COIN 0DTE Trade Breakdown – July 25, 2025

📉 COIN 0DTE Trade Breakdown – July 25, 2025

Put Play or Pass? Let’s break it down 👇

📍 Price: $392.34

🧠 Sentiment: Neutral → Bearish

📊 Call/Put Ratio: 1.08 (Balanced flow)

⚠️ Gamma Risk: HIGH

⌛ Time Decay: Accelerating (0DTE!)

⸻

🎯 TRADE IDEA: 0DTE PUT

✅ Strike: $380.00

💵 Entry Price: $0.69

🎯 Profit Target: $1.00

🛑 Stop Loss: $0.37

📆 Expiration: Today (Jul 25)

📈 Confidence: 65%

📍 Entry Timing: At Open

⸻

⚠️ Why This Trade?

🔻 RSI trending down

🚫 Weak institutional volume

⚠️ High volatility expected from gamma squeeze

🕒 Tick. Tock. Time decay’s your biggest enemy here.

📌 Strategy:

➡️ Naked PUT (speculative short-term play)

⛳ Goal? Quick move → quick exit

⸻

🚨 Risk Warning:

❗ 0DTE = Massive swings

❗ One wrong move = rapid premium decay

❗ Stay nimble. Know your exit.

⸻

💬 Drop a 🔥 if you’re watching COIN today

#OptionsTrading #0DTE #COIN #DayTrading #PutOption #TradingView #StockTok #GammaRisk #TradeSetup

Coinbaseidea

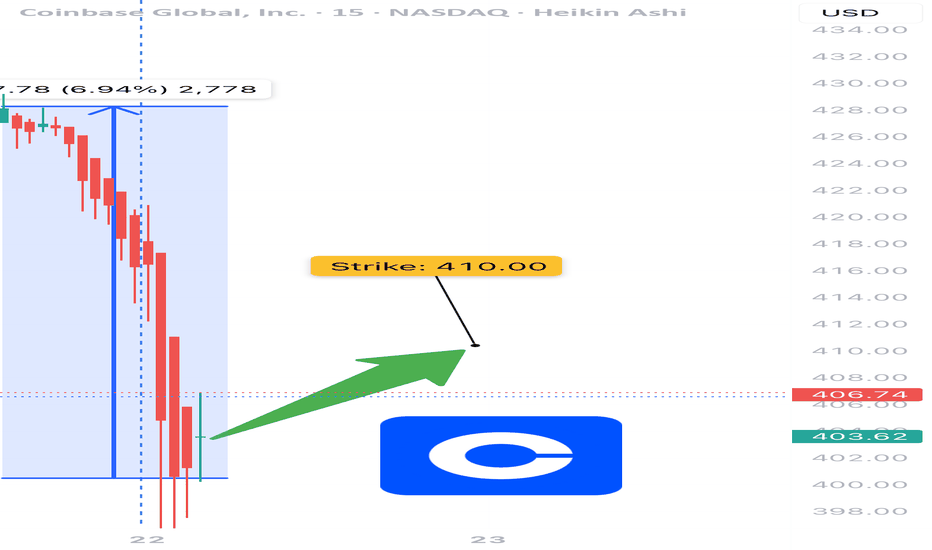

COIN Weekly Bullish Options Setup (Jul 22, 2025)

🚀 NASDAQ:COIN Weekly Bullish Options Setup (Jul 22, 2025)

Institutional call flow is heavy. Momentum is fading — but not dead. Volume confirms bulls. This is a calculated strike before earnings zone noise.

⸻

📊 Trade Setup

• 🎯 Direction: CALL

• 📍 Strike: 410

• 💰 Entry: $14.70

• 🎯 Target: $17.00+

• 🛑 Stop: $11.60

• ⏰ Expiry: 07/25/2025 (3DTE)

• 📈 Confidence: 65%

• 📍 Entry Timing: Market open

⸻

🔍 Model Consensus (Multi-AI Synthesis)

• 🟢 3/5 models bullish: Grok, Llama, DeepSeek

• 🟡 1 neutral: Gemini (momentum divergence noted)

• 🔴 1 bearish: Claude (overbought RSI divergence risk)

• 📈 VIX < 22 = Green Light

• 🧠 Key Catalyst: PNC x Coinbase partnership + institutional volume surge

• 📉 Watch for RSI reversal > Weekly 83.5

⸻

📎 Trade Logic

• Options flow + volume = 🔥 institutional accumulation

• RSI high but manageable — expect momentum pockets, not full reversals

• Range target: $428–$444.65

• Stop loss = discipline, not fear

⸻

🧠 Risk Note:

• Momentum divergence is real.

• Avoid chasing if VIX > 22 or if open shows reversal.

• Size small. Let the volume do the work.

⸻

📢 Tagline (for virality)

“Snakes see a breakout, but bulls smell blood. NASDAQ:COIN loading calls on institutional flow. 3DTE scalp or breakout runner. Your move.” 🐂📈

Coinbase (COIN) Shares Reach All-Time HighCoinbase (COIN) Shares Reach All-Time High

According to the chart of Coinbase Global (COIN), the share price of the cryptocurrency exchange has reached a historical all-time high (closing price).

The bullish sentiment has been supported by the following factors:

→ Bitcoin price rally. Yesterday, we analysed the BTC/USD chart and anticipated that bulls might attempt to set a new record. Following the publication, Bitcoin made a strong upward move, breaking above the $118,000 level.

→ Passage of the GENIUS bill in the US , which establishes a regulatory framework for the use of stablecoins.

Can COIN stock continue to climb?

Technical Analysis of Coinbase (COIN) Share Price

At the end of June, our analysis of the COIN chart highlighted the following:

→ From a broader perspective, COIN’s price fluctuations over the past year had formed an ascending channel (marked in grey).

→ The ongoing intermediate rally (marked in blue) had the potential to drive the price towards the upper boundary of this grey channel.

This scenario has materialised: today, COIN shares are trading near the upper edge of the grey channel. However, several factors now warrant a bearish outlook:

→ The upper boundary of the channel may act as resistance;

→ The psychological level of $400 could also serve as resistance;

→ Shareholders may be tempted to lock in profits;

→ A potential bearish divergence on the RSI indicator.

It is possible that in the near term, COIN bulls will attempt to break through the $400 level. However, if buying momentum weakens, the conditions may favour a price correction — which would appear justified after a nearly 60% rally since early June.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase (COIN) Shares Hit Year-to-Date HighCoinbase (COIN) Shares Hit Year-to-Date High

As we reported six days ago, shares of Coinbase Global (COIN) received a strong bullish boost after the US Senate approved the GENIUS bill, which sets out regulations for the use of stablecoins.

As the Coinbase Global (COIN) stock chart shows, the rally is ongoing. Yesterday, the price surged by over 12%, once again becoming the top performer in the S&P 500 index (US SPX 500 mini on FXOpen).

Bullish sentiment is being fuelled by news that:

→ Two funds managed by Cathie Wood’s Ark Invest acquired around 4,200 Coinbase shares;

→ Analysts at Benchmark raised their target price for Coinbase Global (COIN) from $301 to $421.

Could the COIN share price continue to rise?

Technical Analysis of the Coinbase (COIN) Stock Chart

From a broader perspective, the COIN share price has formed an ascending channel over the past year (marked in grey), and only once — in reaction to news about Trump tariffs — did the price briefly fall outside of this channel.

Based on this, it is reasonable to assume that the developing intermediate rally (highlighted in blue) could reach the upper boundary of the grey channel. However, the psychological level of $350 — near the 2024 peak — appears to be a significant resistance point on this path.

It is possible that we will soon see this level act as resistance on the COIN stock chart, leading to the formation of a correction — which would seem appropriate after a nearly 40% price increase since the start of the month.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coinbase: Catching BreathCoinbase is currently catching its breath in a sideways movement. We still attribute more upside potential to the ongoing wave b in orange, expecting it to rise close to the resistance at $422.11. However, wave c should start below this mark and ultimately complete the blue wave (ii) above the support at $138.45. The subsequent blue wave (iii) should then carry the price significantly above the $422.11 mark.

Coinbase: Brief BreakoutCoinbase’s positive earnings initially served as a catalyst for a brief breakout from the previously established range, with shareholders enjoying a nearly 16% gain. However, the euphoria was short-lived, and the stock quickly retreated. We attribute the current fluctuation to the blue wave (v), which should provide further increases and ultimately complete the larger magenta wave above the resistance at $343.92. Adjustments to our wave count will only be necessary if the price falls below the support at $224 (probability: 33%).

Beyond BTC - Why Coinbase (COIN) is a Long-Term Buy?As a trader, I'm always watching the markets, but building long-term wealth is also key. That's why I'm digging into assets like Coinbase (COIN) . While my day job is trading, Coinbase has definitely caught my eye as something portfolio-worthy for the long haul. We might have missed the IPO buzz back in 2021, but looking at where Coinbase is headed, I think we're still early in a massive growth story.

Don't let short-term crypto ups and downs distract you. Coinbase is playing a long game, and here's why it's a smart long-term investment -

CEO Brian Armstrong's Big Vision (and Big Numbers):

Already a Financial Giant: Think of Coinbase as a bank or brokerage – it's already HUGE. It's as big as the 21st largest US bank by assets ($0.42 trillion!) or the 8th largest brokerage. This size matters.

Going Global: Coinbase isn't just focused on the US. They're expanding worldwide to grab new users and markets.

Becoming Your All-in-One Financial Hub: Forget old-school banks. Coinbase wants to be your single crypto-powered financial account for everything – payments, investing, and more. This is where finance is heading.

Token Powerhouse: Crypto is about more than just Bitcoin. Coinbase wants to list every token, becoming the go-to place for the entire crypto universe.

Blending Crypto Worlds: Coinbase is smart – they're linking up with new decentralized crypto systems (DeFi) to give you the best of both worlds, easy to use but with more options.

Working with Regulators: Coinbase is playing it smart, working with governments to make crypto safe and trusted for everyone long-term.

Massive Crypto Payments: People are using crypto to pay – big time. $30 TRILLION in stablecoin payments happened last year alone. Coinbase is ready to cash in on this payment revolution.

Why This Matters for Long-Term Investors:

Crypto is Exploding: Everyone knows crypto is going to get bigger. Coinbase is in the perfect spot to ride this massive wave.

Big Money is Coming: Big institutions like banks are starting to invest in crypto. Coinbase is built for them – safe, secure, and ready for big players.

Coinbase is the Brand You Trust: Coinbase is the big name in crypto. People know and trust them, which is gold in a new market.

Bottom Line: Coinbase isn't just a trend; it's building the future of finance. Yes, crypto is bumpy, but for the long haul, Coinbase is positioned to be a winner.

Now let's get technical and have a look at what the charts are saying -

Uptrend is Clear: Forget short-term noise – this chart shows Coinbase has been on a solid climb since late 2023. There's a strong bullish structural break which indicates the trend has shifted up after a short bearish run.

$350 is the Line in the Sand: Think of $350 as the ceiling right now. The price hit it, and we saw some selling. Gotta break above $350 to really see the bulls charging again.

$225-$250 is the Safety Net: On the flip side, $225-$250 is like solid ground. As long as we stay above that, the bull run is still in play.

Just Taking a Breather: Right now, the chart says "consolidation." Think of it as Coinbase catching its breath after a big run. This pause can be a good thing – building up energy for the next push up.

RSI is Neutral for Now: The RSI thing is the 50% level. Not screaming "buy" or "sell," just saying "wait and see." After showing us bearish divergence we are likely to see oversold conditions within the current range - if that does happen it would be a good time to strike.

What to Watch For (Trader Style):

Breakout Above $350 = Green Light: If COIN blasts through $350 with some volume, that's the signal to jump in long. Think higher targets.

Stuck Between $250 and $350 = Range Trade Time: If it stays in this range, you can play the range – buy low, sell high within the range. But be ready for a break either way.

Drop Below $250 = Caution Flag: If we crack below $250, that's a warning sign. Might be time to get a bit more defensive.

Final Notes:

Coinbase looks good long-term, but we're in a "show me" moment right now. Watch those key levels – $350 and $250. Patience is key, but the chart is set up for a potential bullish move if we get the right trigger. If you're looking to invest for the long-haul, now would be a good time to add some shares to your portfolio.

Important Disclaimer:

Please remember, I am not a financial advisor. My analysis here is based on my personal research and is intended for informational and educational purposes only. Before making any investment decisions, it is essential to consult with a qualified financial professional who can provide advice tailored to your individual circumstances.

Investing in financial markets, especially in assets like cryptocurrencies and related stocks, carries significant risk. There are no guaranteed returns, and it's crucial to understand that investing is not gambling. Strategic investing involves thorough research, careful timing, and a clear understanding of your own risk tolerance and investment amounts. Always conduct your own independent research and due diligence before investing in any asset.

NASDAQ:COIN COINBASE:CBETHUSD COINBASE:CBETHETH COINBASE:CBETHUSDC OANDA:NAS100USD

Coinbase: Wave (v) of [iii]!At $241, Coinbase recently reached a new local low, after which the price surged an impressive 17% at its peak. Thus, we now consider the blue wave (iv) as complete and locate the stock in the blue wave (v), which should push to new all-time highs to complete the larger wave of the ongoing magenta upward impulse. However, this upward trajectory will be postponed if COIN encounters selling pressure and falls below the support at $224. We assign a 33% probability to this alternative scenario.

Coinbase: ResistanceSo far, Coinbase was unable to decisively break above the resistance at $341.50. Our primary expectation is that the stock should soon make a significant move above this level, as we anticipate the peak of the ongoing wave in magenta well above it. However, our 33% likely alternative scenario suggests that the stock may have just completed the high of the corrective wave alt.(b) in blue. In this case, it would be moving toward the conclusion of the magenta wave alt. between the supports at $160 and $70.76.

DON'T FOMO ON COINBASE! HERES WHY:NASDAQ:COIN

COINBASE ( NASDAQ:COIN ) has absolutely surged with CRYPTOCAP:BTC , but now is not the time to hit the buy button due to FOMO!

Some trades Cometh and some trades Goethe. You can't have them all!

But you can stay patient and line an entry point for when this stock pulls back, as all stocks do. Remember!

I'm targeting a GAP fill and retest of this massive Cup n Handle breakout to add to my position with shares and options.

Good luck and stay patient

NFA

COINBASE Surges as Bitcoin Breaks $71,000! Next Price Target?Analysis of Coinbase (COIN) - 15m Timeframe

Trade Setup: Coinbase has shown a significant uptick as Bitcoin surged past the $71,000 mark, triggering a bullish entry point at $214.90.

Volume and Momentum: Current trading volume stands at 10.46M, surpassing the 30-day average of 9.32M, signaling strong interest and momentum.

Technical Levels:

Entry: $214.90

Target 1 (TP1): $221.45

Target 2 (TP2): $232.06

Target 3 (TP3): $242.66

Target 4 (TP4): $249.21

Stop Loss (SL): $209.60

Catalyst:

Bitcoin’s recent price surge has positively influenced Coinbase’s stock, aligning with its correlation to crypto trends. The upcoming earnings report in 2 days may add further volatility, providing potential upside if positive results are announced.

Conclusion: This entry marks an opportune moment to capitalize on Coinbase's rally tied to Bitcoin’s performance. Traders should watch the earnings announcement closely as it could propel the stock further, potentially reaching the set targets.

COINBASE Bears in Control: More Downside Likely!COINBASE Short Trade Technical Analysis:

Coinbase Global on the 15-minute timeframe shows a strong short trade setup, with TP1 already hit. The stock is trading below the Risological dotted trendline, reinforcing the bearish sentiment.

Key Levels:

Entry: 207.12

Stop Loss (SL): 213.68

Target 1 (TP1): 199.00 (Done)

Target 2 (TP2): 185.87

Target 3 (TP3): 172.74

Target 4 (TP4): 164.62

Observations:

The price remains under significant selling pressure, evident by its inability to recover above the Risological dotted trendline.

With increasing volume on the down moves and resistance holding strong, the continuation of the downtrend appears highly likely.

The structure suggests more downside as sellers maintain control, and buyers struggle to regain any meaningful momentum.

Coinbase Global continues to look bearish after TP1, and the price action is aligned for further declines. Keep an eye on the lower targets as they are within reach, supported by the clear downward trend and weak buying attempts!

Coinbase Surges! Long Trade Hits All Targets – Bulls Drive GainsCoinbase has shown strong bullish momentum since the long entry at 168.72 on 11th October, reaching all designated profit targets.

Key Levels

Entry: 168.72 – The long trade was initiated at this level, supported by a bullish breakout.

Stop-Loss (SL): 165.30 – Positioned below recent support to manage risk and guard against downside movement.

Take Profit 1 (TP1): 172.93 – The first target was hit, confirming the strength of the upward move.

Take Profit 2 (TP2): 179.76 – Continued buying pressure led to this level being reached.

Take Profit 3 (TP3): 186.59 – The bullish momentum carried the price to this target.

Take Profit 4 (TP4): 190.81 – The final profit target, signaling a successful trade completion.

Trend Analysis

The price remains well above the Risological Dotted trendline, affirming the strong uptrend. The sustained upward movement indicates solid market sentiment, which has driven the price through all target levels.

The long trade on Coinbase has been highly successful, with all targets hit and the final level at 190.81 achieved. The trade's success showcases the power of the Risological Dotted trendline in guiding bullish entries and exits.

Coinbase GlobalJust a reminder to keep an eye on Coinbase Global's current trading price of $160. Last time we were at this price level, we saw a 7.30% gain in the stock. If it shows any bullish signs, such as a bullish candle, consider taking a long position.

Set your stop loss at $150 and your take profit at $210.

Coinbase Gearing Up for its next MoveHi guys! This is an Update on recent Technical developments found for Coinbase (COIN).

I've successfully identified the Inverse Head & Shoulders Pattern. Check out that idea down below.

We have completed the Return Rally back to test Support on the Neckline. Now ive been assessing if there are signs that we continue the Inverse Head and Shoulders with our final explosive breakout move.

This analysis is done on the 1 day timeframe.

As you can see we have tested and CONFIRMED Support on the Neckline.

After doing so we have inched higher.

Notice now, we are ABOVE the 21 EMA.

With the last 3 days of candles, forming LOWER WICKS off the 21 EMA.

This is a great sign of SUPPORT.

We must continue to stay ABOVE the 21 EMA.

Being Above the 21 EMA on any timeframe indicates that we will most likely have an UPTREND in price.

Notice also the Orange Rectangle. This highlights a consolidation zone. This shows to me that we are building up momentum for our final rally of the Inverse Head & Shoulders Pattern.

A confirmation ABOVE the Upper Border of Rectangle, will indicate Rally may be starting.

To keep us on our toes, just remember that if price action goes BELOW the Lower Border of the Rectangle, we risk testing the Neckline again. Which is always a possibility . As long as we maintain the Neckline as Support, we good.

Watch VOLUME -> We need it to start picking up for indication of the major move.

This move will essentially lead to trend reversal for COIN, confirming the bottom.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on COIN in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

COINBASE - POssible Trend Reversal in play?Hi guys! So something ive been monitoring for some time now is Coinbase. Ive been extremely excited on Crypto since 15k - 20k range, in the hunt for potential bottoms. As ive missed the previous cycle bottoms in crypto. Anyway what im trying to get at is, BTC reclaiming the 30k level will show even stronger evidence that we are in fact in a BULL MARKET.

This means that stocks related to Bitcoin will also be impacted.

And COIN in a pure technical analysis point of view is showing great evidence of a bottom formation and trend reversal.

Lets jump in!

Firstly, lets take a look at price action:

Firstly, lets acknowledge our MAJOR bearish resistance trend line depicted in RED.

This line has acted as resistance since the top in November 2021 and has pushed the price down to our lows and this range (white rectangle). Notice the red circles, which shows price being rejected off this line.

This shows how powerful this line has been depicted in the history of the price action. So breaking above it and maintaing support would be indicative of a reversal in trend, in my opinion.

Now notice the ORANGE resistance trend line. This trend is since August 2022 and indicates an intermediate resistance trend that also worked to push price down.

Another Resistance trend is the YELLOW trend line, from January of 2023, that acted as a short term resistance.

The upper rim of the white rectangle is also a crucial area to watch. From $64 to $84 is a heavy resistance area that needs observation. If we get above $84, getting to $160 is easy play as theres no price structure above $84.

This analysis is on the weekly timeframe. So we need to see what happens on the close of friday. But we are currently in the process of breaking through the RED and YELLOW resistance trend lines.

Though its possible this week pushes us down again. A double bottom can be at play which would be extremely BULLISH.

Its IMPORTANT to note -> More we touch trend lines, the weaker they get! And the Structure seen by WHITE rectangle, indicates a consolidation area and possible bottom of COIN.

Now lets take a look at some of my indicators:

1. Notice the light PURPLE moving average, the 21 weekly EMA. Notice how we've been battling this line and ow moving above it. This becoming support and staying above will be supportive of trend reversal.

2. RSI -> notice how we have lower highs. If we break above the upper white line drawn, and create a higher high. This will support trend reversal. Ill be observing this.

3. Wave Trend Oscillator - Notice the GREEN arrows. You don't even need knowledge of what these indicators depict, visually you can get so much out of them! Check how when the green line is on top of the red dots, price moves up..... Check our current progress, we are currently showing similar pattern. This can mean trend change.

CONCLUSION: Though as of today, its still premature to say that we will be breaking trend at the end of this week. I believe there is evidence to state that its the time to be watching COIN.

If we are above these lines come the friday close of weekly candle, next couple weeks would be important and places to watch for buying positions. However, if you see rejection it is possible that we go down lower, possible to the lower rim of the WHITE rectangle. That would be a double bottom play, and potential area where i buy large positions. My opinion within this WHITE rectangle range, solid area to DCA. Its also important to remember to watch BTC prices, if prices stays above 30k, the case for crypto stocks also becomes bullish, in my opinion.

ALl in All, Hope this helped. If you liked my analysis, please do help me out by boosting and if you like TA info and direction please follow and or check out my other ideas. Also, let me know what you think by commenting!

DISCLAIMER: This is not financial advice, i am not a financial advisor. This is strictly my opinions and for educational purposes. When trading/investing please do work to make your own strategies, never listen 100% to other people. Also always practice strong risk management strategies and use stop losses!

Thank you!

Coinbase Q1 Earnings Highlights BUT I STAY SHORTTREND STRONG SELL

I love the WALLSTREET: Everytime the reports are beyond the estimates of the Wallstreet I sell.

My axxuacy is far beyond 75%.

Why does it work?

Everytime the news are released, the big boys have aleady taken profits, and now the gonna for better prices o better to make more money in the opposite direction. That is what I call the smart money

I do not care if I like the name or the company or the product, when I trade.

Emotions are your enemies,when trading.

You heard expressions like

Never catch a falling knife

There is time to go long, time to go short and time to go fishing.” — Jesse Lauriston Livermore

“Markets can remain irrational longer than you can remain solvent.” – John Maynard Keynes

“Most people, whether bull or bear, when they are right, are right for the wrong reason, in my opinion.” – Jesse Lauriston Livermore

“Someone will always be getting richer faster than you. This is not a tragedy.” – Charlie Munger

“The trend is your friend except at the end where it bends.” — Ed Seykota

What is a Falling Knife?

A falling knife is a colloquial term for a rapid drop in the price or value of a security. The term is commonly used in phrases like, "don't try to catch a falling knife," which can be translated to mean, "wait for the price to bottom out before buying it." A falling knife can quickly rebound - in what's known as a whipsaw—or the security may lose all of its value, as in the case of a bankruptcy.

Falling knife refers to a sharp drop, but there is no specific magnitude or duration to the drop before it constitutes a falling knife.

A falling knife is generally used as a caution not to jump into a stock or other asset during a drop.

Traders will trade on a sharp drop, but they generally want to be in a short position and will use technical indicators to time their trades.

What a Falling Knife Tells You

The term falling knife suggests that buying into a market with a lot of downward momentum can be extremely dangerous—just like trying to catch an actual falling knife. In practice, however, there are many different profit points with a falling knife. If timed perfectly, a trader that buys at the bottom of a downtrend can realize a significant profit as the price recovers. Likewise, piling into a short position as the price falls and getting out before a rebound can be profitable. Moreover, even buy and hold investors can use a falling knife as a buy opportunity provided they have a fundamental case for owning the stock.

That said, there is a very real risk that the timing will be off and there could be significant losses before any gains. So many traders still pay lip service to the adage. Instead of trying to "catch the falling knife," traders should look for confirmation of a trend reversal using other technical indicators and chart patterns. An example of a confirmation could be as simple as waiting for several days of upward momentum after the fall or looking at the relative strength index (RSI) for signs of a stronger uptrend before buying into the new trend.

CONCLUSION: The trend direction is short! BASTA! The short volumes are high what means more selles are enthusiastic to risk more money in short direction.

Fundamentals:

Although the Q1 reportings where positive the market paticipants have not been enthusiastic. No bull volume, no, new Higher Hihs. Instead the market did the opposite: Wallstreet went short. IF THIS IS BEYOND THE ESTIMATES:THEN I decide to sell more on weakness.

Coinbase touches SMA resistanceCoinbase's stock (COIN) advanced in the intraday levels after announcing plans to let go of 950 employees in a step to reduce costs, especially in the crypto sector, with severance package and other costs of the termination estimated at $163 million, with the stock tumbling 12.96% in the last session, or 4.96 points, settling at 43.23, with trading volumes surpassing 24.4 million shares, above 10-day averages of 13.6 million shares.

Technically, the stock is trying to regain some recent losses, touching the 50-day SMA, while retesting the resistance of 40.83, as the RSI reached overbought levels compared to the stock's movements.

Therefore we can expect the stock to return lower, targeting the support of 20.20, provided the resistance of 40.83 holds on.

COIN Coinbase: Where Is It Headed?Hello friends, today you can review the technical analysis on a 1D linear scale chart for Coinbase Global, Inc. (COIN), a stock traded on the Nasdaq exchange.

Please review the chart as it is self explanatory. The overall pattern is a bearish one so there is concern for potential downside.

Also noted in the chart: Volume, Support and Resistance Lines, RSI (relative strength index), MACD, and Fibonacci Retracement.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Have you read my recent Bitcoin chart and analysis on finding the bottom. See below:

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #cryptopickk

COIN Daily TimeframeSNIPER STRATEGY (new version)

It works ALMOST ON ANY CHART.

It produces Weak, Medium and Strong signals based on consisting elements.

NOT ALL TARGETS CAN BE ACHIEVED, let's make that clear.

TARGETS OR ENTRY PRICES ARE STRONG SUPPORT AND RESISTANCE LEVELS.

ENTRY PRICE BLACK COLOR

TARGETS GREEN COLOR

STOP LOSS RED COLOR

DO NOT USE THIS STROTEGY FOR LEVERAGED TRADING.

It will not give you the whole wave like any other strategy out there but it will give you a huge part of the wave.

The BEST TIMEFRAMES for this strategy are Daily, Weekly and Monthly however it can work on any timeframe.

Consider those points and you will have a huge advantage in the market.

There is a lot more about this strategy.

It can predict possible target and also give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

START BELIEVING AND GOOD LUCK

HADIMOZAYAN

COINBASE Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.