has been noted that Brazil is currently harvesting a record setting yield of robusta coffee beans. However, the risk of frost hitting Brazil’s crop might not have been priced into its current trading price.

Start trading coffee futures with live and demo accounts today

Up, up and away!The coffee futures have broken today the bullish flag, and this derivate on coffee follows the coffee price accordingly. Maybe in the following days, a pullback is possible, reaching 3,71 or the vicinity of the broken trendline below.

According to the seasonality and inflation, I expect a general bullish trend in coffee until the end of the year. But buying this instrument and holding it until the end of the year could be difficult because of the volatility decay. Take care!

Expect the price of your cup of coffee to increase. We have both technical and fundamental justifications as to why coffee is the next inflationary trade to jump into.

With supply chain issues and the seasonal changes in Brazil affecting coffee production and shipping, we can expect the value of the black breakfast gold to rise. Latin American coffee farmers are also reported to have gone on strike in the last few months to demand better prices for their produce as they are barely turning a profit.

Technical wise, the symmetrical triangle break shows us the fundamentals are playing out on the charts.

Coffee (KC); Let's get ready to break out those SHORTs ...... Again. Wait for it, tough! Let the U$D bottom vs. the Real, first, this being a pure currency play on the USD/BRL. (Fundamentals don't matter here; The market is balanced, nothing is happening - despite the occasional make-belief news flashes to the contrary.)

Made an awful lot of money on the way up here ;-) and now, it's time to cash in on the upcoming sell-off.

COFFEE - LONG (for now); Free coffee for your Great Depression!Could Coffee drop to $0 (or even go negative), much like crude oil did not too long ago??... You be the judge.

While currently long (a generational speculative bubble and all), this is likely the one to watch for one of the greatest Short Setups in ages!

Here is the Monthly. See it, yet?...

No?!

The Quarterly;

How about now?

Still no?! Let me zoom in for you.