COIN 0DTE Trade Breakdown – July 25, 2025

📉 COIN 0DTE Trade Breakdown – July 25, 2025

Put Play or Pass? Let’s break it down 👇

📍 Price: $392.34

🧠 Sentiment: Neutral → Bearish

📊 Call/Put Ratio: 1.08 (Balanced flow)

⚠️ Gamma Risk: HIGH

⌛ Time Decay: Accelerating (0DTE!)

⸻

🎯 TRADE IDEA: 0DTE PUT

✅ Strike: $380.00

💵 Entry Price: $0.69

🎯 Profit Target: $1.00

🛑 Stop Loss: $0.37

📆 Expiration: Today (Jul 25)

📈 Confidence: 65%

📍 Entry Timing: At Open

⸻

⚠️ Why This Trade?

🔻 RSI trending down

🚫 Weak institutional volume

⚠️ High volatility expected from gamma squeeze

🕒 Tick. Tock. Time decay’s your biggest enemy here.

📌 Strategy:

➡️ Naked PUT (speculative short-term play)

⛳ Goal? Quick move → quick exit

⸻

🚨 Risk Warning:

❗ 0DTE = Massive swings

❗ One wrong move = rapid premium decay

❗ Stay nimble. Know your exit.

⸻

💬 Drop a 🔥 if you’re watching COIN today

#OptionsTrading #0DTE #COIN #DayTrading #PutOption #TradingView #StockTok #GammaRisk #TradeSetup

Coinbaseanalysis

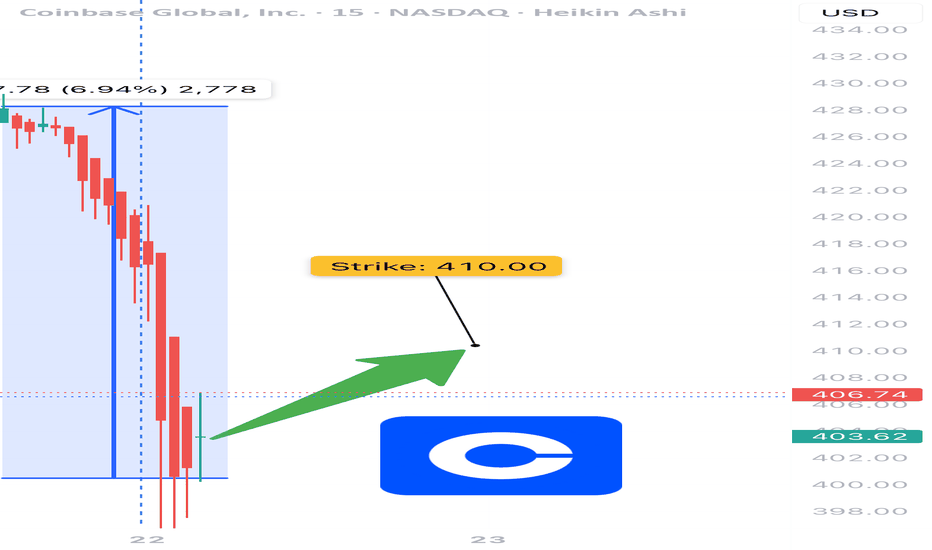

COIN Weekly Bullish Options Setup (Jul 22, 2025)

🚀 NASDAQ:COIN Weekly Bullish Options Setup (Jul 22, 2025)

Institutional call flow is heavy. Momentum is fading — but not dead. Volume confirms bulls. This is a calculated strike before earnings zone noise.

⸻

📊 Trade Setup

• 🎯 Direction: CALL

• 📍 Strike: 410

• 💰 Entry: $14.70

• 🎯 Target: $17.00+

• 🛑 Stop: $11.60

• ⏰ Expiry: 07/25/2025 (3DTE)

• 📈 Confidence: 65%

• 📍 Entry Timing: Market open

⸻

🔍 Model Consensus (Multi-AI Synthesis)

• 🟢 3/5 models bullish: Grok, Llama, DeepSeek

• 🟡 1 neutral: Gemini (momentum divergence noted)

• 🔴 1 bearish: Claude (overbought RSI divergence risk)

• 📈 VIX < 22 = Green Light

• 🧠 Key Catalyst: PNC x Coinbase partnership + institutional volume surge

• 📉 Watch for RSI reversal > Weekly 83.5

⸻

📎 Trade Logic

• Options flow + volume = 🔥 institutional accumulation

• RSI high but manageable — expect momentum pockets, not full reversals

• Range target: $428–$444.65

• Stop loss = discipline, not fear

⸻

🧠 Risk Note:

• Momentum divergence is real.

• Avoid chasing if VIX > 22 or if open shows reversal.

• Size small. Let the volume do the work.

⸻

📢 Tagline (for virality)

“Snakes see a breakout, but bulls smell blood. NASDAQ:COIN loading calls on institutional flow. 3DTE scalp or breakout runner. Your move.” 🐂📈

Coinbase (COIN) Shares Reach All-Time HighCoinbase (COIN) Shares Reach All-Time High

According to the chart of Coinbase Global (COIN), the share price of the cryptocurrency exchange has reached a historical all-time high (closing price).

The bullish sentiment has been supported by the following factors:

→ Bitcoin price rally. Yesterday, we analysed the BTC/USD chart and anticipated that bulls might attempt to set a new record. Following the publication, Bitcoin made a strong upward move, breaking above the $118,000 level.

→ Passage of the GENIUS bill in the US , which establishes a regulatory framework for the use of stablecoins.

Can COIN stock continue to climb?

Technical Analysis of Coinbase (COIN) Share Price

At the end of June, our analysis of the COIN chart highlighted the following:

→ From a broader perspective, COIN’s price fluctuations over the past year had formed an ascending channel (marked in grey).

→ The ongoing intermediate rally (marked in blue) had the potential to drive the price towards the upper boundary of this grey channel.

This scenario has materialised: today, COIN shares are trading near the upper edge of the grey channel. However, several factors now warrant a bearish outlook:

→ The upper boundary of the channel may act as resistance;

→ The psychological level of $400 could also serve as resistance;

→ Shareholders may be tempted to lock in profits;

→ A potential bearish divergence on the RSI indicator.

It is possible that in the near term, COIN bulls will attempt to break through the $400 level. However, if buying momentum weakens, the conditions may favour a price correction — which would appear justified after a nearly 60% rally since early June.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase (COIN) Shares Hit Year-to-Date HighCoinbase (COIN) Shares Hit Year-to-Date High

As we reported six days ago, shares of Coinbase Global (COIN) received a strong bullish boost after the US Senate approved the GENIUS bill, which sets out regulations for the use of stablecoins.

As the Coinbase Global (COIN) stock chart shows, the rally is ongoing. Yesterday, the price surged by over 12%, once again becoming the top performer in the S&P 500 index (US SPX 500 mini on FXOpen).

Bullish sentiment is being fuelled by news that:

→ Two funds managed by Cathie Wood’s Ark Invest acquired around 4,200 Coinbase shares;

→ Analysts at Benchmark raised their target price for Coinbase Global (COIN) from $301 to $421.

Could the COIN share price continue to rise?

Technical Analysis of the Coinbase (COIN) Stock Chart

From a broader perspective, the COIN share price has formed an ascending channel over the past year (marked in grey), and only once — in reaction to news about Trump tariffs — did the price briefly fall outside of this channel.

Based on this, it is reasonable to assume that the developing intermediate rally (highlighted in blue) could reach the upper boundary of the grey channel. However, the psychological level of $350 — near the 2024 peak — appears to be a significant resistance point on this path.

It is possible that we will soon see this level act as resistance on the COIN stock chart, leading to the formation of a correction — which would seem appropriate after a nearly 40% price increase since the start of the month.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase: Surging HigherCoinbase has surged sharply above the $275.90 level, prompting us to consider green wave finished. Now, we see the stock advancing in wave , which still has more upside potential to finalize light green wave a. Afterward, we expect a corrective pullback in wave b, which may dip below $275.90, before green wave c resumes the advance, thus completing orange wave b distinctly above $275.90.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Coinbase Shares Rise Following Stablecoin Legislation ApprovalCoinbase (COIN) Shares Rise Following Stablecoin Legislation Approval

Shares in Coinbase Global (COIN) surged by 11% yesterday, making the company the top performer in the S&P 500 index (US SPX 500 mini on FXOpen).

The sharp rise was driven by news that the US Senate has approved the GENIUS stablecoin bill, which sets out a regulatory framework for the use of stablecoins — crypto assets whose value is pegged to another currency or financial instrument, such as the US dollar.

The bill (which still requires approval from the House of Representatives) would pave the way for banks, fintech companies, and other financial market participants to use stablecoins. This development acted as a strong bullish catalyst for COIN shares.

Technical Analysis of Coinbase (COIN) Share Price Chart

In our previous analysis of the COIN share price chart, we:

→ identified an ascending channel (shown in blue);

→ suggested that the COIN share price could rise towards the psychological level of $300.

That projection has played out — the price is now very close to the $300 mark. So, what comes next?

In a bold, optimistic scenario, buyers may hope for a continuation of the rally, with the share price pushing towards the upper boundary of the long-term ascending channel, especially following the recent news. In the medium term, the blue ascending channel may remain relevant, given the strong signal of improved cryptocurrency regulation in the US legislative framework.

However, we also note some vulnerability to a pullback, as:

→ the $300 level may act as significant resistance;

→ the price is approaching the upper boundary of the blue channel, which also shows resistance characteristics;

→ once the initial wave of positive sentiment fades, some investors may look to take profits, especially given the more than 20% rise in Coinbase (COIN) shares since the beginning of the month.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase (COIN) Shares to Be Added to the S&P 500Coinbase (COIN) Shares to Be Added to the S&P 500

According to media reports, shares of the cryptocurrency exchange Coinbase Global (COIN) are scheduled to be added to the S&P 500 index (US SPX 500 mini on FXOpen) on 19 May, replacing Discover Financial Services (DFS), which is in the final stages of being acquired by Capital One Financial (COF). The deal, having received all necessary approvals from regulators and shareholders of both companies, is expected to be completed on 18 May 2025.

As a result, Coinbase Global will become the first cryptocurrency-related company to be included in the S&P 500 index — a development that sent COIN shares surging to their highest level since late February. Inclusion in the S&P 500 is considered a bullish catalyst, as it suggests increased demand for the stock from index funds and signals improved prospects. Analysts have taken note; Rosenblatt Securities raised their price target for Coinbase Global Inc. (COIN) from $260 to $300.

Technical Analysis of COIN Stock Chart

In previous analyses of the COIN stock chart, we:

→ drew a descending channel;

→ identified a resistance zone in the $225–240 range (highlighted in purple).

However, the surge in demand triggered by the news of COIN’s inclusion in the S&P 500 has led to:

→ the descending channel appearing to lose relevance entirely;

→ the price gapping above the purple resistance zone;

→ increasing grounds to draw a potential upward trend trajectory (shown with blue lines).

Given the current momentum, it is possible that the COIN share price could rise towards the psychological $300 level, which acted as resistance earlier in 2025.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase: Catching BreathCoinbase is currently catching its breath in a sideways movement. We still attribute more upside potential to the ongoing wave b in orange, expecting it to rise close to the resistance at $422.11. However, wave c should start below this mark and ultimately complete the blue wave (ii) above the support at $138.45. The subsequent blue wave (iii) should then carry the price significantly above the $422.11 mark.

Why Coinbase (COIN) Shares Are RisingWhy Coinbase (COIN) Shares Are Rising

As the Coinbase (COIN) stock chart shows, trading closed yesterday above the $200 mark — for the first time since March.

Since the beginning of April, COIN's share price has risen by nearly 20%, while the S&P 500 index (US SPX 500 mini on FXOpen) has declined by approximately 2%.

Bullish Drivers Behind COIN’s Price Rise

According to media reports, several factors are contributing to the bullish momentum:

→ Yesterday’s announcement that Coinbase and PayPal are expanding their partnership in the areas of crypto payments and decentralised finance (DeFi). The collaboration aims to increase the adoption of the PYUSD stablecoin and integrate it into merchant settlements.

→ The anticipated adoption of US stablecoin legislation, designed to establish a regulatory framework for the use of stablecoins. This is being supported by the Trump administration’s progressive stance on cryptocurrencies, including the appointment of crypto-friendly officials, the creation of a strategic crypto reserve, and other pro-crypto initiatives.

Technical Analysis of COIN Stock

The psychological level of $150, which served as strong support in 2024, has proven resilient again in April 2025. However, despite the rapid rise in price from $150 to $200 in under three weeks, there are reasons to believe that bullish sentiment may begin to fade:

→ The COIN share price remains within a downward trend, highlighted by a channel originating in early 2025.

→ The upper boundary of the channel may act as a resistance level.

→ Bears have previously demonstrated control in the $225–240 zone, where the price declined sharply (marked with a red rectangle).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase (COIN) Shares Drop to Three-Month LowCoinbase (COIN) Shares Drop to Three-Month Low

The Coinbase (COIN) chart shows that, for the first time in 2025, the share price has fallen below the psychological $250 level.

Bearish factors impacting COIN:

One key factor driving negative sentiment is the confirmed hack of the ByBit cryptocurrency exchange, raising concerns about deposit security in the industry. According to media reports:

→ The attack may have been carried out by North Korean hacker group Lazarus.

→ Hackers allegedly drained Ethereum tokens worth between $1 billion and $5 billion from ByBit’s wallet.

→ This is the largest crypto hack in history.

Another factor is growing concerns about the US economy, which have negatively impacted stock markets. As reported by Reuters:

→ The S&P 500 index (US SPX 500 mini on FXOpen) fell by 1.66% on Friday, marking its worst performance of the year.

→ The decline followed a drop in Walmart’s share price and weak consumer sentiment data.

→ Friday’s Purchasing Managers’ Index (PMI) figures were below previous levels. Investors are now focusing on this week’s release of the Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred inflation gauge.

Technical Analysis of Coinbase (COIN) Chart

COIN price movements form an upward channel (marked in blue), but several bearish signals are emerging:

→ The price has dropped into the lower half of the channel.

→ The psychological resistance level has shifted from $300 to potentially $250.

If bearish sentiment persists, COIN’s share price could fall further towards a support zone consisting of:

→ A bullish gap (marked in purple).

→ The lower boundary of the blue channel.

→ The psychological $200 level.

Coinbase (COIN) Price Forecast

Wall Street analysts remain cautiously optimistic following Coinbase’s quarterly earnings report on 13 February, which exceeded expectations.

According to TipRanks:

→ 10 out of 21 analysts recommend buying COIN.

→ The average 12-month price target for COIN is $350.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase: Brief BreakoutCoinbase’s positive earnings initially served as a catalyst for a brief breakout from the previously established range, with shareholders enjoying a nearly 16% gain. However, the euphoria was short-lived, and the stock quickly retreated. We attribute the current fluctuation to the blue wave (v), which should provide further increases and ultimately complete the larger magenta wave above the resistance at $343.92. Adjustments to our wave count will only be necessary if the price falls below the support at $224 (probability: 33%).

Halftime Update: COIN on a Crypto Rebound Play?After CRYPTOCAP:BTC rebounded above $100K and has since settled, stocks such as COIN has of course benefitted by seeing $1.162B in Trading Volume going into Halftime of Today's Trading Session.

It's currently trading above a Longer Resistance Level (as support) so this could push up along the bottom of our Purple Trend you see there, bouncing downward, delivery better entries on it's way up.

With that being said, we could see a $240-$246 retest before the push higher as it has dipped twice to those levels since Mid-Dec. 2024.

Just watching for now but stay tuned for more at @MyMIWallet by visiting our website and connecting with us everywhere you are! We'll be there!

Coinbase: Wave (v) of [iii]!At $241, Coinbase recently reached a new local low, after which the price surged an impressive 17% at its peak. Thus, we now consider the blue wave (iv) as complete and locate the stock in the blue wave (v), which should push to new all-time highs to complete the larger wave of the ongoing magenta upward impulse. However, this upward trajectory will be postponed if COIN encounters selling pressure and falls below the support at $224. We assign a 33% probability to this alternative scenario.

Coinbase: ResistanceSo far, Coinbase was unable to decisively break above the resistance at $341.50. Our primary expectation is that the stock should soon make a significant move above this level, as we anticipate the peak of the ongoing wave in magenta well above it. However, our 33% likely alternative scenario suggests that the stock may have just completed the high of the corrective wave alt.(b) in blue. In this case, it would be moving toward the conclusion of the magenta wave alt. between the supports at $160 and $70.76.

COIN: NOW IS TIME TO BUY, NOT LATERNASDAQ:COIN

COIN: NOW IS TIME TO BUY, NOT LATER

Pullback levels are so important because they allow you to understand what is happening to the stock you are trading or investing in.

Typically when a stock pulls back and peoples gains begin to deminish or losses begin to mount they let emotions take over and guide their finger to the SELL button.

But, as you can see on the chart and if you watched my don't FOMO into Coinbase video, you know that 80-90% of breakouts retest and we need to wait for that to happen before entering or adding to our position.

I present to you the pullback with levels: I'm 1/2 into my trading position at this time.

Lvl 1: The cup and Handle breakout point once resistance turned support - $283

Lvl 2: Price GAP fill at $273.50

These are the levels to watch and buy if you want into this trade.

All indicators are still BULLISH and we still have a #HIGHFIVESETUP

See previous video attached to this post if you missed the full thesis.

Like l Follow l Share

DON'T FOMO ON COINBASE! HERES WHY:NASDAQ:COIN

COINBASE ( NASDAQ:COIN ) has absolutely surged with CRYPTOCAP:BTC , but now is not the time to hit the buy button due to FOMO!

Some trades Cometh and some trades Goethe. You can't have them all!

But you can stay patient and line an entry point for when this stock pulls back, as all stocks do. Remember!

I'm targeting a GAP fill and retest of this massive Cup n Handle breakout to add to my position with shares and options.

Good luck and stay patient

NFA

COINBASE Surges as Bitcoin Breaks $71,000! Next Price Target?Analysis of Coinbase (COIN) - 15m Timeframe

Trade Setup: Coinbase has shown a significant uptick as Bitcoin surged past the $71,000 mark, triggering a bullish entry point at $214.90.

Volume and Momentum: Current trading volume stands at 10.46M, surpassing the 30-day average of 9.32M, signaling strong interest and momentum.

Technical Levels:

Entry: $214.90

Target 1 (TP1): $221.45

Target 2 (TP2): $232.06

Target 3 (TP3): $242.66

Target 4 (TP4): $249.21

Stop Loss (SL): $209.60

Catalyst:

Bitcoin’s recent price surge has positively influenced Coinbase’s stock, aligning with its correlation to crypto trends. The upcoming earnings report in 2 days may add further volatility, providing potential upside if positive results are announced.

Conclusion: This entry marks an opportune moment to capitalize on Coinbase's rally tied to Bitcoin’s performance. Traders should watch the earnings announcement closely as it could propel the stock further, potentially reaching the set targets.

COINBASE Bears in Control: More Downside Likely!COINBASE Short Trade Technical Analysis:

Coinbase Global on the 15-minute timeframe shows a strong short trade setup, with TP1 already hit. The stock is trading below the Risological dotted trendline, reinforcing the bearish sentiment.

Key Levels:

Entry: 207.12

Stop Loss (SL): 213.68

Target 1 (TP1): 199.00 (Done)

Target 2 (TP2): 185.87

Target 3 (TP3): 172.74

Target 4 (TP4): 164.62

Observations:

The price remains under significant selling pressure, evident by its inability to recover above the Risological dotted trendline.

With increasing volume on the down moves and resistance holding strong, the continuation of the downtrend appears highly likely.

The structure suggests more downside as sellers maintain control, and buyers struggle to regain any meaningful momentum.

Coinbase Global continues to look bearish after TP1, and the price action is aligned for further declines. Keep an eye on the lower targets as they are within reach, supported by the clear downward trend and weak buying attempts!

Coinbase Surges! Long Trade Hits All Targets – Bulls Drive GainsCoinbase has shown strong bullish momentum since the long entry at 168.72 on 11th October, reaching all designated profit targets.

Key Levels

Entry: 168.72 – The long trade was initiated at this level, supported by a bullish breakout.

Stop-Loss (SL): 165.30 – Positioned below recent support to manage risk and guard against downside movement.

Take Profit 1 (TP1): 172.93 – The first target was hit, confirming the strength of the upward move.

Take Profit 2 (TP2): 179.76 – Continued buying pressure led to this level being reached.

Take Profit 3 (TP3): 186.59 – The bullish momentum carried the price to this target.

Take Profit 4 (TP4): 190.81 – The final profit target, signaling a successful trade completion.

Trend Analysis

The price remains well above the Risological Dotted trendline, affirming the strong uptrend. The sustained upward movement indicates solid market sentiment, which has driven the price through all target levels.

The long trade on Coinbase has been highly successful, with all targets hit and the final level at 190.81 achieved. The trade's success showcases the power of the Risological Dotted trendline in guiding bullish entries and exits.

COIN Technical Analysis: Wave (4) Correction Nearing CompletionTechnical analysis chart of the cryptocurrency "COIN" using Elliott Wave Theory. Elliott Wave Theory is a technical analysis method that suggests that financial markets move in predictable patterns based on a series of five waves.

The information provided in this post is for educational purposes only and should not be considered as financial advice. There is a risk of being completely wrong, and users are warned not to trade or invest solely based on this study. The content is not an advisory and does not guarantee profits. We are not responsible for any kind of profits and losses; individuals should consult a financial advisor before making any trading or investment decisions.

Based on the chart, we had identified a potential impulse wave pattern from January 2023 to the present. An impulse wave pattern consists of five waves, with each wave labeled (1), (2), (3), (4), and (5).

Wave (1): This is the first wave in the impulse pattern and is typically a strong upward trend. In this case, wave (1) appears to have run from the low near 31-32 to a high near 114.

Wave (2): This is a corrective wave that moves in the opposite direction of wave (1). It is typically a retracement of wave (1), but it can also extend beyond the starting point of wave (1). Wave (2) appears to have run from the high near 114 to a low near 69.

Wave (3): This is the second wave in the impulse pattern and is typically a strongest upward trend that extends most of times. Wave (3) given move from 69 to 283

Wave (4): This is a corrective wave that moves in the opposite direction of wave (3). It is typically a retracement of wave (3). Wave (4) is currently in progress, but at verge of completion now any time.

Wave (5): This is the final wave in the impulse pattern and is typically a strong upward trend that completes the pattern. Wave (5) is expected to start soon and could potentially reach the levels of 300 plus.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Since Mid-2024 Coinbase SP has been sucked down with all Crypto!

Coinbase is a well established setup and professional company in the Crypto world, a new-base may be forming on its chart and new, fresh buying emerging right now.

This next 15 minute shows the bottom of the Coinbase chart structure.

See next chart below