COIN 0DTE Trade Breakdown – July 25, 2025

📉 COIN 0DTE Trade Breakdown – July 25, 2025

Put Play or Pass? Let’s break it down 👇

📍 Price: $392.34

🧠 Sentiment: Neutral → Bearish

📊 Call/Put Ratio: 1.08 (Balanced flow)

⚠️ Gamma Risk: HIGH

⌛ Time Decay: Accelerating (0DTE!)

⸻

🎯 TRADE IDEA: 0DTE PUT

✅ Strike: $380.00

💵 Entry Price: $0.69

🎯 Profit Target: $1.00

🛑 Stop Loss: $0.37

📆 Expiration: Today (Jul 25)

📈 Confidence: 65%

📍 Entry Timing: At Open

⸻

⚠️ Why This Trade?

🔻 RSI trending down

🚫 Weak institutional volume

⚠️ High volatility expected from gamma squeeze

🕒 Tick. Tock. Time decay’s your biggest enemy here.

📌 Strategy:

➡️ Naked PUT (speculative short-term play)

⛳ Goal? Quick move → quick exit

⸻

🚨 Risk Warning:

❗ 0DTE = Massive swings

❗ One wrong move = rapid premium decay

❗ Stay nimble. Know your exit.

⸻

💬 Drop a 🔥 if you’re watching COIN today

#OptionsTrading #0DTE #COIN #DayTrading #PutOption #TradingView #StockTok #GammaRisk #TradeSetup

Coinbasesignals

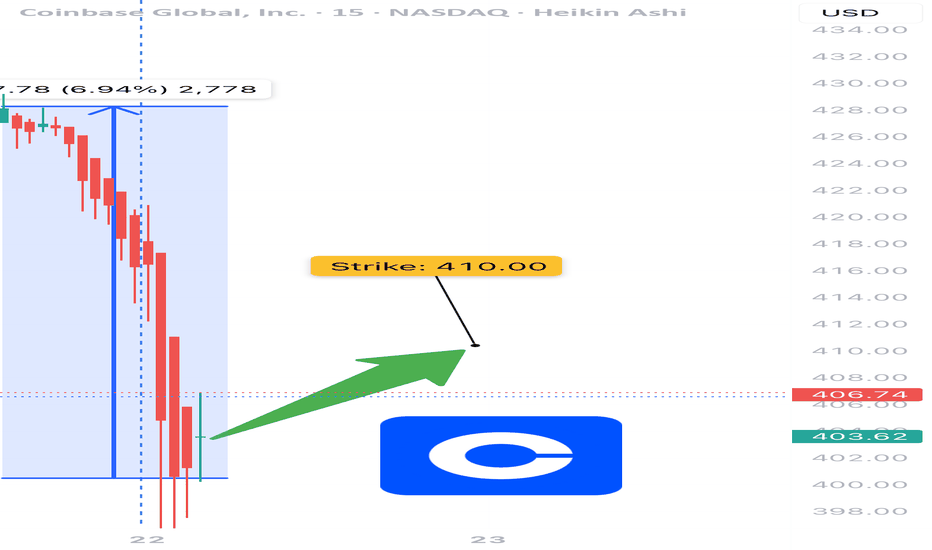

COIN Weekly Bullish Options Setup (Jul 22, 2025)

🚀 NASDAQ:COIN Weekly Bullish Options Setup (Jul 22, 2025)

Institutional call flow is heavy. Momentum is fading — but not dead. Volume confirms bulls. This is a calculated strike before earnings zone noise.

⸻

📊 Trade Setup

• 🎯 Direction: CALL

• 📍 Strike: 410

• 💰 Entry: $14.70

• 🎯 Target: $17.00+

• 🛑 Stop: $11.60

• ⏰ Expiry: 07/25/2025 (3DTE)

• 📈 Confidence: 65%

• 📍 Entry Timing: Market open

⸻

🔍 Model Consensus (Multi-AI Synthesis)

• 🟢 3/5 models bullish: Grok, Llama, DeepSeek

• 🟡 1 neutral: Gemini (momentum divergence noted)

• 🔴 1 bearish: Claude (overbought RSI divergence risk)

• 📈 VIX < 22 = Green Light

• 🧠 Key Catalyst: PNC x Coinbase partnership + institutional volume surge

• 📉 Watch for RSI reversal > Weekly 83.5

⸻

📎 Trade Logic

• Options flow + volume = 🔥 institutional accumulation

• RSI high but manageable — expect momentum pockets, not full reversals

• Range target: $428–$444.65

• Stop loss = discipline, not fear

⸻

🧠 Risk Note:

• Momentum divergence is real.

• Avoid chasing if VIX > 22 or if open shows reversal.

• Size small. Let the volume do the work.

⸻

📢 Tagline (for virality)

“Snakes see a breakout, but bulls smell blood. NASDAQ:COIN loading calls on institutional flow. 3DTE scalp or breakout runner. Your move.” 🐂📈

COINBASE and ALTS going hand in hand! Massive break-out expectedCoinbase (COIN) and the Crypto Total Market Cap (excluding top 10) are going hand in hand in this Cycle as their patterns since the November 08 2021 High have been virtually identical.

Right now we are on a strong rebound which was initiated on both after breaching below the 1W MA200 (orange trend-line). That is basically a Double Bottom, aiming at a break-out above their respective Resistance levels, which is expected to be massive.

Notice how even their 1W RSI patterns are similar, both Falling Wedges. Also their Bull Cycles both started on an Inverse Head and Shoulders pattern, so there is every reason to expect that the two will continue hand in had until their very peaks of the Cycles.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE Can the 1D MA50 catapult it to $400?Coinbase (COIN) has been trading within a Fibonacci Channel Up ever since the Bull Cycle started on the January 06 2023 market bottom. The price made a Double Bottom on April 07 following the correction from its most recent High in early December.

That is a strong long-term market Support and a clear Demand Level as the stock's immediate rebound showed. The fact that it has currently flipped the 1D MA50 (blue trend-line) into a Support and is consolidating is a clear signal of a Re-accumulation Phase.

A break above its 1D MA200 (orange trend-line) will technically confirm the extension of the new Bullish Leg. The previous High was on the 0.786 Fibonacci Channel level and the one before that on the 1.0 Fib. If this declining rate continues, we should be expecting the next High to just hit the 0.618 Fib.

As a result, we have $400 as a medium-term Target, slightly above the stocks previous All Time High (ATH) at $370.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE This is the time to buy and target $400Coinbase Global (COIN) has been trading within a Channel Up pattern since the March 25 2024 High, so effectively a whole year. In the past 10 days it has been consolidating on top of the 1W MA100 (red trend-line), which is the natural long-term Support of the market.

During the same time it entered the Mayer Multiple Bands (MMB) Buy Zone, consisting of the 3 SD (green trend-line) and 2 SD (blue trend-line) below levels, which has given the ultimate buy signals since the January 2023 market bottom. Practically, the stock is consolidating within the 2 SD below and 1W MA100, a tight buy range.

Given the symmetry of the Channel Down Bearish Legs (both -48.39%), we expect a similar symmetry on its Bullish Legs too. Since the previous one reached the 1.236 Fibonacci extension, we are confidently targeting $400 before this Cycle tops. That would also make a perfect entry within the MMB Sell Zone that consists of the Mean MM (black trend-line) and 1 SD above (grey trend-line).

Notice also how the 1W RSI touched the Support of the September 06 2024 Low.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE about to start a rally to $550Coinbase (COIN) broke above its 1D MA50 (blue trend-line) again yesterday, but is practically still consolidating around it for the past 2 weeks. Still, it has already broke above December's Channel Down, which on the wider, long-term bullish trend, is nothing but a Bull Flag pattern, similar to January 2024.

As you can see, both patterns were initiated after previously a Falling Wedge broke upwards and above the 1D MA50 and on all occasions, the price increase has been significant, with the smallest being +139.50%.

As a result, being also on a 1D MACD Bullish Cross, we expect the stock to kick-start the new Bullish Leg soon. Expecting to register at least another +139.50% Leg from the recent Low, our Target is $550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE approaching the 1W MA50 and turns into a Buy again.Coinbase (COIN) has gone a long way since our September 09 buy signal (see chart below):

Even though it marginally missed the $360 Target, the pattern served in an excellent way those investors who bought at the bottom of its dominant 2-year Channel Up. The September - December Bullish Leg was by a narrow margin, the shortest (+141.45%) of Coinbase's total 5 major rallies within this pattern.

As the price is yet again approaching the 1W MA50 (blue trend-line), it is gradually turning into a Buy opportunity again. Even though the shortest Bearish Leg has been -38.74% and that currently places the projected bottom level a little over $215, the 1W RSI has already broken below its MA (yellow trend-line), which has been the ultimate buy signal on all previous technical corrections with the exception of last April.

As a result, there are more probabilities to see COIN resume the 2-year bullish trend, with the Risk/ Reward Ratio (RRR) turning favorable again. A Dollar-cost-averaging strategy is also suited for those seeking less risk.

Our Target from now on is $500, which represents a +141.45% rise (as mentioned above, the shortest within the Channel Up).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE Ahead of an enormous bullish break-out.In recent times, we have focused on Coinbase's (COIN) long-term potential on higher time-frames (1W) like the one below (September 09) where we gave a great buy signal on the absolute bottom of the 2-year Channel Up:

On today's analysis we look into the 1D time-frame as Coinbase is about to test its longest 2024 Resistance, the Lower Highs trend-line that started after the March 25 2024 High. With added bullish pressure by the 1D MACD Bullish Cross formed 2 days ago, if this Lower Highs trend-line breaks, we can technically have a very aggressive rally.

The September 06 bottom can be seen as the start of the Head of an Inverse Head and Shoulders (IH&S) pattern, which has a standard Target on the 2.0 Fibonacci extension. That is just above $340. As a result, if the Lower Highs trend-line breaks, you can take additional buys to target $340.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE Surges as Bitcoin Breaks $71,000! Next Price Target?Analysis of Coinbase (COIN) - 15m Timeframe

Trade Setup: Coinbase has shown a significant uptick as Bitcoin surged past the $71,000 mark, triggering a bullish entry point at $214.90.

Volume and Momentum: Current trading volume stands at 10.46M, surpassing the 30-day average of 9.32M, signaling strong interest and momentum.

Technical Levels:

Entry: $214.90

Target 1 (TP1): $221.45

Target 2 (TP2): $232.06

Target 3 (TP3): $242.66

Target 4 (TP4): $249.21

Stop Loss (SL): $209.60

Catalyst:

Bitcoin’s recent price surge has positively influenced Coinbase’s stock, aligning with its correlation to crypto trends. The upcoming earnings report in 2 days may add further volatility, providing potential upside if positive results are announced.

Conclusion: This entry marks an opportune moment to capitalize on Coinbase's rally tied to Bitcoin’s performance. Traders should watch the earnings announcement closely as it could propel the stock further, potentially reaching the set targets.

COINBASE Bears in Control: More Downside Likely!COINBASE Short Trade Technical Analysis:

Coinbase Global on the 15-minute timeframe shows a strong short trade setup, with TP1 already hit. The stock is trading below the Risological dotted trendline, reinforcing the bearish sentiment.

Key Levels:

Entry: 207.12

Stop Loss (SL): 213.68

Target 1 (TP1): 199.00 (Done)

Target 2 (TP2): 185.87

Target 3 (TP3): 172.74

Target 4 (TP4): 164.62

Observations:

The price remains under significant selling pressure, evident by its inability to recover above the Risological dotted trendline.

With increasing volume on the down moves and resistance holding strong, the continuation of the downtrend appears highly likely.

The structure suggests more downside as sellers maintain control, and buyers struggle to regain any meaningful momentum.

Coinbase Global continues to look bearish after TP1, and the price action is aligned for further declines. Keep an eye on the lower targets as they are within reach, supported by the clear downward trend and weak buying attempts!

Coinbase Surges! Long Trade Hits All Targets – Bulls Drive GainsCoinbase has shown strong bullish momentum since the long entry at 168.72 on 11th October, reaching all designated profit targets.

Key Levels

Entry: 168.72 – The long trade was initiated at this level, supported by a bullish breakout.

Stop-Loss (SL): 165.30 – Positioned below recent support to manage risk and guard against downside movement.

Take Profit 1 (TP1): 172.93 – The first target was hit, confirming the strength of the upward move.

Take Profit 2 (TP2): 179.76 – Continued buying pressure led to this level being reached.

Take Profit 3 (TP3): 186.59 – The bullish momentum carried the price to this target.

Take Profit 4 (TP4): 190.81 – The final profit target, signaling a successful trade completion.

Trend Analysis

The price remains well above the Risological Dotted trendline, affirming the strong uptrend. The sustained upward movement indicates solid market sentiment, which has driven the price through all target levels.

The long trade on Coinbase has been highly successful, with all targets hit and the final level at 190.81 achieved. The trade's success showcases the power of the Risological Dotted trendline in guiding bullish entries and exits.

COINBASE Enormous upside from this point. $360 minimum Target.Coinbase (COIN) has staged a strong bullish turnaround since our last analysis (September 09, see chart below) and it appears that we caught the perfect bottom buy:

The stock has been trading within a long-term Channel Up since the first week of January 2023 (22 months). Within this time span, it has seen 4 corrections with the latter being the longest as we haven't seen a new High since the week of March 25 2024. The current correction is almost the same (-48.50%) as the January - April 2023 (-47.15%), while the other two have been around -39%.

The key for now is to close a 1W candle above both the 1W MA50 (blue trend-line) and the 1D MA50 (red trend-line). That will be the last confirmation for this Bullish Leg. This on its own is a very pessimistic development, with the presence of only the 1W MA100 (green trend-line) remaining to offer support long-term.

Now as for the upside, the minimum % rise of a Bullish Leg within this Channel Up has been +146.82% (two times). As a result, as long as the 1W RSI closes this week above its MA trend-line (yellow), a bullish signal that emerged on all previous 4 bottoms of the Channel, we can expect the new Bullish Leg to rise on a minimum +146.82% from its bottom, which gives us a $360.00 Target.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE at the bottom of the 20month Channel. Will it go lower?Coinbase (COIN) has been trading within a long-term Channel Up since the first week of January 2023 (almost 20 months). Within this time span, it has seen 4 corrections with the latter being the longest as we haven't seen a new High since the week of March 25 2024.

Last Friday saw the week close on the strongest red 1W candle (-20%) since the 2022 Bear Cycle, as it failed to rebound on the 1W MA50 (blue trend-line). This on its own is a very pessimistic development, with the presence of only the 1W MA100 (green trend-line) remaining to offer support long-term.

However, this Friday closing made an exact Higher Low at the bottom of the Channel Up, something we hadn't seen since the June 05 2023 1W candle. That was the candle that completed the longest (until the current one) correction on Coinbase. Both Bearish Legs have similar declines (-47% then and -48% now). The minimum % rise of a Bullish Leg within this Channel Up has been +146.82% (two times).

As a result, as long as we close this week inside the Channel Up and ideally the 1W RSI remains above the 30.00 oversold barrier, we can expect a long-term bullish reversal on COIN with the start of the Channel's new Bullish Leg, with a minimum expectation being at $360.00 (+146.82% rally).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE rebounded on its 1W MA50. Next target = $390Coinbase (COIN) hit (and even broke) last week its 1W MA50 (blue trend-line) for the first time in more than 1 year (since the week of June 26 2023) and posted an incredibly bullish reaction by almost recovering all of the weekly losses.

At the same time, that drop almost touched the bottom of the 1.5 year Channel Up that started after the 2022 market bottom. All similar bottoms registered at least +146.82% rallies on the Bullish Legs that followed, so we expect the stock to have a minimum $390 Target, which will also reach the 0.786 Fibonacci Channel level, that is always hit during such rallies.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE targeting $470 after this accumulation is over.Coinbase Global (COIN) has been consolidating around its 1D MA50 (blue trend-line) since late May. The long-term trend remains bullish (since the January 2023 bottom) and is best illustrated by the use of the Fibonacci Channel. Right now the price is exactly on its middle (0.5 Fib level).

The stock is no stranger to consolidations like this as within this Channel Up pattern, it has seen another 3 similar Accumulation Phases (green arcs). The minimum rise following such a phase has been +146.82% and it has so far happened twice. The last Bullish Leg is such an example.

Technically, the current Accumulation Phase resembles more the one that ended in October 2023. The next time we close a 1W candle above the 1D MA50, COIN will most likely confirm the start of the new Bullish Leg.

If we assume it will again rise by the 'minimum' +146.82% rate from May's Low, then expect a direct hit this time at the top (Higher Highs trend-line) of the Channel Up. Our Target is $470.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE Can catapult above $300 any time.Coinbase Global (COIN) has been trading within a long-term Channel Up pattern since the October 27 2023 bottom. Its long-term Support level is the 4H MA200 (orange trend-line) which was most recently tested on May 14 2024 and held.

Just like the February 07 (near) test, this is technically the latest Higher Low of the Channel Up. The break-out above the Falling Wedge that followed, similar to the February bottom, has found Support on the 4H MA50 (blue trend-line), which held even during Friday's dramatic pull-back.

With the Sine Waves accurately depicting COIN's all recent bottoms (Higher Lows) and tops (Higher Highs), they clearly show that we are past the latest bottom and have already started the new Bullish Leg to a Higher High.

The previous one was priced just above the 1.786 Fibonacci extension level. As a result, we remain bullish on this stock, setting a new price Target at $380.00 (Fib 1.786), which can be achieved by mid-July.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE Bottomed and turning bullish for 2 months.Coinbase (COIN) completed a 2-day green streak following a Lower Low within the Falling Wedge, which is technically the Bearish Leg of the 6-month Channel Up pattern that started on the October 27 2023 Low.

By tomorrow the 4H MA50 (blue trend-line) would have crossed below the 4H MA100 (green trend-line), forming a Bearish Cross, which is a pattern last seen on February 02 2024. The stock bottomed 2 days later, above the 4H MA200 (orange trend-line), which is currently at.

In contrast to the stocks Lower Lows, the 4H RSI formed Higher Lows, which is a Bullish Divergence, the same kind of pattern it completed on February 05. Technically, once it breaks above the 4H MA50 again, we will have a confirmed Bullish Leg (dotted) at its very start. The last one reached the 1.786 Fibonacci extension, so we are targeting at least $370.00 on this run.

It is worth noting that there is a high degree of consistency in the frequency on the Highs and Lows of the Channel Up, which is clearly shown by the Sine Waves on this chart.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE around the 1D MA50 but the MA100 more likely to supportCoinbase Global (COIN) rose as high as our last target (March 05, see chart below) and has been pulling back since:

The best way to view this short-term correction is on the diverging Channel Up (blue) which started on the October 27 2023 bottom. As with the longer term Channel Up, it consolidates considerably below the 1D MA50 (blue trend-line), with the last (February 05 2024) Low finding support just above the 1D MA100 (green trend-line).

As a result we expect a Higher Low for the diverging Channel Up close to 185.00, before start seeing the new Bullish Leg. In addition, we need to see the 1D RSI touching its 2-year Support Zone, which usually tends to touch it twice during an Accumulation Phase. The price also tends to Double Bottom. This means that there will be time most likely (always account for how strongly the Bitcoin Halving might do to the market) to identify the new bottom and most optimal buy entry based on the conditions above.

We are willing to buy there for the Bullish Leg that will follow and target $370.00, which is the top of the long-term Fibonacci Channel. Note that in case of a break-out, the price can even go as high as the 2.0 (blue) Fibonacci extension ($440.00), which is around the Fib level that the last two Higher Highs where priced.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE rallying as it should since our last call. What's next?Coinbase Global, Inc. (COIN) has started an amazing rally following our February 05 buy signal (see chart below) and is headed towards the $285.00 Target:

We are modifying the Channel Up to make contact with all three Higher Lows as the Higher Highs comfortably fit the 0.786 Fibonacci Channel retracement level. As you can see all previous Higher Highs have been formed with a 1D candle closing below the 0.786 Fib and right now the price is sitting exactly on that level.

This indicates that as long as the stock doesn't clos a 1D candle above it, we may see one last short-term pull-back towards the 0.5 Fib before eventually reaching the $285.00 Target. If however a 1D candle does close above the 0.786 Fib, we do expect the current rally to continue straight to the Target.

Notice at the same time the 1D RSI entering the 2023 Resistance Zone. This is an unnoticed key dynamic as the previous Higher Highs were priced after the RSI got rejected on the Resistance Zone and it entered back blow the 70.00 overbought barrier. Keep an eye for a timely exit.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Navigating Sympathy Plays: A Guide to Trading BITCOIN & COINBASE** Introduction **

Sympathy trading, a strategic approach rooted in both technical and fundamental analysis, capitalizes on correlated movements between assets to uncover profitable opportunities. In this article, we delve into the nuanced realm of sympathy trading using Bitcoin (BTCUSD) and Coinbase Global Inc. (COIN) as case studies, exploring how a blend of technical and fundamental analysis can enhance trading strategies.

** Understanding Sympathy Trading **

Sympathy trading hinges on discerning and exploiting the symbiotic relationship between correlated assets. It involves analyzing both technical indicators and fundamental factors to identify potential entry and exit points, as well as underlying drivers influencing price movements.

** BTCUSD and COIN: A Sympathetic Relationship **

BTCUSD and COIN exemplify a compelling case study in sympathy trading within the cryptocurrency domain. Bitcoin's price dynamics often exert a significant influence on Coinbase's stock value, reflecting the exchange's dependency on Bitcoin's performance and trading volumes.

Technical Analysis Insights:

Technical analysis provides crucial insights into price trends, momentum, and support/resistance levels. Key technical indicators for trading BTCUSD and COIN include:

1.Moving Averages: Analyzing moving average crossovers and trends helps identify potential entry or exit points. Golden crosses (short-term moving average crossing above long-term moving average) or death crosses (opposite) can signal trend reversals.

2.Volume Analysis: Monitoring trading volumes in both BTCUSD and COIN can confirm price movements and signal changes in market sentiment. An increase in volume accompanying price movements suggests stronger market conviction.

3.Chart Patterns: Identifying chart patterns such as triangles, flags, and head and shoulders formations can provide insights into potential price reversals or continuation patterns, guiding trading decisions.

Fundamental Analysis Insights:

Fundamental analysis delves into underlying factors driving asset valuations and market sentiment. Key fundamental factors influencing BTCUSD and COIN include:

1.Regulatory Developments: Changes in regulatory frameworks governing cryptocurrencies can impact investor sentiment and trading activity. Positive regulatory developments may boost confidence in BTCUSD and COIN, while regulatory uncertainties could lead to volatility.

2.User Adoption and Trading Volumes: Monitoring user adoption rates and trading volumes on Coinbase's platform can provide insights into the exchange's revenue prospects and growth trajectory. Increased user activity often correlates with higher revenues for the exchange.

3.Market Sentiment and News Catalysts: Market sentiment surrounding Bitcoin, such as institutional adoption, macroeconomic factors, or geopolitical events, can influence both BTCUSD and COIN prices. News catalysts, such as product launches, partnerships, or earnings reports from Coinbase, can drive short-term price movements.

** Crafting Sympathy Strategies: **

Sympathy trading strategies integrating technical and fundamental analysis may involve:

1.Confirmation of Technical Signals: Confirming technical signals with fundamental catalysts can strengthen trading convictions. For example, if a bullish technical pattern emerges in BTCUSD, traders may look for positive fundamental catalysts supporting the uptrend in COIN.

2.Event-Based Trading: Leveraging fundamental analysis to anticipate market-moving events, traders may position themselves ahead of key announcements or developments. For instance, if positive regulatory news is expected for cryptocurrencies, traders may preemptively buy COIN in anticipation of increased trading activity.

** Risk Management Considerations: **

Effective risk management is paramount in sympathy trading to mitigate potential losses:

1.Position Sizing: Determine appropriate position sizes based on risk tolerance, account capital, and trade conviction. Avoid overexposure to a single trade and diversify across multiple assets to spread risk.

2.Stop-Loss Orders: Implement stop-loss orders to limit potential losses and protect capital. Place stop-loss levels based on technical levels, volatility considerations, or predetermined risk-reward ratios.

** Case study in action **

Let's look at the charts, both on the 1W time-frame in order to catch and get an understanding of the bigger trends and see if the theory is applied on the price action.

Bitcoin has provided 5 excellent Sympathy Play signals for Coinbase in the last 2 years. Starting with a Bear Flag that was rejected on its 1W MA50 (blue trend-line), Bitcoin initiated a huge decline on Coinbase (red shape), proportionally much stronger that its own. Then as its was attempting to find a market bottom, it provided 2 recovery signals that gave a proportionally bigger rise on Coinbase. Then a BTC Bull Flag again turned into a proportionally bigger rise on Coinbase with the last signal coming on October 2023.

As you can see during this significantly sample, Bitcoin tends to provide strong early buy/ sell signals on Coinbase. It is worth noting that even though Coinbase is a stock, it follows Bitcoin's price movements more closely than the S&P500 stock index, which we have illustrated on the right chart by the grey trend-line. As you can see there have been numerous occasions where Coinbase failed to follow a big stock market rally and instead was tied to BTC with the most notable examples being recently in January 2024, March 2023 and October 2022.

** A few things to consider that distinguish Bitcoin from Coinbase: **

Market Factors: Bitcoin's price is influenced by various market factors such as supply and demand dynamics, investor sentiment, macroeconomic trends, regulatory developments, and technological advancements. Coinbase's stock price, on the other hand, is influenced by factors specific to the company, including financial performance, earnings reports, regulatory compliance, competition, and market sentiment towards the cryptocurrency industry.

Liquidity and Trading Volume: Bitcoin, being the largest and most well-known cryptocurrency, typically exhibits higher liquidity and trading volume compared to Coinbase's stock. As a result, Bitcoin may experience more significant price movements and volatility compared to COIN, which could impact their respective charts differently.

Correlation vs. Causation: While Bitcoin's price movements may influence sentiment towards Coinbase and vice versa, correlation does not necessarily imply causation. While there may be periods where BTC and COIN prices move in tandem due to shared market sentiment or external factors, they are ultimately distinct assets with their own fundamental drivers.

Market Participants: Bitcoin is traded on cryptocurrency exchanges by a diverse range of market participants, including retail investors, institutional investors, miners, and traders. Coinbase's stock, on the other hand, is traded on traditional stock exchanges and may attract a different set of investors, including institutional investors, hedge funds, and retail traders.

** Conclusion: **

Sympathy trading using BTCUSD and COIN as case studies demonstrates the synergy between technical and fundamental analysis in identifying trading opportunities and managing risk. By integrating insights from both disciplines, traders can enhance their trading strategies, navigate market dynamics with confidence, and strive for consistent profitability in the dynamic cryptocurrency market.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE Has it found a bottom? Caution if it breaks this level.Last time we looked into Coinbase (COIN), we set a long-term target of $150 (November 14 2023, see chart below) that was easily surpassed:

At the moment the stock is on a short-term pull-back following the rejection near the 1D MA50 (blue trend-line). It is approaching a dangerous level, the 0.5 Fibonacci of the Channel Up, which is its middle but most of all the 116.50 level which is the former Resistance level (two Highs on August 04 2022 and on July 14 2023) that could now turn into Support.

If it holds, we can expect a rebound targeting $285, which would be a +146.82% rise, above the top (Higher Highs trend-line) of the Channel Up. If it closes a 1D candle below it though, we expect the price to seek the maximum % decline it has had within this pattern, -47.15%, which would bring the stock around $100 and would be technical test of the 1D MA200 (orange trend-line) and an excellent long-term buy entry, which is what took place on the October 27 2023 bottom. In that case a +146.82% rise would be $245.00 and that would be our Target. Note that at any given price, if the 1D RSI hits the 1-year Support Zone, it will be a solid buy entry regardless.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE above the 1W MA100 for the first time ever.Coinbase Global (COIN) broke on Thursday above the 1W MA100 (red trend-line) for the first time in its trading history, following a strong rebound on the 1D MA200 (orange trend-line). The prevailing pattern is a Channel Up, which with the help of the Fibonacci Channel extensions, gets put into a better context.

The 1D RSI shows that there is one pump left on the current rise, similar to the previous two bullish sequences of the Channel Up. Since the 116.50 Resistance 1 level has been unbroken for more than a year, our first target is 115.00, which will make an ideal technical Higher High for the Channel Up.

Beyond that, we will buy after a rejection to the 1D MA50 (blue trend-line) again. In the event that a 1D candle closes above Resistance 1, we will have a bullish break-out in our hands and again after a pull-back (this time not as deep as the 1D MA50), the trend should extend to 150.00 and the 1.5 Fibonacci Channel extension.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

COINBASE Final dip before bullish break-out.Coinbase Global (COIN) is failing on successive attempts to stay above the 1D MA50 (blue trend-line) and that is technically establishing it as the medium-term Resistance. The long-term one is the 1W MA100 (red trend-line), which has never been broken. Based on the MACD sequence, we have potentially one more dip to make on the Higher Lows trend-line, simiarl to May 04 and June 06, before first to test the 1W MA50 and then Resistance 1 (116.50), which is intact since August 04 2022. Our first target is 80.00 (1W MA100 projected path) and second is 115.00 (just below Resistance 1).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇