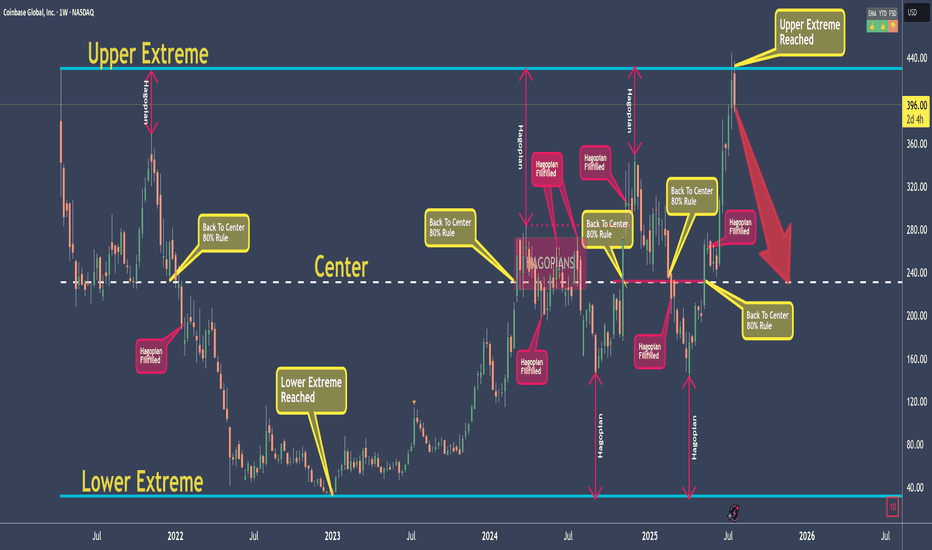

COINBASE - My rules say: Down with high probabilityI don't elaborate too much here, because I want to give you a chance to learn something!

As for the Trade, my rules say that it is a good Short.

The Short is not valid anymore, if price open and close above the Upper Extreme!

So, what are the rules?

Well, that's exactly what you will learn today ;-)

Go to my previous post which I will link, and you find everything you need to jump on the Steam-Train if you like.

As my old Mentors always said: "Larn To Earn"

Happy Profits Guys & Gals §8-)

Coinbaseshort

COINBASE Bears in Control: More Downside Likely!COINBASE Short Trade Technical Analysis:

Coinbase Global on the 15-minute timeframe shows a strong short trade setup, with TP1 already hit. The stock is trading below the Risological dotted trendline, reinforcing the bearish sentiment.

Key Levels:

Entry: 207.12

Stop Loss (SL): 213.68

Target 1 (TP1): 199.00 (Done)

Target 2 (TP2): 185.87

Target 3 (TP3): 172.74

Target 4 (TP4): 164.62

Observations:

The price remains under significant selling pressure, evident by its inability to recover above the Risological dotted trendline.

With increasing volume on the down moves and resistance holding strong, the continuation of the downtrend appears highly likely.

The structure suggests more downside as sellers maintain control, and buyers struggle to regain any meaningful momentum.

Coinbase Global continues to look bearish after TP1, and the price action is aligned for further declines. Keep an eye on the lower targets as they are within reach, supported by the clear downward trend and weak buying attempts!

COIN - Further Lows On The PlateThe last chart i COIN I showed you (see linked) was a nice play. Will this one cooperate too?

Let's analyze the chart:

The white Fork's CL was reached.

It came down hard and fell beyond the L-MLH.

We see the orange Fork, a pullback Fork.

Price struggled to jump above it's CL a view days ago, and now opened and closed below it, AND below the white Forks L-MLH.

Because I want to give this trade a little room, I initiated an Options Strategy by combining Short & Long Spreads.

You can see in the Black Window (Graph), there is plenty of room to let it go against the initial idea.

The B/E point is at the $85 short Call.

When time passes and price would stay exactly where it is now, the position would create a little profit.

If price is going up and stays between the horizontal line (yellow Arrow in the Graph), we profit.

If price of COIN starts to fall, we make profits along the dotted white line.

So, what's the benefit of this trade?

Why not play it directional by just shorting COIN?

1. There's a time decay involved.

My short Call-Debit-Spread generates money, every day by decaying in value.

2. There's the directional aspect.

If price cooperates, then the position profits from the "right" movement AND 1.

Downside?

If price MOVES (it HAS to move) in the wrong direction above $85, then I loose with both positions.

Luckily I can manage this options strategy when ever I want. I can open and/or close Spreads, I can add or remove Legs in favor of my position. I can add Stocks Long OR Short.

Too complicated?

I learned, that success does not just come from a 1-Trick trading Setup/System. If you want to survive in to-days markets, you have to learn, adapt and never stop this process.

I personally like to have as many possibilities to skin my Cats as possible.

I'm a Nerd, a Tr8dingN3rd and I live for what I do §8-)

Coinbase Goes deeper Coinbase Shatters Expectations: Here's Everything Investors Need to Know

Trend bearish

bullish breakout has to be confirmed,otherwise it will be a bulltrap

that offers the oppurtunity to sell more the asset

Bearish breakouts often confirmed strongly,the bearish trend continues

Up against the world’s largest crypto exchange (Binance) and the largest publicly-traded crypto company (Coinbase), it’s likely Gensler is in for a fight. Coinbase CEO Brian Armstrong said months ago that the SEC was building its case, and, if it sued, the exchange would counter.

SEC delays its recommendation on Coinbase petition

The SEC told the court, though it hasn’t made a decision on Coinbase’s rulemaking petition yet, it may make a recommendation within 120 days.

The SEC added that until and unless it decides to propose new guidelines, Coinbase must follow current law.

It was only last week that the agency charged Coinbase and Binance with securities violations.

The U.S. Securities and Exchange Commission (SEC) said it hasn’t made a decision on Coinbase’s rulemaking petition yet. However, its staff members think that it will make a recommendation within 120 days, i.e. four months.

The regulator made these remarks while responding to a court order on whether it was taking any action on rulemaking as asked in Coinbase’s petition filed earlier, even as it was suing the crypto exchange for securities violations.

Coinbase alleged in the court that the SEC has decided to reject the petition. The SEC said that this was not the case, though it thinks that it will make a recommendation within a period of 120 days.

The agency also stated that its enforcement action against the crypto trading platform was not in conflict with any regulation decision. Until and unless the SEC decides to propose new guidelines, Coinbase must follow current law, according to the enforcement agency.

On the other hand, the SEC argued that “statements by the Chair do not – and could not – constitute Commission action denying Coinbase’s rulemaking petition.”

Any SEC decision would also need a majority of a quorum vote, the regulator argued.

The SEC charged Coinbase last week, alleging that it was operating as an unregistered securities exchange, broker and clearing agency. A day before its action against Coinbase, SEC charged Binance, world’s leading crypto exchange, with similar allegations.

Coinbase Q1 Earnings Highlights BUT I STAY SHORTTREND STRONG SELL

I love the WALLSTREET: Everytime the reports are beyond the estimates of the Wallstreet I sell.

My axxuacy is far beyond 75%.

Why does it work?

Everytime the news are released, the big boys have aleady taken profits, and now the gonna for better prices o better to make more money in the opposite direction. That is what I call the smart money

I do not care if I like the name or the company or the product, when I trade.

Emotions are your enemies,when trading.

You heard expressions like

Never catch a falling knife

There is time to go long, time to go short and time to go fishing.” — Jesse Lauriston Livermore

“Markets can remain irrational longer than you can remain solvent.” – John Maynard Keynes

“Most people, whether bull or bear, when they are right, are right for the wrong reason, in my opinion.” – Jesse Lauriston Livermore

“Someone will always be getting richer faster than you. This is not a tragedy.” – Charlie Munger

“The trend is your friend except at the end where it bends.” — Ed Seykota

What is a Falling Knife?

A falling knife is a colloquial term for a rapid drop in the price or value of a security. The term is commonly used in phrases like, "don't try to catch a falling knife," which can be translated to mean, "wait for the price to bottom out before buying it." A falling knife can quickly rebound - in what's known as a whipsaw—or the security may lose all of its value, as in the case of a bankruptcy.

Falling knife refers to a sharp drop, but there is no specific magnitude or duration to the drop before it constitutes a falling knife.

A falling knife is generally used as a caution not to jump into a stock or other asset during a drop.

Traders will trade on a sharp drop, but they generally want to be in a short position and will use technical indicators to time their trades.

What a Falling Knife Tells You

The term falling knife suggests that buying into a market with a lot of downward momentum can be extremely dangerous—just like trying to catch an actual falling knife. In practice, however, there are many different profit points with a falling knife. If timed perfectly, a trader that buys at the bottom of a downtrend can realize a significant profit as the price recovers. Likewise, piling into a short position as the price falls and getting out before a rebound can be profitable. Moreover, even buy and hold investors can use a falling knife as a buy opportunity provided they have a fundamental case for owning the stock.

That said, there is a very real risk that the timing will be off and there could be significant losses before any gains. So many traders still pay lip service to the adage. Instead of trying to "catch the falling knife," traders should look for confirmation of a trend reversal using other technical indicators and chart patterns. An example of a confirmation could be as simple as waiting for several days of upward momentum after the fall or looking at the relative strength index (RSI) for signs of a stronger uptrend before buying into the new trend.

CONCLUSION: The trend direction is short! BASTA! The short volumes are high what means more selles are enthusiastic to risk more money in short direction.

Fundamentals:

Although the Q1 reportings where positive the market paticipants have not been enthusiastic. No bull volume, no, new Higher Hihs. Instead the market did the opposite: Wallstreet went short. IF THIS IS BEYOND THE ESTIMATES:THEN I decide to sell more on weakness.

COINBASE stock (280% gains if you're patient) NEW analysisCOINBASE stock looks great.

Falling wedge broke out bullishly and what we saw on 13 and 14 of February was creation of higher low and support retest.

Target 1 is at 114$ . It's a technical target from the bullish falling wedge pattern.

Target 2 is for patient investors/swing traders as it may take some time to get it.

At 205$ most likely we will see a trend reversal and heavy sell pressure as it's a strong resistance.

We are bullish on COIN in Q1 and Q2 2023.

Good luck

Coinbase touches SMA resistanceCoinbase's stock (COIN) advanced in the intraday levels after announcing plans to let go of 950 employees in a step to reduce costs, especially in the crypto sector, with severance package and other costs of the termination estimated at $163 million, with the stock tumbling 12.96% in the last session, or 4.96 points, settling at 43.23, with trading volumes surpassing 24.4 million shares, above 10-day averages of 13.6 million shares.

Technically, the stock is trying to regain some recent losses, touching the 50-day SMA, while retesting the resistance of 40.83, as the RSI reached overbought levels compared to the stock's movements.

Therefore we can expect the stock to return lower, targeting the support of 20.20, provided the resistance of 40.83 holds on.

Selling Coinbase slightly above previous support.Coinbase - 30d expiry - We look to Sell at 62.28 (stop at 67.21)

Our bespoke support of 60.00 has been clearly broken.

Previous support at 60.00 now becomes resistance.

Daily signals are bearish.

We are trading at oversold extremes.

There is no clear indication that the downward move is coming to an end.

This stock has seen poor sales growth.

The primary trend remains bearish.

Our profit targets will be 50.51 and 48.51

Resistance: 55.00 / 60.00 / 63.50

Support: 50.00 / 46.00 / 40.80

Daily chart

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

COIN - Unusual Options Activity. More downside expected.Observing unusual Options activity is often a good indication on how big players are betting.

( The snippet here was taken from the YTuber Maverick Of Wallstreet. I watch his channel every single day. I learned so much from him, and everyone else can too - 100% free btw.)

Here we see large PUT buying volume for the 120 Strike.

However, you can't take this as the holy grail and bet your house and dog on it. As with anything else, it's just an Indication, a puzzle for the whole pitcure.

Hope this helps.

#careandshare

COIN Coinbase sold by ARKK fund???Is Cathie Wood`s ARK fund anticipating a top in the crypto space right now?

On 10/12/2021 ARKK fund sold 5,855 shares of COIN COINBASE GLOBAL INC, for about 1.5Mil usd.

When the fund starts a sell, it`s usually a multiple day sell on "small" positions. In this case it was 1.5Mil worth of shares.

The only thing that makes me optimistic right now about Coinbase, is the NFT marketplace.

On Oct. 12 Coinbase NFT was launched, a peer-to-peer marketplace that lets users mint, collect and trade NFTs, or non-fungible tokens.

On the other hand, on 10/14/2021 Devin Ryan from JMP Securities Boosted the Price Target with an Outperform rating from $300.00 to $330.00

This is a one year price target.

I`m looking forward to read your opinion on it.

COIN Daily TimeframeSNIPER STRATEGY (new version)

It works ALMOST ON ANY CHART.

It produces Weak, Medium and Strong signals based on consisting elements.

NOT ALL TARGETS CAN BE ACHIEVED, let's make that clear.

TARGETS OR ENTRY PRICES ARE STRONG SUPPORT AND RESISTANCE LEVELS.

ENTRY PRICE BLACK COLOR

TARGETS GREEN COLOR

STOP LOSS RED COLOR

DO NOT USE THIS STROTEGY FOR LEVERAGED TRADING.

It will not give you the whole wave like any other strategy out there but it will give you a huge part of the wave.

The BEST TIMEFRAMES for this strategy are Daily, Weekly and Monthly however it can work on any timeframe.

Consider those points and you will have a huge advantage in the market.

There is a lot more about this strategy.

It can predict possible target and also give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

START BELIEVING AND GOOD LUCK

HADIMOZAYAN