Color

Stock of the Week: Poddar Pigments with Robust Financial HealthStock of the Week: Poddar Pigments ( NSE:PODDARMENT PODR)

Fundamental Analysis :

Poddar Pigments showcases a robust financial profile, making it an attractive pick for this week. The company holds more cash than debt on its balance sheet, indicating strong liquidity. Its liquid assets exceed any obligations, providing a solid financial cushion. Additionally, NSE:PODDARMENT Poddar Pigments has reported consistent profits over the last six quarters, highlighting its stable and reliable performance.

Technical Analysis :

From a technical perspective, NSE:PODDARMENT Poddar Pigments is trading above all major moving averages, signalling a bullish trend. The stock has achieved a significant 52-week breakout and is also breaking out of a box formed by the last 12 months’ consolidation zone. This breakout is supported by good volume strikes, indicating strong market interest. Moreover, Poddar Pigments demonstrates relatively higher strength than the Nifty index, with the RSI crossing above 60, further affirming its upward momentum.

Entry - CMP

Stop loss - 396.55

Potential upside - 643

Navigate the Markets with PressureO DMI

Idea Description:

Introducing PressureO DMI: the culmination of a 13-year journey through the world of trading, encapsulated in a single, powerful indicator. Crafted to cut through the market's noise, this tool is your ally in decoding the subtle cues that signal shifts in momentum and sentiment.

Rooted in Real Trading Experience:

PressureO DMI isn't an abstract concept; it's a practical instrument forged in the fires of daily trading. It's a distilled essence of market understanding, offering you a nuanced

view of the forces that move the markets. With an emphasis on directional movement, this indicator simplifies complex market conditions into actionable insights.

Your Tactical Compass:

Trading requires more than just data; it demands context. PressureO DMI provides that context by overlaying directly onto your charts, offering a visual guide to market pressure points. It's designed to enhance your interpretation of market trends, helping you to identify potential entry and exit points with greater confidence.

Strategic Clarity:

With adjustable settings for length and smoothing, the PressureO DMI adapts to your trading style, allowing you to tune into the market's frequency. Whether you're a day

trader seeking agility or a long-term investor requiring broader strokes of insight, this indicator scales to your needs.

A Preview to Proficiency:

For those curious to experience what a blend of data-driven analysis and seasoned intuition feels like, the PressureO DMI offers a free version. It’s a taste of strategic clarity, a preview of what it means to have a tactical edge in your trading arsenal.

An Open Invitation:

Try the PressureO DMI today and step into a realm where data meets intuition. You're not just applying an indicator; you're adopting a piece of market wisdom, a slice of a trader's life-long quest for consistent performance.

How To Customize The Look & Feel Of Your ChartA brief tutorial on how to build out a custom chart here on Tradingview.

In this video we'll take a look at changing your theme, customizing your background & candlesticks along with adding relevant information & removing what's not needed from your trading chart.

If you have any questions or comments about anything mentioned in the video please feel free to leave them below.

Akil

Chart paletteIt's really important if you work long time with a charts on Tradingview to have a clean color setup, your eyes feel more comfortable. Here is few of my combination what I personally use.

Also just a small tip why do I use black and white candles. Its all about psychology. When you see red candles you think more about sales, green greed. Its all about human nature. But white and black candles give you option to look on a chart without emotion background.

When you setup your colors youll see how more productive and comfortable for you will be the time front of charts

Few combination

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Manage Input variables with Pine Script v5Welcome to this new tutorial that helps traders and investors better understand the powerful Pine Script programming language v5.

In this tutorial, we will program together three Input variables:

Color type Input: a color input is a parameter that allows specifying a custom color for the indicator or script. It can be used to set the color of lines, areas, texts, or other graphical components in the indicator.

Float type Input: a float input is a parameter that allows specifying a floating-point numerical value for the indicator or script. It can be used to set parameters such as threshold levels, indicator sizes, or any other numerical value that requires decimal precision.

Integer type Input: an integer input is a parameter that allows specifying an integer numerical value for the indicator or script. It can be used to set parameters such as moving average periods, length of a time interval, or any other integer numerical value.

IMPORTANT: The code used in this tutorial has been created purely for educational purposes.

Our indicator is a simple indicator that plots the close data of the underlying asset on the chart in a weighted manner. The displayed data is the sum of the close price plus 20%. The goal of the indicator is to provide a fully dynamic tool that can vary its parameters from the user interface and update automatically.

Here is the complete code for this tutorial:

//@version=5

indicator("Input Tutorial", overlay = false)

pond = input.float(defval = 0.20, title = "Float", minval = 0.10, maxval = 1, step = 0.10)

color_indicator = input.color(defval = color.red, title = "Color")

data = close + (close * pond)

linewidth_feature = input.int(defval = 1, title = "Integer", minval = 1, maxval = 10, step = 1)

plot(close, color = color_indicator, linewidth = linewidth_feature)

//@version=5

Indicates the version of the Pine Script language used in the code.

indicator("Input Tutorial", overlay = false)

Set the name of the indicator as "Input Tutorial", and overlay=false indicates that the indicator should not overlap the main chart.

pond = input.float(defval = 0.20, title = "Float", minval = 0.10, maxval = 1, step = 0.10)

Create a float input called "pond" with a default value of 0.20. The input title is "Float", and the minimum value is 0.10, the maximum value is 1, and the step is 0.10.

color_indicator = input.color(defval = color.red, title = "Color")

Create a color input called "color_indicator" with a default value of red color. The input title is "Color".

data = close + (close * pond)

Calculate a new value "data" by adding the closing price value with the closing price multiplied by the "pond" input.

linewidth_feature = input.int(defval = 1, title = "Integer", minval = 1, maxval = 10, step = 1)

Create an integer input called "linewidth_feature" with a default value of 1. The input title is "Integer", and the minimum value is 1, the maximum value is 10, and the step is 1.

plot(close, color = color_indicator, linewidth = linewidth_feature)

Plot the chart of the closing value with the color specified by the "color_indicator" input and the line width specified by the "linewidth_feature" input.

Colour design and personalising your layout and indicatorsHi everyone,

This post is not about trading, it's about colour design and why you should consider it for your trading layout (so ignore all the indicators, they're just to show you how things can be coloured). Just to clarify, as I'm Scottish, I'm using "colour" but it is "color" on TV code etc.

TradingView gives almost unprecedented access to us, its users, as we can write code and colour our indicators (and more) to our heart's desire. So why not take advantage of that freedom and colour your trading setup in a visually appealing way?

I've seen a lot of indicators and many that have one or two colours working well, but then they need a fourth colour start going with a completely different palette that just makes it all a bit sore on the eyes. But hey! Aren't we here to earn money, why should I care how my indicator/setup looks? This is a perfectly reasonable attitude and yeah, this is you, this post probably isn't going to useful producing aesthetically pleasing indicators is not high on everyone's list - just as people don't always notice bad chord progression in music, colours don't impact everyone the same way.

Some basic rules I try and follow:

the colours should complement one another

they complement the colour of the background

I should be able to clearly see all the indicators/oscillators and what not, without getting confused by the colours, OR

I should immediately be able to tell if the indicators/oscillators are suggesting buy, sell or neutral

the less colours you can (sensibly) use, the better (but make sure you can understand the indicator)

shades of a colour often work better than a completely different colour

brighter doesn't always mean better

The preprogrammed (and industry standard) versions of colours available(e.g. plain Red, Blue, Green, etc.) are not my favourites, but luckily now there are now many good sites that allow you create your own colour palette - just search "create colour palette". Once I have a site, I start by picking three colours to represent:

the Bulls (buying signals, positive, rising, increasing, etc.)

the Bears (selling signals, negative, falling, decreasing, etc.)

Neutral (zero lines, figures or lines that lie in between user determined Buy and Sell levels, etc.)

Start with the Bulls colour, lock it in, and then the generator should find complementary colours for the Bears (lock it in) and then Neutral. For me, these are usualy close cousins of the archetypal green, red and yellow, but it's important to choose a colour you like - you're going to be seeing a lot of it. Then I will use the colour generator to find different shades of the main colours, as well as other complimentary colours, so that I have enough to form a colour wheel, or at least a scale of colour. I will then create a script with these colours in it, so that they are handy for copy-pasting, and I won't lose them.

The website should give you the HEX code for your colours as well as the RGB code. If you are not coding, and just want to change the colours of your indicators through the "Style " tab, click on the colour you want to change, then on the + symbol, then add the colour in by copy and pasting their HEX code, and finish by clicking Add. Although a bit time consuming, if I am going ahead with a new palette I will add them all in one go.

When it comes to coding a script, I assign the colours to bullCol, bearCol, neutCol etc., and direct any colour calling to these variables. This allows you to easily change one colour and have it impact all the places you've used it throughout the script, much easier than rather than having to find and replace "(#16FF72, 0)" ten times in a script.

The Candlesticks/Bars

I've read somewhere that having Red as a negative candlestick is actually detrimental to the mindset of the trader on a subconscious level (after all, we associate red with danger and alerts), so I try and have my candles as different colours altogether. But it is important that they are in the same family of colours as my indicators, so I have usually started with the important indicator colours and then gone back and edited the candlesticks to complementing colours. If you have created a colour wheel (or have around eight colours to use, not including shades) you may find two of these work best for your candle colours.

Finally, I would say, experiment! I have had three main colour palettes, and some have worked better than others! (you can see the worst of mine on my Jurik MACD script) The key is finding those three colours that you really like, to represent the Bulls, Bears and neutral, and then using the generators and some commons sense, it all comes together.

And that's it, really. It makes such a difference for me, seeing my layout on desktop, browser, phone in my colours and my design. Yes, it is all dressing and won't necessarily help you make the right decisions or more money, but it worth considering.

Good luck! If anyone wants any help with colours, just send me a message.

The BEST Chart Colours For Trading With!I often used to struggle with how to find the best chart colours to trade with but I never could quite pick between clear white or clear black. It's an often overlooked topic but when clarity, contrast, sharpness all depend on how well you see patterns, candles or your preferred techniques, it's one of the most crucial. So here's what I found out:

White is a no-go for various reasons. Firstly, it's a very bright and sharp colour that will be the focus of your eye. Secondly, depending on your laptop/PC it can be very bright, leading you to turn down brightness further reducing your vision. It's not great at night either to check the charts for an hour before bed and your screen is blinding.

Black is also a no-go as it's the exact opposite of my last point. It blends in to easily to the background leaving you feeling as if there's not enough brightness when your candles are often a darker colour also. If your laptop/PC monitor is a mid-lower end, it won't have the brightness to really pop out and if it's not an OLED panel you will also find the black isn't true black, but more of a dark grey. Not a good idea...

So this brings me to the holy grail which is: GREYSCALE!

A lot of people don't realise this but 1 in 8 men and 1 in 200 women, a total 5% of the population are colour deficient which means you have a difficulty with certain colours, differentiating certain colours and similar conditions. By setting your background to greyscale, it's a natural base colour everybody can see, it's easy on the eyes and most importantly it provides a certain contrast between the candles and the background that I never quite got with other charts.

By setting your candles to simple black borders/outlines and green/red fill, you get a really nice looking chart! Then you want your indicators and chart objects to be a sharp colour, so it really stands out, like yellow or white.

This is how you get a great looking chart so you can really see what's going on!

Dynamic Color Table from arrays.a table that takes a number of arrays or names/colors and plots them for color scheme design and such. can be used to show data as well, however more work is needed. building a kit for design work tools. color scheme design and storage in arrays

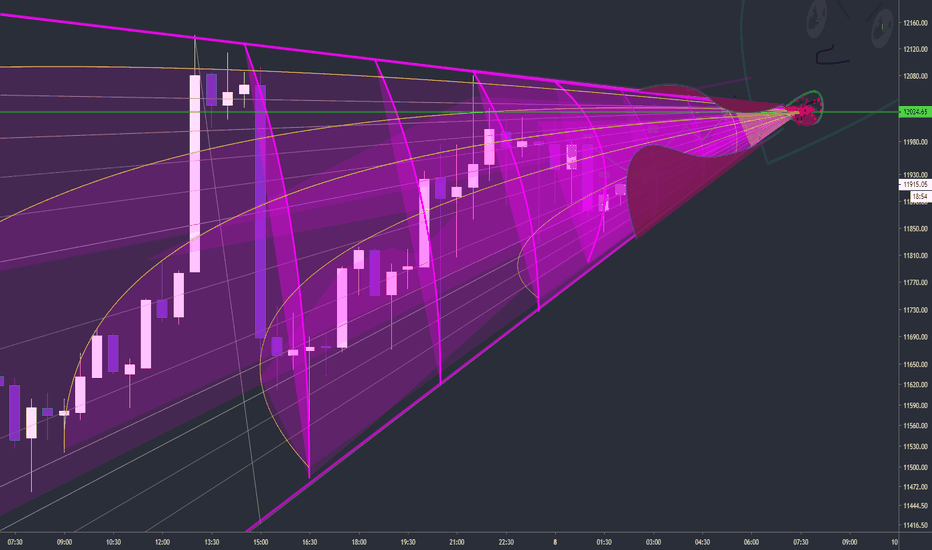

Bitcoin macro "3W" Time frame Trend Lines of resistance .

This publication is not financial or trading advice :) I am a meme not your financial advisor :)

Bitcoin price action Chart Art color based on based on rsi strength, volatility and heikin ashi style .

Drawing because I am bored :)

Publication for future historical reference ...

never invest in a way that would keep you up at night ...

"sideways price action is bullish price action "

INDEX:BTCUSD

4 Color Palettes For Charts 🎨📊Hi traders

there are 4 color palettes here that you can use in @TradingView charts.

1. Standard green & red

2. Neon Carrot & Neon Blue

3. white & Neon Blue

4. green body & green border

In future posts, I will publish more palettes in different backgrounds here.

so don't forget to like this post ❤

How to Color Grade your Charts & IndicatorsHello everyone, in this video we are going to talk about the possibilities to personalize your charts and therefore improve your own strategy (emotionally) and the attractiveness for other traders. Feel free to check out the previous two videos where were talking about trends, candlestick- and chart-patterns.

Cheers,

Ares

Basic understanding of Candlestick- and Chart-Patterns

How to scale your charts & use the right timeframe

What more ugly charts will people produce with this functionalitTradingView introduced gradient background.

I wonder what kind of ugly charts people will produce with this functionality...?

TradingView if you want to add something like this please give us a background image so you can brand your chart.

- Url to background image

- width in pixels, height will be calculated based on proportions

- position (x,y) or list (top/left, top/right, bottom/left, bottom/right, center)

- opacity (so you can watermark your charts)

Buying vs Selling Pt1- COLOR, Most have it completely backwardsI'm making a little educational series of tutorials to put some of my trading philosophies into writing for myself but also to help teach anyone interested or provide a fresh perspective to others.

Let's start with COLOR .

From indicator lines, fill regions, background colors, arrows, to barcolors (be it from an indicator or just the basic candle), most traders are looking at a green candle and a red candle in reverse. Novice traders see a big fat candle and think, "Wow, lots of BUYING" then see a huge red candle and think, "Lots of SELLING". I think we inherently associate green with money and like to see lots of green when we have long positions. And then we associate red with emotions of fear and panic, bad things.

Let's have a look at a chart of SPY using the "Ehlers Instantaneous Trend" with ribbon and barcolor to help identify trends and paint them the color we are accustomed to seeing-

Very quickly I'm sure a lot of people think the coloring makes sense and might be looking up the Ehler indicator right now (it is a really cool one so go ahead). What we're seeing is this-

Most of the time the green candles have been when SPY has been rising

Most of the time the red candles have been when SPY has been falling

Seems natural to buy when you see these green candles going up and sell/avoid buying when you see red candles going down.

The problem is that that's what dumb money does! They buy when smart money is SELLING. Those green candles are actually the result of a smart buyer who timed things correctly and bought at the lows and is now 1) holding onto their shares, 2) waiting for sell signals. And when those red candles start showing up, dumb money gets all panicky and starts selling their shares. They might wait for closing cost to fall beneath a moving average or some other indicator, then they start selling and voila- capitulation. The price those sellers get is probably not great and when it's all said and done was not very much above what their entry price was.

But as people are selling, smart money is BUYING. They are fishing for a bottom to start accumulating shares. They look for really 'red' days with lots of volume, a perfect cocktail of emotion that gets weak hands to tremble and chase the price down before capitulating and selling for whatever price they can get. And usually when this is occurring, the bottom forms.

Let's reverse the colors of the bars and start seeing things through the lens of smart money-

Now if you are still associating green with buying and red with selling, the world should make much more sense. When the candles turn green here you're a buyer and when they turn red you're a seller. That doesn't mean buy the first candle and every candle, all the time, every time. It means that is when you are waiting patiently for the most opportune moment to buy. And when these candles are red you aren't freaking out and selling, you tell yourself "I am looking for moments when I can take some profits off the board when we get really crazy moves up, and maybe replace some of those shares with a few new shares I purchase at lows or on some bad days". The point is that this is a selling phase. I will go into depth as to why selling phases go up*, because I know that's a concept that people struggle with psychologically. (* there's two kinds of selling, as well as buying, which we'll get into).

Here are some close-ups on candles and their default colors-

Same chart, colors flipped -

Tradingview Color Themes and Indicator TemplatesIn this tutorial, I show you the basics of changing your chart's color theme, including how to save and recall it. I also show you how to change the color theme of your indicators as well as how to save your indicators as a template for easy recall any time you open a new chart. This two tips will save you endless hours and help you personalize your charting experience.

AAPL "Volume Strength Candles / Colored Bars" **NEW INDICATOR**Is Price Action Higher or Lower on STRONG or WEAK VOLUME from lookback

(Strong or Weak Bulls // Strong or Weak Bears)

Candles / Bars Indicate the Following (default 13 period lookback / Length)

MAROON Bear Candle with STRONG VOLUME more than 150% of the lookback / length (13 default), STRONG Bear Candle Confirmed With Volume

RED Bear Candle while VOLUME is BETWEEN 50% & 150% of the Lookback / Length (13 default), Neutral Bear Volume Neither strong or weak

ORANGE Bear Candle with WEAK VOLUME (Less than 50% of the Length / Lookback)

DARK GREEN Bull Candle with STRONG VOLUME MORE than 150% of lookback

GREEN Bull Candle with Neutral VOLUME BETWEEN 50% & 150% of the lookback / Length

AQUA Bull Candle with WEAK VOLUME less than 50% of the Lookback

Is price confirmed by volume?

Can Change the Lookback / Length from 13

Can Change the Colors and Transparency to easily see based off your chart background colors I recommend ZERO Transparency to easily identify volume strength (i use white background but many use black or other)

FB "Volume Strength Candles / Colored Bars" **NEW INDICATOR**Is Price Action Higher or Lower on STRONG or WEAK VOLUME from lookback

(Strong or Weak Bulls // Strong or Weak Bears)

Candles / Bars Indicate the Following (default 13 period lookback / Length)

MAROON Bear Candle with STRONG VOLUME more than 150% of the lookback / length (13 default), STRONG Bear Candle Confirmed With Volume

RED Bear Candle while VOLUME is BETWEEN 50% & 150% of the Lookback / Length (13 default), Neutral Bear Volume Neither strong or weak

ORANGE Bear Candle with WEAK VOLUME (Less than 50% of the Length / Lookback)

DARK GREEN Bull Candle with STRONG VOLUME MORE than 150% of lookback

GREEN Bull Candle with Neutral VOLUME BETWEEN 50% & 150% of the lookback / Length

AQUA Bull Candle with WEAK VOLUME less than 50% of the Lookback

Is price confirmed by volume?

Can Change the Lookback / Length from 13

Can Change the Colors and Transparency to easily see based off your chart background colors I recommend ZERO Transparency to easily identify volume strength (i use white background but many use black or other)